TripleBullet

- 专家

- Hashimoto Takuma

- 版本: 3.3

- 激活: 5

Achieving the Ultimate Hands-Off Approach

"Isn't there an EA that can be operated with true peace of mind?"

Even though it's called automated trading (automatic settlement), if you still have to think and adjust settings each time, isn't it more like "semi-automatic trading"? This not only leads to potential losses but also significant time loss.

Ultimately, despite investing a considerable amount of money in EA:

It's less likely to be profitable in the long run.

Losses can occur unnoticed.

The time spent monitoring before and after implementation remains unchanged, resulting in lost opportunities.

The main features of this EA

This EA pursues to the utmost extent various aspects demanded by EAs such as 'risk,' 'time,' and 'profit'.

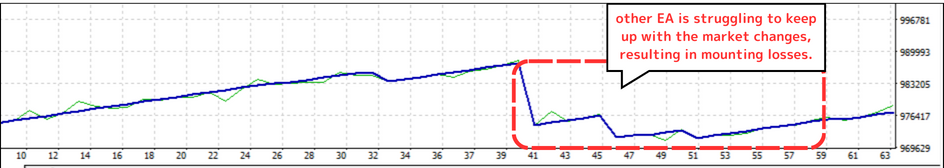

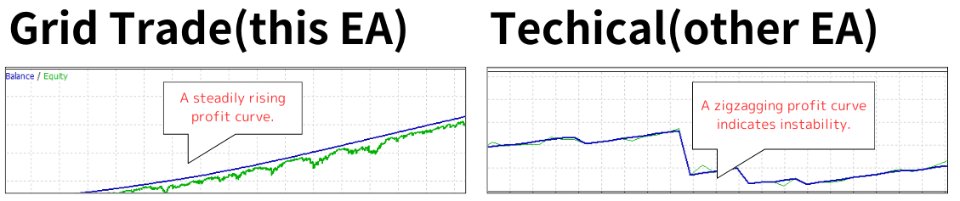

"Resilience" Unaffected by Market Conditions

This EA employs a grid trading strategy, which is its cornerstone. One of the greatest strengths of grid trading lies in its independence from market conditions and past data. Even in the face of significant fluctuations or uncertain factors in the market environment, grid trading remains resilient and effective over the long term.

The running costs are low, and there is no need to worry about settings every time you introduce the EA. This is one of the strengths of this EA.

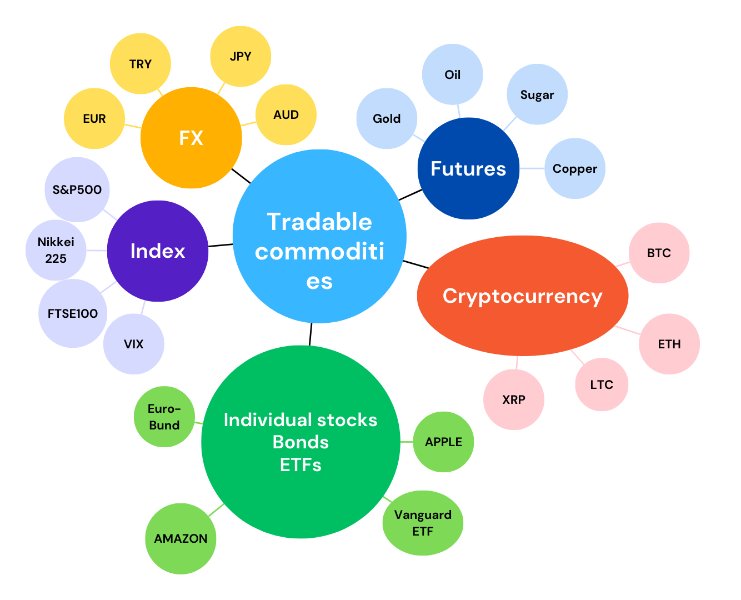

Diversification

In this EA, trading with "3 pairs" is possible. The advantage of being able to use multiple currencies is the ability to reduce risk through diversification.

Example settings:

-

Pairs with low market volatility (e.g., USDCHF / EURGBP / AUDNZD)

-

Pairs with negative correlation (e.g., USDJPY / S&P500)

There are no restrictions on currency pairs. You can choose from a wide range of options.

Examples:

S&P500 (CFD), Bitcoin (BTCUSD), Gold, and more are available for selection.

