这个问题没有完全定义。如果你说你想冒2%的风险,那么你必须固定其中的一个变量:止损水平或交易量。既然你问的是计算手数,这意味着你不希望它被固定,但这需要你对止损点感兴趣,尽管你说你不感兴趣。如果你没有止损,那么冒2%的风险意味着采取固定的手数,例如1.0,并等到你目前的损失达到初始保证金的2%。你不需要在这里计算手数,因为你看到了。

一旦止损水平进入视野,计算就简单了。

double tradeVolume =AccountFreeMargin() * Risk/100 / ( StopLossPoints * MarketInfo( Symbol(), MODE_TICKVALUE )。

也就是说,给定任何特定交易的止损水平,如果采取了止损,你将永远有初始保证金的指定百分比的损失。

你还想通过MODE_LOTSTEP将结果值归一化,并以MODE_MINLOT和MODE_MAXLOT为上限。

这个问题没有完全确定。如果你说你想冒2%的风险,那么你必须固定其中一个变量:止损水平或交易量。既然你问的是计算手数,这意味着你不希望它被固定,但这需要你对止损点感兴趣,尽管你说你没有。如果你没有止损,那么冒2%的风险意味着采取固定的手数,例如1.0,并等到你目前的损失达到初始保证金的2%。你不需要在这里计算手数,因为你看到了。

一旦止损水平进入视野,计算就很简单了。

double tradeVolume = AccountFreeMargin() * Risk/100 / ( StopLossPoints * MarketInfo( Symbol(), MODE_TICKVALUE ) ) 。

也就是说,给定任何特定交易的止损水平,如果止损,你将总是损失你初始保证金的指定百分比。

你还想通过MODE_LOTSTEP将结果值归一化,并以MODE_MINLOT和MODE_MAXLOT为上限。

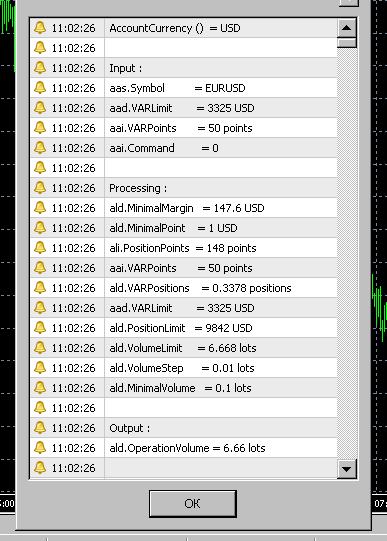

这在一个迷你账户上产生的答案是6.66。 这似乎是正确的吗?

double risk3 = 2.0;

stopLossPips = 30;

double orderLotSize3 = AccountFreeMargin() * risk3/100 / ( stopLossPips * MarketInfo( Symbol(), MODE_TICKVALUE ) ) 。

orderLotSize3 = orderLotSize3 - MathMod( orderLotSize3, 2*MarketInfo( Symbol( ), MODE_LOTSTEP ))。

orderLotSize3 = NormalizeDouble(orderLotSize3, 2);

Hello.

int init ()

{

double ad.Volume ;

string as.Symbol = "EURUSD" ;

double ad.LotStep = MarketInfo ( as.Symbol , MODE_LOTSTEP ) ;

double ad.MinimalVolume = MarketInfo ( as.Symbol , MODE_MINLOT ) ;

double ad.NominalLot = MarketInfo ( as.Symbol , MODE_LOTSIZE ) ;

double ad.NominalMargin = MarketInfo ( as.Symbol , MODE_MARGINREQUIRED ) ;

double ad.QuoteAsk = MarketInfo ( as.Symbol , MODE_ASK ) ;

double ad.QuoteBid = MarketInfo ( as.Symbol , MODE_BID ) ;

double ad.EquityQuant = 0.01 ;

double ad.MarginLimit = AccountEquity () * ad.EquityQuant ;

double ad.VolumeLimit = ad.MarginLimit / ad.NominalMargin ;

if ( ad.VolumeLimit < ad.MinimalVolume )

ad.Volume = 0 ;

else { int ai.Steps = MathFloor ( ( ad.VolumeLimit - ad.MinimalVolume ) / ad.LotStep ) ;

ad.Volume = ad.MinimalVolume + ad.LotStep * ai.Steps ; }

double ad.Leverage = AccountLeverage () ;

double ad.RealLeverage = ad.Leverage ;

double ad.MarginBuy.1 = ad.QuoteAsk * ad.Volume * ad.NominalLot / ad.RealLeverage ;

double ad.MarginSell.1 = ad.QuoteBid * ad.Volume * ad.NominalLot / ad.RealLeverage ;

double ad.MarginBuy.2 = AccountFreeMargin () - AccountFreeMarginCheck ( as.Symbol , OP_BUY , ad.Volume ) ;

double ad.MarginSell.2 = AccountFreeMargin () - AccountFreeMarginCheck ( as.Symbol , OP_SELL , ad.Volume ) ;

