Claws and Horns / Profil

Claws and Horns

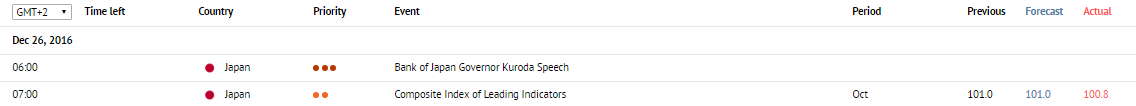

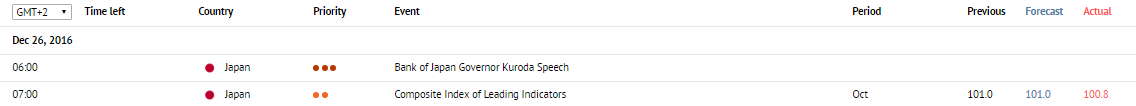

News of the day. 26.12.2016

BOJ Meeting Minutes. Japan 01:50

At 01:50 (GMT+2) protocols of the last meeting of the Bank of Japan will be published. Investors will be able to understand the mood inside the Japanese regulator and to find hints of further steps in monetary policy, which the bank can undertake.

BOJ's Kuroda speeks. Japan 06:00

At 06:00 (GMT+2) during a meeting of Japan Business Federation advisers, Head of Bank of Japan Haruhiko Kuroda will make a speech. He will share his vision on the state of the Japanese economy and may hint at further monetary actions of the Japanese regulator in the near future.

BOJ Meeting Minutes. Japan 01:50

At 01:50 (GMT+2) protocols of the last meeting of the Bank of Japan will be published. Investors will be able to understand the mood inside the Japanese regulator and to find hints of further steps in monetary policy, which the bank can undertake.

BOJ's Kuroda speeks. Japan 06:00

At 06:00 (GMT+2) during a meeting of Japan Business Federation advisers, Head of Bank of Japan Haruhiko Kuroda will make a speech. He will share his vision on the state of the Japanese economy and may hint at further monetary actions of the Japanese regulator in the near future.

Claws and Horns

News of the day. 23.12.2016

KOF Leading Indicator. Switzerland, 10:00 am

Data on the KOF Leading Indicator for December is due at 10:00 am (GMT+2). The index is based on 12 major economic indicators (including business activity in manufacturing and property sectors, consumer confidence and confidence in the banking sector) that represents the prospects of economic development for the next 6 months. For nearly all year, the index remained above 100 points. In December, it is expected to continue its growth, increasing from 102.2 to 103.1 points that might support the Franc.

Gross Domestic Product. Canada, 3:30 pm

Data on the GDP for October is due at 3:30 pm (GMT+2) in Canada. It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. In October, the index is expected to stay at 0.0%, which might be considered as a negative figure after four months of small growth. Forecasts realisation could pressure the CAD.

New Home Sales. US, 5:00 pm

November data on New Home Sales is due at 5:00 pm (GMT+2). The indicator is one of the most important for the property market and has an impact on the economy as the whole, as growth in construction and house sales stimulates development in a number of related industries and in the labour market. The index has been falling since August, but this time is expected to increase from 563 thousands to 575 thousands. Forecasts realisation could mean a break of descending tendency in the property market that would strengthen the USD.

KOF Leading Indicator. Switzerland, 10:00 am

Data on the KOF Leading Indicator for December is due at 10:00 am (GMT+2). The index is based on 12 major economic indicators (including business activity in manufacturing and property sectors, consumer confidence and confidence in the banking sector) that represents the prospects of economic development for the next 6 months. For nearly all year, the index remained above 100 points. In December, it is expected to continue its growth, increasing from 102.2 to 103.1 points that might support the Franc.

Gross Domestic Product. Canada, 3:30 pm

Data on the GDP for October is due at 3:30 pm (GMT+2) in Canada. It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. In October, the index is expected to stay at 0.0%, which might be considered as a negative figure after four months of small growth. Forecasts realisation could pressure the CAD.

New Home Sales. US, 5:00 pm

November data on New Home Sales is due at 5:00 pm (GMT+2). The indicator is one of the most important for the property market and has an impact on the economy as the whole, as growth in construction and house sales stimulates development in a number of related industries and in the labour market. The index has been falling since August, but this time is expected to increase from 563 thousands to 575 thousands. Forecasts realisation could mean a break of descending tendency in the property market that would strengthen the USD.

