Golden Bullet

- 专家

- Svetoslav Ognyano Chilingirov

- 版本: 1.0

- 激活: 20

Introducing the ICT Silver Bullet's upgrade - The Golden Bullet!

After long consideration I decided to release my personal project to the public. It is a fresh and complex spin of the ICT Silver Bullet.

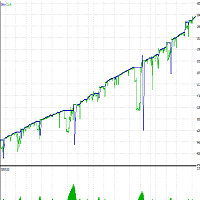

Similar to the Silver Bullet, it draws time ranges and as soon as price brakes out, the EA starts working it's magic. It has a multi-scenario built-in entry system:

For example - if price brakes the low of the range and goes back up, stop loss hunt (SLH) potentially happened and the algo will search for the start of that liquidity sweep, wait for a break upwards, search for a fair value gap (FVG) and patiently wait for a long trade setup #1.

In case that was not a SLH though, the EA is prepared too. It will wait for the next break of structure to the downside, and carefully search for a FVG from which a short trade setup #2 will be expected.

And in the case that price continues downwards without touching the short FVG, we would have one last chance to participate in the move - the EA will search for another newly formed FVG and potentially a short trade setup #3.

It's a simple concept based on ICT's methods, I know because I've traded it manually for an year. But it gets really complicated when we start asking questions:

- I see two FVGs, should I wait for the deeper one?

- Should I place my stop above the swing high or above the kill zone range?

- My TP is too close to the entry, should I aim for a higher Risk:Reward? How does my win ratio change if I do that?

- Should I shave some profit at that high/low? And how much?

- Are there any other kill zones available?

- Will this work on the other timeframes? Other instruments?

... and so many more. Try manually backtesting for all those variables. I did. It took me 6 months, excel spreadsheet with 22 different columns and a thousand rows representing a thousand different trades. Looks like a big dataset. But it wasn't big enough. Not even close.

This is why the answer lies in automation. This is why the input settings menu of that EA looks complicated. Because there are many questions and those questions lead to many possibilities for strategy modulation. Too many.

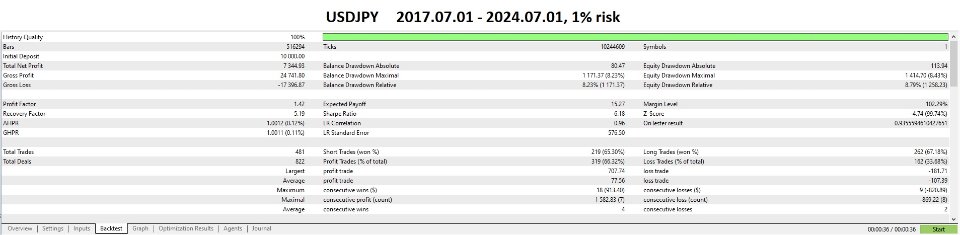

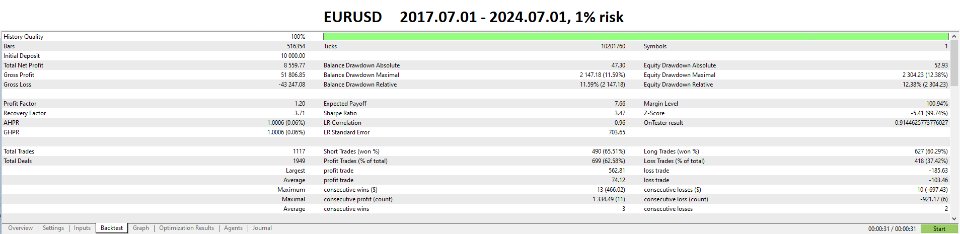

In order to avoid the waste of time and other precious resources, I will provide you with my sets for GBPUSD, EURUSD, USDJPY, NDX, SPY and DJI (the default set is one of the sets I use for USDJPY). And more importantly I will share my discoveries and conclusions about the use of this EA. For example using the PartialClose feature usually decreases the final net profit, but also the expected maximum drawdown - you might end up with more stable performance. If you're interested I can also give you a version of the EA that calculates the % probability for passing a prop firm challenge. I am happy to answer to any of your questions and provide clarity, especially before purchasing.

Special Promotion: Double Bubble! Purchase the Golden Bullet today, and get The Silver Bullet at no extra cost! This offer goes the other way too.

You can explore our full suite of EAs here: https://www.mql5.com/en/users/s_moksa/seller

YouTube portfolio management explanation: https://youtu.be/G54PqsaGih0?si=cZQKvjTTDoLXGiWP

P.S. For the people that want to pass prop firm challenges with this algo, I can provide additional version that allows the usage of "Custom max" optimizations (you can backtest and see the percentage of challenges that you would have won in a custom time period).

Reach out after purchase so I can provide the input sets' package, and instructions on how to set up the EA.

(Provided sets are created for GMT+2 timezone! Change your time range settings accordingly if you're in a different time zone - for example if you're in the UK GMT+0, instead of 7:30 to 19:00, you should switch to 5:30 and 17:00!!!)

Disclaimer: Please remember, all trading involves risk. While the Golden Bullet has been rigorously tested, past performance is not necessarily indicative of future results. I am not a financial advisor, and this is not financial advice. The responsibility to trade wisely and manage risk remains yours.