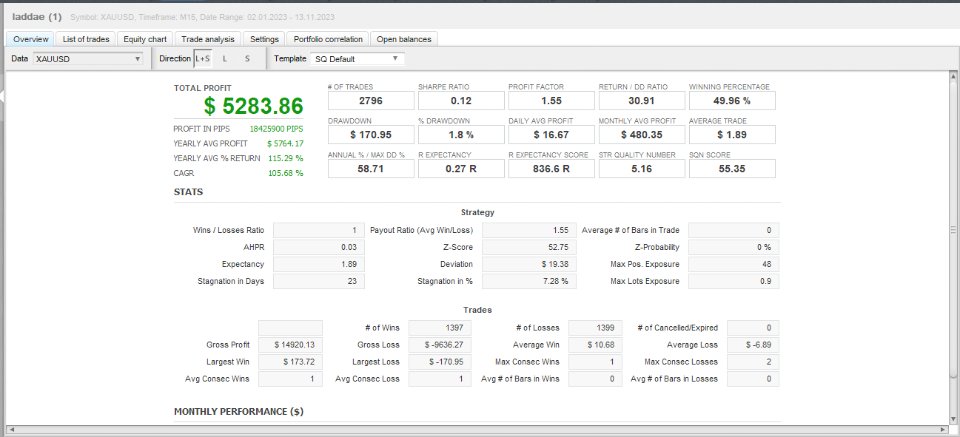

Super Hedge ladder

- 专家

- Hong Ling Mu

- 版本: 1.0

- 激活: 5

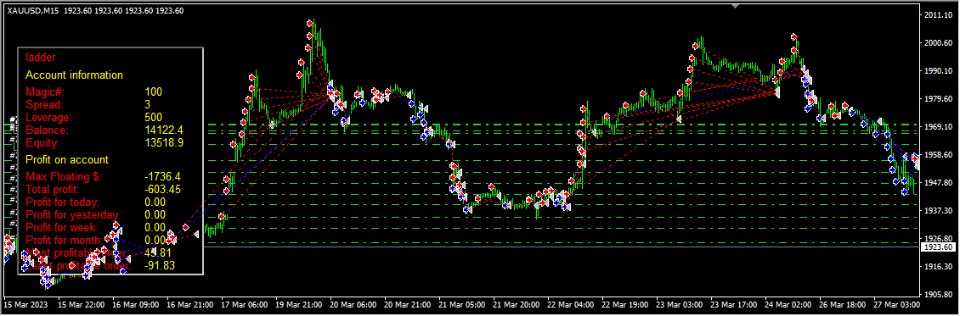

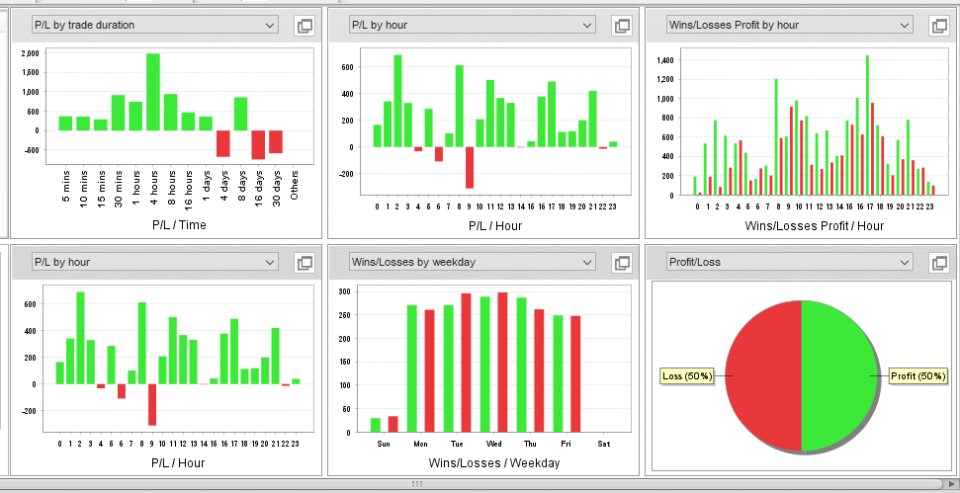

Hedging logic, or simply "hedging," refers to a strategy used in trading and investing to reduce or eliminate the risk of adverse price movements in an asset. This is typically done by taking an offsetting position in a related security or asset. The goal of hedging is to protect the portfolio from significant losses while still allowing for potential gains.