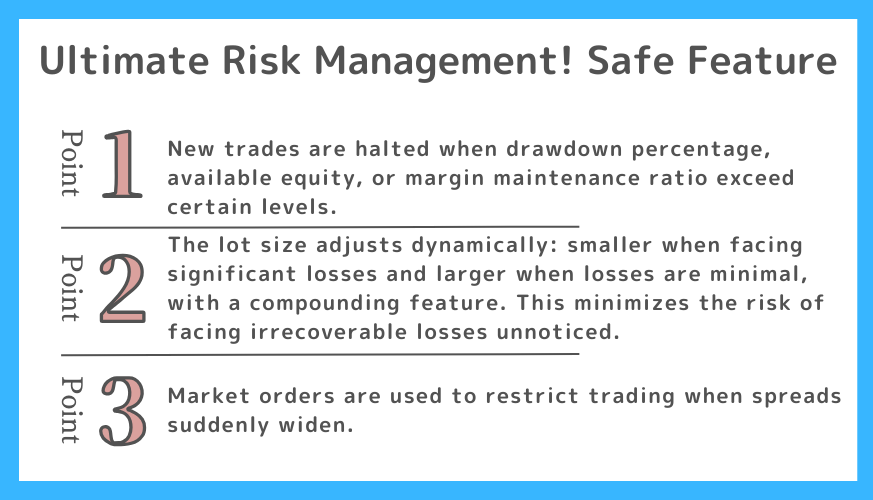

Safety Feature

We have incorporated a safety feature that provides peace of mind in abundance.

-

When the drawdown rate, available margin, or margin maintenance rate exceeds a certain threshold, new trades will be halted.

-

The lot size decreases when there is a significant unrealized loss, and increases when the unrealized loss is small. This design minimizes the occurrence of "irrecoverable losses."

-

By adopting market orders, trades can be restricted when spreads suddenly widen.

An EA developed with such meticulous consideration for the user's "risk" is indeed rare. It allows for the pursuit of profits without being solely fixated on them.

Looking at TripleBullet in Numbers

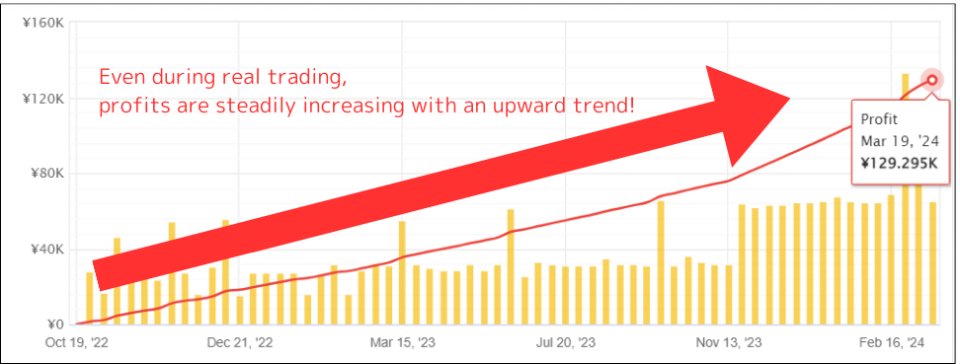

Below is the actual performance data of TripleBullet, operated by the author in 2023 for 12 months on a real account:

https://www.mql5.com/en/signals/2240348

It shows an annual profit of approximately 14% with a maximum drawdown of less than 10%.

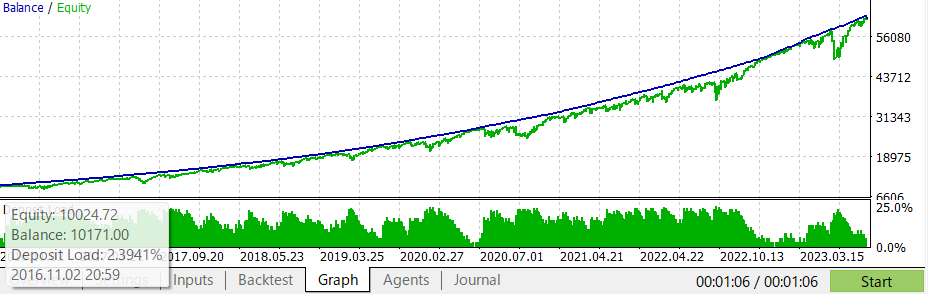

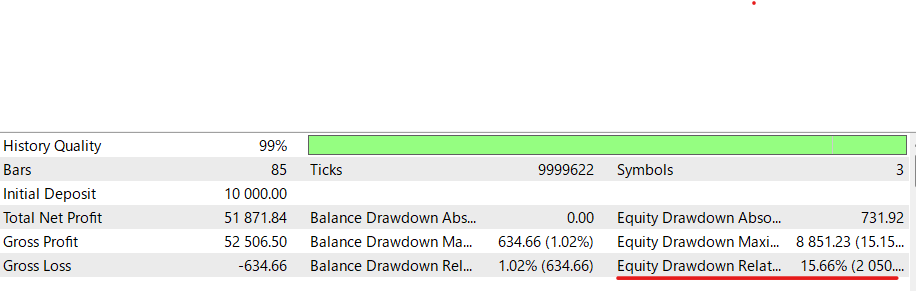

Profit Example: Over a 7-year period of operation,

starting with $10,000 in capital, you could potentially reach $50,000 in profit! with less than 16% maximum drawdown

To be clear, achieving such figures while rigorously managing risks is quite rare for an EA.

A Quick Start Guide for EA Beginners

Are you new to considering EA, or have you been contemplating its adoption for some time? Do you find yourself overwhelmed by the barrage of technical jargon and the myriad parameters you need to understand and select? Frankly, I believe that comprehending intricate settings and adjusting them while operating can be quite daunting for beginners.

Even though you aim to profit from automated trading, entrusting intricate settings to users without proper risk management can lead to uncertainty about whether the settings are correct and progress with apprehension.

To address such concerns, TripleBullet provides a Quick Start Guide to ensure that anyone can easily implement it. Rest assured, it's designed for everyone, from beginners to advanced users, allowing for worry-free long-term usage.

Whether you've had failed attempts with other EAs or are considering one for the first time, TripleBullet is an EA that I confidently recommend as a developer. It has been meticulously crafted to pursue users' benefits.

Please consider TripleBullet, an EA built with user benefits in mind.

※explore its detailed specifications here

https://www.mql5.com/ja/blogs/post/756839

Beginner's Quick Start Guide

You can quickly start using the EA by following the setup below:

SetUp

-

Provide a hedging-enabled account.

-

Maximum Leverage: Set to 25x

-

Timeframe: Monthly

-

Currency Pair: Specify EURGBP

Setting Parameters

| Parameter | Value | Roll | Usage |

|---|---|---|---|

| debugMode | false | Log Output | tWhen set to true, debug logs are displayed in the journal. |

| magicNumber | 98352 | Magic Number | Set a unique value that does not overlap with other EAs. |

| stopEquity | 0 | Safe Feature | No new orders will be placed when the equity falls below this value. Set to 0 to disable. |

| stopMarginLevel | 500 | Safe Feature | No new orders will be placed when the margin level falls below this value. Set to 0 to disable. |

| stopDrawDownPer | 20 | Safe Feature | No new orders will be placed when the drawdown exceeds this percentage. Set to 100 to disable. |

| spreadLimit | 20 | Safe Feature | No new orders will be placed when the spread exceeds this value. Set to a large number to disable. |

| risk | 2.5 | Safe Feature | Automatically calculates lot size based on risk. Cannot be set simultaneously with lot. Set to 0 to disable. |

| lot | 0 | Safe Feature | Sets a fixed lot size for trades. Cannot be set simultaneously with risk. Set to 0 to disable. |

| pricePeriod | 36 | Trading Strategy | Determines how many monthly periods to use for calculations. |

| noTradeCoreRange | 0.16 | Trading Strategy | Determines the core range. |

| positionHalf | 31 | Trading Strategy | Determines the position size outside the core range. |

| minTP | 95 | Trading Strategy | Sets the minimum TakeProfit in pips. |

| maxTP | 271 | Trading Strategy | Sets the maximum TakeProfit in pips. |

| sl | 0 | Trading Strategy | Sets the StopLoss in pips. Set to 0 to disable. |

| symbol2 | USDCHF | Trading Pair | Specifies an additional currency pair for trading. Make sure to use the correct pair name from MarketWatch. |

| symbol3 | AUDNZD | Trading Pair | Specifies an additional currency pair for trading. Make sure to use the correct pair name from MarketWatch. |

| upperLimit1 | 0 | Trading Strategy | If the rate of the first pair (the pair with the EA running) is higher than the upperLimit, trading will stop. Set to 0 to disable. |

| upperLimit2 | 0 | Trading Strategy | If the rate of the first pair (symbol2) is higher than the upperLimit, trading will stop. Set to 0 to disable. |

| upperLimit3 | 0 | Trading Strategy | If the rate of the first pair (symbol3) is higher than the upperLimit, trading will stop. Set to 0 to disable. |

| loweLimit1 | 0 | Trading Strategy | If the rate of the first pair (the pair with the EA running) is lower than the lowerLimit, trading will stop. Set to 0 to disable. |

| loweLimit2 | 0 | Trading Strategy | If the rate of the first pair (symbol2) is lower than the lowerLimit, trading will stop. Set to 0 to disable. |

| lowerLimit3 | 0 | Trading Strategy | If the rate of the first pair (symbol3) is lower than the lowerLimit, trading will stop. Set to 0 to disable. |

Reference

- Specification Document

- Performance of Live Account