Claws and Horns

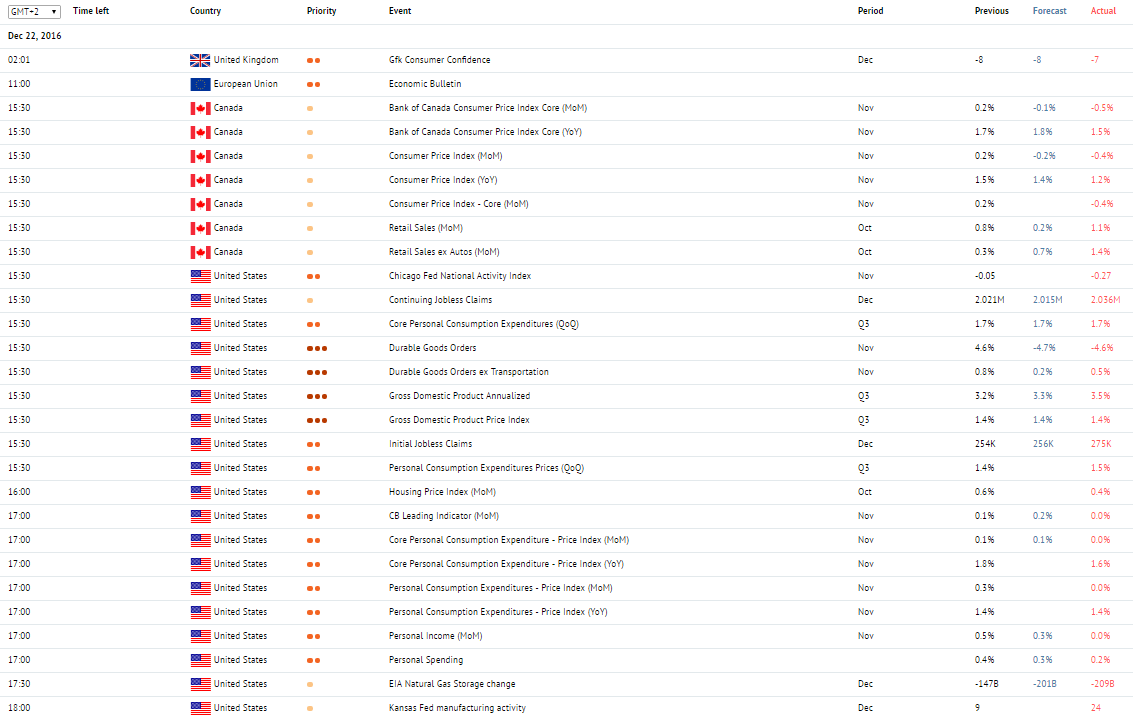

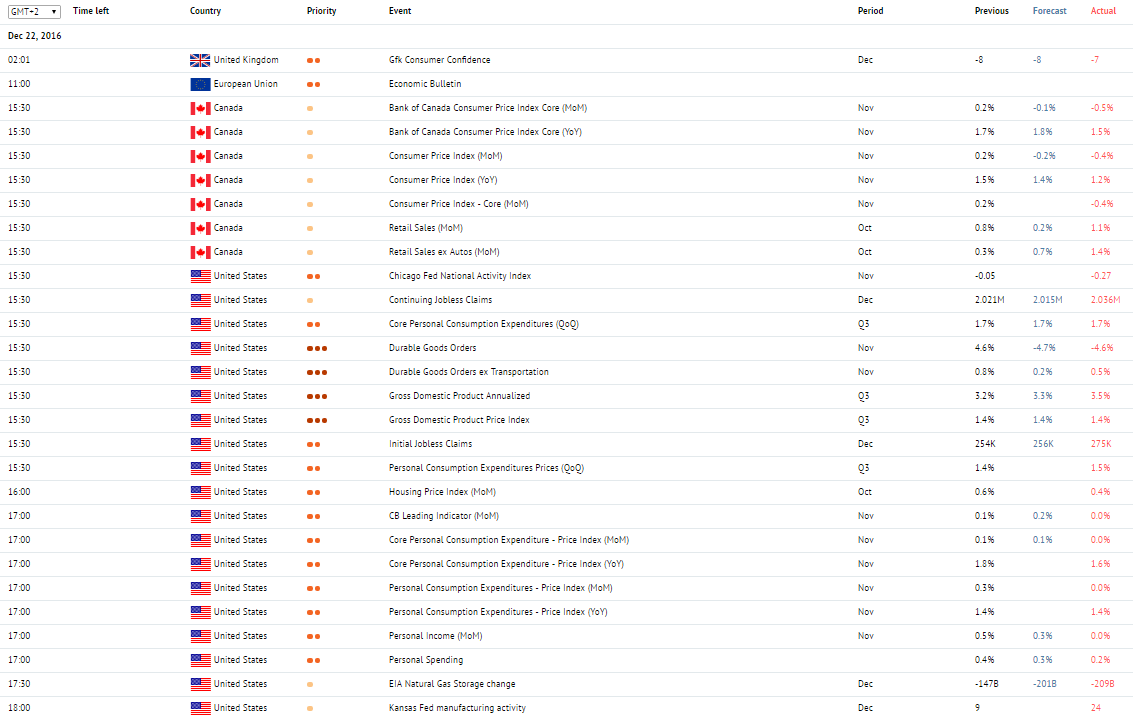

News of the day. 22.12.2016

Economic Bulletin. EU, 11:00 am

The ECB will release its monthly Economic Bulletin at 11:00 am (GMT+2) that contains data on development prospects in money markets, economic forecasts and other macroeconomic indicators. Investors might find some hints in it regarding further actions of the regulator.

Gross Domestic Product. UK, 11:30 am

Data on the GDP for the third quarter of the year is due at 11:30 am (GMT+2). It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. According to preliminary data, on a quarter-to-quarter basis the index will show a 0.5% growth, and on a year-to-year basis – 2.3%. The readings could be considered positive considering country’s recent exit from the EU. Forecasts realisation might strengthen the Pound.

Gross Domestic Product. US, 3:30 pm

Data on the GDP for the third quarter of the year is due at 3:30 pm (GMT+2). It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. On a quarter-to-quarter basis, the GDP’s growth is expected to increase from 3.2% to 3.3%. Compared to previous quarters, the growth is quite significant. Forecasts realisation might strengthen the Dollar.

Durable Goods Orders. US, 3:30 pm

November data on Durable Goods Orders is due at 3:30 pm (GMT+2). Durable are called those goods that last for more than 3 years. Their purchase requires substantial funds, including borrowed, and therefore represents consumer confidence in the state of the economy and can be considered a leading indicator of industrial activity. The general index is expected to decline by 4.7% while Durable Goods Order excluding Transportation will grow by 0.2%, which is significantly less than its October reading. In general, the forecasts are negative for the Dollar.

Retails Sales. Canada, 3:30 pm

Data on Retail Sales for November is due at 3:30 pm (GMT+2). The index represents the change in the volume of retail sales and characterises consumer spending and demand. Retail sales, usually, make up a significant part of the GDP. In November, the index is expected to fall from 0.6% to 0.3% that might pressure the CAD.

