Mirza Baig / Профиль

- Информация

|

10+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Друзья

301

Заявки

Исходящие

Mirza Baig

Sergey Golubev

Комментарий к теме Something Interesting in Financial Video December 2013

17. How to trade the Stochastics indicator in Forex In this Forex training video we discuss how to trade the Stochastics indicator. We discuss three main ways to trade it and it is up to you and your

Mirza Baig

Sergey Golubev

Комментарий к теме How to Start with Metatrader 5

The members of this forum asked this question by several threads : "Is it possible to create one EA, attach it to one chart for one pair, and this EA will trade many pairs ... possible?". Yes, it is

Mirza Baig

Sergey Golubev

Комментарий к теме How to Start with Metatrader 5

Analyzing Candlestick Patterns Plotting of candlestick charts and analysis of candlestick patterns is an amazing line of technical analysis. The advantage of candlesticks is that they represent data

Mirza Baig

Sergey Golubev

Комментарий к теме How to Start with Metatrader 5

An Example of a Trading System Based on a Heiken-Ashi Indicator With the appearance of candlestick chart in the U.S., more than two decades ago, there was a revolution in the understanding of how the

Mirza Baig

Sergey Golubev

Комментарий к теме How to Start with Metatrader 5

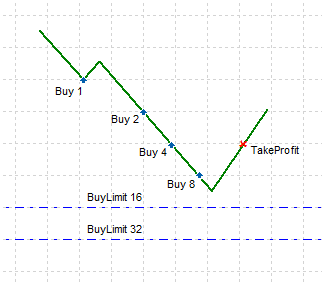

Order Strategies. Multi-Purpose Expert Advisor Scaling in Using Limit Orders You open an initial position and set one or more Limit orders in the same direction with increasing lot size. As Limit

Mirza Baig

::: US Week Ahead: Payrolls, ISM, GDP, Beige Book, Trade Balance, Housing, UMich Svy (eFxnews) :::

Holiday spending begins. Traditionally, the day after the US Thanksgiving holiday, is referred to as Black Friday – the point at which retailers’ profits are ‘in the black’. However, this mega-shopping event has become a 4-day sales marathon beginning on Thanksgiving Day and running through the weekend as folks begin their traditional year-end Christmas shopping. Retailers have scheduled heavy promotions throughout the period to get shoppers through the doors and spending as there are six fewer shopping days between Thanksgiving and Christmas relative to last year. The black Friday news reports on holiday spending figures may be more difficult to interpret this year. The inclusion of sales on Thanksgiving Day, when stores were traditionally closed, will be widespread and poor weather, expected to move through the eastern seaboard, may damp Thanksgiving sales. Retailers have been cautious in their inventory planning and conservative in guidance for holiday season sales expectations. Demand at high-end and low-end retailers has been outpacing mid-market department store sales. There has also been a consumer spending shift towards durable goods from soft goods.

The November ISM Manufacturing survey will likely decline 0.6 points to 55.8. Regional manufacturing surveys for November have generally moved lower. The Philadelphia Fed Business Outlook Survey dropped 13.3 points this month as new orders, shipments and the rate of employment growth slowed. Similar movements were seen in the Empire State Manufacturing Survey. While a decline in the ISM is expected, the level of our forecast for the index remains consistent with modest to moderate growth in the manufacturing sector during November-We forecast total vehicle sales to bounced back 3.6% to a 15.7 million-unit annual rate. While industry analysts report that sales got off to a slow start at the beginning, a significant boost from after-Thanksgiving deals is expected. Sales in September and October were held down by external factors. A 15.7 million unit rate in November would be 2.6% above a year earlier. The YoY growth will appear softer as we saw a jump in vehicle sales in November 2012 as many in the Northeast were replacing autos after Hurricane Sandy. Moreover, if our forecast is accurate, November retail sales are likely to come in strong and should contribute to solid personal consumption expenditures in Q4 GDP.

We look for a USD0.8bn narrowing in the October trade deficit to -USD41.0bn. Much of the narrowing in the trade deficit for October will be attributable to lower energy prices during the month, which will bring down the nominal size of the import bill for crude oil products. Elsewhere in the report, a small reversal in exports of foods, feeds and beverages is expected following last month’s USD1.4bn increase, alongside softer agricultural prices (-1.4% MoM in the export price index). The October ISM survey showed a pick-up in demand in new export orders, suggesting an increase in manufactured goods exports may offset other declines. On the import side, automotive imports likely increased alongside an expected pick-up in auto sales.

September and October data on new home sales will be released together after delays from the shutdown. We forecast September new home sales declined 0.1% to a 420K pace, and bounced back 1.2% in October to a 425K pace. Data on new building permits for October suggested that more positive housing activity was occurring in the multi-family sector, rather than in single-family homes where new building permits rose just 0.8%. Together with this, the National Association of Homebuilders’ survey also noted a more muted pace of present single family sales in October, suggesting a more modest gain for new home sales during the month.

Fed’s Beige Book likely more positive, on balance, alongside stronger consumer confidence and household spending in November. The Fed’s Beige Book for use at the upcoming December FOMC meeting is expected to show modest signs of increased activity compared to the previous report. Retail Sales in October held up relatively well despite the government shutdown. Our forecast for November auto sales suggests that household spending figures should be solid. Some monthly Fed manufacturing surveys have declined this month, suggesting that the Beige Book might contain reports of a moderation in manufacturing activity, though the outlook for the next six months remains strong. Employment gains likely continued at a modest to moderate rate in most regions.

Q3 Real GDP growth is expected to be revised higher due to higher inventories. Expect some payback in Q4. We look for Q3 real GDP growth to be revised up to a 3.1% annual rate from 2.8% in the BEA’s first estimate. The September inventory data came in well above BEA ‘guesstimates’, boosting Q3 growth. We believe that Q4 will see an inventory correction that will result in a sub-2% growth in Q4 despite an expected acceleration in consumer spending. No significant revision to the GDP deflator is anticipated.

October factory orders likely fell 1.6%, with softer nondurable orders alongside lower energy and commodity prices. Durable orders were previously reported down 2.0%, with lower transportation orders responsible for much of the decline. The new information in the report will be on nondurable orders, which we forecast fell nominally alongside lower energy and commodity prices.

Our preliminary nonfarm payrolls forecast looks for a 180K gain in November with the unemployment rate moving back down to 7.2% after the government shutdown impacted last months report. Employment related information released so far this month is consistent with a continued moderate pace of hiring. The November Consumer Confidence report suggested slight improvements in the labour market with fewer people reporting jobs as hard to get, and slightly more reporting jobs as plentiful. The employment component in the Dallas Fed’s Texas Service Sector Outlook survey moved lower but was consistent with a moderate pace of hiring in the private services sector. Regional manufacturing surveys such as the Philadelphia Fed Business Outlook Survey and the Empire State Manufacturing Survey pointed to a slowdown in the pace of hiring, suggesting a softer gain in factory hiring in November. The ADP Employment Report and ISM Manufacturing survey will round out the set of data we input into our forecasting models, and we will look at revising our forecast if these reports come in far from expectations.

We look for the unemployment rate to move back down to 7.2%, after impacts from the government shutdown in the October report resulted in an increase in the unemployment rate to 7.3%. The interpretation of the impacts of the shutdown on the household survey was not immediately clear. Furloughed government workers during the shutdown should have been technically classified as “unemployed, on temporary layoff,” though the household survey showed a 17K increase in the number of unemployed persons in October, alongside a 735K decline in the number of employed persons and a 720K drop in the labour force. We anticipate that we will see a rebound in both employment and the labour force. Moreover, we look for a decline in the number of unemployed persons to bring the unemployment rate down to 7.2%.

Personal income likely increased 0.3% in October, alongside a 0.3% increase in personal spending. Our forecast for the core PCE price index is for a 0.1% m/m increase. Last month’s employment report showed stronger payrolls gains alongside a modest increase in average hourly earnings and an unchanged workweek. Together the data suggest a 0.3% gain in personal income. The October retail sales report suggests a solid gain in personal spending. Durable goods spending is likely to be strong in the report, alongside moderate gains in nondurables and services spending. We look for a trend-like 0.1% increase in the core PCE price index, reflecting soft inflationary pressures seen earlier this month in the October CPI report. This would bring the YoY rate down 0.1 percentage point to 1.1%.

We look for the preliminary University of Michigan Consumer Sentiment index to rise to 76.0 from 75.1. Recent indicators suggest consumer confidence rebounded in the latter half of November as rising equity and home prices alongside lower gasoline prices support household wealth. A pickup in the consumer outlook would be a strong positive for retail sales during the holiday shopping season.

Holiday spending begins. Traditionally, the day after the US Thanksgiving holiday, is referred to as Black Friday – the point at which retailers’ profits are ‘in the black’. However, this mega-shopping event has become a 4-day sales marathon beginning on Thanksgiving Day and running through the weekend as folks begin their traditional year-end Christmas shopping. Retailers have scheduled heavy promotions throughout the period to get shoppers through the doors and spending as there are six fewer shopping days between Thanksgiving and Christmas relative to last year. The black Friday news reports on holiday spending figures may be more difficult to interpret this year. The inclusion of sales on Thanksgiving Day, when stores were traditionally closed, will be widespread and poor weather, expected to move through the eastern seaboard, may damp Thanksgiving sales. Retailers have been cautious in their inventory planning and conservative in guidance for holiday season sales expectations. Demand at high-end and low-end retailers has been outpacing mid-market department store sales. There has also been a consumer spending shift towards durable goods from soft goods.

The November ISM Manufacturing survey will likely decline 0.6 points to 55.8. Regional manufacturing surveys for November have generally moved lower. The Philadelphia Fed Business Outlook Survey dropped 13.3 points this month as new orders, shipments and the rate of employment growth slowed. Similar movements were seen in the Empire State Manufacturing Survey. While a decline in the ISM is expected, the level of our forecast for the index remains consistent with modest to moderate growth in the manufacturing sector during November-We forecast total vehicle sales to bounced back 3.6% to a 15.7 million-unit annual rate. While industry analysts report that sales got off to a slow start at the beginning, a significant boost from after-Thanksgiving deals is expected. Sales in September and October were held down by external factors. A 15.7 million unit rate in November would be 2.6% above a year earlier. The YoY growth will appear softer as we saw a jump in vehicle sales in November 2012 as many in the Northeast were replacing autos after Hurricane Sandy. Moreover, if our forecast is accurate, November retail sales are likely to come in strong and should contribute to solid personal consumption expenditures in Q4 GDP.

We look for a USD0.8bn narrowing in the October trade deficit to -USD41.0bn. Much of the narrowing in the trade deficit for October will be attributable to lower energy prices during the month, which will bring down the nominal size of the import bill for crude oil products. Elsewhere in the report, a small reversal in exports of foods, feeds and beverages is expected following last month’s USD1.4bn increase, alongside softer agricultural prices (-1.4% MoM in the export price index). The October ISM survey showed a pick-up in demand in new export orders, suggesting an increase in manufactured goods exports may offset other declines. On the import side, automotive imports likely increased alongside an expected pick-up in auto sales.

September and October data on new home sales will be released together after delays from the shutdown. We forecast September new home sales declined 0.1% to a 420K pace, and bounced back 1.2% in October to a 425K pace. Data on new building permits for October suggested that more positive housing activity was occurring in the multi-family sector, rather than in single-family homes where new building permits rose just 0.8%. Together with this, the National Association of Homebuilders’ survey also noted a more muted pace of present single family sales in October, suggesting a more modest gain for new home sales during the month.

Fed’s Beige Book likely more positive, on balance, alongside stronger consumer confidence and household spending in November. The Fed’s Beige Book for use at the upcoming December FOMC meeting is expected to show modest signs of increased activity compared to the previous report. Retail Sales in October held up relatively well despite the government shutdown. Our forecast for November auto sales suggests that household spending figures should be solid. Some monthly Fed manufacturing surveys have declined this month, suggesting that the Beige Book might contain reports of a moderation in manufacturing activity, though the outlook for the next six months remains strong. Employment gains likely continued at a modest to moderate rate in most regions.

Q3 Real GDP growth is expected to be revised higher due to higher inventories. Expect some payback in Q4. We look for Q3 real GDP growth to be revised up to a 3.1% annual rate from 2.8% in the BEA’s first estimate. The September inventory data came in well above BEA ‘guesstimates’, boosting Q3 growth. We believe that Q4 will see an inventory correction that will result in a sub-2% growth in Q4 despite an expected acceleration in consumer spending. No significant revision to the GDP deflator is anticipated.

October factory orders likely fell 1.6%, with softer nondurable orders alongside lower energy and commodity prices. Durable orders were previously reported down 2.0%, with lower transportation orders responsible for much of the decline. The new information in the report will be on nondurable orders, which we forecast fell nominally alongside lower energy and commodity prices.

Our preliminary nonfarm payrolls forecast looks for a 180K gain in November with the unemployment rate moving back down to 7.2% after the government shutdown impacted last months report. Employment related information released so far this month is consistent with a continued moderate pace of hiring. The November Consumer Confidence report suggested slight improvements in the labour market with fewer people reporting jobs as hard to get, and slightly more reporting jobs as plentiful. The employment component in the Dallas Fed’s Texas Service Sector Outlook survey moved lower but was consistent with a moderate pace of hiring in the private services sector. Regional manufacturing surveys such as the Philadelphia Fed Business Outlook Survey and the Empire State Manufacturing Survey pointed to a slowdown in the pace of hiring, suggesting a softer gain in factory hiring in November. The ADP Employment Report and ISM Manufacturing survey will round out the set of data we input into our forecasting models, and we will look at revising our forecast if these reports come in far from expectations.

We look for the unemployment rate to move back down to 7.2%, after impacts from the government shutdown in the October report resulted in an increase in the unemployment rate to 7.3%. The interpretation of the impacts of the shutdown on the household survey was not immediately clear. Furloughed government workers during the shutdown should have been technically classified as “unemployed, on temporary layoff,” though the household survey showed a 17K increase in the number of unemployed persons in October, alongside a 735K decline in the number of employed persons and a 720K drop in the labour force. We anticipate that we will see a rebound in both employment and the labour force. Moreover, we look for a decline in the number of unemployed persons to bring the unemployment rate down to 7.2%.

Personal income likely increased 0.3% in October, alongside a 0.3% increase in personal spending. Our forecast for the core PCE price index is for a 0.1% m/m increase. Last month’s employment report showed stronger payrolls gains alongside a modest increase in average hourly earnings and an unchanged workweek. Together the data suggest a 0.3% gain in personal income. The October retail sales report suggests a solid gain in personal spending. Durable goods spending is likely to be strong in the report, alongside moderate gains in nondurables and services spending. We look for a trend-like 0.1% increase in the core PCE price index, reflecting soft inflationary pressures seen earlier this month in the October CPI report. This would bring the YoY rate down 0.1 percentage point to 1.1%.

We look for the preliminary University of Michigan Consumer Sentiment index to rise to 76.0 from 75.1. Recent indicators suggest consumer confidence rebounded in the latter half of November as rising equity and home prices alongside lower gasoline prices support household wealth. A pickup in the consumer outlook would be a strong positive for retail sales during the holiday shopping season.

Mirza Baig

::: Europe Week Ahead: ECB, BoE, Ger Factory Orders, EZ PMI, UK PMI (eFxnews) :::

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

Mirza Baig

::: USD/JPY: 2 Scenarios After The Triangle Breakout - Citi (eFxnews) :::

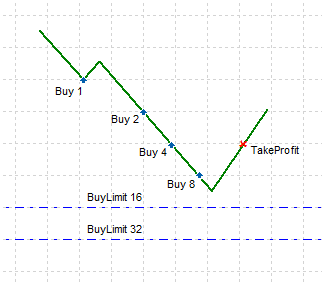

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

Mirza Baig

::: UK As A Currency Area: 'In For A Penny, In For The Pound' - Deutsche Bank (eFxnews) :::

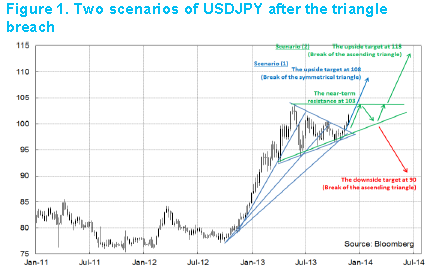

Focus of the day:

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

Focus of the day:

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

Mirza Baig

::: Potential Currency Impact From Iranian Nuclear Accord - Credit Agricole (eFxnews) :::

In what is likely to be a quiet week ahead of the US holiday, news that the US and Iran reached a nuclear deal helped currencies diverge from recent trends. The dollar, in particular, rallied against nearly all the G10 currencies but declined against some EM currencies. The price action displayed an interesting shift away from the monetary policy outlook towards broader macro trends related to the sensitivity to oil prices. The outlook for oil importers and exporters terms of trade is likely the driver behind the knee-jerk market reaction to the nuclear deal.

However, the reaction may offer a script for long-term trends in FX rates if commodity prices continue to trend lower. Indeed, crude oil gapped lower and is now trading about 3% above its multi-month low, with the biggest crude oil exporters among the weakest performing against the dollar on the news. The prospects of more supply hitting the market in the near-term is clearly a negative for a commodity that remains in competition with the shale gas revolution in the US.

The sensitivity of currencies to oil prices is fairly intuitive and straightforward. Above all, an increase in oil prices boosts the terms of trade of commodity exporters and thus increases the demand for currency. This tends to boost the current account balance of commodity exporters. At the same time, lower oil prices are beneficial more commodity importers – whose current account is likely to improve as the cost of imports decline.

In short, among the best performers on the day were INR, TRY and INR while Asian equities outperformed, which suggests that the lower oil prices provided a brief respite for oil importers. Alternatively, the weakest performers were NOK, MXN, CAD and RUB – all currencies that commodity exporters.

Moving forward, while the deal with Iran may only provide a knee-jerk market reaction, the broader themes related to the US shale revolution and the end of the commodity super-cycle are likely to impact commodity producers (and their currencies) in much the same way.

In what is likely to be a quiet week ahead of the US holiday, news that the US and Iran reached a nuclear deal helped currencies diverge from recent trends. The dollar, in particular, rallied against nearly all the G10 currencies but declined against some EM currencies. The price action displayed an interesting shift away from the monetary policy outlook towards broader macro trends related to the sensitivity to oil prices. The outlook for oil importers and exporters terms of trade is likely the driver behind the knee-jerk market reaction to the nuclear deal.

However, the reaction may offer a script for long-term trends in FX rates if commodity prices continue to trend lower. Indeed, crude oil gapped lower and is now trading about 3% above its multi-month low, with the biggest crude oil exporters among the weakest performing against the dollar on the news. The prospects of more supply hitting the market in the near-term is clearly a negative for a commodity that remains in competition with the shale gas revolution in the US.

The sensitivity of currencies to oil prices is fairly intuitive and straightforward. Above all, an increase in oil prices boosts the terms of trade of commodity exporters and thus increases the demand for currency. This tends to boost the current account balance of commodity exporters. At the same time, lower oil prices are beneficial more commodity importers – whose current account is likely to improve as the cost of imports decline.

In short, among the best performers on the day were INR, TRY and INR while Asian equities outperformed, which suggests that the lower oil prices provided a brief respite for oil importers. Alternatively, the weakest performers were NOK, MXN, CAD and RUB – all currencies that commodity exporters.

Moving forward, while the deal with Iran may only provide a knee-jerk market reaction, the broader themes related to the US shale revolution and the end of the commodity super-cycle are likely to impact commodity producers (and their currencies) in much the same way.

Mirza Baig

::: EUR: 'The ECB Is Importing Deflation From Around The World' - UBS :::

"The window for the ECB Governing Council to act on deflation pressures appears to be closing as even the Bank of Spain Governor noted on Monday that there was no risk of deflation in his country. He also backed up comments by fellow ECB officials noting that both lower rates and outright asset purchases are ‘difficult’. Markets will likely hold fire on euro longs ahead of the Eurozone inflation prints on Friday, but we believe there is merit in taking a step back to assess why the ECB itself seems less concerned about the current headwinds...

Even with the recent downside surprises in the Eurozone, it cannot mask the fact that structural inflationary impulse is falling in the US due to structural reasons. As such, whatever the ECB response is, the Fed has actually done more than expected, thereby containing EURUSD weakness.

Even if in the short-term the ECB chooses not to act, the lack of inflation upside surprises amongst its major trading partners needs close monitoring as well. With many other central banks still on blast the ECB is importing deflation from around the world. The REER appreciation pressure over the medium- to longer-term will become an issue, even if absolute price prints do not register strongly. As the ECB would probably be last to be dragged into such competitive easing as stimulus, markets may be more willing to own the currency if there is no clear policy signal to the contrary. Only then, when it looks a little late, might the ECB change tack."

"The window for the ECB Governing Council to act on deflation pressures appears to be closing as even the Bank of Spain Governor noted on Monday that there was no risk of deflation in his country. He also backed up comments by fellow ECB officials noting that both lower rates and outright asset purchases are ‘difficult’. Markets will likely hold fire on euro longs ahead of the Eurozone inflation prints on Friday, but we believe there is merit in taking a step back to assess why the ECB itself seems less concerned about the current headwinds...

Even with the recent downside surprises in the Eurozone, it cannot mask the fact that structural inflationary impulse is falling in the US due to structural reasons. As such, whatever the ECB response is, the Fed has actually done more than expected, thereby containing EURUSD weakness.

Even if in the short-term the ECB chooses not to act, the lack of inflation upside surprises amongst its major trading partners needs close monitoring as well. With many other central banks still on blast the ECB is importing deflation from around the world. The REER appreciation pressure over the medium- to longer-term will become an issue, even if absolute price prints do not register strongly. As the ECB would probably be last to be dragged into such competitive easing as stimulus, markets may be more willing to own the currency if there is no clear policy signal to the contrary. Only then, when it looks a little late, might the ECB change tack."

Mirza Baig

::: Outlooks & Strategies For EUR/USD, GBP/USD, USD/JPY, & AUD/USD - Barclays (eFxnews) :::

The following are the latest technical outlooks and strategies for EUR/USD, GBP/USD, USD/JPY and AUD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are clinging to our bearish view for EUR/USD against resistance in the 1.3630/50 area. While this caps we look for a move back in range toward targets near 1.3400. A move above 1.3650 would force us to assume a stronger-than-expected rally toward the 1.3700 area.

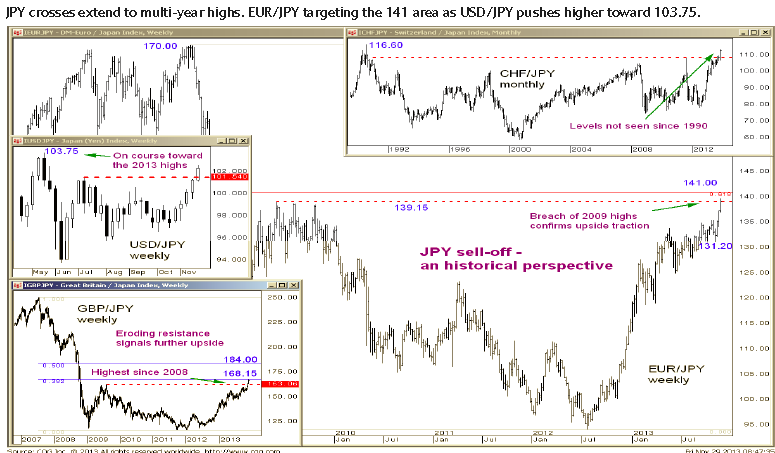

USD/JPY: Broad JPY weakness helps keep our bullish USD/JPY view on track toward the 2013 peak near 103.75. Beyond this, medium-term retracement objectives are at 105.75.

GBP/USD: Our adoption of a more positive view for GBP/USD was vindicated by the rally toward our initial target near 1.6380. A move above there would signal further upside toward the range highs near 1.6620.

AUD/USD: A move below our initial downside target in the 0.9040 area would signal further weakness toward 0.8900/0.8850, the range lows. We would place stops on short positions in the 0.9200 area, Tuesday’s reaction high.

The following are the latest technical outlooks and strategies for EUR/USD, GBP/USD, USD/JPY and AUD/USD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are clinging to our bearish view for EUR/USD against resistance in the 1.3630/50 area. While this caps we look for a move back in range toward targets near 1.3400. A move above 1.3650 would force us to assume a stronger-than-expected rally toward the 1.3700 area.

USD/JPY: Broad JPY weakness helps keep our bullish USD/JPY view on track toward the 2013 peak near 103.75. Beyond this, medium-term retracement objectives are at 105.75.

GBP/USD: Our adoption of a more positive view for GBP/USD was vindicated by the rally toward our initial target near 1.6380. A move above there would signal further upside toward the range highs near 1.6620.

AUD/USD: A move below our initial downside target in the 0.9040 area would signal further weakness toward 0.8900/0.8850, the range lows. We would place stops on short positions in the 0.9200 area, Tuesday’s reaction high.

Mirza Baig

::: 3 Reasons Why AUD/USD Still A Sell On Rallies - Credit Agricole (eFxnews) :::

The AUD has been rebounding of late, mainly on the back of improving risk sentiment and better than expected Q3 capital expenditure data.

However, we stick to the view that intraday rallies should be sold.

First of all the currency has been less correlated to risk appetite of late.

Secondly, the RBA is unlikely to become less dovish on the back of the most recent data. On the contrary, they will likely continue to keep a cautious stance when it comes to tighter monetary conditions on the back of the still strong currency.

Last but not least, pairs such as AUD/USD keep a close correlation to US yields. As we stick to the notion that there is room for investors’ Fed monetary policy expectations to adjust higher, this would come to the detriment of the AUD.

The AUD has been rebounding of late, mainly on the back of improving risk sentiment and better than expected Q3 capital expenditure data.

However, we stick to the view that intraday rallies should be sold.

First of all the currency has been less correlated to risk appetite of late.

Secondly, the RBA is unlikely to become less dovish on the back of the most recent data. On the contrary, they will likely continue to keep a cautious stance when it comes to tighter monetary conditions on the back of the still strong currency.

Last but not least, pairs such as AUD/USD keep a close correlation to US yields. As we stick to the notion that there is room for investors’ Fed monetary policy expectations to adjust higher, this would come to the detriment of the AUD.

Mirza Baig

::: Morgan Stanley Booked 570 Pips On EUR/JPY Long, Hold 2 USD/JPY Longs (eFxnews) :::

With EUR/JPY hitting the 139 mark today, Morgan Stanley booked a 570 pips profit on its long EUR/JPY position. The trade was running in MS medium-term macro portfolio for almost a month-long (from 133.30).

MS is still betting on more JPY losses with 2 running trades: a long USD/JPY in its short-term macro portfolio targeting 103 with a revised stop at 100.40 and another long in its medium-term macro portfolio targeting 105, with a revised stop at 99.40.

"We hold our long USD/JPY position as the three main drivers of the pair remain supportive. These are, (1) a widening rate differential between the US and Japan, (2) constructive global risk appetite, and (3) optimism on Japan’s structural reforms. Meanwhile, we expect more action from the BoJ next spring as fiscal consolidation begins to take its toll. As real rate expectations fall, Japanese investors are likely to allocate more to risk assets, including those outside of Japan," MS says as rationale behind this call.

With EUR/JPY hitting the 139 mark today, Morgan Stanley booked a 570 pips profit on its long EUR/JPY position. The trade was running in MS medium-term macro portfolio for almost a month-long (from 133.30).

MS is still betting on more JPY losses with 2 running trades: a long USD/JPY in its short-term macro portfolio targeting 103 with a revised stop at 100.40 and another long in its medium-term macro portfolio targeting 105, with a revised stop at 99.40.

"We hold our long USD/JPY position as the three main drivers of the pair remain supportive. These are, (1) a widening rate differential between the US and Japan, (2) constructive global risk appetite, and (3) optimism on Japan’s structural reforms. Meanwhile, we expect more action from the BoJ next spring as fiscal consolidation begins to take its toll. As real rate expectations fall, Japanese investors are likely to allocate more to risk assets, including those outside of Japan," MS says as rationale behind this call.

Mirza Baig

::: Morgan Stanley Sells $10 Million EUR/USD From 1.36 Targeting 1.27 (eFxnews) :::

Morgan Stanley added a short EUR/USD position to its medium-term macro portfolio via selling $10 million in cash from 1.36 with a stop at 1.3830, and a target at 1.2700.

"The ECB continues to push a dovish message, most recently suggesting a numerical negative deposit rate target. While we don’t expect imminent policy action, we do think the growth backdrop will ultimately force the ECB to do more. As such, we like selling the EUR on rallies," MS says as a rationale behind this call.

"The next EMU HICP flash print, which is out on Friday, November 29, will be extremely important – with the last one at 0.7% seemingly provoking the ECB to cut its refi rate. A key risk to our trade could be a lack of action from the ECB to fight disinflationary pressures," MS adds.

"The geographic break down of CPI within Europe shows that the disinflationary pressure is not confined to the periphery (see Exhibit 2) where austerity and constrained credit conditions have been the most extreme, but is broad based with even core EMU countries experiencing a sharp decline in CPI. Draghi has also observed that disinflationary pressure in EMU is broad based. As a result, the ECB is likely to be more sensitive to any further sharp declines in the inflation rate, we believe, leaving the EUR vulnerable to soft inflation indicators," MS clarifies.

Morgan Stanley added a short EUR/USD position to its medium-term macro portfolio via selling $10 million in cash from 1.36 with a stop at 1.3830, and a target at 1.2700.

"The ECB continues to push a dovish message, most recently suggesting a numerical negative deposit rate target. While we don’t expect imminent policy action, we do think the growth backdrop will ultimately force the ECB to do more. As such, we like selling the EUR on rallies," MS says as a rationale behind this call.

"The next EMU HICP flash print, which is out on Friday, November 29, will be extremely important – with the last one at 0.7% seemingly provoking the ECB to cut its refi rate. A key risk to our trade could be a lack of action from the ECB to fight disinflationary pressures," MS adds.

"The geographic break down of CPI within Europe shows that the disinflationary pressure is not confined to the periphery (see Exhibit 2) where austerity and constrained credit conditions have been the most extreme, but is broad based with even core EMU countries experiencing a sharp decline in CPI. Draghi has also observed that disinflationary pressure in EMU is broad based. As a result, the ECB is likely to be more sensitive to any further sharp declines in the inflation rate, we believe, leaving the EUR vulnerable to soft inflation indicators," MS clarifies.

Mirza Baig

Exit EUR/USD Longs Into 1.37; Re-Buy Cable & USD/JPY Dips - UBS (eFxnews)

The following are the short-term strategies for EUR/USD, USD/JPY, EUR/JPY, and GBP/USD as provided by the FX Strategy team at UBS.

EUR/USD: The bid tone we have seen lately in EURUSD is intact, and going into month end, we see no reason to fight it. Buyers will still be lined up ahead of 1.3500 and pain will come into play above the high from early October at 1.3646. A break above will open for 1.3700 but will have no interest for being long above there.

USD/JPY: The move in yen was stop-driven in thin market overnight. EURJPY is trading on multi year highs; it is through 139.22 and the next level is the psychological mark of 140 ahead of 141.03, the 61.8% retracement of the 2008-2012 downtrend and the 50% retracement of the July 08-Jan09 drop. The drop in Nikkei stopped the upmove in the pair, and we think there is risk of a short term correction. Look to buy dips to 101.70 and 138.50.

GBP/USD: The hawkish tone from BOE's Carney and the Financial Policy Committee taking steps cutting the FLS for households gave Sterling another boost yesterday. Flows are light in holiday markets. European corporates bought the dip in EURGBP while overnight private money demand took Cable just shy of 1.6381, the January high. Square Cable longs ahead of 1.6381, looking to re buy towards 1.6260 next week.

The following are the short-term strategies for EUR/USD, USD/JPY, EUR/JPY, and GBP/USD as provided by the FX Strategy team at UBS.

EUR/USD: The bid tone we have seen lately in EURUSD is intact, and going into month end, we see no reason to fight it. Buyers will still be lined up ahead of 1.3500 and pain will come into play above the high from early October at 1.3646. A break above will open for 1.3700 but will have no interest for being long above there.

USD/JPY: The move in yen was stop-driven in thin market overnight. EURJPY is trading on multi year highs; it is through 139.22 and the next level is the psychological mark of 140 ahead of 141.03, the 61.8% retracement of the 2008-2012 downtrend and the 50% retracement of the July 08-Jan09 drop. The drop in Nikkei stopped the upmove in the pair, and we think there is risk of a short term correction. Look to buy dips to 101.70 and 138.50.

GBP/USD: The hawkish tone from BOE's Carney and the Financial Policy Committee taking steps cutting the FLS for households gave Sterling another boost yesterday. Flows are light in holiday markets. European corporates bought the dip in EURGBP while overnight private money demand took Cable just shy of 1.6381, the January high. Square Cable longs ahead of 1.6381, looking to re buy towards 1.6260 next week.

Mirza Baig

::: A Daring GBP/JPY Trade That’s Well Worth the Risk ::: DailyFX :::

*******************************************************

Talking Points:

> 3 Patterns That Justify a Countertrend Trade

> Controversial Pattern on GBP/JPY Daily Chart

> The Clearest Reason of All to Take This Trade

The market has proven a little gun shy lately, avoiding entering safe support and resistance zones where risk on new positions can be better controlled. This happened twice this week, both in the EURGBP short set-up we targeted on Monday and the GBPCAD long set-up we spotted Tuesday. Both trades turned sharply profitable just before price touched the support/resistance zones we identified as potential entry areas.

This is usually when more inexperienced traders start thinking about how a small tweak to their strategy would have allowed them to catch those trades. However, without serious testing, this is very ill-advised, as even "small" tweaks to a working strategy usually result in only a few more winners while opening the floodgates to more losing trades and a bevy of unforeseen problems.

Instead, the best thing to do is keep plugging away using the existing strategy, even if it means narrowly missing new entry opportunities. As there have been no trades, there have been no losses, either, and that is far preferable to suffering through losing trades.

As experienced traders will have noticed, virtually every strategy goes through periods of being miraculously correct, being dead wrong, and being everything in between. This is just one of those "in-between" phases.

In sticking with the current strategy, today, we highlight a countertrend trade on the “big kahuna” of volatility, GBPJPY.

On the weekly chart below, price is reaching upwards to test the resistance offered by the top of a very large wedge pattern.

Indeed, this pattern is so large that it could qualify as a monthly wedge.

*******************************************************

Talking Points:

> 3 Patterns That Justify a Countertrend Trade

> Controversial Pattern on GBP/JPY Daily Chart

> The Clearest Reason of All to Take This Trade

The market has proven a little gun shy lately, avoiding entering safe support and resistance zones where risk on new positions can be better controlled. This happened twice this week, both in the EURGBP short set-up we targeted on Monday and the GBPCAD long set-up we spotted Tuesday. Both trades turned sharply profitable just before price touched the support/resistance zones we identified as potential entry areas.

This is usually when more inexperienced traders start thinking about how a small tweak to their strategy would have allowed them to catch those trades. However, without serious testing, this is very ill-advised, as even "small" tweaks to a working strategy usually result in only a few more winners while opening the floodgates to more losing trades and a bevy of unforeseen problems.

Instead, the best thing to do is keep plugging away using the existing strategy, even if it means narrowly missing new entry opportunities. As there have been no trades, there have been no losses, either, and that is far preferable to suffering through losing trades.

As experienced traders will have noticed, virtually every strategy goes through periods of being miraculously correct, being dead wrong, and being everything in between. This is just one of those "in-between" phases.

In sticking with the current strategy, today, we highlight a countertrend trade on the “big kahuna” of volatility, GBPJPY.

On the weekly chart below, price is reaching upwards to test the resistance offered by the top of a very large wedge pattern.

Indeed, this pattern is so large that it could qualify as a monthly wedge.

Mirza Baig

****************************************************

::: Sharpening Your Trading Skills: Moving Average (Kitco.com) :::

****************************************************

I take a “toolbox” approach to analyzing and trading markets. The more technical and analytical tools I have in my trading toolbox at my disposal, the better my chances for success in trading. One of my favorite "secondary" trading tools is moving averages. First, let me give you an explanation of moving averages, and then I’ll tell you how I use them.

Moving averages are one of the most commonly used technical tools. In a simple moving average, the mathematical median of the underlying price is calculated over an observation period. Prices (usually closing prices) over this period are added and then divided by the total number of time periods. Every day of the observation period is given the same weighting in simple moving averages. Some moving averages give greater weight to more recent prices in the observation period. These are called exponential or weighted moving averages. In this educational feature, I’ll only discuss simple moving averages.

The length of time (the number of bars) calculated in a moving average is very important. Moving averages with shorter time periods normally fluctuate and are likely to give more trading signals. Slower moving averages use longer time periods and display a smoother moving average. The slower averages, however, may be too slow to enable you to establish a long or short position effectively.

Moving averages follow the trend while smoothing the price movement. The simple moving average is most commonly combined with other simple moving averages to indicate buy and sell signals. Some traders use three moving averages. Their lengths typically consist of short, intermediate, and long-term moving averages. A commonly used system in futures trading is 4-, 9-, and 18-period moving averages. Keep in mind a time interval may be ticks, minutes, days, weeks, or even months. Typically, moving averages are used in the shorter time periods, and not on the longer-term weekly and monthly bar charts.

The normal moving average “crossover” buy/sell signals are as follows: A buy signal is produced when the shorter-term average crosses from below to above the longer-term average. Conversely, a sell signal is issued when the shorter-term average crosses from above to below the longer-term average.

Another trading approach is to use closing prices with the moving averages. When the closing price is above the moving average, maintain a long position. If the closing price falls below the moving average, liquidate any long position and establish a short position.

Here is the important caveat about using moving averages when trading futures markets: They do not work well in choppy or non-trending markets. You can develop a severe case of whiplash using moving averages in choppy, sideways markets. Conversely, in trending markets, moving averages can work very well.

In futures markets, my favorite moving averages are the 9- and 18-day. I have also used the 4-, 9- and 18-day moving averages on occasion.

When looking at a daily bar chart, you can plot different moving averages (provided you have the proper charting software) and immediately see if they have worked well at providing buy and sell signals during the past few months of price history on the chart.

I said I like the 9-day and 18-day moving averages for futures markets. For individual stocks, I have used (and other successful veterans have told me they use) the 100-day moving average to determine if a stock is bullish or bearish. If the stock is above the 100-day moving average, it is bullish. If the stock is below the 100-day moving average, it is bearish. I also use the 100-day moving average to gauge the health of stock index futures markets.

One more bit of sage advice: A veteran market watcher told me the “commodity funds” (the big trading funds that many times seem to dominate futures market trading) follow the 40-day moving average very closely--especially in the grain futures. Thus, if you see a market that is getting ready to cross above or below the 40-day moving average, it just may be that the funds could become more active.

I said earlier that simple moving averages are a "secondary" tool in my trading toolbox. My primary (most important) tools are basic chart patterns, trend lines and fundamental analysis.

::: Sharpening Your Trading Skills: Moving Average (Kitco.com) :::

****************************************************

I take a “toolbox” approach to analyzing and trading markets. The more technical and analytical tools I have in my trading toolbox at my disposal, the better my chances for success in trading. One of my favorite "secondary" trading tools is moving averages. First, let me give you an explanation of moving averages, and then I’ll tell you how I use them.

Moving averages are one of the most commonly used technical tools. In a simple moving average, the mathematical median of the underlying price is calculated over an observation period. Prices (usually closing prices) over this period are added and then divided by the total number of time periods. Every day of the observation period is given the same weighting in simple moving averages. Some moving averages give greater weight to more recent prices in the observation period. These are called exponential or weighted moving averages. In this educational feature, I’ll only discuss simple moving averages.

The length of time (the number of bars) calculated in a moving average is very important. Moving averages with shorter time periods normally fluctuate and are likely to give more trading signals. Slower moving averages use longer time periods and display a smoother moving average. The slower averages, however, may be too slow to enable you to establish a long or short position effectively.

Moving averages follow the trend while smoothing the price movement. The simple moving average is most commonly combined with other simple moving averages to indicate buy and sell signals. Some traders use three moving averages. Their lengths typically consist of short, intermediate, and long-term moving averages. A commonly used system in futures trading is 4-, 9-, and 18-period moving averages. Keep in mind a time interval may be ticks, minutes, days, weeks, or even months. Typically, moving averages are used in the shorter time periods, and not on the longer-term weekly and monthly bar charts.

The normal moving average “crossover” buy/sell signals are as follows: A buy signal is produced when the shorter-term average crosses from below to above the longer-term average. Conversely, a sell signal is issued when the shorter-term average crosses from above to below the longer-term average.

Another trading approach is to use closing prices with the moving averages. When the closing price is above the moving average, maintain a long position. If the closing price falls below the moving average, liquidate any long position and establish a short position.

Here is the important caveat about using moving averages when trading futures markets: They do not work well in choppy or non-trending markets. You can develop a severe case of whiplash using moving averages in choppy, sideways markets. Conversely, in trending markets, moving averages can work very well.

In futures markets, my favorite moving averages are the 9- and 18-day. I have also used the 4-, 9- and 18-day moving averages on occasion.

When looking at a daily bar chart, you can plot different moving averages (provided you have the proper charting software) and immediately see if they have worked well at providing buy and sell signals during the past few months of price history on the chart.

I said I like the 9-day and 18-day moving averages for futures markets. For individual stocks, I have used (and other successful veterans have told me they use) the 100-day moving average to determine if a stock is bullish or bearish. If the stock is above the 100-day moving average, it is bullish. If the stock is below the 100-day moving average, it is bearish. I also use the 100-day moving average to gauge the health of stock index futures markets.

One more bit of sage advice: A veteran market watcher told me the “commodity funds” (the big trading funds that many times seem to dominate futures market trading) follow the 40-day moving average very closely--especially in the grain futures. Thus, if you see a market that is getting ready to cross above or below the 40-day moving average, it just may be that the funds could become more active.

I said earlier that simple moving averages are a "secondary" tool in my trading toolbox. My primary (most important) tools are basic chart patterns, trend lines and fundamental analysis.

: