당사 팬 페이지에 가입하십시오

- 조회수:

- 12878

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

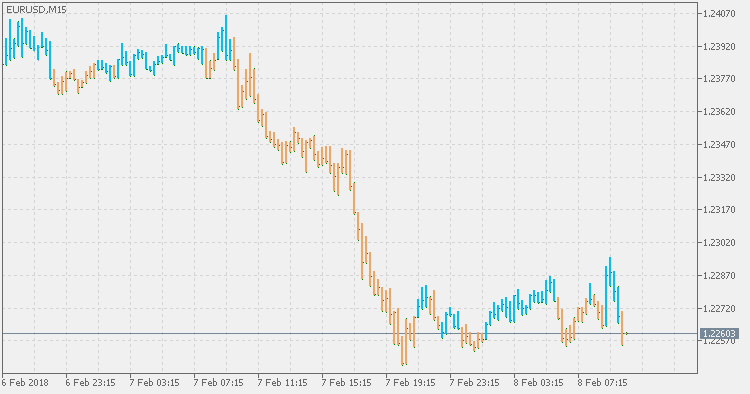

There is already one TTM trend in the code base, but this one is doing the calculation in a different way.

The TTM (Trade The Markets) Trend is basically an easier way to look at candlesticks. It is the The Heikin-Ashi method. Literally translated Heikin is "average" or "balance,", while Ashi means "foot" or "bar." The TTM trend is a visual technique that eliminates the irregularities from a normal candlestick chart and offers a better picture of trends and consolidations.

The TTM Trend can be modified to suit your trading personality or style. If look back bars closes above the 50% mark of the average for the past look back candlesticks, it changes color to bearish. If look back bars closes below the 50% mark of the average for the past look back candlesticks, the TTM Trend changes color to bullish. It is simple, but the TTM Trend is definitely an easier way to look at charts.

MACD TEMA

MACD TEMA

MACD TEMA is even a bit more "faster" than MACD DEMA so, depending on the parameters, in scalping mode (short calculating periods) or trending mode (when longer periods are used. Never forget that MACD is primarily a momentum indicator and that it is the main goal of MACD.

MACD DEMA

MACD DEMA

MACD that is using DEMA fo calculation.

Directional Efficiency Ratio

Directional Efficiency Ratio

The Efficiency Ratio (ER) was first presented by Perry Kaufman in his 1995 book "Smarter Trading". It is calculated by dividing the price change over a period by the absolute sum of the price movements that occurred to achieve that change. The resulting ratio ranges between 0 and 1 with higher values representing a more efficient or trending market.

Stochastic Momentum Index

Stochastic Momentum Index

The Stochastic Momentum Index (SMI) was developed by William Blau and was introduced in the January 1993 issue of Technical Analysis of Stocks & Commodities magazine. It incorporates an interesting twist on the popular Stochastic Oscillator. While the Stochastic Oscillator provides you with a value showing the distance the current close is relative to the recent x-period high/low range, the SMI shows you where the close is relative to the midpoint of the recent x-period high/low range.