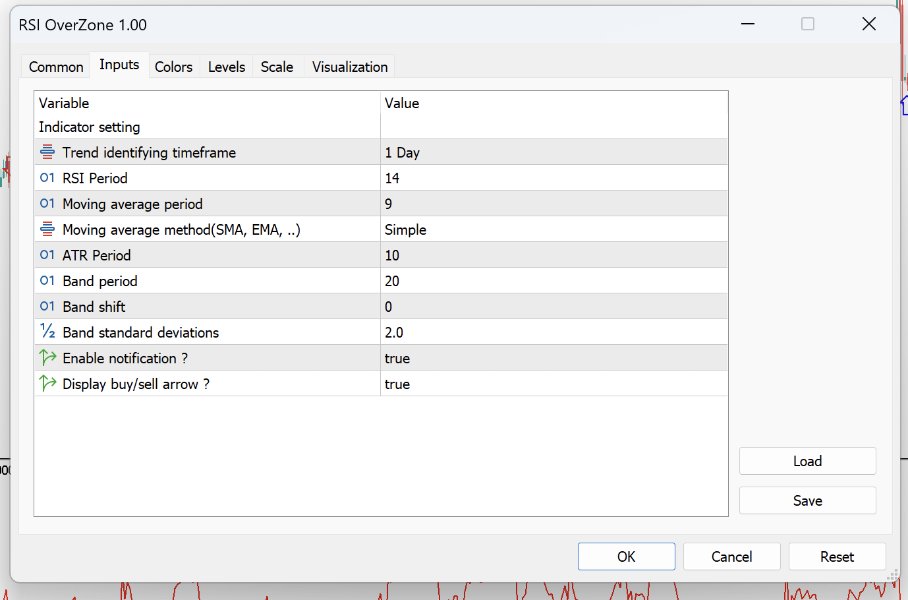

RSI OverZone

- 指标

- Van Thanh Tran

- 版本: 1.0

- 激活: 5

RSI OverZone: Enhancing Trading Accuracy

RSI OverZone is a trading tool designed to optimize the use of the Relative Strength Index (RSI) by dynamically adjusting its values to identify overbought and oversold conditions. Here’s how it works:

-

Higher Timeframe Analysis:

- RSI OverZone leverages higher timeframes to determine the current trend. By doing so, it aims to maximize profitability.

- We recommend using the H1 (1-hour) and D1 (daily) timeframes for trend analysis.

-

Trend as Our Guide:

- Recognizing that “the trend is our friend,” RSI OverZone employs two different timeframes:

- One for entry point determination.

- Another for trend assessment.

- This dual approach helps traders make informed decisions.

- Recognizing that “the trend is our friend,” RSI OverZone employs two different timeframes:

-

Dynamic Oversold/Overbought Levels:

- While some traders rely on fixed RSI levels (e.g., 30/70) to identify oversold or overbought conditions, RSI OverZone takes a different approach.

- Consider a strong downtrend: Level 30 may not suffice; even levels as low as 10 could be relevant.

- Similarly, during a robust uptrend, level 70 might be indistinguishable from 50 or 60. Prices often consolidate before resuming their trend.

- Therefore, determining the overall trend is crucial.

-

Key Features:

- Color-Coded Trends: RSI OverZone visually represents the current trend:

- Bullish trend: Displayed in green.

- Bearish trend: Displayed in red.

- Buy/Sell Arrows: The tool provides buy/sell signals when potential entry points arise.

- Notifications: Traders receive notifications via MetaTrader 5 to stay informed.

- Versatility: RSI OverZone can be used across multiple symbols and timeframes.

- User-Friendly: The parameters are easily configurable.

Happy trading!