National Prise Reversal

- 指标

- Alexey Surkov

- 版本: 23.31

- 更新: 3 三月 2023

- 激活: 20

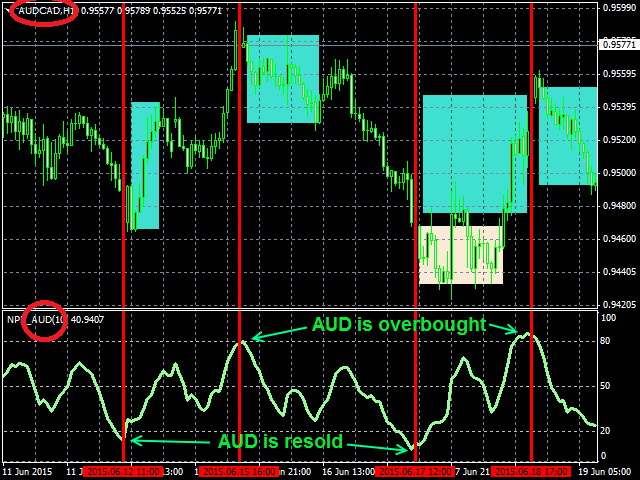

The National Prise Reversal indicator represents an oscillator of a national currency (options: USD, CAD, CHF, JPY, GBP, EUR, AUD. It is based on already known Prise Reversal oscillator. But it analyzes particularly movement of a selected national currency on pairs with other specified currencies. Basing on these data the National Prise Reversal indicator determines overbought or oversold of the selected currency. When the indicator is in the overbought zone, it indicates possible weakening of of the corresponding currency which may soon happen on specified pairs. When the indicator is in the oversold zone, it indicates potential growth of this currency.

The idea of the indicator usage is described in detail in the article The Indicator of Overbought and Oversold of National Currency.

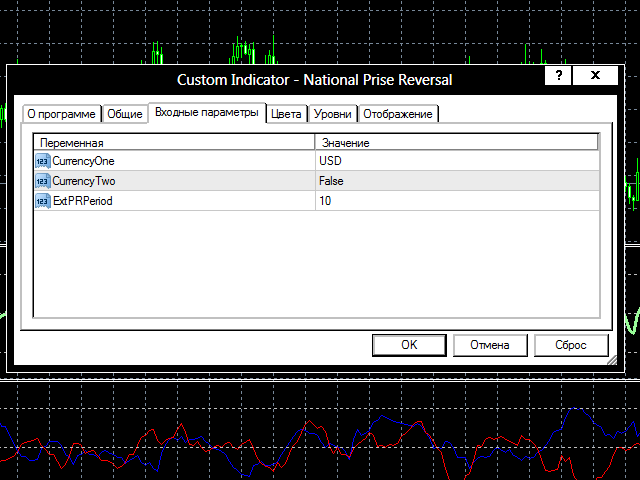

Indicator input parameters:

- CurrencyOne - currency No.1. Default value is USD, displayed as a blue chart. If you want data concerning other national currencies to be displayed, use following symbols: CAD, CHF, JPY, GBP, EUR, AUD.

- CurrencyTwo - currency No.2. Default value is False (not displayed). If you want data concerning national currencies to be displayed, use following symbols: USD, CAD, CHF, JPY, GBP, EUR, AUD (red chart).

- ExtPRPeriod – period to calculate the indicator. Default value is 10.