LiteFinance / プロファイル

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

LiteFinance

Dollar got into a time trap. Forecast as of 06.04.2021

Monthly US dollar fundamental forecast

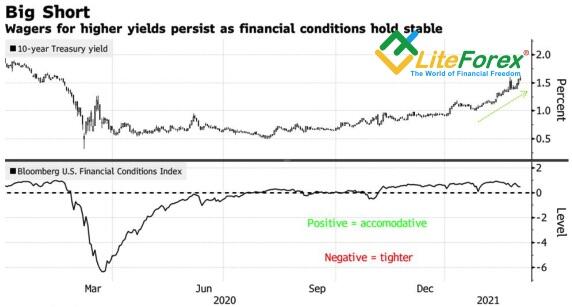

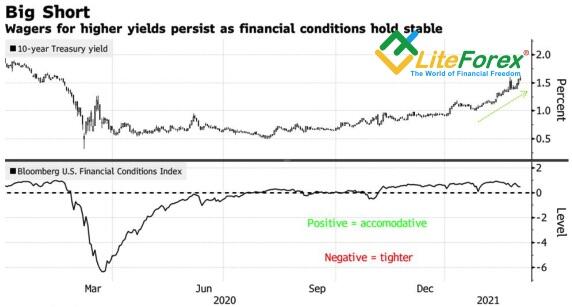

I have many times written that the US dollar won’t rise on the US strong domestic data in April like it did on weak reports in March. In March, the major growth driver for the greenback was the Treasury yields rally. However, the US debt market was overvalued at that time. It is high time the situation stabilized, which the EURUSD bulls have taken advantage of.

It would seem that an impressive employment increase by 916,000 in March and the strongest growth in the ISM services PMI since the record began in 1997 should have discouraged the US dollar bears. However, as I expected, the market has revealed its true nature – the Treasury yield hasn’t increased, while the S&P 500, on the contrary, has hit a new all-time high. An increase in the global risk appetite usually puts pressure on safe-haven assets, such as the greenback. Therefore, the EURUSD bulls managed to test level 1.18.

Some analysts suggest that the purchasing managers’ indexes and employment data are not strong enough to force the Fed to consider any moves towards monetary normalization. Furthermore, Federal Reserve Bank of Cleveland President Loretta Mester said the better-than-expected March payroll report was “great” but not great enough, so the Fed is willing to be patient. But how could it be better!

In my opinion, the Treasury yields are not growing because investors doubt the adoption of Joe Biden’s $3-$4 trillion fiscal stimulus by Congress. The aid project should be paid for by the tax rise, which the big business behind the legislators is not willing to accept. Eventually, the Treasuries issue may not be as sizable as it was expected, and the US economy may not be growing that fast.

It is incorrect to compare March hand April, also because of the epidemiological situation in Europe. Therefore, those who try to act according to the former principles could fall into a trap. For example, Goldman Sachs recommends closing USD shorts versus commodity currencies, as firm U.S. growth and rising bond yields may keep the greenback supported over the short term. The majority of Forex traders share this opinion.

I believe Goldman Sachs and others, sharing the same opinion, could fall into a time trap, missing the start of the EURUSD uptrend. However, Goldman is still quite bearish on the dollar medium- and long-term outlook. The bank suggests the euro should be at $1.21 and $1.28 in 3 and 12 months, respectively.

Monthly EURUSD trading plan

As I noted earlier, it is too early to be optimistic about the euro and too late to be pessimistic. The EURUSD is likely to be consolidating in the range of 1.17-1.195, and it will be relevant to sell on the price rise and buy on the price fall.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-got-into-a-time-trap-forecast-as-of-06042021/?uid=285861726&cid=79634

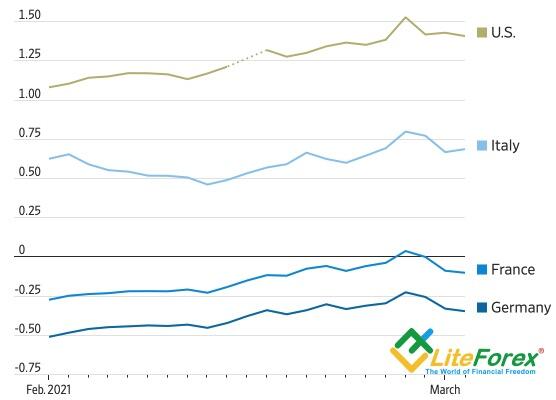

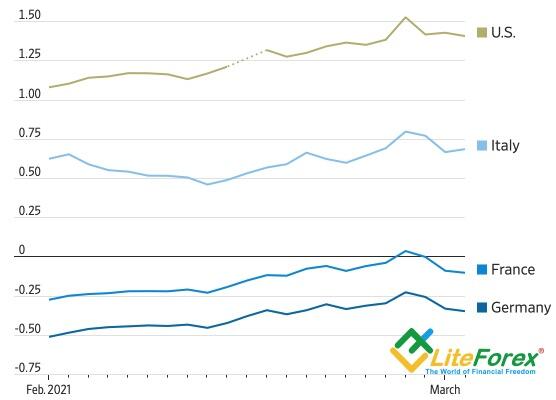

Dynamics of US services PMI

Monthly US dollar fundamental forecast

I have many times written that the US dollar won’t rise on the US strong domestic data in April like it did on weak reports in March. In March, the major growth driver for the greenback was the Treasury yields rally. However, the US debt market was overvalued at that time. It is high time the situation stabilized, which the EURUSD bulls have taken advantage of.

It would seem that an impressive employment increase by 916,000 in March and the strongest growth in the ISM services PMI since the record began in 1997 should have discouraged the US dollar bears. However, as I expected, the market has revealed its true nature – the Treasury yield hasn’t increased, while the S&P 500, on the contrary, has hit a new all-time high. An increase in the global risk appetite usually puts pressure on safe-haven assets, such as the greenback. Therefore, the EURUSD bulls managed to test level 1.18.

Some analysts suggest that the purchasing managers’ indexes and employment data are not strong enough to force the Fed to consider any moves towards monetary normalization. Furthermore, Federal Reserve Bank of Cleveland President Loretta Mester said the better-than-expected March payroll report was “great” but not great enough, so the Fed is willing to be patient. But how could it be better!

In my opinion, the Treasury yields are not growing because investors doubt the adoption of Joe Biden’s $3-$4 trillion fiscal stimulus by Congress. The aid project should be paid for by the tax rise, which the big business behind the legislators is not willing to accept. Eventually, the Treasuries issue may not be as sizable as it was expected, and the US economy may not be growing that fast.

It is incorrect to compare March hand April, also because of the epidemiological situation in Europe. Therefore, those who try to act according to the former principles could fall into a trap. For example, Goldman Sachs recommends closing USD shorts versus commodity currencies, as firm U.S. growth and rising bond yields may keep the greenback supported over the short term. The majority of Forex traders share this opinion.

I believe Goldman Sachs and others, sharing the same opinion, could fall into a time trap, missing the start of the EURUSD uptrend. However, Goldman is still quite bearish on the dollar medium- and long-term outlook. The bank suggests the euro should be at $1.21 and $1.28 in 3 and 12 months, respectively.

Monthly EURUSD trading plan

As I noted earlier, it is too early to be optimistic about the euro and too late to be pessimistic. The EURUSD is likely to be consolidating in the range of 1.17-1.195, and it will be relevant to sell on the price rise and buy on the price fall.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-got-into-a-time-trap-forecast-as-of-06042021/?uid=285861726&cid=79634

Dynamics of US services PMI

LiteFinance

Dollar is to reveal its true nature. Forecast as of 05.04.2021

Weekly US dollar fundamental forecast

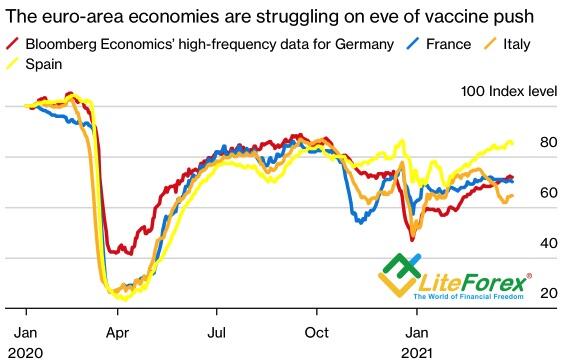

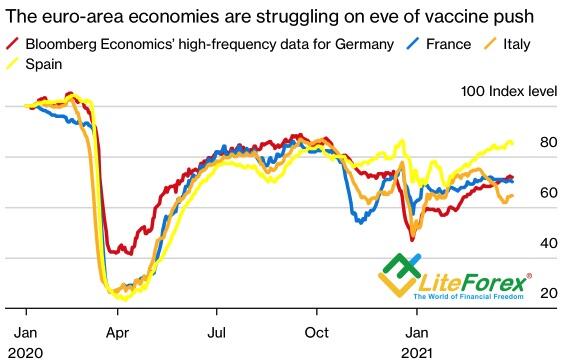

In April, it is too late to be pessimistic about the EURUSD outlook, and it is too early to be optimistic. Europe faces a gloomy spring as the continent manages the vaccine shortage, more infectious variants of COVID-19, and pandemic fatigue. However, the euro bulls hope that the epidemiological situation will soon improve, the European Recovery Fund will be ratified, and the euro-area economy will rebound, also due to the USA.

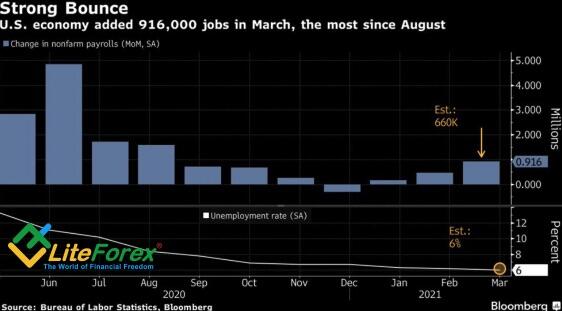

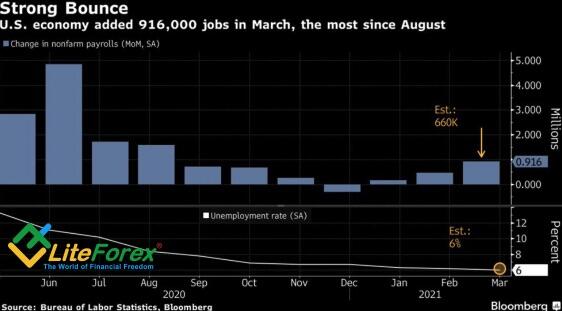

In March, the US labor market added 916,000 new jobs. In addition to the revision of the January and February employment up and the drop in the unemployment to a pandemic low of 6%, it allows optimists to say that the US economy undergoes radical changes. Pessimists, on the contrary, note that another 8.4 million new jobs are needed for the labor market recovery. The US has a long way to go, and the Fed has no choice but to continue monetary stimulus and keep rates at current levels until at least 2023.

