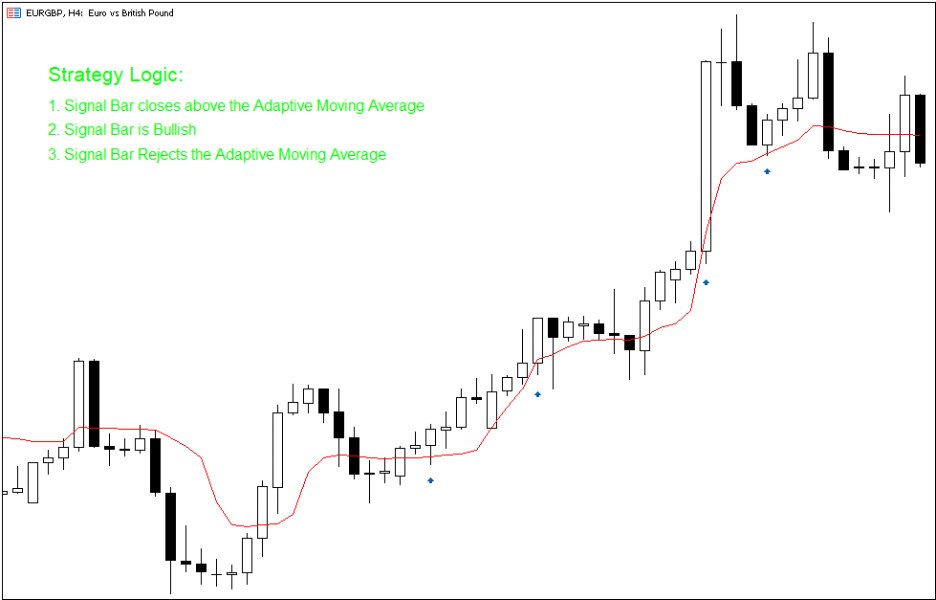

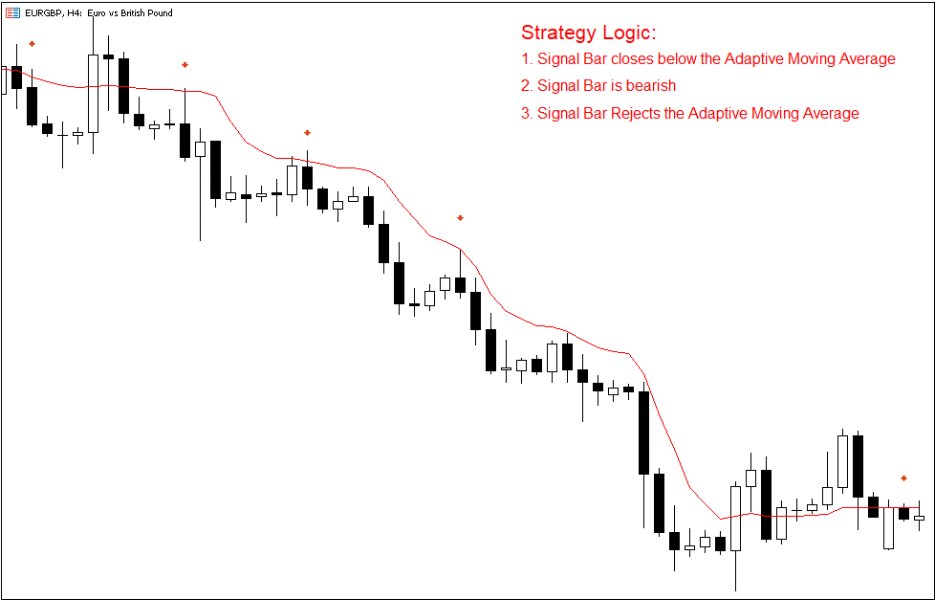

True Adaptive Continuation

- 专家

- George Kamwanga

- 版本: 1.1

- 激活: 5

Welcome to hybrid trading. Welcome to objective and seemless execution, coupled with discretionary management.

This is not a standalone automated strategy.

This system is designed to facilitate the uncertainty and uniqueness of all individual trading opportunities within the scope of the strategy and trader discretion!

THIS SYSTEM IS NOT OPTIMISED, FITTED TO OR FOR PAST PERFORMANCE. IT IS DESIGNED.

It is a complementary discretional trading tool, designed to do the heavy lifting of objective market analysis and fast and precise market execution.

The objective of this system, if any, is to develop individual trader competence, in the execution of a defined and automated market edge.

Stop your search for the illusive holy grail strategy and commit to a simple, effective and free-flowing system of consistent trading.

Developer tips:

This is a plug and TRADE system, with an defined market edge.

Use VPS for uninterrupted strategy execution, not compulsory for higher timeframe trader(uses pending orders).

The position bars exit input is a mechanism used to solely close positions, thus, any losses and profits incurred; as a result of this variable are random (not as a result of strategy edge) and not subject to discretional trader scrutiny.

This system variable can be switched off by passing a 0 value to the relevant expert input.

More supportive trader features are oncoming in the updates, and this will reflect in expert price.

Trader tips:

This strategy performs in all MAJOR and MINOR currency pairs, trade symbols are up to the trader.

The higher the timeframe, the more reliable the strategy edge is, plus less time for babysitting system. Suggested timeframes are H4 to D1.

A discretionary trading plan should be developed for stop loss orders. This is dependent on individual trading styles. Suggestions include, entry bar low/high or AMA value

Trailing stops are better exit orders than fixed take profit orders.

High impact news events should be accounted for in trade exits.