工作已完成

指定

Hi guys,

I'm currently looking for a competent developer to assist me in writing a suitable EA that will comply to all my requirements. Only candidates with a high repute would be considered. The basic operation of the EA as described in this document should cover all my requirements as well as the expected functionality of the EA. A few optional features would be added but these would not be required within the final EA, compensation to include these optional features would be discussed and the value would be considered to justify the additional functionality. Apart from the compiled EX5 code, the source MQ5 code should also be provided and this should be in a neat structure, with comments to all functions, variables, actions etc. to ease modification of the EA if required and to allow for the addition of code not disclosed within this document. My native language is not English, thus if anything is unclear, wrong terminology used, contradicting statements etc., please feel free to contact me for any clarifications.

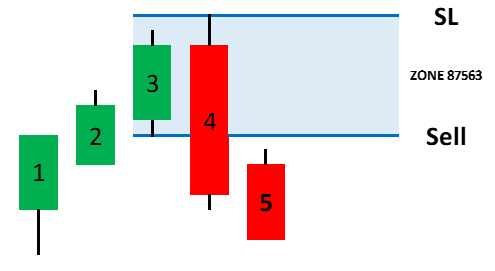

The idea of the trading system is as follows: The EA is meant to be used during a Bullish Market Trend and should place Sell Limits and Stop Losses at mathematical logic levels obtained during the execution of the EA, these levels would be obtained during the formation of a Bearing Engulfing Pattern, potentially including levels obtained from candles leading up to the Bearish Engulfing Pattern. The Bearish Engulfing Pattern should follow a strict set of mathematical logic levels to be considered a Valid Zone. Should the Bearish Engulfing Pattern fail to comply with the Logic Levels required then the Zone would not be valid. Should the Zone be valid, a Sell Entry would be placed at a predetermined level within the Demarcated Zone. During the Sell Entry a Trend Reversal would be expected resulting in profit, if not, the Sell Entry would remain open until it would reach a demarcated SL Zone where the trade would be closed. This strategy has been tested with a high result of accuracy and a favorable Win/Loss Ratio. Exact Structure as follows:

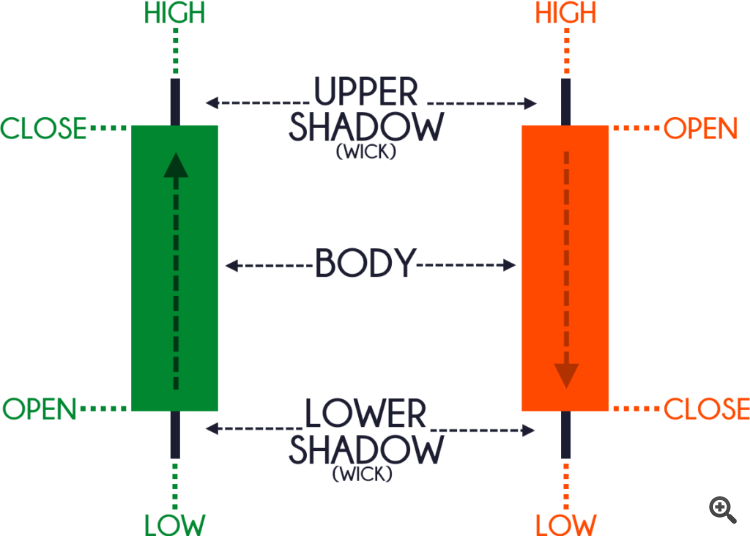

Trading Signals: The Bearish Engulfing Signal would be the only signal used to prequalify trading positions*.

Trading Zone Qualifications: A suitable trading zone would only be valid should the following conditions be met during a Bearish Engulfing Signal:

- The Closing Price of the Bullish Candle (3) would be equal to the Opening Price of the Bearish Candle (4).

- Provision should be made for an adjustable quantity of Bullish Candles preceding the final Bullish Candle (3). For example 0 - 10 Candles. Should any of these candles break the structure, such as a Bearish Candle the Signal would be void.

- Provision should be made for an adjustable quantity of Bearish Candles following the Bearish Engulfing Candle (4). For example 0 - 10 Candles. Should any of these candles break the structure, such as a Bullish Candle the Signal would be void.

- Provision should be made for the Bearish Engulfing Candle (4) to be larger than the Bearish Candle by a factor, for example to allow for either a ratio or a percentage. A useable range would be 100 - 500% larger than the Bullish Candle (3).

- Provision should be made for a Sell Stop to be placed in one of two areas when all other conditions are satisfied. The Sell Stop should be placed at either the Low Point (wick) or the Open Price of the Bullish Candle (3).

- Provision should be made for a Stop Loss to be placed in one of three areas when all other conditions are satisfied. The Stop Loss should be placed at either the High Point (wick) of Candle 3 or 4, or the Close Price of the Bullish Candle (3).

- The Zone should be clearly marked out as per the example, Sell as an entry point as well as SL for a closing point should clearly be indicated. A fill colour should be used between the two vertical zone lines to indicate an existing zone. The Zone Number as indicated should be omitted as this would not be required.

Trading Zone Voiding: Existing Trading Zones could be voided in two ways, when this should happen the Existing Trading Zone would be Void and should be deleted from the current graph. This could happen due to various reasons such as:

- When a Trade (Sell Entry) enters a Valid Trading Zone, but does not produce any profit and closes in the Stop Loss Zone.

- When market movement enters Valid Trading, places a Trade (Sell Entry), the Market turns into an opposite direction before reaching SL. Regardless if profit has been made or BE has been reached, the Valid Trading Zone is Void.

- When the market moves higher than previous Zones, these Zones should be Void.

- When a Zone reaches a predetermined time as set in Trading Parameters.

Positions are opened: Positions (Sell Entries) should only be opened in Valid Zones at the Selected Entry Point.

Positions are closed: Positions (Sell Entries) should only be closed by the following:

- If the position would reach the SL Level in a Valid Trading Zone.

- If a position should reach a Trailing Stop as specified in Trading Parameters.

- If a position should reach a Trailing Pips Stop function*, Value to be provided in Parameters. This should allow a profitable trade to retrace for a preset quantity of Pips before the trade is closed, similar to Trailing Stop but allowing for a closer margin.

Adjustable Trading Parameters: The following should be adjustable to suit the End Users' requirements. Description - Default

- Lot Size - 0.50

- Enable Stop Loss - Yes

- Stop Loss Value - 500

- Enable Trailing Stop - Yes

- Trailing Stop Value - 200

- Enable PIP Stop - Yes

- PIP Stop Value - 250

- Commodity - XAU/USD

- Timeframe - 30M

- Valid Zone Expiry - 6H

- Trading Days - Mon, Tue, Wed etc. All selectable.

- Trading Times - For each day, adjustable from 00h00 to 23h59 GMT.

- Open Lots - 1

- Magic Number - 123456

- Bullish Candles before Bearish Engulfing - 2

- Bearish Candles after Bearish Engulfing - 2

- Bearish Engulfing Candle Ratio to Bullish Candle 1: - 3

For Testing Purposes: The EA should be provided with all the functions as requested. A date limit to allow for at least 7 days should be allowed for testing purposes. The EA should be able to operate on all market, Financials and Synthetics as provided by Deriv to test the functionality Modules, in addition the timeframe should be adjustable to allow for testing on faster moving synthetic markets to test functionality at a faster pace in order not to delay the testing process. The EA may be locked to Demo Account numbers if required.

Budget: The budget for this project is flexible and entirely up to the experience of the Coder and the duration in which the project would be completed. Suggestions to improve the functionality of the existing code as well as pointing out any flaws would significantly raise the odds in your favour.