The financial market reaction to the release of the US jobs report was muted as the stock market was closed due to Good Friday, and the bond market had reduced working hours. U.S. Treasury yields received a bump higher following the report, with the 10-year rate climbing as high as 1.724%, which somehow discouraged the EURUSD bulls. Investors shifted their focus to the report on the ISM services PMI data. The market should feature a more genuine reaction then.

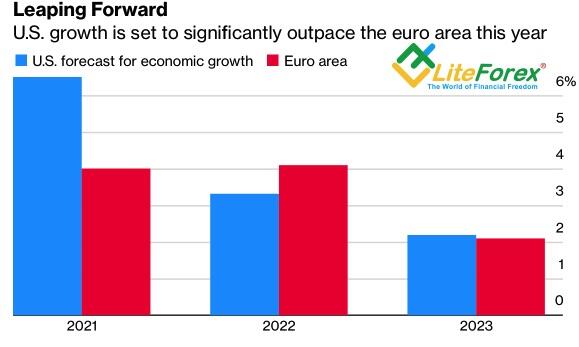

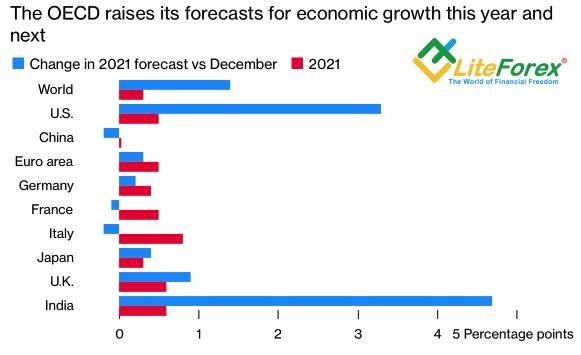

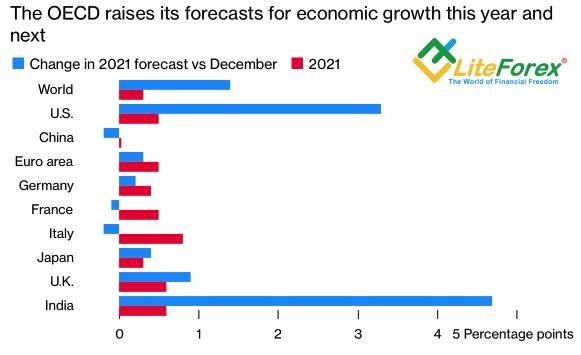

The update of the IMF forecasts for global growth is also worth attention. In January, the IMF expected to see the global GDP at 5.1%. However, due to a new fiscal stimulus package from Joe Biden and accelerated vaccinations in the USA, the estimate is likely to be raised. Much of the International Monetary Fund's optimism is associated with the United States, which will become the engine of global economic growth in 2021. It would seem that American exclusivity will continue to support the USD rally, but a lot can change in the second part of spring.

Analysts are increasingly speaking about the two-speed economy. Among the leaders are the United States, China, UK, and other countries where vaccines are being actively introduced. The outsiders are emerging markets, whose access to drugs from Pfizer, AstraZeneca, Moderna, and other companies is limited, and Europe, where the vaccination company is progressing extremely slowly. However, the EU vaccination rate could increase, and the export-led euro-area economy could benefit from the increase in US imports.

Weekly EURUSD trading plan

Under such circumstances, it is important to choose the right time. It should be too early to buy the euro, but it is already too late to sell the euro-dollar actively. The potential of the EURUSD downtrend looks limited, and it should soon be relevant to buy the pair on the price decline to 1.158-1.164. However, until the EURUSD price consolidates above 1.184, bears continue to dominate in the market, and it is still relevant to enter short-term sell trades.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-to-reveal-its-true-nature-forecast-as-of-05042021/?uid=285861726&cid=79634

Dynamics of US employment

Weekly US dollar fundamental forecast

In April, it is too late to be pessimistic about the EURUSD outlook, and it is too early to be optimistic. Europe faces a gloomy spring as the continent manages the vaccine shortage, more infectious variants of COVID-19, and pandemic fatigue. However, the euro bulls hope that the epidemiological situation will soon improve, the European Recovery Fund will be ratified, and the euro-area economy will rebound, also due to the USA.

In March, the US labor market added 916,000 new jobs. In addition to the revision of the January and February employment up and the drop in the unemployment to a pandemic low of 6%, it allows optimists to say that the US economy undergoes radical changes. Pessimists, on the contrary, note that another 8.4 million new jobs are needed for the labor market recovery. The US has a long way to go, and the Fed has no choice but to continue monetary stimulus and keep rates at current levels until at least 2023.

The financial market reaction to the release of the US jobs report was muted as the stock market was closed due to Good Friday, and the bond market had reduced working hours. U.S. Treasury yields received a bump higher following the report, with the 10-year rate climbing as high as 1.724%, which somehow discouraged the EURUSD bulls. Investors shifted their focus to the report on the ISM services PMI data. The market should feature a more genuine reaction then.

The update of the IMF forecasts for global growth is also worth attention. In January, the IMF expected to see the global GDP at 5.1%. However, due to a new fiscal stimulus package from Joe Biden and accelerated vaccinations in the USA, the estimate is likely to be raised. Much of the International Monetary Fund's optimism is associated with the United States, which will become the engine of global economic growth in 2021. It would seem that American exclusivity will continue to support the USD rally, but a lot can change in the second part of spring.

Analysts are increasingly speaking about the two-speed economy. Among the leaders are the United States, China, UK, and other countries where vaccines are being actively introduced. The outsiders are emerging markets, whose access to drugs from Pfizer, AstraZeneca, Moderna, and other companies is limited, and Europe, where the vaccination company is progressing extremely slowly. However, the EU vaccination rate could increase, and the export-led euro-area economy could benefit from the increase in US imports.

Weekly EURUSD trading plan

Under such circumstances, it is important to choose the right time. It should be too early to buy the euro, but it is already too late to sell the euro-dollar actively. The potential of the EURUSD downtrend looks limited, and it should soon be relevant to buy the pair on the price decline to 1.158-1.164. However, until the EURUSD price consolidates above 1.184, bears continue to dominate in the market, and it is still relevant to enter short-term sell trades.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-to-reveal-its-true-nature-forecast-as-of-05042021/?uid=285861726&cid=79634

Dynamics of US employment

LiteFinance

Dollar: It is time of facts. Forecast as of 02.04.2021

The US jobs report for March could determine the EURUSD trend for the next month or even longer. Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast today

In March, the US dollar showed quite a good performance, often amid weak US domestic data. We shall see the dollar price moves when the economic data start improving steadily. The EURUSD reaction to the US jobs report could determine the market trend for the next month or even longer. We shall closely watch the market movements.

Daiwa Securities notes that not only speculators buy the greenback but also asset managers. The company says the USD index will continue the rally as long as the US economy grows and Treasury yields are rising. Nordea Markets shares the same opinion, suggesting the EURUSD is heading for 1.15. I do not think so.

Markets are rising on the expectations. It happened so that the US GDP forecasts for 2021 were upgrading amid massive fiscal stimulus and rapid vaccination, while the failure of the COVID-19 vaccination campaign in the EU, the extension of the lockdowns, and the third pandemic wave in Europe made JP Morgan and Deutsche Bank downgrade the euro-area growth forecasts from 5.8% to 5.3% and from 5.6% to 4.6%, respectively. Therefore, investors were selling off the EURUSD on the rumors, and now it is time to take the facts into account. The fact is that the euro-area PMIs are growing despite the restrictions, and the US economic recovery could support other world’s economies, including the euro area.

The euro-area manufacturing sector managed to provide a growth momentum for the composite PMI in March. Germany’s manufacturing PMI has featured the best growth over the 25-year history of records. Furthermore, the WTO increases international trade forecasts for 2021 to 8%, which is a strong argument for buying the export-led countries' currencies. I mean euro. The WTO notes that Joe Biden’s $1.9 trillion stimulus will increase demand in North America by 11.4%. Most of the demand will be satisfied by the producers from Asia and Europe.

Therefore, EURUSD bulls lack only one thing, the acceleration of the vaccination campaign. In the EU, only 16.5% of the population received at least one dose, compared to 45.6% in the USA. I believe the situation should improve in the second quarter. The matter is in psychology, first of all. There are quite many people who are unwilling to vaccinate. Therefore, a quick start does not guarantee a victorious finish.

A strong jobs report will only convince the strong position of the US economy, which in the medium term is a benefit for export-led countries. In this regard, employment growth above 647,000 expected by Reuters experts may provoke a further rally in the S&P 500 and support the EURUSD. On the other hand, if Treasury yields resume growth, the euro will come under pressure.

EURUSD trading plan today

The market reaction is interesting and should determine the EURUSD trend for the next month or even longer. It will be relevant to enter longs if the price breaks out the resistance levels of 1.18 and 1.184. If the EURUSD bulls fail to consolidate the price above the indicated levels, they will prove their weakness.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-it-is-time-of-facts-forecast-as-of-02042021/?uid=285861726&cid=79634

Dynamics of leading economic indicators

The US jobs report for March could determine the EURUSD trend for the next month or even longer. Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast today

In March, the US dollar showed quite a good performance, often amid weak US domestic data. We shall see the dollar price moves when the economic data start improving steadily. The EURUSD reaction to the US jobs report could determine the market trend for the next month or even longer. We shall closely watch the market movements.

Daiwa Securities notes that not only speculators buy the greenback but also asset managers. The company says the USD index will continue the rally as long as the US economy grows and Treasury yields are rising. Nordea Markets shares the same opinion, suggesting the EURUSD is heading for 1.15. I do not think so.

Markets are rising on the expectations. It happened so that the US GDP forecasts for 2021 were upgrading amid massive fiscal stimulus and rapid vaccination, while the failure of the COVID-19 vaccination campaign in the EU, the extension of the lockdowns, and the third pandemic wave in Europe made JP Morgan and Deutsche Bank downgrade the euro-area growth forecasts from 5.8% to 5.3% and from 5.6% to 4.6%, respectively. Therefore, investors were selling off the EURUSD on the rumors, and now it is time to take the facts into account. The fact is that the euro-area PMIs are growing despite the restrictions, and the US economic recovery could support other world’s economies, including the euro area.

The euro-area manufacturing sector managed to provide a growth momentum for the composite PMI in March. Germany’s manufacturing PMI has featured the best growth over the 25-year history of records. Furthermore, the WTO increases international trade forecasts for 2021 to 8%, which is a strong argument for buying the export-led countries' currencies. I mean euro. The WTO notes that Joe Biden’s $1.9 trillion stimulus will increase demand in North America by 11.4%. Most of the demand will be satisfied by the producers from Asia and Europe.

Therefore, EURUSD bulls lack only one thing, the acceleration of the vaccination campaign. In the EU, only 16.5% of the population received at least one dose, compared to 45.6% in the USA. I believe the situation should improve in the second quarter. The matter is in psychology, first of all. There are quite many people who are unwilling to vaccinate. Therefore, a quick start does not guarantee a victorious finish.

A strong jobs report will only convince the strong position of the US economy, which in the medium term is a benefit for export-led countries. In this regard, employment growth above 647,000 expected by Reuters experts may provoke a further rally in the S&P 500 and support the EURUSD. On the other hand, if Treasury yields resume growth, the euro will come under pressure.

EURUSD trading plan today

The market reaction is interesting and should determine the EURUSD trend for the next month or even longer. It will be relevant to enter longs if the price breaks out the resistance levels of 1.18 and 1.184. If the EURUSD bulls fail to consolidate the price above the indicated levels, they will prove their weakness.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-it-is-time-of-facts-forecast-as-of-02042021/?uid=285861726&cid=79634

Dynamics of leading economic indicators

LiteFinance

Dollar is in a blaze of glory. Won’t it burn? Forecast as of 01.04.2021

Quarterly US dollar fundamental forecast

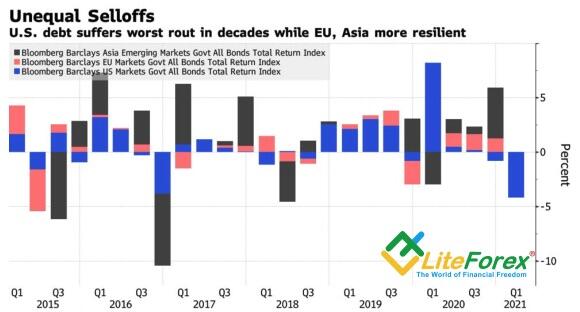

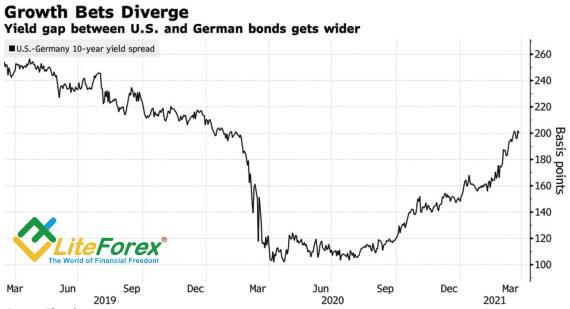

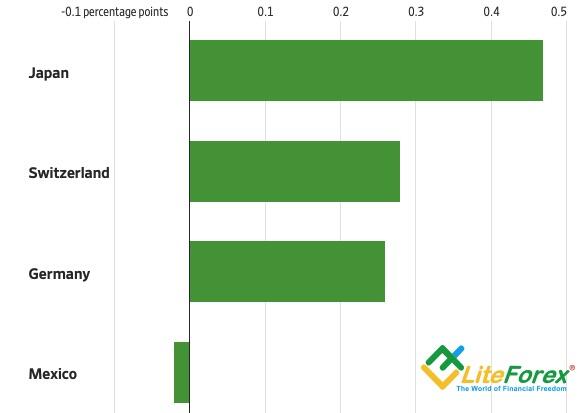

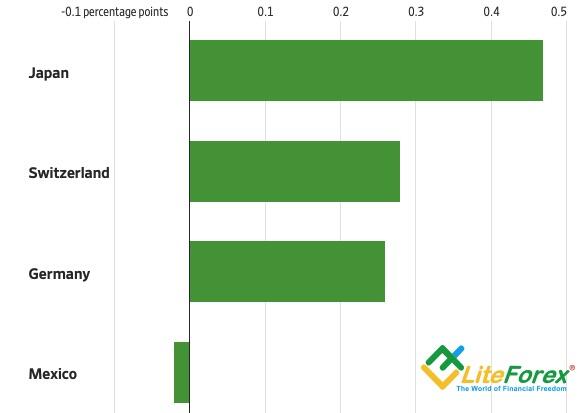

The US Treasuries rally has become the primary growth driver for the US dollar, which has featured the best quarterly rise over the past few years. According to Barclays research, Treasuries faced the worst sell-off since 1980, which spiked yields and dramatically increased the demand for US assets. By comparison, yields on European and Asian bonds fell at the same rate as in 2019 and 2020, respectively.

Rapid vaccinations, massive stimulus, and the associated confidence in the U.S. economy picking up to its best growth rate since 1983 have boosted 10-year Treasury yields from 0.91% to 1.74%. According to Morgan Stanley, Japanese investors were the first to start selling US government bonds. The bank noted the increased activity of sellers at the Asian session at the end of February, at Asian and European sessions in early March. At the same time, according to the Japanese Ministry of Finance, the net profits of local investors from the sale of foreign bonds from early February to March 20 amounted to $25.5 billion.

Therefore, Japan contributed to the 4% EURUSD drop since the beginning of the year. The matter is if the euro downtrend is about to stop or the worst is yet to come.

Joe Biden announced a new $2.3 trillion fiscal stimulus package that is planned to expand in April to bring the total additional aid to $3-$4 trillion. In theory, this should further accelerate economic growth. However, the inflation rise, the increase in the debt servicing costs and taxes will lead to the fact that the recovery after the 2020 recession will be much shorter than after the previous crisis. It can well end by the middle of this decade.

The long-term dollar outlook is not as positive as the short-term, and the euro could start rising in the next six months. Meanwhile, the ECB continues to repeat the mantra that temporary factors caused the inflation growth in Germany and the euro area in March. Christine Lagarde says that financial markets can test the central bank's strength for as long as necessary. The central bank has enough tools to clamp on the yield growth, and it should retain the policy unchanged. However, there is a growing split among the Governing Council's members.

The German population is aging and is saving more than spending. The negative interest rates hit the economy. As vaccination progresses and the lockdowns are lifted, the euro-area bond yield growth will become an objective reality. Furthermore, the euro-area bond yields could be growing faster than the US yields. If so, the euro will be supported.

Quarterly EURUSD trading plan

I believe the EURUSD trend should reverse in April or May. Many bearish drivers have already been priced, and positive news from Europe will allow the euro to go up. It will be relevant to enter long- and medium-term longs if the EURUSD goes back above the resistances at 1.185 and 1.193 or if the bears fail to break out the support zone of 1.158-1.164.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-in-a-blaze-of-glory-wont-it-burn-forecast-as-of-01042021/?uid=285861726&cid=79634

Dynamics of Barclays indexes

Quarterly US dollar fundamental forecast

The US Treasuries rally has become the primary growth driver for the US dollar, which has featured the best quarterly rise over the past few years. According to Barclays research, Treasuries faced the worst sell-off since 1980, which spiked yields and dramatically increased the demand for US assets. By comparison, yields on European and Asian bonds fell at the same rate as in 2019 and 2020, respectively.

Rapid vaccinations, massive stimulus, and the associated confidence in the U.S. economy picking up to its best growth rate since 1983 have boosted 10-year Treasury yields from 0.91% to 1.74%. According to Morgan Stanley, Japanese investors were the first to start selling US government bonds. The bank noted the increased activity of sellers at the Asian session at the end of February, at Asian and European sessions in early March. At the same time, according to the Japanese Ministry of Finance, the net profits of local investors from the sale of foreign bonds from early February to March 20 amounted to $25.5 billion.

Therefore, Japan contributed to the 4% EURUSD drop since the beginning of the year. The matter is if the euro downtrend is about to stop or the worst is yet to come.

Joe Biden announced a new $2.3 trillion fiscal stimulus package that is planned to expand in April to bring the total additional aid to $3-$4 trillion. In theory, this should further accelerate economic growth. However, the inflation rise, the increase in the debt servicing costs and taxes will lead to the fact that the recovery after the 2020 recession will be much shorter than after the previous crisis. It can well end by the middle of this decade.

The long-term dollar outlook is not as positive as the short-term, and the euro could start rising in the next six months. Meanwhile, the ECB continues to repeat the mantra that temporary factors caused the inflation growth in Germany and the euro area in March. Christine Lagarde says that financial markets can test the central bank's strength for as long as necessary. The central bank has enough tools to clamp on the yield growth, and it should retain the policy unchanged. However, there is a growing split among the Governing Council's members.

The German population is aging and is saving more than spending. The negative interest rates hit the economy. As vaccination progresses and the lockdowns are lifted, the euro-area bond yield growth will become an objective reality. Furthermore, the euro-area bond yields could be growing faster than the US yields. If so, the euro will be supported.

Quarterly EURUSD trading plan

I believe the EURUSD trend should reverse in April or May. Many bearish drivers have already been priced, and positive news from Europe will allow the euro to go up. It will be relevant to enter long- and medium-term longs if the EURUSD goes back above the resistances at 1.185 and 1.193 or if the bears fail to break out the support zone of 1.158-1.164.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-in-a-blaze-of-glory-wont-it-burn-forecast-as-of-01042021/?uid=285861726&cid=79634

Dynamics of Barclays indexes

LiteFinance

Euro sees no light. Forecast as of 29.03.2021

The divergence in the epidemiological situation and economic expansion in the US and euro area creates a solid foundation for the EURUSD downtrend. Will the pair find support or continue falling? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

The euro hasn’t found support even though there are several positive factors. Germany IFO Business Climate index increased, which suggests Germany’s economy to strengthen despite a surge in coronavirus cases. The S&P 500 returned to the zone of all-time highs. This situation is another evidence that the EURUSD bulls are in a panic. The euro could end March with the worst result since mid-2020, and there is no light in the dark clouds.

The major driver for the EURUSD downtrend is the divergence in the epidemiological situation. The US should return to normal within the next few months, while Europe fails to effectively manage the pandemic. Germany warns that the third coronavirus wave could be the worst in Europe, suggesting the return to curfew. At the beginning of the year, the EU governments planned to vaccinate 70% of the population by the end of the summer, but, as Christine Lagarde ironically noted, the summer may not end on September 21.

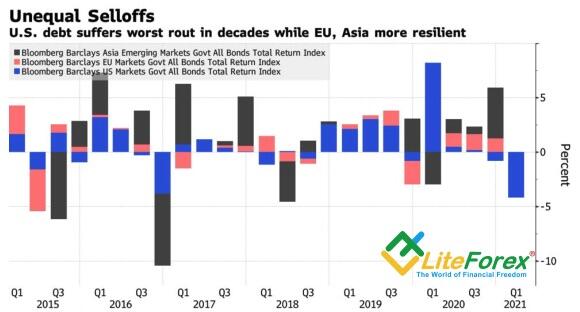

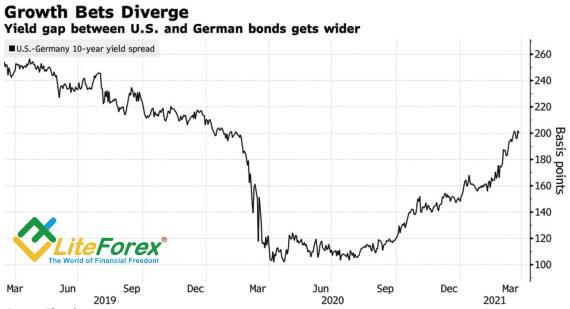

As a result, options traders are at their most bearish on the euro since July, and the gap between German and US 10-year yields is the widest in a year, which forces the capital outflow from Europe into the USA, pressing down the EURUSD.

The euro is pressed down not only by the coronavirus but also by the weaker yuan and the absence of the European recovery fund project ratification by the German Constitutional Court.

After growth in eight months out of nine from April to December last year, Renminbi weakened in February and featured the worst performance in a year in March. Investors are concerned about a potential resumption of the US-China trade war. China has fulfilled only one-third of its promises under the trade deal signed with Donald Trump and shows that it is now afraid of Joe Biden. In response to retaliatory measures from the West, China imposed sanctions on the United States and Canada and signed a 25-year cooperation agreement with Iran, thereby challenging the United States. The US forbids other countries to buy oil from Tehran, but Beijing ignores this instruction. The yuan is falling in price, discouraging the EURUSD bulls.

Germany’s constitutional court said that the president may not sign off on legislation ratifying the European Union’s Recovery Fund due to urgent appeals from certain political parties in the country alleging that it violates European treaties by opening the door to joint borrowing by member states. After the ECB Chief Economist, Philip Lane, noted that the euro-area economic recovery is highly dependent on fiscal policy, it is clear how important the fund is for the currency bloc and the euro.

Weekly EURUSD trading plan

Therefore, the EURUSD bulls are in a difficult situation. There are too many negative factors in the euro area, and the pair’s inability to consolidate at the new red line of 1.18 could continue sell-offs. Nordea Markets suggests the euro is heading to $1.15. In my opinion, if the pair breaks out the support at 1.176, it can continue falling to 1.172 and 1.168.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-sees-no-light-forecast-as-of-29032021/?uid=285861726&cid=79634

Dynamics of German-US 10-year yield gap

The divergence in the epidemiological situation and economic expansion in the US and euro area creates a solid foundation for the EURUSD downtrend. Will the pair find support or continue falling? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

The euro hasn’t found support even though there are several positive factors. Germany IFO Business Climate index increased, which suggests Germany’s economy to strengthen despite a surge in coronavirus cases. The S&P 500 returned to the zone of all-time highs. This situation is another evidence that the EURUSD bulls are in a panic. The euro could end March with the worst result since mid-2020, and there is no light in the dark clouds.

The major driver for the EURUSD downtrend is the divergence in the epidemiological situation. The US should return to normal within the next few months, while Europe fails to effectively manage the pandemic. Germany warns that the third coronavirus wave could be the worst in Europe, suggesting the return to curfew. At the beginning of the year, the EU governments planned to vaccinate 70% of the population by the end of the summer, but, as Christine Lagarde ironically noted, the summer may not end on September 21.

As a result, options traders are at their most bearish on the euro since July, and the gap between German and US 10-year yields is the widest in a year, which forces the capital outflow from Europe into the USA, pressing down the EURUSD.

The euro is pressed down not only by the coronavirus but also by the weaker yuan and the absence of the European recovery fund project ratification by the German Constitutional Court.

After growth in eight months out of nine from April to December last year, Renminbi weakened in February and featured the worst performance in a year in March. Investors are concerned about a potential resumption of the US-China trade war. China has fulfilled only one-third of its promises under the trade deal signed with Donald Trump and shows that it is now afraid of Joe Biden. In response to retaliatory measures from the West, China imposed sanctions on the United States and Canada and signed a 25-year cooperation agreement with Iran, thereby challenging the United States. The US forbids other countries to buy oil from Tehran, but Beijing ignores this instruction. The yuan is falling in price, discouraging the EURUSD bulls.

Germany’s constitutional court said that the president may not sign off on legislation ratifying the European Union’s Recovery Fund due to urgent appeals from certain political parties in the country alleging that it violates European treaties by opening the door to joint borrowing by member states. After the ECB Chief Economist, Philip Lane, noted that the euro-area economic recovery is highly dependent on fiscal policy, it is clear how important the fund is for the currency bloc and the euro.

Weekly EURUSD trading plan

Therefore, the EURUSD bulls are in a difficult situation. There are too many negative factors in the euro area, and the pair’s inability to consolidate at the new red line of 1.18 could continue sell-offs. Nordea Markets suggests the euro is heading to $1.15. In my opinion, if the pair breaks out the support at 1.176, it can continue falling to 1.172 and 1.168.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-sees-no-light-forecast-as-of-29032021/?uid=285861726&cid=79634

Dynamics of German-US 10-year yield gap

LiteFinance

Dollar drags on euro. Forecast as of 25.03.2021

Based on different vaccination rates and the growth gap, the EURUSD bulls should be losing. However, the strong US economy could drag on the rest of the world, including the euro-area. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Investors were focused on the Treasury yield rally, ignoring the US weak domestic data. The drop in the durable goods orders by 1.1% M-o-M in February, following nine months of growth, added to the negative produced by declines in retail sales, industrial production, and new home sales. Nonetheless, traders were selling Treasuries, and the EURUSD was falling. What will happen when the US economic data start improving?

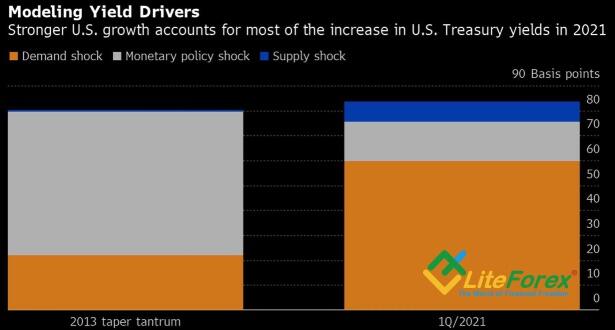

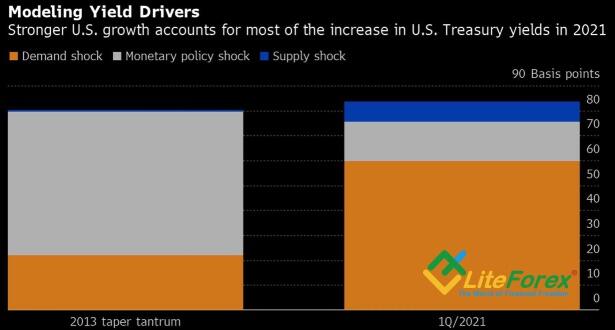

In fact, the Treasury yield could be growing without strong economic data. Markets are growing or falling on the expectations, and belief in the US GDP rise to 6.5% in 2021 encourages investors to sell safe-haven assets. According to the Bloomberg model, of the 84-basis-point increase in the 10-year U.S. Treasury yield since the start of the year, 60 resulted from stronger growth expectations. That’s a clear contrast to the 2013 taper tantrum when the rise in yields was driven by expectations of premature QE end.

So, the Fed is not worried about the rising cost of borrowing in the markets. Jerome Powell continues to repeat the mantra that it is an orderly process that does not materially degrade financial conditions. This means that the central bank should not be concerned about this. The Fed will make decisions based on evidence, but what will strong US statistics mean for the dollar?

In 2020, the US current account deficit increased to 3.5% of GDP; the budget deficit widened to 15% of GDP. The imports growth and fiscal stimulus would further expand the US twin deficit, which would press the greenback down in the long-term outlook. Eventually, foreign investors will not want to fund the US national debt, and the Fed will have to boost the QE pace to cover the deficit. Besides, increasing the US foreign trade deficit will increase the surplus in the euro-area. It means the US economy will support the euro-area growth. In addition to the increase in the global risk appetite amid the US economic data improvement, this fact will support the EURUSD bulls.

Of course, without positive changes in the euro-area economic data and vaccination process, the euro will not grow. However, I can’t say everything is that bad in Europe. Germany manufacturing PMI has featured the best rise since the records began in 1996, and European commodity prices are growing faster than US ones. The ECB could be worried about inflation!

Weekly EURUSD trading plan

The euro-area PMI data provided some positive, but will the EURUSD rebound? I do not think the euro will start rising without an increase in the vaccination rate in the EU. Europe is preparing for the third wave of the COVID-19 pandemic, and the US vaccination campaign is progressing. The euro-dollar price is more likely to drop to 1.18, 1.176, and 1.172 than go back to the red line at 1.193, but this is the case when I would be glad if I were wrong. It is still relevant to sell the euro.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-drags-on-euro-forecast-as-of-25032021/?uid=285861726&cid=79634

Treasury yields growth drivers

Based on different vaccination rates and the growth gap, the EURUSD bulls should be losing. However, the strong US economy could drag on the rest of the world, including the euro-area. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Investors were focused on the Treasury yield rally, ignoring the US weak domestic data. The drop in the durable goods orders by 1.1% M-o-M in February, following nine months of growth, added to the negative produced by declines in retail sales, industrial production, and new home sales. Nonetheless, traders were selling Treasuries, and the EURUSD was falling. What will happen when the US economic data start improving?

In fact, the Treasury yield could be growing without strong economic data. Markets are growing or falling on the expectations, and belief in the US GDP rise to 6.5% in 2021 encourages investors to sell safe-haven assets. According to the Bloomberg model, of the 84-basis-point increase in the 10-year U.S. Treasury yield since the start of the year, 60 resulted from stronger growth expectations. That’s a clear contrast to the 2013 taper tantrum when the rise in yields was driven by expectations of premature QE end.

So, the Fed is not worried about the rising cost of borrowing in the markets. Jerome Powell continues to repeat the mantra that it is an orderly process that does not materially degrade financial conditions. This means that the central bank should not be concerned about this. The Fed will make decisions based on evidence, but what will strong US statistics mean for the dollar?

In 2020, the US current account deficit increased to 3.5% of GDP; the budget deficit widened to 15% of GDP. The imports growth and fiscal stimulus would further expand the US twin deficit, which would press the greenback down in the long-term outlook. Eventually, foreign investors will not want to fund the US national debt, and the Fed will have to boost the QE pace to cover the deficit. Besides, increasing the US foreign trade deficit will increase the surplus in the euro-area. It means the US economy will support the euro-area growth. In addition to the increase in the global risk appetite amid the US economic data improvement, this fact will support the EURUSD bulls.

Of course, without positive changes in the euro-area economic data and vaccination process, the euro will not grow. However, I can’t say everything is that bad in Europe. Germany manufacturing PMI has featured the best rise since the records began in 1996, and European commodity prices are growing faster than US ones. The ECB could be worried about inflation!

Weekly EURUSD trading plan

The euro-area PMI data provided some positive, but will the EURUSD rebound? I do not think the euro will start rising without an increase in the vaccination rate in the EU. Europe is preparing for the third wave of the COVID-19 pandemic, and the US vaccination campaign is progressing. The euro-dollar price is more likely to drop to 1.18, 1.176, and 1.172 than go back to the red line at 1.193, but this is the case when I would be glad if I were wrong. It is still relevant to sell the euro.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-drags-on-euro-forecast-as-of-25032021/?uid=285861726&cid=79634

Treasury yields growth drivers

LiteFinance

Dollar has the key. Forecast as of 24.03.2021

The pandemic seems to have been over. But it still has a significant impact on Forex. Europe is preparing for the third wave, and the euro-area PMI will hardly recover soon. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Everyone makes mistakes. Some get away with it, and others have to pay a high price. Donald Trump didn’t recognize the pandemic in the beginning, which caused 550,000 deaths in the US. As a result, Trump lost the presidential election, and the US dollar significantly weakened. Slow vaccination and EU mistakes in the vaccine roll-out sent the euro down to the November lows. I am afraid the single European currency could continue falling.

According to Penn Wharton research, if 25% of Americans refuse vaccinations and the level of social activity rises to 70% of the pre-pandemic, 4.6 million people in the US may be infected with the COVID-19 in 2021. In Europe, there can be much more new cases, as the vaccination is progressing very slowly, and the alleged side effects from AstraZeneca drugs seriously scared the population. The faster is the roll-out of the vaccine, the higher is the economic growth rate, and the stronger is the local currency. The EURUSD downtrend proves it.

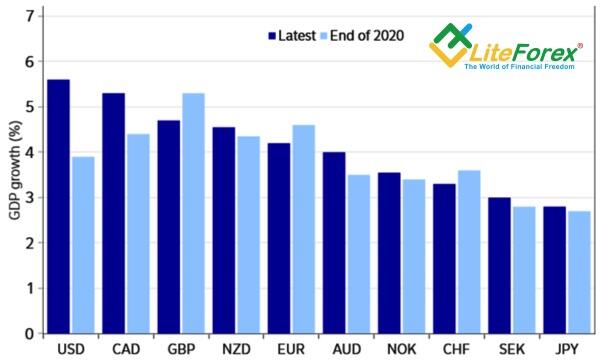

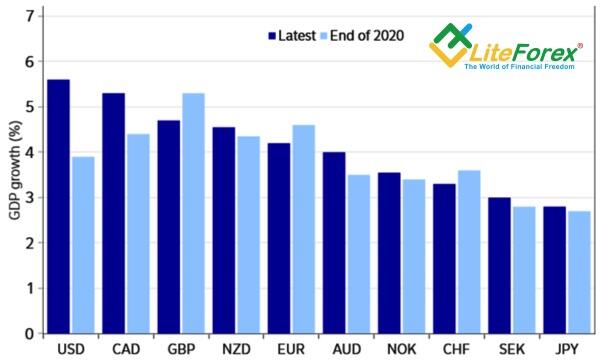

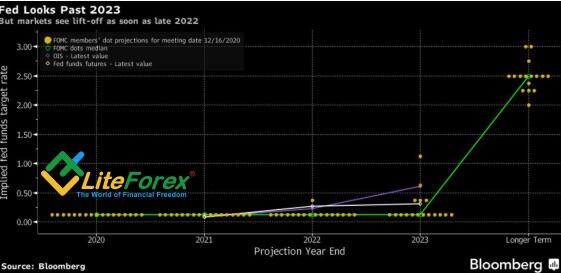

In late March, 127.1 million people (38.7% of the population) received at least one dose in the US; in the EU - only 59.2 million (13.2%). The US GDP forecasts have naturally increased compared to late 2020. The euro-area growth forecasts have been downgraded. And the leading growth of the US economy compared to the G10 countries is the key to the dollar strengthening.

Europe faces an increase in the number of infections, hospitalizations, and deaths, preparing for the third wave of the pandemic and seriously frightened by the story of AstraZeneca. France and Germany are extending lockdowns, and the European Union is limiting the export of vaccines produced on its territory. Is it possible in such conditions to count on the PMI rebound?

The release of Markit's Purchasing Managers' Index was initially presented as the highlight of the week ending March 26. According to Bloomberg experts, the euro-area manufacturing PMI will decline from 57.9 to 57.7 in March. Services PMI will increase from 45.7 to 46 but will remain below the critical mark of 50, which indicates a contraction of the sector. By contrast, the US PMI can well increase amid rapid vaccinations and massive fiscal stimulus. The growth gap between the US and the euro area will widen, pressing the EURUSD down.

Weekly EURUSD trading plan

My trading ideas to sell the pair on the rise to 1.199 and add to shorts if the price fails to break out the red line at 1.193 have been profitable. But it is the case when I am not happy with the correct forecast. I am an optimist and used to believe that the pandemic will end sooner. However, it doesn’t seem so. The downside targets at 1.18, 1.176, and 1.172, marked in the previous forecasts, are getting closer. The PMI data will give a clue on the EURUSD future price movements.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-has-the-key-forecast-as-of-24032021/?uid=285861726&cid=79634

GDP forecasts

The pandemic seems to have been over. But it still has a significant impact on Forex. Europe is preparing for the third wave, and the euro-area PMI will hardly recover soon. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Everyone makes mistakes. Some get away with it, and others have to pay a high price. Donald Trump didn’t recognize the pandemic in the beginning, which caused 550,000 deaths in the US. As a result, Trump lost the presidential election, and the US dollar significantly weakened. Slow vaccination and EU mistakes in the vaccine roll-out sent the euro down to the November lows. I am afraid the single European currency could continue falling.

According to Penn Wharton research, if 25% of Americans refuse vaccinations and the level of social activity rises to 70% of the pre-pandemic, 4.6 million people in the US may be infected with the COVID-19 in 2021. In Europe, there can be much more new cases, as the vaccination is progressing very slowly, and the alleged side effects from AstraZeneca drugs seriously scared the population. The faster is the roll-out of the vaccine, the higher is the economic growth rate, and the stronger is the local currency. The EURUSD downtrend proves it.

In late March, 127.1 million people (38.7% of the population) received at least one dose in the US; in the EU - only 59.2 million (13.2%). The US GDP forecasts have naturally increased compared to late 2020. The euro-area growth forecasts have been downgraded. And the leading growth of the US economy compared to the G10 countries is the key to the dollar strengthening.

Europe faces an increase in the number of infections, hospitalizations, and deaths, preparing for the third wave of the pandemic and seriously frightened by the story of AstraZeneca. France and Germany are extending lockdowns, and the European Union is limiting the export of vaccines produced on its territory. Is it possible in such conditions to count on the PMI rebound?

The release of Markit's Purchasing Managers' Index was initially presented as the highlight of the week ending March 26. According to Bloomberg experts, the euro-area manufacturing PMI will decline from 57.9 to 57.7 in March. Services PMI will increase from 45.7 to 46 but will remain below the critical mark of 50, which indicates a contraction of the sector. By contrast, the US PMI can well increase amid rapid vaccinations and massive fiscal stimulus. The growth gap between the US and the euro area will widen, pressing the EURUSD down.

Weekly EURUSD trading plan

My trading ideas to sell the pair on the rise to 1.199 and add to shorts if the price fails to break out the red line at 1.193 have been profitable. But it is the case when I am not happy with the correct forecast. I am an optimist and used to believe that the pandemic will end sooner. However, it doesn’t seem so. The downside targets at 1.18, 1.176, and 1.172, marked in the previous forecasts, are getting closer. The PMI data will give a clue on the EURUSD future price movements.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-has-the-key-forecast-as-of-24032021/?uid=285861726&cid=79634

GDP forecasts

LiteFinance

Dollar is prone to volatility. Forecast as of 23.03.2021

The former US dollar growth drivers could crash it now. The Forex market situation is always changing, and traders should be cautious not to face a loss. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

How fast the Forex market changes! In 2018-2019, US-China trade wars strengthened the US dollar. In 2021, the trade war escalation could weaken the greenback. The tone of the talks between Washington and Beijing in Alaska was cold, and the United States, the European Union, the United Kingdom, and Canada imposed sanctions against China for human rights abuses related to the Uighur minority in Xinjiang. Investors’ demand for the US Treasuries surged. The 10-year Treasury yield dropped, the tech stocks increased, and the EURUSD tested the important level of 1.193.

The Treasury yield rally has been the major growth driver for the greenback in 2021. According to Bloomberg, holding dollar shorts would have yielded investors about a 2% loss this year after being a profitable strategy in eight of the nine months through to December. For the first time since November, hedge funds became net buyers of the dollar against seven major currencies during the week to March 16.

Speculators see Treasury yields soaring to 2% amid a global recovery spurred by vaccine rollouts and stimulus spending. Joe Biden is willing to add more stimulus. After the adoption of a $1.9 trillion aid package by Congress, Biden’s team, according to a Bloomberg source, is preparing a new project of $3 trillion. The money will be spent on infrastructure and green technologies. Rich Americans will have to pay for the aid package, as they have significantly increased their savings amid the pandemic and recession. According to the US President, those who earn more than $400 thousand a year should prepare for a tax hike.

While US-China relations are likely to remain tense, the trade war is unlikely to resume. The potential for correction to the downtrend for Treasury prices looks limited, so the Treasury yields should resume growth (the indicator is inversely proportional to the price). The Treasury yield rise will pull up the bond yields around the world. The ECB can hardly resist the global trends. However, by stepping up asset purchases, the ECB could clamp down on the sales in the European bond market, compared to the US and UK. In the week through March 17, the ECB bought bonds for €21.1 billion, which is 1.5 times more than five days earlier and above the average weekly pace of €18 billion for the entire period of the PEPP.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-prone-to-volatility-forecast-as-of-23032021/?uid=285861726&cid=79634

Dynamics of USD index and dollar speculative positions

The former US dollar growth drivers could crash it now. The Forex market situation is always changing, and traders should be cautious not to face a loss. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Monthly US dollar fundamental forecast

How fast the Forex market changes! In 2018-2019, US-China trade wars strengthened the US dollar. In 2021, the trade war escalation could weaken the greenback. The tone of the talks between Washington and Beijing in Alaska was cold, and the United States, the European Union, the United Kingdom, and Canada imposed sanctions against China for human rights abuses related to the Uighur minority in Xinjiang. Investors’ demand for the US Treasuries surged. The 10-year Treasury yield dropped, the tech stocks increased, and the EURUSD tested the important level of 1.193.

The Treasury yield rally has been the major growth driver for the greenback in 2021. According to Bloomberg, holding dollar shorts would have yielded investors about a 2% loss this year after being a profitable strategy in eight of the nine months through to December. For the first time since November, hedge funds became net buyers of the dollar against seven major currencies during the week to March 16.

Speculators see Treasury yields soaring to 2% amid a global recovery spurred by vaccine rollouts and stimulus spending. Joe Biden is willing to add more stimulus. After the adoption of a $1.9 trillion aid package by Congress, Biden’s team, according to a Bloomberg source, is preparing a new project of $3 trillion. The money will be spent on infrastructure and green technologies. Rich Americans will have to pay for the aid package, as they have significantly increased their savings amid the pandemic and recession. According to the US President, those who earn more than $400 thousand a year should prepare for a tax hike.

While US-China relations are likely to remain tense, the trade war is unlikely to resume. The potential for correction to the downtrend for Treasury prices looks limited, so the Treasury yields should resume growth (the indicator is inversely proportional to the price). The Treasury yield rise will pull up the bond yields around the world. The ECB can hardly resist the global trends. However, by stepping up asset purchases, the ECB could clamp down on the sales in the European bond market, compared to the US and UK. In the week through March 17, the ECB bought bonds for €21.1 billion, which is 1.5 times more than five days earlier and above the average weekly pace of €18 billion for the entire period of the PEPP.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-prone-to-volatility-forecast-as-of-23032021/?uid=285861726&cid=79634

Dynamics of USD index and dollar speculative positions

LiteFinance

Euro is sad about lost summer. Forecast as of 22.03.2021

Weekly euro fundamental forecast

How resilient is the euro-area economy to new COVID-19 restrictions? This question will be crucial for the EURUSD in the week ending March 26. Slow vaccinations and often inappropriate EU actions undermine investors’ confidence and encourage them to sell the euro. Moreover, lockdowns can turn into another lost summer for those EU countries where the tourism share in the GDP is significant. As a result, the euro bulls will be challenged by the problem of the rich North and the poor South.

Emmanuel Macron's introduction of a new four-week lockdown in Paris and Angela Merkel's proposal of additional restrictive measures in Germany, where the national seven-day rate of infections per 100,000 people rose to 103.9, put significant pressure on the single European currency. According to ING, if earlier forecasts for the euro-area economy were based on the easing of restriction measures in March, now we should forget about it. The bank has revised down its estimate for the European GDP for 2021 from -0.8% to 1.5%, and it is not alone. Barclays believes the lockdown will be lifted by the end of the second quarter, weakening domestic demand. Berenberg claims monthly quarantine deducts 0.3 % from the euro-area GDP rate.

The situation is aggravated by the slow vaccination and the often inappropriate EU behavior. In the European Union, 12.7% of the population were vaccinated, in the United States - 37.6%. According to a Bloomberg source familiar with the matter, the EU will likely reject the export authorization of AstraZeneca Plc coronavirus vaccines to the U.K. until the drugmaker fulfills its delivery obligations to the 27-nation bloc. But even a couple of days ago, vaccinations with the AstraZeneca drug were suspended due to the alleged side effects.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-sad-about-lost-summer-forecast-as-of-22032021/?uid=285861726&cid=79634

Forecasts for euro-area and US GDPs

Weekly euro fundamental forecast

How resilient is the euro-area economy to new COVID-19 restrictions? This question will be crucial for the EURUSD in the week ending March 26. Slow vaccinations and often inappropriate EU actions undermine investors’ confidence and encourage them to sell the euro. Moreover, lockdowns can turn into another lost summer for those EU countries where the tourism share in the GDP is significant. As a result, the euro bulls will be challenged by the problem of the rich North and the poor South.

Emmanuel Macron's introduction of a new four-week lockdown in Paris and Angela Merkel's proposal of additional restrictive measures in Germany, where the national seven-day rate of infections per 100,000 people rose to 103.9, put significant pressure on the single European currency. According to ING, if earlier forecasts for the euro-area economy were based on the easing of restriction measures in March, now we should forget about it. The bank has revised down its estimate for the European GDP for 2021 from -0.8% to 1.5%, and it is not alone. Barclays believes the lockdown will be lifted by the end of the second quarter, weakening domestic demand. Berenberg claims monthly quarantine deducts 0.3 % from the euro-area GDP rate.

The situation is aggravated by the slow vaccination and the often inappropriate EU behavior. In the European Union, 12.7% of the population were vaccinated, in the United States - 37.6%. According to a Bloomberg source familiar with the matter, the EU will likely reject the export authorization of AstraZeneca Plc coronavirus vaccines to the U.K. until the drugmaker fulfills its delivery obligations to the 27-nation bloc. But even a couple of days ago, vaccinations with the AstraZeneca drug were suspended due to the alleged side effects.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-sad-about-lost-summer-forecast-as-of-22032021/?uid=285861726&cid=79634

Forecasts for euro-area and US GDPs

LiteFinance

Gold acts too impulsive. Forecast as of 18.03.2021

Fundamental gold forecast for a week

Looking at how strong gold was ahead of the FOMC meeting against the backdrop of growing US Treasury yields and the US dollar's strengthening, I caught myself thinking that the precious metal was waiting for the Fed's verdict. As a result, the gold price soared to a 2-week high, but the EURUSD bulls' inability to break out the resistance at level 1.199 drove the gold price down. Perhaps the central bank would like the greenback to be weaker than it is now, but without the recovery of the economies competing with the US, this will be extremely difficult to implement.

The Fed has both good and bad news for gold. The regulator expects inflation to accelerate to 2.2% in 2021, followed by a slowdown to 2% in 2022 and 2.1% in 2023, and, most importantly, is ready to tolerate consumer prices' rise. Jerome Powell considers the current monetary policy parameters are fair, and most FOMC members do not plan to raise rates until 2024. The precious metal is traditionally perceived as a hedge against inflationary risks. In turn, accommodative monetary policy tends to create a tailwind for gold, contributing to the dollar weakening and low debt market rates. This time it's not like that.

The Fed's move to target average inflation and get rid of incentives ahead of time makes financial markets doubt Powell's words. As a result, US Treasury yields are rising, while gold ETFs holdings are rapidly decreasing, having dropped by 150 tons since the beginning of the year.

US debt market rates will continue to rise. These are the outcomes of a situation where the economy is ready to accelerate to 6.5% in 2021 and where the population has about $1.7 trillion in excess savings, according to Bloomberg estimates, excluding Joe Biden's fiscal stimulus. Expectations of faster US GDP growth compared to competitors tend to strengthen the greenback.

Perhaps the Fed would like the USD index to be weaker than it is now, but without acceleration of the EU vaccination campaign and the associated improvement in eurozone business activity, the EURUSD price at best will begin to consolidate, and at worst will continue to fall. The euro share in the USD index structure is 57%, so the European currency is an important driver of gold market changes. It is likely that in the third quarter, or perhaps a little earlier, a lot will change, but so far, the XAUUSD bulls' attacks look too impulsive. As a rule, such behavior leads to a loss of money.

Weekly gold trading plan

In my opinion, the strong USD and growing US Treasury yields create preconditions for gold sales on the rise to $1755 and $1775, or on the breakout of supports at $1730 and $1710 per ounce. The targets for the downward movement are $1675 and $1640.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gold-acts-too-impulsive-forecast-as-of-18032021/?uid=285861726&cid=79634

Dynamics of gold and ETFs holdings

Fundamental gold forecast for a week

Looking at how strong gold was ahead of the FOMC meeting against the backdrop of growing US Treasury yields and the US dollar's strengthening, I caught myself thinking that the precious metal was waiting for the Fed's verdict. As a result, the gold price soared to a 2-week high, but the EURUSD bulls' inability to break out the resistance at level 1.199 drove the gold price down. Perhaps the central bank would like the greenback to be weaker than it is now, but without the recovery of the economies competing with the US, this will be extremely difficult to implement.

The Fed has both good and bad news for gold. The regulator expects inflation to accelerate to 2.2% in 2021, followed by a slowdown to 2% in 2022 and 2.1% in 2023, and, most importantly, is ready to tolerate consumer prices' rise. Jerome Powell considers the current monetary policy parameters are fair, and most FOMC members do not plan to raise rates until 2024. The precious metal is traditionally perceived as a hedge against inflationary risks. In turn, accommodative monetary policy tends to create a tailwind for gold, contributing to the dollar weakening and low debt market rates. This time it's not like that.

The Fed's move to target average inflation and get rid of incentives ahead of time makes financial markets doubt Powell's words. As a result, US Treasury yields are rising, while gold ETFs holdings are rapidly decreasing, having dropped by 150 tons since the beginning of the year.

US debt market rates will continue to rise. These are the outcomes of a situation where the economy is ready to accelerate to 6.5% in 2021 and where the population has about $1.7 trillion in excess savings, according to Bloomberg estimates, excluding Joe Biden's fiscal stimulus. Expectations of faster US GDP growth compared to competitors tend to strengthen the greenback.

Perhaps the Fed would like the USD index to be weaker than it is now, but without acceleration of the EU vaccination campaign and the associated improvement in eurozone business activity, the EURUSD price at best will begin to consolidate, and at worst will continue to fall. The euro share in the USD index structure is 57%, so the European currency is an important driver of gold market changes. It is likely that in the third quarter, or perhaps a little earlier, a lot will change, but so far, the XAUUSD bulls' attacks look too impulsive. As a rule, such behavior leads to a loss of money.

Weekly gold trading plan

In my opinion, the strong USD and growing US Treasury yields create preconditions for gold sales on the rise to $1755 and $1775, or on the breakout of supports at $1730 and $1710 per ounce. The targets for the downward movement are $1675 and $1640.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gold-acts-too-impulsive-forecast-as-of-18032021/?uid=285861726&cid=79634

Dynamics of gold and ETFs holdings

LiteFinance

Bank of Japan is gaining ground. Forecast as of 17.03.2021

Quarterly Japanese yen fundamental forecast

While the Fed is preparing to provide evidence that it will remain passive for a very long time without making adjustments to monetary policy, the ECB is trying its best to slow down the rise in European bond yields. The Bank of Japan looks forward to future benefits. The regulator has struggled with deflation to no avail for years, but now the situation has begun to improve. The yield curve control, introduced in 2016 by the Bank of Japan, is starting to pay off.

The current Governor of the Bank of Japan, Haruhiko Kuroda, resembles a boxer who was quickly knocked down but managed to get up and continue the fight. He needs to work out a strategy on stopping deflation, and it looks like his plan is working. The monetary stimulus launched in 2013 increased the BoJ balance to 135% of GDP, making the central bank a whale in Japan's debt market pond. Is it any wonder that local bond sellers are passive? They are getting rid of bonds with an eye on the Bank of Japan and have managed to raise the yield on 10-year bonds only to 0.175% with the target range of about 0.2%. As a result, the USDJPY prices depend only on the situation in the US debt market.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/bank-of-japan-is-gaining-ground-forecast-as-of-17032021/?uid=285861726&cid=79634

Quarterly Japanese yen fundamental forecast

While the Fed is preparing to provide evidence that it will remain passive for a very long time without making adjustments to monetary policy, the ECB is trying its best to slow down the rise in European bond yields. The Bank of Japan looks forward to future benefits. The regulator has struggled with deflation to no avail for years, but now the situation has begun to improve. The yield curve control, introduced in 2016 by the Bank of Japan, is starting to pay off.

The current Governor of the Bank of Japan, Haruhiko Kuroda, resembles a boxer who was quickly knocked down but managed to get up and continue the fight. He needs to work out a strategy on stopping deflation, and it looks like his plan is working. The monetary stimulus launched in 2013 increased the BoJ balance to 135% of GDP, making the central bank a whale in Japan's debt market pond. Is it any wonder that local bond sellers are passive? They are getting rid of bonds with an eye on the Bank of Japan and have managed to raise the yield on 10-year bonds only to 0.175% with the target range of about 0.2%. As a result, the USDJPY prices depend only on the situation in the US debt market.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/bank-of-japan-is-gaining-ground-forecast-as-of-17032021/?uid=285861726&cid=79634

LiteFinance

Dollar is calm before the storm. Forecast as of 16.03.2021

The EURUSD is trading in a narrow trading range ahead of one of the most important Fed meetings. It is natural, and investors do not want to risk. Traders are waiting for Jerome Powell’s speech to get clues on the Fed’s future policy. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

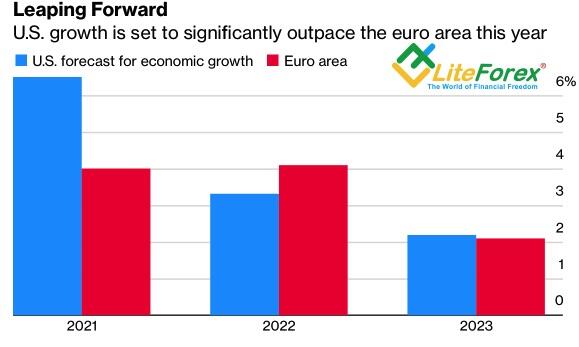

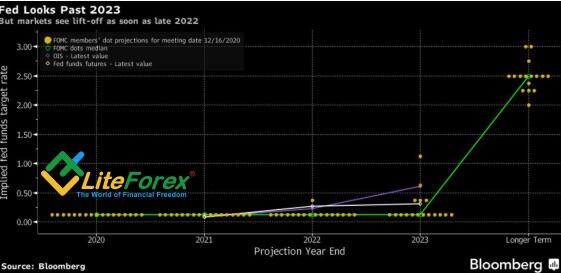

Markets worry because of the Fed’s patience. The Treasury yield is rallying up, reminding the taper tantrum of 2013. Derivatives signal the interest rates should be up in the first quarter. However, 75% of Bloomberg experts believe that the FOMC will not change its forecasts for the federal funds rate, suggesting that it will rise no earlier than the beginning of 2024. There will be a battle between investors and Fed, and the current EURUSD consolidation gives rise to associations with the calm before the storm.

It seems that the FOMC March meeting is the one the Fed would like to avoid. Much has changed since December when the Fed released its latest forecasts. Congress added about $ 3 trillion in fiscal stimulus, which, along with rapid vaccinations in the US, increases the expected economic growth. According to Bloomberg experts, the Fed will revise up its forecast for the US GDP for 2021 from 4.2% to 5.8%, although it will remain very conservative. The OECD expects to see the US GDP at 6.5%, while Goldman Sash even suggests 7.7%.

The increased growth expectations suggest a soon monetary normalization. However, according to Powell, the Fed doesn’t want to repeat the error made in 2013, when an early end of the QE resulted in the taper tantrum. Nevertheless, the current structure of the debt and derivatives markets suggests that investors, even without the Fed, know what to do. Options signal 10-year Treasury yields will rise to 1.85% by the end of 2021, and CME futures signal a 75% probability of a federal funds rate hike in December 2022. In the latest FOMC forecast, only one member of the Open Market Committee believed that this would happen next year, five expected monetary tightening in 2023; the rest said the federal funds rate wouldn’t be up until 2024.

Meanwhile, Jerome Powell and his fellow central-bankers repeat the mantra that the Treasury yield rally should not raise concerns as it signals the expectations of the US economy’s explosive growth. But what if the 10-year yield exceeds 2%? Based on the PMI data, the US yield could grow above 3%.

Of course, the Fed will stop being patient sooner or later. Due to the pandemic and recession, government loans in the world have increased by 60% over the past 12 months, which is twice as much as during the previous crisis. The US national debt has exceeded 100% of GDP, and the growth in the servicing cost will slow down the economy. And then there's Joe Biden, who is planning the first massive tax hike since 1993.

Weekly EURUSD trading plan

The Treasury yield growth and tightening of the fiscal policy are powerful drivers for the S&P 500 correction. Jerome Powell should be cautious not to trigger a sell-off wave in mid-March. Meanwhile, investors are waiting for the Fed meeting to revise investment ideas, and the EURUSD is consolidating in the range of 1.188-1.199. I do not recommend entering any trades.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-calm-before-the-storm-forecast-as-of-16032021/?uid=285861726&cid=79634

December FOMC forecasts for federal funds rate

The EURUSD is trading in a narrow trading range ahead of one of the most important Fed meetings. It is natural, and investors do not want to risk. Traders are waiting for Jerome Powell’s speech to get clues on the Fed’s future policy. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Markets worry because of the Fed’s patience. The Treasury yield is rallying up, reminding the taper tantrum of 2013. Derivatives signal the interest rates should be up in the first quarter. However, 75% of Bloomberg experts believe that the FOMC will not change its forecasts for the federal funds rate, suggesting that it will rise no earlier than the beginning of 2024. There will be a battle between investors and Fed, and the current EURUSD consolidation gives rise to associations with the calm before the storm.

It seems that the FOMC March meeting is the one the Fed would like to avoid. Much has changed since December when the Fed released its latest forecasts. Congress added about $ 3 trillion in fiscal stimulus, which, along with rapid vaccinations in the US, increases the expected economic growth. According to Bloomberg experts, the Fed will revise up its forecast for the US GDP for 2021 from 4.2% to 5.8%, although it will remain very conservative. The OECD expects to see the US GDP at 6.5%, while Goldman Sash even suggests 7.7%.

The increased growth expectations suggest a soon monetary normalization. However, according to Powell, the Fed doesn’t want to repeat the error made in 2013, when an early end of the QE resulted in the taper tantrum. Nevertheless, the current structure of the debt and derivatives markets suggests that investors, even without the Fed, know what to do. Options signal 10-year Treasury yields will rise to 1.85% by the end of 2021, and CME futures signal a 75% probability of a federal funds rate hike in December 2022. In the latest FOMC forecast, only one member of the Open Market Committee believed that this would happen next year, five expected monetary tightening in 2023; the rest said the federal funds rate wouldn’t be up until 2024.

Meanwhile, Jerome Powell and his fellow central-bankers repeat the mantra that the Treasury yield rally should not raise concerns as it signals the expectations of the US economy’s explosive growth. But what if the 10-year yield exceeds 2%? Based on the PMI data, the US yield could grow above 3%.

Of course, the Fed will stop being patient sooner or later. Due to the pandemic and recession, government loans in the world have increased by 60% over the past 12 months, which is twice as much as during the previous crisis. The US national debt has exceeded 100% of GDP, and the growth in the servicing cost will slow down the economy. And then there's Joe Biden, who is planning the first massive tax hike since 1993.

Weekly EURUSD trading plan

The Treasury yield growth and tightening of the fiscal policy are powerful drivers for the S&P 500 correction. Jerome Powell should be cautious not to trigger a sell-off wave in mid-March. Meanwhile, investors are waiting for the Fed meeting to revise investment ideas, and the EURUSD is consolidating in the range of 1.188-1.199. I do not recommend entering any trades.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-calm-before-the-storm-forecast-as-of-16032021/?uid=285861726&cid=79634

December FOMC forecasts for federal funds rate

LiteFinance

Dollar has a double bottom. Forecast as of 15.03.2021

It looks as if the divergence in the economic expansion, monetary policies, and the bond yields growth rates should have broken down the EURUSD uptrend. Is it really so? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

The market moves so unexpectedly that conspiracy theories appear very frequently. However, large traders cannot afford to act like the Reddit traders as they will instantly be charged with the manipulations and could be sent to prison. Cheating is investors’ minds. They are wishful thinking and act according to what they see on the surface, unable to look deeper.

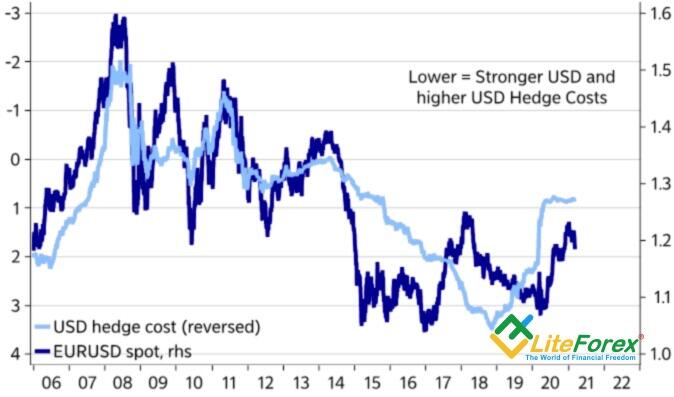

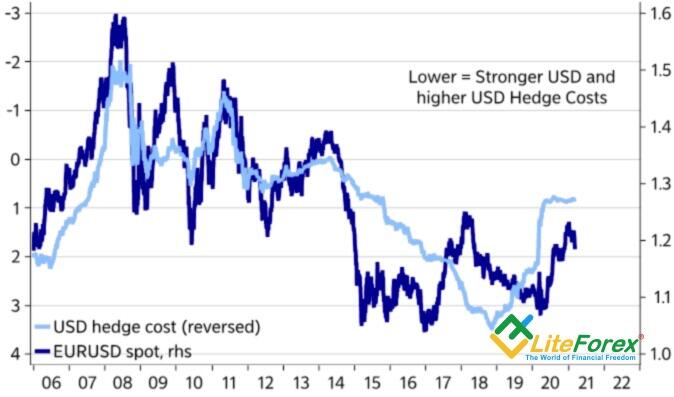

Why is the dollar growing? I see at least three reasons. First, amid the US government's massive fiscal stimulus and high vaccination rate, the US GDP could be up to 10% already in the first quarter while the euro-area is likely to slide down into a double-dip recession. Furthermore, Treasury yields are rising faster than their European peers. The Fed's reluctance to worry about increasing debt market rates fuels the panic, leading to an increase in the currency-hedging costs, which historically supports the EURUSD bears.

However, the US strong economy will provide benefits for export-led countries, including the euro-area, in the future. Thanks to massive financial aid, the US domestic demand is so high that the global economy faces a substantial shortage of products. The lengthening of the suppliers’ delivery time is a persuasive concern. The delivery time has increased in February to the second greatest value ever. If there is demand, there will be supply. Therefore, the euro-area economy will be catching up with the US in the second-fourth quarters amid the increase in exports.

The deficit of goods results in consumer prices’ growth. Investors are nervous, and the Fed’s passive attitude fuels the market turmoil, contributing to the Treasuries sell-offs and the correction of the US stock indexes. In fact, 2- and 5-year inflation expectations are growing faster than 10-year ones. That is, the Fed's assumption that the inflation surge is temporary is correct. According to economists polled by Bloomberg, the FOMC will hike the interest rates in 2023 but is unlikely to signal this at the meeting on March 16-17.

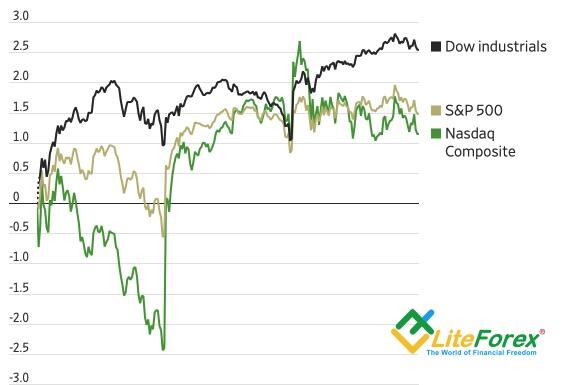

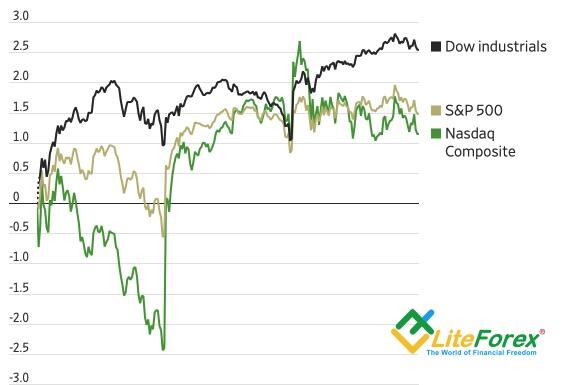

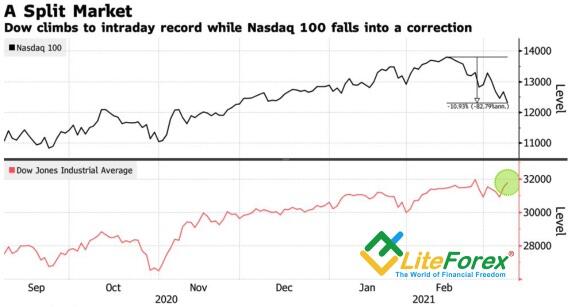

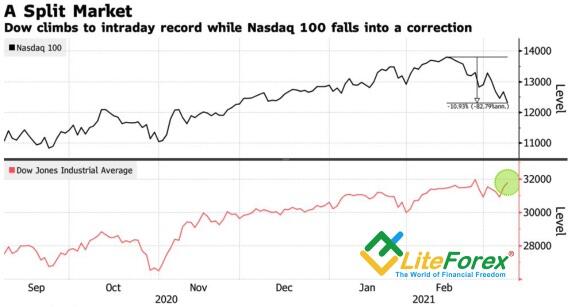

The leading growth of the US bond yields over the euro-area peers is also a temporary situation. If the euro-area economy starts to show signs of recovery, the situation will change, and the ECB will not need to increase the asset purchases under the PEPP. Moreover, the lagging pace of the yield growth in the euro-area allows local stock indices to outpace their US peers. EuroStoxx 600 added 4.5% in March, S&P 500 - 3.5% and Nasdaq Composite - only 1%. Investors are buying out the stocks of the companies, which were the outsiders in 2020. The structure of the euro-area stock market suggests it should rise.

Weekly EURUSD trading plan

By and large, the medium- and long-term EURUSD outlook is still bullish, although the US dollar could strengthen in the short term. Meanwhile, hold the shorts entered at level 1.199 and enter new sell trades when the price breaks out the supports at 1.191 and 1.188. However, if the euro goes up above $1.199 and $1.204, it will be relevant to open long positions.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-has-a-double-bottom-forecast-as-of-15032021/?uid=285861726&cid=79634

Dynamics of EURUSD and hedging costs

It looks as if the divergence in the economic expansion, monetary policies, and the bond yields growth rates should have broken down the EURUSD uptrend. Is it really so? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

The market moves so unexpectedly that conspiracy theories appear very frequently. However, large traders cannot afford to act like the Reddit traders as they will instantly be charged with the manipulations and could be sent to prison. Cheating is investors’ minds. They are wishful thinking and act according to what they see on the surface, unable to look deeper.

Why is the dollar growing? I see at least three reasons. First, amid the US government's massive fiscal stimulus and high vaccination rate, the US GDP could be up to 10% already in the first quarter while the euro-area is likely to slide down into a double-dip recession. Furthermore, Treasury yields are rising faster than their European peers. The Fed's reluctance to worry about increasing debt market rates fuels the panic, leading to an increase in the currency-hedging costs, which historically supports the EURUSD bears.

However, the US strong economy will provide benefits for export-led countries, including the euro-area, in the future. Thanks to massive financial aid, the US domestic demand is so high that the global economy faces a substantial shortage of products. The lengthening of the suppliers’ delivery time is a persuasive concern. The delivery time has increased in February to the second greatest value ever. If there is demand, there will be supply. Therefore, the euro-area economy will be catching up with the US in the second-fourth quarters amid the increase in exports.