Tyrell Strategy 3

- 专家

- Alessandro Bertoli

- 版本: 1.0

- 激活: 10

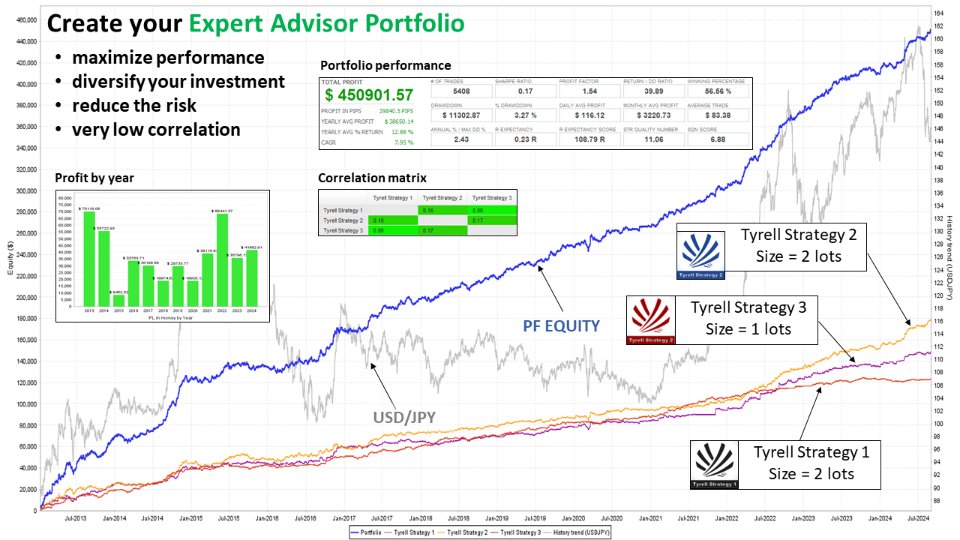

Tyrell Strategy 3 is a professional trading strategy based on the key concepts of Technical Analysis and developed by a team of traders and programmers with many years of experience.

The Expert Advisor operates by placing pending Buy Stop orders and has the aim of identifying the reversal phases and riding the new trend until it runs out.

The Expert Advisor operates by placing pending Buy Stop orders and has the aim of identifying the reversal phases and riding the new trend until it runs out.

Tyrell Strategy 3 is equipped with several risk management systems, including a trailing stop that intervenes once the market order exceeds a specific profit threshold. An additional protection system prevents the Expert Advisor from placing orders when the risk is too high. Finally, the Expert Advisor includes a time filter that allows it to place pending orders only in specific time slots of the day.

The user can select the preferred Money Management technique among:

- fixed size

- automatic size increase with each balance increase

- maximum monetary risk for each operation (calculated with respect to the Stop Loss)

- maximum risk as a percentage of the balance for each operation (calculated with respect to the Stop Loss)

Advantages

- is NOT a grid system

- is NOT a martingale system

- is NOT a price mediation system

- is NOT a fake AI system

- Each position has its own Stop Loss

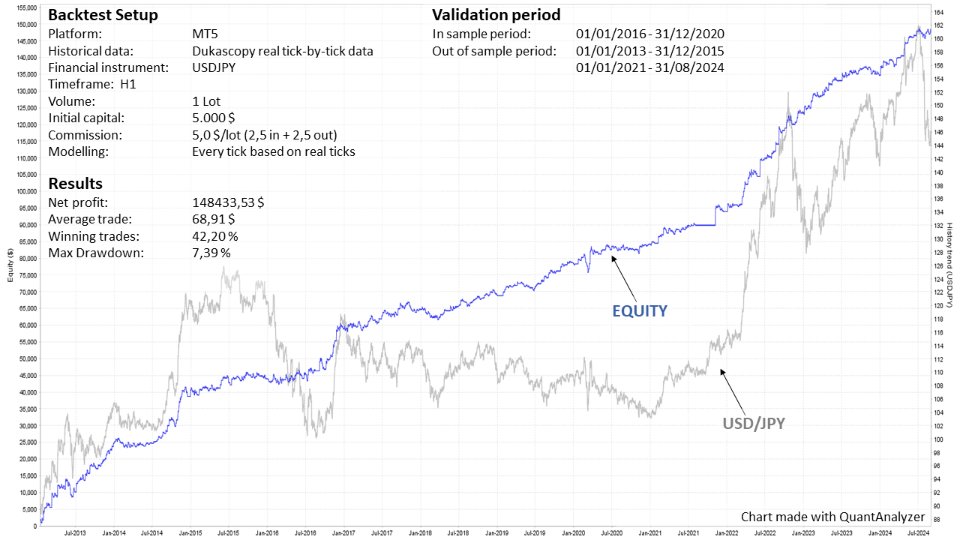

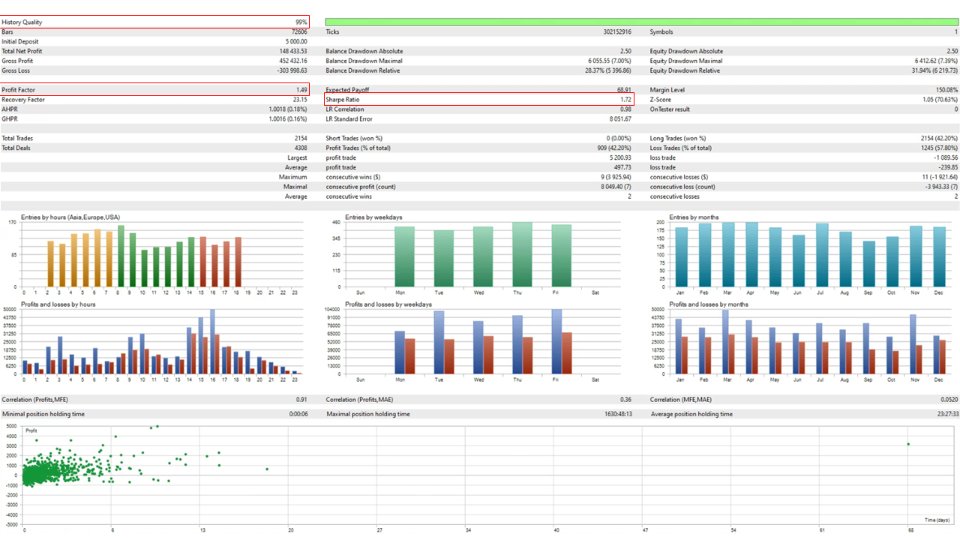

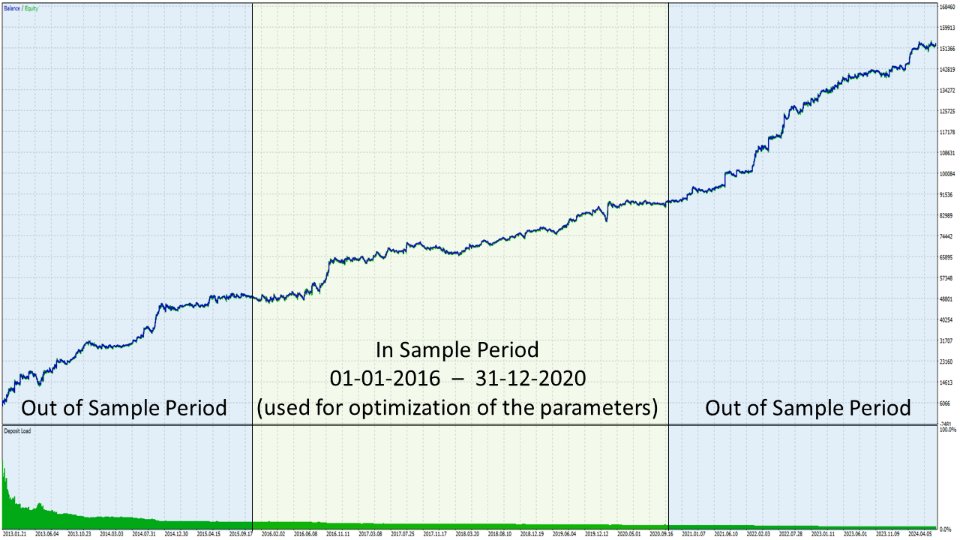

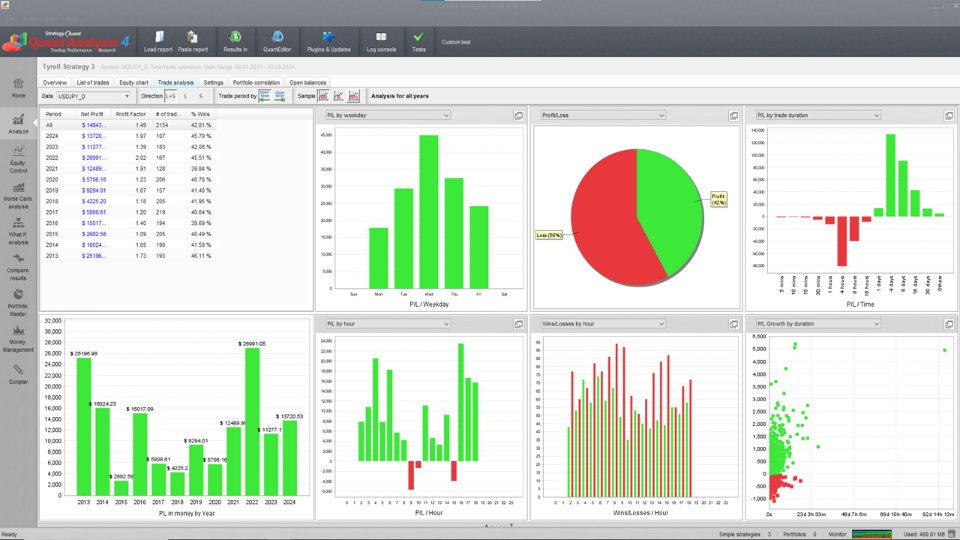

- The EA has been validated using the Walk Forward Analysis method with excellent results since 2013

Minimum requirements and recommendations

- Currency pair: USDJPY

- Timeframe: H1

- Broker: any broker with a low spread

- Minimum deposit: $100

- Leverage: at least 1:30

- Account type: Hedging

Strategy Tester

- Currency pair: USDJPY

- Timeframe: H1

- Modellling: Every tick based on real ticks

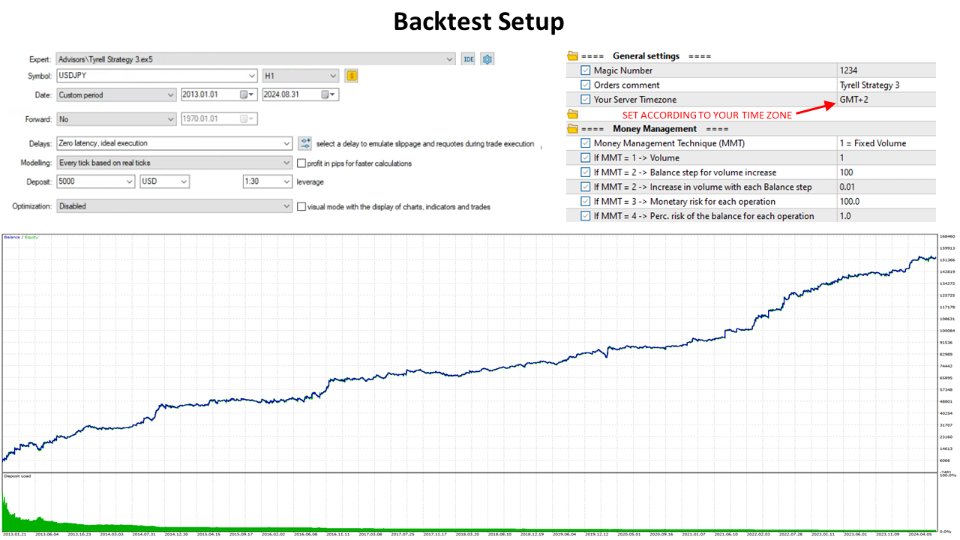

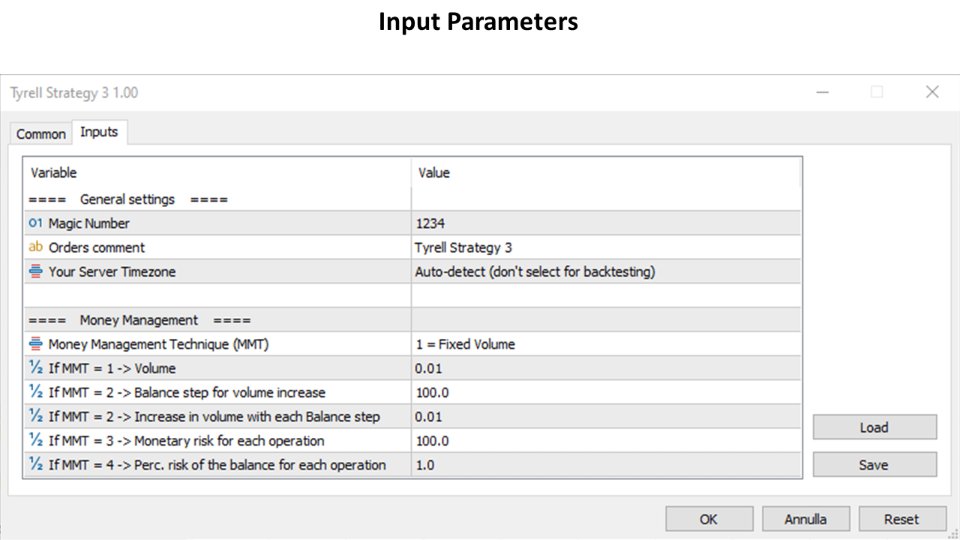

Input parameters

General settings

- Magic Number: EA Magic Number, it is important to set a different Magic Number for each Expert Advisor activated on the platform

- Order Comment: comment to assign to buy and sell orders

- Your Server Timezone = Metatrader server time zone (see note at the bottom)

Money Management

- Money Management Technique (MMT): select your preferred MM method

- If MMT = 1 -> Volume: if the MM method set is 1, set the volume of each operation

- If MMT = 2 -> Balance step for volume increase: if the MM method set is 2, set the Balance increment to allow an increase in the volume of the operation (see next point)

- If MMT = 2 -> Increase in volume with each Balance step: if the MM method set is 2, set the increase in operation volume once the balance increment is reached

- If MMT = 3 -> Monetary risk for each operation: if the MM method set is 3, indicate the maximum monetary risk accepted for each operation in reference to the Stop Loss

- If MMT = 4 -> Perc. risk of the balance for each operation: if the MM method set is 4, indicate the percentage of the Balance that you want to risk for each operation in reference to the Stop Loss

ATTENTION: the Auto-detect function that automatically detects the platform's time zone cannot be used during backtests, so the time zone must be set manually. To set the time zone, check the time indicated on Metatrader in the Market Watch window and the UTC time on any online site. For example, if the Metatrader time is 14:32:00, while the UTC time is 12:32:00, the value to enter is "+2" because 14-12 = +2. If instead the Metatrader time is 9:32:00, the value to enter is "-3" because 9-12 = -3.