PTraderMAHigh

- 专家

- Christopher Louis Barry

- 版本: 1.0

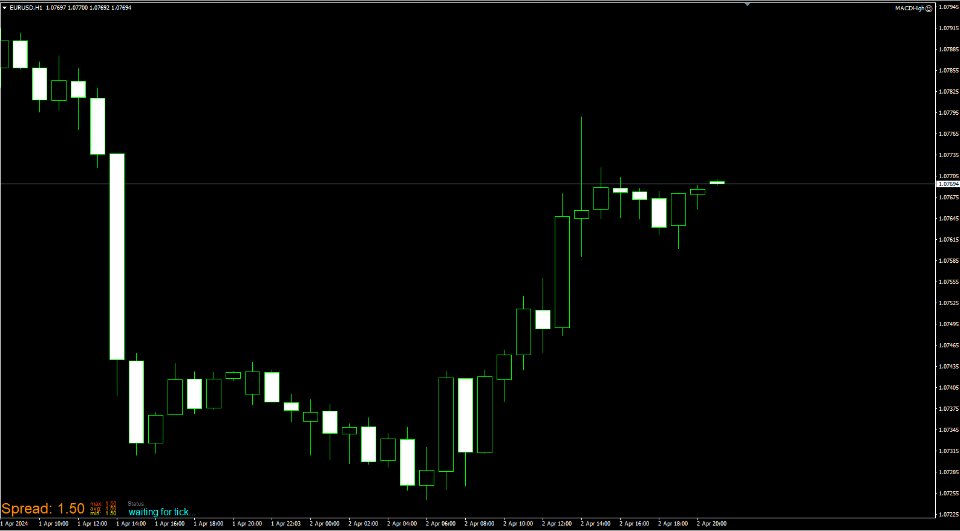

A Moving Average (MA) Trading Expert Advisor (EA) for MetaTrader 4 (MT4) is an automated trading system designed to execute trades based on signals generated by one or multiple moving averages. Moving averages are a popular technical analysis tool used to smooth out price data and identify trends. Here's a description of how a Moving Average Trading EA typically operates:

-

Moving Averages Used: The EA utilizes one or more moving averages to generate buy or sell signals. Common choices include the simple moving average (SMA), exponential moving average (EMA), or a combination of different types of moving averages.

-

Signal Generation: Buy and sell signals are generated based on the relationship between the price and the moving average(s). For example, a buy signal may occur when the price crosses above a moving average, indicating potential upward momentum, while a sell signal may occur when the price crosses below a moving average, suggesting potential downward momentum.

-

Confirmation Filters: To improve the accuracy of signals and reduce false signals, the EA may incorporate additional confirmation filters. These filters could include other technical indicators, such as oscillators (e.g., RSI, Stochastic) or trend-following indicators (e.g., MACD), as well as support and resistance levels or candlestick patterns.

-

Trade Execution: Once a valid signal is generated, the EA automatically executes trades according to predefined parameters set by the trader. This includes determining the position size, stop loss, take profit, and any other trade management rules. The EA operates continuously without the need for manual intervention, allowing traders to capitalize on trading opportunities 24/5.

-

Risk Management: Proper risk management is crucial in any trading strategy, including those automated by an EA. The Moving Average Trading EA should incorporate features to manage risk, such as setting a maximum percentage of the account balance to risk per trade, implementing trailing stops to protect profits, and incorporating a maximum drawdown limit to preserve capital.

-

Backtesting and Optimization: Before deploying the EA in live trading, it's essential to conduct thorough backtesting and optimization to evaluate its performance under various market conditions and parameter settings. This helps identify any weaknesses or areas for improvement and fine-tune the EA for optimal results.

-

Monitoring and Maintenance: Although the Moving Average Trading EA operates automatically, it still requires regular monitoring to ensure it's functioning correctly and to make any necessary adjustments. Market conditions can change over time, requiring updates to the EA's parameters or even its underlying strategy.

In summary, a Moving Average Trading EA for MT4 offers traders a systematic approach to trading based on signals generated by moving averages. By automating the trading process, it allows traders to execute their strategies consistently and efficiently while minimizing emotional biases. However, traders should actively monitor the EA to ensure its effectiveness and make adjustments as needed.

Really Insane!!! Just 1 trade en a lot of profit on my T4T account. I don't get the EA on the chart of a Vantage account. Wenn someone knows the reason why this happens? I defenitly want to buy this EA! Congratulation to the author!!!