Young Ho Seo / Профиль

- Информация

|

10+ лет

опыт работы

|

62

продуктов

|

1182

демо-версий

|

|

4

работ

|

0

сигналов

|

0

подписчиков

|

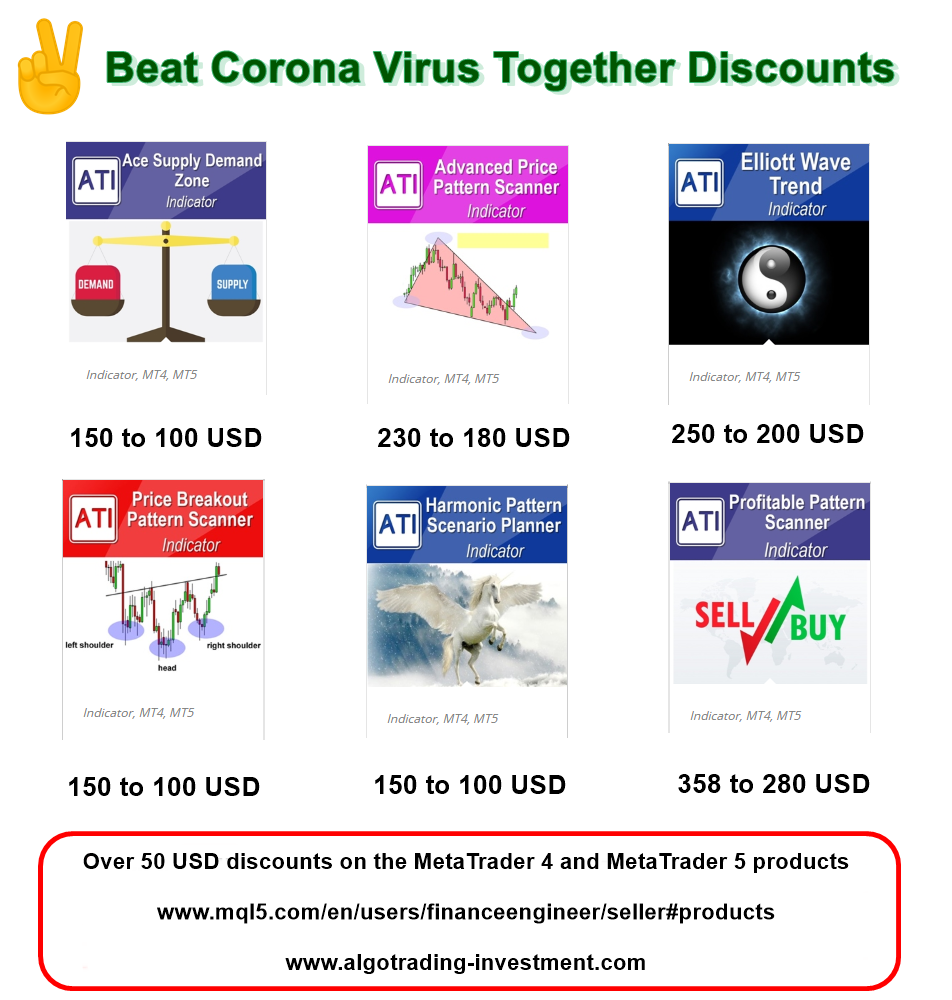

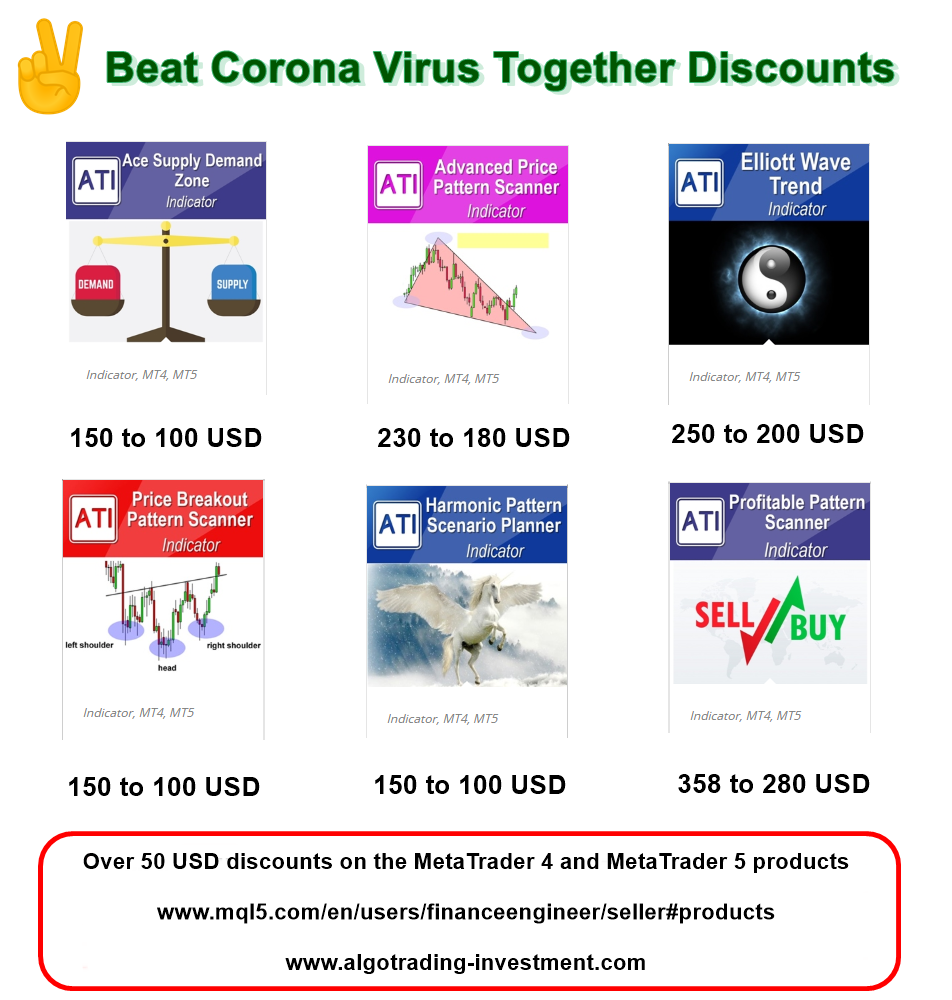

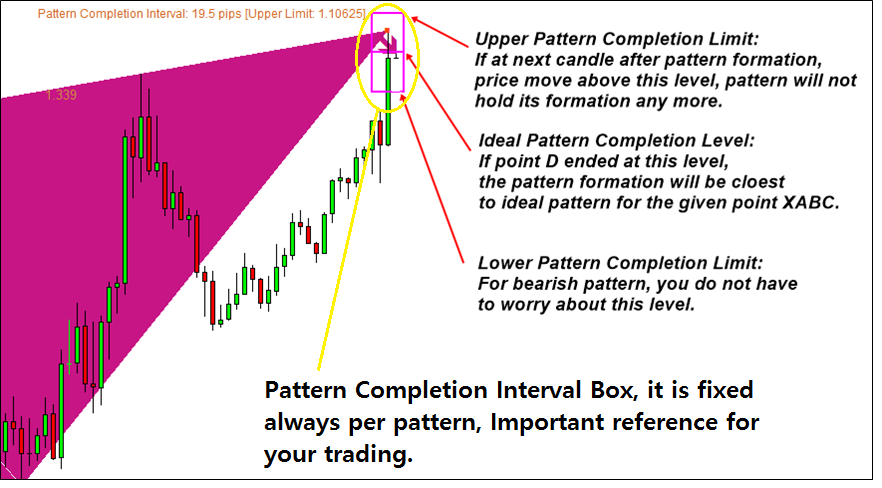

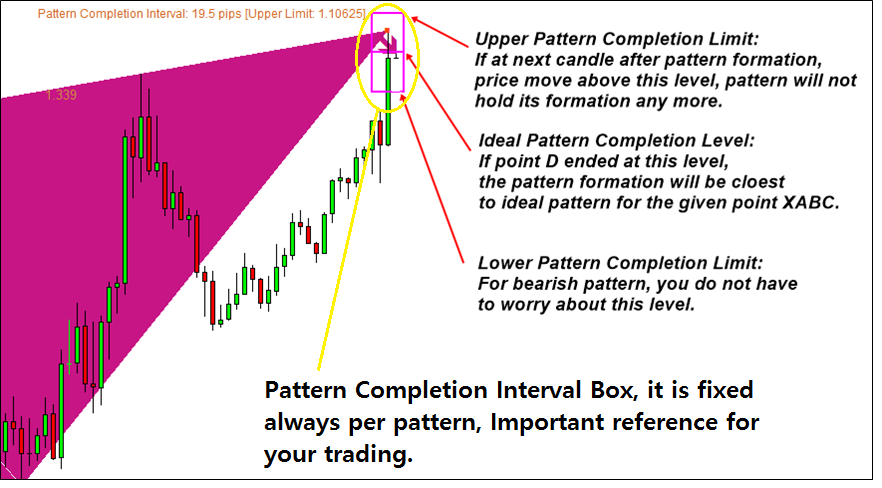

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

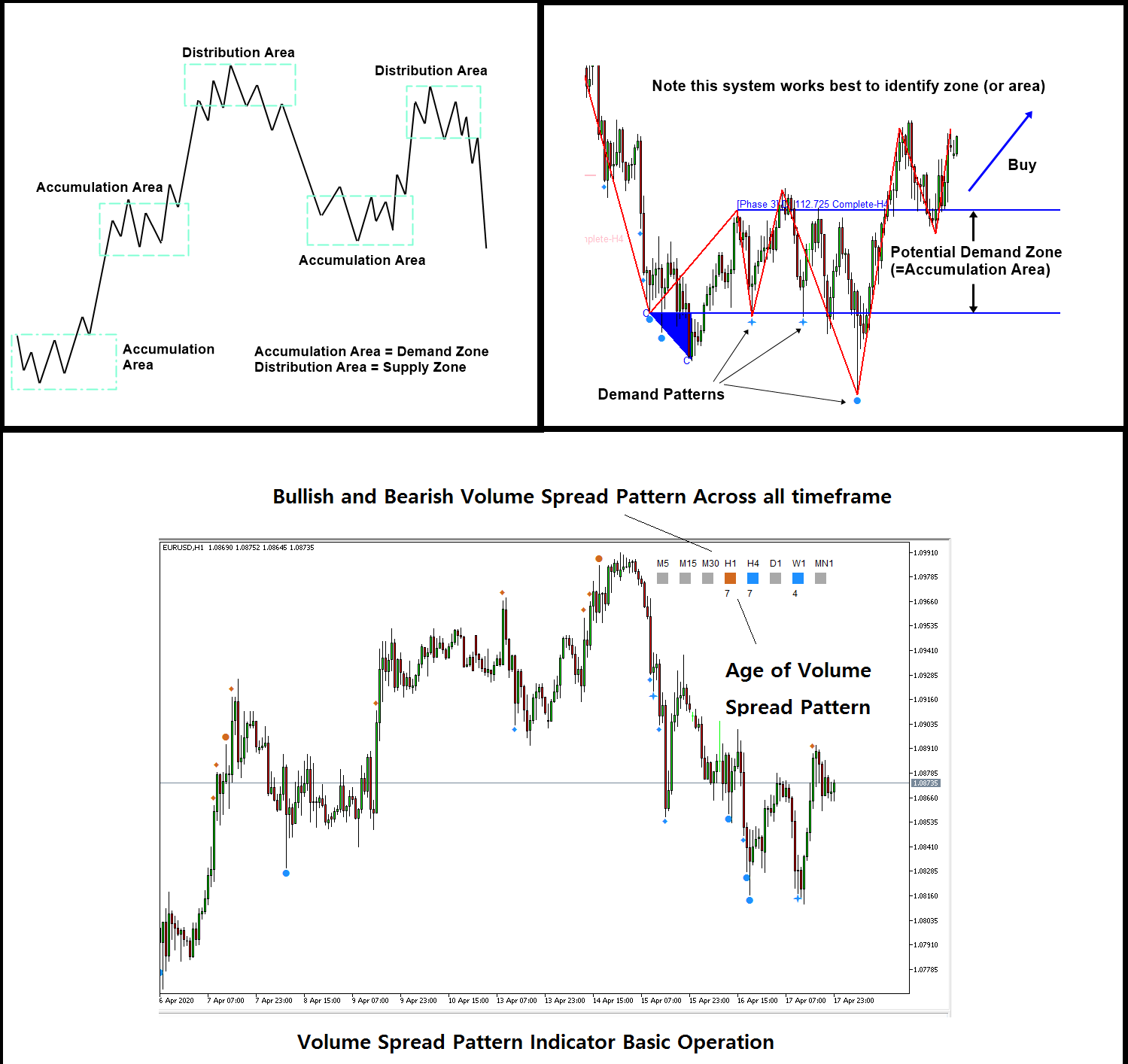

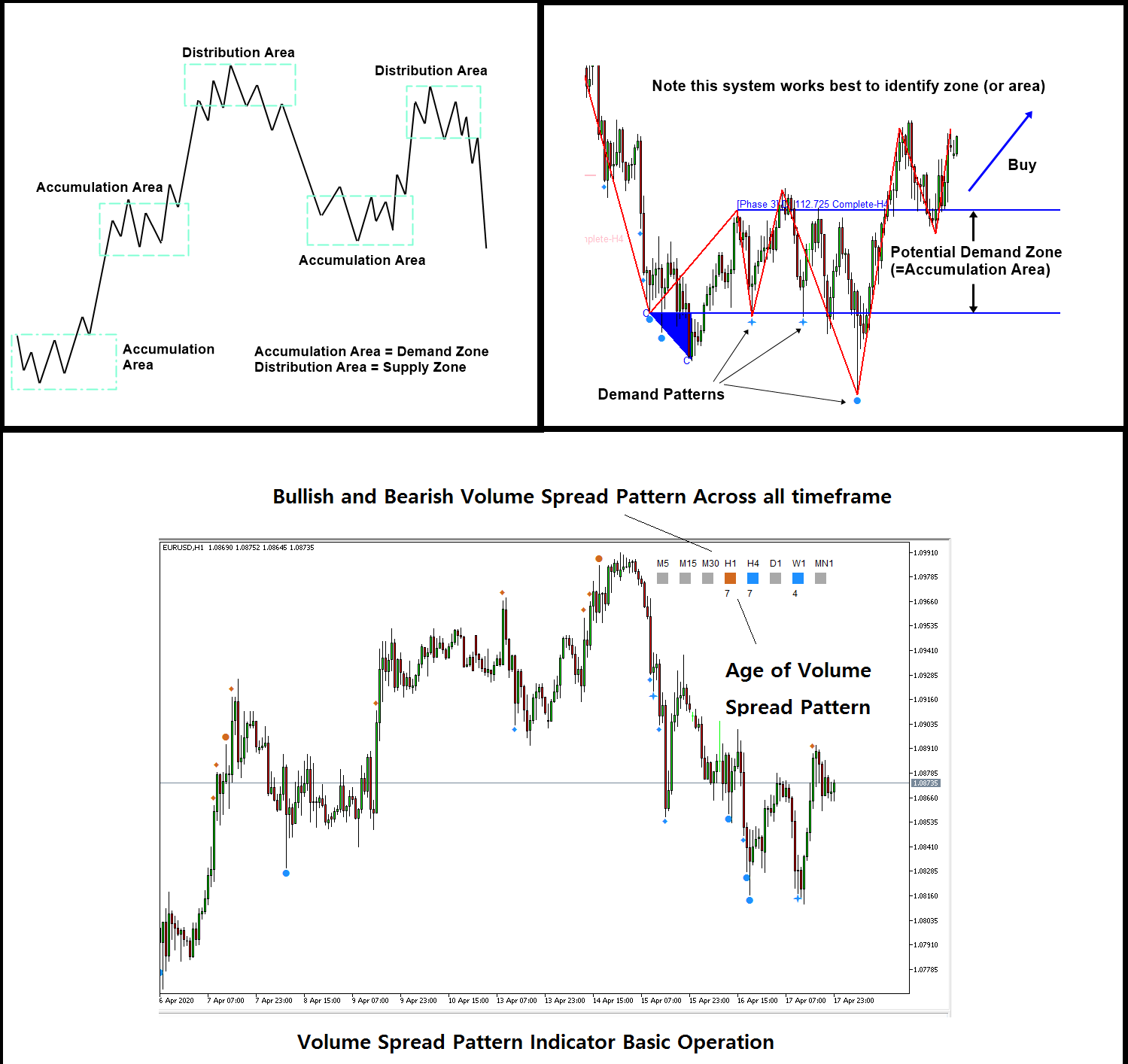

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

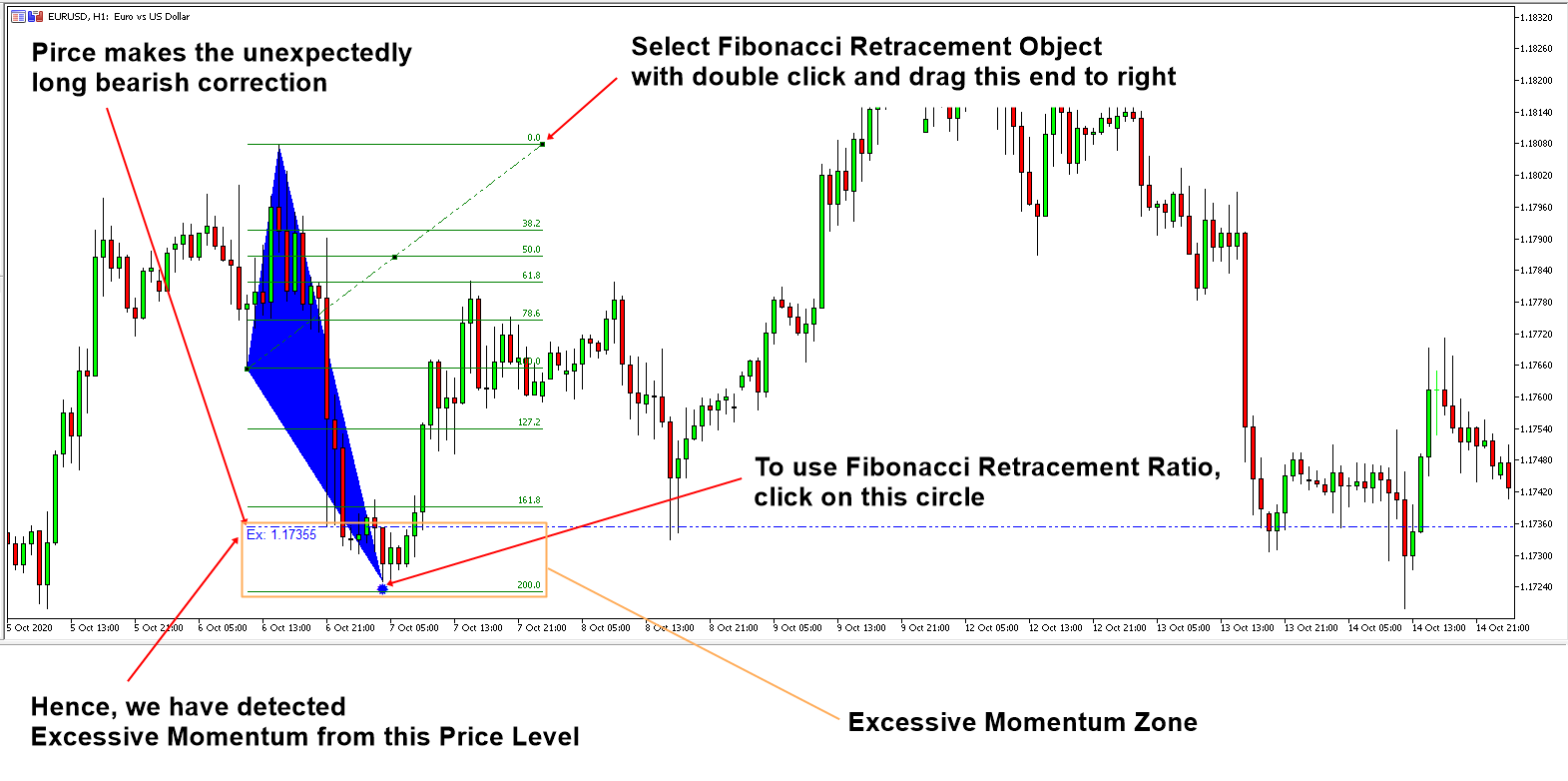

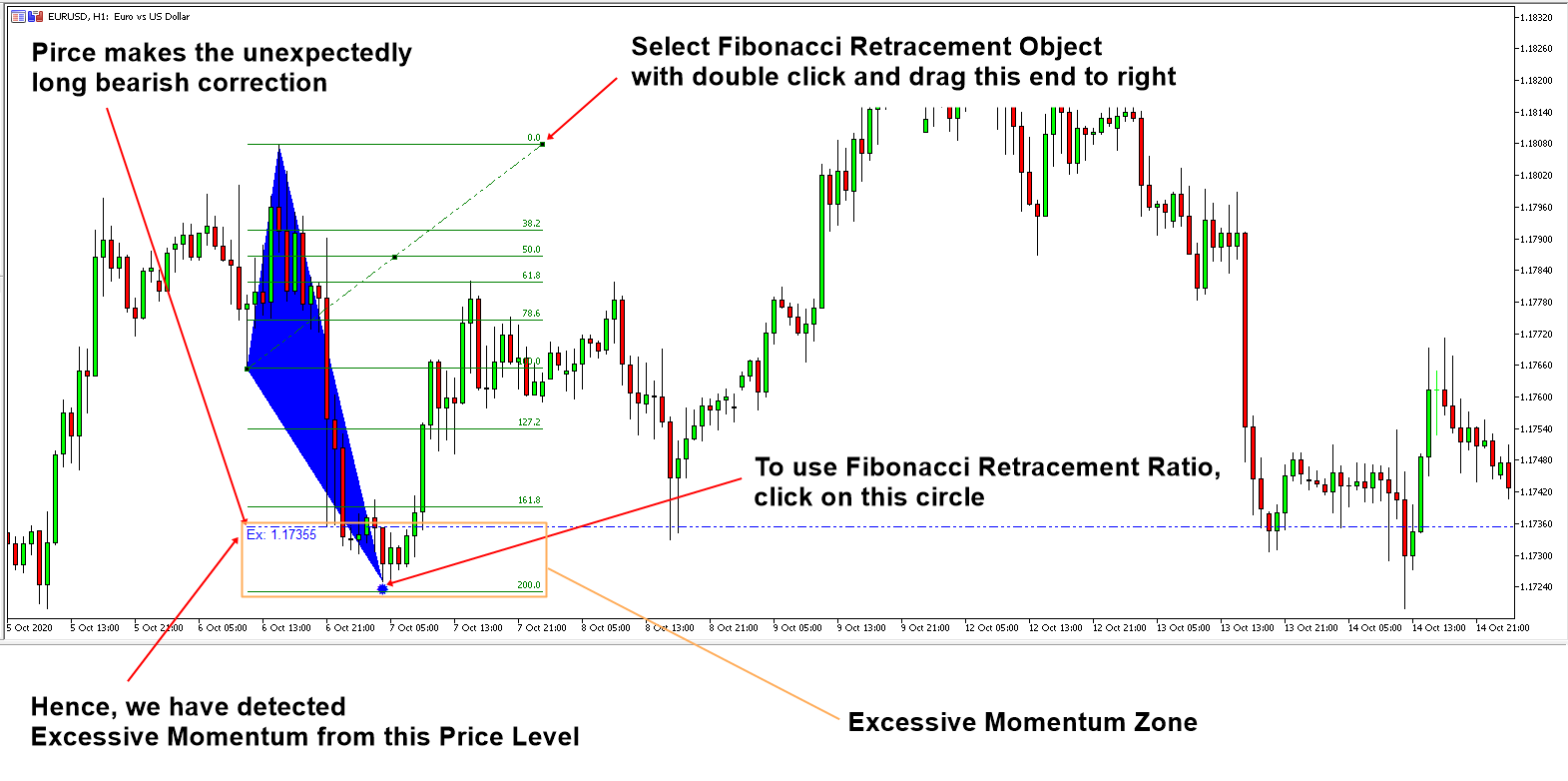

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

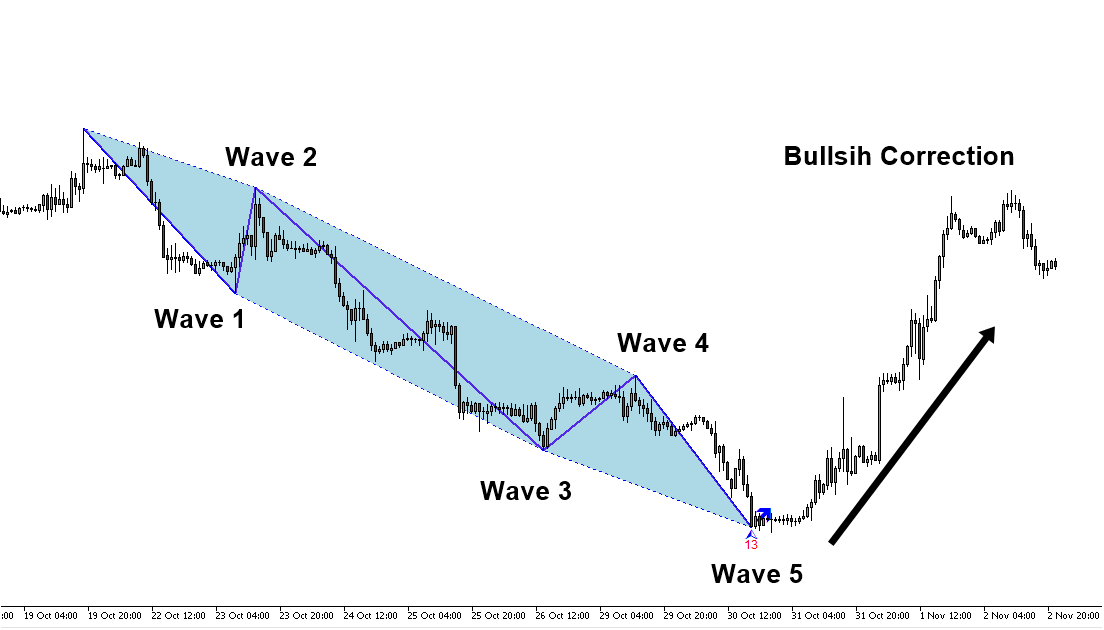

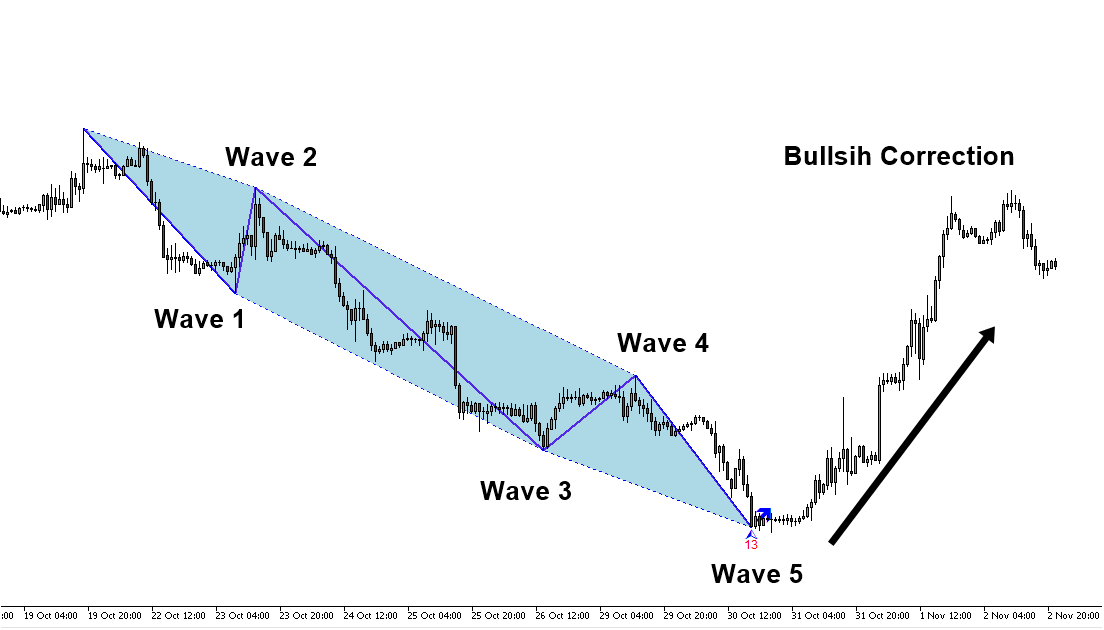

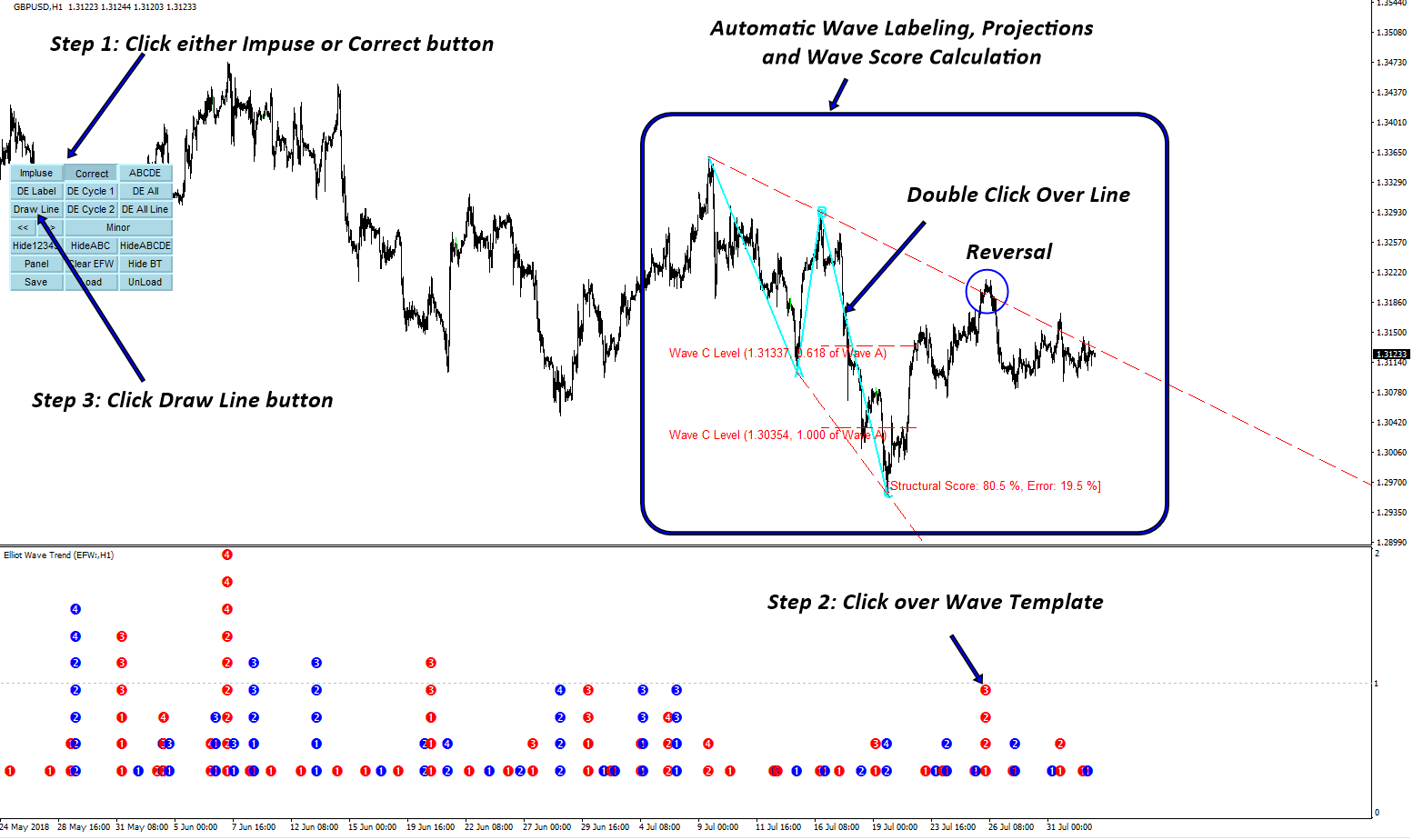

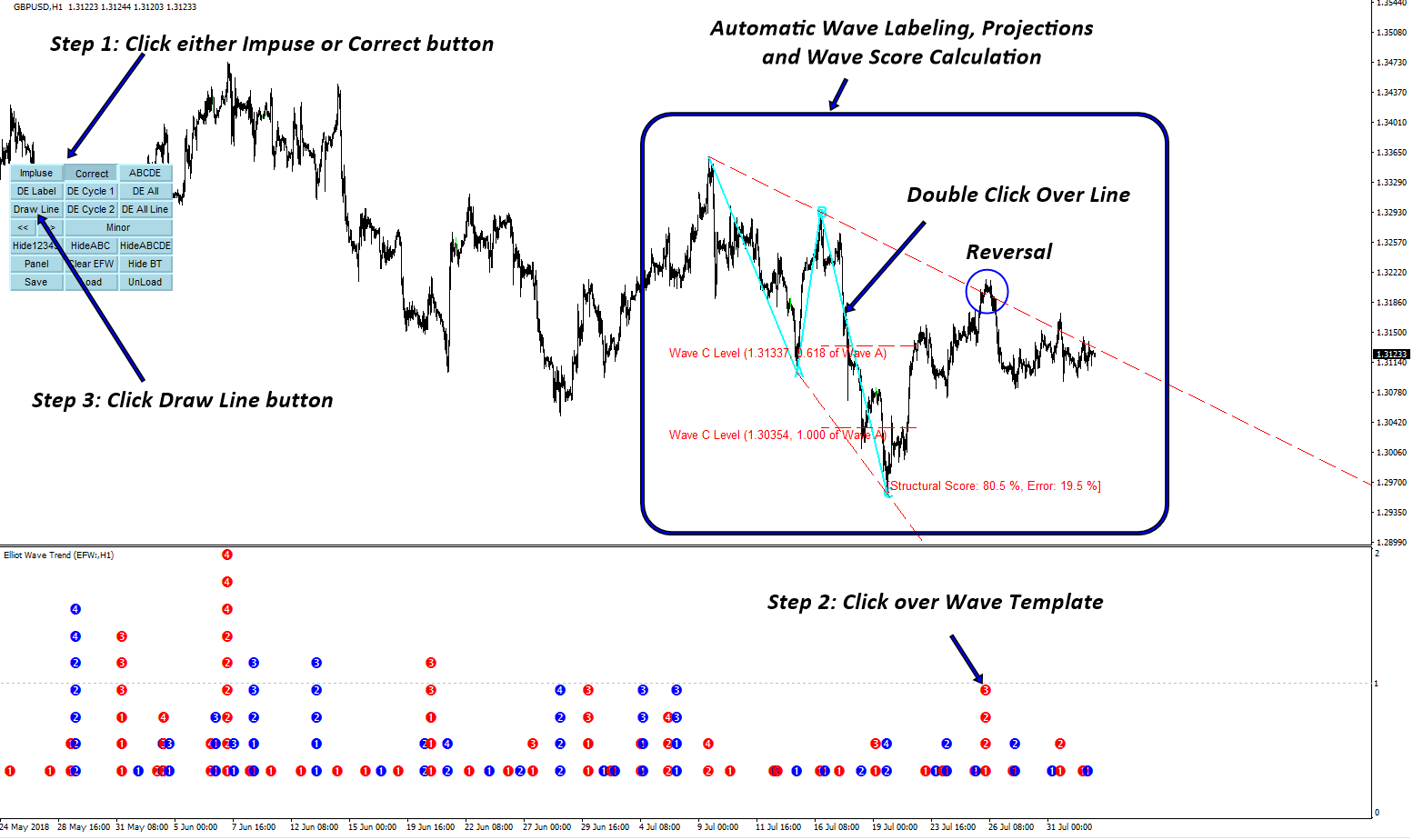

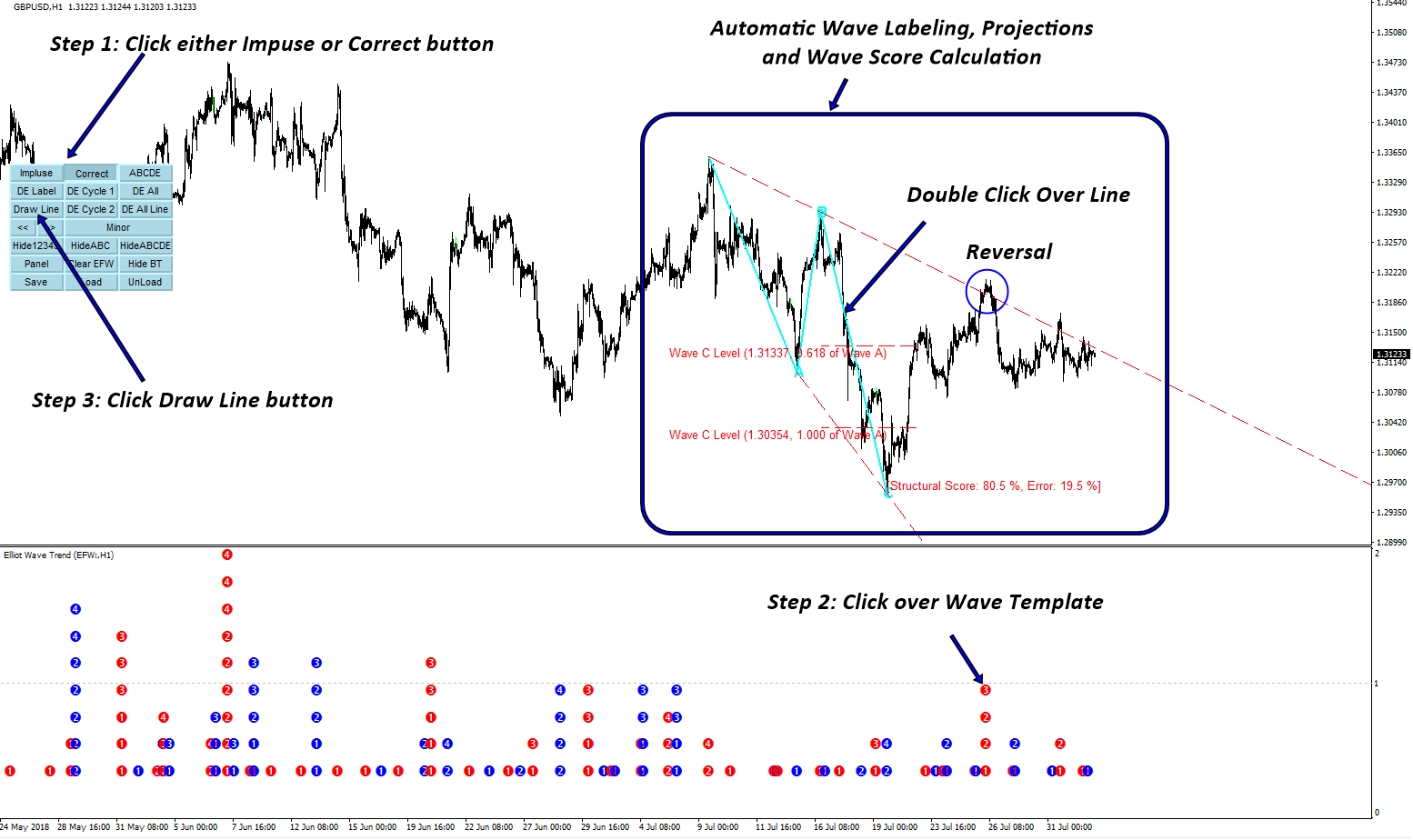

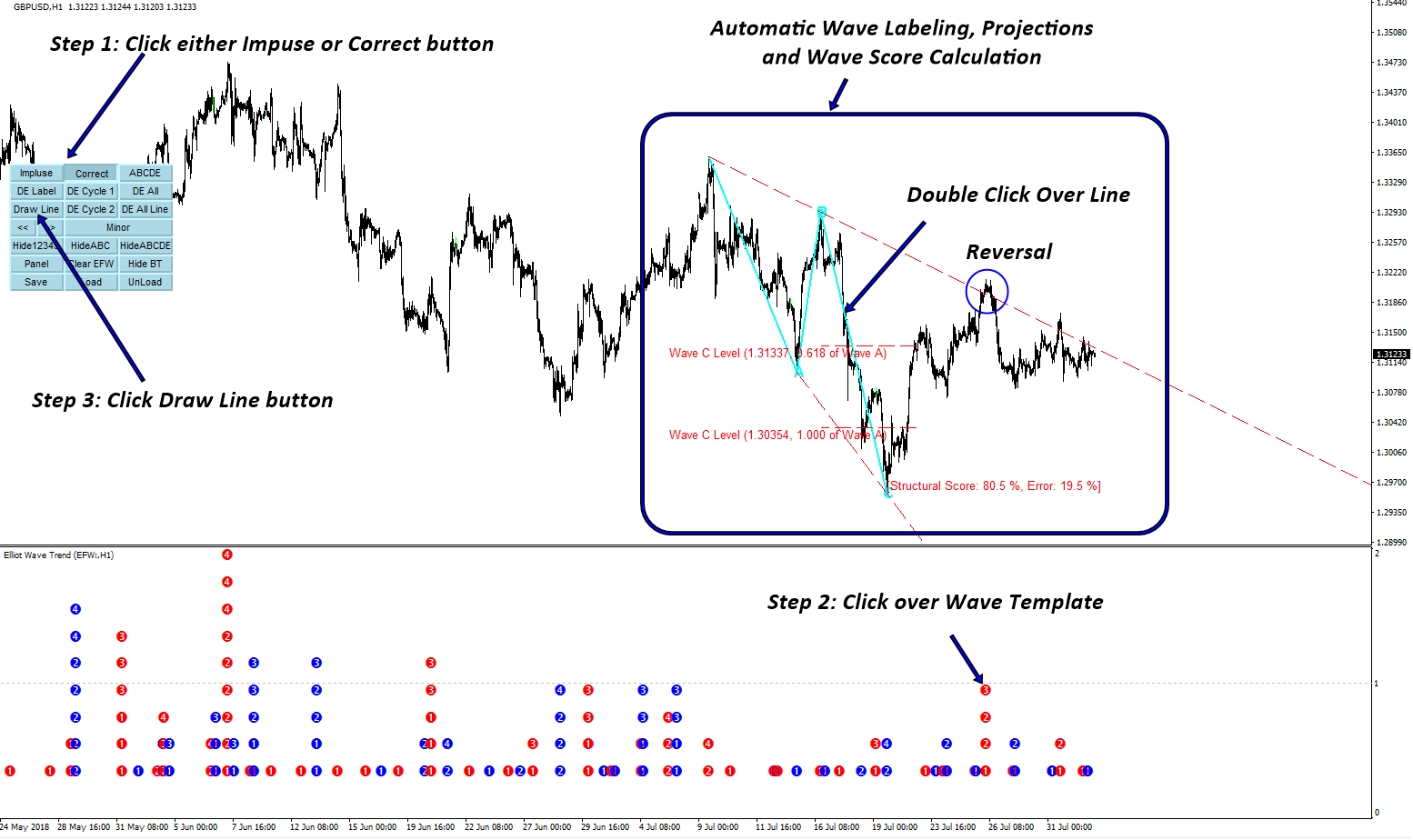

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

Market Timing of Turning Point and Trend

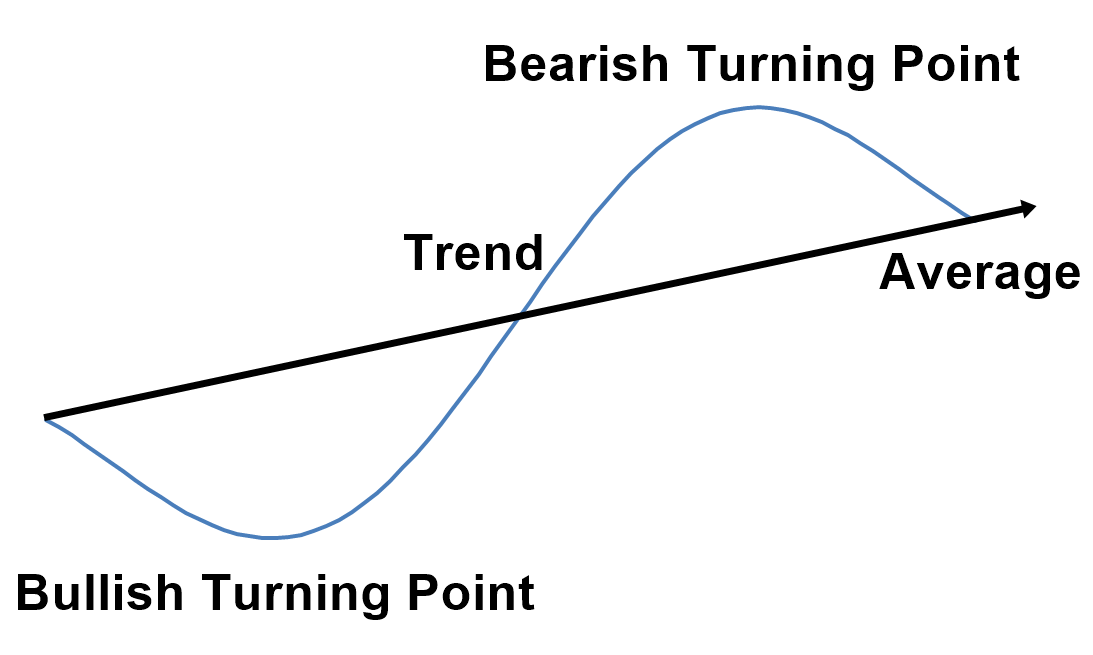

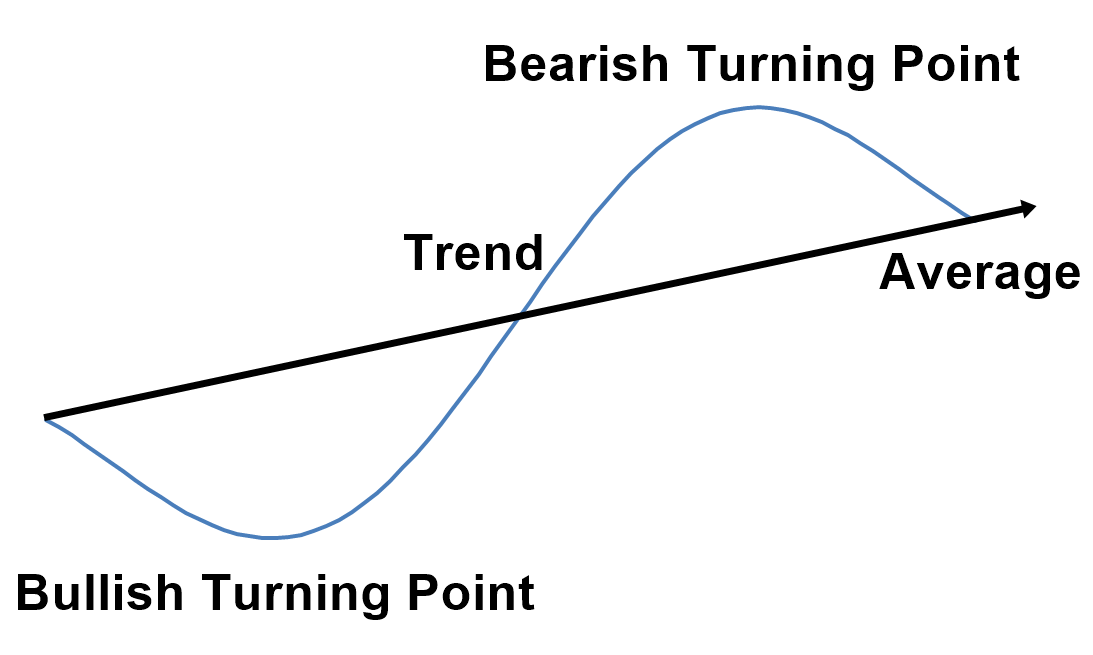

When you trade in the financial market, the first thing you need to understand is the turning point and trend. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as one subject.

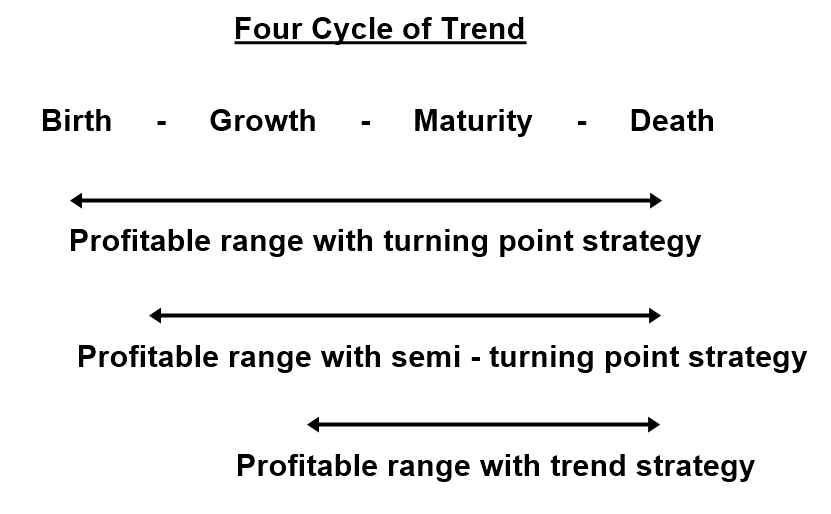

Figure 1-2: Conceptual drawing of trend and turning Point

Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

Birth – Growth – Maturity – Death

Trend also goes through these four stages. Let us take an example in the financial market. For example, if we hear that Apple Inc. has some temporary problem in their smartphone supply line, this could stir up the stock price of Samsung Electronics because the demand for Samsung’s smart phone will be increased. Once this news is spread on the financial market, the upward trend will be born for Samsung’s stock price. At the beginning, this news could be known by few people. Later, more and more people could hear this news. Hence, Samsung’s stock price can build up upward momentum. However, this momentum will not last forever. Once people start to recognize that price rallied too high and some people start taking the profit by selling the stocks, the upward momentum can slow down. Especially, if we hear that Apple recovered the temporary problem in their smartphone supply line, the trend could die completely. As shown in this example, Birth, Growth, Maturity, and Death are the life cycle of trend.

Figure 1-3: Process of birth of new trend in stock market (Chart: www.algotrading-investment.com)

Now let us revisit the definition of turning point and trend. Turning point is the beginning of new trend after the death of an old trend. Hence, turning point strategy refers to the strategy that tries to pick up this new trend as early as possible. This sometimes involves picking up the turning point at the birth stage of the trend. In financial trading, trend strategy typically refers to the strategy that tries to pick up the trend during the growth stage. Hence, most of trend strategy we know is in fact momentum strategy. When the growth of trend is strong, many technical indicators are designed to react on this strong growth.

Therefore, most of trend strategy provides you entry at the growth stage not at the birth stage. For example, if you trade on the buy signal when 20 moving average line crosses over the 50 moving average line, you do need strong upwards movement to lift the 20 moving average line over the 50 moving average line.

Figure 1-4: Buy entry confirmed by moving average cross over strategy

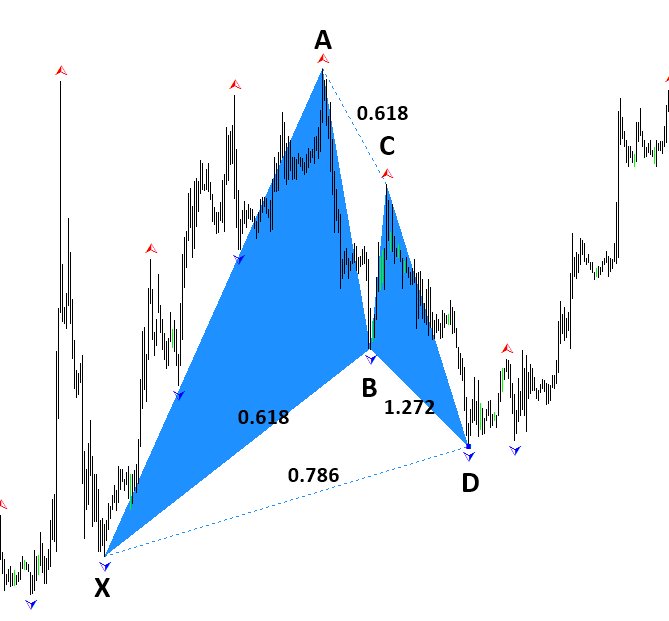

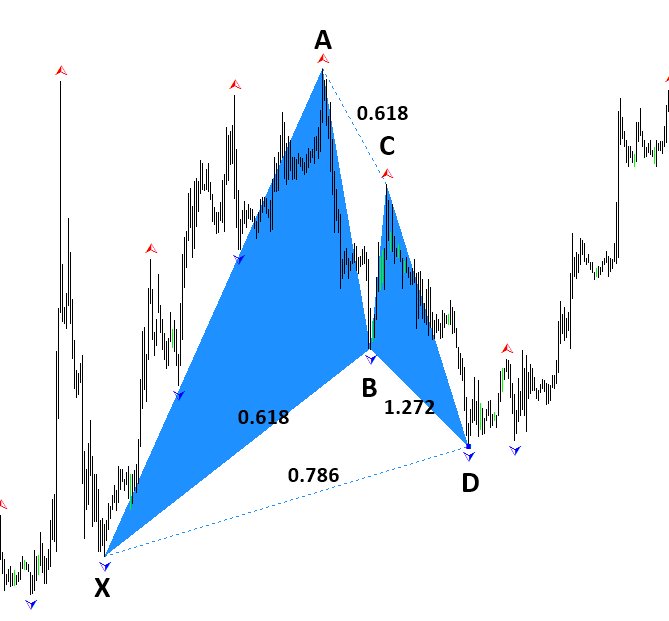

In contrast to this, in the turning point strategy using the Fibonacci ratio analysis, Harmonic patterns, Elliott wave patterns and X3 patterns, we are looking for the newly born trend instead of the trend in growth stage. Hence, the main difference in turning point and trend strategy is when to enter during the life cycle of trend. Typically, we are seeking to enter near the birth of trend in the turning point strategy. In the trend strategy, we are seeking to enter at the growth stage of trend. You can probably see the difference between these two strategies.

Figure 1-5: Buy entry confirmed by harmonic pattern (Chart: www.algotrading-investment.com, Optimum Chart)

In our example, we considered only one trend. In practice, situation is tougher because we will have many financial and political news released in 24/7 days. Hence, we have to deal with the collection of trends instead of one trend. Some trends will be cancelled off each other and some trends will be adding up to form bigger trend. As a result, sometimes, this collective trend can have a clear direction. However, sometimes, we may not see clear direction from this collective trend but just ranging movement. At the same time, we could have many short-lived trends confusing our entries. Therefore, our trading strategy is subjective to probability of success rate regardless of that you are using turning point strategy or trend strategy.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use X3 Chart Pattern Scanner in MetaTrader to accomplish your technical analysis. Here is the product page for the X3 Chart Pattern Scanner. Enjoy the powerful non repainting and non lagging Harmonic Pattern, X3 Pattern and Elliott Wave Pattern indicator.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

When you trade in the financial market, the first thing you need to understand is the turning point and trend. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as one subject.

Figure 1-2: Conceptual drawing of trend and turning Point

Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

Birth – Growth – Maturity – Death

Trend also goes through these four stages. Let us take an example in the financial market. For example, if we hear that Apple Inc. has some temporary problem in their smartphone supply line, this could stir up the stock price of Samsung Electronics because the demand for Samsung’s smart phone will be increased. Once this news is spread on the financial market, the upward trend will be born for Samsung’s stock price. At the beginning, this news could be known by few people. Later, more and more people could hear this news. Hence, Samsung’s stock price can build up upward momentum. However, this momentum will not last forever. Once people start to recognize that price rallied too high and some people start taking the profit by selling the stocks, the upward momentum can slow down. Especially, if we hear that Apple recovered the temporary problem in their smartphone supply line, the trend could die completely. As shown in this example, Birth, Growth, Maturity, and Death are the life cycle of trend.

Figure 1-3: Process of birth of new trend in stock market (Chart: www.algotrading-investment.com)

Now let us revisit the definition of turning point and trend. Turning point is the beginning of new trend after the death of an old trend. Hence, turning point strategy refers to the strategy that tries to pick up this new trend as early as possible. This sometimes involves picking up the turning point at the birth stage of the trend. In financial trading, trend strategy typically refers to the strategy that tries to pick up the trend during the growth stage. Hence, most of trend strategy we know is in fact momentum strategy. When the growth of trend is strong, many technical indicators are designed to react on this strong growth.

Therefore, most of trend strategy provides you entry at the growth stage not at the birth stage. For example, if you trade on the buy signal when 20 moving average line crosses over the 50 moving average line, you do need strong upwards movement to lift the 20 moving average line over the 50 moving average line.

Figure 1-4: Buy entry confirmed by moving average cross over strategy

In contrast to this, in the turning point strategy using the Fibonacci ratio analysis, Harmonic patterns, Elliott wave patterns and X3 patterns, we are looking for the newly born trend instead of the trend in growth stage. Hence, the main difference in turning point and trend strategy is when to enter during the life cycle of trend. Typically, we are seeking to enter near the birth of trend in the turning point strategy. In the trend strategy, we are seeking to enter at the growth stage of trend. You can probably see the difference between these two strategies.

Figure 1-5: Buy entry confirmed by harmonic pattern (Chart: www.algotrading-investment.com, Optimum Chart)

In our example, we considered only one trend. In practice, situation is tougher because we will have many financial and political news released in 24/7 days. Hence, we have to deal with the collection of trends instead of one trend. Some trends will be cancelled off each other and some trends will be adding up to form bigger trend. As a result, sometimes, this collective trend can have a clear direction. However, sometimes, we may not see clear direction from this collective trend but just ranging movement. At the same time, we could have many short-lived trends confusing our entries. Therefore, our trading strategy is subjective to probability of success rate regardless of that you are using turning point strategy or trend strategy.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use X3 Chart Pattern Scanner in MetaTrader to accomplish your technical analysis. Here is the product page for the X3 Chart Pattern Scanner. Enjoy the powerful non repainting and non lagging Harmonic Pattern, X3 Pattern and Elliott Wave Pattern indicator.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Turning Point and Fundamental Data in the Forex Market

The foreign exchange market, also known as the Forex market, is a global marketplace where currencies are traded. Currencies are important because we need them to purchase goods and services locally and across borders. There is no central marketplace for the Forex market. The forex market is the largest financial market in the world. It is even bigger than the entire US stock market. There are various participants with different purpose trading currencies in the Forex market. The participants in the Forex market include banks, international companies, hedge funds, money managers, tourists, and individual investors. Just like the price of a stock, the price of a currency is fluctuating every day. The price of a stock is often affected by the intrinsic value of the company and the national economic conditions. However, the price of a currency is affected more with national economic conditions. Hence, the value of a currency can rise and fall when the following economic data are released.

Economic indicator (e.g. Gross Domestic Product)

Employment indicator (e.g. Unemployment rate)

Inflation indicator (e.g. consumer price index)

Interest rate

Decisions and announcements from the central banks

Changes in political and financial regulations

And so on

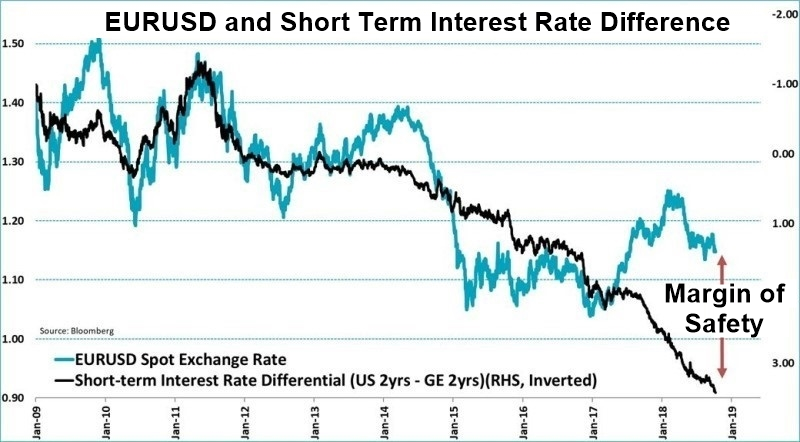

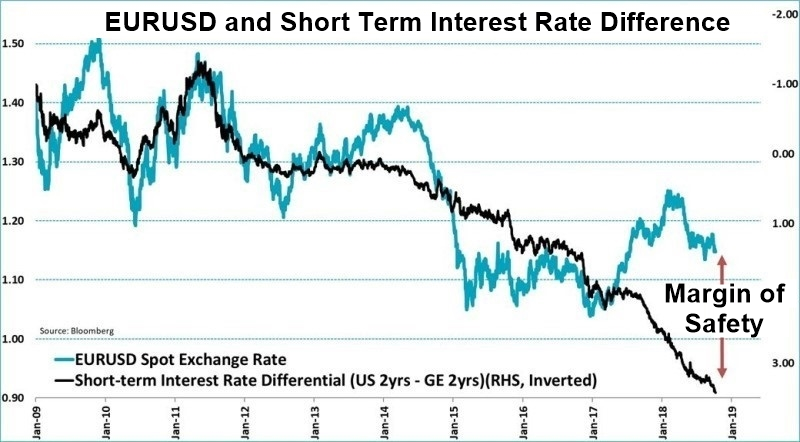

As in the stock market, these economic data play some important role to reduce any irrational movement in a currency price. Let us take a look at the interest rate example on EURUSD, the Euro to Dollar rate. The interest rate is considered as an important variable moving a currency price. To find out any adverse effect of the interest rate to EURUSD, we can graph the interest rate difference between USA and Germany against the EURUSD rate. We can observe the mean reversion effect whenever the gap between the interest rate difference and EURUSD rate is large. Simply speaking, the EURUSD rate tends to go back to the fair value whenever the market value is highly deviated from the fair value.

Figure 2-2: EURUSD vs Short Term Interest Rate Difference between USA and Germany (Chart: Bloomberg)

Interest rate is one of many economic data in the Forex market. Besides, many other economic data, like the consumer price index, unemployment rate, trade of balance and so on, can move a currency price in the similar manner. In our trading, we need to watch out the influential economic data. Then, we can identify the currency with the high margin of safety in regards to this influential economic data. As in the stock market, the release of these economic data can affect the forex market in short and long terms. Sometimes, the released economic data can create the turning point during the day. Sometimes, the released economic data can create the turning point in several weeks. The turning points occur to accomplish the mean reversion whenever the currency is overvalued or undervalue too much to the fair value. Sometimes, the government does not like the currency price to move too high or too low. They can take some actions like the quantitative easing, interest rate change, setting up new regulation and so on. As the result of the government actions, the mean reversion process can take place after the price makes the turning point.

As in the price mechanism illustrated with the value investing, the economic data in the Forex market drive the currency price in the similar manner. The economic data provides the ways to describe the intrinsic value of the currency in the Forex market. The bullish turning point and the bearish turning point will occur whenever the spread between the market value and intrinsic value is too high, in fact, it is the absolute spread. This also provides one of the explanation to why price moves in the complex zigzag path and why we get to see many price patterns in the market.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Advanced Price Pattern Scanner in MetaTrader to accomplish your technical analysis. Advanced Price Pattern Scanner is the automatic price pattern scanner. It is designed to scan the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder, Cup and Handle or Cup with Handle, Reverse of Cup and Handle or Cup with Handle. What is even better? This is non-repainting and non-lagging indicator. Here is link for more information

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

The foreign exchange market, also known as the Forex market, is a global marketplace where currencies are traded. Currencies are important because we need them to purchase goods and services locally and across borders. There is no central marketplace for the Forex market. The forex market is the largest financial market in the world. It is even bigger than the entire US stock market. There are various participants with different purpose trading currencies in the Forex market. The participants in the Forex market include banks, international companies, hedge funds, money managers, tourists, and individual investors. Just like the price of a stock, the price of a currency is fluctuating every day. The price of a stock is often affected by the intrinsic value of the company and the national economic conditions. However, the price of a currency is affected more with national economic conditions. Hence, the value of a currency can rise and fall when the following economic data are released.

Economic indicator (e.g. Gross Domestic Product)

Employment indicator (e.g. Unemployment rate)

Inflation indicator (e.g. consumer price index)

Interest rate

Decisions and announcements from the central banks

Changes in political and financial regulations

And so on

As in the stock market, these economic data play some important role to reduce any irrational movement in a currency price. Let us take a look at the interest rate example on EURUSD, the Euro to Dollar rate. The interest rate is considered as an important variable moving a currency price. To find out any adverse effect of the interest rate to EURUSD, we can graph the interest rate difference between USA and Germany against the EURUSD rate. We can observe the mean reversion effect whenever the gap between the interest rate difference and EURUSD rate is large. Simply speaking, the EURUSD rate tends to go back to the fair value whenever the market value is highly deviated from the fair value.

Figure 2-2: EURUSD vs Short Term Interest Rate Difference between USA and Germany (Chart: Bloomberg)

Interest rate is one of many economic data in the Forex market. Besides, many other economic data, like the consumer price index, unemployment rate, trade of balance and so on, can move a currency price in the similar manner. In our trading, we need to watch out the influential economic data. Then, we can identify the currency with the high margin of safety in regards to this influential economic data. As in the stock market, the release of these economic data can affect the forex market in short and long terms. Sometimes, the released economic data can create the turning point during the day. Sometimes, the released economic data can create the turning point in several weeks. The turning points occur to accomplish the mean reversion whenever the currency is overvalued or undervalue too much to the fair value. Sometimes, the government does not like the currency price to move too high or too low. They can take some actions like the quantitative easing, interest rate change, setting up new regulation and so on. As the result of the government actions, the mean reversion process can take place after the price makes the turning point.

As in the price mechanism illustrated with the value investing, the economic data in the Forex market drive the currency price in the similar manner. The economic data provides the ways to describe the intrinsic value of the currency in the Forex market. The bullish turning point and the bearish turning point will occur whenever the spread between the market value and intrinsic value is too high, in fact, it is the absolute spread. This also provides one of the explanation to why price moves in the complex zigzag path and why we get to see many price patterns in the market.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Advanced Price Pattern Scanner in MetaTrader to accomplish your technical analysis. Advanced Price Pattern Scanner is the automatic price pattern scanner. It is designed to scan the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder, Cup and Handle or Cup with Handle, Reverse of Cup and Handle or Cup with Handle. What is even better? This is non-repainting and non-lagging indicator. Here is link for more information

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Trading with Turning Point and Trend

In the trend strategy, your entry will be at the strong trend movement during the growth phase. This might be good if our entry is not too late. However, if we are late, then we will encounter the loss from early enterers starting to materialize their profits. In the turning point strategy, we are trying to pick up the new trend as early as possible in their birth stage. Therefore, it gives you the opportunity to become the early enterer. Hence, the profitable range is longer than typical trend strategy. In addition, you can also quit your position much earlier than other trend strategy players can.

The longer profitable range means that we need fewer trades to achieve good profits. At the same time, there are some weaknesses of the turning point strategy too. For example, turning point strategy might signal buy or sell entry too early while the ongoing trend was not finished. Since both trend and turning point strategy have their own strength and weakness, it is possible that you can compromise between turning point strategy and trend strategy too. For example, you do not immediately trade at the turning point signal but you can wait until you observe that some price movement is following the new trend direction. Therefore, this becomes semi-turning point strategy. Many of good traders use semi-turning point strategy since they are the hybrid of turning point strategy and trend strategy. The fact is that skills to predict the turning point is important for the successful trading. Even though you are trading with trend strategy, it is still advantageous to have good skills in predicting turning point. Hence, the methodology of predicting turning point was sought after by many legendary traders in the financial market nearly 100 years. It is one clear piece of winning logic for successful trading helping “You act faster than other trader.”

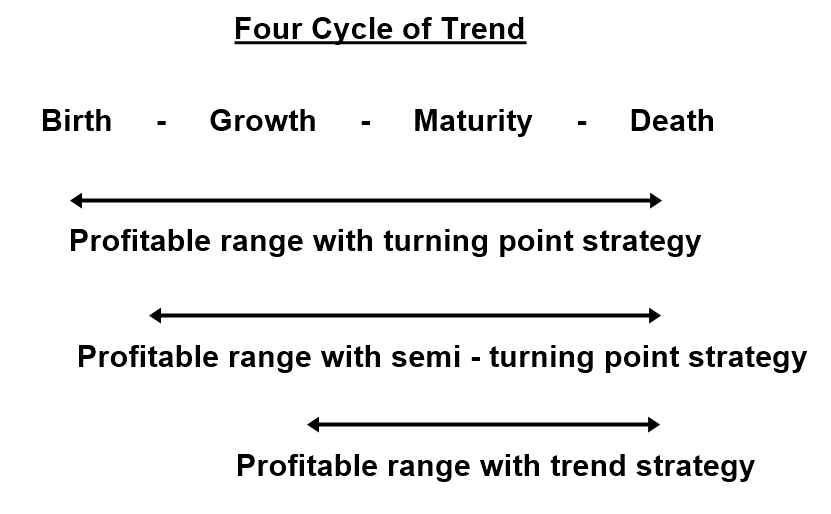

Figure 1-6: Profitable range for turning point strategy, semi –turning point strategy and trend strategy

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis. Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

In the trend strategy, your entry will be at the strong trend movement during the growth phase. This might be good if our entry is not too late. However, if we are late, then we will encounter the loss from early enterers starting to materialize their profits. In the turning point strategy, we are trying to pick up the new trend as early as possible in their birth stage. Therefore, it gives you the opportunity to become the early enterer. Hence, the profitable range is longer than typical trend strategy. In addition, you can also quit your position much earlier than other trend strategy players can.

The longer profitable range means that we need fewer trades to achieve good profits. At the same time, there are some weaknesses of the turning point strategy too. For example, turning point strategy might signal buy or sell entry too early while the ongoing trend was not finished. Since both trend and turning point strategy have their own strength and weakness, it is possible that you can compromise between turning point strategy and trend strategy too. For example, you do not immediately trade at the turning point signal but you can wait until you observe that some price movement is following the new trend direction. Therefore, this becomes semi-turning point strategy. Many of good traders use semi-turning point strategy since they are the hybrid of turning point strategy and trend strategy. The fact is that skills to predict the turning point is important for the successful trading. Even though you are trading with trend strategy, it is still advantageous to have good skills in predicting turning point. Hence, the methodology of predicting turning point was sought after by many legendary traders in the financial market nearly 100 years. It is one clear piece of winning logic for successful trading helping “You act faster than other trader.”

Figure 1-6: Profitable range for turning point strategy, semi –turning point strategy and trend strategy

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis. Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Mean Reversion and Momentum Trading in the Financial Market

Mean reversion and momentum trading are the two dominating trading strategies used in the Forex and Stock Market. Most of trading strategy we can think of will fall under a category of mean reversion or momentum trading. These two trading strategies show completely different market timing. For example, momentum trading tries to take the entry when the price shows a strong directional movement. Momentum trading is often considered as the trend following strategy. On the other hand, mean reversion trading tries to take the entry when the price is far from the mean. Mean Reversion trading is often the core trading principle behind “Buy Low and Sell High” strategy like value investing. In momentum trading, the trader tries to pick trend whereas in the mean reversion trading, trader tries to pick the turning point.

Figure 1-1: Conceptual drawing of mean reversion and momentum

Among the trading community, the preference between the mean reversion trading and momentum trading are completely different. Some trader uses the mean reversion trading better and some trader uses the momentum trading better. To find out which trading style you are good at with, you need to try both trading strategies. In fact, mean reversion and momentum trading can explain the water and fire elements of the human characteristics. Mean reversion trading explains the human characteristics of being “Cautious” or being “Realistic” like water. Momentum trading explains the human characteristics of “Impulsive behaviour” or “Heard Behaviour” like fire. However, the wise trader will not view these two trading strategy as two different subjects because one comes after the other. For example, mean reversion will come after momentum. Likewise, momentum will come after mean reversion. Therefore, the legendary trader like Jesse Livermore emphasized to observe the turning point, where the market shift its major direction. This does not mean that you have to trade against the large momentum in the financial market. This means that we need to buy the stock or currency as low price as possible near the turning point before another momentum is established. Once the momentum is established, it is not easy to ride on the momentum because the price move too fast. The heard or impulsive behaviour in the market can push the price in the shortest possible time. If you enter them too late, then you are likely to end up buying the stock or currency in high price. You will either make a thin profit or loss. For this reason, you need to find a way to enter the market between the turning point and the momentum. In doing so, you need to become familiar with the turning point as well as the trend. Therefore, you need to learn the methods of identifying the turning point and trend.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Scenario Planner in MetaTrader to accomplish your technical analysis.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Mean reversion and momentum trading are the two dominating trading strategies used in the Forex and Stock Market. Most of trading strategy we can think of will fall under a category of mean reversion or momentum trading. These two trading strategies show completely different market timing. For example, momentum trading tries to take the entry when the price shows a strong directional movement. Momentum trading is often considered as the trend following strategy. On the other hand, mean reversion trading tries to take the entry when the price is far from the mean. Mean Reversion trading is often the core trading principle behind “Buy Low and Sell High” strategy like value investing. In momentum trading, the trader tries to pick trend whereas in the mean reversion trading, trader tries to pick the turning point.

Figure 1-1: Conceptual drawing of mean reversion and momentum

Among the trading community, the preference between the mean reversion trading and momentum trading are completely different. Some trader uses the mean reversion trading better and some trader uses the momentum trading better. To find out which trading style you are good at with, you need to try both trading strategies. In fact, mean reversion and momentum trading can explain the water and fire elements of the human characteristics. Mean reversion trading explains the human characteristics of being “Cautious” or being “Realistic” like water. Momentum trading explains the human characteristics of “Impulsive behaviour” or “Heard Behaviour” like fire. However, the wise trader will not view these two trading strategy as two different subjects because one comes after the other. For example, mean reversion will come after momentum. Likewise, momentum will come after mean reversion. Therefore, the legendary trader like Jesse Livermore emphasized to observe the turning point, where the market shift its major direction. This does not mean that you have to trade against the large momentum in the financial market. This means that we need to buy the stock or currency as low price as possible near the turning point before another momentum is established. Once the momentum is established, it is not easy to ride on the momentum because the price move too fast. The heard or impulsive behaviour in the market can push the price in the shortest possible time. If you enter them too late, then you are likely to end up buying the stock or currency in high price. You will either make a thin profit or loss. For this reason, you need to find a way to enter the market between the turning point and the momentum. In doing so, you need to become familiar with the turning point as well as the trend. Therefore, you need to learn the methods of identifying the turning point and trend.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Scenario Planner in MetaTrader to accomplish your technical analysis.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Price Patterns to Identify the Potential Turning Point and Trend

To understand the technical turning point, it is important to check its connection with economics. For example, in Stock market trading, the underlying value of a company can explain the occurrence of the major turning point in the market. Likewise, in the foreign exchange market, the strength and weakness of a currency is often influenced by the fundamental value of a country. The fundamental and economic data release can cause to change the direction of the current price movement. As a result, they often become the major driving force behind the bullish and bearish turning point. Hence, to understand why an important turning point occurs in the financial market, we recommend you to look at following three cases.

Turning point in the Stock market with “Value investing”

Turning point in the Forex market with “Fundamental analysis”

Pairs Trading with turning point

When you understand the driving force of the turning point in connection with economics, it helps you to follow the flow of the smart money from the investment banks and hedge funds. Besides, the price pattern can also help you to predict the turning point technically. When you apply the price pattern together with the knowledge of the fundamental driving force of the turning point, you can increase your performance marginally. Therefore, it is important to understand the price patterns used by the trading community last 100 years. We list the important price patterns for your technical analysis below.

Horizontal support and resistance

Diagonal support and resistance (i.e. trend lines)

Triangles and wedge patterns

Fibonacci analysis

Harmonic pattern

Elliott wave theory

X3 Chart Pattern

To apply these price patterns better in practice, we must understand the origin of these price patterns with the scientific view. Fractal and fractal wave can explain the scientific rational behind these price patterns. Hence, we will look at how these price patterns are connected with “Fractal” and “Fractal Wave”. The scientific knowledge around these price patterns will help you to understand the flow of the financial market as said by Mark Twain “History Doesn’t Repeat, But It Often Rhymes”. In addition, you will find out that “Fractal” and “Fractal Wave” is the powerful tool to overcome the limitation of the modern trend and cycle analysis. The price patterns are in fact the practical application of “Fractal” and “Fractal Wave” in the financial market. Furthermore, we will provide the universal pattern framework to help you understand these price patterns with one unified knowledge. Therefore, we will make use of the X3 Pattern Framework while educating these price patterns.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

To understand the technical turning point, it is important to check its connection with economics. For example, in Stock market trading, the underlying value of a company can explain the occurrence of the major turning point in the market. Likewise, in the foreign exchange market, the strength and weakness of a currency is often influenced by the fundamental value of a country. The fundamental and economic data release can cause to change the direction of the current price movement. As a result, they often become the major driving force behind the bullish and bearish turning point. Hence, to understand why an important turning point occurs in the financial market, we recommend you to look at following three cases.

Turning point in the Stock market with “Value investing”

Turning point in the Forex market with “Fundamental analysis”

Pairs Trading with turning point

When you understand the driving force of the turning point in connection with economics, it helps you to follow the flow of the smart money from the investment banks and hedge funds. Besides, the price pattern can also help you to predict the turning point technically. When you apply the price pattern together with the knowledge of the fundamental driving force of the turning point, you can increase your performance marginally. Therefore, it is important to understand the price patterns used by the trading community last 100 years. We list the important price patterns for your technical analysis below.

Horizontal support and resistance

Diagonal support and resistance (i.e. trend lines)

Triangles and wedge patterns

Fibonacci analysis

Harmonic pattern

Elliott wave theory

X3 Chart Pattern

To apply these price patterns better in practice, we must understand the origin of these price patterns with the scientific view. Fractal and fractal wave can explain the scientific rational behind these price patterns. Hence, we will look at how these price patterns are connected with “Fractal” and “Fractal Wave”. The scientific knowledge around these price patterns will help you to understand the flow of the financial market as said by Mark Twain “History Doesn’t Repeat, But It Often Rhymes”. In addition, you will find out that “Fractal” and “Fractal Wave” is the powerful tool to overcome the limitation of the modern trend and cycle analysis. The price patterns are in fact the practical application of “Fractal” and “Fractal Wave” in the financial market. Furthermore, we will provide the universal pattern framework to help you understand these price patterns with one unified knowledge. Therefore, we will make use of the X3 Pattern Framework while educating these price patterns.

About this Article

This article is the part taken from the draft version of the Book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart, which is the standalone tool to scan the trading opportunities for all symbols and all timeframe in one button click.

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

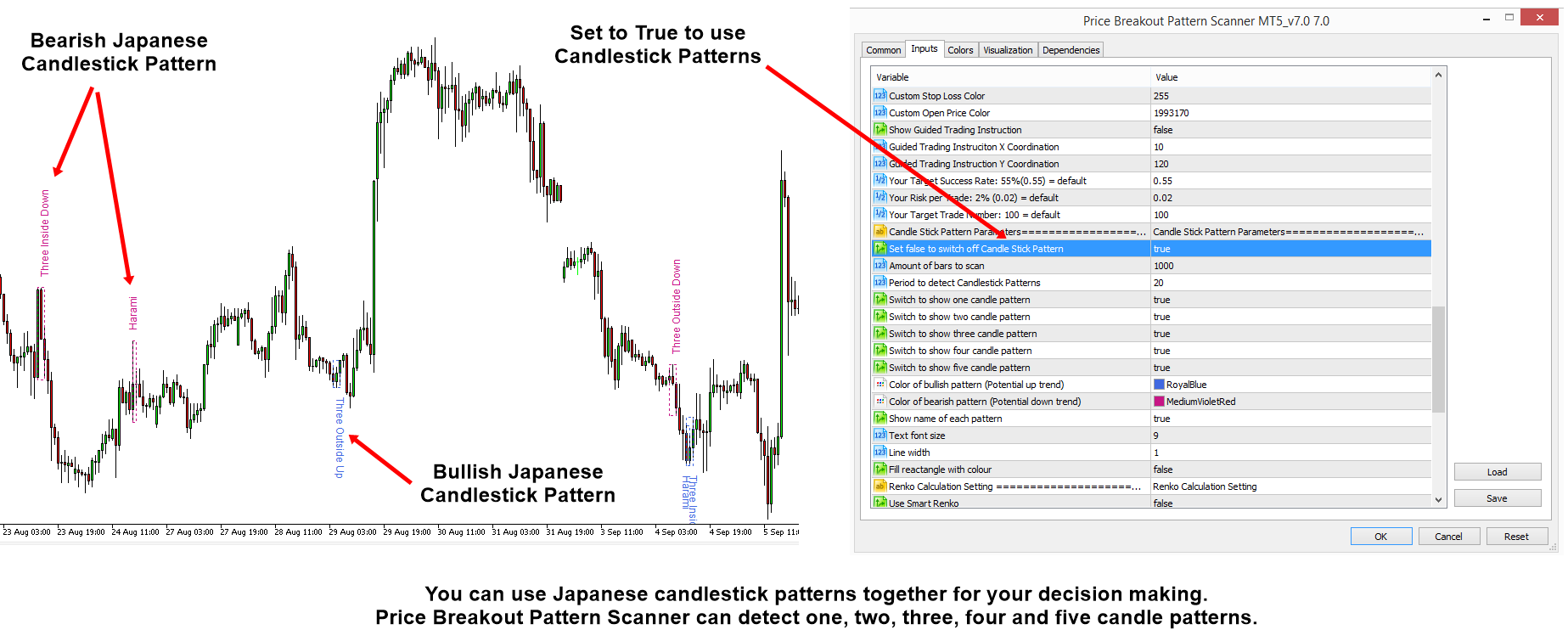

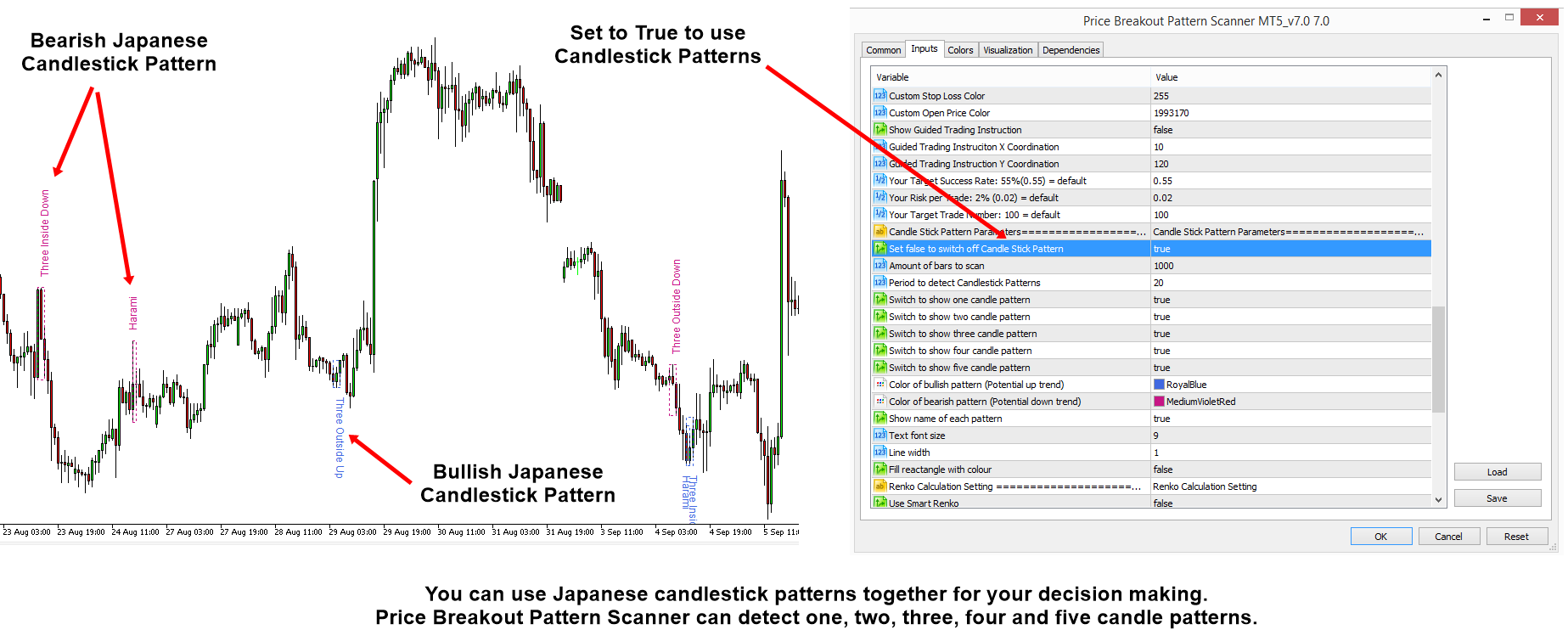

Using Japanese candlestick patterns with Price Breakout Pattern Scanner

Price Breakout Pattern Scanner combines several trading systems in one product. Properly used, they can yield excellent trading results. One of the trading system built inside Price Breakout Pattern Scanner is Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have enable the candlestick pattern from Price Breakout Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Price Breakout Pattern Scanner combines several trading systems in one product. Properly used, they can yield excellent trading results. One of the trading system built inside Price Breakout Pattern Scanner is Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have enable the candlestick pattern from Price Breakout Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

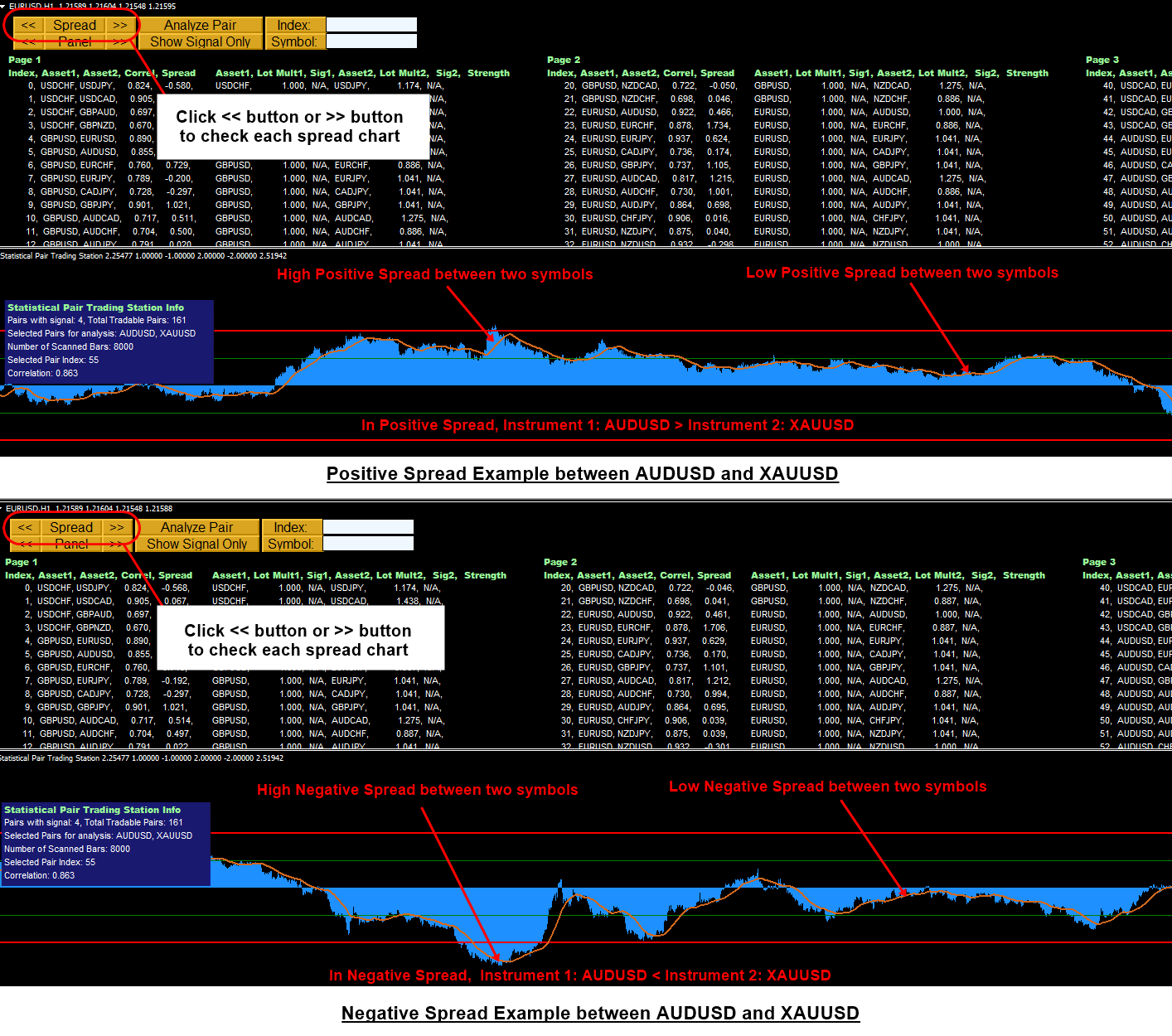

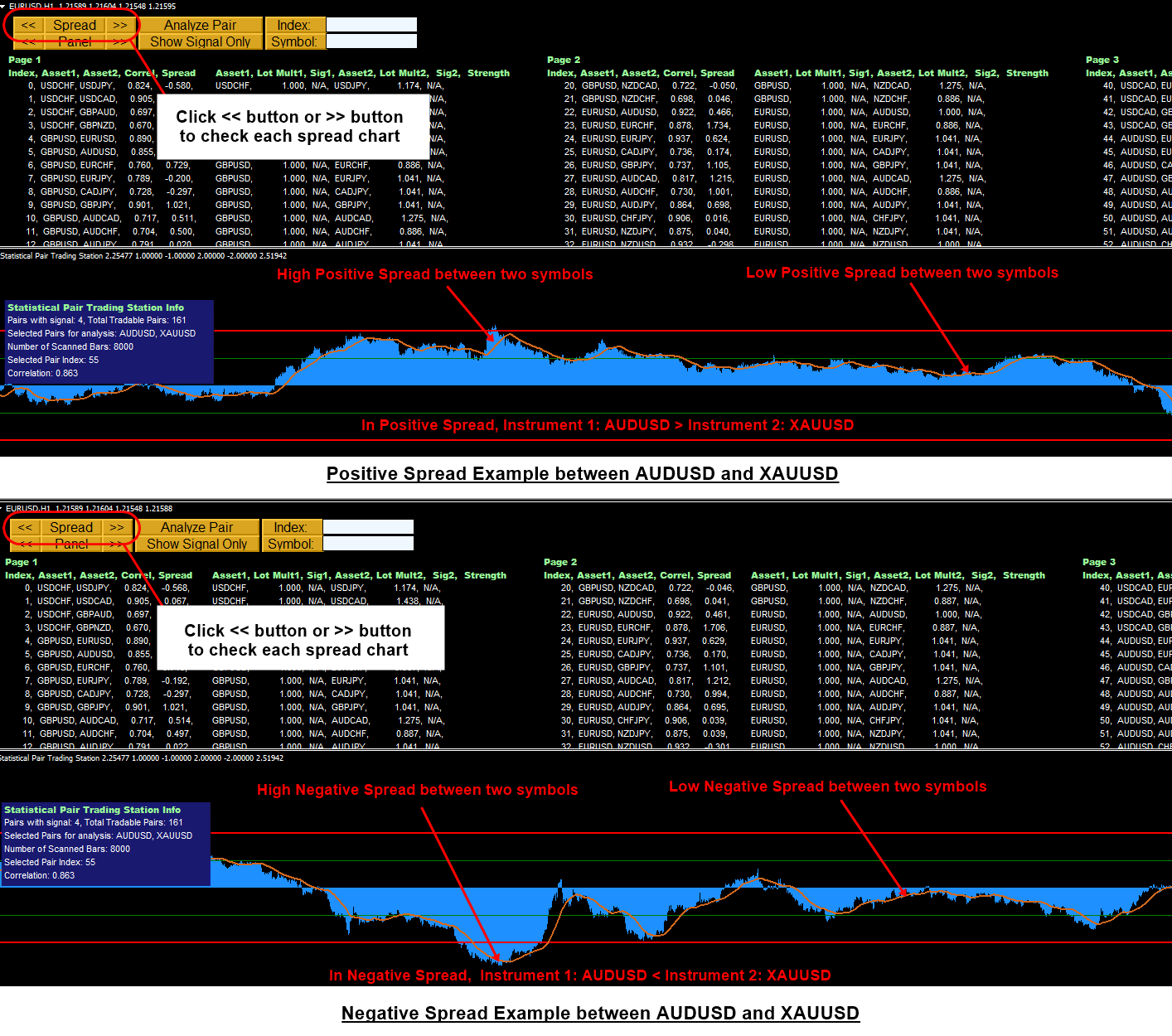

Manual For Pair Trading Station

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Young Ho Seo

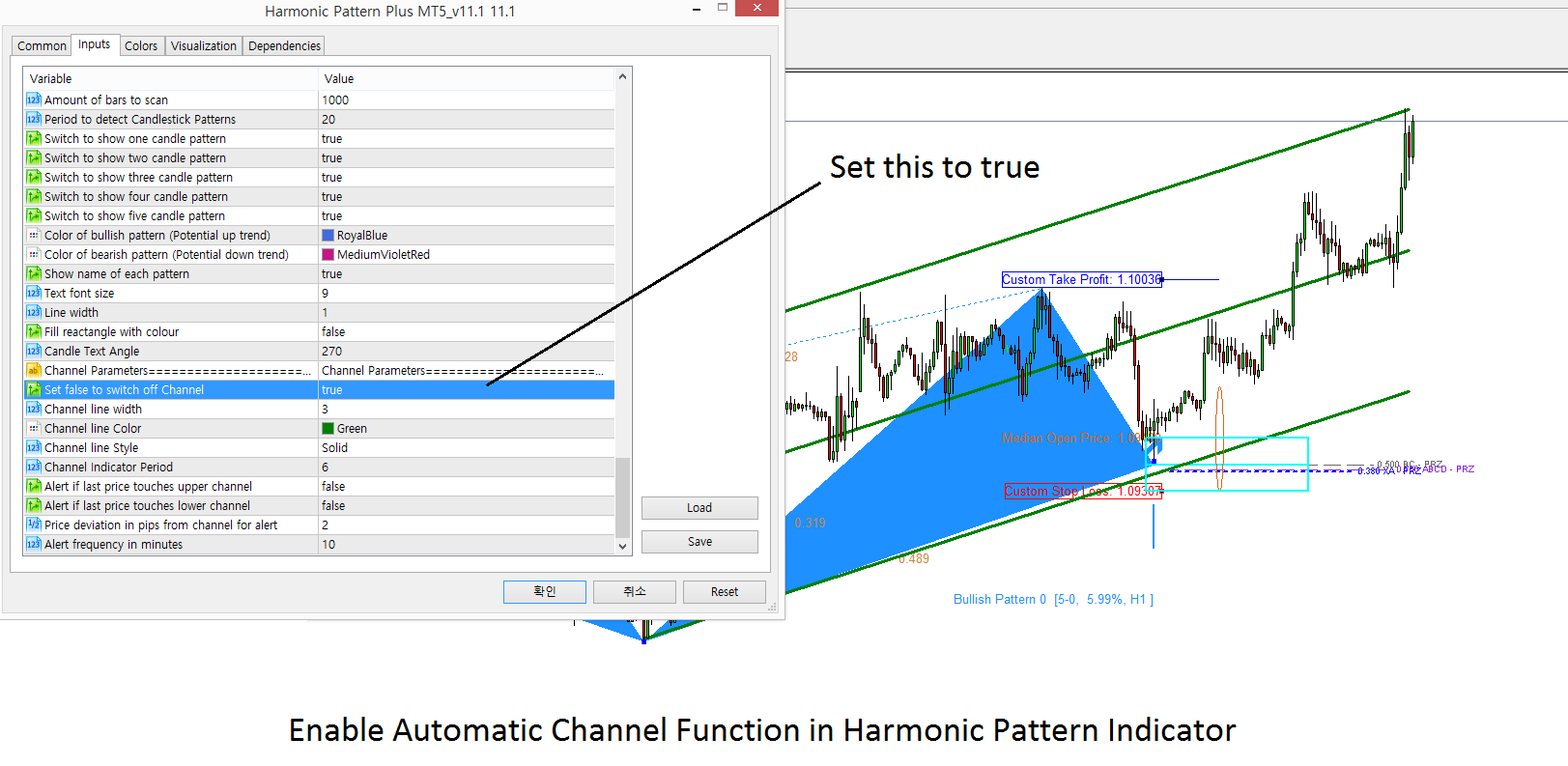

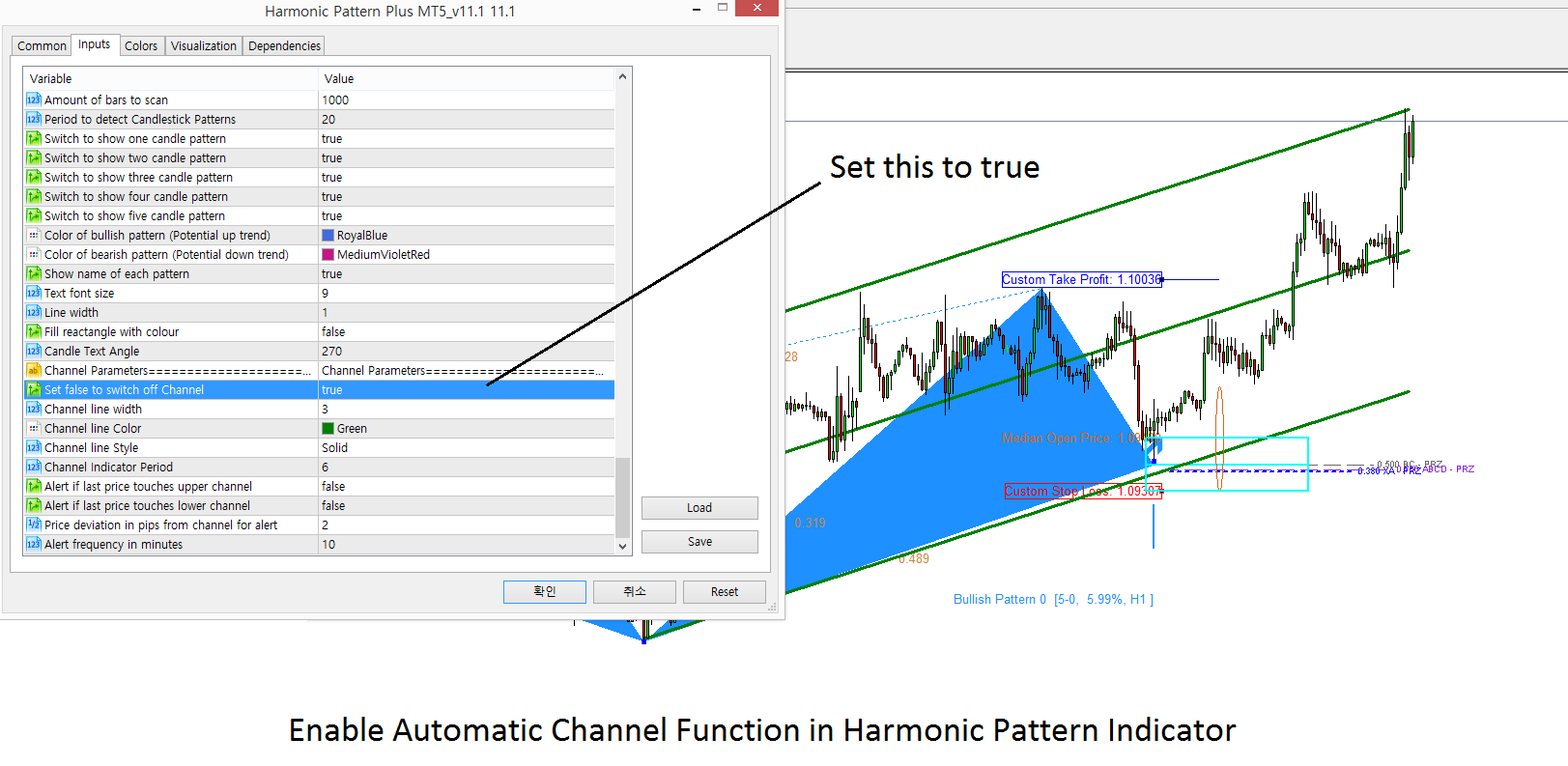

Enable Automatic Channel in Harmonic Pattern Indicator

We provided powerful automatic channel features in the Harmonic Pattern Indicator. To enable the automatic Channel Function, just set Use Channel = true under Channel Parameter inputs.

Together with Harmonic Pattern and Elliott Wave patterns, the provided automatic channel can be the great help for your trading. Enjoy this powerful features. This feature applies to Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner.

Important Note to read

For your information, the provided channel are dynamic. As new bars are arrived in your chart, it will update the size of Standard deviation and 95% intervals in real time. Please bear this in your mind when you are using the provided channel. Another important note is that we provide Double Standard Deviation Channel for X3 Chart Pattern Scanner. This is the channel indicator specially tuned to work for Harmonic Pattern and X3 Pattern. It is more advanced Channel than the one shown in the screenshot below. In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

===============

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

We provided powerful automatic channel features in the Harmonic Pattern Indicator. To enable the automatic Channel Function, just set Use Channel = true under Channel Parameter inputs.

Together with Harmonic Pattern and Elliott Wave patterns, the provided automatic channel can be the great help for your trading. Enjoy this powerful features. This feature applies to Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner.

Important Note to read

For your information, the provided channel are dynamic. As new bars are arrived in your chart, it will update the size of Standard deviation and 95% intervals in real time. Please bear this in your mind when you are using the provided channel. Another important note is that we provide Double Standard Deviation Channel for X3 Chart Pattern Scanner. This is the channel indicator specially tuned to work for Harmonic Pattern and X3 Pattern. It is more advanced Channel than the one shown in the screenshot below. In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

===============

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Volume Spread Analysis Indicator List

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

Young Ho Seo

Using Harmonic Pattern Plus and X3 Chart Pattern Scanner Together

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Elliott Wave Indicator for MetaTrader 4

For Elliott Wave Trader, it is necessary to have a good Elliott Wave tools for your trading. It is because Elliott Wave theory is not easy to be completed manually. However, once you understand its trading principle, Elliott Wave can advance your trading performance pretty fast. They do provide the great approach to solve the geometric puzzle in the forex and stock market. We provide two Elliott Wave tools in MetaTrader 4 platform.

MetaTrader 4 is one of the most popular trading platform since 2010. It is accessible for free of charge for any trader from all over the world. We provide two powerful Elliott Wave Indicators for this platform. Hence, you have two choice in selecting Elliott Wave Indicators for your trading. These tools are already used by thousands professional trader in day to day operation.

1. Elliott Wave Trend for MetaTrader 4

Elliott Wave Trend is extremely powerful Elliott wave indicator. This indicator allows you to perform Elliott wave counting as well as Elliott wave pattern detection. All these are the essential steps in predicting market with Elliott Wave theory. On top of them, it provides built in support and resistance system and turning point strength indicator to improve your trading performance. Yet, there are many additional features for you to explorer inside this technical indicator.

https://www.mql5.com/en/market/product/16479

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

At the same time, you can watch YouTube video titled as “Elliott Wave Trend Intro to find out more about Elliott Wave Trend Indicator.

YouTube Link: https://youtu.be/Oftml-JKyKM

2. X3 Chart Pattern Scanner for MetaTrader 4

X3 Chart Pattern Scanner is specialized tools in detecting the chart patterns including Harmonic Pattern and Elliott Wave Patterns, and more more patterns. Pattern detection process is fully automatic + you can even create customized Elliott wave and Harmonic patterns if you wish. Yet, this is only short summary though, you can find out more information and its features from product page. It is very unique and powerful tool in the world of trading.

https://www.mql5.com/en/market/product/41993

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

In summary, both tools are the high performance trading system. However, if you want to use Elliott wave trading exclusively, then you should go for Elliott Wave trend. If you do not mind both Elliott Wave and Harmonic Pattern Trading, then you should use X3 Chart Pattern Scanner.

For Elliott Wave Trader, it is necessary to have a good Elliott Wave tools for your trading. It is because Elliott Wave theory is not easy to be completed manually. However, once you understand its trading principle, Elliott Wave can advance your trading performance pretty fast. They do provide the great approach to solve the geometric puzzle in the forex and stock market. We provide two Elliott Wave tools in MetaTrader 4 platform.

MetaTrader 4 is one of the most popular trading platform since 2010. It is accessible for free of charge for any trader from all over the world. We provide two powerful Elliott Wave Indicators for this platform. Hence, you have two choice in selecting Elliott Wave Indicators for your trading. These tools are already used by thousands professional trader in day to day operation.

1. Elliott Wave Trend for MetaTrader 4

Elliott Wave Trend is extremely powerful Elliott wave indicator. This indicator allows you to perform Elliott wave counting as well as Elliott wave pattern detection. All these are the essential steps in predicting market with Elliott Wave theory. On top of them, it provides built in support and resistance system and turning point strength indicator to improve your trading performance. Yet, there are many additional features for you to explorer inside this technical indicator.

https://www.mql5.com/en/market/product/16479

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

At the same time, you can watch YouTube video titled as “Elliott Wave Trend Intro to find out more about Elliott Wave Trend Indicator.

YouTube Link: https://youtu.be/Oftml-JKyKM

2. X3 Chart Pattern Scanner for MetaTrader 4

X3 Chart Pattern Scanner is specialized tools in detecting the chart patterns including Harmonic Pattern and Elliott Wave Patterns, and more more patterns. Pattern detection process is fully automatic + you can even create customized Elliott wave and Harmonic patterns if you wish. Yet, this is only short summary though, you can find out more information and its features from product page. It is very unique and powerful tool in the world of trading.

https://www.mql5.com/en/market/product/41993

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