Promotion on going ! -30% on all trading bot purchase and rental durations.

This offer is valid only until October 31, 2024

Prices will be as follows:

- Purchase: 659$

- 1-month rental: 49.99$

- 3-month rental: 134.99$

- 6-month rental: 264.99$

- 12-month rental: 499.99$

Stochastic Pro is a trading strategy optimized for trading the NASDAQ-100 future contracts.

The underlying strategy is relatively simple, and based on market trends.

This trading bot is NOT based on a grid or martingale system. Each position is accompagnied by a stop loss.

Trading bot set-up :

Recommended asset : MNQ (Micro E-mini Nasdaq-100) or NQ (E-mini Nasdaq-100)

Time period : 15 minutes

Minimum recommended balance : 2000$ on MNQ

Setup is very simple. Simply open a 15-minute chart on MNQ or NQ. Then drag the EA onto the chart and set the desired risk and trading hours.

Additional parameters are described below.

It is highly recommended that you get started with a demo account. That way, you will have an idea of what to expect during live trading.

If you have any question about the EA or its configuration, please contact me.

Also, this robot will continue to be developed based on your feedback. So if you have any ideas that you think would be interesting to incorporate into this robot, please contact me.

Input parameters:

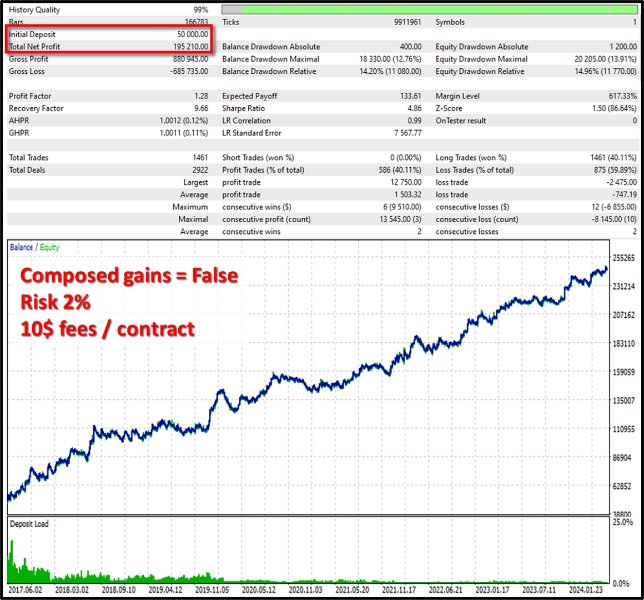

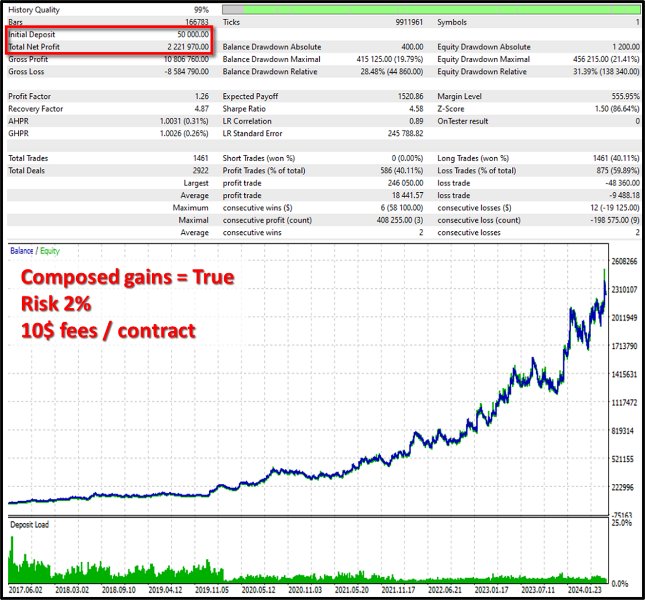

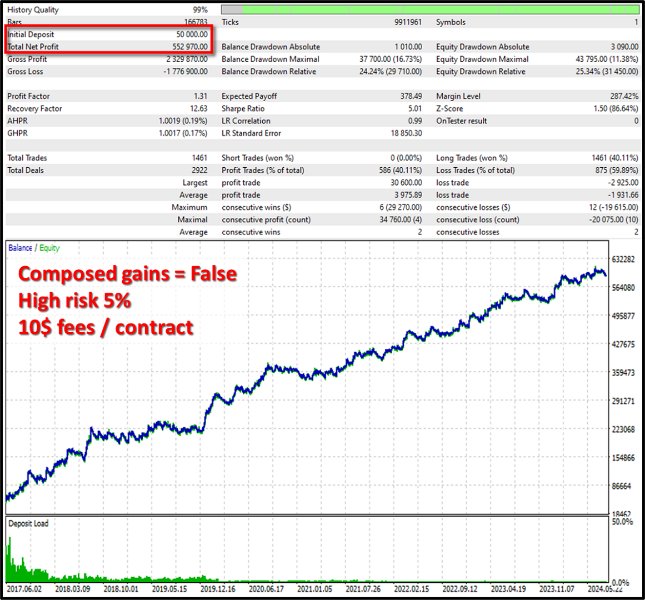

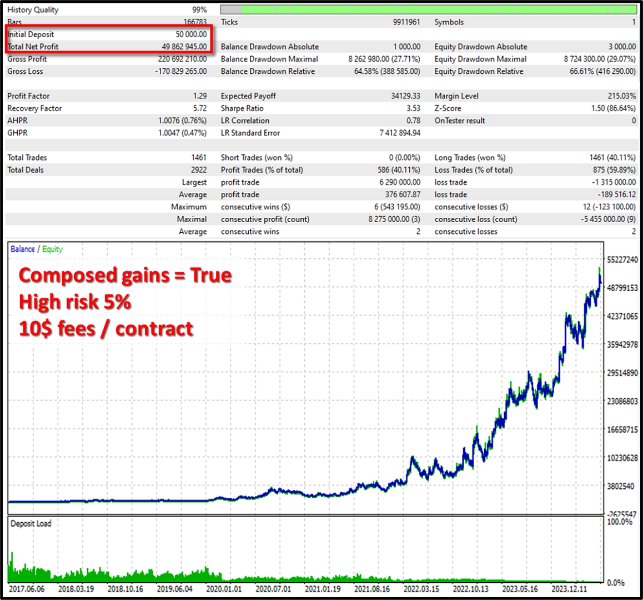

Stochastic indicator calculation period : Calculation period of the stochastic indicator (in number of candles) on wich the strategy is based. Stochastic trigger level for long positions : Level on the stochastic that triggers a long position Stochastic trigger level to exit long positions : Level on the stochastic that triggers the exit of a position ATR (Average True Range) indicator calculation period : ATR indicator calculation period (in number of candles). This is the indicator used for stop-loss positioning. TP Size (Number of times the ATR value) : Take-profit size. This is defined as a multiplier of the ATR value. For example, a value of 1 means that the TP is positioned 1 ATR above the entry level. SL Size (Number of times the ATR value) : Stop loss size. This is defined as a multiplier of the ATR value. For example, a value of 1 means that the SL is positionned 1 ATR below the entry level. Risk to take for each trade (% of portfollio) : Desired risk for each position (defined as a fraction of the portfolio). Ex: a value of 2 means that the number of contracts for the position will be calculated so as to take 2% risk on the portfolio is the SL is hit. Activate composed gains ? : "True" calculates the risk to be taken based on the current portfolio value. The "False" value is used to calculate the risk on the initial portfolio. Hour where the trading session begins : Session start time (24h format). This parameter limits the robot's trading hours. Minute where the trading session begins : Session start time (60-minute format). (e.g. with a value of 30 and a value of 15 on the previous parameter: trading will start at 3:30 p.m.) Trading session beginning hour shift : Number of hours to be added (or subtracted if negative value provided) to the session start time. This parameter is mainly used for backtest optimization. Trading session beginning minute shift : Number of minutes to be added (or subtracted if negative value provided) to the session start minute. This parameter is mainly used for backtest optimization. Hour where the trading session ends : Session end time (24h format). This parameter can be used to limit the robot's trading hours. Minute where the trading session ends : Session end time (60-minute format). Trading session end hour shift : same principle as entry time shift Trading session end minute shift : same principle as for the input minute shift True to trade one hour later between November and March : The “True” value automatically shifts the session start and end times (+1 hour shift between November and March). To use if your market data provider makes a time change. If your data provider does not change the time, use the “False” value. True to trade if minimum position size exceeds risk (not recomended) : The “True” value authorizes trading even if the position taken exceeds the risk defined with the “Risk to take for each trade” parameter. Such cases may arise, as the minimum position on future contracts is 1 contract. On certain positions, if the risk requested is too low to be respected with a 1-contract position, the trade will still be taken with the “True” value and not with the “False” value. We recommend setting this parameter to “False”. True to trade with reduced volume when needed to meet margin requirements (recommended) : The “True” value automatically reduces the position size if necessary, so as not to exceed the broker's margin requirement. With “False”, an attempt will be made to send the order even if the margin requirement is not met. It is recommended to set this parameter to “True”. True to NOT trade short positions : The “True” value is used to avoid taking short positions. The use of the “True” value is recommended in view of the backtests that have been carried out. True to NOT trade long positions : The “True” value is used to avoid taking long positions. The “False” value is recommended in view of the backtests that have been carried out. WARNING: If you choose to maintain a position beyond the end of the US trading session, you must personally ensure that the "overnight" margin requirement is met. To avoid this problem, you must maintain trading hours within the US session and ask your brokerage firm.