Va bank

- 专家

- Viktor Glovluk

- 版本: 1.3

- 更新: 18 十一月 2021

- 激活: 5

This multi-currency EA analyzes the last closed candle of a specified timeframe (Weekly is recommended), calculated candle body and, if it exceeds the set parameter, opens an order in the opposite direction from the calculated price. Pairs are specifies in the EA's settings. It has the trailing stop function. You can also set a trading day (for D1, W1) and day of closing open orders.

Specify trading type in settings: all pairs or by the largest candle body.

Manual tests of the strategy using "by the largest candle body" parameter have revealed the ratio of profitable trades equal to 6/1. This strategy can also be used for boosting a deposit with increased risk per trade, as profit is highly probable.

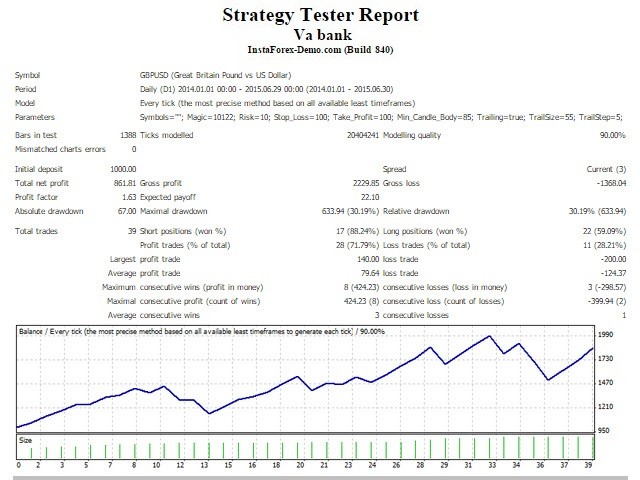

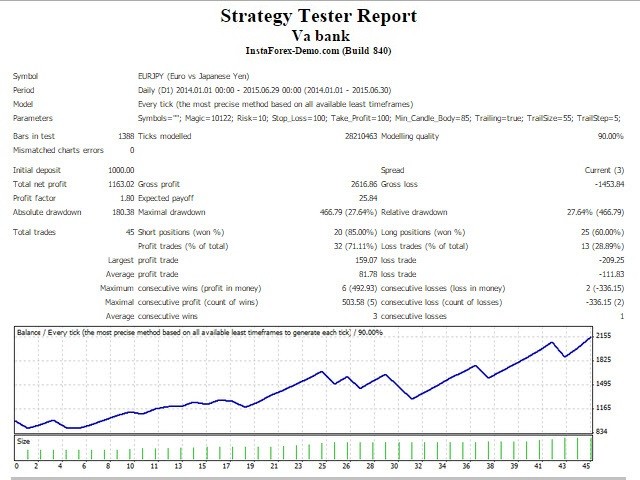

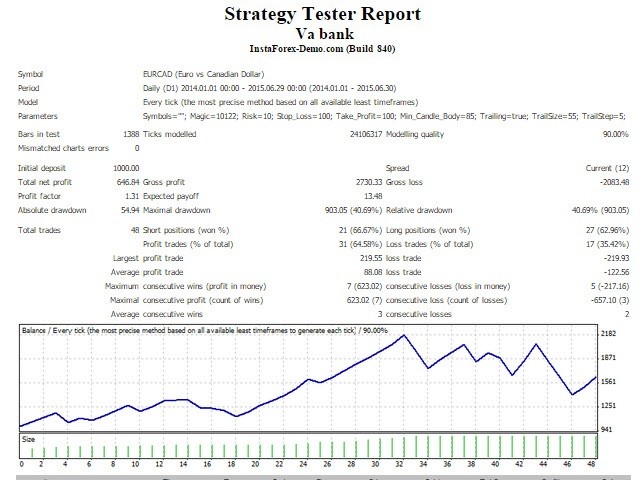

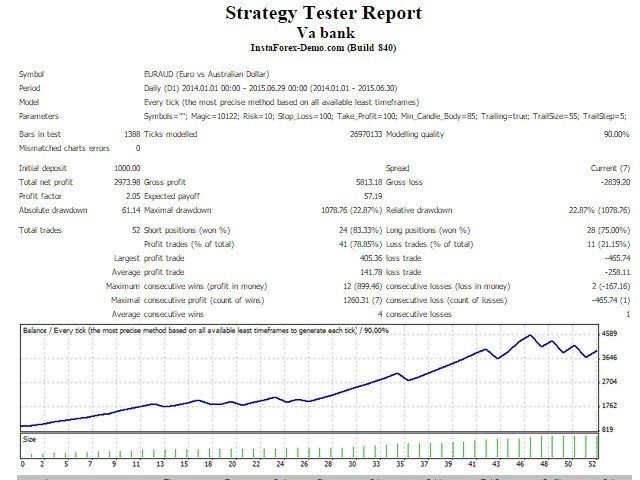

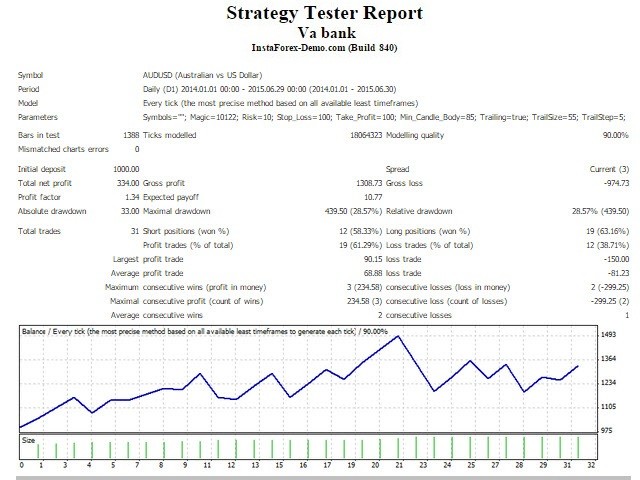

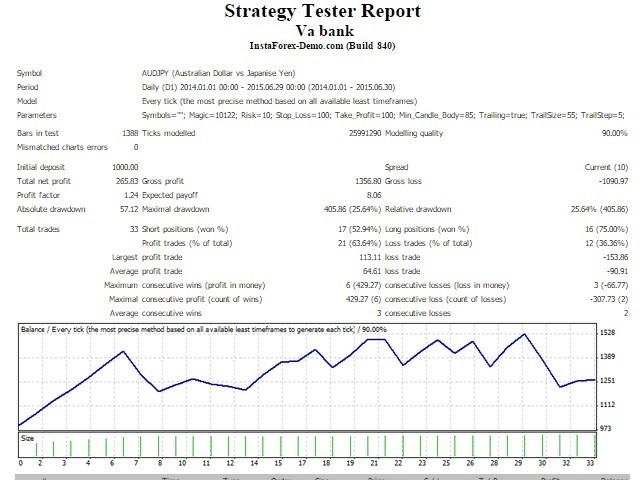

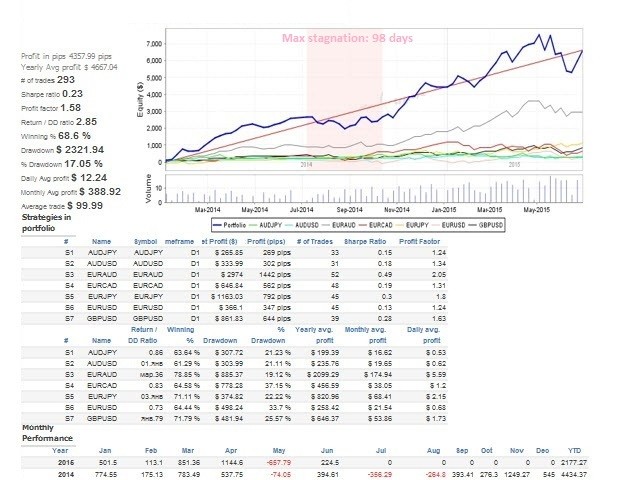

Automated tests of 7 pairs and subsequent portfolio preparation have revealed the ratio of profitable trades equal to 68.6%. If you use the latter version, we recommend to reduce risk per trade to 10%, as several orders can be opened at a time.

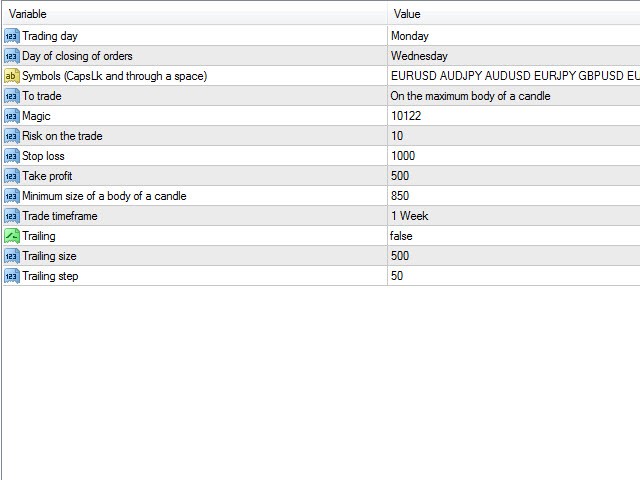

Settings

- Trading day - day to open orders (for D1, W1)

- Day of closing of orders - day to close orders

- Symbols (CapsLk and through a space) - traded pairs (use Caps Lock and divide by space), leave blank or enter one tested pair when testing in the strategy tester

- To trade - trading type (All pairs, By the largest candle body)

- Magic - order magic number

- Risk on the trade - risk per trade as percentage

- Stop loss - stop loss

- Take profit - take profit

- Minimum size of a body of a candle (For every symbol and through a space) - minimum size of the candle to open an order

- Trade timeframe - trading period

- Trailing - enable/disable trailing stop

- Trailing size - points to start trailing

- Trailing step - distance in points for trailing

- For optimization - optimization block

- Minimum size candle body - minimum acceptable candle body to open an order

works well over the long term