Consumer Price Index. Canada, 3:30 pm

November data on one of the major inflation indicators – the Consumer Price Index, is due at 3:30 pm (GMT+2). On a month-to-month basis, after two months of growth the index is expected to show a fall of 0.2%. On a year-to-year basis, growth in the index will slow from 1.5% to 1.4%. Forecasts realisation will pressure the Canadian Dollar.

Economic Bulletin. EU, 11:00 am

The ECB will release its monthly Economic Bulletin at 11:00 am (GMT+2) that contains data on development prospects in money markets, economic forecasts and other macroeconomic indicators. Investors might find some hints in it regarding further actions of the regulator.

Gross Domestic Product. UK, 11:30 am

Data on the GDP for the third quarter of the year is due at 11:30 am (GMT+2). It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. According to preliminary data, on a quarter-to-quarter basis the index will show a 0.5% growth, and on a year-to-year basis – 2.3%. The readings could be considered positive considering country’s recent exit from the EU. Forecasts realisation might strengthen the Pound.

Gross Domestic Product. US, 3:30 pm

Data on the GDP for the third quarter of the year is due at 3:30 pm (GMT+2). It is one of the most important indicators for representing the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. On a quarter-to-quarter basis, the GDP’s growth is expected to increase from 3.2% to 3.3%. Compared to previous quarters, the growth is quite significant. Forecasts realisation might strengthen the Dollar.

Durable Goods Orders. US, 3:30 pm

November data on Durable Goods Orders is due at 3:30 pm (GMT+2). Durable are called those goods that last for more than 3 years. Their purchase requires substantial funds, including borrowed, and therefore represents consumer confidence in the state of the economy and can be considered a leading indicator of industrial activity. The general index is expected to decline by 4.7% while Durable Goods Order excluding Transportation will grow by 0.2%, which is significantly less than its October reading. In general, the forecasts are negative for the Dollar.

Retails Sales. Canada, 3:30 pm

Data on Retail Sales for November is due at 3:30 pm (GMT+2). The index represents the change in the volume of retail sales and characterises consumer spending and demand. Retail sales, usually, make up a significant part of the GDP. In November, the index is expected to fall from 0.6% to 0.3% that might pressure the CAD.

Consumer Price Index. Canada, 3:30 pm

November data on one of the major inflation indicators – the Consumer Price Index, is due at 3:30 pm (GMT+2). On a month-to-month basis, after two months of growth the index is expected to show a fall of 0.2%. On a year-to-year basis, growth in the index will slow from 1.5% to 1.4%. Forecasts realisation will pressure the Canadian Dollar.

Claws and Horns

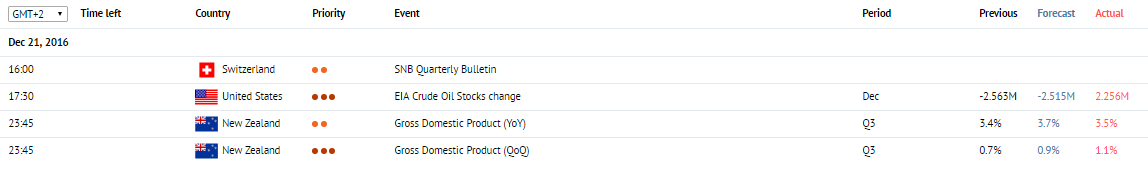

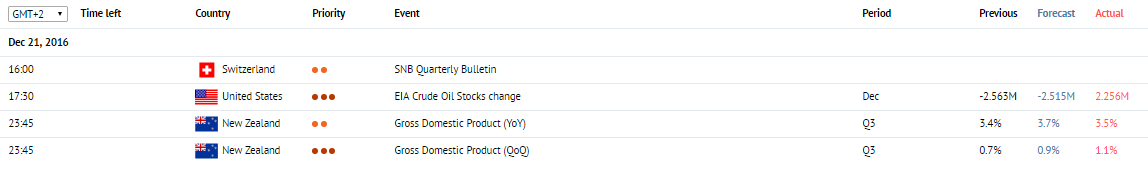

News of the day. 21.12.2016

SNB Quarterly Bulletin. Switzerland, 4:00 pm

The SNB Quarterly Bulletin is due at 4:00 pm (GMT+2). It contains information about monetary policy, analyzes economic trends and forecasts Franc’s movement against all other major currencies. Could have a significant impact on the market.

Existing Home Sales. US, 5:00 pm

November data on Existing Home Sales is due at 5:00 pm (GMT+2). It is one of the most important indicators of the US property market and its growth supports the Dollar. According to expectations, after a two-month growth the index will fall again from 5.6 million to 5.5 million. The fall seems insignificant and is unlikely to change the upward tendency on the market but could lead to a short-term correction.

EIA Crude Oil Stocks change. US, 5:30 pm

Weekly data on the Crude Oil Stocks change published by the US Energy Information Administration is due at 5:30 pm (GMT+2). The index has a significant impact on the market, as the US is one of the biggest oil consumers. Oil reserves are expected to fall by 2.425 million barrels. Forecasts realisation could support oil prices.

Gross Domestic Product. New Zealand, 11:45 pm

Data on the GDP for the third quarter of the year is due at 11:45 pm (GMT+2). It is one of the most important indicators that represents the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. According to forecasts, on a year-to-year basis, the index will remain unchanged at 0.9% while on a month-to-month basis it could continue its positive tendency and increase from 3.6% to 3.7%. In general, the readings could be considered positive and strengthen the NZD.

SNB Quarterly Bulletin. Switzerland, 4:00 pm

The SNB Quarterly Bulletin is due at 4:00 pm (GMT+2). It contains information about monetary policy, analyzes economic trends and forecasts Franc’s movement against all other major currencies. Could have a significant impact on the market.