Here are a few common hedging methods:

1. **Options**: Buying put options to hedge against potential declines in the value of an asset.

2. **Futures Contracts**: Entering into futures contracts to lock in prices and protect against price fluctuations.

3. **Diversification**: Spreading investments across various asset classes to reduce overall risk.

4. **Inverse ETFs**: Investing in exchange-traded funds that gain value when the market or specific asset declines.

The effectiveness of hedging depends on the accuracy of predicting market movements and the correlation between the hedging instrument and the underlying asset.

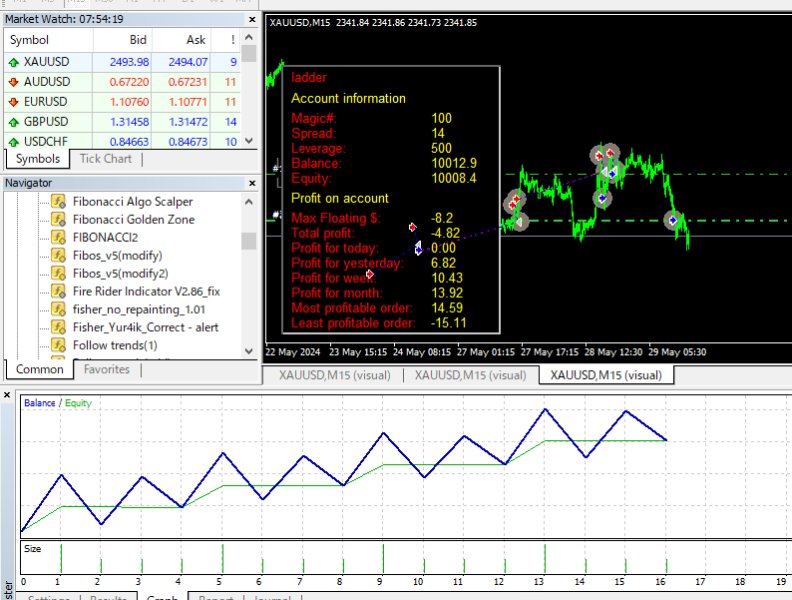

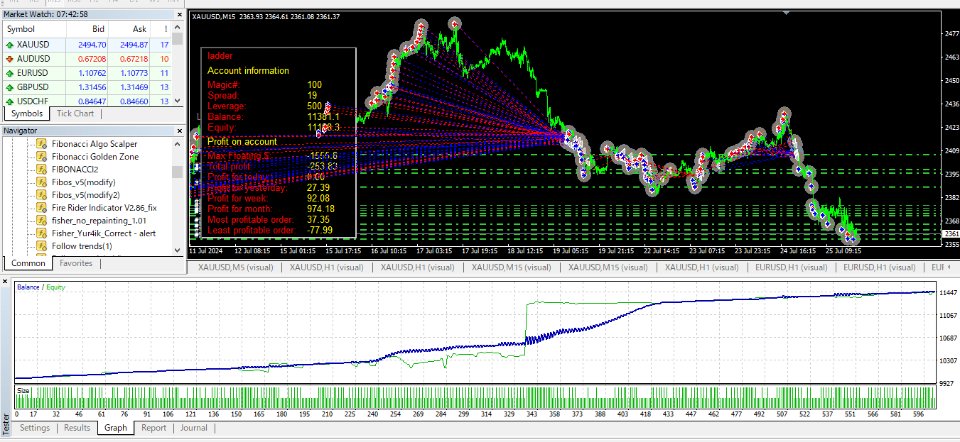

Best pair XAUUSD

TF M5/M15/H1