Claws and Horns / Profil

Claws and Horns

News of the day. 25.08.2016

Foreign Bond Investment. Japan, 1:50 am

Data on the Foreign Bond Investment is due in Japan at 1:50 am (GMT+2). The indicator shows the volume of investment from Japan and represents how attractive foreign securities and currencies are for Japanese investors. Positive values indicate sales of securities by residents (capital inflow); negative values indicate purchases of foreign securities by residents (capital outflow).

Industrial Production. Switzerland, 9:15 am

Data on the Industrial Production for the second quarter is due in Switzerland at 9:15 am (GMT+2). The indicator represents the change in industrial output in Switzerland. A growth in industrial production is a positive factor for the economy and strengthens the CHF.

IFO - Current Assessment. Germany, 10:00 am

The IFO Current Assessment index is due in Germany at 10:00 am (GMT+2). The indicator is expected to grow from 114.7 to 114.9 points in August. The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due US at 2:30 pm (GMT+2). The indicator is expected to grow from 262 000 to 265 000 new claims. The indicator represents the number of new unemployment claims. The data in published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

Durable Goods Orders. US, 2:30 pm

Data on the Durable Goods Orders for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -3.9% to 3.5%. The indicator represents the value change for durable goods, which last for more than three years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

Markit Services PMI. US, 3:45 pm

Data on the Markit Services PMI is due in the US at 3:45 pm (GMT+2). The indicator is expected to grow from 51.4 to 52.0 points in August. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Foreign Bond Investment. Japan, 1:50 am

Data on the Foreign Bond Investment is due in Japan at 1:50 am (GMT+2). The indicator shows the volume of investment from Japan and represents how attractive foreign securities and currencies are for Japanese investors. Positive values indicate sales of securities by residents (capital inflow); negative values indicate purchases of foreign securities by residents (capital outflow).

Industrial Production. Switzerland, 9:15 am

Data on the Industrial Production for the second quarter is due in Switzerland at 9:15 am (GMT+2). The indicator represents the change in industrial output in Switzerland. A growth in industrial production is a positive factor for the economy and strengthens the CHF.

IFO - Current Assessment. Germany, 10:00 am

The IFO Current Assessment index is due in Germany at 10:00 am (GMT+2). The indicator is expected to grow from 114.7 to 114.9 points in August. The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index strengthens the EUR. A fall in the index is perceived as a negative factor for the EUR.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due US at 2:30 pm (GMT+2). The indicator is expected to grow from 262 000 to 265 000 new claims. The indicator represents the number of new unemployment claims. The data in published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

Durable Goods Orders. US, 2:30 pm

Data on the Durable Goods Orders for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -3.9% to 3.5%. The indicator represents the value change for durable goods, which last for more than three years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

Markit Services PMI. US, 3:45 pm

Data on the Markit Services PMI is due in the US at 3:45 pm (GMT+2). The indicator is expected to grow from 51.4 to 52.0 points in August. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

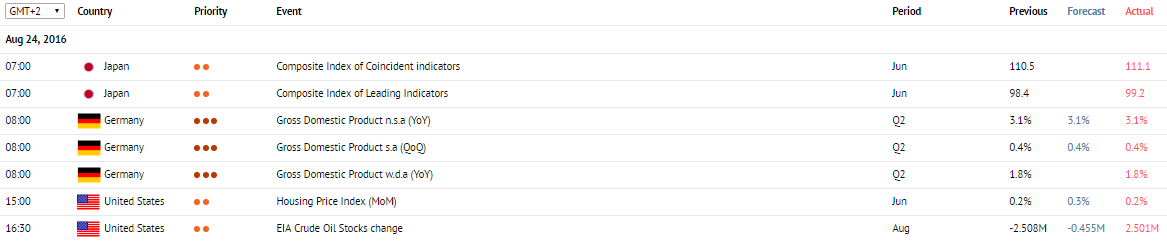

News of the day. 24.08.2016

Trade Balance. New Zealand, 0:45 am

Data on the Trade Balance is due in New Zealand at 0:45 am (GMT+2). In monthly terms, New Zealand is expected to record a trade deficit of NZ$320 million in July against a NZ$127 million surplus in June. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

Exports, Imports. New Zealand, 0:45 am

Statistics on the Exports and Imports are due in New Zealand at 0:45 am (GMT+2). Exports represent the total value of all exported goods and services. A growth in exports has a positive impact on the country’s economy. Imports represent the total value of all imported goods and services. A growth in imports indicates a growth in consumption.

Composite Index of Leading Indicators. Japan, 7:00 am

Data on the Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The index, based on 13 indicators, is used to assess short- and medium-term economic prospects. A growth in the index is a positive factor and strengthens the JPY. A fall in the index is a negative factor for the JPY.

Composite Index of Coincident Indicators. Japan, 7:00 am

Data on the Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The index, based on 11 indicators, is used to assess the current state of the economy. A growth in the index represents economic growth and strengthens the JPY. A fall in the index represents a slowdown of the economy that, on its part, has a negative impact on the JPY.

Gross Domestic Product. Germany, 8:00 am

Data on the Gross Domestic Product is due in Germany at 8:00 am (GMT+2). In quarterly terms, the indicator is expected to remains unchanged at 0.4% in the second quarter. The indicator represents the value of all goods and services created in the country during the period. A high reading strengthens the EUR. A low reading weakens the EUR.

Housing Price Index. US, 3:00 pm

Data on the Housing Price Index is due in the US at 3:00 pm (GMT+2). The indicator is expected to grow from 0.2% to 0.3% in June. The index represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

Trade Balance. New Zealand, 0:45 am

Data on the Trade Balance is due in New Zealand at 0:45 am (GMT+2). In monthly terms, New Zealand is expected to record a trade deficit of NZ$320 million in July against a NZ$127 million surplus in June. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

Exports, Imports. New Zealand, 0:45 am

Statistics on the Exports and Imports are due in New Zealand at 0:45 am (GMT+2). Exports represent the total value of all exported goods and services. A growth in exports has a positive impact on the country’s economy. Imports represent the total value of all imported goods and services. A growth in imports indicates a growth in consumption.

Composite Index of Leading Indicators. Japan, 7:00 am

Data on the Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The index, based on 13 indicators, is used to assess short- and medium-term economic prospects. A growth in the index is a positive factor and strengthens the JPY. A fall in the index is a negative factor for the JPY.

Composite Index of Coincident Indicators. Japan, 7:00 am

Data on the Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The index, based on 11 indicators, is used to assess the current state of the economy. A growth in the index represents economic growth and strengthens the JPY. A fall in the index represents a slowdown of the economy that, on its part, has a negative impact on the JPY.

Gross Domestic Product. Germany, 8:00 am

Data on the Gross Domestic Product is due in Germany at 8:00 am (GMT+2). In quarterly terms, the indicator is expected to remains unchanged at 0.4% in the second quarter. The indicator represents the value of all goods and services created in the country during the period. A high reading strengthens the EUR. A low reading weakens the EUR.

Housing Price Index. US, 3:00 pm

Data on the Housing Price Index is due in the US at 3:00 pm (GMT+2). The indicator is expected to grow from 0.2% to 0.3% in June. The index represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 23.08.2016

Markit Manufacturing PMI. Germany, 9:30 am

Preliminary data for August on the Markit Manufacturing PMI is due in Germany at 9:30 am (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to fall from 53.8 to 53.5 points that could pressure the EUR slightly.

Markit Services PMI. Germany, 9:30 am

Preliminary data for August on the Markit Services PMI is due in Germany at 9:30 am (GMT+2). The index is based on surveys of executives of the largest companies operating in the services sector regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 54.4 points that could support the EUR.

Markit Manufacturing PMI. EU, 10:00 am

Preliminary data for August on the Markit Eurozone Manufacturing PMI is due at 10:00 am (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.0 points that is above the key level of 50.0 points and suggests a gradual growth of the manufacturing sector.

Markit Services PMI. EU, 10:00 am

Preliminary data for August on the Markit Eurozone Services PMI is due at 10:00 am (GMT+2). The index is based on surveys of executives of the largest companies operating in the services sector regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.9 points that is a positive factor for the EUR.

Markit Manufacturing PMI. US, 3:45 pm

Preliminary data for August on the Markit Manufacturing PMI is due in the US at 3:45 pm (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.9 points that could support the USD.

Markit Manufacturing PMI. Germany, 9:30 am

Preliminary data for August on the Markit Manufacturing PMI is due in Germany at 9:30 am (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to fall from 53.8 to 53.5 points that could pressure the EUR slightly.

Markit Services PMI. Germany, 9:30 am

Preliminary data for August on the Markit Services PMI is due in Germany at 9:30 am (GMT+2). The index is based on surveys of executives of the largest companies operating in the services sector regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 54.4 points that could support the EUR.

Markit Manufacturing PMI. EU, 10:00 am

Preliminary data for August on the Markit Eurozone Manufacturing PMI is due at 10:00 am (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.0 points that is above the key level of 50.0 points and suggests a gradual growth of the manufacturing sector.

