RSI Rush

- 指标

- MARTIN ANDRES DEL NEGRO

- 版本: 1.0

- 激活: 5

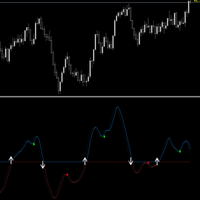

Certainly! Let’s discuss the RSI Rush, an aggressive momentum indicator that combines weighted moving averages (WMAs) at lows, mid-price, and tight highs. Here are the key components:

-

Weighted Moving Averages (WMAs):

- The RSI Rush employs three WMAs:

- WMA at Lows: Calculated based on the lowest prices during a specific period.

- WMA at Mid-Price: Considers the average price (midway between highs and lows) during the same period.

- WMA at Tight Highs: Based on the highest prices during the specified timeframe.

- These WMAs provide a smoothed representation of price action.

- The RSI Rush employs three WMAs:

-

Entry During Aggressive Phase:

- The RSI Rush aims to enter trades during the aggressive phase of price movement.

- An aggressive phase occurs when the price crosses above or below the central line (typically the 50 level).

- Crossing above the central line signals potential bullish movement.

- Crossing below the central line signals potential bearish movement.

-

Tight Price Action:

- The RSI Rush focuses on tight price ranges.

- Tight highs and lows indicate reduced volatility and potential breakouts.

- The indicator seeks to capture these breakouts during the aggressive phase.

-

Relative Strength Index (RSI):

- While not explicitly mentioned, the RSI Rush likely incorporates RSI as part of its analysis.

- RSI helps confirm overbought or oversold conditions, aligning with the concept of the aggressive phase.

In summary, the RSI Rush identifies high-probability entry points based on weighted moving averages, adjusted price action, and RSI signals. Traders can use this indicator to enhance their trading strategies and improve timing for their trades.