당사 팬 페이지에 가입하십시오

- 조회수:

- 7454

- 평가:

- 게시됨:

- 2011.10.04 15:24

- 업데이트됨:

- 2016.11.22 07:32

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

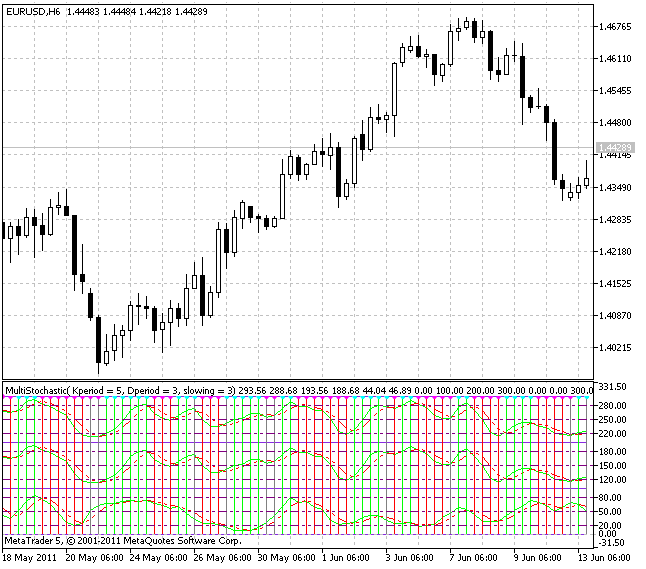

The indicator for multi-currency technical analysis based on the related financial assets resonances.

The idea of the correlation between different financial assets is not new and it would be interesting to develop the algorithm based exactly on the analysis of such a regularities. The indicator contains multi-currency code based on the article of Vasily Yakimkin "Resonances - a New Class of Technical Indicators" published in the "Currency Speculator" magazine (2001).

In few words, the idea of this method is as follows. For example, to analyze the EUR/USD market we may use not only the readings of any indicator concerning this asset but also the readings of the same indicator concerning the related assets - EUR/JPY and USD/JPY.

It is better to use the indicator with the values normalized in the same range of changes to provide simplicity and convenience of measurements and calculations. Stochastic Oscillator is quite suitable for that purposes and it was used in this indicator.

Detailed description of this indicator and its signals can be found in the article "Creating an Expert Advisor, which Trades on a Number of Instruments".

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/451

Keltner Channels Set

Keltner Channels Set

Set of Keltner Channels based on the universal smoothing.

Murrey Math Lines for the Current Bar

Murrey Math Lines for the Current Bar

Murrey Math Lines for the current bar are an effective tool for the market movements forecasts.

Chaikin Volatility Index With a Smoothing Algorithm Selection

Chaikin Volatility Index With a Smoothing Algorithm Selection

Chaikin Volatility Index determines volatility on the basis of the range width between minimum and maximum. The presented variant of this popular indicator allows to select the smoothing algorithm out of ten possible variants.

ZigZag

ZigZag

The variant of the ZigZag indicator optimized by its operation rate.