Alert ( "ad.MarginSell.2 = " , ad.MarginSell.2 , " " , AccountCurrency () ) ;

Alert ( "ad.MarginBuy.2 = " , ad.MarginBuy.2 , " " , AccountCurrency () ) ;

Alert ( "ad.MarginSell.1 = " , ad.MarginSell.1 , " " , AccountCurrency () ) ;

Alert ( "ad.MarginBuy.1 = " , ad.MarginBuy.1 , " " , AccountCurrency () ) ;

Alert ( "ad.Volume = " , ad.Volume , " " , "lots" ) ;

Alert ( "Output :" ) ;

Alert ( " " ) ;

Alert ( "ai.Steps = " , ai.Steps ) ;

Alert ( "ad.LotStep = " , ad.LotStep , " " , "lots" ) ;

Alert ( "ad.MinimalVolume = " , ad.MinimalVolume , " " , "lots" ) ;

Alert ( "ad.VolumeLimit = " , ad.VolumeLimit , " " , "lots" ) ;

Alert ( "ad.MarginLimit = " , ad.MarginLimit , " " , AccountCurrency () ) ;

Alert ( "ad.NominalMargin = " , ad.NominalMargin , " " , AccountCurrency () ) ;

Alert ( "ad.RealLeverage = " , ad.RealLeverage ) ;

Alert ( "ad.NominalLot = " , ad.NominalLot , " " , StringSubstr ( as.Symbol , 0 , 3 ) ) ;

Alert ( "Processing :" ) ;

Alert ( " " ) ;

Alert ( "ad.EquityQuant = " , ad.EquityQuant ) ;

Alert ( "AccountEquity () = " , AccountEquity () , " " , AccountCurrency () ) ;

Alert ( "as.Symbol = " , as.Symbol ) ;

Alert ( "Input :" ) ;

Alert ( " " ) ;

Alert ( "AccountCurrency () = " , AccountCurrency () ) ;

} Ais.

2. Calculation of the "ad.Margin****.2" is more universal but some symbols may have miscounts.

3. Real leverage and "AccountLeverage ()" may differ.

4. Real leverage calculation formula depends on forex symbol parsing.

Example.

...

//<method 24>

int air.Ticker.Compute.4

(//<0>

){//<24>

if ( avi.Ticker.Conversion == ac.Direct )

{ avi.Ticker.ConversionDigits = avi.Ticker.QuoteDigits ;

avd.Ticker.ConversionAsk = avd.Ticker.QuoteAsk ;

avd.Ticker.ConversionBid = avd.Ticker.QuoteBid ;

avd.Ticker.RealLeverage = avd.Ticker.QuoteAsk * avd.Ticker.NominalLot / avd.Ticker.NominalMargin ; }

else if ( avi.Ticker.Conversion == ac.DirectCross )

{ avi.Ticker.ConversionDigits = MarketInfo ( avs.Ticker.ConversionSymbol , MODE_DIGITS ) ;

avd.Ticker.ConversionAsk = MarketInfo ( avs.Ticker.ConversionSymbol , MODE_ASK ) ;

avd.Ticker.ConversionBid = MarketInfo ( avs.Ticker.ConversionSymbol , MODE_BID ) ;

avd.Ticker.RealLeverage = ( avd.Ticker.ConversionAsk + avd.Ticker.ConversionBid ) / 2

* avd.Ticker.NominalLot / avd.Ticker.NominalMargin ; }

else if ( avi.Ticker.Conversion == ac.Inverse )

{ avi.Ticker.ConversionDigits = 8 - avi.Ticker.QuoteDigits ;

avd.Ticker.ConversionAsk = 1.0 / avd.Ticker.QuoteBid ;

avd.Ticker.ConversionBid = 1.0 / avd.Ticker.QuoteAsk ;

avd.Ticker.RealLeverage = avd.Ticker.NominalLot / avd.Ticker.NominalMargin ; }

else { avi.Ticker.ConversionDigits = 8 - MarketInfo ( avs.Ticker.ConversionSymbol , MODE_DIGITS ) ;

avd.Ticker.ConversionAsk = 1.0 / MarketInfo ( avs.Ticker.ConversionSymbol , MODE_BID ) ;

avd.Ticker.ConversionBid = 1.0 / MarketInfo ( avs.Ticker.ConversionSymbol , MODE_ASK ) ;

avd.Ticker.RealLeverage = ( avd.Ticker.ConversionAsk + avd.Ticker.ConversionBid ) / 2