Markit Services PMI. EU, 10:00 am

Preliminary data for August on the Markit Eurozone Services PMI is due at 10:00 am (GMT+2). The index is based on surveys of executives of the largest companies operating in the services sector regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.9 points that is a positive factor for the EUR.

Markit Manufacturing PMI. US, 3:45 pm

Preliminary data for August on the Markit Manufacturing PMI is due in the US at 3:45 pm (GMT+2). The index is based on surveys of executives of the largest manufacturing companies regarding their opinion on the current economic situation and business conditions prospects. The index is expected to remain unchanged at 52.9 points that could support the USD.

Claws and Horns

News of the day. 19.08.2016

Japan

Data on the All Industry Activity Index for June is due in Japan at 6:30 am (GMT+2). The index represents expenditures of large manufacturers in all sectors excluding the financial one. The data is considered as a leading indicator of productivity growth. A growth in the index strengthens the JPY. A fall in the index weakens the JPY.

Germany

Data on the Producer Price Index for July is due in Germany at 8:00 am (GMT+2). The indicator represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Canada

Data on the Consumer Price Index for July is due in Canada at 2:30 pm (GMT+2). The indicator represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Japan

Data on the All Industry Activity Index for June is due in Japan at 6:30 am (GMT+2). The index represents expenditures of large manufacturers in all sectors excluding the financial one. The data is considered as a leading indicator of productivity growth. A growth in the index strengthens the JPY. A fall in the index weakens the JPY.

Germany

Data on the Producer Price Index for July is due in Germany at 8:00 am (GMT+2). The indicator represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Canada

Data on the Consumer Price Index for July is due in Canada at 2:30 pm (GMT+2). The indicator represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Claws and Horns

News of the day. 18.08.2016

Japan

Data Trade Balance for July is due in Japan at 1:50 am (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values occur when exports exceed imports and imply the balance is in surplus. Negative values imply the balance is in deficit indicating imports exceed exports. A high reading strengthens the JPY. A low reading weakens the JPY.

Australia

Data on the Participation Rate for July is due in Australia at 3:30 am (GMT+2). The indicator measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Data on the Unemployment Rate for July is due in Australia at 3:30 am (GMT+2). The indicator represents a percentage of the unemployed among the total labour force. A growth in the indicator is a negative factor for the country’s economy and weakens the AUD. A fall in the indicator, on the contrary, is a positive factor and strengthens the AUD.

UK

Data on the Retail Sales for July is due in the UK at 10:30 am (GMT+2). The indicator represents the total value of all receipts from retail shops in the country. It characterizes the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economic development. A high reading strengthens the GBP. A low reading weakens the GBP.

EU

Data on the Consumer Price Index for July is due in the EU at 11:00 am (GMT+2). It is the key indicator of inflation in the eurozone which represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

USA

Data on the Initial Jobless Claims for the past week is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

Japan

Data Trade Balance for July is due in Japan at 1:50 am (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values occur when exports exceed imports and imply the balance is in surplus. Negative values imply the balance is in deficit indicating imports exceed exports. A high reading strengthens the JPY. A low reading weakens the JPY.

Australia

Data on the Participation Rate for July is due in Australia at 3:30 am (GMT+2). The indicator measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Data on the Unemployment Rate for July is due in Australia at 3:30 am (GMT+2). The indicator represents a percentage of the unemployed among the total labour force. A growth in the indicator is a negative factor for the country’s economy and weakens the AUD. A fall in the indicator, on the contrary, is a positive factor and strengthens the AUD.

UK

Data on the Retail Sales for July is due in the UK at 10:30 am (GMT+2). The indicator represents the total value of all receipts from retail shops in the country. It characterizes the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economic development. A high reading strengthens the GBP. A low reading weakens the GBP.

EU

Data on the Consumer Price Index for July is due in the EU at 11:00 am (GMT+2). It is the key indicator of inflation in the eurozone which represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

USA

Data on the Initial Jobless Claims for the past week is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new unemployment claims. The data is published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

Claws and Horns

News of the day. 17.08.2016

New Zealand

Data on the Unemployment Rate for the second quarter of the year is due at 0:45 am (GMT+2). The data on the unemployment rate is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that are currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD.

Data on the Employment Change for the second quarter of the year is due at 0:45 am (GMT+2). The data on employment change represents the change in the percentage of employed citizens. A growth in the indicator suggests a growth in consumer spending. A high reading strengthens the NZD. A low reading weakens the NZD.

Switzerland

Data on the ZEW Survey – Expectations for August is due at 11:00 am (GMT+2). The indicator is released by the Centre for European Economic Research (ZEW) and represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the CHF, while a low reading weakens the CHF.

USA

The FOMC Minutes are due at 8:00 pm (GMT+2). The committee gives their opinion on current economic conditions in the US and decides on the direction of monetary policy. Has a high impact on the market.

New Zealand

Data on the Unemployment Rate for the second quarter of the year is due at 0:45 am (GMT+2). The data on the unemployment rate is one of the main indicators of the labour market in New Zealand. It represents a percentage of the total labour force of the country that are currently unemployed. A growth in the indicator is a negative factor and weakens the NZD. A fall in the indicator, on the contrary, is a positive factor and strengthens the NZD.

Data on the Employment Change for the second quarter of the year is due at 0:45 am (GMT+2). The data on employment change represents the change in the percentage of employed citizens. A growth in the indicator suggests a growth in consumer spending. A high reading strengthens the NZD. A low reading weakens the NZD.

Switzerland

Data on the ZEW Survey – Expectations for August is due at 11:00 am (GMT+2). The indicator is released by the Centre for European Economic Research (ZEW) and represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the CHF, while a low reading weakens the CHF.

USA

The FOMC Minutes are due at 8:00 pm (GMT+2). The committee gives their opinion on current economic conditions in the US and decides on the direction of monetary policy. Has a high impact on the market.

Claws and Horns

News of the day. 16.08.2016

Australia

The Reserve Bank of Australia releases its meeting minutes at 3:30 am (GMT+2). Minutes are released two weeks after each meeting and contain commentaries regarding the most recent decisions.

UK

The Consumer Price Index for July is due in the UK at 10:30 am (GMT+2). It is one of the key indicators of inflation in the country. The index represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

EU

The eurozone’s ZEW Economic Sentiment is due at 11:00 am (GMT+2). The index, released by the Centre for European Economic Research (ZEW), is based on surveys of 350 leading experts regarding their assessment of the eurozone’s economic future. Positive values represent an optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

Data on the eurozone’s trade balance for June is due at 11:00 am (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Germany

The ZEW Economic Sentiment is due in Germany at 11:00 am (GMT+2). The index, released by the Centre for European Economic Research (ZEW), is based on surveys of the leading experts regarding their assessment of Germany’s economic future. Positive values represent an optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

USA

The Consumer Price Index for July is due in the US at 2:30 pm (GMT+2). It is the key indicator of inflation in the country which represents the change in the value of the basket of goods and services. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Data on the Housing Starts for July is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Capacity Utilization for July is due in the US at 3:15 pm (GMT+2). It is the percentage expression of the production capacity utilization in the economy of the country. The indicator represents the pace of economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% suggests inflation acceleration. A growth in the index generally strengthens the USD.

Data on the Industrial Production for July is due in the US at 3:15 pm (GMT+2). The indicator represents the change in US industrial output. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the USD. A fall in the indicator pressures the USD.

Australia

The Reserve Bank of Australia releases its meeting minutes at 3:30 am (GMT+2). Minutes are released two weeks after each meeting and contain commentaries regarding the most recent decisions.

UK

The Consumer Price Index for July is due in the UK at 10:30 am (GMT+2). It is one of the key indicators of inflation in the country. The index represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

EU

The eurozone’s ZEW Economic Sentiment is due at 11:00 am (GMT+2). The index, released by the Centre for European Economic Research (ZEW), is based on surveys of 350 leading experts regarding their assessment of the eurozone’s economic future. Positive values represent an optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

Data on the eurozone’s trade balance for June is due at 11:00 am (GMT+2). The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Germany

The ZEW Economic Sentiment is due in Germany at 11:00 am (GMT+2). The index, released by the Centre for European Economic Research (ZEW), is based on surveys of the leading experts regarding their assessment of Germany’s economic future. Positive values represent an optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

USA

The Consumer Price Index for July is due in the US at 2:30 pm (GMT+2). It is the key indicator of inflation in the country which represents the change in the value of the basket of goods and services. A growth in the index strengthens the USD. A fall in the index weakens the USD.

Data on the Housing Starts for July is due in the US at 2:30 pm (GMT+2). The indicator represents the number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Capacity Utilization for July is due in the US at 3:15 pm (GMT+2). It is the percentage expression of the production capacity utilization in the economy of the country. The indicator represents the pace of economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% suggests inflation acceleration. A growth in the index generally strengthens the USD.

Data on the Industrial Production for July is due in the US at 3:15 pm (GMT+2). The indicator represents the change in US industrial output. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the USD. A fall in the indicator pressures the USD.

Claws and Horns

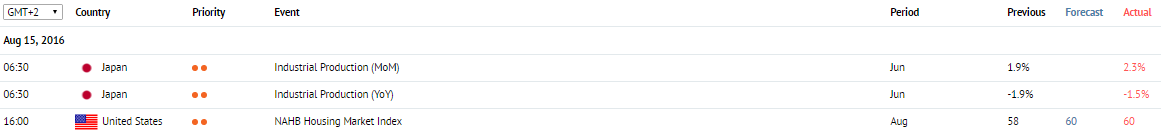

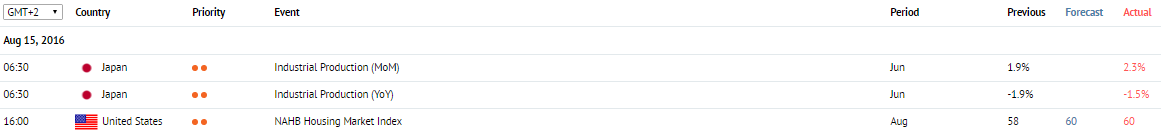

News of the day. 15.08.2016

Japan

Data on Industrial Production for June is due in Japan at 6:30 am (GMT+2). The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

USA

The NAHB Housing Market Index for August is due in the US at 4:00 pm (GMT+2). The index is based on a survey of randomly sampled homeowners aiming at estimating a current market value of their property and its further dynamics for the next 6 months. A value above 50 represents favourable situation on the property market as participants find house prices acceptable.

Japan

Data on Industrial Production for June is due in Japan at 6:30 am (GMT+2). The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

USA

The NAHB Housing Market Index for August is due in the US at 4:00 pm (GMT+2). The index is based on a survey of randomly sampled homeowners aiming at estimating a current market value of their property and its further dynamics for the next 6 months. A value above 50 represents favourable situation on the property market as participants find house prices acceptable.

Claws and Horns

News of the day. 12.08.2016

Business NZ PMI. New Zealand, 0:30 am

The Business NZ PMI for July is due in New Zealand at 0:30 am (GMT+2). The index is based on survey responses from purchasing managers regarding their assessment of current economic conditions and economic growth prospects. A reading above 50 represents a generally optimistic assessment and strengthens the NZD. A reading below 50 represents a generally pessimistic assessment and weakens the NZD.

Retail Sales. New Zealand, 0:45 am

Data on the Retail Sales for the second quarter is due in New Zealand at 0:45 am (GMT+2). The indicator is based on the general number of retail store purchases and represents consumer spending and demand. An increase in retail sales is an important factor of economic growth. A high reading strengthens the NZD. A low reading weakens the NZD.

Consumer Price Index. Germany, 8:00 am

The Consumer Price Index for July is due in Germany at 8:00 am (GMT+2). The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Gross Domestic Product. Germany, 8:00 am

Data on the Gross Domestic Product for the second quarter is due in Germany at 8:00 am (GMT+2). The indicator represents the value of all goods and services produced by Germany in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Gross Domestic Product. EU, 11:00 am

Data on the eurozone’s Gross Domestic Product for the second quarter is due at 11:00 am (GMT+2). The indicator represents the value of all goods and services produced by the eurozone in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Industrial Production. EU, 11:00 am

Data on the eurozone’s Industrial Production for June is due at 11:00 am (GMT+2). The indicator represents the change in industrial output. It is one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for July is due in the US at 2:30 pm (GMT+2). It is an indicator of consumer spending, which represents the change in the volume of retail sales. A growth in the indicator is a positive factor for the economy and strengthens the USD. A fall in the indicator weakens the USD.

Business NZ PMI. New Zealand, 0:30 am

The Business NZ PMI for July is due in New Zealand at 0:30 am (GMT+2). The index is based on survey responses from purchasing managers regarding their assessment of current economic conditions and economic growth prospects. A reading above 50 represents a generally optimistic assessment and strengthens the NZD. A reading below 50 represents a generally pessimistic assessment and weakens the NZD.

Retail Sales. New Zealand, 0:45 am

Data on the Retail Sales for the second quarter is due in New Zealand at 0:45 am (GMT+2). The indicator is based on the general number of retail store purchases and represents consumer spending and demand. An increase in retail sales is an important factor of economic growth. A high reading strengthens the NZD. A low reading weakens the NZD.

Consumer Price Index. Germany, 8:00 am

The Consumer Price Index for July is due in Germany at 8:00 am (GMT+2). The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Gross Domestic Product. Germany, 8:00 am

Data on the Gross Domestic Product for the second quarter is due in Germany at 8:00 am (GMT+2). The indicator represents the value of all goods and services produced by Germany in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Gross Domestic Product. EU, 11:00 am

Data on the eurozone’s Gross Domestic Product for the second quarter is due at 11:00 am (GMT+2). The indicator represents the value of all goods and services produced by the eurozone in a time period. A high reading strengthens the EUR. A low reading weakens the EUR.

Industrial Production. EU, 11:00 am

Data on the eurozone’s Industrial Production for June is due at 11:00 am (GMT+2). The indicator represents the change in industrial output. It is one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for July is due in the US at 2:30 pm (GMT+2). It is an indicator of consumer spending, which represents the change in the volume of retail sales. A growth in the indicator is a positive factor for the economy and strengthens the USD. A fall in the indicator weakens the USD.

Claws and Horns

News of the day. 08.08.2016

Eco Watchers Survey. Japan, 7:00 am

The Eco Watchers Survey for July is due in Japan at 7:00 am (GMT+2). The index is based on survey responses from employees of the largest companies regarding their opinion on current and future economic trends. A reading above 50 represents positive assessments of economic prospects and strengthens the JPY. A reading below 50, on the contrary, weakens the JPY suggesting that respondents are generally pessimistic about economic conditions.

Consumer Price Index. Switzerland, 9:15 am

The Consumer Price Index for July is due in Switzerland at 9:15 am (GMT+2). The index represents changes in prices of goods and services for household consumption. It is the key indicator of inflation. A growth in the index strengthens the CHF. A fall in the index weakens the CHF.

Labor Market Conditions Index. US, 4:00 pm

The Labor Market Conditions Index for July is due in the US at 4:00 pm (GMT+2). The index was developed by Federal Reserve economists and is derived from 19 labor market indicators. It is considered to be one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Eco Watchers Survey. Japan, 7:00 am

The Eco Watchers Survey for July is due in Japan at 7:00 am (GMT+2). The index is based on survey responses from employees of the largest companies regarding their opinion on current and future economic trends. A reading above 50 represents positive assessments of economic prospects and strengthens the JPY. A reading below 50, on the contrary, weakens the JPY suggesting that respondents are generally pessimistic about economic conditions.

Consumer Price Index. Switzerland, 9:15 am

The Consumer Price Index for July is due in Switzerland at 9:15 am (GMT+2). The index represents changes in prices of goods and services for household consumption. It is the key indicator of inflation. A growth in the index strengthens the CHF. A fall in the index weakens the CHF.

Labor Market Conditions Index. US, 4:00 pm

The Labor Market Conditions Index for July is due in the US at 4:00 pm (GMT+2). The index was developed by Federal Reserve economists and is derived from 19 labor market indicators. It is considered to be one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

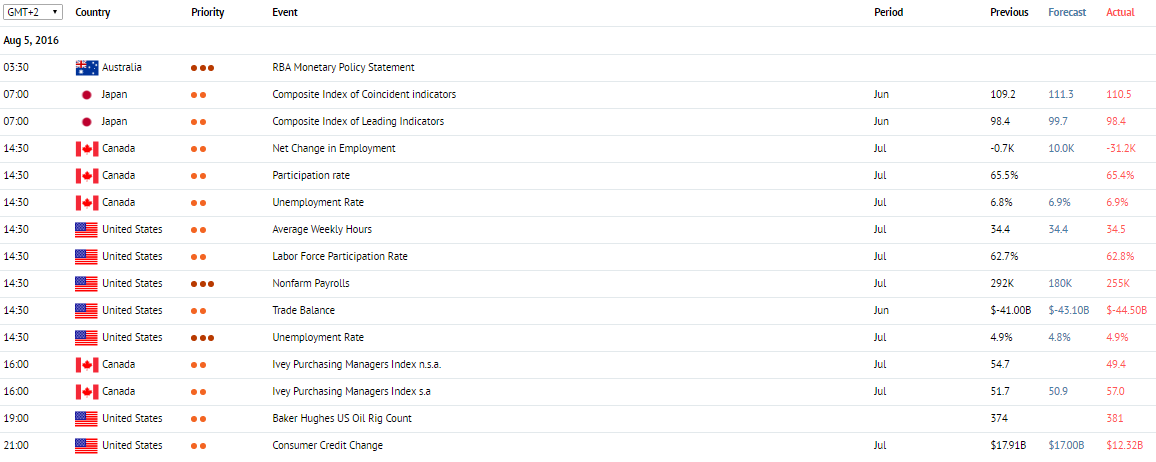

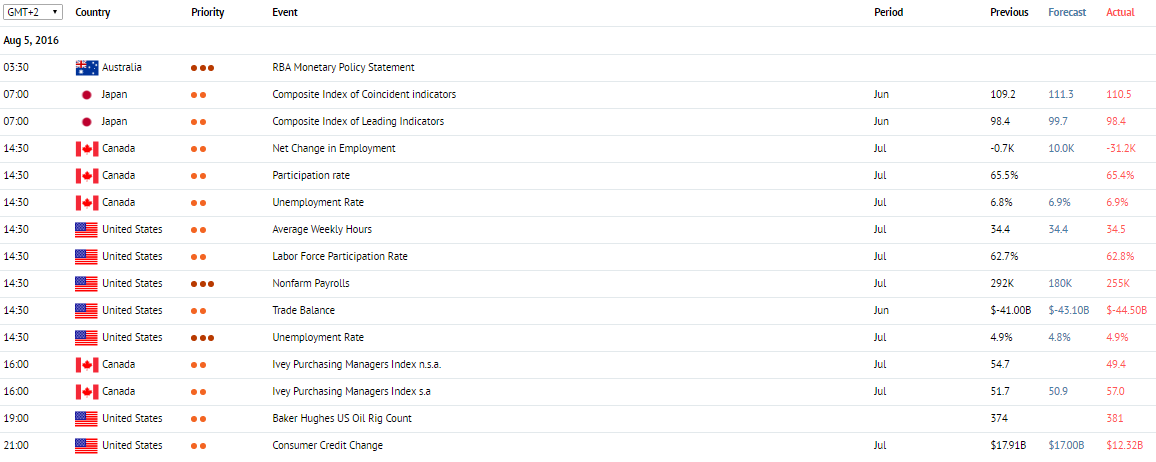

News of the day. 05.08.2016

AiG Performance of Construction Index. Australia, 1:30 am

The AiG Performance of Construction Index for July is due in Australia at 1:30 am (GMT+2). The index is constructed from survey data collected from executives of 120 construction companies regarding their assessment of such criteria as sales, production, new orders, supplier deliveries and employment in the sector. A reading above 50 is perceived as positive and strengthens the AUD. A reading below 50, on the contrary, is perceived as negative and weakens the AUD.

Composite Index of Coincident Indicators. Japan, 7:00 am

The Composite Index of Coincident Indicators is due in Japan at 7:00 am (GMT+2). The indicator is expected to be up to 111.3 points in June from 109.9 points in the previous month. The index is based on 11 indicators and shows the current state of the economy. A result above 50 represents economic growth and strengthens the JPY. A result below 50 indicates a slowdown of the economy that, in its turn, has a negative impact on the JPY.

Composite Index of Leading Indicators. Japan, 7:00 am

The Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The indicator is expected to remain unchanged at 99.7 points. The index, based on 13 indicators, is used to assess economic prospects in the short- and medium terms. A result above 50 is perceived as a positive factor and strengthens the JPY. A result below 50 is perceived as a negative factor and weakens the JPY.

Nonfarm Payrolls. US, 2:30 pm

Data on the Nonfarm Payrolls for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to 180 000 from 287 000. It is a key macroeconomic indicator which shows the change in the number of employed in non-agricultural sectors. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Unemployment Rate. US, 2:30 pm

Data on the Unemployment Rate for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to 4.8% from 4.9%. It is a key macroeconomic indicator which represents the share of unemployment in the total labour force. A growth in the indicator strengthens the USD. A fall in the indicator weakens the USD.

Trade Balance. US, 2:30 pm

Data on the Trade Balance is due in the US at 2:30 pm (GMT+2). US trade deficit is expected to widen to 43.10 billion in June from 41.14 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

Unemployment Rate. Canada, 2:30 pm

Data on the Unemployment Rate for July is due in Canada at 2:30 pm (GMT+2). The indicator is expected to be up to 6.9% in July from 6.8% in the previous month. The indicator, released by Statistics Canada, represents the number of unemployed as a percentage of the total labour force. A growth in the indicator suggests a slowdown of the economy and weakens the CAD. A fall in the indicator supports the national economy growth and strengthens the CAD.

Participation Rate. Canada, 2:30 pm

Data on the Participation Rate for July is due in Canada at 2:30 pm (GMT+2). The indicator is expected to rise to 10 000 in July from -700 in the previous month. The indicator represents the change in the number of employed people. An increase in the number of employed people suggests a growth of the economy and strengthens the CAD. A fall in the indicator weakens the CAD.

Consumer Credit Change. US, 9:00 pm

Data on the Consumer Credit Change is due in the US at 9:00 pm (GMT+2). The indicator is expected to be down to 17.0 billion in July from 18.56 billion in the previous month. The indicator represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

AiG Performance of Construction Index. Australia, 1:30 am

The AiG Performance of Construction Index for July is due in Australia at 1:30 am (GMT+2). The index is constructed from survey data collected from executives of 120 construction companies regarding their assessment of such criteria as sales, production, new orders, supplier deliveries and employment in the sector. A reading above 50 is perceived as positive and strengthens the AUD. A reading below 50, on the contrary, is perceived as negative and weakens the AUD.

Composite Index of Coincident Indicators. Japan, 7:00 am

The Composite Index of Coincident Indicators is due in Japan at 7:00 am (GMT+2). The indicator is expected to be up to 111.3 points in June from 109.9 points in the previous month. The index is based on 11 indicators and shows the current state of the economy. A result above 50 represents economic growth and strengthens the JPY. A result below 50 indicates a slowdown of the economy that, in its turn, has a negative impact on the JPY.

Composite Index of Leading Indicators. Japan, 7:00 am

The Composite Index of Leading Indicators for June is due in Japan at 7:00 am (GMT+2). The indicator is expected to remain unchanged at 99.7 points. The index, based on 13 indicators, is used to assess economic prospects in the short- and medium terms. A result above 50 is perceived as a positive factor and strengthens the JPY. A result below 50 is perceived as a negative factor and weakens the JPY.

Nonfarm Payrolls. US, 2:30 pm

Data on the Nonfarm Payrolls for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to 180 000 from 287 000. It is a key macroeconomic indicator which shows the change in the number of employed in non-agricultural sectors. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Unemployment Rate. US, 2:30 pm

Data on the Unemployment Rate for July is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall to 4.8% from 4.9%. It is a key macroeconomic indicator which represents the share of unemployment in the total labour force. A growth in the indicator strengthens the USD. A fall in the indicator weakens the USD.

Trade Balance. US, 2:30 pm

Data on the Trade Balance is due in the US at 2:30 pm (GMT+2). US trade deficit is expected to widen to 43.10 billion in June from 41.14 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the USD. Negative values represent the balance deficit and weaken the USD.

Unemployment Rate. Canada, 2:30 pm

Data on the Unemployment Rate for July is due in Canada at 2:30 pm (GMT+2). The indicator is expected to be up to 6.9% in July from 6.8% in the previous month. The indicator, released by Statistics Canada, represents the number of unemployed as a percentage of the total labour force. A growth in the indicator suggests a slowdown of the economy and weakens the CAD. A fall in the indicator supports the national economy growth and strengthens the CAD.

Participation Rate. Canada, 2:30 pm

Data on the Participation Rate for July is due in Canada at 2:30 pm (GMT+2). The indicator is expected to rise to 10 000 in July from -700 in the previous month. The indicator represents the change in the number of employed people. An increase in the number of employed people suggests a growth of the economy and strengthens the CAD. A fall in the indicator weakens the CAD.

Consumer Credit Change. US, 9:00 pm

Data on the Consumer Credit Change is due in the US at 9:00 pm (GMT+2). The indicator is expected to be down to 17.0 billion in July from 18.56 billion in the previous month. The indicator represents the change in the volume of outstanding consumer credit in the US. A high reading strengthens the USD. A low reading weakens the USD. Sometimes, a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Claws and Horns

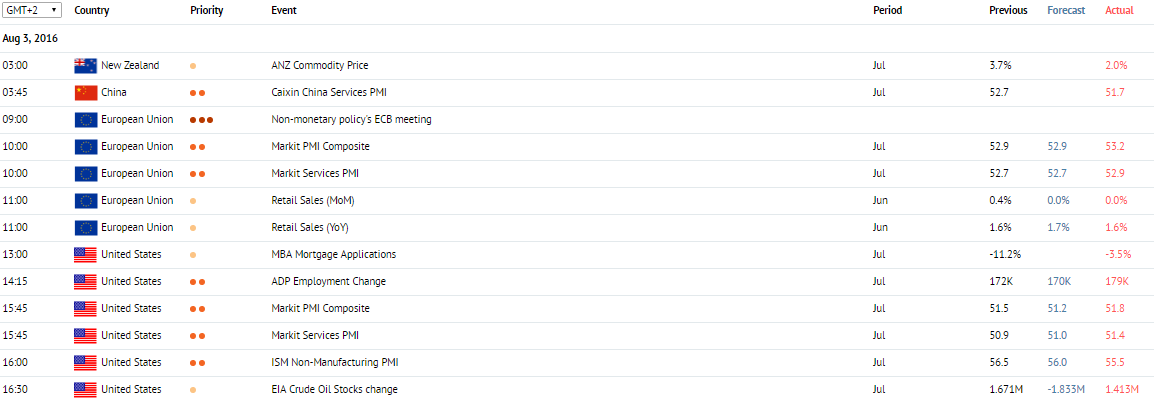

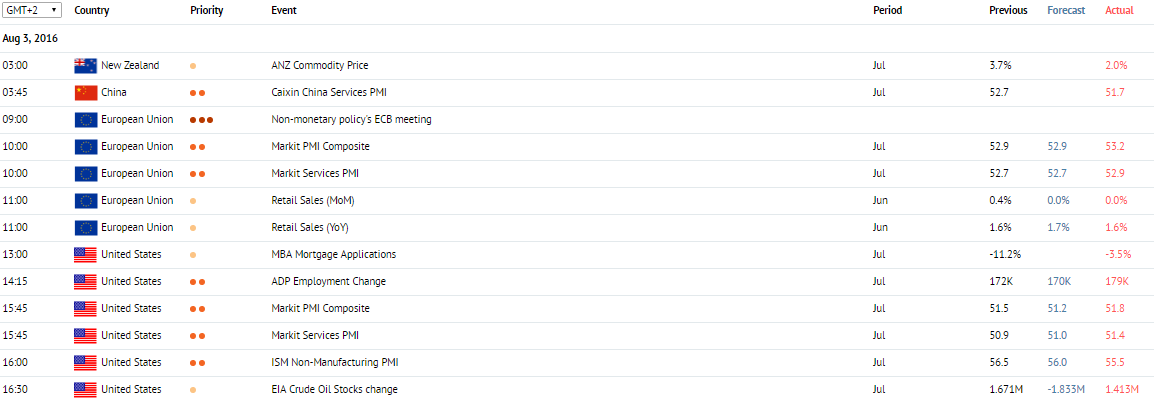

News of the day. 03.08.2016

Participation Rate. New Zealand, 0:45 am

Data on the Participation Rate in the second quarter is due in New Zealand at 0:45 am (GMT+2). The indicator measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Caixin China Services PMI. China, 3:45 am

The Caixin Services PMI for July is due in China at 3:45 am (GMT+2). The index is based on surveys of executives of Chinese companies operating in the services sector regarding their opinion on current economic conditions in the sector. The data is used to evaluate the state of the services sector. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Non-monetary policy's ECB meeting. EU, 9:00 am

The European Central Bank is holding a non-monetary policy meeting at 9:00 am (GMT+2). Note: The meetings dedicated to monetary policy are held every six weeks. Non-monetary policy meetings are held at least once a month.

Markit Services PMI. EU, 10:00 am

Data on the Markit Services PMI is due in the EU at 10:00 am (GMT+2). The indicator is expected to remain unchanged at 52.7 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

ADP Employment Change. US, 2:15 pm

Data on the ADP Employment Change is due in the US at 2:15 pm (GMT+2). The indicator is expected to fall to 168 000 in July from 172 000 in the previous month. The indicator is based on data from about 500 thousands companies in the US and represents employment change in non-agricultural sectors. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

ISM Non-Manufacturing PMI. US, 4:00 pm

Data on the ISM Non-Manufacturing PMI is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall to 56.0 points from 56.5 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50 represents a slowdown of the economy. A growth in the index strengthens the USD.

Participation Rate. New Zealand, 0:45 am

Data on the Participation Rate in the second quarter is due in New Zealand at 0:45 am (GMT+2). The indicator measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Caixin China Services PMI. China, 3:45 am

The Caixin Services PMI for July is due in China at 3:45 am (GMT+2). The index is based on surveys of executives of Chinese companies operating in the services sector regarding their opinion on current economic conditions in the sector. The data is used to evaluate the state of the services sector. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

Non-monetary policy's ECB meeting. EU, 9:00 am

The European Central Bank is holding a non-monetary policy meeting at 9:00 am (GMT+2). Note: The meetings dedicated to monetary policy are held every six weeks. Non-monetary policy meetings are held at least once a month.

Markit Services PMI. EU, 10:00 am

Data on the Markit Services PMI is due in the EU at 10:00 am (GMT+2). The indicator is expected to remain unchanged at 52.7 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

ADP Employment Change. US, 2:15 pm

Data on the ADP Employment Change is due in the US at 2:15 pm (GMT+2). The indicator is expected to fall to 168 000 in July from 172 000 in the previous month. The indicator is based on data from about 500 thousands companies in the US and represents employment change in non-agricultural sectors. A high reading strengthens the USD. A low reading and values below expectations weaken the USD.

ISM Non-Manufacturing PMI. US, 4:00 pm

Data on the ISM Non-Manufacturing PMI is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall to 56.0 points from 56.5 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 45-50 represents economic growth. A reading below 45-50 represents a slowdown of the economy. A growth in the index strengthens the USD.

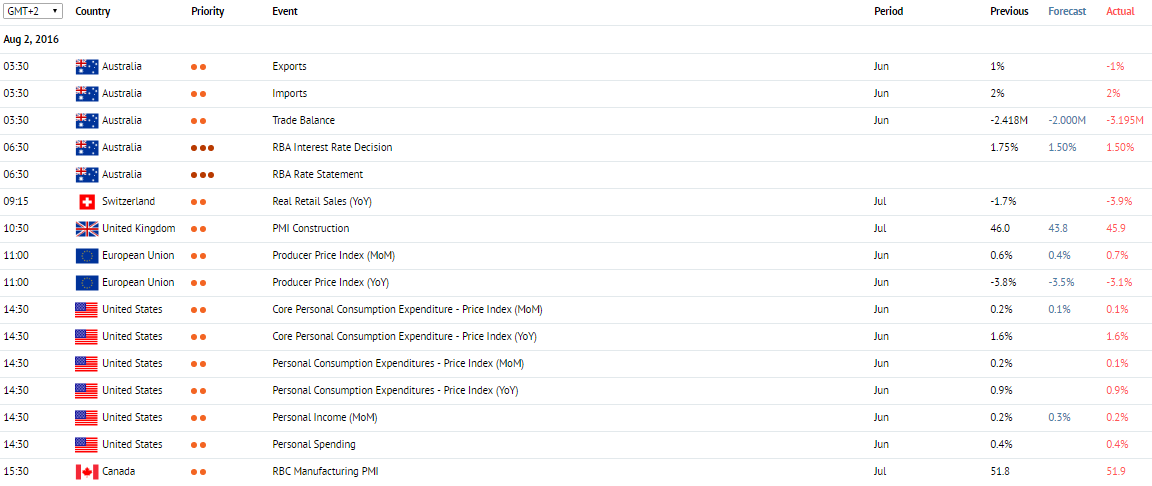

Claws and Horns

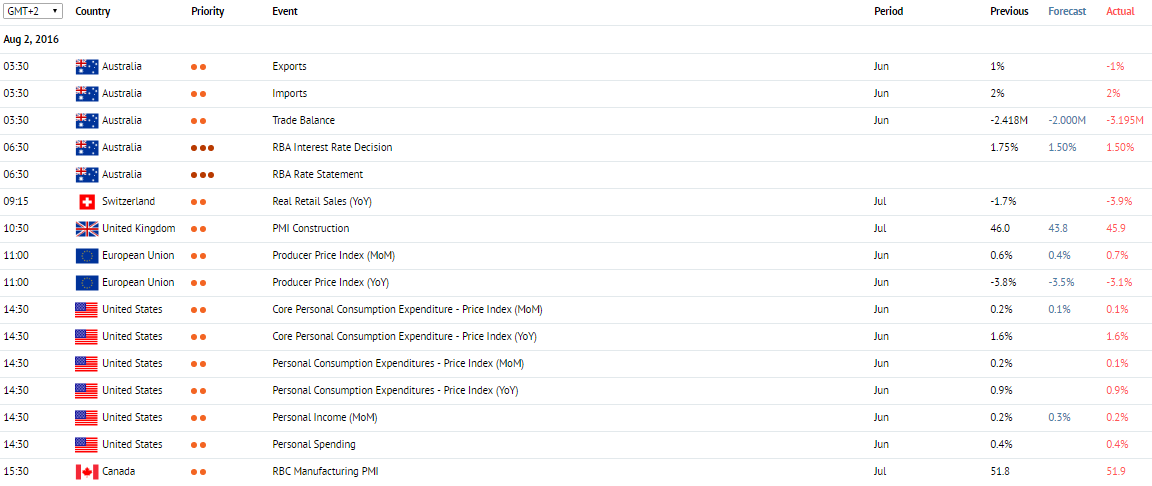

News of the day. 2.08.2016

Imports, Exports. Australia, 3:30 am

Data on Australia’s Imports and Exports is due at 3:30 am (GMT+2). The Imports represent the change in the volume of imported goods and services. The Exports represent the change in the volume of exported goods and services.

Trade Balance. Australia, 3:30 am

Data on the Trade Balance is due at 3:30 am (GMT+2). Australia’ trade deficit is expected to narrow to 2 billion in June from 2.218 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

RBA Interest Rate Decision. Australia, 6:30 am

The Reserve Bank of Australia announces its interest rates decision at 6:30 am (GMT+2). The Regulator is expected to cut interest rates from 1.75% to 1.5%. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Real Retail Sales. Switzerland, 9:15 am

Data on the Real Retail Sales for July is due in Switzerland 9:15 am (GMT+2). The indicator represents the change in the volume of retail sales. It is considered to be an indicator of consumer spending. A growth in retail sales suggests a growth in consumption. A high reading strengthens the CHF. A low reading weakens the CHF.

PMI Construction. UK, 10:30 am

Data on the UK Construction PMI is due at 10:30 am (GMT+2). The indicator is expected to be down to 44 points in July from 46 points in the previous month. The index evaluates the state of the construction sector. The data is based on surveys of executives of the biggest UK construction companies regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Producer Price Index. EU, 11:00 am

Data on the EU Producer Price Index for June is due at 11:00 am (GMT+2). The indicator is expected to fall from 0.6% to 0.4% in monthly terms. On a year-over-year basis, a growth from -3.9% to -3.5 is expected. The index represents the price change on goods, produced in the eurozone. A growth in the index supports the EUR. A decline in the index weakens the EUR.

Personal Income. US, 2:30 pm

Data on the Personal Income is due in the US at 2:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to grow to 0.3% in June from 0.2% in the previous month. The indicator represents income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the indicator suggests consumer readiness to spend money in current economic conditions.

Personal Spending. US, 2:30 pm

Data on the Personal Spending for June is due in the US at 2:30 pm (GMT+2). The indicator consists of spending on services, durable goods and nondurable goods.

RBC Manufacturing PMI. Canada, 3:30 pm

Data on the Manufacturing PMI for July is due in Canada at 3:30 pm (GMT+2). The index is based on surveys of executives of 400 large companies regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 represents a predominance of positive reviews and strengthens the CAD. A reading below 50 represents a predominance of negative reviews and weakens the CAD.

Imports, Exports. Australia, 3:30 am

Data on Australia’s Imports and Exports is due at 3:30 am (GMT+2). The Imports represent the change in the volume of imported goods and services. The Exports represent the change in the volume of exported goods and services.

Trade Balance. Australia, 3:30 am

Data on the Trade Balance is due at 3:30 am (GMT+2). Australia’ trade deficit is expected to narrow to 2 billion in June from 2.218 billion in the previous month. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

RBA Interest Rate Decision. Australia, 6:30 am

The Reserve Bank of Australia announces its interest rates decision at 6:30 am (GMT+2). The Regulator is expected to cut interest rates from 1.75% to 1.5%. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Real Retail Sales. Switzerland, 9:15 am

Data on the Real Retail Sales for July is due in Switzerland 9:15 am (GMT+2). The indicator represents the change in the volume of retail sales. It is considered to be an indicator of consumer spending. A growth in retail sales suggests a growth in consumption. A high reading strengthens the CHF. A low reading weakens the CHF.

PMI Construction. UK, 10:30 am

Data on the UK Construction PMI is due at 10:30 am (GMT+2). The indicator is expected to be down to 44 points in July from 46 points in the previous month. The index evaluates the state of the construction sector. The data is based on surveys of executives of the biggest UK construction companies regarding their opinion on current economic conditions in the sector and its prospects. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Producer Price Index. EU, 11:00 am

Data on the EU Producer Price Index for June is due at 11:00 am (GMT+2). The indicator is expected to fall from 0.6% to 0.4% in monthly terms. On a year-over-year basis, a growth from -3.9% to -3.5 is expected. The index represents the price change on goods, produced in the eurozone. A growth in the index supports the EUR. A decline in the index weakens the EUR.

Personal Income. US, 2:30 pm

Data on the Personal Income is due in the US at 2:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to grow to 0.3% in June from 0.2% in the previous month. The indicator represents income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the indicator suggests consumer readiness to spend money in current economic conditions.

Personal Spending. US, 2:30 pm

Data on the Personal Spending for June is due in the US at 2:30 pm (GMT+2). The indicator consists of spending on services, durable goods and nondurable goods.

RBC Manufacturing PMI. Canada, 3:30 pm

Data on the Manufacturing PMI for July is due in Canada at 3:30 pm (GMT+2). The index is based on surveys of executives of 400 large companies regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 represents a predominance of positive reviews and strengthens the CAD. A reading below 50 represents a predominance of negative reviews and weakens the CAD.

Claws and Horns

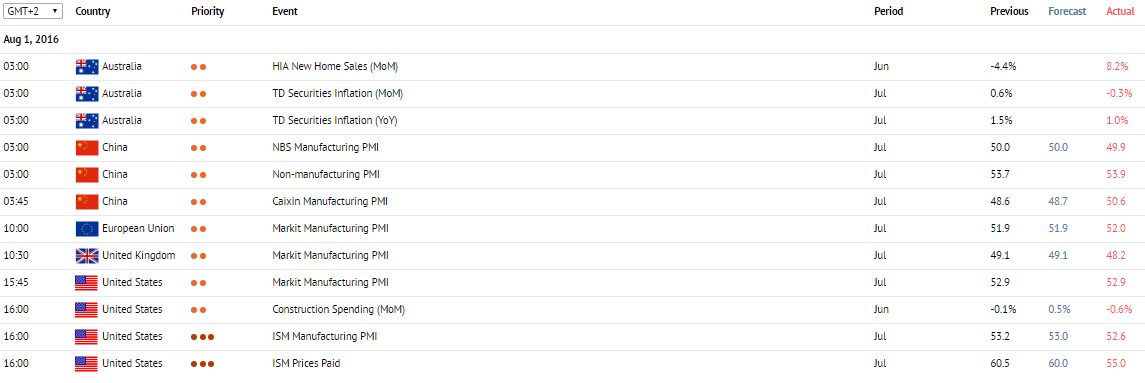

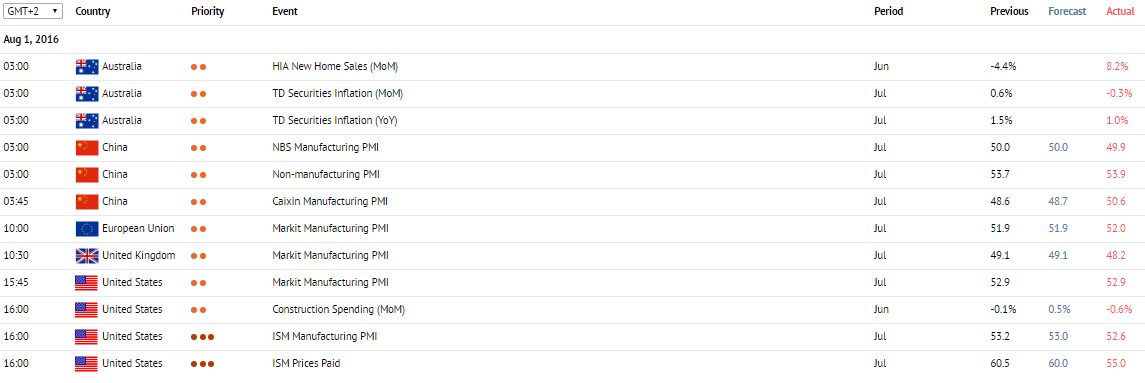

News of the day. 01.08.2016

Australia

The AiG Performance of Mfg Index is due in Australia at 1:30 am (GMT+2). The index, released by the Australian Industry Group (AiG), is constructed from survey data collected from executives of 200 manufacturing companies regarding their assessment of current business conditions in the sector. The index is based on such indicators as sales, production, new orders, supplier deliveries and employment. A reading above 50 is perceived as positive and strengthens the AUD. A reading below 50 is perceived as negative and weakens the AUD.

Data on the TD Securities Inflation for July is due in Australia at 2:30 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Data on the HIA New Home Sales is due in Australia at 3:00 am (GMT+2). The indicator is released by the Housing Industry Association (HIA) and represents the change the number of new home sales. A growth in the indicator suggests economic growth and strengthens the AUD. A fall in the indicator weakens the AUD.

China

The Non-manufacturing PMI is due in China at 3:00 am (GMT+2). The index is based on a research of the activity of approximately 1200 Chinese companies from 27 industries. A reading above 50 indicates a good state of the sectors. A reading below 50 signals a slowdown in the sectors.

The Caixin Manufacturing PMI is due in China at 3:45 am (GMT+2). The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

EU

The eurozone’s Markit Manufacturing PMI for July is due at 3:45 am (GMT+2). The index represents economic conditions in the manufacturing sector and its prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

UK

The Markit Manufacturing PMI is due in the UK at 10:30 am (GMT+2). The index is based on surveys of executives of the biggest manufacturing companies and evaluates the state of the manufacturing sector. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

USA

Data on the Construction Spending for June is due in the US at 4:00 pm (GMT+2). The indicator represents expenditures by construction companies on all types of construction activities. An increase in construction spending indicates economic growth. A high reading strengthens the USD.

Data on the ISM Prices Paid is due in the US at 4:00 pm (GMT+2). The index is based on surveys of executives of manufacturing companies and evaluates current economic conditions in the manufacturing sector.

The ISM Manufacturing PMI is due in the US at 4:00 pm (GMT+2). It is an indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

Australia

The AiG Performance of Mfg Index is due in Australia at 1:30 am (GMT+2). The index, released by the Australian Industry Group (AiG), is constructed from survey data collected from executives of 200 manufacturing companies regarding their assessment of current business conditions in the sector. The index is based on such indicators as sales, production, new orders, supplier deliveries and employment. A reading above 50 is perceived as positive and strengthens the AUD. A reading below 50 is perceived as negative and weakens the AUD.

Data on the TD Securities Inflation for July is due in Australia at 2:30 am (GMT+2). The indicator, released by Melbourne Institute, measures changes in inflation. A growth in inflation might result in RBA’s decision to introduce higher interest rates. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Data on the HIA New Home Sales is due in Australia at 3:00 am (GMT+2). The indicator is released by the Housing Industry Association (HIA) and represents the change the number of new home sales. A growth in the indicator suggests economic growth and strengthens the AUD. A fall in the indicator weakens the AUD.

China

The Non-manufacturing PMI is due in China at 3:00 am (GMT+2). The index is based on a research of the activity of approximately 1200 Chinese companies from 27 industries. A reading above 50 indicates a good state of the sectors. A reading below 50 signals a slowdown in the sectors.

The Caixin Manufacturing PMI is due in China at 3:45 am (GMT+2). The index evaluates the state of the manufacturing industry. A reading above 50 is perceived as positive for the Chinese economy. A reading below 50 is perceived as negative.

EU

The eurozone’s Markit Manufacturing PMI for July is due at 3:45 am (GMT+2). The index represents economic conditions in the manufacturing sector and its prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

UK

The Markit Manufacturing PMI is due in the UK at 10:30 am (GMT+2). The index is based on surveys of executives of the biggest manufacturing companies and evaluates the state of the manufacturing sector. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

USA

Data on the Construction Spending for June is due in the US at 4:00 pm (GMT+2). The indicator represents expenditures by construction companies on all types of construction activities. An increase in construction spending indicates economic growth. A high reading strengthens the USD.

Data on the ISM Prices Paid is due in the US at 4:00 pm (GMT+2). The index is based on surveys of executives of manufacturing companies and evaluates current economic conditions in the manufacturing sector.

The ISM Manufacturing PMI is due in the US at 4:00 pm (GMT+2). It is an indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the USD. Values below 50 indicate a slowdown of the economy and weaken the USD.

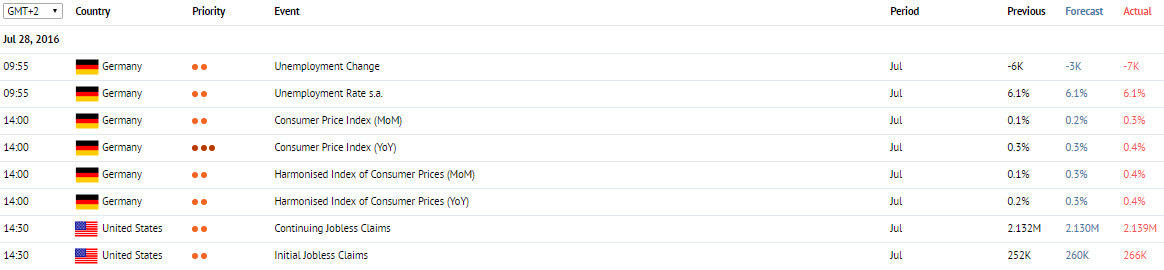

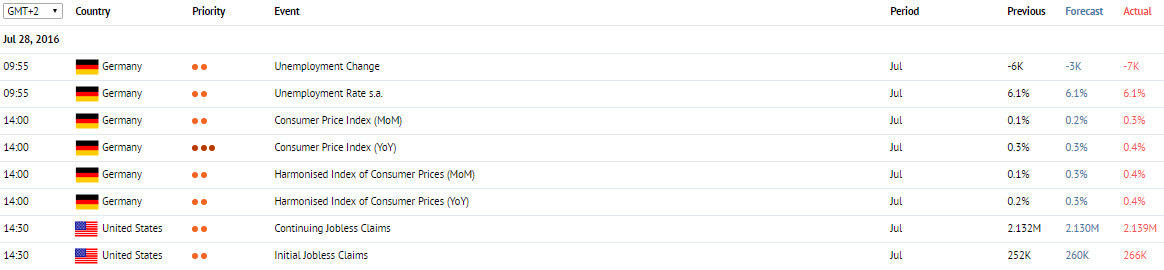

Claws and Horns

News of the day. 28.07.2016

Germany

Data on the Unemployment Rate is due in Germany at 9:55 am (GMT+2). The indicator is expected to remain unchanged at 6.1% in July. The indicator represents the number of unemployed as a percentage of the total labour force. A growth in the indicator suggests a slowdown of the economy and weakens the EUR. A fall in the indicator strengthens the EUR.

The Consumer Price Index is due in Germany at 2:00 pm (GMT+2). In annual terms, the indicator is expected to remain unchanged at 0.3% in July. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

USA

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). The indicator is expected to come out at 260 000, up from 253 000. The indicator represents the number of new unemployment claims. The data is released every Thursday and allows approximating what Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

Germany

Data on the Unemployment Rate is due in Germany at 9:55 am (GMT+2). The indicator is expected to remain unchanged at 6.1% in July. The indicator represents the number of unemployed as a percentage of the total labour force. A growth in the indicator suggests a slowdown of the economy and weakens the EUR. A fall in the indicator strengthens the EUR.

The Consumer Price Index is due in Germany at 2:00 pm (GMT+2). In annual terms, the indicator is expected to remain unchanged at 0.3% in July. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

USA

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). The indicator is expected to come out at 260 000, up from 253 000. The indicator represents the number of new unemployment claims. The data is released every Thursday and allows approximating what Nonfarm Payrolls will be. A fall in the indicator strengthens the USD. A growth in the indicator weakens the USD.

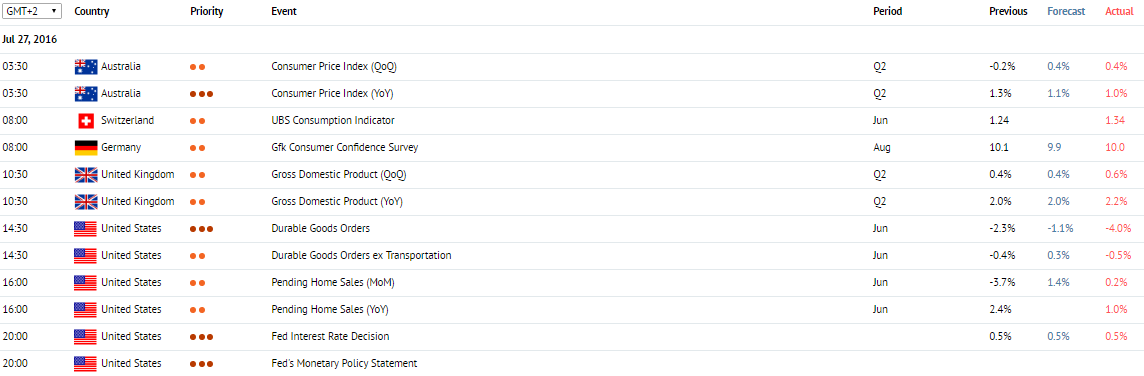

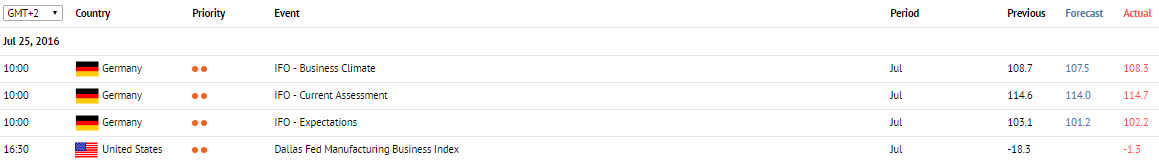

Claws and Horns

News of the day. 27.07.2016

Australia

Data on the Consumer Price Index is due in Australia at 3:30 (GMT+2). The indicator is expected to fall from 1.3% to 1.1% in the second quarter. The index represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Switzerland

The UBS Consumption Indicator for June is due in Switzerland at 8:00 am (GMT+2). The data is based on 5 economic indicators of consumption: car sales, consumer confidence, retail sales, the number of domestic overnight hotel stays, credit card transactions volumes.

Germany

Data on the Gfk Consumer Confidence Survey is due in Germany at 8:00 am (GMT+2). The indicator is expected to fall to 9.9 points in August from 10.1 points in the previous month. The indicator is released by the marketing company Gfk and is based on surveys of consumers regarding their level of confidence in the economy of the country. Values above 0 represent optimistic moods and strengthen the EUR. Values below 0 represent pessimistic moods and weaken the EUR.

UK

Data on the Gross Domestic Product is due in the UK at 10:30 am (GMT+2). The indicator is expected to grow both in annual and quarterly terms, from 2.0% to 2.1% and from 0.4% to 0.5% respectively. The indicator represents the total value of all goods and services created in the UK. It is also an indicator of the pace of economic growth/decline. A high reading strengthens the GBP. A low reading weakens the GBP.

USA

Data on the Durable Goods Orders is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -1.1% in June from -2.3% in the previous month. The indicator represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

Data on the Pending Home Sales is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to be up to 1.8% in June from -3.7% in the previous month. It is one of the main indicators of the property market which is also considered one of the indicators of the general state of the economy. A high reading strengthens the USD. A low reading weakens the USD.

The Federal Open Market Committee announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important indicator which has an impact on commercial banks’ interest rates and the USD exchange rate. An interest rate increase strengthens the USD; a decrease weakens the USD.

Australia

Data on the Consumer Price Index is due in Australia at 3:30 (GMT+2). The indicator is expected to fall from 1.3% to 1.1% in the second quarter. The index represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Switzerland

The UBS Consumption Indicator for June is due in Switzerland at 8:00 am (GMT+2). The data is based on 5 economic indicators of consumption: car sales, consumer confidence, retail sales, the number of domestic overnight hotel stays, credit card transactions volumes.

Germany

Data on the Gfk Consumer Confidence Survey is due in Germany at 8:00 am (GMT+2). The indicator is expected to fall to 9.9 points in August from 10.1 points in the previous month. The indicator is released by the marketing company Gfk and is based on surveys of consumers regarding their level of confidence in the economy of the country. Values above 0 represent optimistic moods and strengthen the EUR. Values below 0 represent pessimistic moods and weaken the EUR.

UK

Data on the Gross Domestic Product is due in the UK at 10:30 am (GMT+2). The indicator is expected to grow both in annual and quarterly terms, from 2.0% to 2.1% and from 0.4% to 0.5% respectively. The indicator represents the total value of all goods and services created in the UK. It is also an indicator of the pace of economic growth/decline. A high reading strengthens the GBP. A low reading weakens the GBP.

USA

Data on the Durable Goods Orders is due in the US at 2:30 pm (GMT+2). The indicator is expected to be up to -1.1% in June from -2.3% in the previous month. The indicator represents the value change for durable goods (including transportations) that last for more than 3 years. A growth in the number of orders is considered positive for the economy. A fall in the number of orders represents a slowdown of the economy. A high reading strengthens the USD.

Data on the Pending Home Sales is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to be up to 1.8% in June from -3.7% in the previous month. It is one of the main indicators of the property market which is also considered one of the indicators of the general state of the economy. A high reading strengthens the USD. A low reading weakens the USD.

The Federal Open Market Committee announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important indicator which has an impact on commercial banks’ interest rates and the USD exchange rate. An interest rate increase strengthens the USD; a decrease weakens the USD.

Claws and Horns

News of the day. 26.07.2016

New Zealand

Data on New Zealand’s Trade Balance is due at 00:45 am (GMT+2). On a year-over-year basis, NZ trade deficit is expected to narrow to NZ$3.300 billion from 3.633 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

USA

The S&P/Case-Shiller Home Price Indices are due in the US at 3:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to grow to 5.5% in May from 5.4% in the previous month. The indices represent the property prices change in 20 of the biggest US states. A high reading strengthens the USD. A low reading weakens the USD.

The Markit Services PMI is due in the US at 3:45 pm (GMT+2). The indicator is expected to grow to 52.0 in July points from 51.4 points in the previous month. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Data on the New Home Sales Change is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to grow to 1.1% in June from -6.0% in the previous month. It is an important indicator of the US property market. A growth in the indicator is a sign of improvement in economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Consumer Confidence is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall to 95.7 points in July from 98.0 points earlier. The indicator represents consumer confidence in current economic conditions. A high reading strengthens the USD. A reading below forecasts weakens the USD.

New Zealand

Data on New Zealand’s Trade Balance is due at 00:45 am (GMT+2). On a year-over-year basis, NZ trade deficit is expected to narrow to NZ$3.300 billion from 3.633 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the NZD. Negative values indicate the balance deficit and weaken the NZD.

USA

The S&P/Case-Shiller Home Price Indices are due in the US at 3:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to grow to 5.5% in May from 5.4% in the previous month. The indices represent the property prices change in 20 of the biggest US states. A high reading strengthens the USD. A low reading weakens the USD.

The Markit Services PMI is due in the US at 3:45 pm (GMT+2). The indicator is expected to grow to 52.0 in July points from 51.4 points in the previous month. The index is based on surveys of executives of the companies operating in the service sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Data on the New Home Sales Change is due in the US at 4:00 pm (GMT+2). In monthly terms, the indicator is expected to grow to 1.1% in June from -6.0% in the previous month. It is an important indicator of the US property market. A growth in the indicator is a sign of improvement in economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Consumer Confidence is due in the US at 4:00 pm (GMT+2). The indicator is expected to fall to 95.7 points in July from 98.0 points earlier. The indicator represents consumer confidence in current economic conditions. A high reading strengthens the USD. A reading below forecasts weakens the USD.

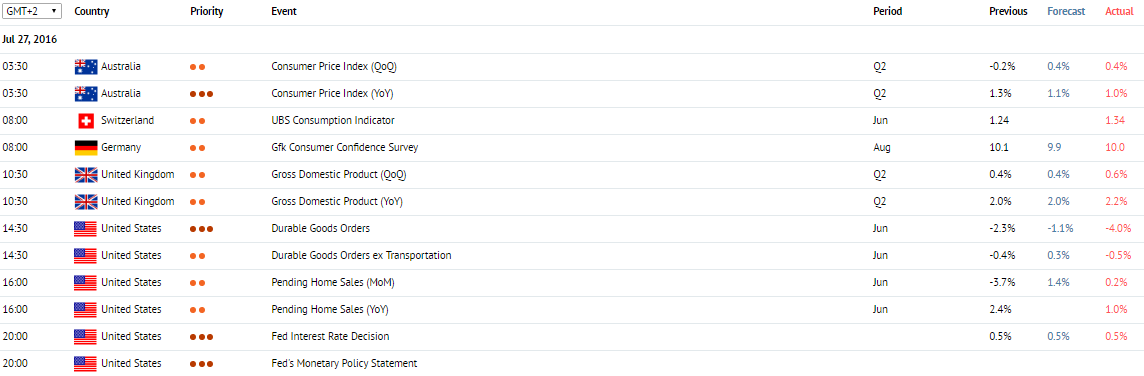

Claws and Horns

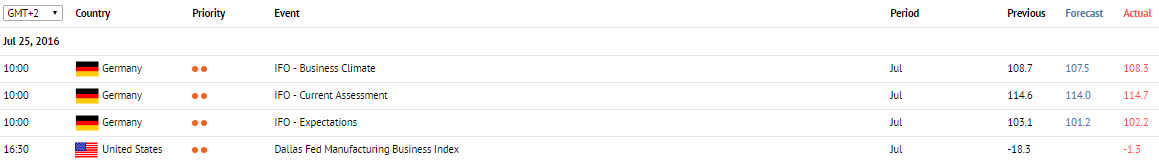

News of the day. 25.07.2016

Germany

Data on the IFO – Expectations is due at 10:00 (GMT+2). The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Data on the IFO – Business Climate is due at 10:00 (GMT+2). The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index is perceived as positive and strengthens the EUR. A fall in the index is perceived as negative and weakens the EUR.

USA

The Dallas Fed Manufacturing Business Index is due at 4:30 pm (GMT+2). The index is released by the Federal Reserve Bank of Dallas and is based on a monthly survey of manufacturing companies in Texas. Includes factors such as output volume, number of orders and prices.

Germany

Data on the IFO – Expectations is due at 10:00 (GMT+2). The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Data on the IFO – Business Climate is due at 10:00 (GMT+2). The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index is perceived as positive and strengthens the EUR. A fall in the index is perceived as negative and weakens the EUR.

USA

The Dallas Fed Manufacturing Business Index is due at 4:30 pm (GMT+2). The index is released by the Federal Reserve Bank of Dallas and is based on a monthly survey of manufacturing companies in Texas. Includes factors such as output volume, number of orders and prices.

: