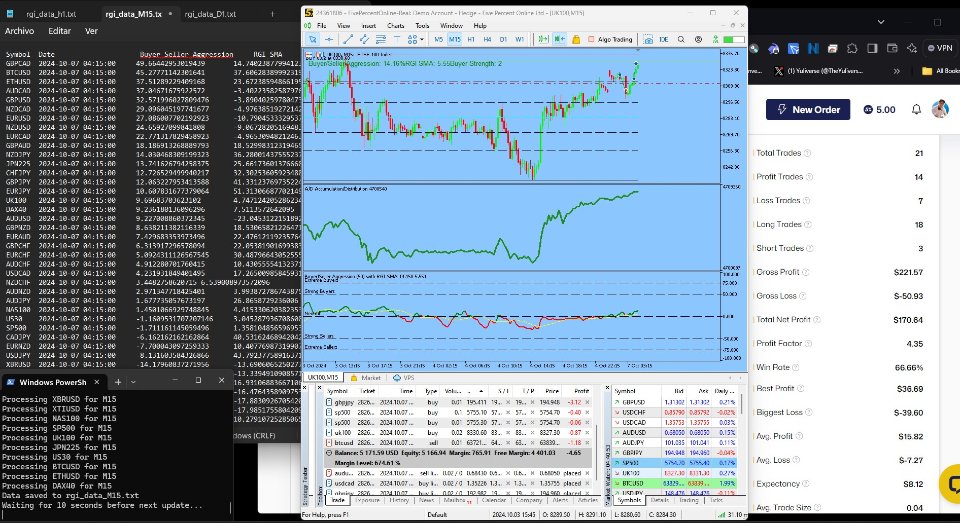

RGI indicator

- Индикаторы

- Avydel Talbo Doctolero

- Версия: 1.6

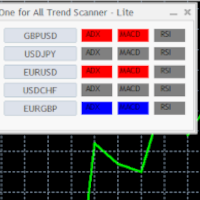

The RGI Buyer/Seller Aggression Indicator is an advanced technical analysis tool designed to measure and visualize the relative strength of buyers and sellers in the market. It plots a line that oscillates between -100 and 100, with positive values indicating buyer dominance and negative values showing seller dominance.Key Components

- Strength Calculation: The indicator analyzes candle structures over a specified lookback period (default 50 bars). It examines body size, upper wick, and lower wick to assess buyer and seller strength.

- ATR Integration: It incorporates the Average True Range (ATR) to adapt to market volatility, ensuring the indicator's responsiveness across different market conditions.

- Dynamic Scaling: The indicator uses a scaling method based on ATR and a user-defined MaxGapPercentage to ensure meaningful readings across different timeframes and instruments.

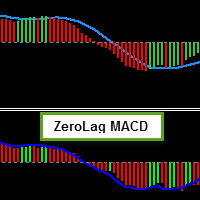

- Color-Coded Visualization: The main line changes color based on whether buyers (green) or sellers (red) are dominant, with a neutral state (gray) when forces are balanced.

- RGI SMA: A Simple Moving Average (SMA) of the main indicator line is plotted to smooth out short-term fluctuations and highlight the overall trend.

Unlike the Relative Strength Index (RSI), this indicator:

- Analyzes entire candle structures, not just closing prices

- Separately calculates and compares buyer and seller strength

- Incorporates ATR for dynamic scaling across different market conditions

- Revealing the invisible tug-of-war between bulls and bears

- Offers more comprehensive visual cues with color-coded lines and multiple plot types

- Provides real-time, detailed market insights through a dynamic label

The core calculation involves:

- Summing buyer and seller strength over the lookback period.

- Calculating the difference between buyer and seller strength.

- Scaling this difference based on ATR and MaxPercentage.

- Normalizing the result to fit within the -100 to 100 range.

- Real-time Information Display: A label provides current indicator values, buyer/seller strengths, ATR, and max strength, updating with each new bar.

- Customizable Levels: Predefined levels (75, 50, 0, -50, -75) help identify extreme buyer/seller conditions and neutral zones.

- Flexible Parameters: Users can adjust lookback period, ATR period, max percentage, and RGI SMA period.

- Values above 50 suggest strong buyer presence

- Values below -50 indicate strong seller presence

- The crossover of the main line with its SMA can signal potential trend changes

Developed by Avydel Talbo, this RGI Buyer/Seller Aggression Indicator represents a significant advancement in technical analysis tools. It offers traders a more nuanced and comprehensive view of market dynamics compared to traditional oscillators, potentially providing earlier and more accurate signals for divergence-based trading strategies.

Important Notice: This powerful indicator is available for free for a limited time only. Traders are encouraged to take advantage of this unique opportunity while it lasts. Don't miss out on the chance to elevate your trading strategy with this cutting-edge tool.

Good Indicator. Testing it out... When it crosses up from neutral or down from neutral it is dangerous. It has a good potential. I will advise the creator to invest more features into it.. Like Push notifications when it crosses from neutral to stronger zones. Keep it up. More Grace for making this Gold free