* avd.Ticker.NominalLot / avd.Ticker.NominalMargin ; }

}//</method 24>

... 我认为获得一手所需保证金数额的最简单方法是

MarketInfo(Symbol(),MODE_MARGINREQUIRED);

我通常使用以下公式来计算手数。

double OneLotMargin = MarketInfo(Symbol(),MODE_MARGINREQUIRED);

double FreeMargin = AccountFreeMargin();

double lotMM = FreeMargin/OneLotMargin*Risk/100;

double LotStep = MarketInfo(Symbol(),MODE_LOTSTEP);

lotMM = NormalizeDouble(lotMM/LotStep,0)*LotStep;

然而,你问的是如何计算使用固定保证金的手数,例如200美元,在这种情况下,傻瓜式的公式应该改为。

double OneLotMargin = MarketInfo(Symbol(),MODE_MARGINREQUIRED);

double MarginAmount = 200; //this means we want to use 200$ for trade

double lotMM = MarginAmount/OneLotMargin;

double LotStep = MarketInfo(Symbol(),MODE_LOTSTEP);

lotMM = NormalizeDouble(lotMM/LotStep,0)*LotStep;

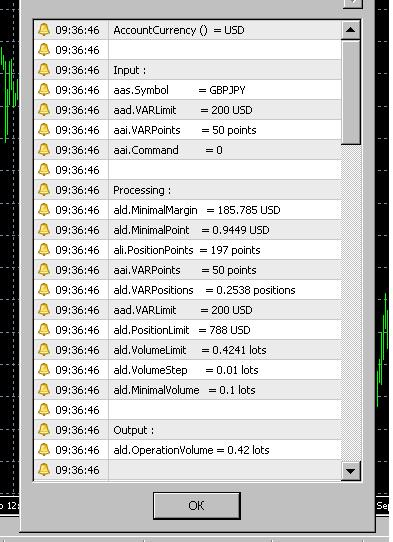

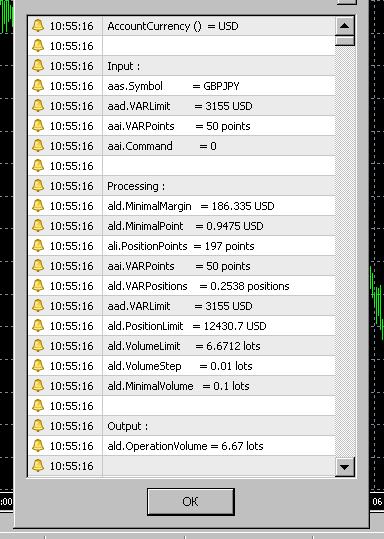

For example, "minimal lot" may be 0.10, "lot step" may be 0.01.

In this case, simple calculation methods may produce incorrect operation volume, for example, 0.05.

For example, "minimal lot" may be 0.10, "lot step" may be 0.01.

In this case, simple calculation methods may produce incorrect operation volume, for example, 0.05.

我正在使用你在'Ищу функцию вычисления размера лота.' 提及的代码。谢谢你。

我有一个关于这个代码的问题。它是否总是产生偶数的lotsize(如6.66而不是6.67)。

如果是这样,那很好。我只是不明白为什么它会这样做。

附件中的代码是以脚本文件的形式出现的,所以你可以把代码粘贴到一个新的脚本中并立即运行。

假设我的迷你账户有10,000美元的保证金,我想在下一笔交易中冒2%的风险(也就是说,只需用200美元买入<某个数量>的合约)。

[我意识到这是对 "风险 "的一种有限看法。我对止损点,或盈利目标,或其他什么都不感兴趣。]

使用MetaTrader,我从我的经纪人那里得到以下迷你账户信息。

accountLeverage =AccountLeverage(); //值 = 200

modeLotSize = MarketInfo("EURUSDm", MODE_LOTSIZE); // 值 = 10000

modeLotStep = MarketInfo("EURUSDm", MODE_LOTSTEP); // 值 = .01

modeMinLot = MarketInfo("EURUSDm", MODE_MINLOT)); // 值 = .01

问题:我如何计算200美元的手数? 知道最小手数的成本会很有用。在这种情况下,最小尺寸的手是0.01)。

问题:所有货币对的手数计算公式都一样吗?

非常感谢你的提议。