Young Ho Seo / Профиль

- Информация

|

10+ лет

опыт работы

|

62

продуктов

|

1182

демо-версий

|

|

4

работ

|

0

сигналов

|

0

подписчиков

|

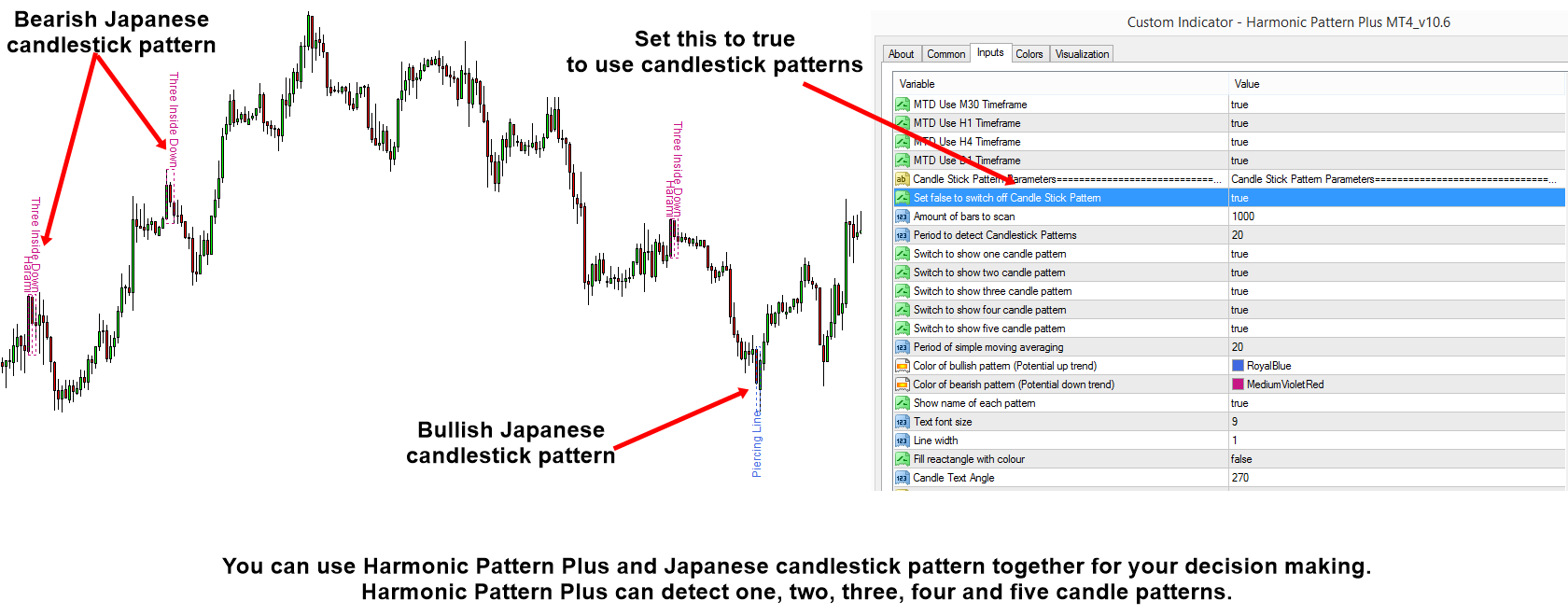

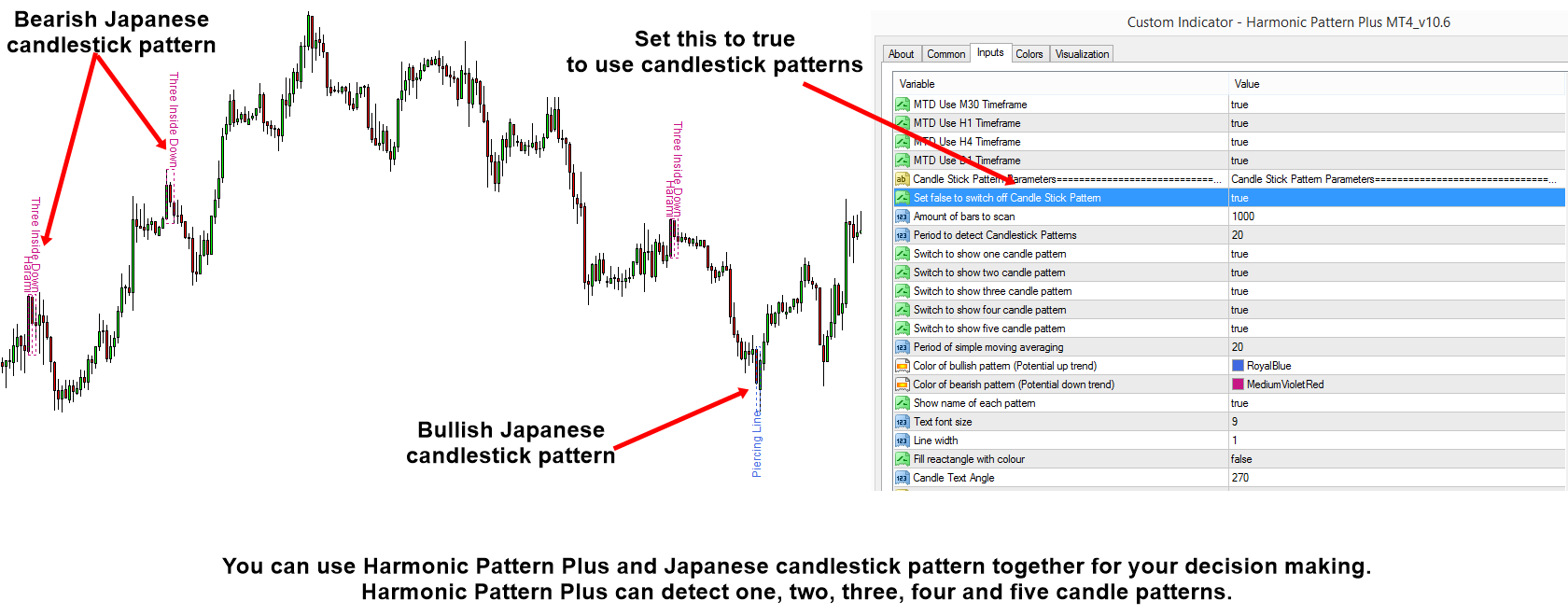

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

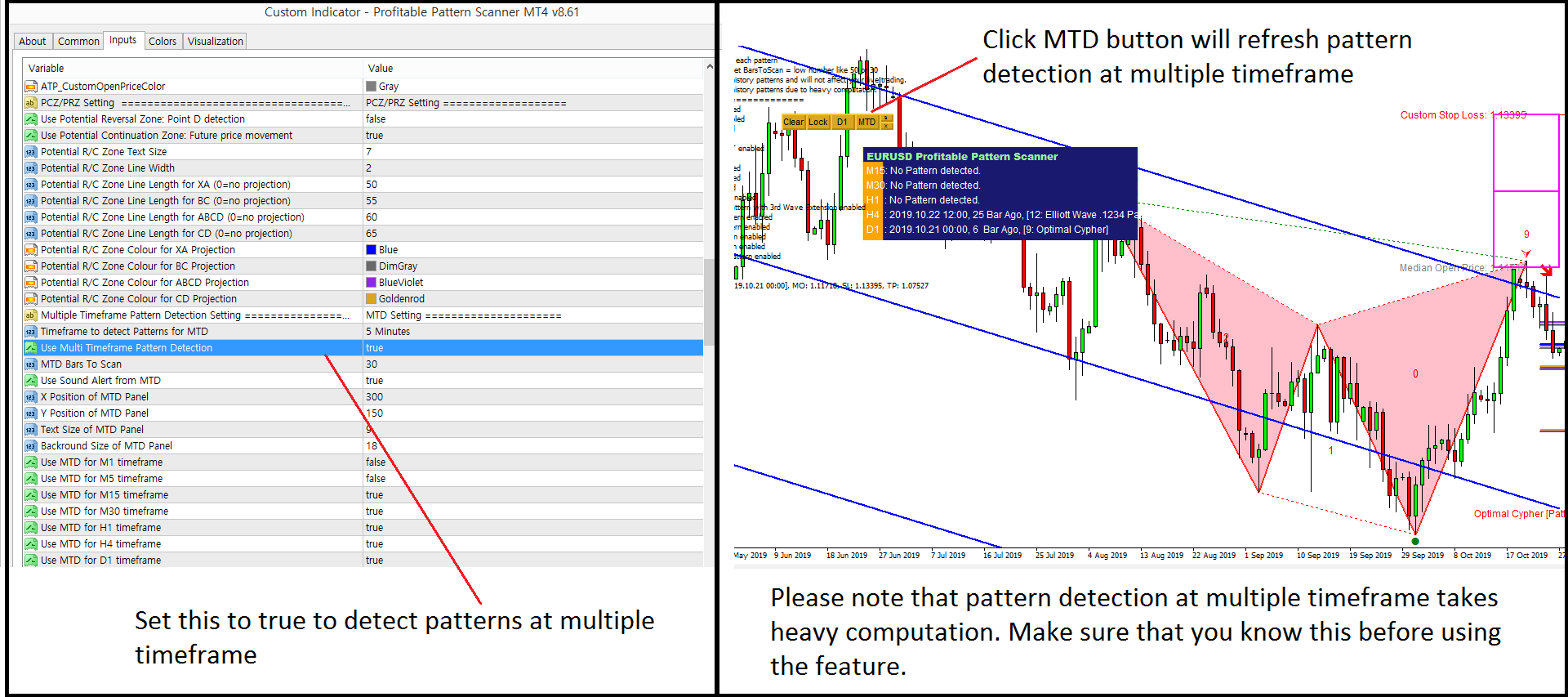

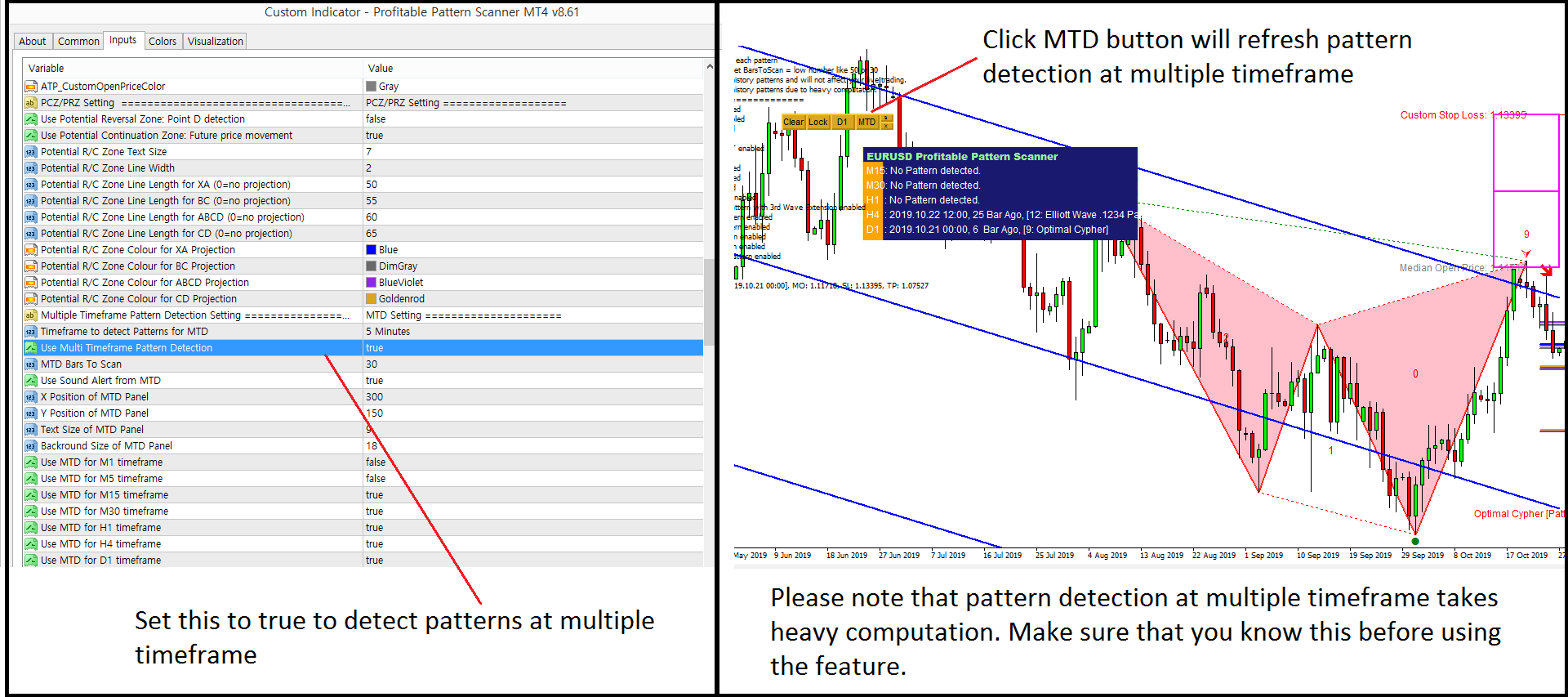

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

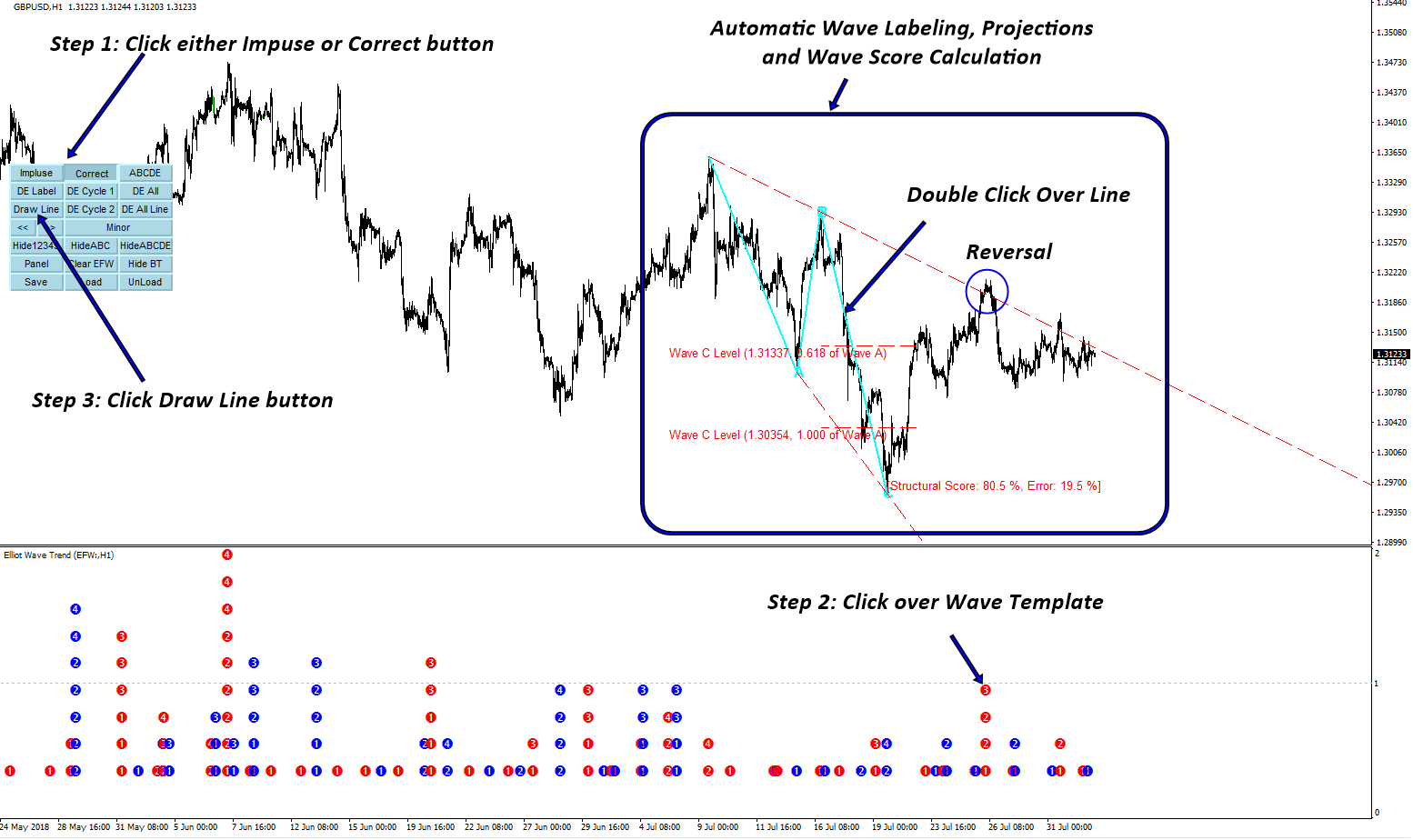

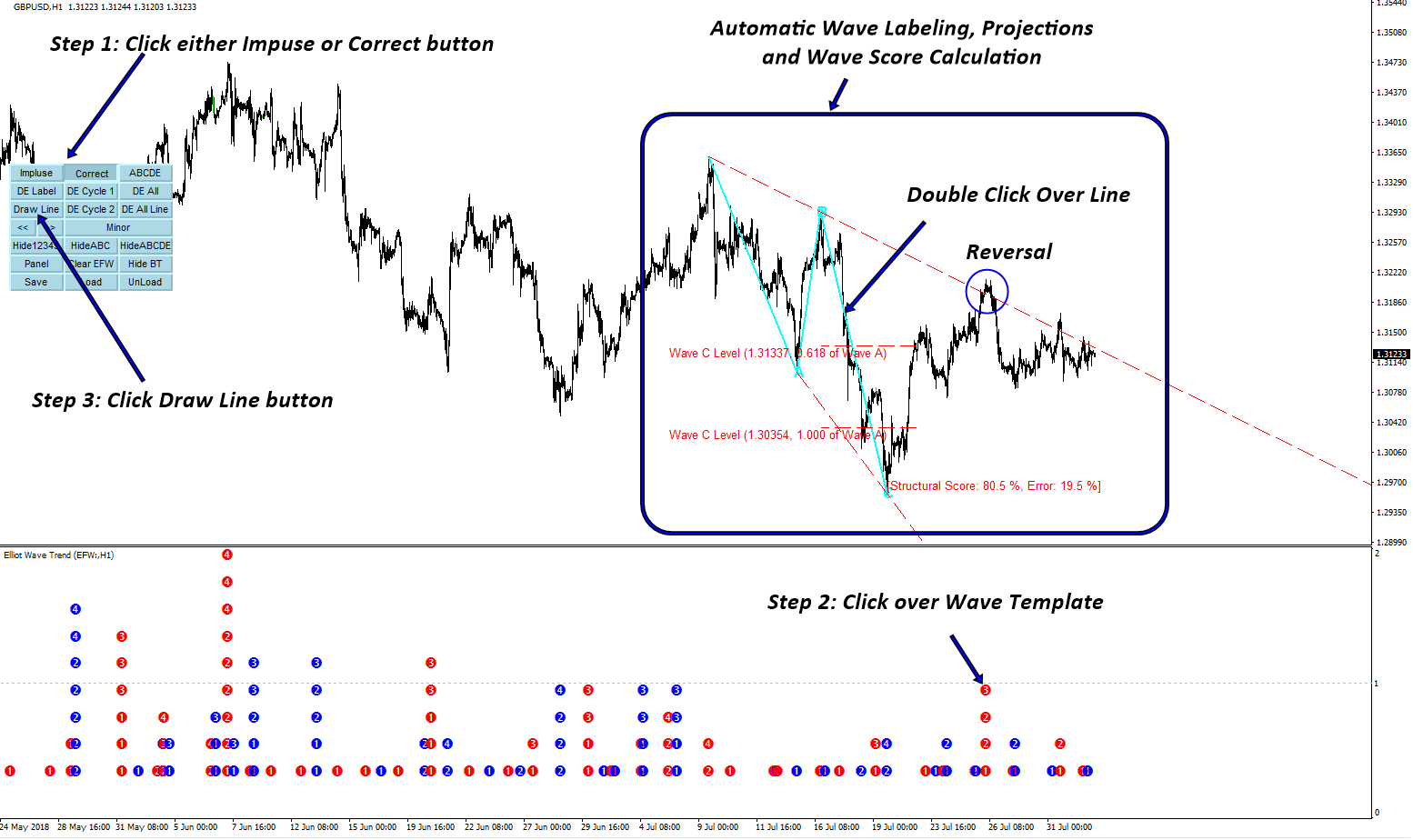

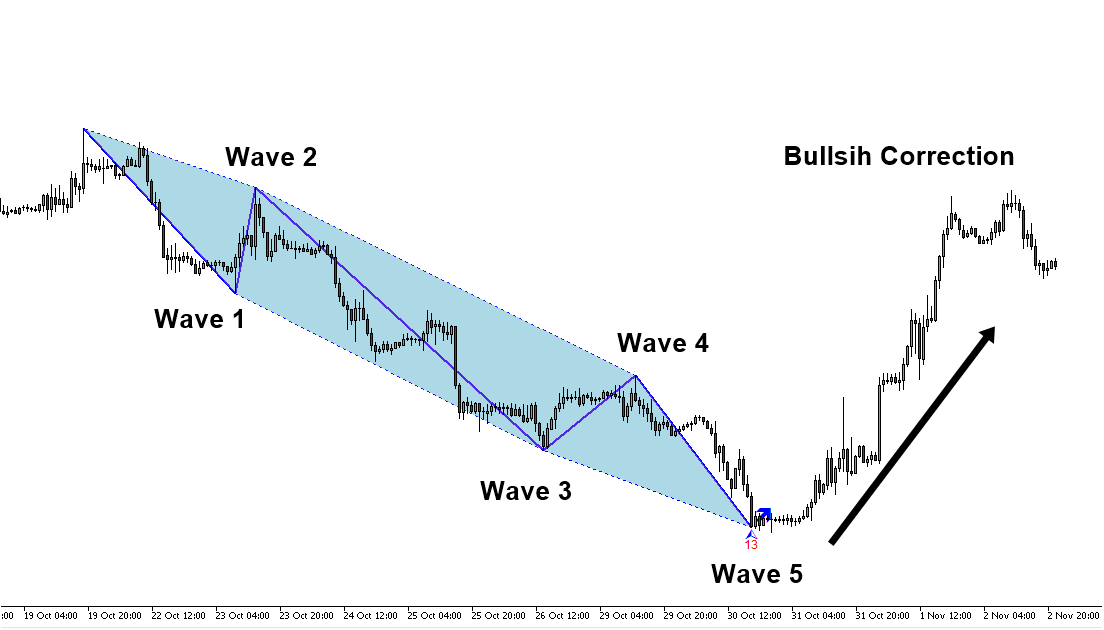

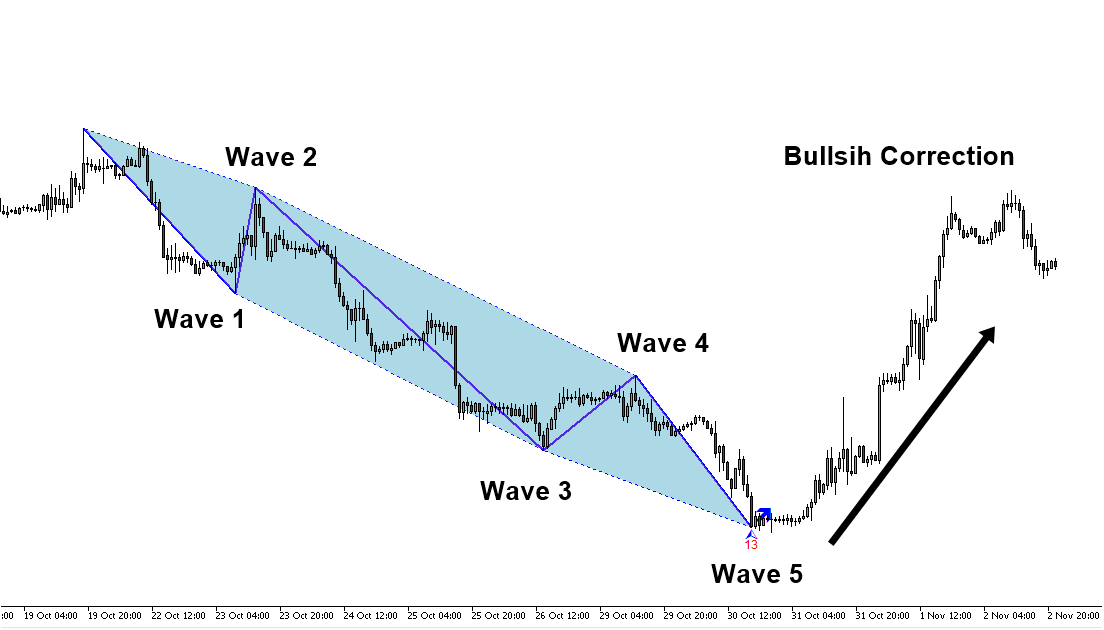

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

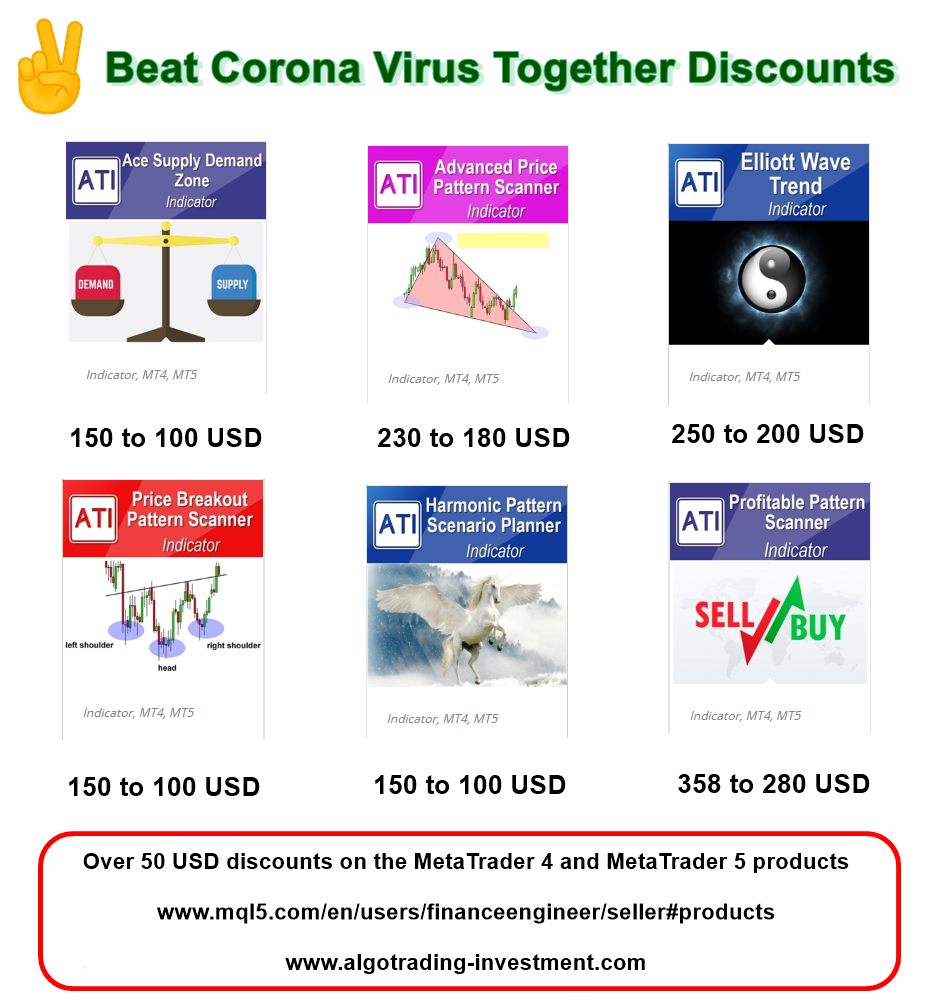

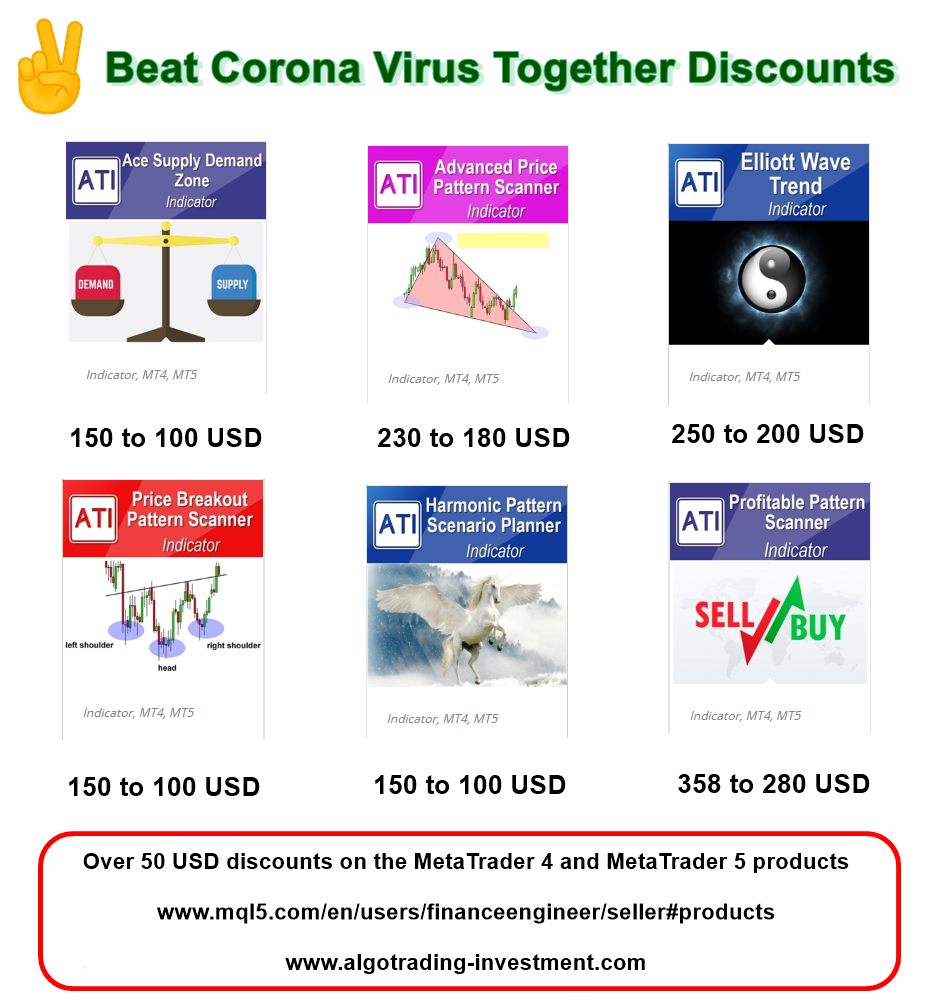

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

Automatic Resizing your Stop Loss and Take Profit Level with Harmonic Pattern Plus (Harmonic Pattern Scenario Planner)

Having understood all the concept behind the Pattern Completion Interval, you might observe that sometime price can react outside the pattern completion interval. Sure, there is nothing perfect in the world. As long as you understand the pros and cons of using large stop loss size, it is still fine to control your own stop loss size.

However, we still prefer to express stop loss size in terms of pattern completion interval range for convenience. For example, if the original stop loss size was equal to 1 x pattern completion interval, you can certainly use 1.5 x pattern completion interval or 2 x pattern completion interval.

Another consideration before you are using pattern completion interval, if you can enter the market at the competitive price, then you can feel less guilty when you increase your stop loss size because you are still remaining good rewards/Risk ratio. On the other hands, if you have entered market at not so competitive price, then you might be cautious when you increase your stop loss size.

The same feature applies to X3 Chart Pattern Scanner (Non Repainting and Non Lagging Harmonic Pattern and Elliott Wave pattern scanner.)

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Having understood all the concept behind the Pattern Completion Interval, you might observe that sometime price can react outside the pattern completion interval. Sure, there is nothing perfect in the world. As long as you understand the pros and cons of using large stop loss size, it is still fine to control your own stop loss size.

However, we still prefer to express stop loss size in terms of pattern completion interval range for convenience. For example, if the original stop loss size was equal to 1 x pattern completion interval, you can certainly use 1.5 x pattern completion interval or 2 x pattern completion interval.

Another consideration before you are using pattern completion interval, if you can enter the market at the competitive price, then you can feel less guilty when you increase your stop loss size because you are still remaining good rewards/Risk ratio. On the other hands, if you have entered market at not so competitive price, then you might be cautious when you increase your stop loss size.

The same feature applies to X3 Chart Pattern Scanner (Non Repainting and Non Lagging Harmonic Pattern and Elliott Wave pattern scanner.)

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Volume Spread Analysis Indicator List

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

Young Ho Seo

Introduction to Charting Techniques

For the Price Action and Pattern Analysis, it is important to have good visualization tools. Since we want to find important patterns for our trading, we will need a good size monitor and good visualization software. Of course, you should invest on them as much as you can afford. No single visualization techniques are perfect. They always possess some advantages as well as some disadvantages. Firstly, line chart is the most basic visualization technique for traders. Line is simply drawn by connecting each session’s closing price. For example, 1-hour line chart is simply drawn by connecting the closing price of 1-hour candle. As line chart are produced by connecting two points at the fixed time interval, they can provide a great insight about some regularities in the price series. For this reason, not only traders use the line chart but also many mathematicians use them to visualize the price series data. Line chart is useful when we want to exam some cyclic behaviour like seasonality or any cyclic patterns made up from sine or cosine function. Line chart is also useful when you want to compare multiple price series in one chart. On the other hands, the disadvantage of the line chart is that it does not provide the trading range of each session. In addition, due to the continuously drawn line, it is difficult to see any gap between sessions. In addition, line chart miss some important attributes like highest and lowest prices of each session.

Figure 2-1: Line chart for EURUSD from 1 September 2016 to 16 January 2017

Candlestick chart provides some additional attributes, which line chart misses. Figure 2-2 presents the anatomy of the candlestick chart. Candlestick chart provides three important information. Firstly, the bottom and top of the box represents the opening and closing price of the session. Secondly, each candlestick shows the trading range between high and low for each session. Thirdly, candlestick shows the direction of movement for each session. In Figure 2-2, the green candle reveals the upward movement for the session immediately whereas the red candle shows the downward movement. From Figure 2-3, we can feel how richer information candlestick chart provide for each session comparing to the Line chart. As shown in Figure 2-3, Candlestick chart is useful to spot the gaps in between sessions. This is very useful property of the candlestick chart since Line chart or any other chart is difficult to spot the gaps. One of the drawbacks of the candlestick chart is that it does not provide the sequence of high and low price but this is the common problem for other visualization techniques too. It is simply because the sequence of high and low price was not collected traditionally by the Financial Institutions. If anyone starts to provide the historical sequence of high and low prices for each session, then this would reveal a lot of information on the psychology of the financial market. All they have to put some simple identifier which price comes first between high and low prices during the session. For example, one can put the letter “h” to highlight that high price comes first before low price. Therefore, storing cost is no more than just a letter for this crucial information. This might be cheap but useful alternative to the expensive tick history data, which often require enormous hard drive space. In addition, the candlestick chart is the basis for the popular Japanese candlestick patterns. Although the Japanese candlestick pattern alone does not provide the perfect trading entry, many traders uses them as the confirming tool for their entry or exit.

Figure 2-2: Anatomy of the Candlestick chart.

Figure 2-3: Candlestick chart for EURUSD from 1 September 2016 to 16 January 2017.

OHLC Bar chart is another popular form of visualization techniques. The OHLC bar chart has some improvement over the line chart. It provides all of the same data including open, close, range and direction to the candlestick chart. However, OHLC bar chart is not visually easy to follow like candlestick chart. In addition, spotting the gap between sessions is not easy with the OHLC bar chart. However, many traders still not given up to use OHLC bar chart over the candlestick and line chart.

Figure 2-4: Anatomy of the Range Bar.

So far, we have introduced the visualization techniques with the fixed time interval. For example, line chart, candlestick chart and the OHLC bar chart uses the information collected in each session. The common time interval for the session is 1 hour, 4 hour, 1 day, 1 week and 1 month. Instead of using the fixed time interval, several techniques do not use the fixed time interval to construct the chart. For example, tick chart record the open, high, low and close prices during the fixed tick arrival intervals. Therefore, all the bars in the Tick chart have the same tick volumes. For example, 100 Tick chart will record the open, high, low and close price during 100 tick arrivals. All the bars in 100 Tick chart will have 100 tick volumes. One can construct line, candlestick chart and OHLC bar chart with Tick chart too. Tick chart will look like normal chart except that every bar has the identical tick volume. In Tick chart, during busy market hours, one candlestick can be formed fast but during slow market hours, one candlestick can be formed slowly. The tick chart is useful to replace the normal candlestick chart with lower timeframe when the candlestick chart produces the poor visual representation of the market with standard time interval. This is not always the case but when there is low interest in the market, this can happen. For example, Figure 2-5 shows the broken 1-minute candlestick chart for NZDSGD currency pairs. In this case, instead of using the candlestick chart with 1-minute chart, trader can use 100 tick chart. Because each candle is completed with 100 tick arrivals every time (Figure 2-6), we naturally have smoother looking chart in comparison to the broken chart in Figure 2-5. Once traders become familiar with tick chart, they tend to stick with them even for the higher timeframe. For example, you can use 500 tick chart or 1000 tick chart for your trading. Disadvantage of the tick chart is that tick is generally much heavier to store in the hard drive in terms of size. Therefore, not many trading package offer the capability of using tick chart for the time of writing this book. Just for your information, one-year worth of tick data can take up over some serous gigabytes of the space on your hard drives. In addition, Tick chart does not provide volatility information since every bar has identical tick volume. However, if programmatically doable, one can store time duration it takes to form the bar in the place of the tick volume. This would provide different insight, which the fixed time interval chart can’t provide.

Figure 2-5: Broken candlestick chart for NZDSGD currency pairs in 1-minute timeframe.

Figure 2-6: EURUSD Tick chat with 100 tick volume. On average, each bar was formed in 182.36 seconds.

Another popular visualization technique, which does not use the fixed time interval, is the Renko chart. The charting principle of the Renko Chart is quite different from the rest. For example, Renko chart is constructed by drawing bricks of fixed height in series. To illustrate the idea, consider Figure 2-7, if the price moved up by 5 points from the top of brick, then we will draw one white up brick. Likewise, if the price moved down by 5 points from the bottom of the brick, then we will draw one black down brick. The brick will be drawn either on the top or on the bottom of the other brick always.

Figure 2-7: Conceptual representation of Renko chart.

Figure 2-8 shows what happens when we transform about 100 candlesticks into Renko bricks with height of 20 pips in EURUSD 1 hour chart. As you can see, Renko bricks are much more concise and 100 candlesticks was transformed into only 52 Renko bricks. During this transformation, we are losing time information of our candlestick chart. Another important point you can observe here is that the Renko chart provide much smoother and readable visualization representation of trend. This is because the equal height of Renko brick reduces a lot of noise present in candlestick chart. With Renko Brick chart, it is much easier to identify trend and reversal patterns.

Figure 2-8: Daily EURUSD price series and Renko chart on the same period.

There are some drawbacks in Renko chart too. Because Renko chart lose all time information from our candlestick chart, you are no longer able to compare your normal candlestick chart to your Renko chart. In addition, unlike the candlestick chart, you have to select the sensible height of brick. Since there are many benefits using Renko chart, some traders are never worried about these disadvantages. Overall, Renko chart provide quite a lot of features which other chart does not provide.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

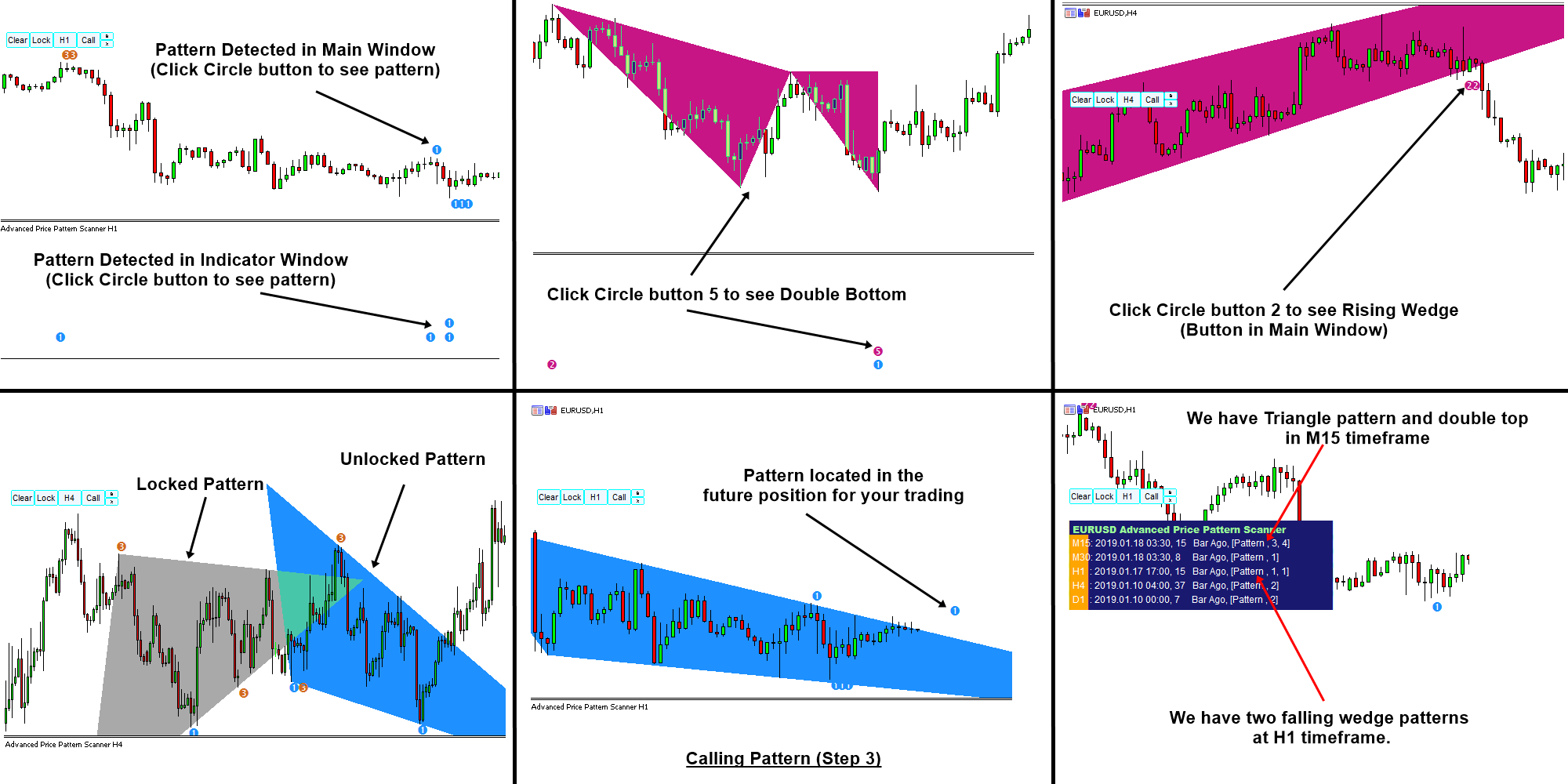

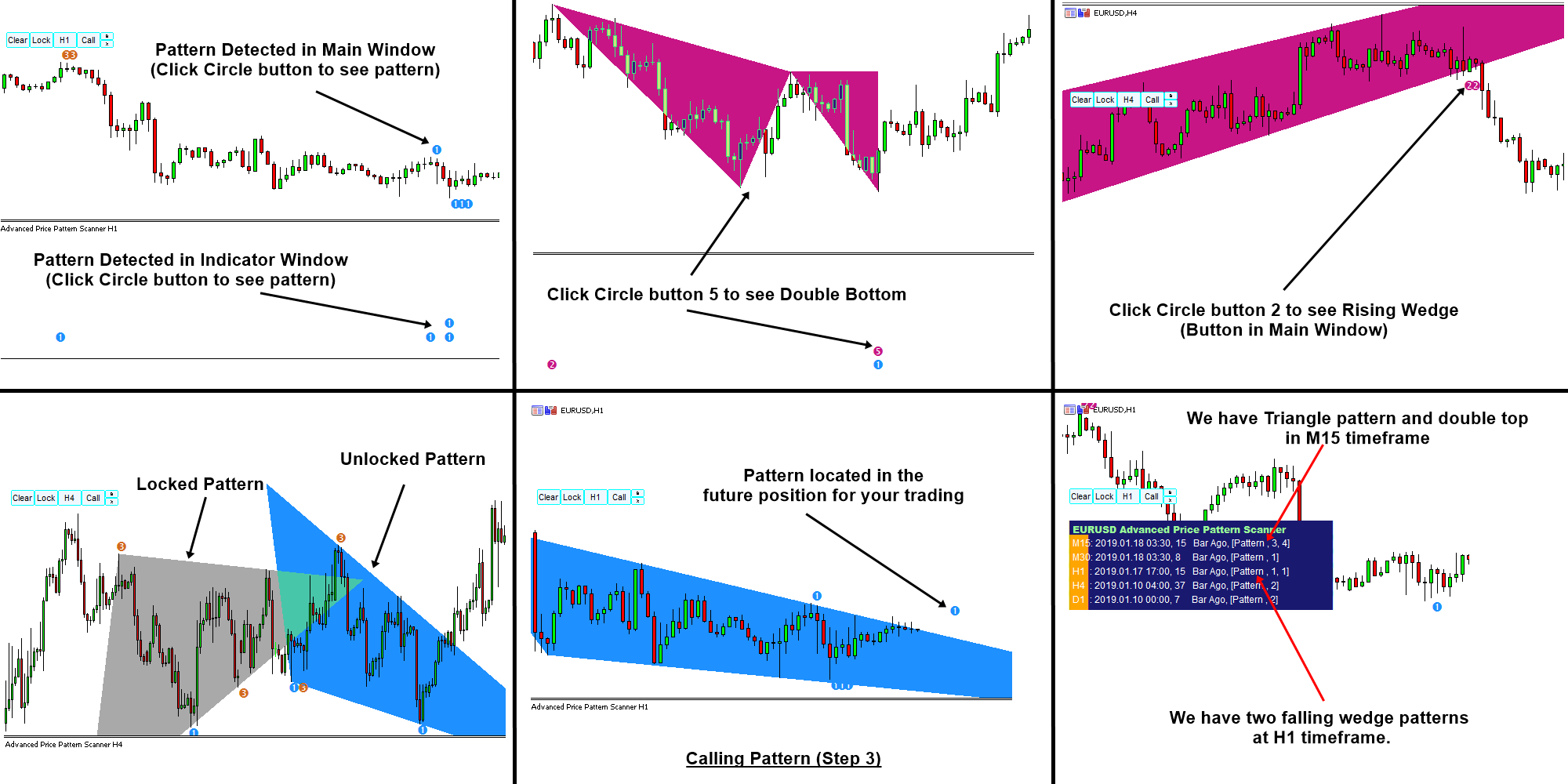

Advanced Price Pattern Scanner uses highly sophisticated pattern detection algorithm. However, we have designed it in the easy to use and intuitive manner. Advanced Price Pattern Scanner will show all the patterns in your chart in the most efficient format for your trading. It is non repainting pattern detector. Below are the links to Advanced Price Pattern Scanner.

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

For the Price Action and Pattern Analysis, it is important to have good visualization tools. Since we want to find important patterns for our trading, we will need a good size monitor and good visualization software. Of course, you should invest on them as much as you can afford. No single visualization techniques are perfect. They always possess some advantages as well as some disadvantages. Firstly, line chart is the most basic visualization technique for traders. Line is simply drawn by connecting each session’s closing price. For example, 1-hour line chart is simply drawn by connecting the closing price of 1-hour candle. As line chart are produced by connecting two points at the fixed time interval, they can provide a great insight about some regularities in the price series. For this reason, not only traders use the line chart but also many mathematicians use them to visualize the price series data. Line chart is useful when we want to exam some cyclic behaviour like seasonality or any cyclic patterns made up from sine or cosine function. Line chart is also useful when you want to compare multiple price series in one chart. On the other hands, the disadvantage of the line chart is that it does not provide the trading range of each session. In addition, due to the continuously drawn line, it is difficult to see any gap between sessions. In addition, line chart miss some important attributes like highest and lowest prices of each session.

Figure 2-1: Line chart for EURUSD from 1 September 2016 to 16 January 2017

Candlestick chart provides some additional attributes, which line chart misses. Figure 2-2 presents the anatomy of the candlestick chart. Candlestick chart provides three important information. Firstly, the bottom and top of the box represents the opening and closing price of the session. Secondly, each candlestick shows the trading range between high and low for each session. Thirdly, candlestick shows the direction of movement for each session. In Figure 2-2, the green candle reveals the upward movement for the session immediately whereas the red candle shows the downward movement. From Figure 2-3, we can feel how richer information candlestick chart provide for each session comparing to the Line chart. As shown in Figure 2-3, Candlestick chart is useful to spot the gaps in between sessions. This is very useful property of the candlestick chart since Line chart or any other chart is difficult to spot the gaps. One of the drawbacks of the candlestick chart is that it does not provide the sequence of high and low price but this is the common problem for other visualization techniques too. It is simply because the sequence of high and low price was not collected traditionally by the Financial Institutions. If anyone starts to provide the historical sequence of high and low prices for each session, then this would reveal a lot of information on the psychology of the financial market. All they have to put some simple identifier which price comes first between high and low prices during the session. For example, one can put the letter “h” to highlight that high price comes first before low price. Therefore, storing cost is no more than just a letter for this crucial information. This might be cheap but useful alternative to the expensive tick history data, which often require enormous hard drive space. In addition, the candlestick chart is the basis for the popular Japanese candlestick patterns. Although the Japanese candlestick pattern alone does not provide the perfect trading entry, many traders uses them as the confirming tool for their entry or exit.

Figure 2-2: Anatomy of the Candlestick chart.

Figure 2-3: Candlestick chart for EURUSD from 1 September 2016 to 16 January 2017.

OHLC Bar chart is another popular form of visualization techniques. The OHLC bar chart has some improvement over the line chart. It provides all of the same data including open, close, range and direction to the candlestick chart. However, OHLC bar chart is not visually easy to follow like candlestick chart. In addition, spotting the gap between sessions is not easy with the OHLC bar chart. However, many traders still not given up to use OHLC bar chart over the candlestick and line chart.

Figure 2-4: Anatomy of the Range Bar.

So far, we have introduced the visualization techniques with the fixed time interval. For example, line chart, candlestick chart and the OHLC bar chart uses the information collected in each session. The common time interval for the session is 1 hour, 4 hour, 1 day, 1 week and 1 month. Instead of using the fixed time interval, several techniques do not use the fixed time interval to construct the chart. For example, tick chart record the open, high, low and close prices during the fixed tick arrival intervals. Therefore, all the bars in the Tick chart have the same tick volumes. For example, 100 Tick chart will record the open, high, low and close price during 100 tick arrivals. All the bars in 100 Tick chart will have 100 tick volumes. One can construct line, candlestick chart and OHLC bar chart with Tick chart too. Tick chart will look like normal chart except that every bar has the identical tick volume. In Tick chart, during busy market hours, one candlestick can be formed fast but during slow market hours, one candlestick can be formed slowly. The tick chart is useful to replace the normal candlestick chart with lower timeframe when the candlestick chart produces the poor visual representation of the market with standard time interval. This is not always the case but when there is low interest in the market, this can happen. For example, Figure 2-5 shows the broken 1-minute candlestick chart for NZDSGD currency pairs. In this case, instead of using the candlestick chart with 1-minute chart, trader can use 100 tick chart. Because each candle is completed with 100 tick arrivals every time (Figure 2-6), we naturally have smoother looking chart in comparison to the broken chart in Figure 2-5. Once traders become familiar with tick chart, they tend to stick with them even for the higher timeframe. For example, you can use 500 tick chart or 1000 tick chart for your trading. Disadvantage of the tick chart is that tick is generally much heavier to store in the hard drive in terms of size. Therefore, not many trading package offer the capability of using tick chart for the time of writing this book. Just for your information, one-year worth of tick data can take up over some serous gigabytes of the space on your hard drives. In addition, Tick chart does not provide volatility information since every bar has identical tick volume. However, if programmatically doable, one can store time duration it takes to form the bar in the place of the tick volume. This would provide different insight, which the fixed time interval chart can’t provide.

Figure 2-5: Broken candlestick chart for NZDSGD currency pairs in 1-minute timeframe.

Figure 2-6: EURUSD Tick chat with 100 tick volume. On average, each bar was formed in 182.36 seconds.

Another popular visualization technique, which does not use the fixed time interval, is the Renko chart. The charting principle of the Renko Chart is quite different from the rest. For example, Renko chart is constructed by drawing bricks of fixed height in series. To illustrate the idea, consider Figure 2-7, if the price moved up by 5 points from the top of brick, then we will draw one white up brick. Likewise, if the price moved down by 5 points from the bottom of the brick, then we will draw one black down brick. The brick will be drawn either on the top or on the bottom of the other brick always.

Figure 2-7: Conceptual representation of Renko chart.

Figure 2-8 shows what happens when we transform about 100 candlesticks into Renko bricks with height of 20 pips in EURUSD 1 hour chart. As you can see, Renko bricks are much more concise and 100 candlesticks was transformed into only 52 Renko bricks. During this transformation, we are losing time information of our candlestick chart. Another important point you can observe here is that the Renko chart provide much smoother and readable visualization representation of trend. This is because the equal height of Renko brick reduces a lot of noise present in candlestick chart. With Renko Brick chart, it is much easier to identify trend and reversal patterns.

Figure 2-8: Daily EURUSD price series and Renko chart on the same period.

There are some drawbacks in Renko chart too. Because Renko chart lose all time information from our candlestick chart, you are no longer able to compare your normal candlestick chart to your Renko chart. In addition, unlike the candlestick chart, you have to select the sensible height of brick. Since there are many benefits using Renko chart, some traders are never worried about these disadvantages. Overall, Renko chart provide quite a lot of features which other chart does not provide.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

Advanced Price Pattern Scanner uses highly sophisticated pattern detection algorithm. However, we have designed it in the easy to use and intuitive manner. Advanced Price Pattern Scanner will show all the patterns in your chart in the most efficient format for your trading. It is non repainting pattern detector. Below are the links to Advanced Price Pattern Scanner.

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Advanced Harmonic Pattern Detection Indicator

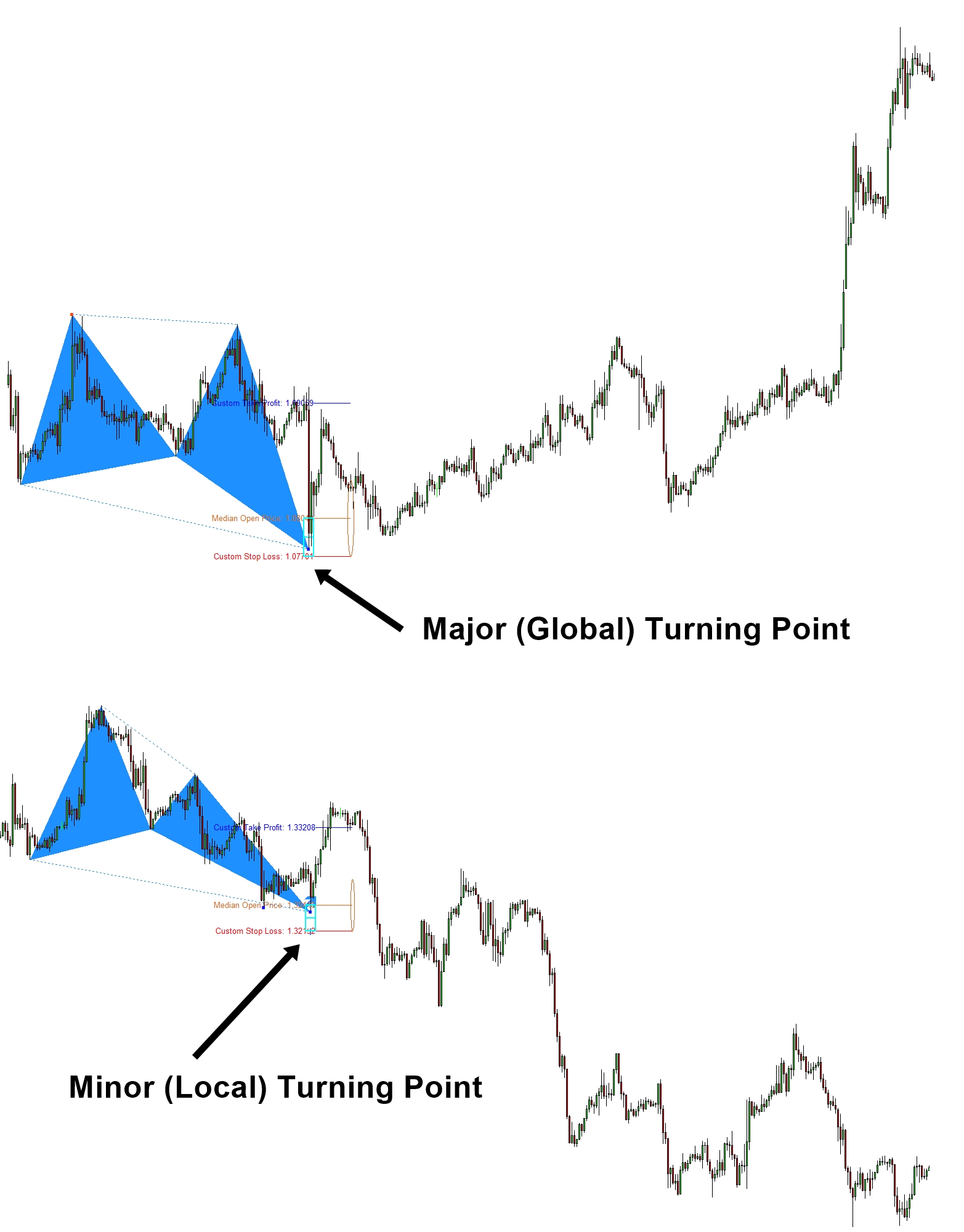

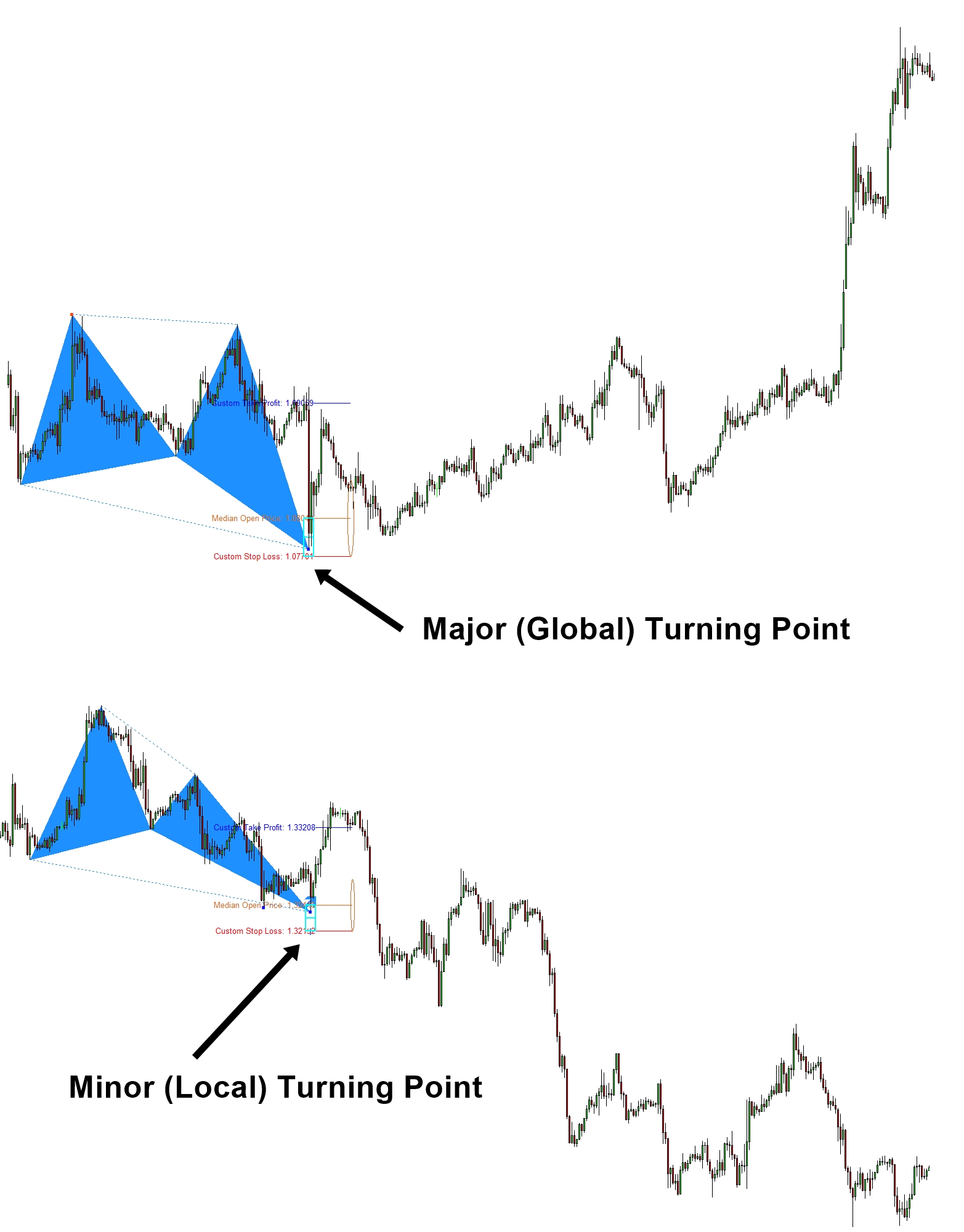

Harmonic Pattern Scenario Planner is an advanced Harmonic Pattern Detection Indicator. This is probably the most sophisticated harmonic pattern detection indicator in the market.

Harmonic Pattern Scenario planner can be used like Harmonic Pattern Plus. Hence, it is easy and friendly to use. At the same time, it combines powerful Monte Carlos Simulation to provide you advanced harmonic pattern search capability.

Monte Carlo Simulation can help you to find future reversal points in advance.

Here is the product link to Harmonic Pattern Scenario Planner. You can find more about the features of this advanced Harmonic Pattern Scenario Planner.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Harmonic Pattern Scenario Planner is an advanced Harmonic Pattern Detection Indicator. This is probably the most sophisticated harmonic pattern detection indicator in the market.

Harmonic Pattern Scenario planner can be used like Harmonic Pattern Plus. Hence, it is easy and friendly to use. At the same time, it combines powerful Monte Carlos Simulation to provide you advanced harmonic pattern search capability.

Monte Carlo Simulation can help you to find future reversal points in advance.

Here is the product link to Harmonic Pattern Scenario Planner. You can find more about the features of this advanced Harmonic Pattern Scenario Planner.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

Fibonacci Retracement and Expansion Patterns

A Fibonacci analysis is a popular tool among technical traders. It is based on the Fibonacci sequence numbers identified by Leonardo Fibonacci in the 13th century. Here are the Fibonacci sequence numbers:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, …………………

As the Fibonacci number become large, the constant relationship is established between neighbouring numbers. For example, every time, when we divide the former number by latter: Fn-1/Fn, we will get nearly 0.618 ratio. Likewise, when we divide the latter number by former: Fn/Fn-1, we will get nearly 1.618. These two Fibonacci ratio 0.618 and 1.618 are considered as the Golden Ratio. We can use these Golden ratios to start our Fibonacci analysis. However, many technical traders use additional Fibonacci ratios derived from the Golden ratio. Since the calculation of each Fibonacci ratio is well known, I have listed all the available Fibonacci ratio calculation in Table 1-1.

Type Ratio Calculation

Primary 0.618 Fn-1/Fn of Fibonacci numbers

Primary 1.618 Fn/Fn-1 of Fibonacci numbers

Primary 0.786

Primary 1.272

Secondary 0.382 0.382=0.618*0.618

Secondary 2.618 2.618=1.618*1.618

Secondary 4.236 4.236=1.618*1.618*1.618

Secondary 6.854 6.854=1.618*1.618*1.618*1.618

Secondary 11.089 11.089=1.618*1.618*1.618*1.618*1.618

Secondary 0.500 0.500=1.000/2.000

Secondary 1.000 Unity

Secondary 2.000 Fibonacci Prime Number

Secondary 3.000 Fibonacci Prime Number

Secondary 5.000 Fibonacci Prime Number

Secondary 13.000 Fibonacci Prime Number

Secondary 1.414

Secondary 1.732

Secondary 2.236

Secondary 3.610

Secondary 3.142 3.142 = Pi = circumference /diameter of the circle

Table 1-1: Fibonacci ratios and corresponding calculations to derive each ratio.

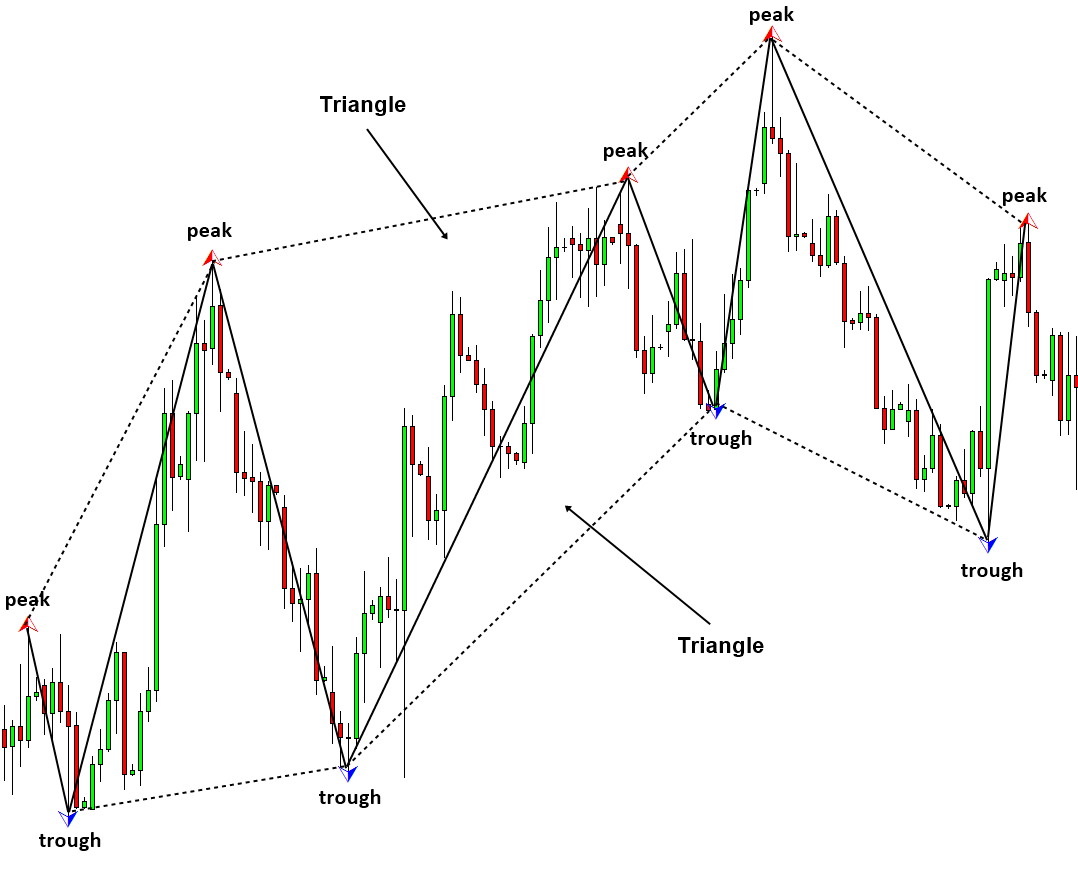

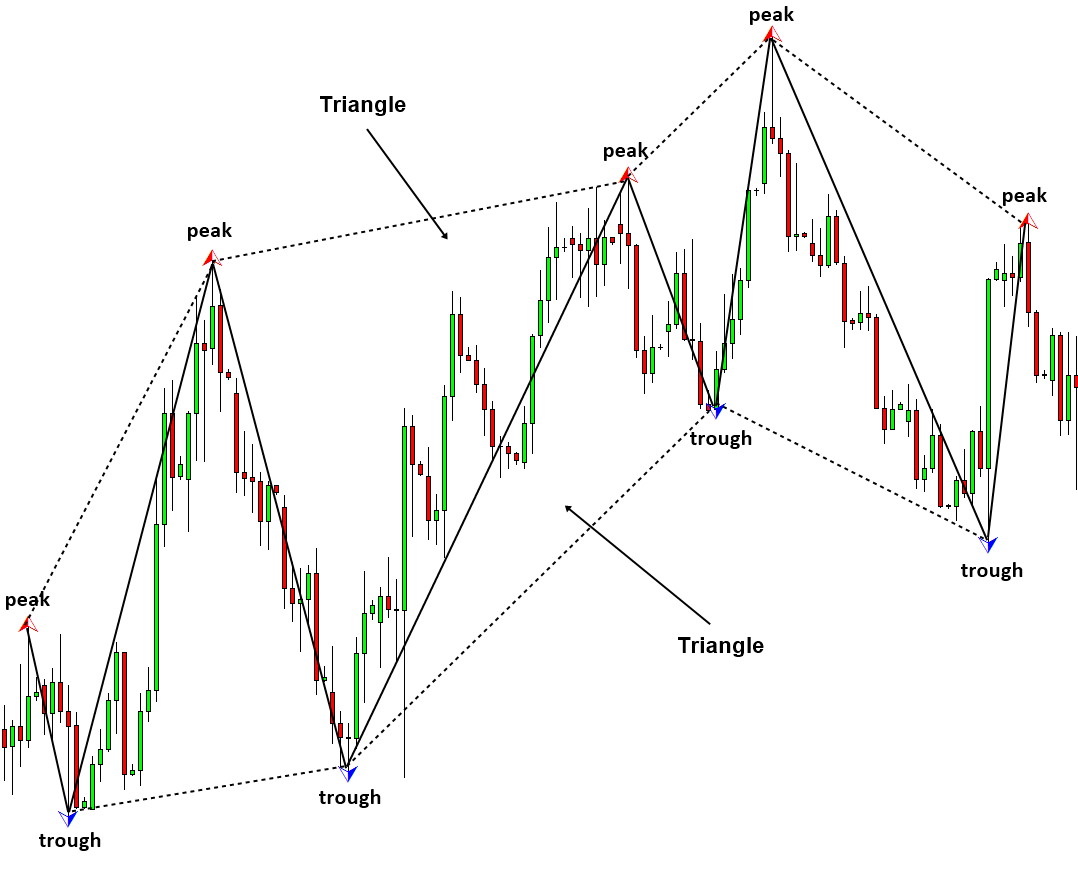

In fact, Fibonacci analysis in financial trading is extremely popular. It is popular on its own. At the same time, it is also basis for many other popular technical analyses like harmonic pattern, Elliott wave pattern, etc. As with support resistance analysis, Fibonacci analysis is probably the most popular technical analysis among traders. There are two important techniques in Fibonacci analysis. First technique is Fibonacci retracement. Second technique is Fibonacci expansion. If you are looking at some other books, you might find some confusing description about retracement, extension, expansion, and projection. For example, the book might give two different names for the ratio over 100% and for the ratio below 100%. We are not using the confusing name practice here but we will stick with just retracement and expansion because it is simple. Both retracement and expansion will need two significant peak and trough to pick up in your chart. If you want to use mechanical setup with Fibonacci analysis, the best way to start is to use the Peak Trough Transformation using ZigZag indicator. Let us start with retracement. For simple example, we use 61.8% Golden ratio. For retracement, we can have two cases including Trough-Peak retracement and Peak-Trough retracement. In Trough-Peak retracement, 61.8% retracement level will act as a support level. Price will reverse in the correction phase to follow the previous bullish movement.

Figure 1-1: Trough-Peak Retracement Example on EURUSD H4 timeframe.

Likewise, in Peak-Trough retracement, 61.8% will act as resistance. Price will reverse in the correction phase to follow the previous bearish movement. In both case, the 61.8% retracement will be measured from end of correction phase to previous peak or trough. We have used percentage in this example. Some technical traders prefer to use the ratios in decimal places like 0.618. It is just your preferences. Using ratio or percentage does not affect the accuracy of trading. You can use other Fibonacci ratios like 0.382 or 1.618 in the exactly same way as 0.618.

Figure 1-2: Peak-Trough Retracement Example on EURUSD H4 timeframe.

Fibonacci expansion is slightly more complicated than Fibonacci retracement. Still it is considered as the basic analysis among technical trader. As in retracement technique, we can have two cases including Trough-Peak expansion and Peak-Trough expansion. In Trough-Peak expansion, we will measure the expansion from where the correction ends to next peak. In the next peak, we will expect the bearish reversal in the same direction to the correction. In fact, the 100% Expansion level is act as the resistance in Figure 1-3. Likewise, in Peak-Trough expansion, we will expect the bullish reversal in the same direction to the correction. In Figure 1-4, 61.8% expansion level acts as the support.

Figure 1-3: Trough-Peak Expansion Example on EURUSD H4 timeframe.

Figure 1-4: Peak-Trough Expansion Example on EURUSD H4 timeframe.

We have just given the technical description of Fibonacci retracement and expansion. The next thing we need to ask is what is the scientific relevance or justification behind these techniques. Unfortunately, it is hard to tell. People just used them for many decades without questioning any scientific relevance. I think most of people will use them in the future without questioning too. As I have mentioned, the very purpose of this book is to connect common technical analysis and trading strategy to the existing science. We really want to break the lack of communication between them. Therefore, we will give an answer to the question.

Connecting Fibonacci ratio to science is not overly complicated. We have already covered that the building block of fractal geometry in financial market is triangle known as equilibrium fractal wave. By drawing a triangle from trough, peak, and trough, we can simply demonstrate that Fibonacci retracement is the technique that predicting the shape ratio of the triangle. In our 61.8% retracement example, we are predicting that the shape ratio of triangle is 61.8%. As we have discussed, the loose-self similarity of equilibrium fractal wave will allow us to have any shape ratio from 0.01 to above 3.0. Our prediction of 61.8% could be wrong and the shape ratio of triangle could end up 123% or 152%, etc. Do we have any justification to predict 61.8% of the triangle? Yes, the justification is how often the shape ratio of 61.8% is repeating in history. If we have 61.8% shape ratio repeating more times than other shape ratio, then we can certainly justify our prediction. To check them, we have already introduced the measurement called Shape ratio index. It is calculated by dividing number of particular shape ratio by total number of peaks and troughs in the price series. In Figure 1-7 and Figure 1-8, we show the distribution of this Shape Ratio index for both EURUSD and GBPUSD daily timeframe. By looking at the distribution in Figure 1-7 and Figure 1-8, we can confirm that 61.8% shape ratio found 27.8% and 23.3% respectively for EURUSD and GBPUSD among all found peaks and troughs. It is certainly much better than 0% or 5%. Over 20% repeating is significant outcome even in statistical sense. However, in GBPUSD, 61.8% shape ratio is not as significant as 50.0% shape ratio. This suggests that 61.8% retracement is not optimal for some currency pairs and stock prices. Another finding is that individual currency pairs or stock price has their own preferred shape ratios.

Shape ratio of equilibrium fractal wave = current move in price units (Y2)/ previous move in price units (Y1).

Shape Ratio index = number of the particular shape of equilibrium fractal wave / total number of peaks and troughs in the price series.

Figure 1-5: Trough-Peak retracement with a triangle drawn.

Figure 1-6: Structure of one triangle, equilibrium fractal wave. It is made up from two price movements (i.e. two legs).

Figure 1-7: EFW Shape Ratio Distribution for EURUSD Daily Timeframe from 2009 09 02 to 2018 02 20 (Label inside callout box, left: Ratio, right: EFW Index, vertical axis: EFW index, horizontal axis: ratio from 0.1 to 3.0).

Figure 1-8: EFW Shape Ratio Distribution for GBPUSD Daily Timeframe from 2009 09 02 to 2018 02 20 (Label inside callout box, left: Ratio, right: EFW Index, vertical axis: EFW index, horizontal axis: ratio from 0.1 to 3.0).

Of course, we can find the scientific relevance for Fibonacci expansion technique too. To do so, we just need to create two triangles by connecting peak, trough, peak, and trough. In our 61.8% expansion example, we are predicting that the Momentum ratio of two adjacent triangles is 61.8%. The loose-self similarity will allow us to have any Momentum ratio from 0.01 to above 3.0. We could be wrong or right with our Momentum ratio prediction. To justify our choice over 61.8% expansion ratio, we just need to calculate the distribution of Momentum ratio index. Unfortunately, I do not have the calculated distribution for the case of Momentum ratio. However, I have provided you the equations in this book. You might attempt it by yourself.

Momentum ratio of equilibrium fractal wave = latest price move of current wave in price units (Y3)/ first movement of previous wave in price units (Y1) where Y3 and Y1 are in the same direction.

Momentum Ratio index = number of the particular Momentum ratio / number of peaks and troughs in the price series.

Figure 1-9: Peak-Trough Expansion Example with two triangles drawn.

Figure 1-10: Momentum ratio for two ascending Equilibrium Fractal waves

Once again, we emphasize that the distribution of Shape Ratio index and Momentum Ratio index can reveal a lot about financial market. When I first created the distribution of Shape Ratio, I felt like that I found the oil reservoir in the Sahara Desert. There were many useful insights for both scientific and financial trading purpose. I do recommend further research on this in academic level too. Finally, it is important to note that Fibonacci ratio is the basis for many other advanced technical analyses including Shape Ratio trading, Harmonic pattern, and Elliott wave patterns. Therefore, it is important to understand how the Fibonacci analysis works before you proceeding to the next chapter of this book.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis. Harmonic Pattern Plus is the advanced Fibonacci Analysis Indicator for your trading. Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

A Fibonacci analysis is a popular tool among technical traders. It is based on the Fibonacci sequence numbers identified by Leonardo Fibonacci in the 13th century. Here are the Fibonacci sequence numbers:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, …………………

As the Fibonacci number become large, the constant relationship is established between neighbouring numbers. For example, every time, when we divide the former number by latter: Fn-1/Fn, we will get nearly 0.618 ratio. Likewise, when we divide the latter number by former: Fn/Fn-1, we will get nearly 1.618. These two Fibonacci ratio 0.618 and 1.618 are considered as the Golden Ratio. We can use these Golden ratios to start our Fibonacci analysis. However, many technical traders use additional Fibonacci ratios derived from the Golden ratio. Since the calculation of each Fibonacci ratio is well known, I have listed all the available Fibonacci ratio calculation in Table 1-1.

Type Ratio Calculation

Primary 0.618 Fn-1/Fn of Fibonacci numbers

Primary 1.618 Fn/Fn-1 of Fibonacci numbers

Primary 0.786

Primary 1.272

Secondary 0.382 0.382=0.618*0.618

Secondary 2.618 2.618=1.618*1.618

Secondary 4.236 4.236=1.618*1.618*1.618

Secondary 6.854 6.854=1.618*1.618*1.618*1.618

Secondary 11.089 11.089=1.618*1.618*1.618*1.618*1.618

Secondary 0.500 0.500=1.000/2.000

Secondary 1.000 Unity

Secondary 2.000 Fibonacci Prime Number

Secondary 3.000 Fibonacci Prime Number

Secondary 5.000 Fibonacci Prime Number

Secondary 13.000 Fibonacci Prime Number

Secondary 1.414

Secondary 1.732

Secondary 2.236

Secondary 3.610

Secondary 3.142 3.142 = Pi = circumference /diameter of the circle

Table 1-1: Fibonacci ratios and corresponding calculations to derive each ratio.

In fact, Fibonacci analysis in financial trading is extremely popular. It is popular on its own. At the same time, it is also basis for many other popular technical analyses like harmonic pattern, Elliott wave pattern, etc. As with support resistance analysis, Fibonacci analysis is probably the most popular technical analysis among traders. There are two important techniques in Fibonacci analysis. First technique is Fibonacci retracement. Second technique is Fibonacci expansion. If you are looking at some other books, you might find some confusing description about retracement, extension, expansion, and projection. For example, the book might give two different names for the ratio over 100% and for the ratio below 100%. We are not using the confusing name practice here but we will stick with just retracement and expansion because it is simple. Both retracement and expansion will need two significant peak and trough to pick up in your chart. If you want to use mechanical setup with Fibonacci analysis, the best way to start is to use the Peak Trough Transformation using ZigZag indicator. Let us start with retracement. For simple example, we use 61.8% Golden ratio. For retracement, we can have two cases including Trough-Peak retracement and Peak-Trough retracement. In Trough-Peak retracement, 61.8% retracement level will act as a support level. Price will reverse in the correction phase to follow the previous bullish movement.

Figure 1-1: Trough-Peak Retracement Example on EURUSD H4 timeframe.

Likewise, in Peak-Trough retracement, 61.8% will act as resistance. Price will reverse in the correction phase to follow the previous bearish movement. In both case, the 61.8% retracement will be measured from end of correction phase to previous peak or trough. We have used percentage in this example. Some technical traders prefer to use the ratios in decimal places like 0.618. It is just your preferences. Using ratio or percentage does not affect the accuracy of trading. You can use other Fibonacci ratios like 0.382 or 1.618 in the exactly same way as 0.618.

Figure 1-2: Peak-Trough Retracement Example on EURUSD H4 timeframe.

Fibonacci expansion is slightly more complicated than Fibonacci retracement. Still it is considered as the basic analysis among technical trader. As in retracement technique, we can have two cases including Trough-Peak expansion and Peak-Trough expansion. In Trough-Peak expansion, we will measure the expansion from where the correction ends to next peak. In the next peak, we will expect the bearish reversal in the same direction to the correction. In fact, the 100% Expansion level is act as the resistance in Figure 1-3. Likewise, in Peak-Trough expansion, we will expect the bullish reversal in the same direction to the correction. In Figure 1-4, 61.8% expansion level acts as the support.

Figure 1-3: Trough-Peak Expansion Example on EURUSD H4 timeframe.

Figure 1-4: Peak-Trough Expansion Example on EURUSD H4 timeframe.

We have just given the technical description of Fibonacci retracement and expansion. The next thing we need to ask is what is the scientific relevance or justification behind these techniques. Unfortunately, it is hard to tell. People just used them for many decades without questioning any scientific relevance. I think most of people will use them in the future without questioning too. As I have mentioned, the very purpose of this book is to connect common technical analysis and trading strategy to the existing science. We really want to break the lack of communication between them. Therefore, we will give an answer to the question.

Connecting Fibonacci ratio to science is not overly complicated. We have already covered that the building block of fractal geometry in financial market is triangle known as equilibrium fractal wave. By drawing a triangle from trough, peak, and trough, we can simply demonstrate that Fibonacci retracement is the technique that predicting the shape ratio of the triangle. In our 61.8% retracement example, we are predicting that the shape ratio of triangle is 61.8%. As we have discussed, the loose-self similarity of equilibrium fractal wave will allow us to have any shape ratio from 0.01 to above 3.0. Our prediction of 61.8% could be wrong and the shape ratio of triangle could end up 123% or 152%, etc. Do we have any justification to predict 61.8% of the triangle? Yes, the justification is how often the shape ratio of 61.8% is repeating in history. If we have 61.8% shape ratio repeating more times than other shape ratio, then we can certainly justify our prediction. To check them, we have already introduced the measurement called Shape ratio index. It is calculated by dividing number of particular shape ratio by total number of peaks and troughs in the price series. In Figure 1-7 and Figure 1-8, we show the distribution of this Shape Ratio index for both EURUSD and GBPUSD daily timeframe. By looking at the distribution in Figure 1-7 and Figure 1-8, we can confirm that 61.8% shape ratio found 27.8% and 23.3% respectively for EURUSD and GBPUSD among all found peaks and troughs. It is certainly much better than 0% or 5%. Over 20% repeating is significant outcome even in statistical sense. However, in GBPUSD, 61.8% shape ratio is not as significant as 50.0% shape ratio. This suggests that 61.8% retracement is not optimal for some currency pairs and stock prices. Another finding is that individual currency pairs or stock price has their own preferred shape ratios.

Shape ratio of equilibrium fractal wave = current move in price units (Y2)/ previous move in price units (Y1).

Shape Ratio index = number of the particular shape of equilibrium fractal wave / total number of peaks and troughs in the price series.

Figure 1-5: Trough-Peak retracement with a triangle drawn.

Figure 1-6: Structure of one triangle, equilibrium fractal wave. It is made up from two price movements (i.e. two legs).

Figure 1-7: EFW Shape Ratio Distribution for EURUSD Daily Timeframe from 2009 09 02 to 2018 02 20 (Label inside callout box, left: Ratio, right: EFW Index, vertical axis: EFW index, horizontal axis: ratio from 0.1 to 3.0).

Figure 1-8: EFW Shape Ratio Distribution for GBPUSD Daily Timeframe from 2009 09 02 to 2018 02 20 (Label inside callout box, left: Ratio, right: EFW Index, vertical axis: EFW index, horizontal axis: ratio from 0.1 to 3.0).

Of course, we can find the scientific relevance for Fibonacci expansion technique too. To do so, we just need to create two triangles by connecting peak, trough, peak, and trough. In our 61.8% expansion example, we are predicting that the Momentum ratio of two adjacent triangles is 61.8%. The loose-self similarity will allow us to have any Momentum ratio from 0.01 to above 3.0. We could be wrong or right with our Momentum ratio prediction. To justify our choice over 61.8% expansion ratio, we just need to calculate the distribution of Momentum ratio index. Unfortunately, I do not have the calculated distribution for the case of Momentum ratio. However, I have provided you the equations in this book. You might attempt it by yourself.

Momentum ratio of equilibrium fractal wave = latest price move of current wave in price units (Y3)/ first movement of previous wave in price units (Y1) where Y3 and Y1 are in the same direction.

Momentum Ratio index = number of the particular Momentum ratio / number of peaks and troughs in the price series.

Figure 1-9: Peak-Trough Expansion Example with two triangles drawn.

Figure 1-10: Momentum ratio for two ascending Equilibrium Fractal waves

Once again, we emphasize that the distribution of Shape Ratio index and Momentum Ratio index can reveal a lot about financial market. When I first created the distribution of Shape Ratio, I felt like that I found the oil reservoir in the Sahara Desert. There were many useful insights for both scientific and financial trading purpose. I do recommend further research on this in academic level too. Finally, it is important to note that Fibonacci ratio is the basis for many other advanced technical analyses including Shape Ratio trading, Harmonic pattern, and Elliott wave patterns. Therefore, it is important to understand how the Fibonacci analysis works before you proceeding to the next chapter of this book.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis. Harmonic Pattern Plus is the advanced Fibonacci Analysis Indicator for your trading. Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

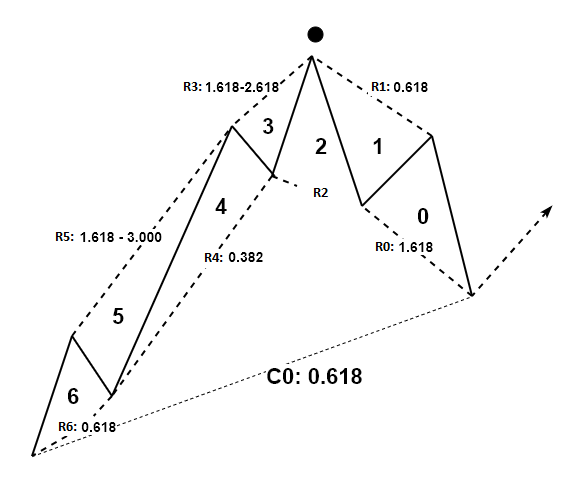

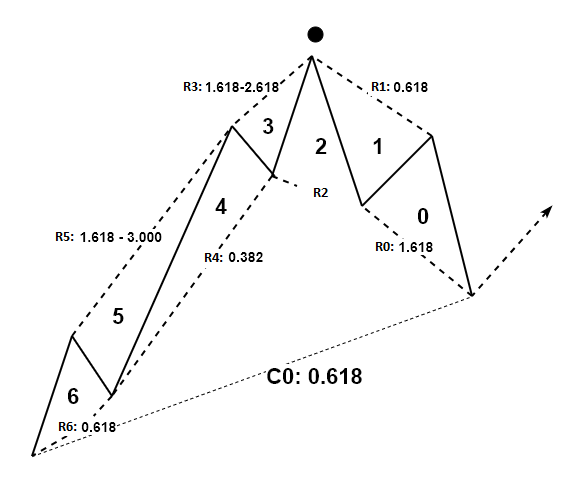

Fibonacci Price Patterns

A Fibonacci analysis is a popular tool among technical traders. It is based on the Fibonacci sequence numbers identified by Leonardo Fibonacci in the 13th century. The Fibonacci sequence numbers are:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, …………………

As the Fibonacci number become large, the constant relationship is established between neighbouring numbers. For example, every time, when we divide the former number by latter: Fn-1/Fn, we will get nearly 0.618 ratio. Likewise, when we divide the latter number by former: Fn/Fn-1, we will get nearly 1.618. These two Fibonacci ratio 0.618 and 1.618 are considered as the Golden Ratio. We can use these Golden ratios to start our Fibonacci analysis. However, many technical traders use additional Fibonacci ratios derived from the Golden ratio. Since the calculation of each Fibonacci ratio is well known, I have listed all the available Fibonacci ratio calculation in Table 6.1.

In fact, Fibonacci pattern analysis in financial trading is extremely popular. As with support and resistance analysis, Fibonacci analysis is probably the most popular technical analysis among traders. There are two important techniques in Fibonacci analysis. First technique is Fibonacci retracement. Second technique is Fibonacci expansion. In fact, former is just one triangle pattern and latter is two triangle patterns. Hence, you can consider these two as Fibonacci price patterns. These two price patterns share the identical concept to the retracement ratio and expansion ratio.

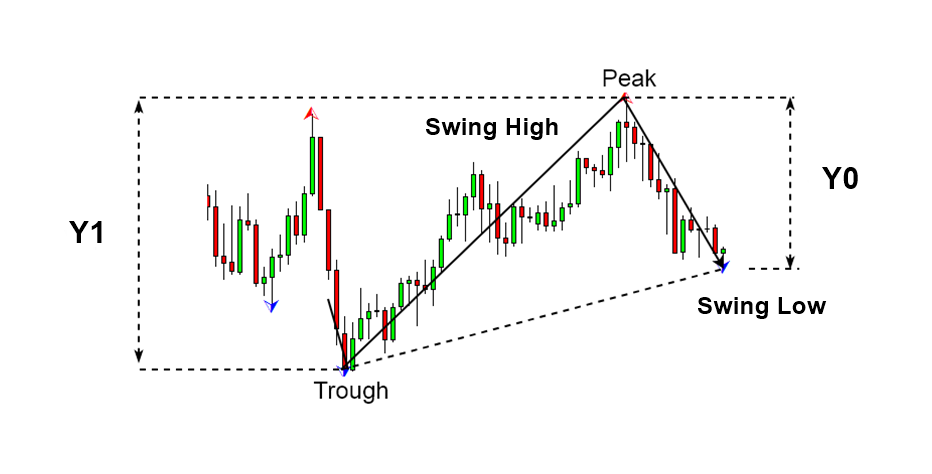

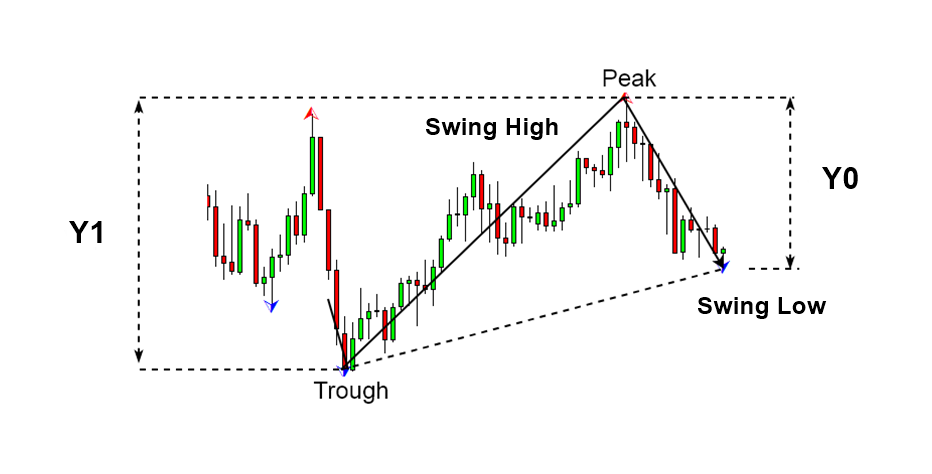

There are two important points in regards to Fibonacci patterns. Firstly, you need to spot swing high and swing low in price series to identify Fibonacci price patterns. The easiest way of doing this is just to apply Peak Trough Transformation using either ZigZag indicator or Renko chart. Therefore, you start with predefined swing points in your chart. Secondly, Fibonacci retracement technique will concern one triangle that is two price swings. Fibonacci expansion technique will concern two triangles that are three price swings. Most importantly, calculation of Fibonacci retracement and expansion is identical to the retracement ratio and expansion ratio calculation in RECF notation. Sometimes, we might use percentage format instead of decimal format. However, two quantities are the same. For example, the Golden ratio 0.618 is the same as 61.8%.

Let us start with Fibonacci retracement example. For simple example, we use 61.8% Golden ratio. For retracement, we can have two cases including bullish (Trough-Peak) retracement and bearish (Peak-Trough) retracement. In bullish retracement, 61.8% retracement level will act as a support level. Price will reverse in the correction phase to follow the previous bullish movement. In RECF pattern definition, 61.8% bullish retracement can be expressed as below:

R0 = 0.618 = Right swing of first triangle / Left swing of first triangle

Likewise, in bearish retracement, 61.8% level will act as resistance. Price will reverse in the correction phase to follow the previous bearish movement. In both case, the 61.8% retracement will be measured from end of correction phase to previous peak or trough. We have used percentage in this example. Some technical traders prefer to use the ratios in decimal places like 0.618. It is just your preferences. Using ratio or percentage does not affect the accuracy of trading. In RECF pattern definition, 61.8% bearish retracement can be expressed as below:

R0 = 0.618 = Right swing of first triangle / Left swing of first triangle

You can use other Fibonacci ratios like 0.382 or 1.618 in the exactly same way as 0.618. Some traders use secondary Fibonacci ratios in addition to the primary ratios.

Fibonacci expansion is slightly more complicated than Fibonacci retracement because it concerns two triangle (i.e. three price swings). As in retracement technique, we can have two cases including bearish (Trough-Peak) expansion and bullish (Peak-Trough) expansion. In bearish expansion, we will measure the expansion from where the correction ends to next peak. In the next peak, we will expect the bearish reversal in the same direction to the correction. In fact, the 100% Expansion level is act as the resistance in Figure 6-3. Likewise, in bullish expansion, we will expect the bullish reversal in the same direction to the correction. In Figure 6-4, 61.8% expansion level acts as the support. In RECF pattern definition, 61.8% bearish and bullish retracement can be expressed as below:

E0 = 0.618 = Right swing of first triangle / Left swing of second triangle

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

You can also use Harmonic Pattern Plus in MetaTrader to accomplish your technical analysis. Harmonic Pattern Plus is the advanced Fibonacci Analysis Indicator for your trading. Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

A Fibonacci analysis is a popular tool among technical traders. It is based on the Fibonacci sequence numbers identified by Leonardo Fibonacci in the 13th century. The Fibonacci sequence numbers are:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, …………………

As the Fibonacci number become large, the constant relationship is established between neighbouring numbers. For example, every time, when we divide the former number by latter: Fn-1/Fn, we will get nearly 0.618 ratio. Likewise, when we divide the latter number by former: Fn/Fn-1, we will get nearly 1.618. These two Fibonacci ratio 0.618 and 1.618 are considered as the Golden Ratio. We can use these Golden ratios to start our Fibonacci analysis. However, many technical traders use additional Fibonacci ratios derived from the Golden ratio. Since the calculation of each Fibonacci ratio is well known, I have listed all the available Fibonacci ratio calculation in Table 6.1.

In fact, Fibonacci pattern analysis in financial trading is extremely popular. As with support and resistance analysis, Fibonacci analysis is probably the most popular technical analysis among traders. There are two important techniques in Fibonacci analysis. First technique is Fibonacci retracement. Second technique is Fibonacci expansion. In fact, former is just one triangle pattern and latter is two triangle patterns. Hence, you can consider these two as Fibonacci price patterns. These two price patterns share the identical concept to the retracement ratio and expansion ratio.

There are two important points in regards to Fibonacci patterns. Firstly, you need to spot swing high and swing low in price series to identify Fibonacci price patterns. The easiest way of doing this is just to apply Peak Trough Transformation using either ZigZag indicator or Renko chart. Therefore, you start with predefined swing points in your chart. Secondly, Fibonacci retracement technique will concern one triangle that is two price swings. Fibonacci expansion technique will concern two triangles that are three price swings. Most importantly, calculation of Fibonacci retracement and expansion is identical to the retracement ratio and expansion ratio calculation in RECF notation. Sometimes, we might use percentage format instead of decimal format. However, two quantities are the same. For example, the Golden ratio 0.618 is the same as 61.8%.

Let us start with Fibonacci retracement example. For simple example, we use 61.8% Golden ratio. For retracement, we can have two cases including bullish (Trough-Peak) retracement and bearish (Peak-Trough) retracement. In bullish retracement, 61.8% retracement level will act as a support level. Price will reverse in the correction phase to follow the previous bullish movement. In RECF pattern definition, 61.8% bullish retracement can be expressed as below:

R0 = 0.618 = Right swing of first triangle / Left swing of first triangle

Likewise, in bearish retracement, 61.8% level will act as resistance. Price will reverse in the correction phase to follow the previous bearish movement. In both case, the 61.8% retracement will be measured from end of correction phase to previous peak or trough. We have used percentage in this example. Some technical traders prefer to use the ratios in decimal places like 0.618. It is just your preferences. Using ratio or percentage does not affect the accuracy of trading. In RECF pattern definition, 61.8% bearish retracement can be expressed as below:

R0 = 0.618 = Right swing of first triangle / Left swing of first triangle

You can use other Fibonacci ratios like 0.382 or 1.618 in the exactly same way as 0.618. Some traders use secondary Fibonacci ratios in addition to the primary ratios.