SX Golden MA Pack MT5

- 指标

- Mojtaba Sarikhani

- 版本: 1.0

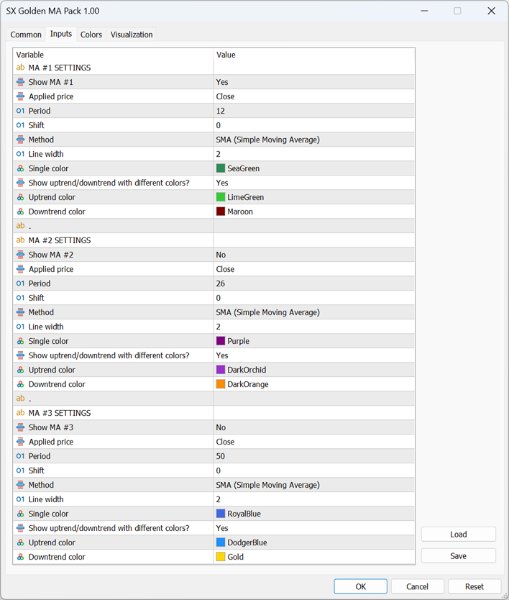

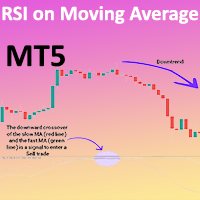

This comprehensive technical indicator calculates and plots up to 3 moving averages with 3 different periods. By employing three moving averages of distinct lookback periods, the trader can confirm whether the market has indeed experienced a change in trend or whether it is merely pausing momentarily before resuming its prior state.

SX Golden MA Pack for MT4 is available here.

The shorter the moving average period, the more closely it tracks the price curve. When a security initiates an uptrend, faster moving averages (short-term) will start rising much earlier than the slower moving averages (long-term).

The third moving average is utilized in conjunction with the other two moving averages to validate or refute the signals they produce. This diminishes the likelihood of the trader acting on false signals.

There are 36 different averaging methods that can be chosen for each of the three MAs:

Basic Moving Averages:

- SMA (Simple Moving Average)

- EMA (Exponential Moving Average)

- SMMA (Smoothed Moving Average)

- LWMA (Linear Weighted Moving Average)

- Median (Moving Median)

Volume-Weighted Moving Averages:

- VWMA (Volume Weighted Moving Average)

- eVWMA (Modified eVWMA)

- VEMA (Volume-weighted Exponential Moving Average)

Advanced Exponential Moving Averages:

- DEMA (Double Exponential Moving Average by Patrick Mulloy)

- TEMA (Triple Exponential Moving Average by Patrick Mulloy)

- TsEMA (Triple Smoothed Exponential Moving Average)

- ZEMA (Zero-Lag Exponential Moving Average)

- REMA (Regularized Exponential Moving Average by Chris Satchwell)

- Wilder (Wilder Exponential Moving Average)

- EWMA (Exponentially Weighted Moving Average)

Specialized Moving Averages:

- HMA (Hull Moving Average by Alan Hull)

- ALMA (Arnaud Legoux Moving Average)

- MD (McGinley Dynamic)

- SuperSmu (SuperSmoother by John Ehlers)

- SineWMA (Sine Weighted Moving Average)

Regression and Least-Squares-Based Moving Averages:

- LSMA (Least Square Moving Average, or EPMA/Linear Regression Line)

- ILRS (Integral of Linear Regression Slope)

- IE_2 (Combination of LSMA and ILRS)

Filter-Based Moving Averages by John Ehlers:

- BF2P (Two-Pole modified Butterworth Filter by John Ehlers)

- BF3P (Three-Pole modified Butterworth Filter by John Ehlers)

- Decycler (Simple Decycler by John Ehlers)

- ITrend (Instantaneous Trendline by John Ehlers)

- Laguerre (Laguerre filter by John Ehlers)

Hybrid or Other Advanced MAs:

- GeoMean (Geometric Mean)

- JSmooth (Jurik Smoothing by Mark Jurik)

- T3 (Correct version by Tim Tillson)

- T3_basic (Original version by Tim Tillson)

- TriMA (Triangular Moving Average)

- TriMAgen (Triangular Moving Average generalized by John Ehlers)

- DsEMA (Double Smoothed EMA)

- SMA_eq (Simplified SMA)

The selection of applied prices used to calculate moving averages is as follows:

Standard Prices:

- Close

- Open

- High

- Low

Derived Prices:

- Median: (High + Low) / 2

- Typical: (High + Low + Close) / 3

- Weighted Close: (High + Low + Close + Close) / 4

- Median Body: (Open + Close) / 2

- Average: (High + Low + Open + Close) / 4

Trend-Biased Prices:

- Trend Biased

- Trend Biased (extreme)

Heiken Ashi Prices:

- Heiken Ashi Close

- Heiken Ashi Open

- Heiken Ashi High

- Heiken Ashi Low

- Heiken Ashi Median: (Heiken Ashi High + Heiken Ashi Low) / 2

- Heiken Ashi Typical: (Heiken Ashi High + Heiken Ashi Low + Heiken Ashi Close) / 3

- Heiken Ashi Weighted Close: (Heiken Ashi High + Heiken Ashi Low + Heiken Ashi Close + Heiken Ashi Close) / 4

- Heiken Ashi Median Body: (Heiken Ashi Open + Heiken Ashi Close) / 2

- Heiken Ashi Average: (Heiken Ashi High + Heiken Ashi Low + Heiken Ashi Open + Heiken Ashi Close) / 4

- Heiken Ashi Trend Biased

- Heiken Ashi Trend Biased (extreme)

All three moving averages are fully customizable. Additionally, you can choose to plot each moving average in a single color or two colors based on uptrend or downtrend.

#Tags: Triple Moving Average Crossover Strategy, Moving Average Trading Strategies, Up Trend, Down Trend, Heiken Ashi

DISCLAIMER: Please notice that we do not provide any financial advice. We only provide tools for anyone interested in improving their trading.

This indicator works very well. Lots of options for the various indicator types and its great that you can use one indicator template to show up to three MA's. Nice work