Existing Home Sales. US, 5:00 pm

November data on Existing Home Sales is due at 5:00 pm (GMT+2). It is one of the most important indicators of the US property market and its growth supports the Dollar. According to expectations, after a two-month growth the index will fall again from 5.6 million to 5.5 million. The fall seems insignificant and is unlikely to change the upward tendency on the market but could lead to a short-term correction.

EIA Crude Oil Stocks change. US, 5:30 pm

Weekly data on the Crude Oil Stocks change published by the US Energy Information Administration is due at 5:30 pm (GMT+2). The index has a significant impact on the market, as the US is one of the biggest oil consumers. Oil reserves are expected to fall by 2.425 million barrels. Forecasts realisation could support oil prices.

Gross Domestic Product. New Zealand, 11:45 pm

Data on the GDP for the third quarter of the year is due at 11:45 pm (GMT+2). It is one of the most important indicators that represents the state of the national economy. It considers national consumption, investments, expenditures, exports and imports. According to forecasts, on a year-to-year basis, the index will remain unchanged at 0.9% while on a month-to-month basis it could continue its positive tendency and increase from 3.6% to 3.7%. In general, the readings could be considered positive and strengthen the NZD.

Claws and Horns

News of the day. 20.12.2016

RBA Meeting's Minutes. Australia, 02:30

The RBA Meeting's Minutes is due at 02:30 (GMT+2). будет опубликован протокол заседания Резервного Банка Австралии. Minutes of the RBA monetary policy meetings are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Producer Price Index. Germany, 09:00

The Producer Price Index is due at 09:00 (GMT+2) in Germany. It is expected to grow to -0.2% in November from -0.5% in the previous month. The index represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Trade Balance. New Zealand, 23:45

The November Trade Balance data are due at 23:45 (GMT+2) in New Zealand. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

RBA Meeting's Minutes. Australia, 02:30

The RBA Meeting's Minutes is due at 02:30 (GMT+2). будет опубликован протокол заседания Резервного Банка Австралии. Minutes of the RBA monetary policy meetings are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Producer Price Index. Germany, 09:00

The Producer Price Index is due at 09:00 (GMT+2) in Germany. It is expected to grow to -0.2% in November from -0.5% in the previous month. The index represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Trade Balance. New Zealand, 23:45

The November Trade Balance data are due at 23:45 (GMT+2) in New Zealand. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

Claws and Horns

News of the day. 19.12.2016

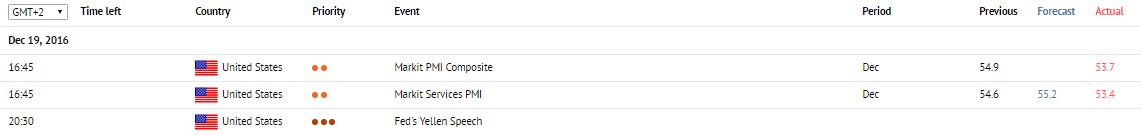

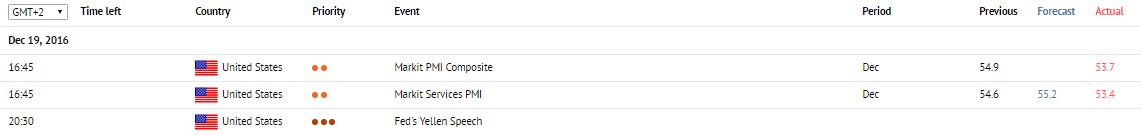

Markit Services PMI. US, 4:45 pm

Data on the Markit Services PMI for December is due at 4:45 pm (GMT+2). The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Markit Services PMI. US, 4:45 pm

Data on the Markit Services PMI for December is due at 4:45 pm (GMT+2). The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

News of the day. 16.12.2016

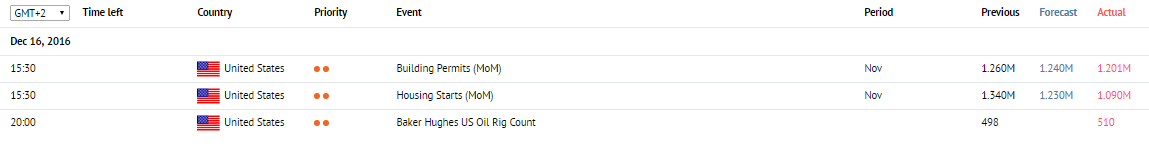

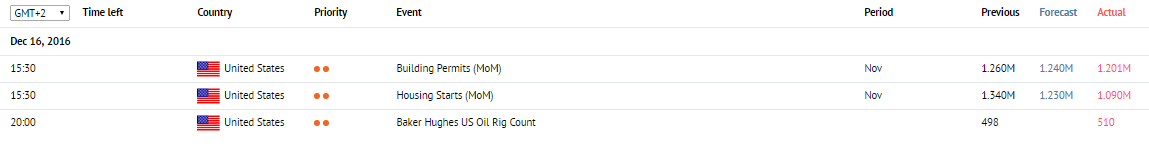

USA

The MoM and YoY Consumer Price Index is due at 12:00 (GMT+2) in the USA. The MoM November value is expected to lower to -0.1% against 0.2% in the previous month. The YoY November value is expected to stay on the same level of 0.6%. It is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

The Building Permits index is due at 15:30 (GMT+2) in the USA. The indicator is expected to lower to 1.225 million in November from 1.323 million in the previous month. The index shows the number of approved permits for building of new houses. Building volumes have close connections with consumer income. Thus, a growth in the index represents economic growth. High values strengthen the USD.

USA

The MoM and YoY Consumer Price Index is due at 12:00 (GMT+2) in the USA. The MoM November value is expected to lower to -0.1% against 0.2% in the previous month. The YoY November value is expected to stay on the same level of 0.6%. It is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

The Building Permits index is due at 15:30 (GMT+2) in the USA. The indicator is expected to lower to 1.225 million in November from 1.323 million in the previous month. The index shows the number of approved permits for building of new houses. Building volumes have close connections with consumer income. Thus, a growth in the index represents economic growth. High values strengthen the USD.

Claws and Horns

Russian stock market analysis from Claws & Horns in MetaTrader 5

The Claws & Horns news feeder integrated with MetaTrader 5 features the daily analysis of Russian shares traded on the Moscow Exchange. The feeder developers have expanded the list of provided services due to the growing demand for such analysis from traders.

Claws & Horns mainly focuses on blue chips — the largest and most liquid Russian companies, such as Sberbank (SBER), Rosneft (ROSN), Gazprom (GAZP), Lukoil (LKOH), ALROSA (ALRS) and Aeroflot (AFTL).

Besides, it provides a regular analysis of basic futures, including MICEX Index, RTS Index, USDRUB, EURRUB, as well as bonds and Eurobonds. About 50 trading instruments are covered in total every week. Claws & Horns analytical feeder is an indispensable tool for brokers aimed at expanding their operations in the Russian market.

Order this service to offer your customers a complete set of analytical tools from Claws & Horns:

economic calendar featuring all the important fundamental releases

technical analysis

fundamental analysis

signals (market entry recommendations with entry/exit points that are updated throughout the day)

daily video podcasts with long-term outlook for the major currency pairs

chat with the leading analysts of the company

Apply for the service right now to receive a free trial month on the website https://www.clawshorns.com.

The Claws & Horns news feeder integrated with MetaTrader 5 features the daily analysis of Russian shares traded on the Moscow Exchange. The feeder developers have expanded the list of provided services due to the growing demand for such analysis from traders.

Claws & Horns mainly focuses on blue chips — the largest and most liquid Russian companies, such as Sberbank (SBER), Rosneft (ROSN), Gazprom (GAZP), Lukoil (LKOH), ALROSA (ALRS) and Aeroflot (AFTL).

Besides, it provides a regular analysis of basic futures, including MICEX Index, RTS Index, USDRUB, EURRUB, as well as bonds and Eurobonds. About 50 trading instruments are covered in total every week. Claws & Horns analytical feeder is an indispensable tool for brokers aimed at expanding their operations in the Russian market.

Order this service to offer your customers a complete set of analytical tools from Claws & Horns:

economic calendar featuring all the important fundamental releases

technical analysis

fundamental analysis

signals (market entry recommendations with entry/exit points that are updated throughout the day)

daily video podcasts with long-term outlook for the major currency pairs

chat with the leading analysts of the company

Apply for the service right now to receive a free trial month on the website https://www.clawshorns.com.

Claws and Horns

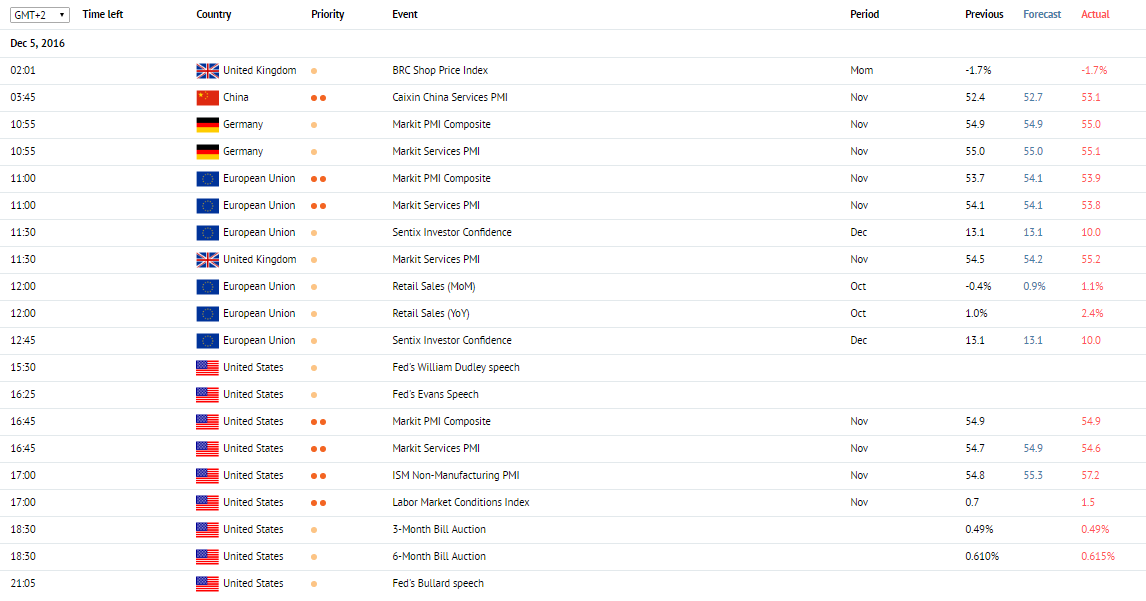

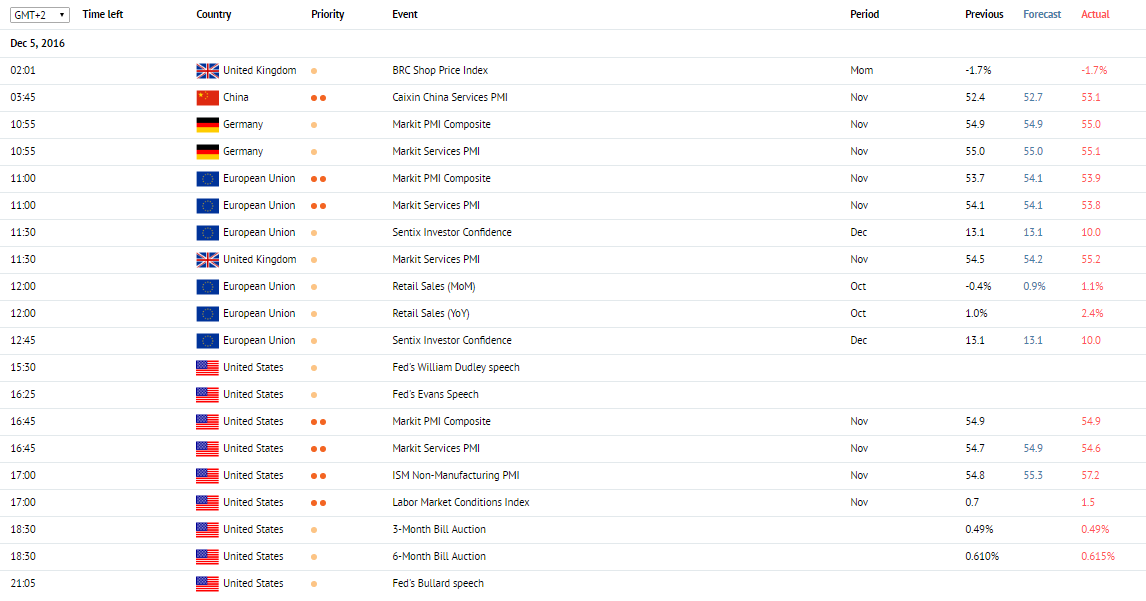

News of the day. 5.12.2016

Caixin China Services PMI. China, 03:45 (GMT+2)

The November Caixin China Services PMI is due at 03:45 (GMT+2). It is based on surveys of executives of companies operating in the services sector regarding their opinion on current economic conditions and its perspectives in the sector. During the last three months the indication is trying to grow and now is above the level of 52 points. The indicator is expected to stay on the same position on November, which is in general positive for the world economy

Markit Services PMI. Germany, 10:55 (GMT+2)

The November Markit Services PMI is due at 10:55 (GMT+2) in Germany. The index is based on surveys of executives of the biggest German companies in manufacturing and services sectors regarding their opinion on current economic conditions in their sector. The index is expecting to stay on the previous level of 55 points, which is positive, but it barely can affect Euro, as the market reacts on the changes more seriously.

Markit Services PMI. EU 11:00 (GMT+2)

The November Markit Services PMI is due at 11:00 (GMT+2) in the EU. The indicator is expected to stay on the previous level of 54.1. In general the indicator is growing since August, but of there would be no growth in November, the reaction of the market would be insignificant.

Markit Services PMI. UK, 11:30 (GMT+2)

The November Markit Services PMI is due at 11:30 (GMT+2) in the UK. It is based on surveys of executives of companies operating in the services sector regarding their opinion on current economic conditions and its perspectives in the sector. The indicator is predicted to decrease from 54.5 to 54.0 points, which can pressure the UK currency, even if the indicator is above the key level of 50.0 points.

Retail Sales. EU, 12:00 (GMT+2)

The Retail Sales data are due at 12:00 (GMT+2) in the Eurozone. The indicator represents changes in the volume of retail sales and is considered as the major indicator of consumer spending. Retail Sales generally is a great part of the GDP. The MoM and YoY indicators are predicted to grow by 0.8% and 1.7% respectively, which will strengthen the Euro.

ISM Non-Manufacturing PMI, USA. 17:00 (GMT+2)

The November ISM Non-Manufacturing PMI is due at 17:00 (GMT+2). The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. After the fall to 54.8 points in October the index is predicted to grow again to the level of 55.3 points, which can strengthen the USD against main currencies.

Caixin China Services PMI. China, 03:45 (GMT+2)

The November Caixin China Services PMI is due at 03:45 (GMT+2). It is based on surveys of executives of companies operating in the services sector regarding their opinion on current economic conditions and its perspectives in the sector. During the last three months the indication is trying to grow and now is above the level of 52 points. The indicator is expected to stay on the same position on November, which is in general positive for the world economy

Markit Services PMI. Germany, 10:55 (GMT+2)

The November Markit Services PMI is due at 10:55 (GMT+2) in Germany. The index is based on surveys of executives of the biggest German companies in manufacturing and services sectors regarding their opinion on current economic conditions in their sector. The index is expecting to stay on the previous level of 55 points, which is positive, but it barely can affect Euro, as the market reacts on the changes more seriously.

Markit Services PMI. EU 11:00 (GMT+2)

The November Markit Services PMI is due at 11:00 (GMT+2) in the EU. The indicator is expected to stay on the previous level of 54.1. In general the indicator is growing since August, but of there would be no growth in November, the reaction of the market would be insignificant.

Markit Services PMI. UK, 11:30 (GMT+2)

The November Markit Services PMI is due at 11:30 (GMT+2) in the UK. It is based on surveys of executives of companies operating in the services sector regarding their opinion on current economic conditions and its perspectives in the sector. The indicator is predicted to decrease from 54.5 to 54.0 points, which can pressure the UK currency, even if the indicator is above the key level of 50.0 points.

Retail Sales. EU, 12:00 (GMT+2)

The Retail Sales data are due at 12:00 (GMT+2) in the Eurozone. The indicator represents changes in the volume of retail sales and is considered as the major indicator of consumer spending. Retail Sales generally is a great part of the GDP. The MoM and YoY indicators are predicted to grow by 0.8% and 1.7% respectively, which will strengthen the Euro.

ISM Non-Manufacturing PMI, USA. 17:00 (GMT+2)

The November ISM Non-Manufacturing PMI is due at 17:00 (GMT+2). The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. After the fall to 54.8 points in October the index is predicted to grow again to the level of 55.3 points, which can strengthen the USD against main currencies.

Claws and Horns

News of the day. 30.11.2016

Industrial Production. Japan, 01:50

Industrial production data are due at 01:50 (GMT+2). It is expected that the MoM indicator will lower to -0.1% in October from 0.6% in the previous month. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Consumer Price Index. EU, 12:00

The consumer price Index is due at 12:00 (GMT+2). It is expected that the YoY indicator will grow up to 0.6% in November from 0.5% in the previous month. This is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

ECB President Draghi's Speech. EU, 14:30

ECB president Draghi's speech is due at 14:30 (GMT+2). Mario Draghi will comment on current economic conditions in the Eurozone. Positive commentaries can strengthen the EUR, while negative commentaries weaken the EUR.

ADP Employment Change. USA, 15:15

It is expected that the index will grow up to 160K from 147K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data collected from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Personal Spending. USA, 15:30

The personal spending index is due at 15:30 (GMT+2). The indicator is expected to grow up to 0.6% in October from 0.5% in the previous month. The index consists of spending on services, durable goods and nondurable goods.

Personal Income. USA, 15:30

The personal income index is due at 15:30 (GMT+2). The indicator is expected to grow up to 0.4% in October from 0.3% in the previous month. The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Gross Domestic Product. Canada, 15:30

The gross domestic product data is due at 15:30 (GMT+2). The QoQ indicator is expected to grow up to 3.4% in the third quarter from -1.6% in the previous month. The indicator represents the value of all goods and services created in the country during a certain period. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Industrial Production. Japan, 01:50

Industrial production data are due at 01:50 (GMT+2). It is expected that the MoM indicator will lower to -0.1% in October from 0.6% in the previous month. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Consumer Price Index. EU, 12:00

The consumer price Index is due at 12:00 (GMT+2). It is expected that the YoY indicator will grow up to 0.6% in November from 0.5% in the previous month. This is the key indicator of inflation in the Eurozone. It represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

ECB President Draghi's Speech. EU, 14:30

ECB president Draghi's speech is due at 14:30 (GMT+2). Mario Draghi will comment on current economic conditions in the Eurozone. Positive commentaries can strengthen the EUR, while negative commentaries weaken the EUR.

ADP Employment Change. USA, 15:15

It is expected that the index will grow up to 160K from 147K in the previous month. The index represents employment change in non-agricultural sectors. It is based on data collected from about 500 thousands companies in the US. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

Personal Spending. USA, 15:30

The personal spending index is due at 15:30 (GMT+2). The indicator is expected to grow up to 0.6% in October from 0.5% in the previous month. The index consists of spending on services, durable goods and nondurable goods.

Personal Income. USA, 15:30

The personal income index is due at 15:30 (GMT+2). The indicator is expected to grow up to 0.4% in October from 0.3% in the previous month. The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Gross Domestic Product. Canada, 15:30

The gross domestic product data is due at 15:30 (GMT+2). The QoQ indicator is expected to grow up to 3.4% in the third quarter from -1.6% in the previous month. The indicator represents the value of all goods and services created in the country during a certain period. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Claws and Horns

News of the day. 29.11.2016

Unemployment Rate. Japan, 01:30 (GMT+2)

The Unemployment Rate indicator is due at 01:30 (GMT+2). It is predicted that the indicator will remain the same (3%). It represents the percentage of the total labor force that is unemployed. The growth of the indicator has negative impact on the country’s economy and weakens the JPY. The lowering of the indicator shows economy growth and strengthens the JPY.

Consumer Credit. United Kingdom, 11:30 (GMT+2)

The Consumer Credit index is due at 11:30 (GMT+2). It is predicted that the indicator will grow up to 1.550 billion pounds sterling in October from 1.405 billion pounds sterling in the previous month. The index represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Mortgage Approvals. United Kingdom, 11:30 (GMT+2)

The Mortgage Approvals data are due at 11:30 (GMT+2). The indicator shows the number of new approved mortgages. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized indicator is due at 15:30 (GMT+2). It is predicted that the indicator will grow up to 3.0% in the third quarter from 2.9% in the previous month. The indicator shows the total value of goods and services created in the country during the year. It indicates the pace of a growth or decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Current Account. Canada, 15:30 (GMT+2)

The Current Account data are due at (GMT+2). The data represent the difference between the amount of payments flowing into the country and the amount of payments leaving the country. The balance of payments is in surplus when payments into the country exceed payments out. Otherwise, the balance of payments is in deficit. A high reading strengthens the CAD. A low reading weakens the CAD.

Consumer Confidence. USA, 17:00 (GMT+2)

The Consumer Confidence index is due at 17:00 (GMT+2). It is predicted that the indicator will grow up to 100.0 points in November from 98.6 points in the previous month. The index represents consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Unemployment Rate. Japan, 01:30 (GMT+2)

The Unemployment Rate indicator is due at 01:30 (GMT+2). It is predicted that the indicator will remain the same (3%). It represents the percentage of the total labor force that is unemployed. The growth of the indicator has negative impact on the country’s economy and weakens the JPY. The lowering of the indicator shows economy growth and strengthens the JPY.

Consumer Credit. United Kingdom, 11:30 (GMT+2)

The Consumer Credit index is due at 11:30 (GMT+2). It is predicted that the indicator will grow up to 1.550 billion pounds sterling in October from 1.405 billion pounds sterling in the previous month. The index represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Mortgage Approvals. United Kingdom, 11:30 (GMT+2)

The Mortgage Approvals data are due at 11:30 (GMT+2). The indicator shows the number of new approved mortgages. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Gross Domestic Product Annualized. USA, 15:30 (GMT+2)

The Gross Domestic Product Annualized indicator is due at 15:30 (GMT+2). It is predicted that the indicator will grow up to 3.0% in the third quarter from 2.9% in the previous month. The indicator shows the total value of goods and services created in the country during the year. It indicates the pace of a growth or decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Current Account. Canada, 15:30 (GMT+2)

The Current Account data are due at (GMT+2). The data represent the difference between the amount of payments flowing into the country and the amount of payments leaving the country. The balance of payments is in surplus when payments into the country exceed payments out. Otherwise, the balance of payments is in deficit. A high reading strengthens the CAD. A low reading weakens the CAD.

Consumer Confidence. USA, 17:00 (GMT+2)

The Consumer Confidence index is due at 17:00 (GMT+2). It is predicted that the indicator will grow up to 100.0 points in November from 98.6 points in the previous month. The index represents consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 28.11.2016

Retail Trade. Japan, 2:50 am

Data on Retail Trade for October is due at 2:50 am (GMT+2). The data shows changes in the volume of sales at large retailers. A growth in the indicator represents a growth in consumption and has a positive impact on the economy. A fall in the indicator is a negative factor for the economy. A high reading strengthens the JPY. A low reading weakens the JPY.

Retail Trade. Japan, 2:50 am

Data on Retail Trade for October is due at 2:50 am (GMT+2). The data shows changes in the volume of sales at large retailers. A growth in the indicator represents a growth in consumption and has a positive impact on the economy. A fall in the indicator is a negative factor for the economy. A high reading strengthens the JPY. A low reading weakens the JPY.

Claws and Horns

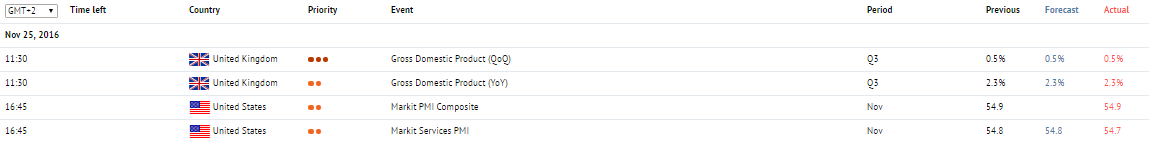

News of the day. 25.11.2016

Japan

The National Consumer Price Index for October is due in Japan at 1:30 am (GMT+2). It is the key indicator of inflation representing the value change of the basket of goods and services. A high reading strengthens the JPY. A low reading weakens the JPY.

UK

Data on the Gross Domestic Product for the third quarter is due in the UK at 11:30 am (GMT+2). The indicator is expected to remain unchanged at 2.3% on a year-on-year basis. GDP represents the total value of all goods and services created in the UK during a period. It is an indicator of the pace of a growth/decline of the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

USA

The Markit Services PMI for November is due in the US at 4:45 pm (GMT+2). The indicator is expected to remain unchanged at 54.8 points. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Japan

The National Consumer Price Index for October is due in Japan at 1:30 am (GMT+2). It is the key indicator of inflation representing the value change of the basket of goods and services. A high reading strengthens the JPY. A low reading weakens the JPY.

UK

Data on the Gross Domestic Product for the third quarter is due in the UK at 11:30 am (GMT+2). The indicator is expected to remain unchanged at 2.3% on a year-on-year basis. GDP represents the total value of all goods and services created in the UK during a period. It is an indicator of the pace of a growth/decline of the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

USA

The Markit Services PMI for November is due in the US at 4:45 pm (GMT+2). The indicator is expected to remain unchanged at 54.8 points. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

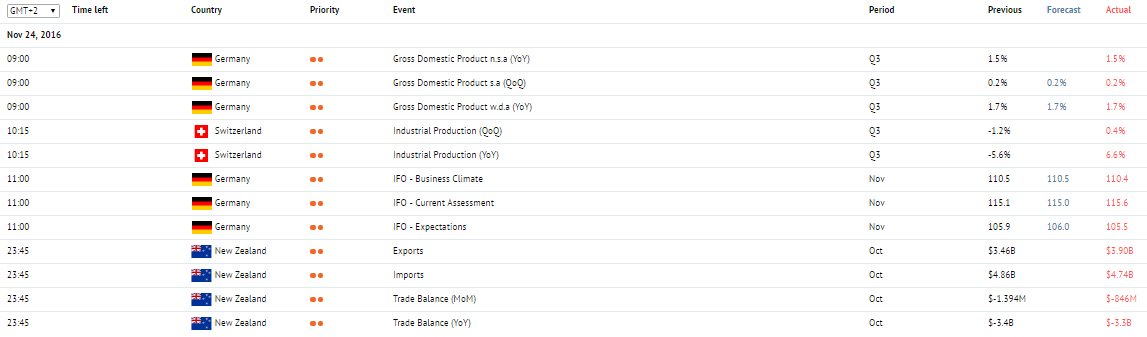

News of the day. 24.11.2016

Gross Domestic Product. Germany, 9:00 am

Data on Germany’s Gross Domestic Product for the third quarter is due at 9:00 am (GMT+2). The indicator is expected to remain unchanged at 0.2%. It is a measure of the total value of all goods and services produced by Germany during a period. A high reading strengthens the EUR, while a low reading pressures the EUR.

Industrial Production. Switzerland, 10:15 am

At 10:15 am (GMT+2), the Industrial Production data for the third quarter is released in Switzerland. The indicator represents the change in industrial output in Switzerland. A growth in industrial production is a positive factor for the economy and strengthens the CHF.

Trade Balance. New Zealand, 11:45 pm

Data on New Zealand’s Trade Balance for October is due at 11:45 pm (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

Gross Domestic Product. Germany, 9:00 am

Data on Germany’s Gross Domestic Product for the third quarter is due at 9:00 am (GMT+2). The indicator is expected to remain unchanged at 0.2%. It is a measure of the total value of all goods and services produced by Germany during a period. A high reading strengthens the EUR, while a low reading pressures the EUR.

Industrial Production. Switzerland, 10:15 am

At 10:15 am (GMT+2), the Industrial Production data for the third quarter is released in Switzerland. The indicator represents the change in industrial output in Switzerland. A growth in industrial production is a positive factor for the economy and strengthens the CHF.

Trade Balance. New Zealand, 11:45 pm

Data on New Zealand’s Trade Balance for October is due at 11:45 pm (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

: