Claws and Horns / Profil

Claws and Horns

News of the day. 26.04.2017

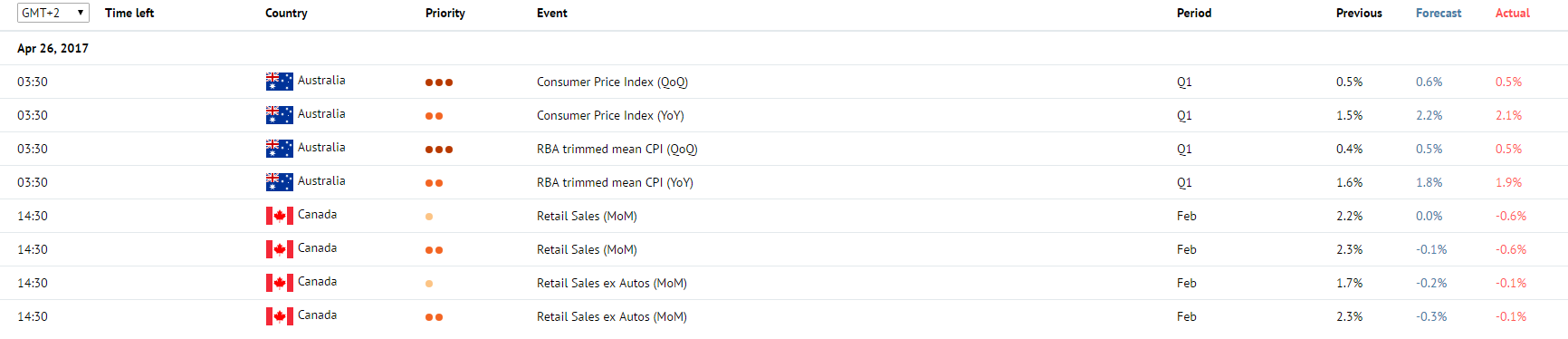

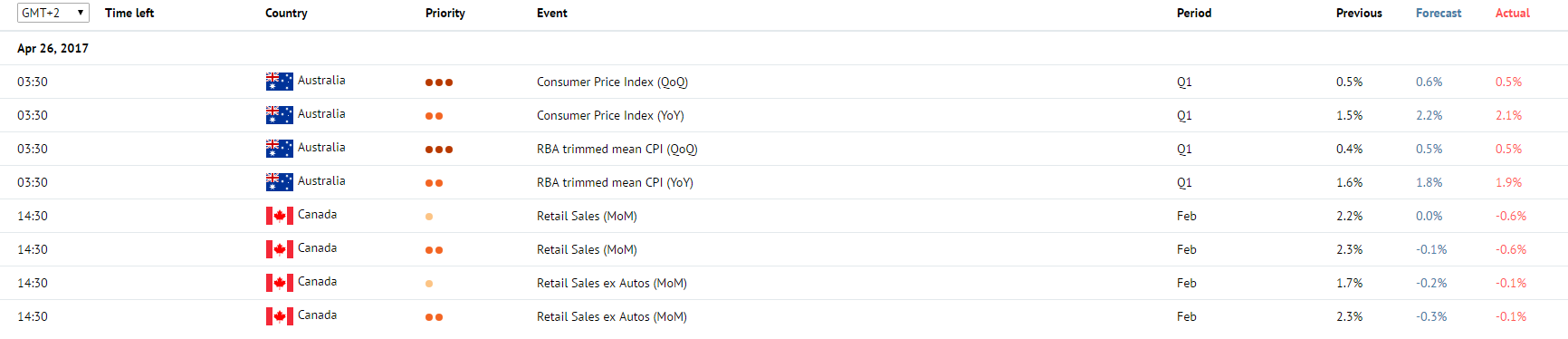

Consumer Price Index. Australia, 03:30 (GMT+2)

The Consumer Price Index is due at 03:30 (GMT+2). The QoQ index is expected to grow to 0.6% in the first quarter from 0.5% in the previous period. The YoY index is expected to grow to 2.2% in the first quarter from 1.5% in the previous period. The index represents changes in the value of the basket of goods and services. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Retail Sales. Canada, 14:30 (GMT+2)

The Retail Sales index is due at 14:30 (GMT+2). The MoM index is expected to lower to 0.0% in February from 2.2% in the previous month. It represents the change in the volume of retail sales. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Consumer Price Index. Australia, 03:30 (GMT+2)

The Consumer Price Index is due at 03:30 (GMT+2). The QoQ index is expected to grow to 0.6% in the first quarter from 0.5% in the previous period. The YoY index is expected to grow to 2.2% in the first quarter from 1.5% in the previous period. The index represents changes in the value of the basket of goods and services. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Retail Sales. Canada, 14:30 (GMT+2)

The Retail Sales index is due at 14:30 (GMT+2). The MoM index is expected to lower to 0.0% in February from 2.2% in the previous month. It represents the change in the volume of retail sales. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Claws and Horns

News of the day. 25.04.2017

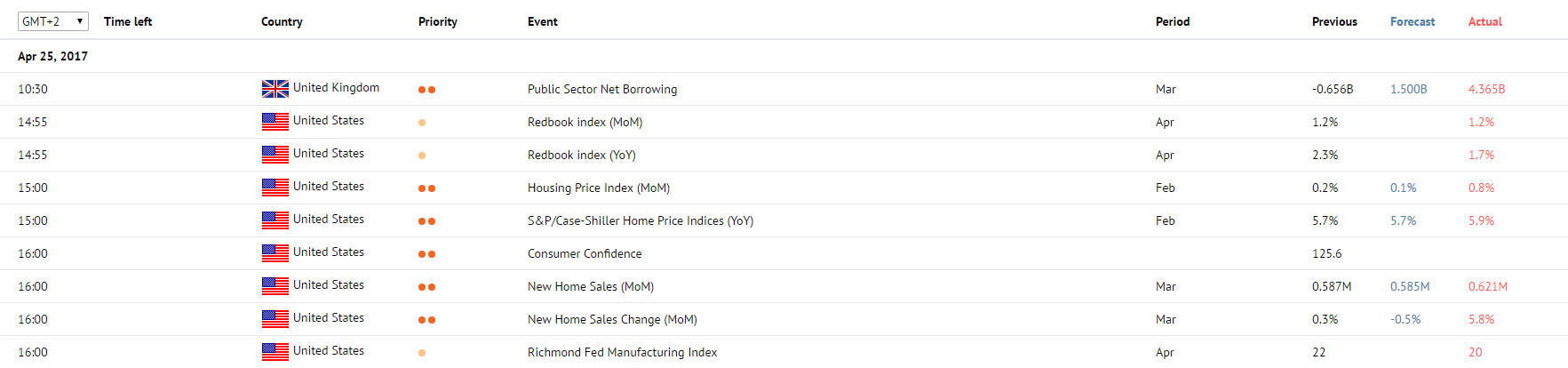

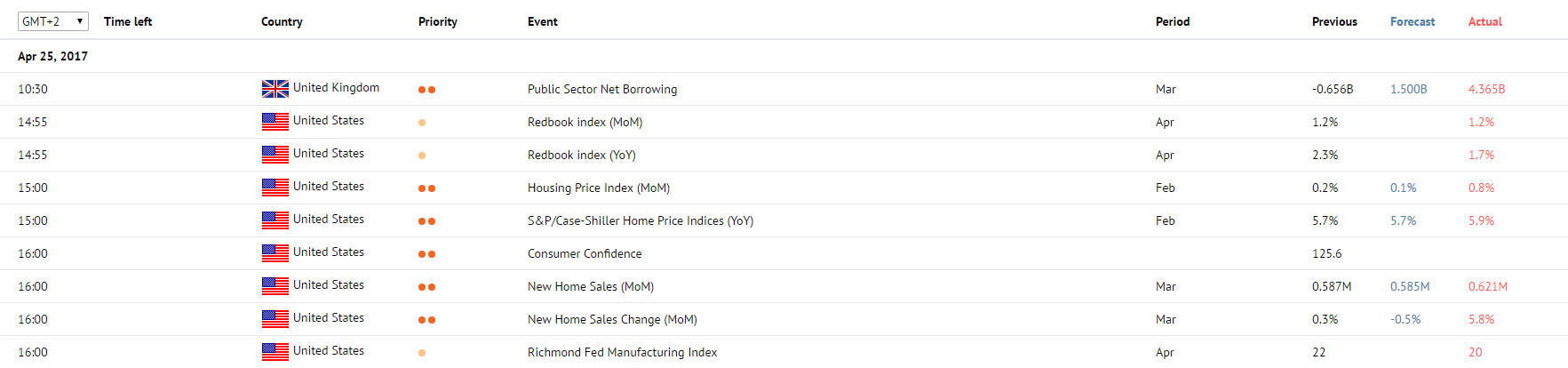

Public Sector Net Borrowing. United Kingdom, 10:30 (GMT+2)

The Public Sector Net Borrowing data are due at 10:30 (GMT+2). The value is expected to grow to 1.5 billion GBP in March from 1.1 billion in the previous month. The index represents the government net debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

S&P/Case-Shiller Home Price Indices. USA, 15:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices is due at 15:00 (GMT+2). The index is expected to stay on the same level of 5.7% in February. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or “bearish”.

Consumer Confidence. USA, 16:00 (GMT+2)

The Consumer Confidence index is due at 16:00 (GMT+2). It is expected to lower to 122.9 points in April from 125.6 points in the previous month. The index represents consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

New Home Sales Change. USA, 16:00 (GMT+2)

The New Home Sales Change index is due at 16:00 (GMT+2). It is expected to be 1.5% in March against 6.1% in the previous month. It is important indicator of the US property market. A growth in the index represents economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Public Sector Net Borrowing. United Kingdom, 10:30 (GMT+2)

The Public Sector Net Borrowing data are due at 10:30 (GMT+2). The value is expected to grow to 1.5 billion GBP in March from 1.1 billion in the previous month. The index represents the government net debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

S&P/Case-Shiller Home Price Indices. USA, 15:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices is due at 15:00 (GMT+2). The index is expected to stay on the same level of 5.7% in February. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or “bearish”.

Consumer Confidence. USA, 16:00 (GMT+2)

The Consumer Confidence index is due at 16:00 (GMT+2). It is expected to lower to 122.9 points in April from 125.6 points in the previous month. The index represents consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

New Home Sales Change. USA, 16:00 (GMT+2)

The New Home Sales Change index is due at 16:00 (GMT+2). It is expected to be 1.5% in March against 6.1% in the previous month. It is important indicator of the US property market. A growth in the index represents economic growth. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 24.04.2017

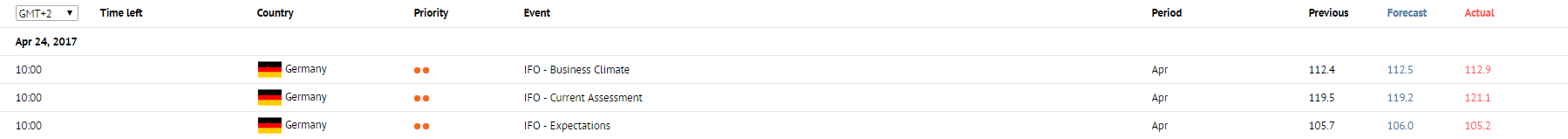

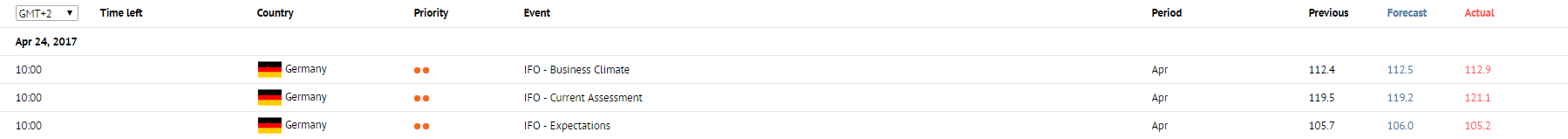

IFO Indicator of Economic Sentiment. Germany, 10:00 (GMT+2)

IFO Indicator of Economic Sentiment for April will be published at 10:00 (GMT+2). The indicator is based on a poll taken among top managers of over 7,000 enterprises in order to learn their estimates of the current economic situation in the business sphere and their forecast for the next six months. A forecast may be optimistic, neutral, or pessimistic. An optimistic forecast from the majority of questioned managers is considered a positive signal and strengthens EUR. Prevailing pessimistic forecasts put pressure on the rate of euro.

IFO Indicator of Economic Sentiment. Germany, 10:00 (GMT+2)

IFO Indicator of Economic Sentiment for April will be published at 10:00 (GMT+2). The indicator is based on a poll taken among top managers of over 7,000 enterprises in order to learn their estimates of the current economic situation in the business sphere and their forecast for the next six months. A forecast may be optimistic, neutral, or pessimistic. An optimistic forecast from the majority of questioned managers is considered a positive signal and strengthens EUR. Prevailing pessimistic forecasts put pressure on the rate of euro.

Claws and Horns

News of the day. 21.04.2017

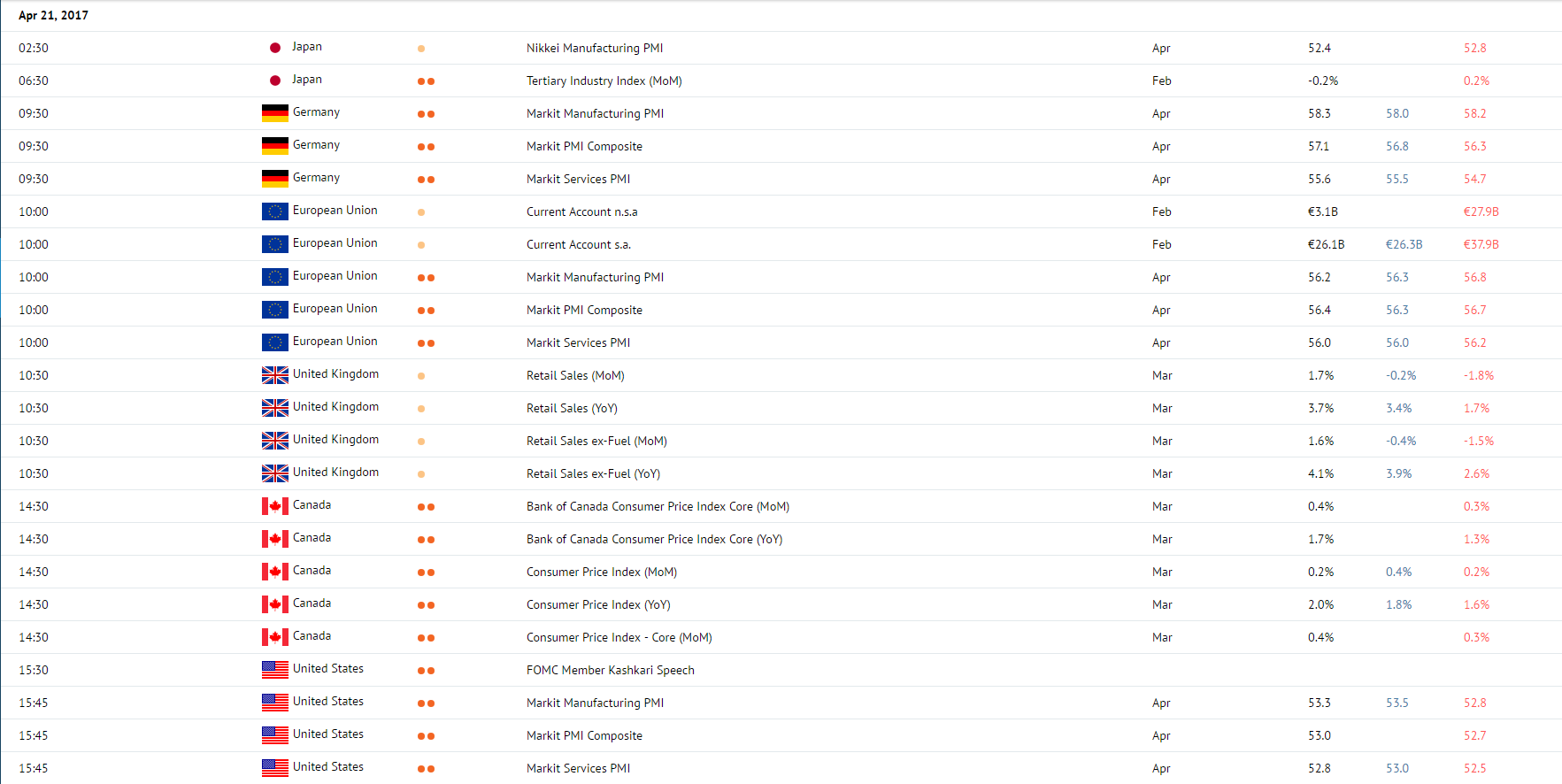

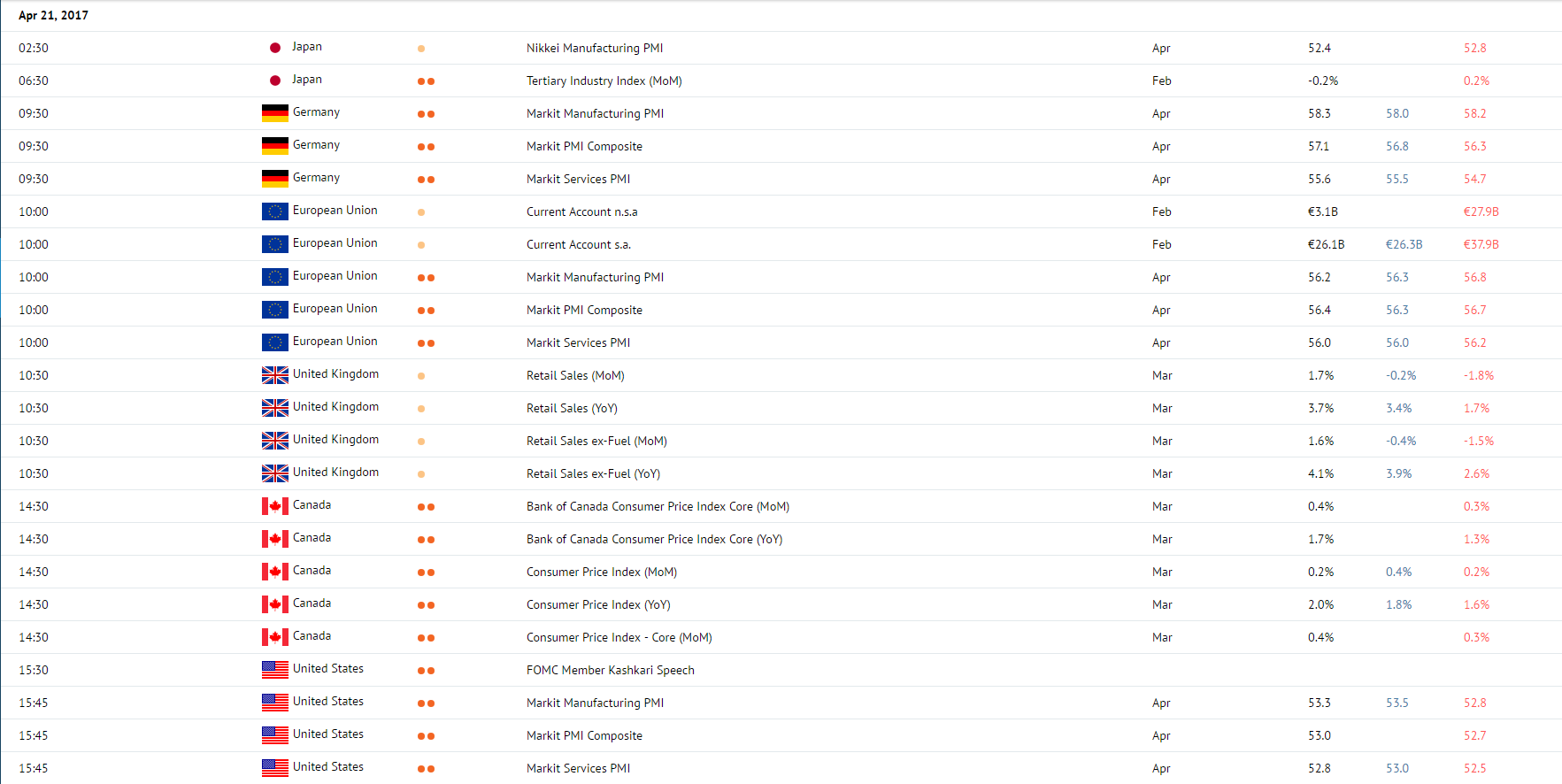

Markit Services PMI. Germany, 09:30 (GMT+2)

German Markit Services PMI is due at 09:30 (GMT+2). The indicator is expected to drop to 55.5 points in April against 55.6 points in the previous month. The indicator evaluates the economic situation in the services sector and is based on a poll taken among the managers of German companies to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Services PMI. EU, 10:00 (GMT+2)

EU Markit Services PMI is due at 10:00 (GMT+2). The indicator is expected to drop to 55.8 points in April against 56.0 points in March. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Retail Sales. UK, 10:30 (GMT+2)

The data on UK retail sales are due at 10:30 (GMT+2). In monthly terms the indicator will make up -0.2% in March against 1.4% in the previous month. On year-on-year basis, the indicator is expected to drop to 3.6% in March from 3.7% in February. The indicator is based on the total number of receipts for retail purchases in stores and characterizes the level of consumer expenses and demand. Sales volume growth is an important factor of economic development. High values have positive effect on the economy and strengthens GBP, and low ones weaken it.

Consumer Price Index. Canada, 14:30 (GMT+2)

Canadian Consumer Price Index is due at 14:30 (GMT+2). The indicator is expected to grow to 0.4% in March from 0.2% a month earlier. The indicator shows the changes in price of the basic market basket. High values are considered an indication of rate rise. The growth of the index strenthens CAD, and its fall weakens it.

Markit Manufacturing PMI. USA, 15:45 (GMT+2)

Markit Manufacturing PMI is due at 15:45 (GMT+2). The indicator is expected to grow to 53.5 in March from 53.3 a month earlier. The index shows economic conditions in manufacturing sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

Markit Services PMI. Germany, 09:30 (GMT+2)

German Markit Services PMI is due at 09:30 (GMT+2). The indicator is expected to drop to 55.5 points in April against 55.6 points in the previous month. The indicator evaluates the economic situation in the services sector and is based on a poll taken among the managers of German companies to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Markit Services PMI. EU, 10:00 (GMT+2)

EU Markit Services PMI is due at 10:00 (GMT+2). The indicator is expected to drop to 55.8 points in April against 56.0 points in March. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Retail Sales. UK, 10:30 (GMT+2)

The data on UK retail sales are due at 10:30 (GMT+2). In monthly terms the indicator will make up -0.2% in March against 1.4% in the previous month. On year-on-year basis, the indicator is expected to drop to 3.6% in March from 3.7% in February. The indicator is based on the total number of receipts for retail purchases in stores and characterizes the level of consumer expenses and demand. Sales volume growth is an important factor of economic development. High values have positive effect on the economy and strengthens GBP, and low ones weaken it.

Consumer Price Index. Canada, 14:30 (GMT+2)

Canadian Consumer Price Index is due at 14:30 (GMT+2). The indicator is expected to grow to 0.4% in March from 0.2% a month earlier. The indicator shows the changes in price of the basic market basket. High values are considered an indication of rate rise. The growth of the index strenthens CAD, and its fall weakens it.

Markit Manufacturing PMI. USA, 15:45 (GMT+2)

Markit Manufacturing PMI is due at 15:45 (GMT+2). The indicator is expected to grow to 53.5 in March from 53.3 a month earlier. The index shows economic conditions in manufacturing sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

Claws and Horns

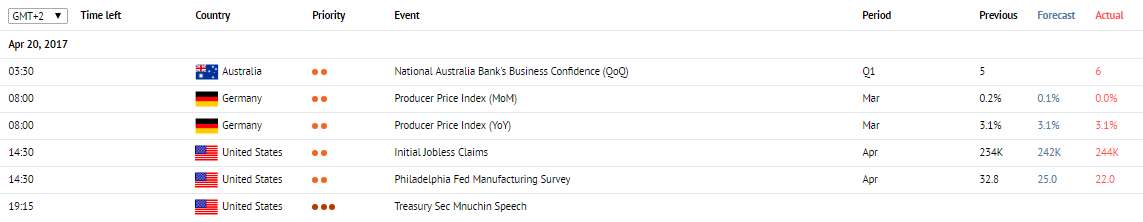

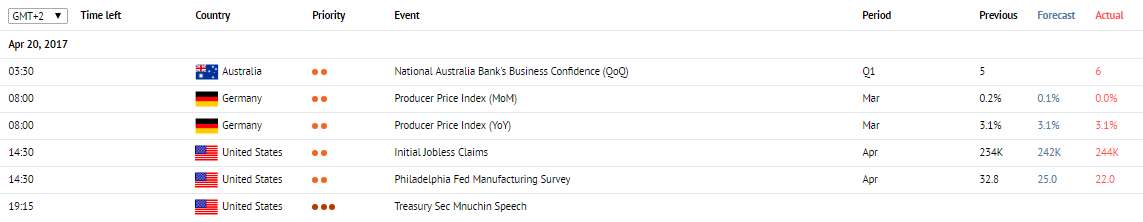

News of the day. 20.04.2017

Consumer Price Index. Australia, 00:45 (GMT+2)

Australian Consumer Prices Index is due at 00:45 (GMT+2). The indicator is expected to grow in quarterly terms to 0.8% in Q1 from 0.4% in the previous quarter. The indicator shows the changes in price of a certain market basket. The growth of the indicator facilitates the growth of AUD, and its fall weakens the Australian currency.

Producer Price Index. Germany, 08:00 (GMT+2)

German Producer Price Index is due at 08:00 (GMT+2). On a monthly basis the indicator is expected to drop to 0.1% in March from 0.2% a month earlier. It is expected that on YoY basis, the indicator will remain unchanged at the level of 3.1% in March. The index shows the dynamics of prices on the markets of raw materials on the wholesale scale. The growth of the indicator leads to the strengthening of EUR, and fall weakens it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to grow to 242K a week against 234K in the previous week. This indicator shows the amount of new initial jobless claims and is published weekly on Thursdays. It also provides information on the number of nonfarm payrolls. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Consumer Price Index. Australia, 00:45 (GMT+2)

Australian Consumer Prices Index is due at 00:45 (GMT+2). The indicator is expected to grow in quarterly terms to 0.8% in Q1 from 0.4% in the previous quarter. The indicator shows the changes in price of a certain market basket. The growth of the indicator facilitates the growth of AUD, and its fall weakens the Australian currency.

Producer Price Index. Germany, 08:00 (GMT+2)

German Producer Price Index is due at 08:00 (GMT+2). On a monthly basis the indicator is expected to drop to 0.1% in March from 0.2% a month earlier. It is expected that on YoY basis, the indicator will remain unchanged at the level of 3.1% in March. The index shows the dynamics of prices on the markets of raw materials on the wholesale scale. The growth of the indicator leads to the strengthening of EUR, and fall weakens it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to grow to 242K a week against 234K in the previous week. This indicator shows the amount of new initial jobless claims and is published weekly on Thursdays. It also provides information on the number of nonfarm payrolls. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Claws and Horns

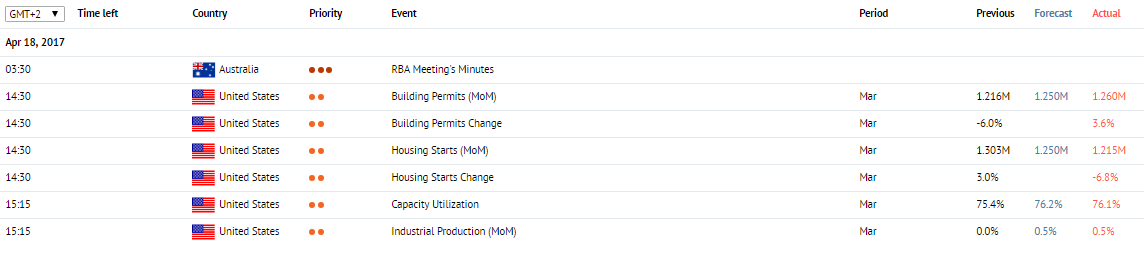

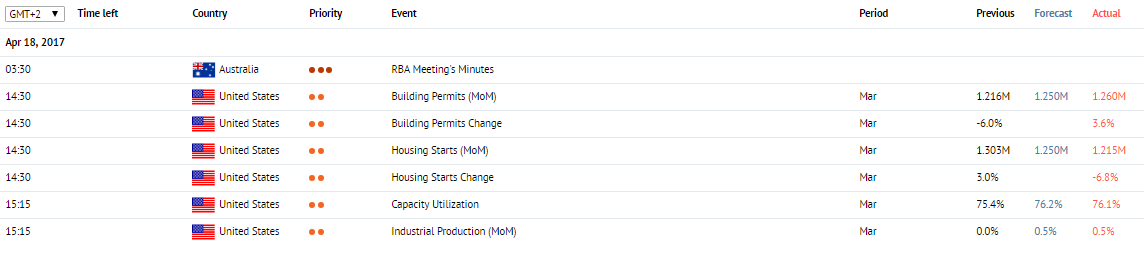

News of the day. 18.04.2017

Minutes of the Meeting of Reserve Bank of Australia. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate and contains comments on RBA decisions. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Construction Permits. USA, 14:30 (GMT+2)

The data on the dynamics of construction permit are due at 14:30 (GMT+2). The indicator is expected to grow to 1.245 mln in March from 1.213 mln a month earlier. The indicator shows the number of issued permits for the construction of new houses. The volumes of construction are closely connected with the income of the population. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. Higher values of the indicator influence the US dollar positively.

Industrial Capacities Use. USA, 15:15 (GMT+2)

The data on industrial capacities use in the USA are due at 15:15 (GMT+2). The indicator shows the level of use of the country's manufacturing potential (in percentage terms) and reflects the growth of the economy and the level of demand. Values on the level of 85% are optimal and indicate a good balance between economic growth and inflation. Values above 85% activate inflation processes in the country. The growth of the indicator's value has a positive impact on the national currency.

Industrial Output. USA, 15:15 (GMT+2)

The data on US industrial output in March is due at 15:15 (GMT+2). The index shows the volume of industrial output in the USA, is one of the main indicators of the state of national economy, and has strong influence on the market. The growth of the indicator strengthens the national currency, and its fall leads to the weakening of USD rates.

Minutes of the Meeting of Reserve Bank of Australia. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate and contains comments on RBA decisions. The minutes also contains information about the votes of certain Monetary Policy Committee members.

Construction Permits. USA, 14:30 (GMT+2)

The data on the dynamics of construction permit are due at 14:30 (GMT+2). The indicator is expected to grow to 1.245 mln in March from 1.213 mln a month earlier. The indicator shows the number of issued permits for the construction of new houses. The volumes of construction are closely connected with the income of the population. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. Higher values of the indicator influence the US dollar positively.

Industrial Capacities Use. USA, 15:15 (GMT+2)

The data on industrial capacities use in the USA are due at 15:15 (GMT+2). The indicator shows the level of use of the country's manufacturing potential (in percentage terms) and reflects the growth of the economy and the level of demand. Values on the level of 85% are optimal and indicate a good balance between economic growth and inflation. Values above 85% activate inflation processes in the country. The growth of the indicator's value has a positive impact on the national currency.

Industrial Output. USA, 15:15 (GMT+2)

The data on US industrial output in March is due at 15:15 (GMT+2). The index shows the volume of industrial output in the USA, is one of the main indicators of the state of national economy, and has strong influence on the market. The growth of the indicator strengthens the national currency, and its fall leads to the weakening of USD rates.

Claws and Horns

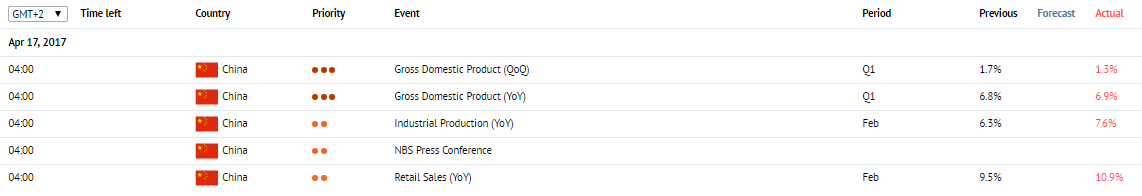

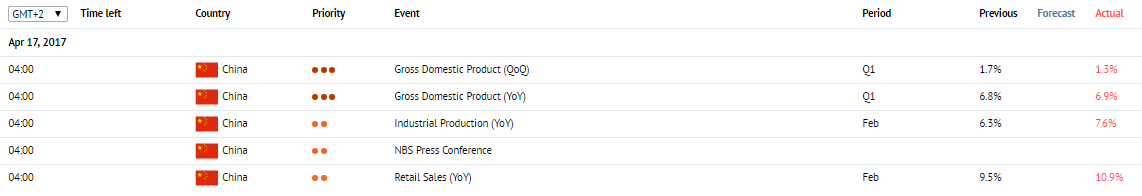

News of the day. 17.04.2017

Retail Sales. China, 05:00 (GMT+2)

The data on Chinese retail sales in February are due on 05:00 (GMT+2). The index is an indicator of consumer expenditure and demionstrates changes in the volumes of retail sales. The growth of the index is a positive factor for the economy and strengthens CNY. The fall of the index weakens CNY.

Industrial Output. China, 05:00 (GMT+2)

The data of Chinese industrial output in February are due at 05:00 (GMT+2). It reflects changes in China's industrial output and shows the state of national economy. Moderate growth of the indicator is a positive factor for CNY, and low values weaken the Chinese currency.

Retail Sales. China, 05:00 (GMT+2)

The data on Chinese retail sales in February are due on 05:00 (GMT+2). The index is an indicator of consumer expenditure and demionstrates changes in the volumes of retail sales. The growth of the index is a positive factor for the economy and strengthens CNY. The fall of the index weakens CNY.

Industrial Output. China, 05:00 (GMT+2)

The data of Chinese industrial output in February are due at 05:00 (GMT+2). It reflects changes in China's industrial output and shows the state of national economy. Moderate growth of the indicator is a positive factor for CNY, and low values weaken the Chinese currency.

Claws and Horns

News of the day. 14.04.2017

Industrial output. Japan, 06:30 (GMT+2)

The data on Japanese industrial output is due at 06:30 (GMT+2). The index reflects changes in Japan's industrial output and shows the state of national economy. The growth of the indicator leads to the increase of the national currency, and its reduction weakens yen.

Retail Sales. USA, 14:30 (GMT+2)

The data on US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.3% in March from 0.1% a month earlier on the monthly basis. On year-on-year basis, the indicator is expected to drop to 2.6% in March from 2.7% in February. This indicator reflects consumer spending and represents the change in the volume of retail sales. The growth of the index is a positive factor for the economy and strengthens USD. The fall of the index weakens USD.

Consumer Price Index. USA, 14:30 (GMT+2)

US Consumer Price Index is due at 14:30 (GMT+2). On YoY basis the indicator is expected to drop to 2.6% in March from 2.7% a month earlier. On the monthly basis the indicator will fall to 0.0% in March from 0.1% in February. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. A positive reading strengthens USD, and negative values weaken it.

Industrial output. Japan, 06:30 (GMT+2)

The data on Japanese industrial output is due at 06:30 (GMT+2). The index reflects changes in Japan's industrial output and shows the state of national economy. The growth of the indicator leads to the increase of the national currency, and its reduction weakens yen.

Retail Sales. USA, 14:30 (GMT+2)

The data on US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.3% in March from 0.1% a month earlier on the monthly basis. On year-on-year basis, the indicator is expected to drop to 2.6% in March from 2.7% in February. This indicator reflects consumer spending and represents the change in the volume of retail sales. The growth of the index is a positive factor for the economy and strengthens USD. The fall of the index weakens USD.

Consumer Price Index. USA, 14:30 (GMT+2)

US Consumer Price Index is due at 14:30 (GMT+2). On YoY basis the indicator is expected to drop to 2.6% in March from 2.7% a month earlier. On the monthly basis the indicator will fall to 0.0% in March from 0.1% in February. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. A positive reading strengthens USD, and negative values weaken it.

Claws and Horns

News of the day. 13.04.2017

New Zealand Manufacturing PMI. New Zealand, 00:30 (GMT+2)

New Zealand Manufacturing PMI for April is due at 00:30 (GMT+2). The index is based on polls taken among procurement and supply managers in order to assess the current economic situation and the prospects of its development. Values over 50 reflect positive comments of the majority of the respondents an lead to the strengthening of NZD. Values under 50, on the contrary, indicate pessimistic estimates and lead to the reduction of NZ dollar.

Employment Rate. Australia, 03:30 (GMT+2)

The data on the employment rate in Australia is due at 03:30 (GMT+2). The indicator is expected to make up 20K in March against -6.4K a month earlier. The index shows the number of recently employed Australian citizens. The growth of its value strengthens AUD, and reduction weakens it.

Consumer Prices Index. Germany, 08:00 (GMT+2)

German Consumer Prices Index is due at 08:00 (GMT+2). In the monthly and YoY terms the indicator is expected to remain unchanged in March on the level of 0.2% and 1.6% respectively. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. The growth of the indicator strengthens euro, and its reduction weakens it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to grow to 245K a week against 234K in the previous week. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays and gives a perspective of the Nonfarm Payrolls indicator. The reduction of the number of claims is a positive factor for US dollar, and the growth of this indicator is considered a negative development.

New Zealand Manufacturing PMI. New Zealand, 00:30 (GMT+2)

New Zealand Manufacturing PMI for April is due at 00:30 (GMT+2). The index is based on polls taken among procurement and supply managers in order to assess the current economic situation and the prospects of its development. Values over 50 reflect positive comments of the majority of the respondents an lead to the strengthening of NZD. Values under 50, on the contrary, indicate pessimistic estimates and lead to the reduction of NZ dollar.

Employment Rate. Australia, 03:30 (GMT+2)

The data on the employment rate in Australia is due at 03:30 (GMT+2). The indicator is expected to make up 20K in March against -6.4K a month earlier. The index shows the number of recently employed Australian citizens. The growth of its value strengthens AUD, and reduction weakens it.

Consumer Prices Index. Germany, 08:00 (GMT+2)

German Consumer Prices Index is due at 08:00 (GMT+2). In the monthly and YoY terms the indicator is expected to remain unchanged in March on the level of 0.2% and 1.6% respectively. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. The growth of the indicator strengthens euro, and its reduction weakens it.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to grow to 245K a week against 234K in the previous week. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays and gives a perspective of the Nonfarm Payrolls indicator. The reduction of the number of claims is a positive factor for US dollar, and the growth of this indicator is considered a negative development.

Claws and Horns

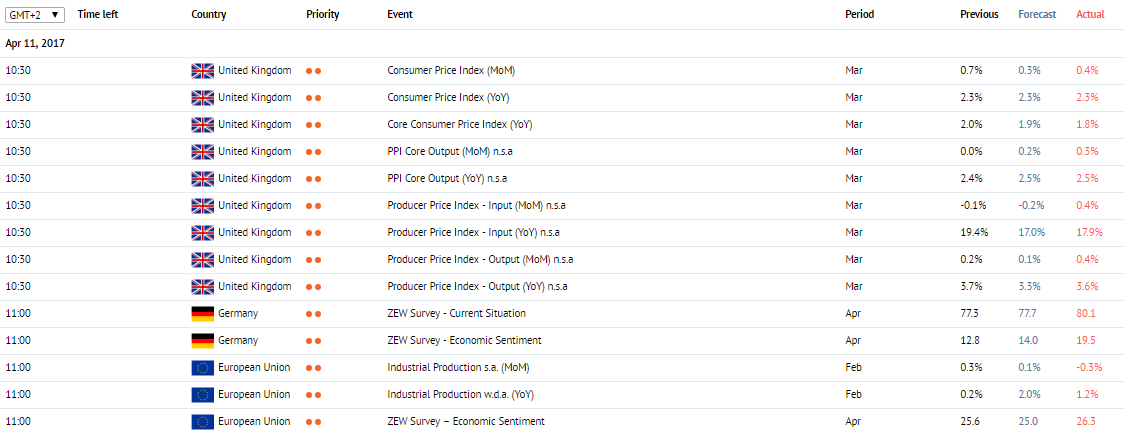

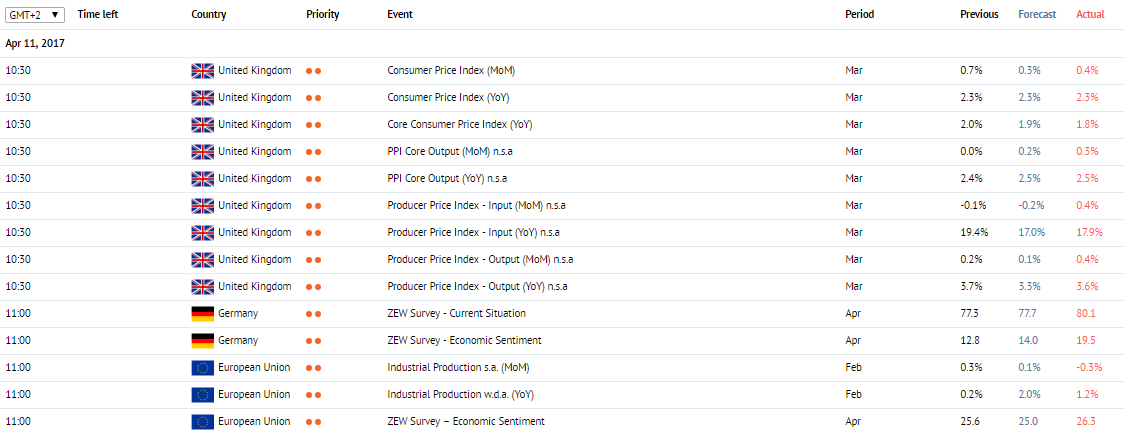

News of the day. 11.04.2017

Consumer Price Index. UK, 10:30 (GMT+2)

UK Consumer Prices Index is due at 10:30 (GMT+2). It is expected that on YoY basis, the indicator will remain unchanged at the level of 2.3% in March. In monthly terms Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

ZEW Institute Business Circles Climate Index. Germany, 11:00 (GMT+2)

ZEW Institute Business Circles Climate Index is due at 11:00 (GMT+2). The indicator is expected to grow to 13.3 points in April against 12.8 points in the previous month. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll o the leading European financial expert that assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic ters and weaken euro.

Industrial Output. EU, 12:00 (GMT+2)

The data on EU industrial output is due at 12:00 (GMT+2). The indicator is expected to grow to 2.0% in February from 0.6% a month earlier on YoY basis. In monthly terms the indicator is expected to drop to 0.1% in February from 0.9% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indexes of the state of the economy. High results strengthen EUR, and low values weaken the European currency.

Consumer Price Index. UK, 10:30 (GMT+2)

UK Consumer Prices Index is due at 10:30 (GMT+2). It is expected that on YoY basis, the indicator will remain unchanged at the level of 2.3% in March. In monthly terms Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

ZEW Institute Business Circles Climate Index. Germany, 11:00 (GMT+2)

ZEW Institute Business Circles Climate Index is due at 11:00 (GMT+2). The indicator is expected to grow to 13.3 points in April against 12.8 points in the previous month. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll o the leading European financial expert that assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic ters and weaken euro.

Industrial Output. EU, 12:00 (GMT+2)

The data on EU industrial output is due at 12:00 (GMT+2). The indicator is expected to grow to 2.0% in February from 0.6% a month earlier on YoY basis. In monthly terms the indicator is expected to drop to 0.1% in February from 0.9% a month earlier. The indicator shows changes in industrial output volume and is one of the most important indexes of the state of the economy. High results strengthen EUR, and low values weaken the European currency.

Claws and Horns

News of the day. 10.04.2017

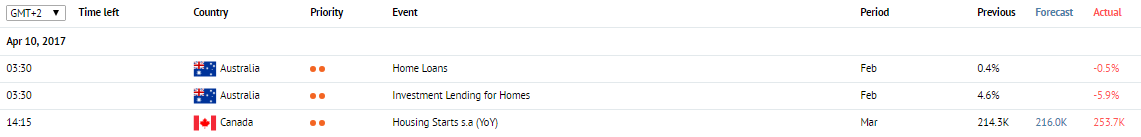

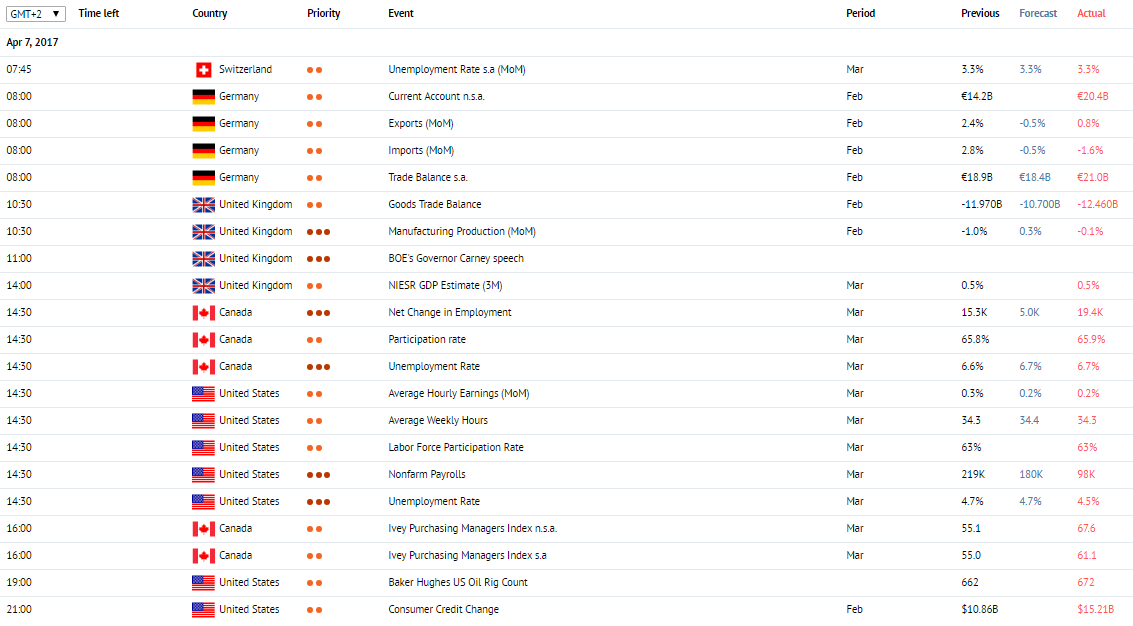

Mortgage Loans. Australia, 03:30 (GMT+2)

Information about Australian mortgage loans in February is due at 03:30 (GMT+2). The index shows the number of new granted mortgage loans and is one of the main real estate market indicators. The growth of its value strengthens AUD, and reduction weakens it.

Housing starts. Canada, 14:15 (GMT+2)

The data on the started housing construction projects in Canada is due at 14:15 (GMT+2). The index is prepared by the Canadian Mortgage Construction Corporation and shows the volume of started one-family housing construction. The volumes of construction are closely connected with the income of the population. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator have a positive influence on CAD, and low ones are a negative factor for the Canadian currency.

Mortgage Loans. Australia, 03:30 (GMT+2)

Information about Australian mortgage loans in February is due at 03:30 (GMT+2). The index shows the number of new granted mortgage loans and is one of the main real estate market indicators. The growth of its value strengthens AUD, and reduction weakens it.

Housing starts. Canada, 14:15 (GMT+2)

The data on the started housing construction projects in Canada is due at 14:15 (GMT+2). The index is prepared by the Canadian Mortgage Construction Corporation and shows the volume of started one-family housing construction. The volumes of construction are closely connected with the income of the population. That is why the growth of the indicator is a signal about increased general well-being and the growth of the economy. High values of the indicator have a positive influence on CAD, and low ones are a negative factor for the Canadian currency.

Claws and Horns

News of the day. 7.04.2017

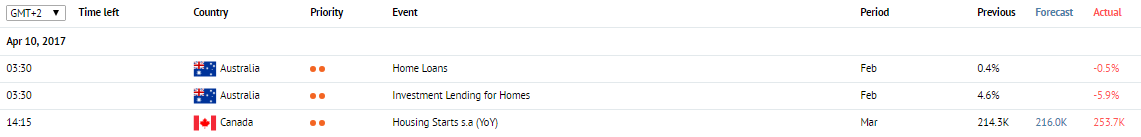

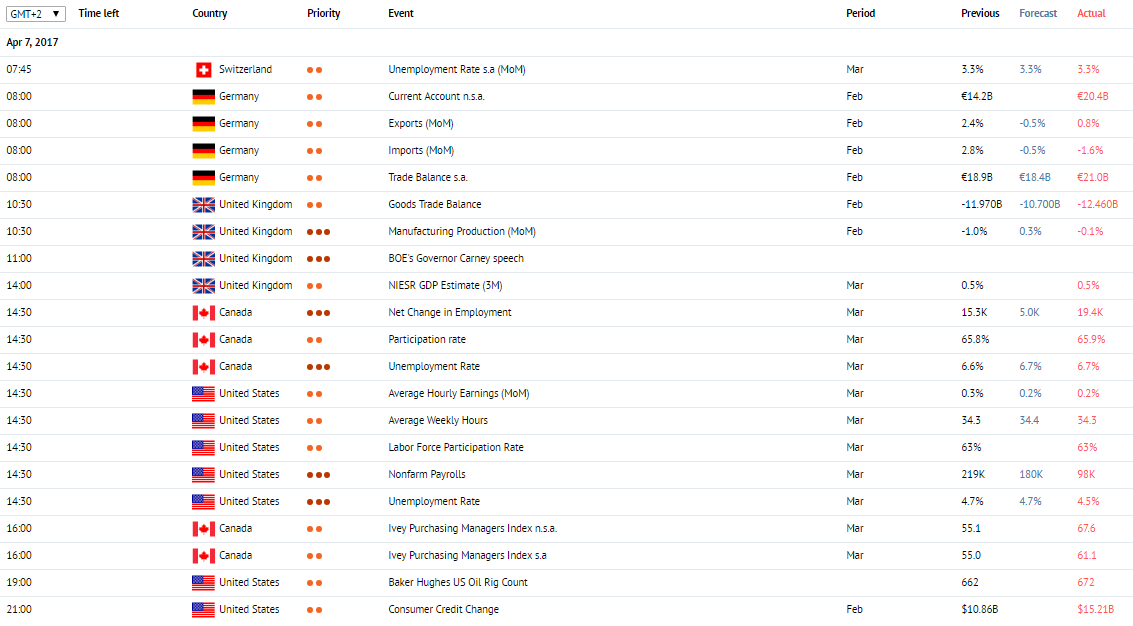

Unemployment Rate. Switzerland, 07:45 (GMT+2)

The data on the unemployment rate in Switzerland is due at 07:45 (GMT+2). The value is expected to drop to 3.4% in March from 3.6% a month earlier. The indicator shows the share of the unemployed among the total number of employable Swiss citizens. The growth of the value indicates slower economy development rates. High values of the indicator weaken CHF, and low ones strengthen it.

Industrial Output. Germany, 08:00 (GMT+2)

The data on the German industrial output is due at 08:00 (GMT+2). The indicator is expected to drop to -0.2% in February against 2.8% a month eralier. The index shows the volume of output in the German manufacturing sector and is considered one of the main indicators of the state of national economy. The growth of the indicator leads to the strengthening of EUR, and its fall puts pressure on the European currency.

Processing Industry Output. UK, 10:30 (GMT+2)

The data on the processing industry output is due at 10:30 (GMT+2). The indicator is expected to grow to 0.3% in February from -0.9% a month earlier. The indicator shows the value of the UK production output and is one of the main indexes illustrating the state of the national economy. The index covers processing and mining industries and electrical energy sector. The growth of the indicator leads to the increase of the national currency, and its reduction weakens GBP.

Nonfarm Payrolls Indicator. USA, 14:30 (GMT+2)

The value of nonfarm payrolls is due at 14:30 (GMT+2). The indicator is expected to reduce to 180 thousand in March against 235 thousand a month earlier. This is one of the main employment indexes in the USA showing the number of employees outside the farming industry. The index has a significant impact on the market. High values indicate the growth of the employment rate and strengthen USD, and low ones weaken it.

Unemployment Rate. Canada, 14:30 (GMT+2)

Canadian unemployment rate is due at 14:30 (GMT+2). The indicator is expected to grow to 6.7% in March from 6.6% a month earlier. The indicator is published by the Canadian Statistics Service and shows the share of the unemployed among the total number of employable Canadian citizens. The growth of the indicator shows slower economy development rates and weakens CAD. Its decrease, on the contrary, is a positive signal for the economy and strengthens the national currency.

Unemployment Rate. Switzerland, 07:45 (GMT+2)

The data on the unemployment rate in Switzerland is due at 07:45 (GMT+2). The value is expected to drop to 3.4% in March from 3.6% a month earlier. The indicator shows the share of the unemployed among the total number of employable Swiss citizens. The growth of the value indicates slower economy development rates. High values of the indicator weaken CHF, and low ones strengthen it.

Industrial Output. Germany, 08:00 (GMT+2)

The data on the German industrial output is due at 08:00 (GMT+2). The indicator is expected to drop to -0.2% in February against 2.8% a month eralier. The index shows the volume of output in the German manufacturing sector and is considered one of the main indicators of the state of national economy. The growth of the indicator leads to the strengthening of EUR, and its fall puts pressure on the European currency.

Processing Industry Output. UK, 10:30 (GMT+2)

The data on the processing industry output is due at 10:30 (GMT+2). The indicator is expected to grow to 0.3% in February from -0.9% a month earlier. The indicator shows the value of the UK production output and is one of the main indexes illustrating the state of the national economy. The index covers processing and mining industries and electrical energy sector. The growth of the indicator leads to the increase of the national currency, and its reduction weakens GBP.

Nonfarm Payrolls Indicator. USA, 14:30 (GMT+2)

The value of nonfarm payrolls is due at 14:30 (GMT+2). The indicator is expected to reduce to 180 thousand in March against 235 thousand a month earlier. This is one of the main employment indexes in the USA showing the number of employees outside the farming industry. The index has a significant impact on the market. High values indicate the growth of the employment rate and strengthen USD, and low ones weaken it.

Unemployment Rate. Canada, 14:30 (GMT+2)

Canadian unemployment rate is due at 14:30 (GMT+2). The indicator is expected to grow to 6.7% in March from 6.6% a month earlier. The indicator is published by the Canadian Statistics Service and shows the share of the unemployed among the total number of employable Canadian citizens. The growth of the indicator shows slower economy development rates and weakens CAD. Its decrease, on the contrary, is a positive signal for the economy and strengthens the national currency.

Claws and Horns

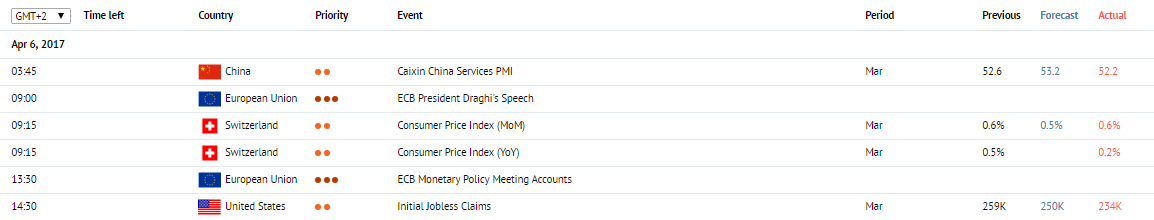

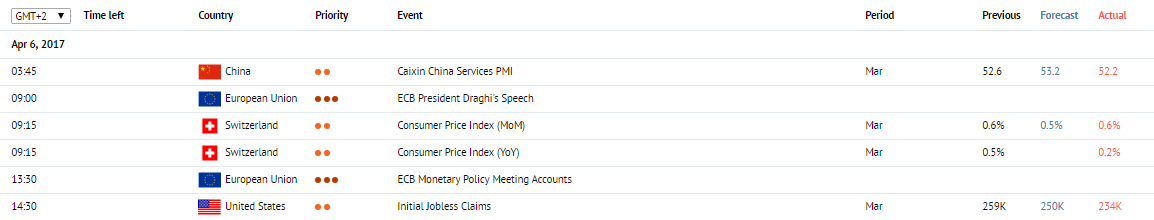

News of the day. 06.04.2017

Statement by Reserve Bank of Australia Head Guy Debelle. Australia, 00:40 (GMT+2)

A statement by Reserve Bank of Australia head Guy Debelle is due at 00:40 (GMT+2). Debelle is also the Deputy Chairman of the Council of Reserve Bank and the Chairman of the Risk Management Committee. Moreover, he is in charge of control over the Bank's operations in the internal and international financial markets.

Caixin Services PMI. China, 03:45 (GMT+2)

Caixin Services PMI is due at 03:45 (GMT+2). The indicator is expected to grow to 53.2 points 53.2 points from 52.6 points a month earlier. The indicator evaluates the economic situation in the services sector and is based on a poll taken among the managers of Chinese companies to estimate current economic situation in this sector and the prospects of its development. Values above 50 are perceived as a positive signal for the Chinese economy. Those below 50 are considered negative signals.

Consumer Prices Index. Switzerland, 09:15 (GMT+2)

Swiss Consumer Prices Index is due at 09:15 (GMT+2). The indicator is expected to drop to 0.5% in March from 0.6% a month earlier. The index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in household commodity and service prices. The growth of its value strengthens CHF, and the reduction weakens the currency.

Information about ECB Meeting on Monetary Policy. EU, 13:30 (GMT+2)

Information about ECB Meeting on Monetary Policy is due at 13:30 (GMT+2). MoM ECB contains a review of the current economic situation, comments on decisions made in the sphere of monetary policy, as well as macroeconomic and inflation outlooks.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to reduce to 250K a week against 258K in the previous week. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Statement by Reserve Bank of Australia Head Guy Debelle. Australia, 00:40 (GMT+2)

A statement by Reserve Bank of Australia head Guy Debelle is due at 00:40 (GMT+2). Debelle is also the Deputy Chairman of the Council of Reserve Bank and the Chairman of the Risk Management Committee. Moreover, he is in charge of control over the Bank's operations in the internal and international financial markets.

Caixin Services PMI. China, 03:45 (GMT+2)

Caixin Services PMI is due at 03:45 (GMT+2). The indicator is expected to grow to 53.2 points 53.2 points from 52.6 points a month earlier. The indicator evaluates the economic situation in the services sector and is based on a poll taken among the managers of Chinese companies to estimate current economic situation in this sector and the prospects of its development. Values above 50 are perceived as a positive signal for the Chinese economy. Those below 50 are considered negative signals.

Consumer Prices Index. Switzerland, 09:15 (GMT+2)

Swiss Consumer Prices Index is due at 09:15 (GMT+2). The indicator is expected to drop to 0.5% in March from 0.6% a month earlier. The index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in household commodity and service prices. The growth of its value strengthens CHF, and the reduction weakens the currency.

Information about ECB Meeting on Monetary Policy. EU, 13:30 (GMT+2)

Information about ECB Meeting on Monetary Policy is due at 13:30 (GMT+2). MoM ECB contains a review of the current economic situation, comments on decisions made in the sphere of monetary policy, as well as macroeconomic and inflation outlooks.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The value is expected to reduce to 250K a week against 258K in the previous week. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Claws and Horns

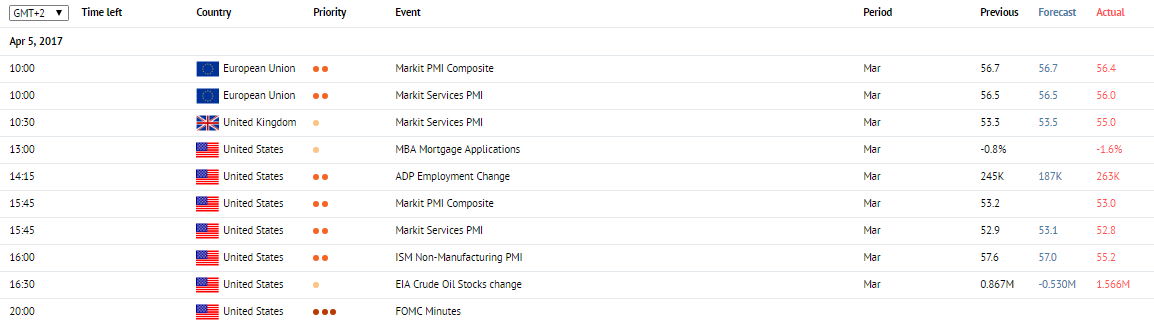

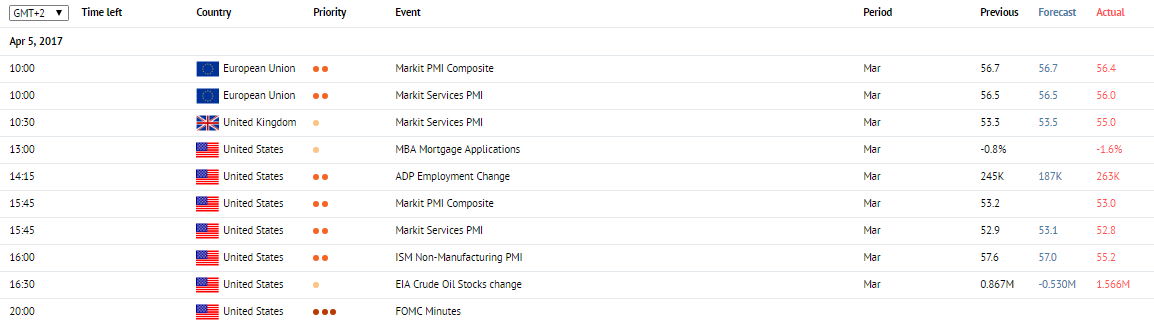

News of the day. 05.04.2017

Markit Services PMI. EU, 10:00 (GMT+2)

Markit Services PMI is due at 10:00 (GMT+2). The indicator is expected to remain unchanged on the levle of 56.5 points in March. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Services PMI. UK, 10:30 (GMT+2)

Services PMI is due at 10:30 (GMT+2). The indicator is expected to grow to 53.5 points in March from 53.3 points month earlier. The indicator shows economic conditions in services sector and is built upon polls of company leaders working in this sector. Values above 50 are perceived as a positive signal and strengthen GBP. Values below 50 are perceived as a negative signal and call for decreasing GBP rate.

ADP Employment Change Report. USA, 14:15 (GMT+2)

ADP Employment Change Report is due today at 14:15 GMT+2. The value is expected to reduce to 187K in March against 298K a month earlier. The index shows the level of employment in nonfarming sectors and is formed on the basis of the data received from about 500 thousand US legal entities. High values have a positive impact on USD. Low values or those below forecast have negative influence on US dollar.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI is due at 15:45 (GMT+2). The indicator is expected to grow to 53.1 points in March from 52.9 points in February. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

Minutes of the meeting of FOMC Open Markets Committee. USA, 20:00 (GMT+2)

Minutes of the meeting of FOMC Open Markets Committee is due at 20:00 (GMT+2). The document will be prepared by the managing board of FOMC and will contain the assessment of the economic situation in the USA. The document will also determine further fiscal policy.

Markit Services PMI. EU, 10:00 (GMT+2)

Markit Services PMI is due at 10:00 (GMT+2). The indicator is expected to remain unchanged on the levle of 56.5 points in March. The index shows economic conditions in services sector, and prospects for further development. Values above 50 are perceived as a positive signal and strengthen EUR. Values below 50 are perceived as a negative signal and call for decreasing EUR rate.

Services PMI. UK, 10:30 (GMT+2)

Services PMI is due at 10:30 (GMT+2). The indicator is expected to grow to 53.5 points in March from 53.3 points month earlier. The indicator shows economic conditions in services sector and is built upon polls of company leaders working in this sector. Values above 50 are perceived as a positive signal and strengthen GBP. Values below 50 are perceived as a negative signal and call for decreasing GBP rate.

ADP Employment Change Report. USA, 14:15 (GMT+2)

ADP Employment Change Report is due today at 14:15 GMT+2. The value is expected to reduce to 187K in March against 298K a month earlier. The index shows the level of employment in nonfarming sectors and is formed on the basis of the data received from about 500 thousand US legal entities. High values have a positive impact on USD. Low values or those below forecast have negative influence on US dollar.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI is due at 15:45 (GMT+2). The indicator is expected to grow to 53.1 points in March from 52.9 points in February. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

Minutes of the meeting of FOMC Open Markets Committee. USA, 20:00 (GMT+2)

Minutes of the meeting of FOMC Open Markets Committee is due at 20:00 (GMT+2). The document will be prepared by the managing board of FOMC and will contain the assessment of the economic situation in the USA. The document will also determine further fiscal policy.

Claws and Horns

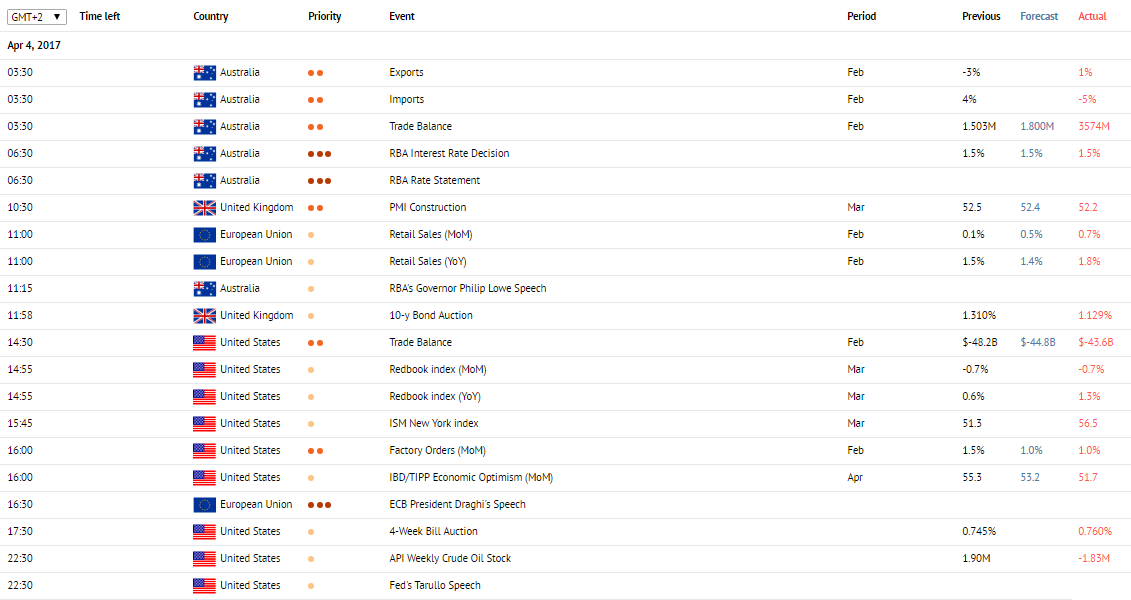

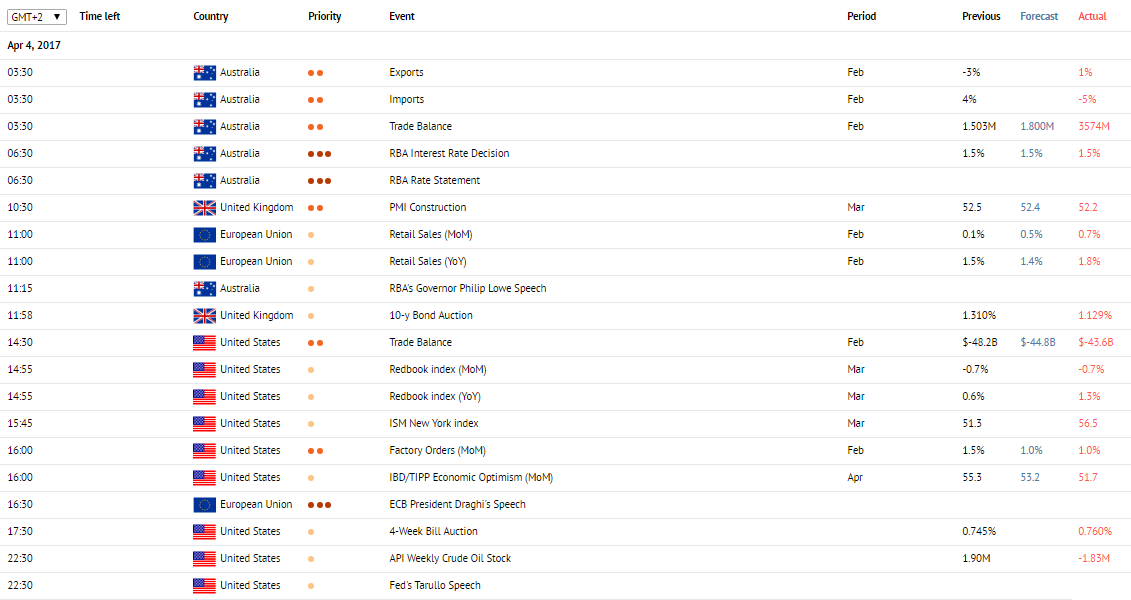

News of the day. 04.04.2017

Trading Balance. Australia, 03:30 (GMT+2)

The data on Australian trading balance in February will be published at 03:30 (GMT+2). Trading balance shows the difference between export and import of goods and services in monetary terms. A positive result indicates a surplus of the trading balance and strengthens AUD. A negative value means a deficite of the trading balance and weakens AUD.

Decision of Reserve Bank of Australia on interest rate. Australia, 06:30 (GMT+2)

The decision of RBA on interest rate is due at 06:30 (GMT+2). The rate is expected to remain unchanged on the level of 1.50%. RBA makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens AUD, and if the rate remains unchanged or decreases, AUD drops.

PMI Business Activity in Construction Sector. UK, 10:30 (GMT+2)

PMI Business Activity in Construction Sector is due at 10:30 (GMT+2). The indicator is expected to grow to 52.6 points in March from 52.5 points a month earlier. The index shows the state of the construction sector and is built upon polls of managers of major UK construction companies to estimate current economic situation in this sector and the prospects of its development. A value above 50 is a positive signal and strengthens GBP, and below 50 weakens the British currency.

Retail Sales. EU, 12:00 (GMT+2)

The data on EU retail sales is due at 12:00 (GMT+2). The indicator is expected to grow to 0.5% in February from -0.1% a month earlier. The indicator shows changes in the volumes of sales in the retail sector and is a major index of consumer expenditure. High values lead to the strengthening of EUR, and low ones – to its weakening.

Production Orders. USA, 16:00 (GMT+2)

The data on US production orders is due at 16:00 (GMT+2). The indicator is expected to drop to 1.0% in February from 1.2% a month earlier. The index shows changes in the volumes of orders in the production sector and allows one to assess the growth rate in the production sphere. The growth of the indicator leads to the increase of USD, and its falls puts US dollar under pressure.

Trading Balance. Australia, 03:30 (GMT+2)

The data on Australian trading balance in February will be published at 03:30 (GMT+2). Trading balance shows the difference between export and import of goods and services in monetary terms. A positive result indicates a surplus of the trading balance and strengthens AUD. A negative value means a deficite of the trading balance and weakens AUD.

Decision of Reserve Bank of Australia on interest rate. Australia, 06:30 (GMT+2)

The decision of RBA on interest rate is due at 06:30 (GMT+2). The rate is expected to remain unchanged on the level of 1.50%. RBA makes the decision based on current economic situation and inflation level. The growth of the indicator strengthens AUD, and if the rate remains unchanged or decreases, AUD drops.

PMI Business Activity in Construction Sector. UK, 10:30 (GMT+2)

PMI Business Activity in Construction Sector is due at 10:30 (GMT+2). The indicator is expected to grow to 52.6 points in March from 52.5 points a month earlier. The index shows the state of the construction sector and is built upon polls of managers of major UK construction companies to estimate current economic situation in this sector and the prospects of its development. A value above 50 is a positive signal and strengthens GBP, and below 50 weakens the British currency.

Retail Sales. EU, 12:00 (GMT+2)

The data on EU retail sales is due at 12:00 (GMT+2). The indicator is expected to grow to 0.5% in February from -0.1% a month earlier. The indicator shows changes in the volumes of sales in the retail sector and is a major index of consumer expenditure. High values lead to the strengthening of EUR, and low ones – to its weakening.

Production Orders. USA, 16:00 (GMT+2)

The data on US production orders is due at 16:00 (GMT+2). The indicator is expected to drop to 1.0% in February from 1.2% a month earlier. The index shows changes in the volumes of orders in the production sector and allows one to assess the growth rate in the production sphere. The growth of the indicator leads to the increase of USD, and its falls puts US dollar under pressure.

Claws and Horns

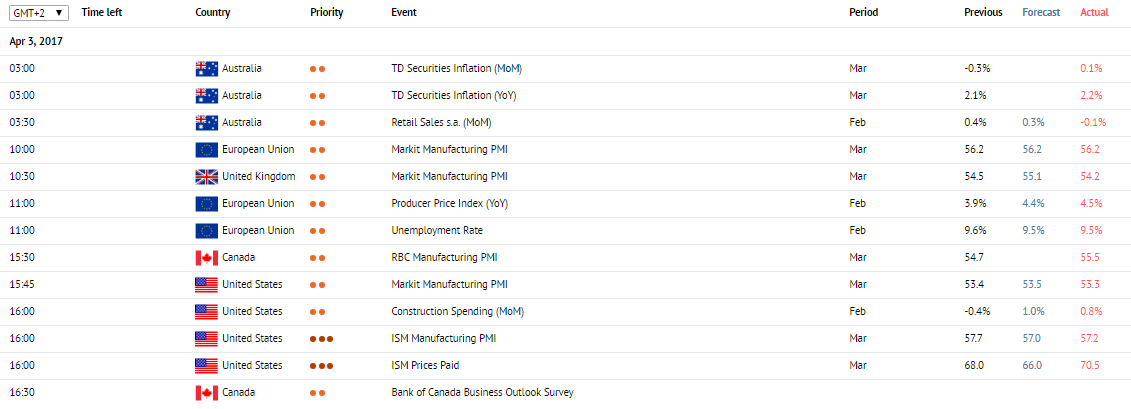

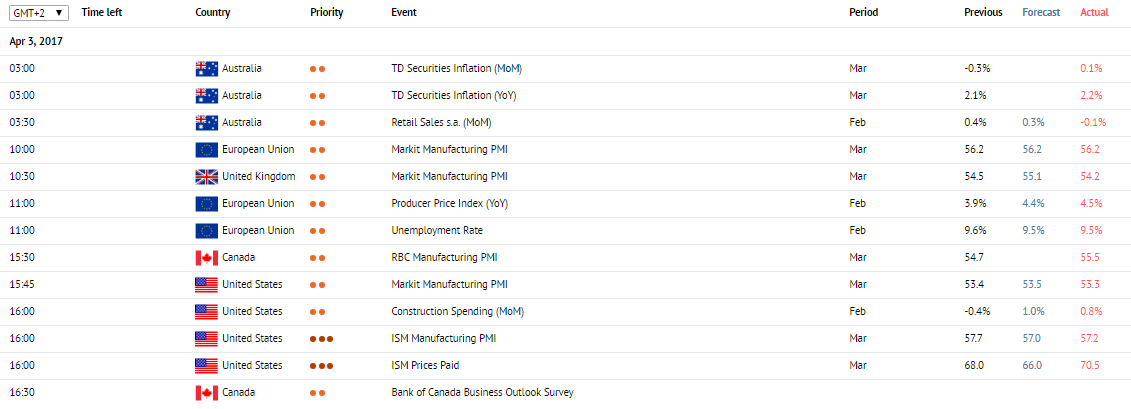

News of the day. 03.04.2017

Retail Sales s.a. Australia, 02:30 (GMT+2)

The February Retail Sales data are due at (GMT+2). The data on retail sales measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Markit Manufacturing PMI. EU, 10:00 (GMT+2)

The Markit Manufacturing PMI is due at 10:00 (GMT+2). The index is expected to stay on the same level of 56.2 points in March. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. United Kingdom, 10:30 (GMT+2)

The March Markit Manufacturing PMI is due at 10:30 (GMT+2). The index evaluates the state of the manufacturing sector. It is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Unemployment Rate. EU, 12:00 (GMT+2)

The Unemployment Rate indicator is due at 12:00 (GMT+2). The index is expected to lower to 9.5% in February from 9.6% in the previous month. The unemployment rate measures the percentage of the total labor force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Producer Price Index. EU, 12:00 (GMT+2)

The Producer Price Index is due at 12:00 (GMT+2). The YoY index is expected to grow to 4.4% in February from 3.5% in the previous month. The index represents a price change on goods, produced in the Eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

ISM Manufacturing PMI. USA, 16:00 (GMT+2)

The ISM Manufacturing PMI is due at 16:00 (GMT+2). The index is expected to lower to 57.0 points in March from 57.7 points in the previous month. The index is based on surveys of executives of manufacturing companies. It evaluates current economic conditions in the manufacturing sector.

Bank of Canada Business Outlook Survey. Canada, 16:30 (GMT+2)

The Bank of Canada Business Outlook Survey indicator is due at 16:30 (GMT+2). It represents current economic conditions for businesses in Canada. The index is based on surveys of a hundred of business executives. Optimistic reviews are perceived as positive for the CAD. Pessimistic reviews are perceived as negative for the CAD.

Retail Sales s.a. Australia, 02:30 (GMT+2)

The February Retail Sales data are due at (GMT+2). The data on retail sales measures the volume of sales in the retail sector. The data is considered an indicator of consumer spending and economic growth. An increase in retail sales strengthens the AUD. A fall in retail sales weakens the AUD.

Markit Manufacturing PMI. EU, 10:00 (GMT+2)

The Markit Manufacturing PMI is due at 10:00 (GMT+2). The index is expected to stay on the same level of 56.2 points in March. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. United Kingdom, 10:30 (GMT+2)

The March Markit Manufacturing PMI is due at 10:30 (GMT+2). The index evaluates the state of the manufacturing sector. It is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived positive and strengthens the GBP. A reading below 50 is perceived negative and weakens the GBP.

Unemployment Rate. EU, 12:00 (GMT+2)

The Unemployment Rate indicator is due at 12:00 (GMT+2). The index is expected to lower to 9.5% in February from 9.6% in the previous month. The unemployment rate measures the percentage of the total labor force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Producer Price Index. EU, 12:00 (GMT+2)

The Producer Price Index is due at 12:00 (GMT+2). The YoY index is expected to grow to 4.4% in February from 3.5% in the previous month. The index represents a price change on goods, produced in the Eurozone. A growth in the index, generally, supports the EUR. A decline in the index weakens the EUR.

ISM Manufacturing PMI. USA, 16:00 (GMT+2)

The ISM Manufacturing PMI is due at 16:00 (GMT+2). The index is expected to lower to 57.0 points in March from 57.7 points in the previous month. The index is based on surveys of executives of manufacturing companies. It evaluates current economic conditions in the manufacturing sector.

Bank of Canada Business Outlook Survey. Canada, 16:30 (GMT+2)

The Bank of Canada Business Outlook Survey indicator is due at 16:30 (GMT+2). It represents current economic conditions for businesses in Canada. The index is based on surveys of a hundred of business executives. Optimistic reviews are perceived as positive for the CAD. Pessimistic reviews are perceived as negative for the CAD.

Claws and Horns

News of the day. 30.03.2017

KOF Leading Indicator. Switzerland, 09:00 (GMT+2)

The KOF Leading Indicator is due at 09:00 (GMT+2). The index is expected to lower to 106.0 points in March from 10 7.2 points in the previous month. The data, based on 12 economic indicators, is used to assess economic conditions in Switzerland. A high reading is considered as a positive factor for the economy and strengthens the CHF. A low reading, on the contrary, is perceived negative and weakens the CHF.

Consumer Confidence. EU, 11:00 (GMT+2)

The Consumer Confidence indicator is due at 11:00 (GMT+2). It is expected to stay on the same level of -5 points in March. The indicator reflects how optimistic or pessimistic consumers are regarding current economic activity. A high result represents an optimistic mood and can support the EUR. A result below the forecast pressures the EUR.

Business Climate. EU, 11:00 (GMT+2)

The Business Climate indicator is due at 11:00 (GMT+2). It is expected to grow to 0.84 points in March from 0.82 points in the previous month. The index is based on monthly survey responses from executives of companies regarding their opinion on current business conditions. A growth in the indicator represents optimism and strengthens the EUR. A decline, on the contrary, pressures the EUR.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2). The index is expected to lower to 248K WoW from 258K in the previous week. It represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product Annualized. USA, 14:30 (GMT+2)

The Gross Domestic Product Annualized is due at 14:30 (GMT+2). The index is expected to grow to 2.0% in the fourth quarter from 1.9% in the previous period. The total value of goods and services created in the country during the year. It indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

KOF Leading Indicator. Switzerland, 09:00 (GMT+2)

The KOF Leading Indicator is due at 09:00 (GMT+2). The index is expected to lower to 106.0 points in March from 10 7.2 points in the previous month. The data, based on 12 economic indicators, is used to assess economic conditions in Switzerland. A high reading is considered as a positive factor for the economy and strengthens the CHF. A low reading, on the contrary, is perceived negative and weakens the CHF.

Consumer Confidence. EU, 11:00 (GMT+2)

The Consumer Confidence indicator is due at 11:00 (GMT+2). It is expected to stay on the same level of -5 points in March. The indicator reflects how optimistic or pessimistic consumers are regarding current economic activity. A high result represents an optimistic mood and can support the EUR. A result below the forecast pressures the EUR.

Business Climate. EU, 11:00 (GMT+2)

The Business Climate indicator is due at 11:00 (GMT+2). It is expected to grow to 0.84 points in March from 0.82 points in the previous month. The index is based on monthly survey responses from executives of companies regarding their opinion on current business conditions. A growth in the indicator represents optimism and strengthens the EUR. A decline, on the contrary, pressures the EUR.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2). The index is expected to lower to 248K WoW from 258K in the previous week. It represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Gross Domestic Product Annualized. USA, 14:30 (GMT+2)

The Gross Domestic Product Annualized is due at 14:30 (GMT+2). The index is expected to grow to 2.0% in the fourth quarter from 1.9% in the previous period. The total value of goods and services created in the country during the year. It indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 29.03.2017

Mortgage Approvals. United Kingdom, 10:30 (GMT+2)

The Mortgage Approvals data are due at 10:30 (GMT+2). The index is expected to lower to 69.250K in February from 69.928K in the previous month. The indicator shows the number of new approved mortgages. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Consumer Credit. United Kingdom, 10:30 (GMT+2)

The Consumer Credit index is due at 10:30 (GMT+2). The index is expected to lower to 1.300 billion GBP from 1.416 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Pending Home Sales. USA, 16:00 (GMT+2)

The Pending Home Sales data are due at 16:00 (GMT+2). The index is expected to grow to 2.1% in February from - 2.8% in the previous month. The index is one of the main indicators of the property market. It is also considered one of the indicators of the general state of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Mortgage Approvals. United Kingdom, 10:30 (GMT+2)

The Mortgage Approvals data are due at 10:30 (GMT+2). The index is expected to lower to 69.250K in February from 69.928K in the previous month. The indicator shows the number of new approved mortgages. A growth in the index supports the GBP. A fall in the index pressures the GBP.

Consumer Credit. United Kingdom, 10:30 (GMT+2)

The Consumer Credit index is due at 10:30 (GMT+2). The index is expected to lower to 1.300 billion GBP from 1.416 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Pending Home Sales. USA, 16:00 (GMT+2)

The Pending Home Sales data are due at 16:00 (GMT+2). The index is expected to grow to 2.1% in February from - 2.8% in the previous month. The index is one of the main indicators of the property market. It is also considered one of the indicators of the general state of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

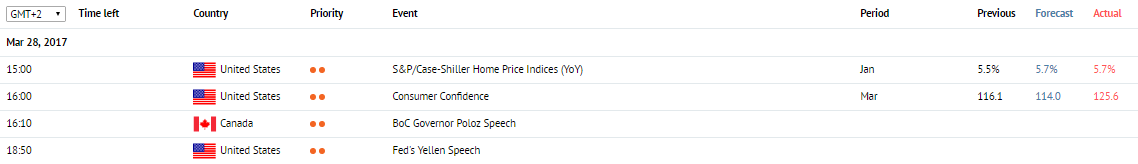

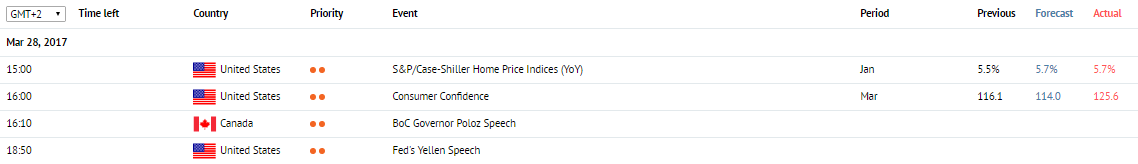

News of the day. 28.03.2017

S&P/Case-Shiller Home Price Indices. USA, 16:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices are due at 16:00 (GMT+2). The YoY index is expected to grow to 5.7% in January from 5.6% in the previous month. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or bearish.

BoC Governor Poloz Speech. Canada, 17:10 (GMT+2)

The Bank of Canada Governor Poloz Speech is due at 17:10 (GMT+2). Steven Poloz is the Governor of the Bank of Canada and the Chairman of the Board of Directors of the Bank since June 2013. He will give commentaries regarding current economic conditions in the country and monetary policy. Depending on the tone of his speech, his comments can either strengthen or weaken the CAD.

S&P/Case-Shiller Home Price Indices. USA, 16:00 (GMT+2)

The S&P/Case-Shiller Home Price Indices are due at 16:00 (GMT+2). The YoY index is expected to grow to 5.7% in January from 5.6% in the previous month. The S&P/Case-Shiller Home Price Indices released by the Standard & Poor's examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or bearish.

BoC Governor Poloz Speech. Canada, 17:10 (GMT+2)

The Bank of Canada Governor Poloz Speech is due at 17:10 (GMT+2). Steven Poloz is the Governor of the Bank of Canada and the Chairman of the Board of Directors of the Bank since June 2013. He will give commentaries regarding current economic conditions in the country and monetary policy. Depending on the tone of his speech, his comments can either strengthen or weaken the CAD.

Claws and Horns

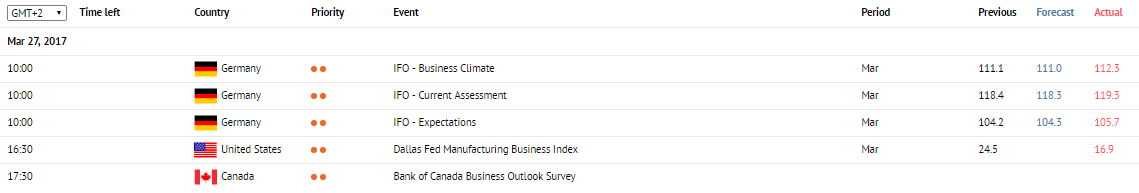

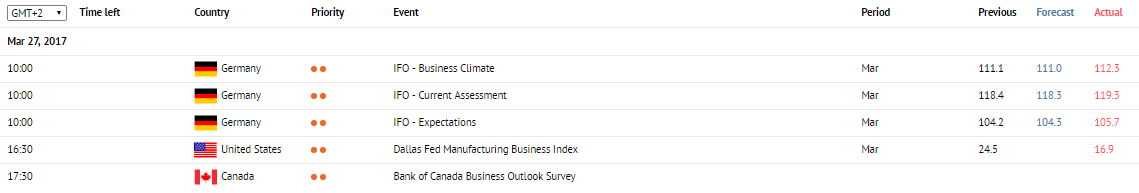

News of the day. 27.03.2017

IFO — Current Assessment. Germany, 10:00 (GMT+2)

The IFO — Current Assessment index is due at 10:00 (GMT+2). The index is expected to lower to 117.9 points in March from 118.4 points in the previous month. It is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index is perceived as positive and strengthens the EUR. A fall in the index is perceived as negative and weakens the EUR.

Dallas Fed Manufacturing Business Index. USA, 16:30 (GMT+2)

The March Dallas Fed Manufacturing Business Index is due at 16:30 (GMT+2). The index is released by the FRB of Dallas and is based on a monthly survey of manufacturing companies in Texas. It includes factors such as output volume, number of orders and prices.

Bank of Canada Business Outlook Survey. Canada, 17:30 (GMT+2)

The Bank of Canada Business Outlook Survey is due at 17:30 (GMT+2). It represents current economic conditions for businesses in Canada. The index is based on surveys of a hundred of business executives. Optimistic reviews are perceived as positive for the CAD. Pessimistic reviews are perceived as negative for the CAD.

IFO — Current Assessment. Germany, 10:00 (GMT+2)

The IFO — Current Assessment index is due at 10:00 (GMT+2). The index is expected to lower to 117.9 points in March from 118.4 points in the previous month. It is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses. A growth in the index is perceived as positive and strengthens the EUR. A fall in the index is perceived as negative and weakens the EUR.

Dallas Fed Manufacturing Business Index. USA, 16:30 (GMT+2)

The March Dallas Fed Manufacturing Business Index is due at 16:30 (GMT+2). The index is released by the FRB of Dallas and is based on a monthly survey of manufacturing companies in Texas. It includes factors such as output volume, number of orders and prices.

Bank of Canada Business Outlook Survey. Canada, 17:30 (GMT+2)

The Bank of Canada Business Outlook Survey is due at 17:30 (GMT+2). It represents current economic conditions for businesses in Canada. The index is based on surveys of a hundred of business executives. Optimistic reviews are perceived as positive for the CAD. Pessimistic reviews are perceived as negative for the CAD.

: