Mirza Baig / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Друзья

300

Заявки

Исходящие

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.15 11:58 GBP/USD Intra-Day Fundamentals: U.K. Jobless Claims and 34 pips price

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.14 08:45 Trading News Events: U.K. Consumer Price Index (adapted from the article ) "

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.11 10:11 Fundamental Weekly Forecasts for Dollar Index, NZD/USD, GBP/USD, USD/CAD

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.09 10:57 GBP/USD Fundamentals: U.K. Goods Trade Balance and 12 pips price movement

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.08 10:48 GBP/USD Intra-Day Fundamentals: U.K. Manufacturing Production and 37 pips

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.06.04 12:06 Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.26 12:25 GBP/USD Intra-Day Fundamentals: U.K. Total Business Investment and 47 pips

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.19 10:52 GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 40 pips price movement

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

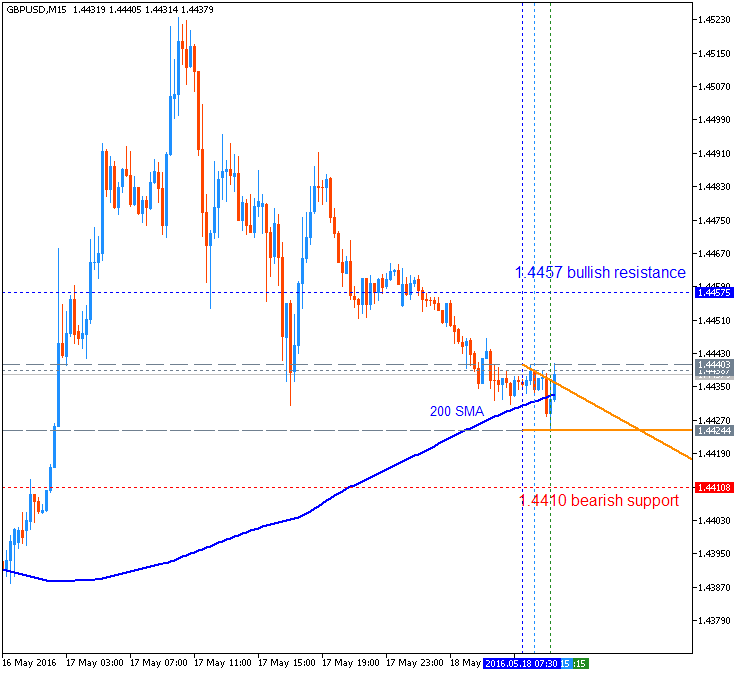

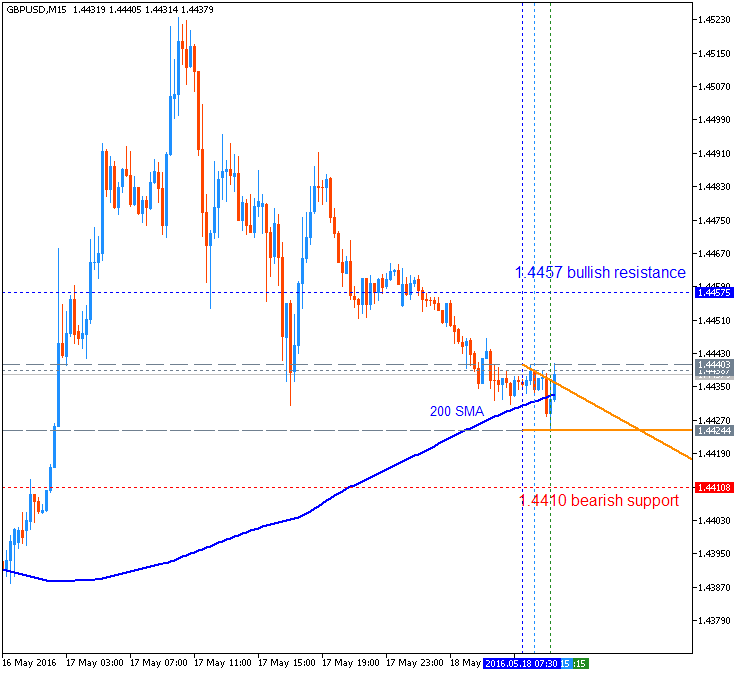

If the price breaks 1.4457 resistance to above on close bar so the bullish trend will be continuing; If the price breaks 1.4410 support level to below so the bearish reversal will be started; If not

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.18 08:31 Trading the News: U.K. Jobless Claims Change (based on the article )

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.17 12:28 GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 38 pips price

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.12 13:10 GBP/USD Intra-Day Fundamentals: BoE Official Bank Rate and 57 pips price

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.12 10:42 Trading News Events: Bank of England Official Bank Rate (based on the article

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.11 16:20 GBP/USD Intra-Day Fundamentals: NIESR GDP Estimate and 25 pips price movement

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

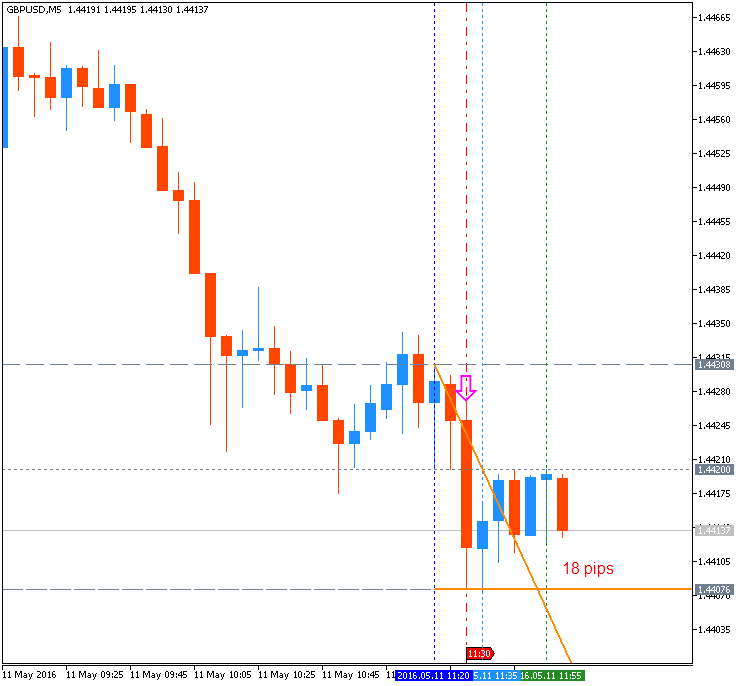

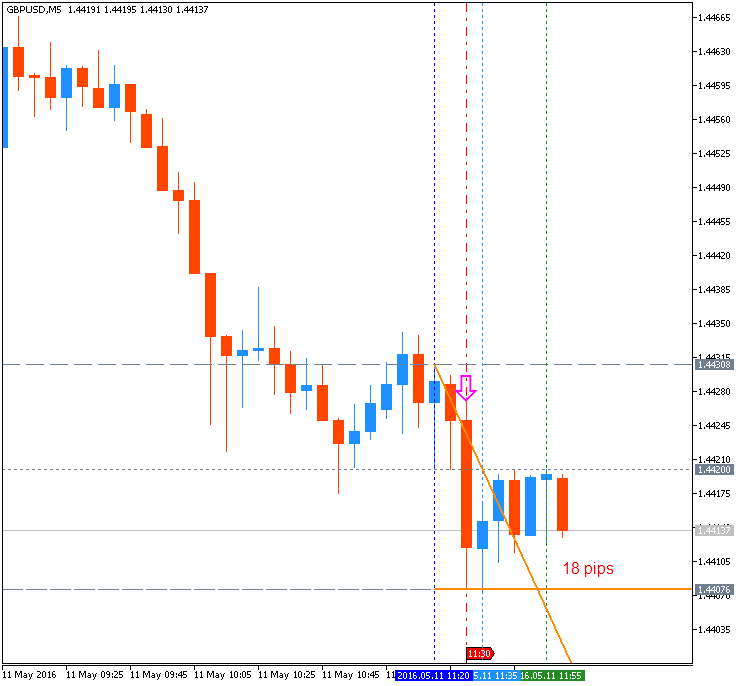

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.11 09:20 Trading News Events: U.K. Manufacturing Production (based on the article )

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.08 08:46 Fundamental Weekly Forecasts for Dollar Index, USD/JPY, GBP/USD, USD/CNH

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.05.03 10:42 GBP/USD Intra-Day Fundamentals: U.K. Manufacturing PMI and 33 pips price

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.04.27 11:17 GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and 30 pips price

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.04.21 10:43 GBP/USD Intra-Day Fundamentals: U.K. Retail Sales and 10 pips price movement

Mirza Baig

Sergey Golubev

Комментарий к теме Forecast for Q2'16 - levels for GBP/USD

Forum on trading, automated trading systems and testing trading strategies Press review Sergey Golubev , 2016.04.21 08:16 Trading the News: U.K. Retail Sales (based on the article ) What’s Expected

: