Cybele Unbound CFD MT5

- 专家

- Evren Caglar

- 版本: 3.0

- 更新: 4 十月 2024

- 激活: 10

Cybele Unbound: The Power Of Professional Traders Is In Your Hands

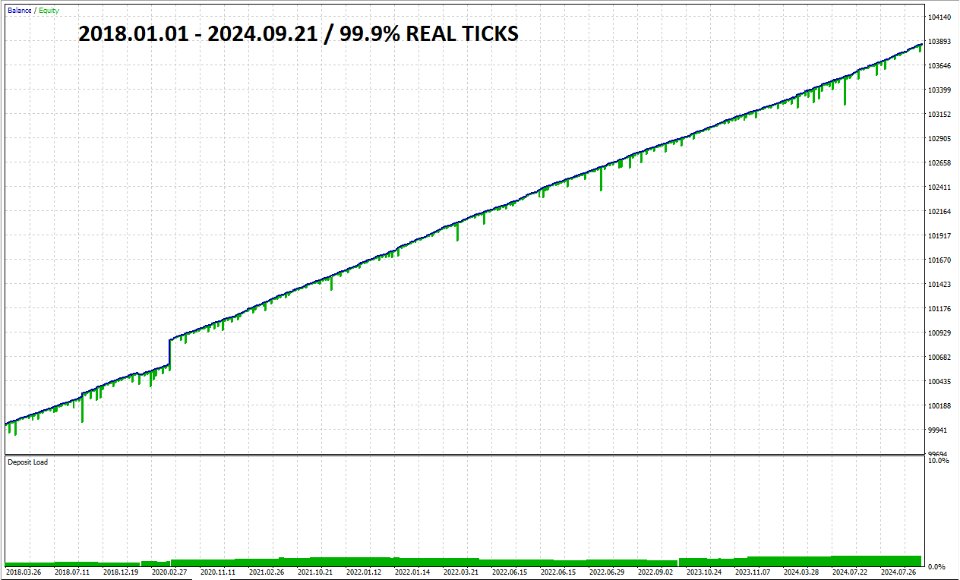

Cybele Unbound is an artificial intelligent quant trading bot built on the price action and probability theories with the way of institutional trading. It continuously adapts the changing market conditions and tightly manages the risk. It does not rely on martingale and grid strategies and can be used for prop trading challenges. Cybele Unbound trades NASDAQ on M6 timeframe.

PLEASE NOTE THAT THERE WILL BE A LIMIT OF 200 COPIES. 196 COPIES LEFT

You can use this set with M6 timeframe: Download.

Professional traders consistently win not because they have a crystal ball or they have some rocket science tools. They consistently win because they are patient in waiting for excellent, pre-planned trade setups and they apply perfect trade management methods.

Cybele Unbound is developed with these two features in mind: filtering the opportunities out for an excellent trade setup and efficiency in trade management. With its complex algorithm put under the hood, Cybele Unbound replicates what professions trades do in trading. With this approach we could reduce the number of open positions and increase risk/reward ratio.

A detailed information about Cybele Unbound: Detailed Information

Before First Time Use Cybele Unbound

We aim for 100% customer satisfaction with our products. We want Cybele Unbound to provide maximum benefits to every user. Therefore, before you purchase, you can consult on us how to setup Cybele Unbound for your broker and with your risk limits.

1. After you purchase, you can contact me for installation and/or face to face remote help.

2. We recommend testing Cybele Unbound with tick data suites to make sure it satisfies your expectations.

3. Due to variations in data, the backtest results can also vary among broker. If your results are not similar to the one we present, you can contact us.

4. We recommend using Cybele Unbound in a demo account for at least 2-3 weeks before you put it in a real account.

5. Recommended minimum balance is $100.

6. You can improve the portfolio return by adding Secutor CFD EA which is freely available from our page.

7. You can join the Institution Breaker's private community after purchasing the product. Only verified users can join. Just PM me after the purchase for the details.

Parameter Description

| Parameter | Description |

|---|---|

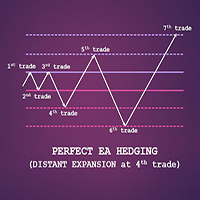

| Grid Mode | When the Grid Mode is ON, you have the opportunity to add grid positions. When this mode is mode is active, TP and SL are managed by the grid algorithm |

| Position Multiplier | The coefficient that multiplies grid positions. |

| Grid Step | The minimum grid length. |

| Grid Multiplier | A coefficient that multiplies current length to the next length. |

| Max Open Trades | Maximum number of trades in the grid mode. |

| Basket Mode | In the grid mode, you can decide the TP and SL either in terms of dollars or points. |

| Overlap Last Order Number | You can close the first and the last position in the cycle. The covering starts with this order. |

| Overlap Percent | First and the last orders are covered after X percent profit. |

| Exit The Position After X bars | Closes all open orders at the end of the time range. It does not consider if it is in profit or not. |

| Trail Stop | Dynamic stop-loss order that adjusts as the market price moves in favor of the trade. |

| Move Breakeven Parameter | Determines the location where the SL will be moved to breakeven point. |

| TS Activation | TS Activation level determines when the trailing stop should become active. |

| TS Step | Triggers when TS will move to the next location |

| Limit Time Range | You can limit the operations of Cybele Unbound within a certain time period. You need to match time with broker's time. |

| Normalization of Data | To stabilize the operations among different brokers, we normalize the data with some coefficient. The default value is 1. |

Suite à mes essais concluant en réel des EA de Evren et après avoir backtester Cybele Unbound, j'ai décidé de sauter le pas de d'acheter l'EA. Il s'est passé plus jours, voir même quelques 2 à 3 semaines en plein mois d'août sans que l'EA ne prenne position. Puis d'un coup la semaine dernière il s'est mit à prendre position. Je joue les EA avec précaution, et la semaine dernière cet EA m'a rapporté 1 % de mon capital sans prise de tête. J'envisage désormais de monter un compte secondaire, moins de capital mais un profil plus risqué afin profiter pleinement du potentiel de cet EA !