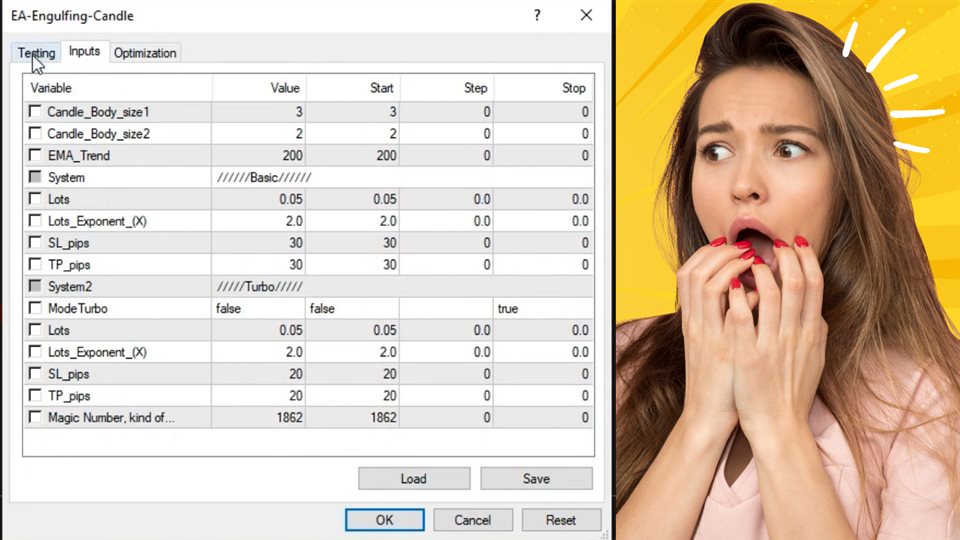

EA Engulfing Candle

- 专家

- Zafar Iqbal Sheraslam

- 版本: 1.0

- 激活: 5

An EA Engulfing Candle is a significant pattern in technical analysis often used in financial markets, especially in trading stocks, forex, and other assets. It occurs on candlestick charts and is a reliable indicator of potential trend reversals or continuation.

An Engulfing Candle consists of two consecutive candlesticks, usually representing two trading periods (e.g., two days for daily charts). The second candlestick "engulfs" the first one, meaning its body completely covers the body of the previous candlestick. There are two types of Engulfing Candles:

-

Bullish Engulfing Candle: This pattern occurs after a downtrend. The first candle is a bearish one, indicating selling pressure. However, the second candle is larger and bullish, meaning buyers have taken control, pushing the price up and covering the entire body of the previous candle. This suggests a potential reversal from a downtrend to an uptrend.

-

Bearish Engulfing Candle: This pattern occurs after an uptrend. The first candle is a bullish one, showing buying pressure. The second candle is larger and bearish, indicating that sellers have taken over and pushed the price down, completely engulfing the first candle's body. This signals a potential reversal from an uptrend to a downtrend.

Engulfing Candles are considered stronger signals if they occur after a prolonged trend and are accompanied by other technical indicators or chart patterns that support the reversal or continuation prediction. Traders often use these patterns in combination with other analysis methods to make informed trading decisions.

It's important to note that while Engulfing Candles can provide valuable insights, they are not foolproof and should be used as part of a comprehensive trading strategy, taking into account other factors such as volume, trendlines, and support/resistance levels. As with any trading strategy, there is still a level of risk involved, and traders should manage their risk appropriately.