LiteFinance / プロファイル

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

LiteFinance

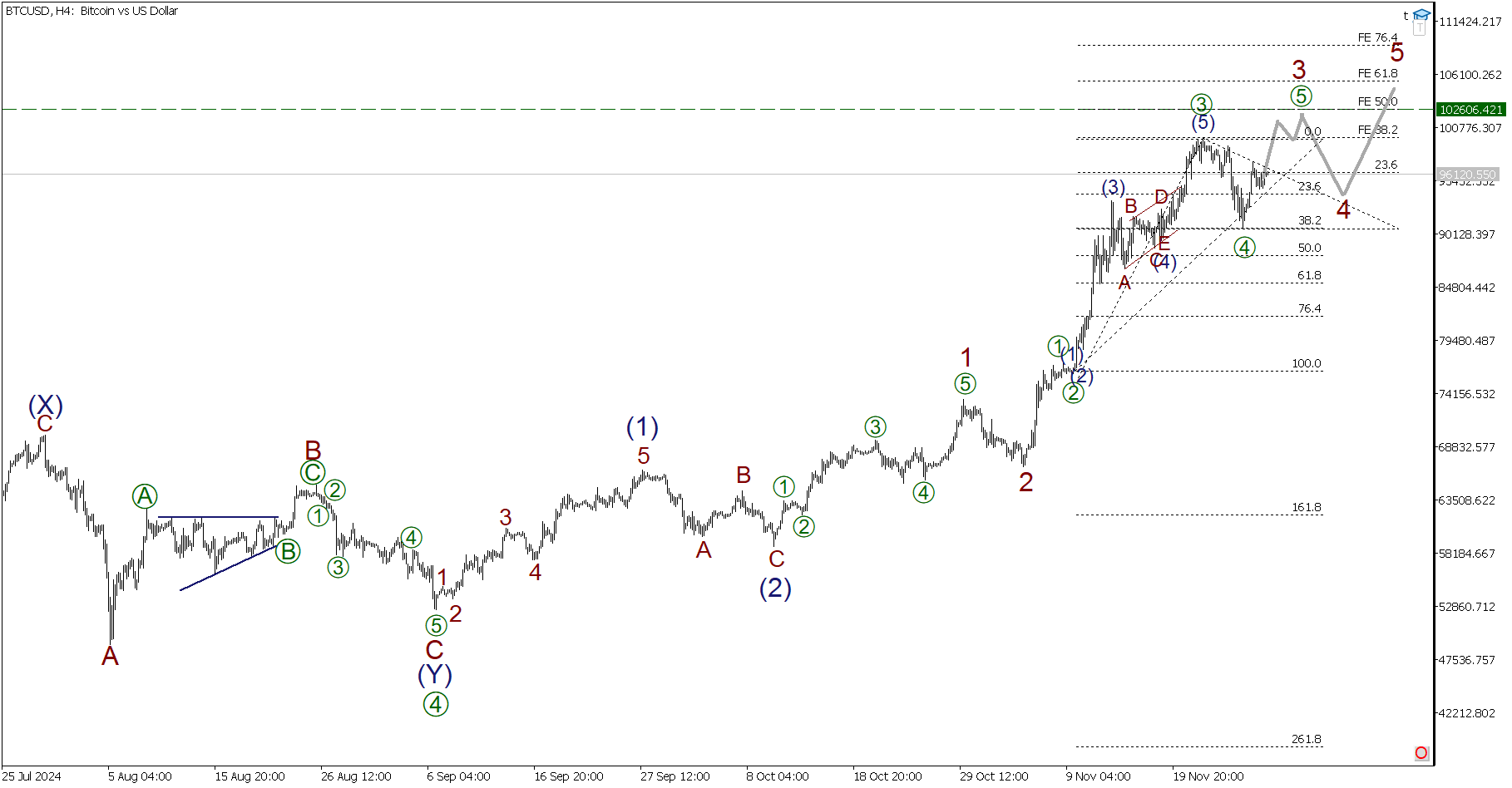

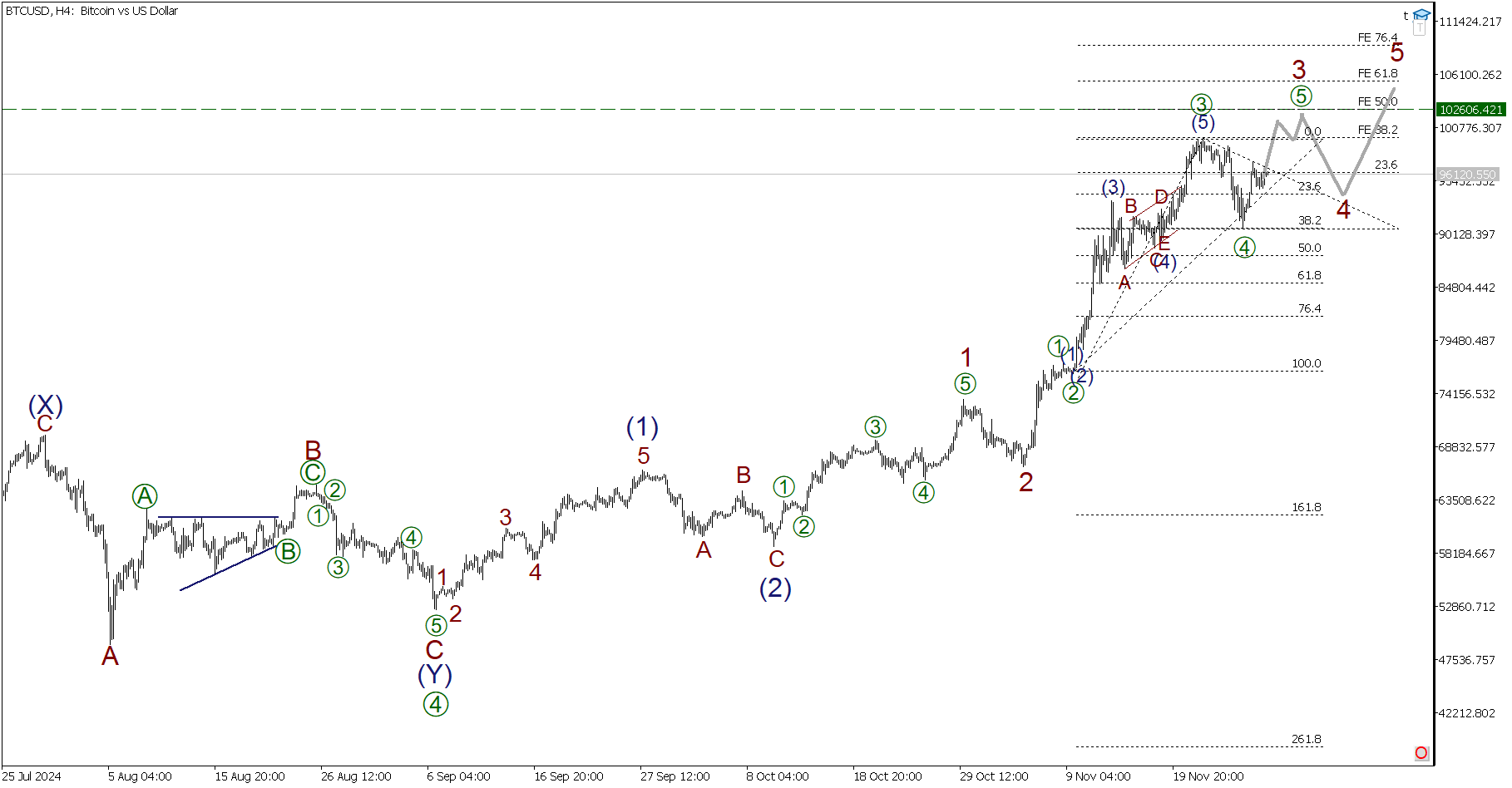

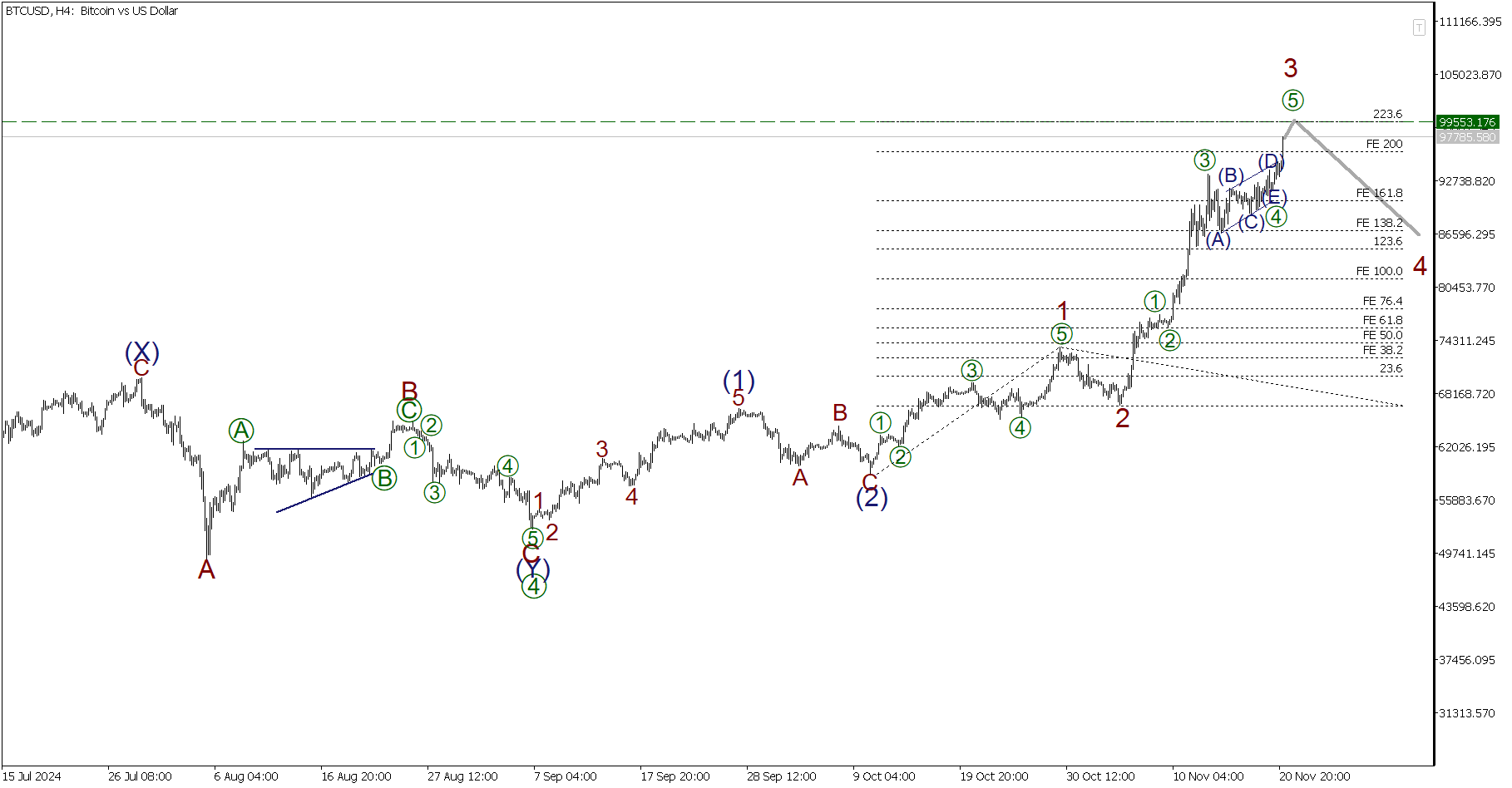

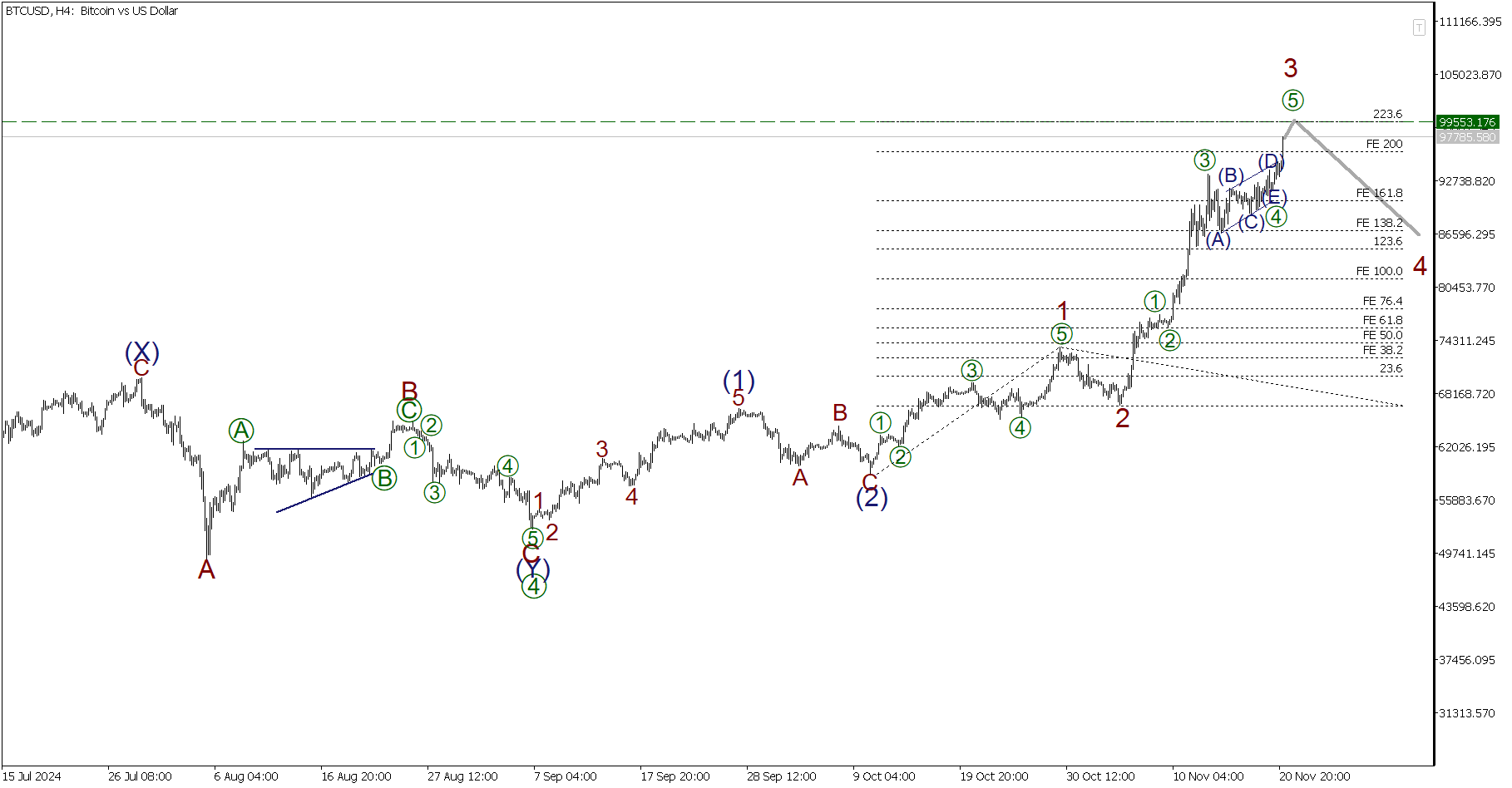

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 29.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

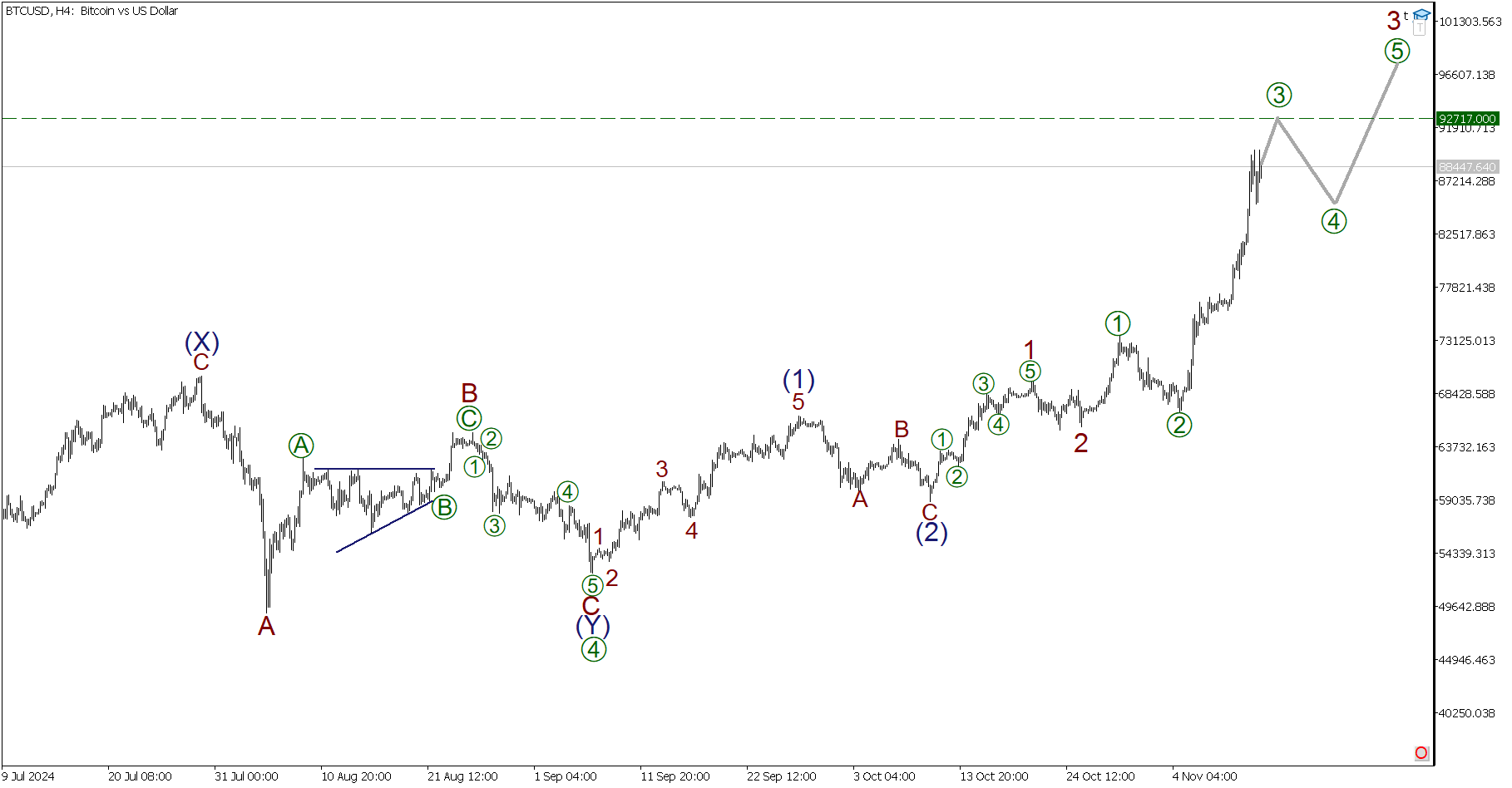

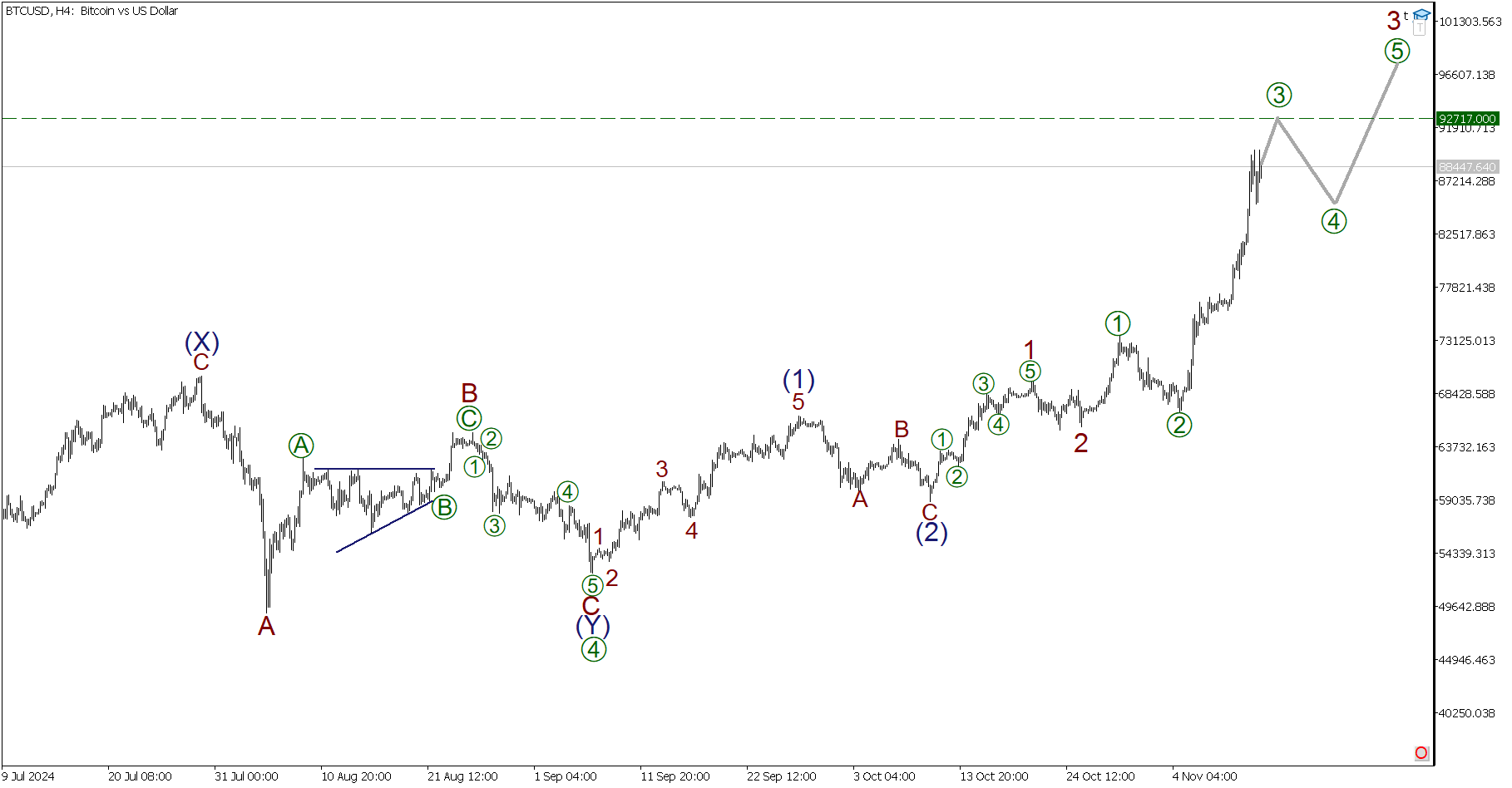

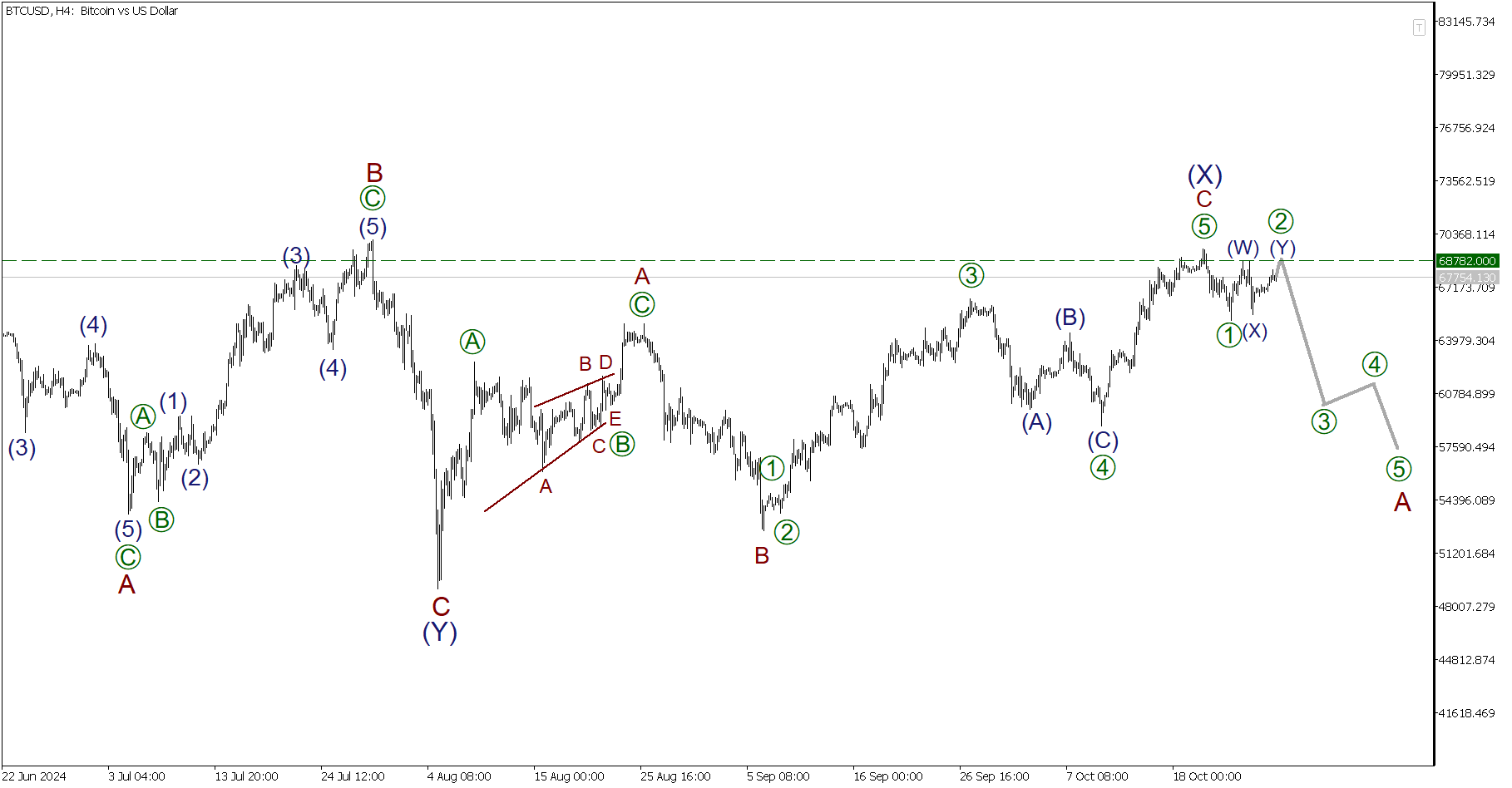

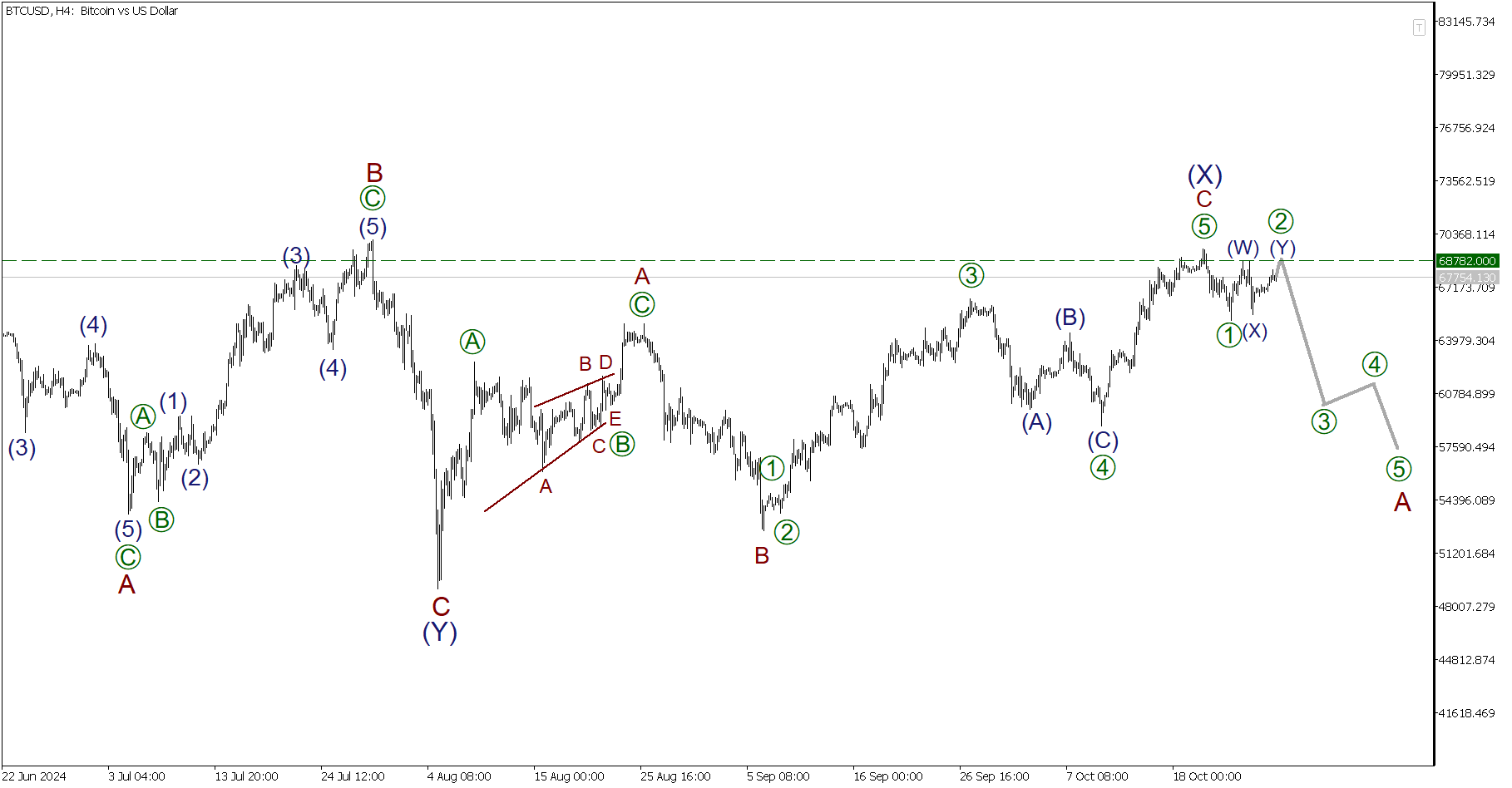

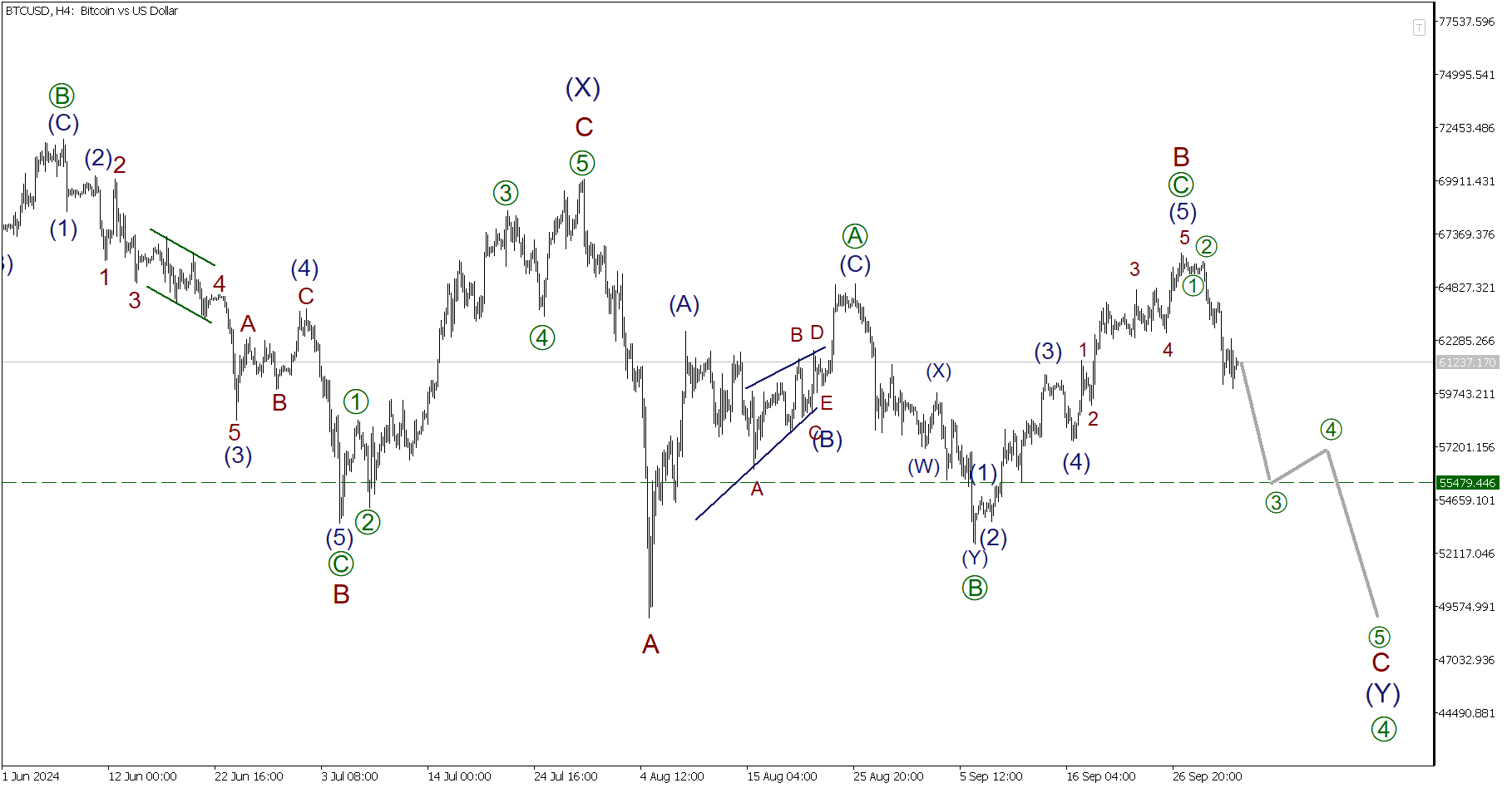

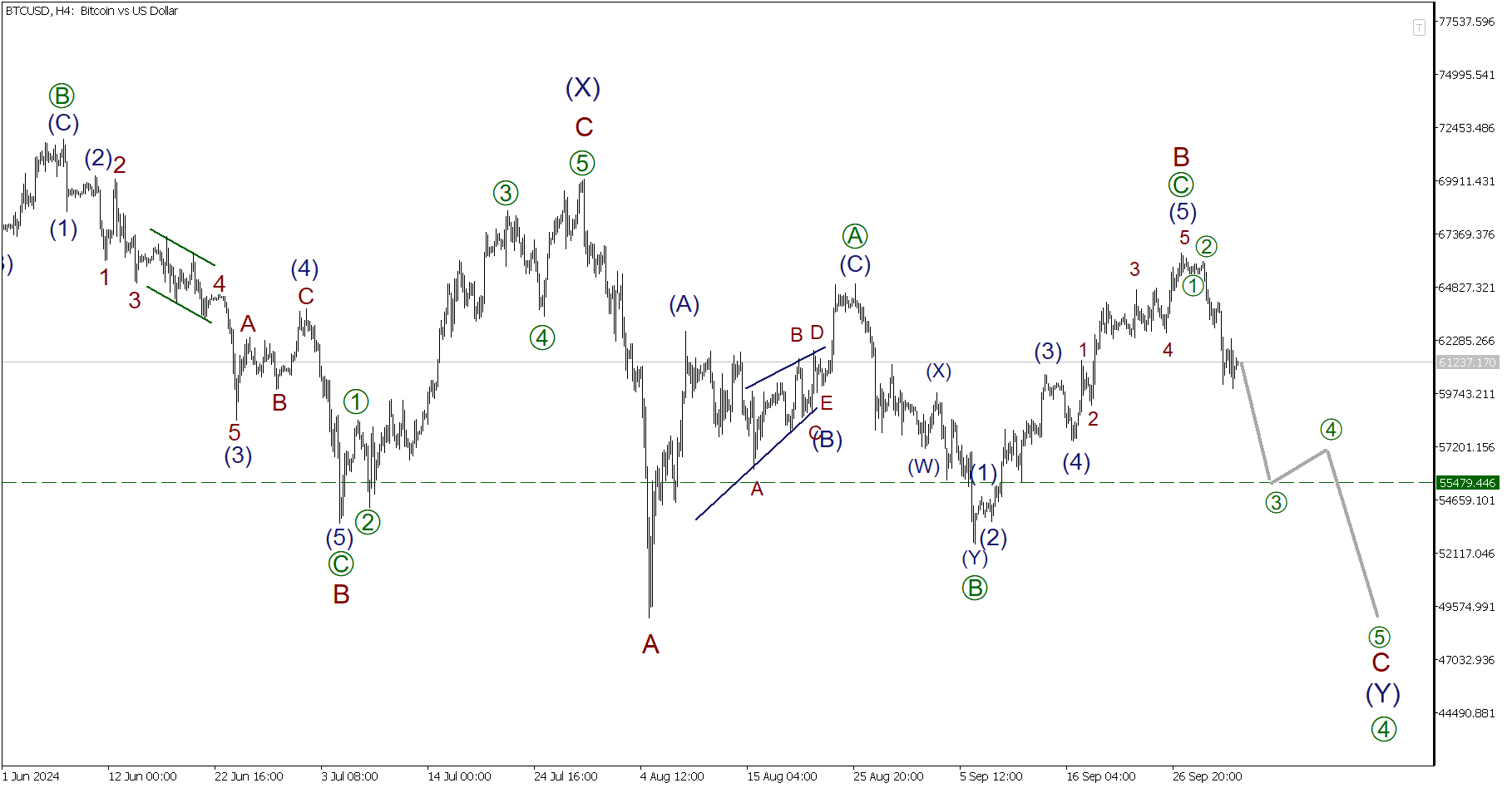

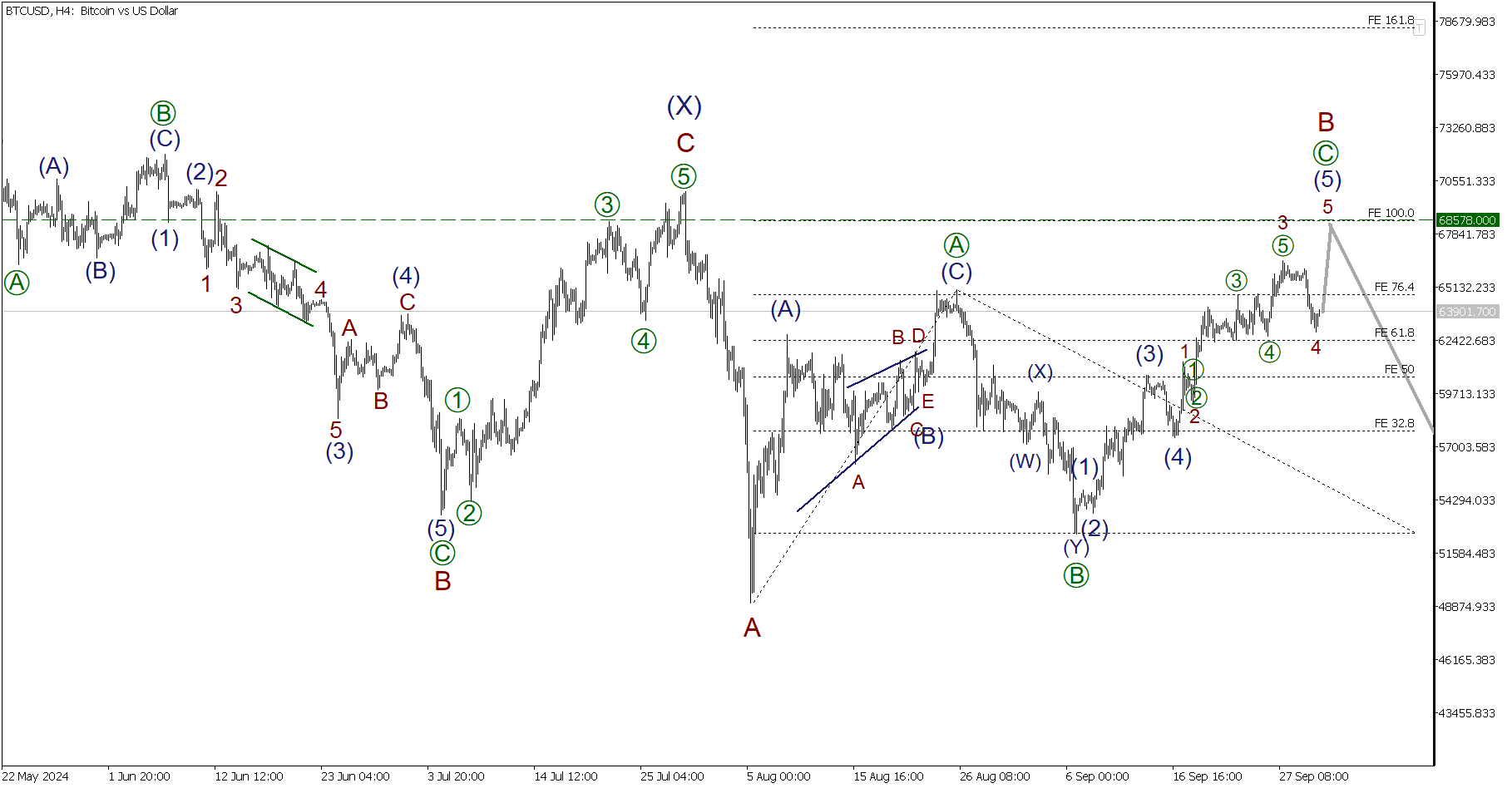

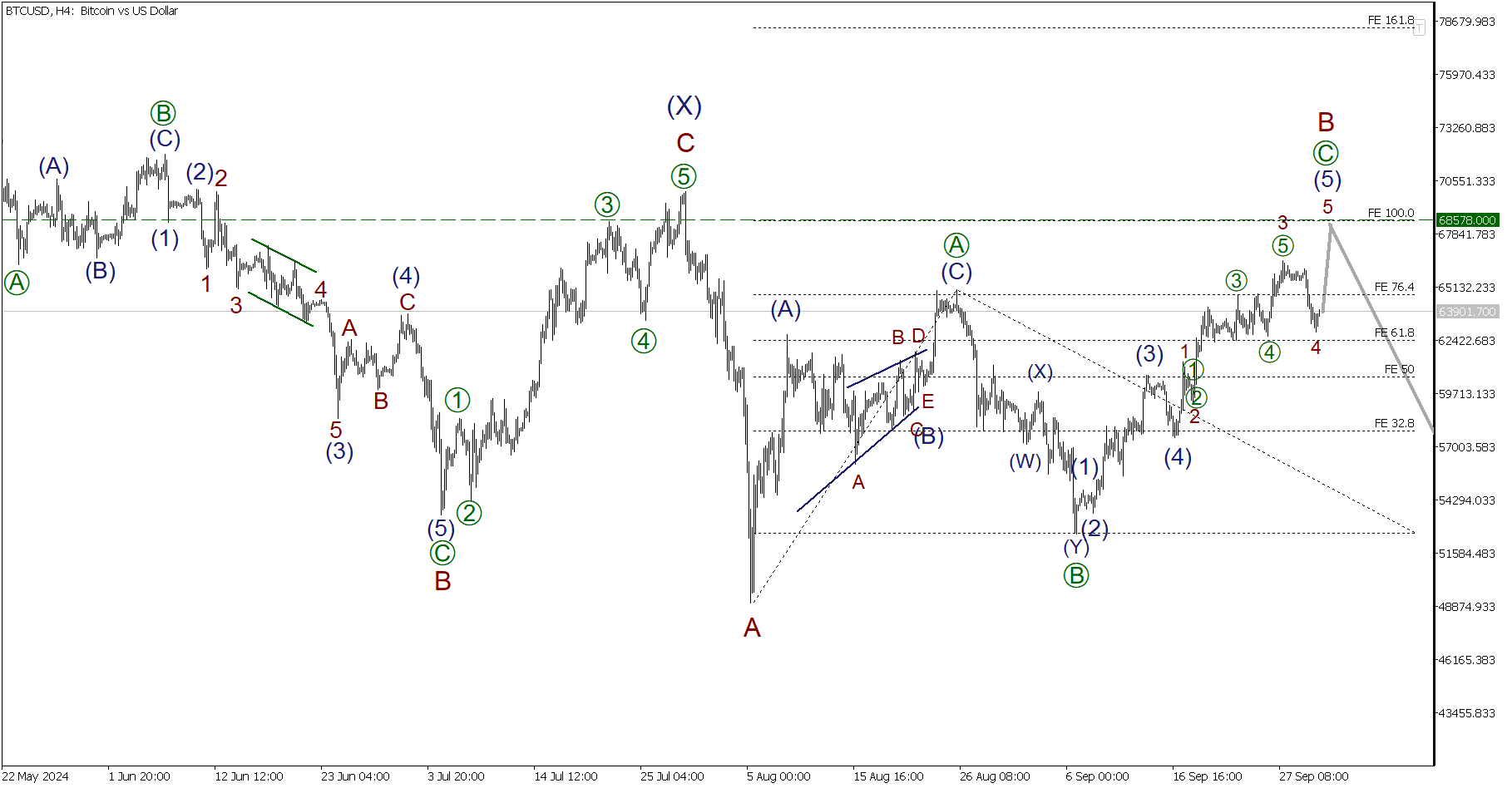

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-29112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-29112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

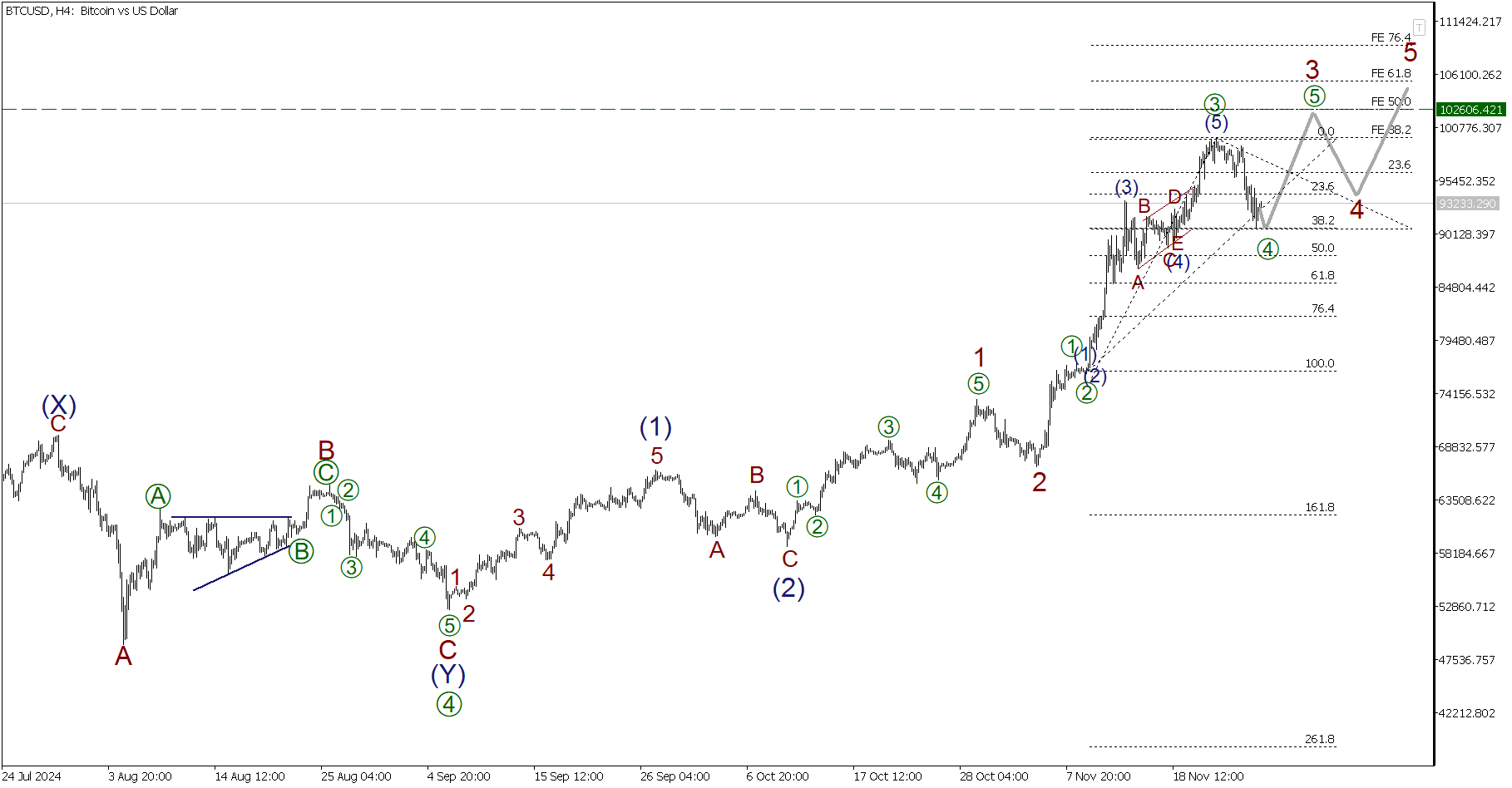

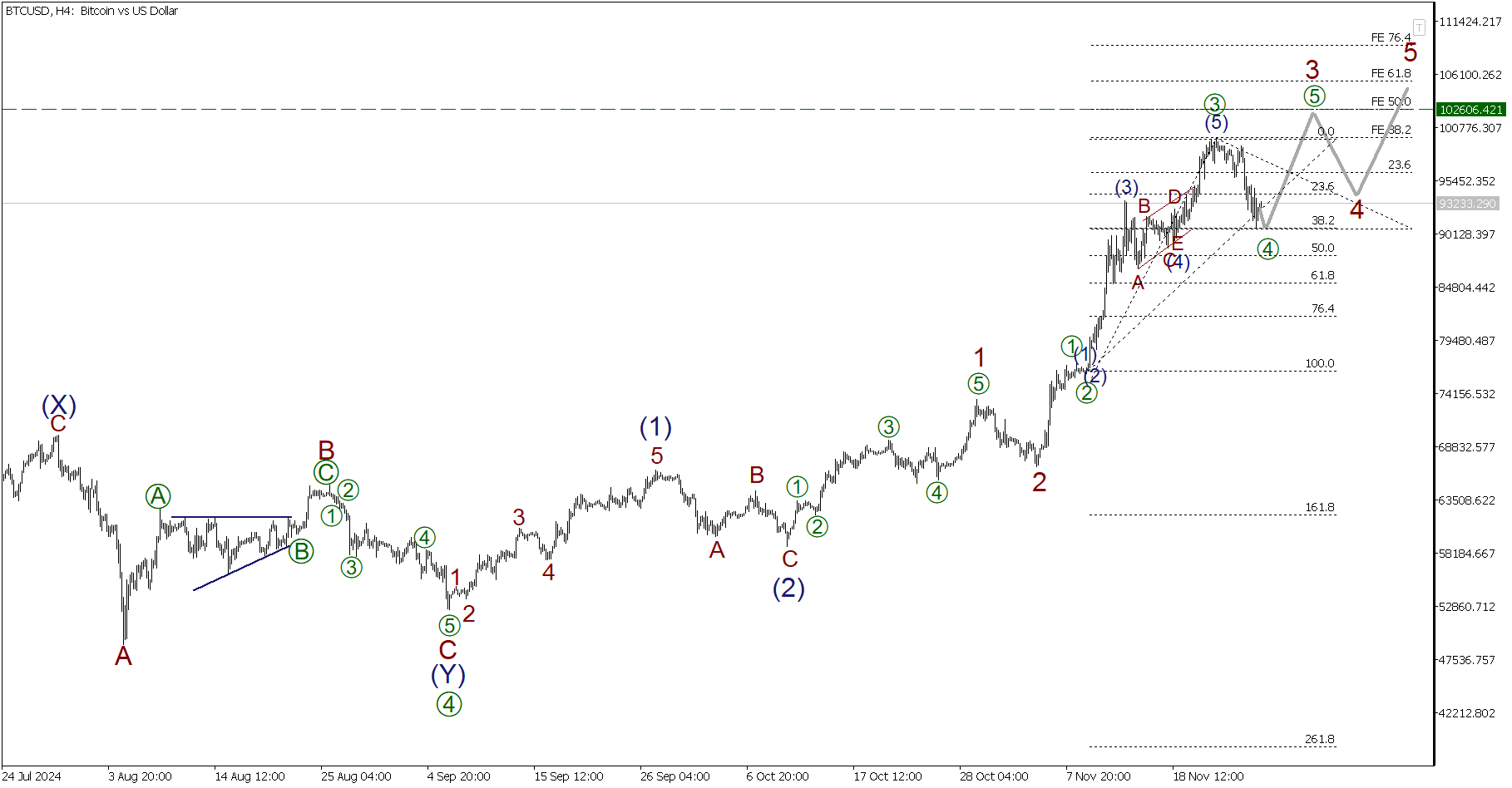

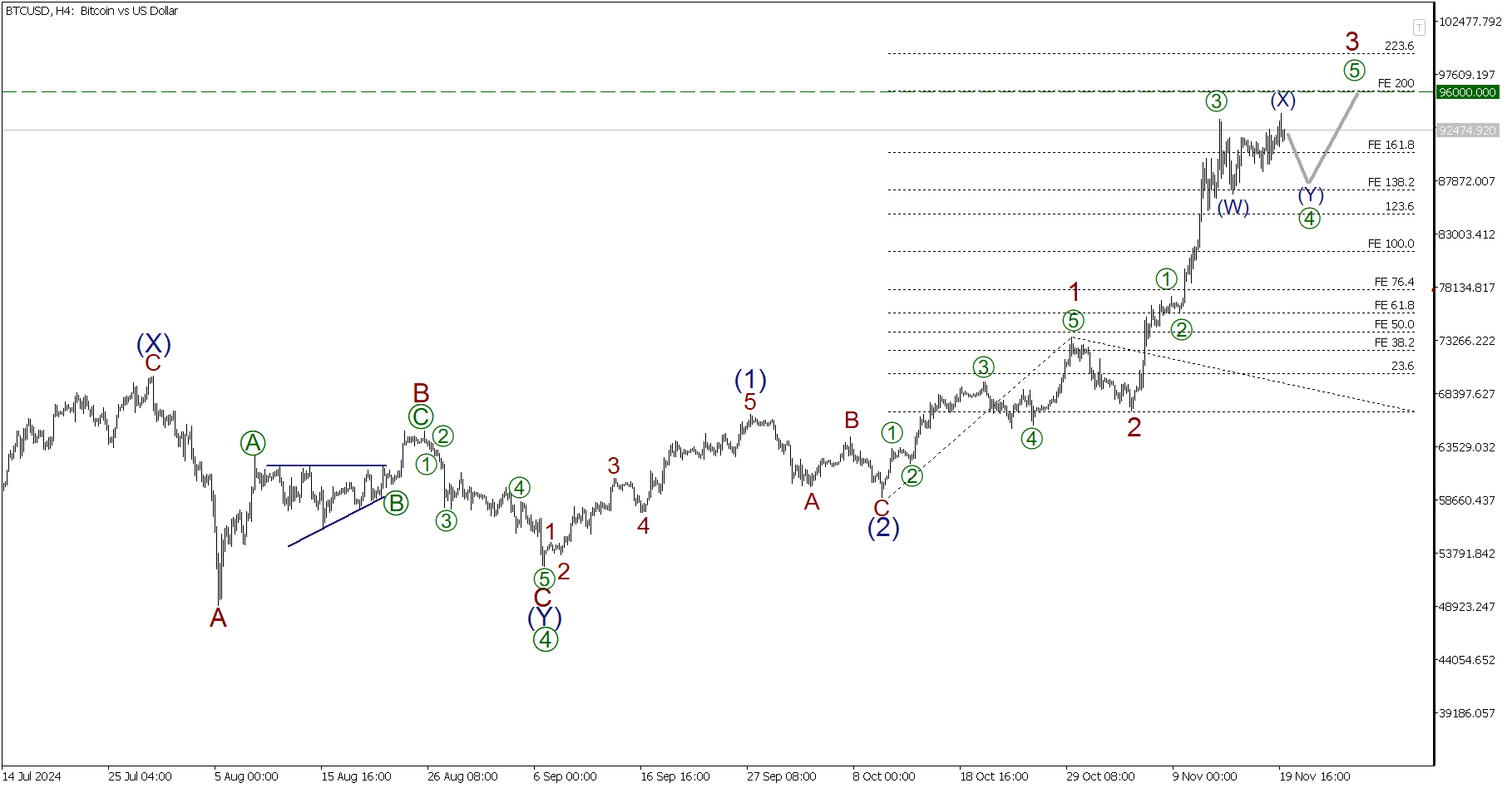

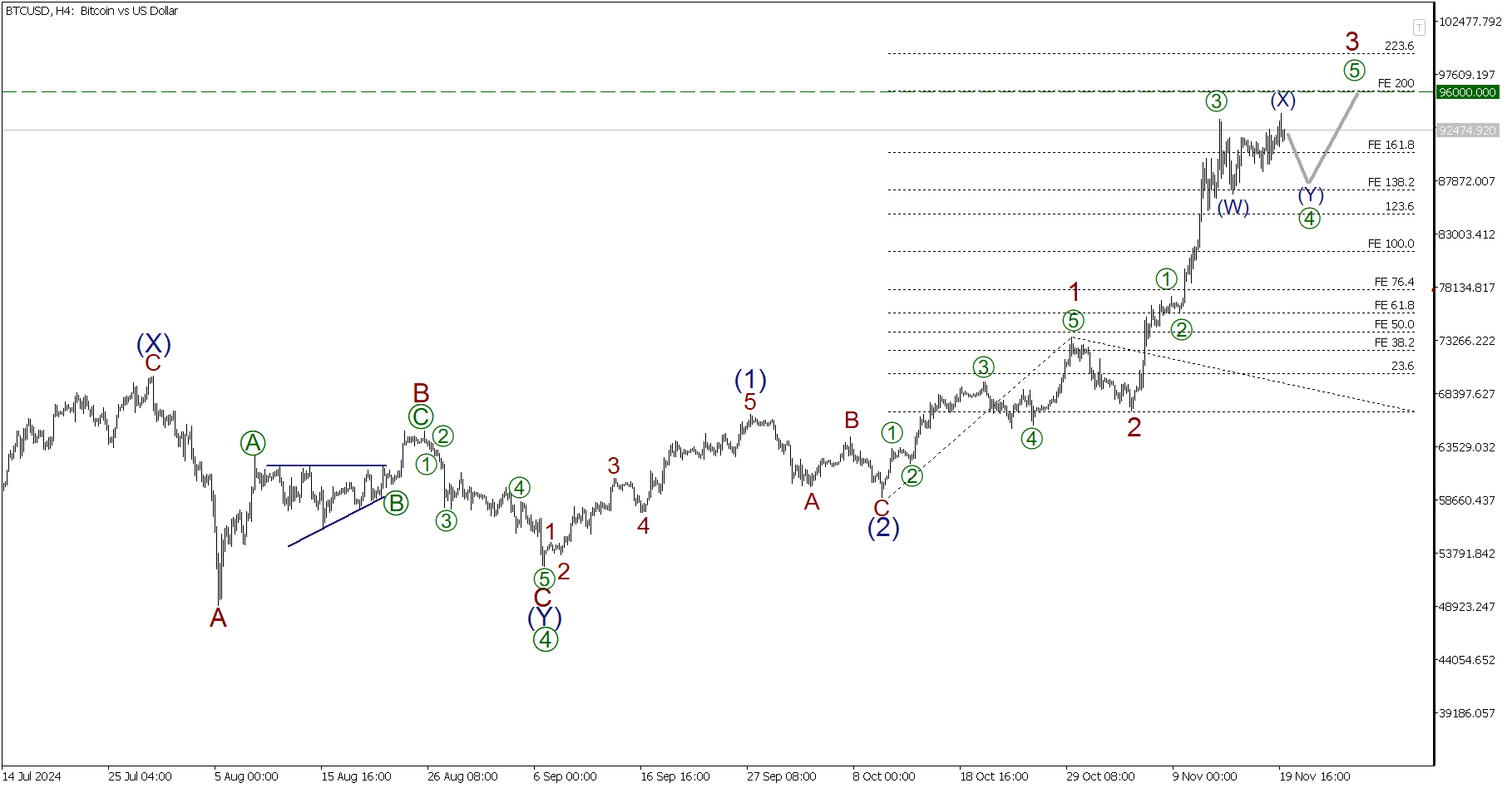

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 27.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

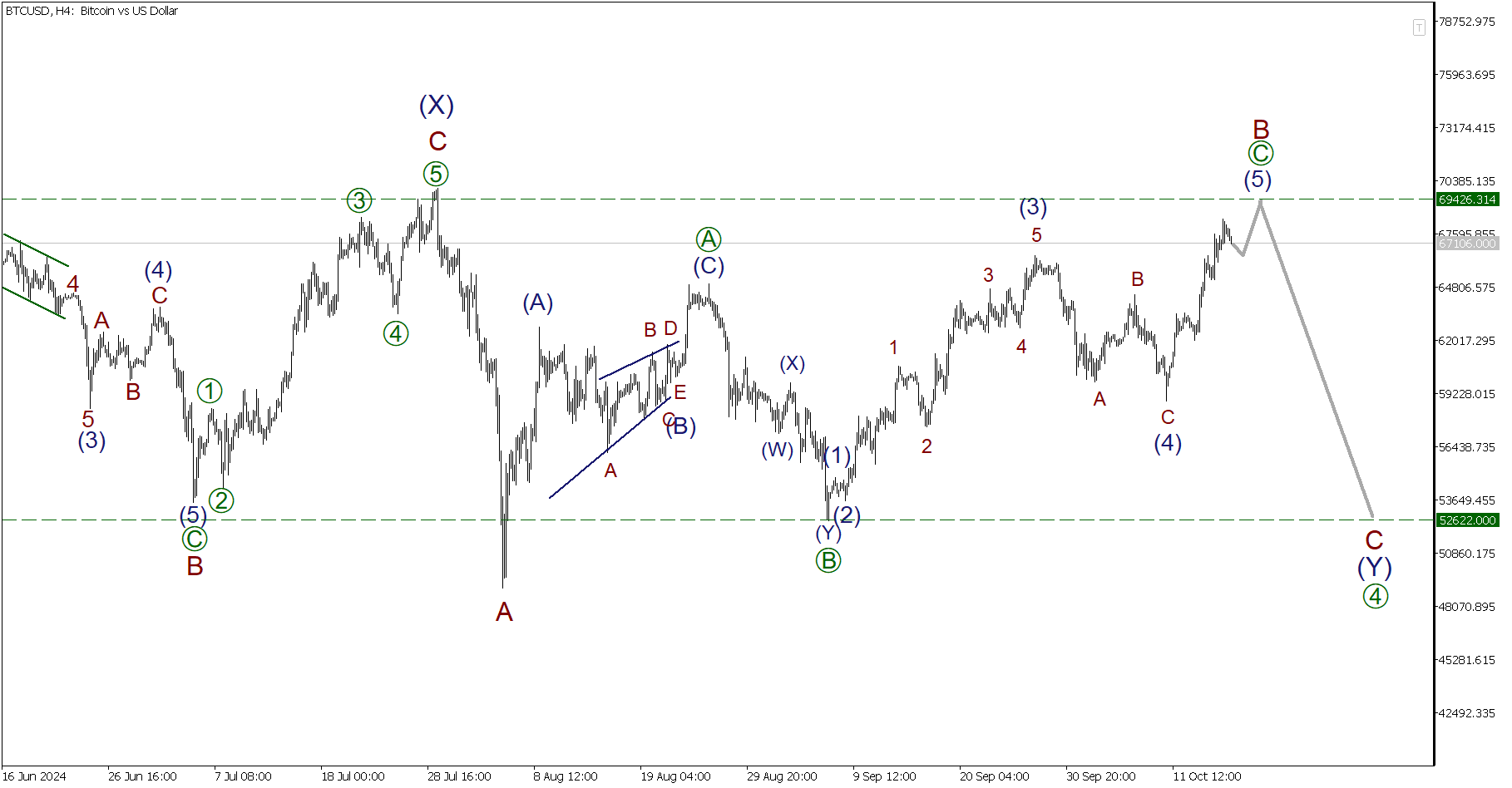

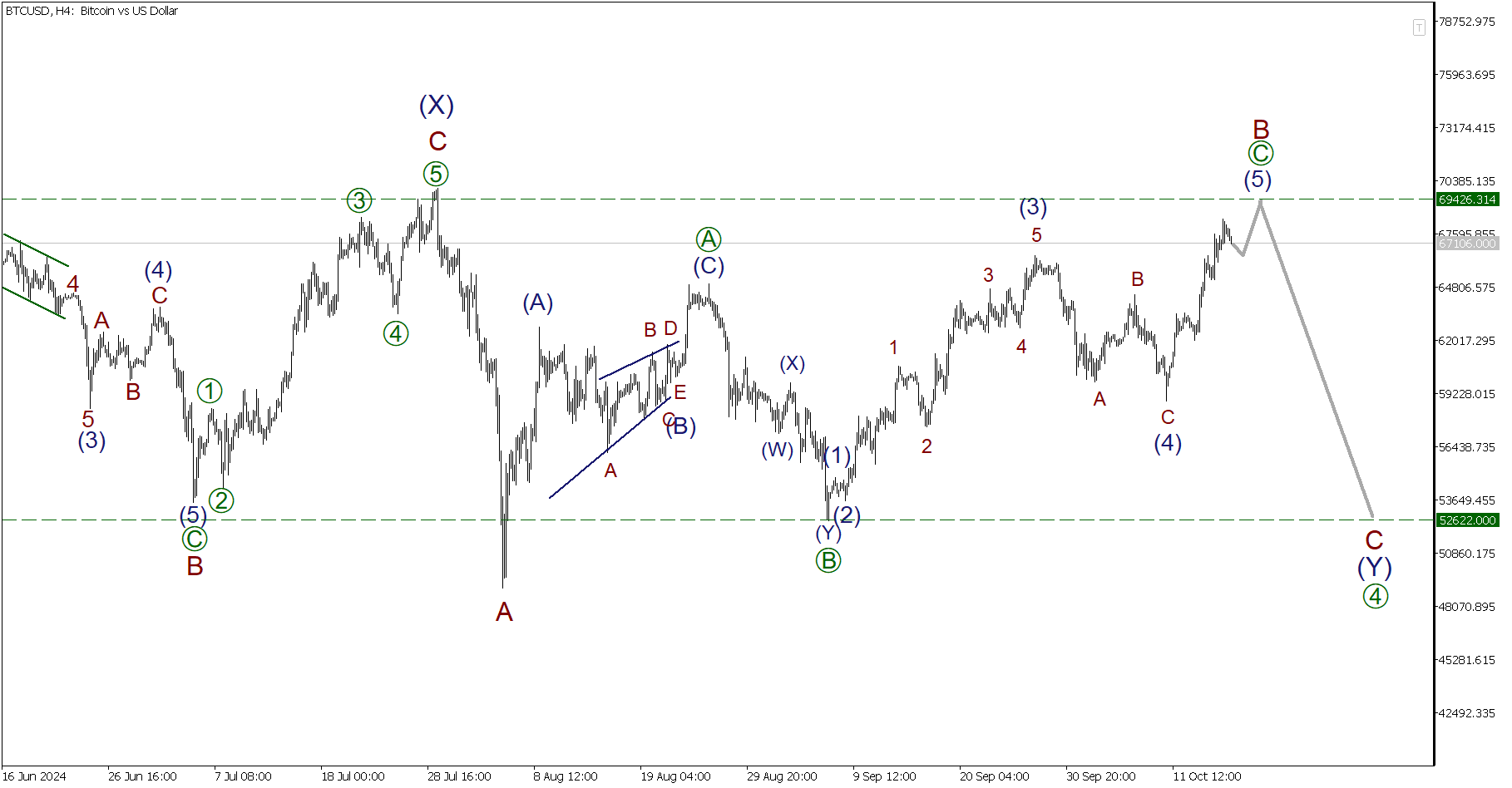

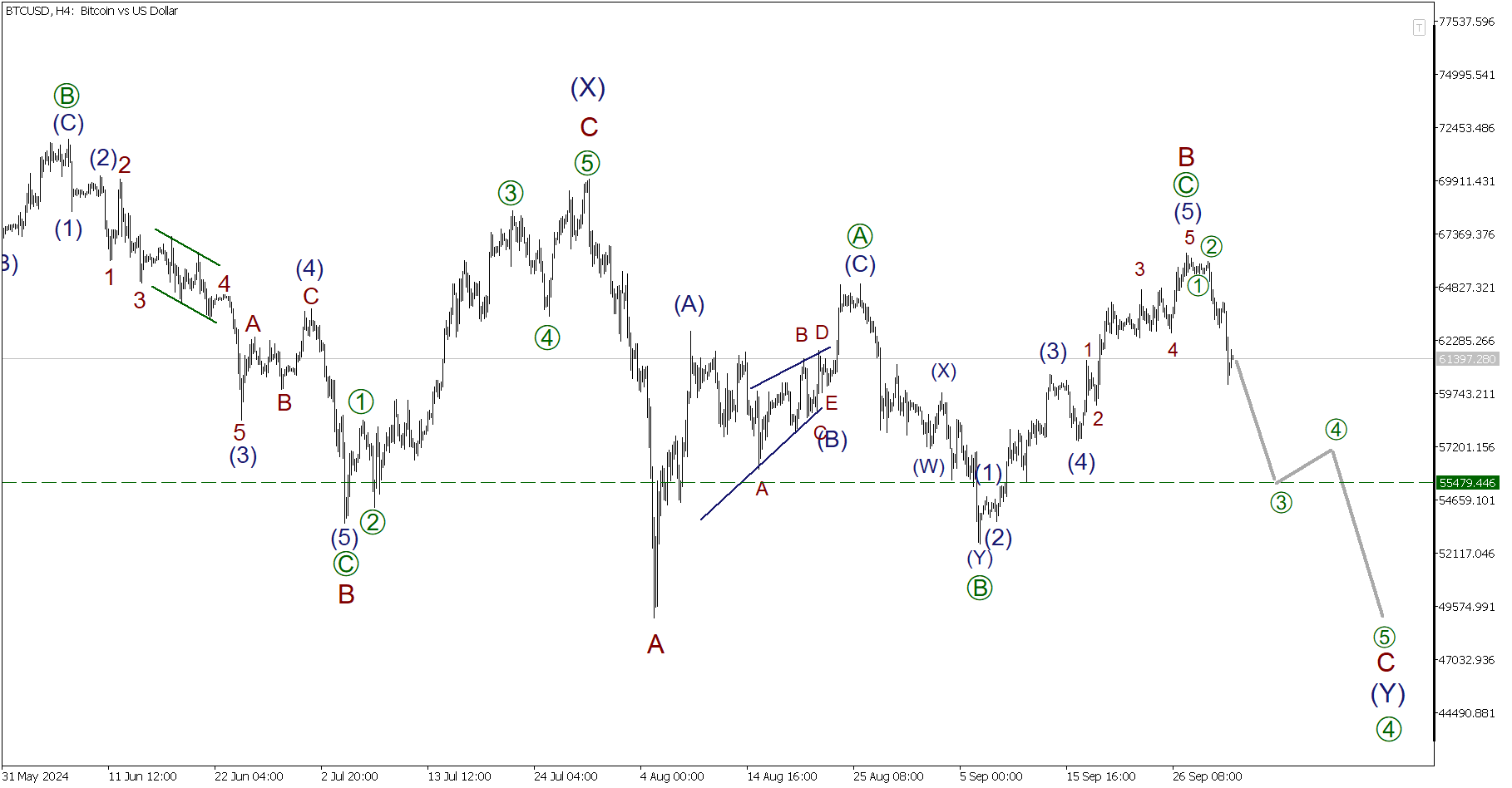

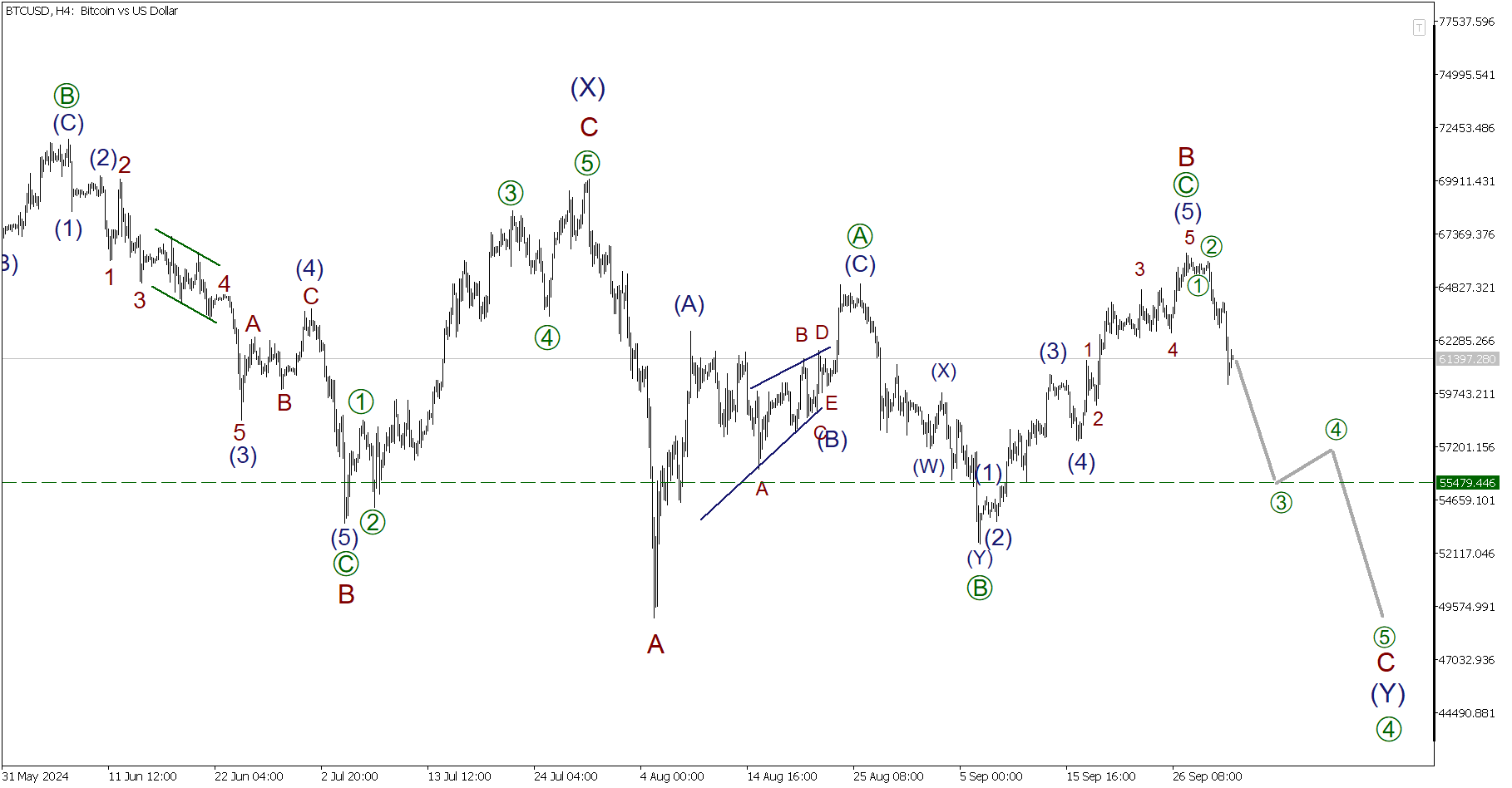

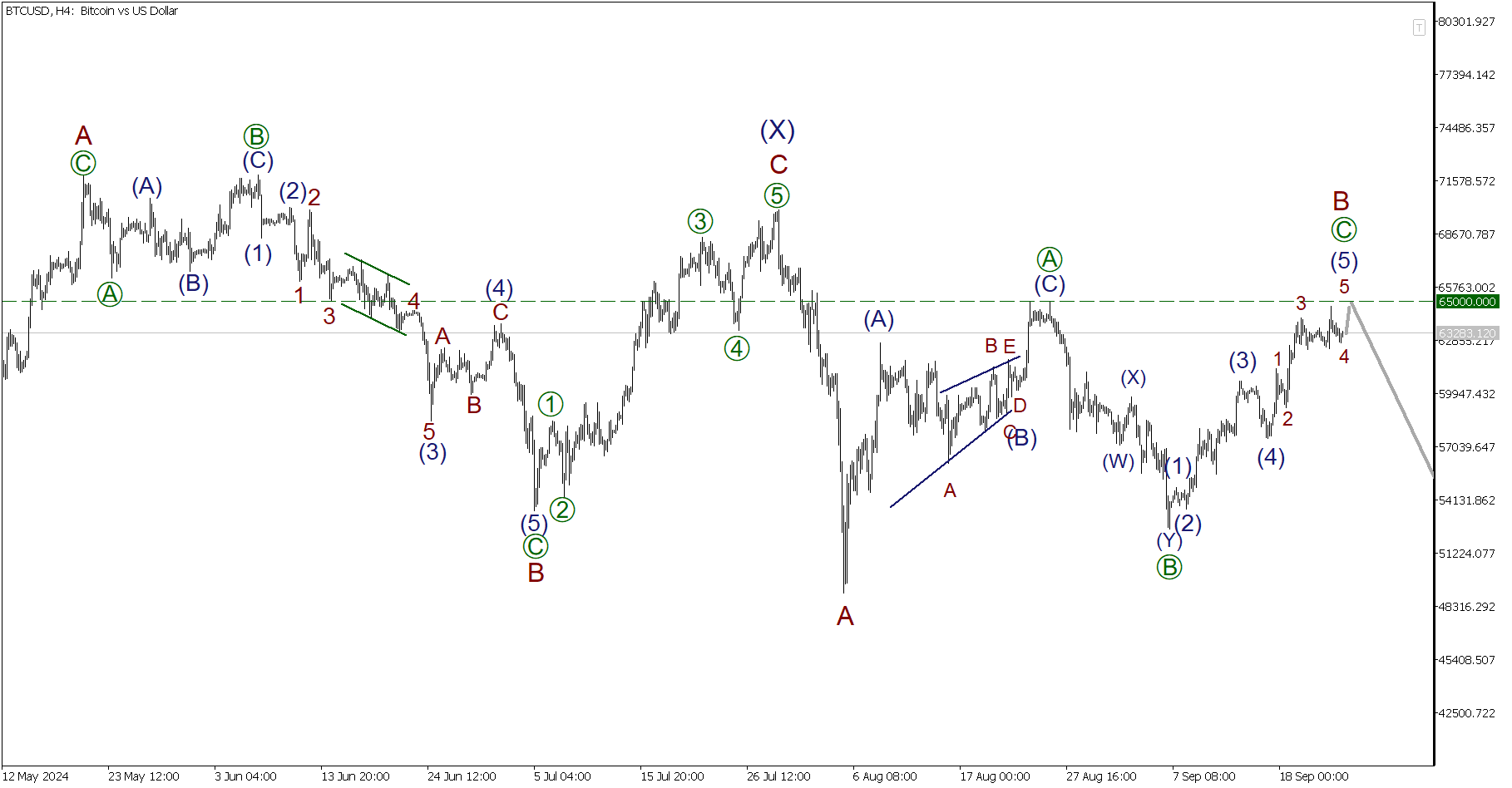

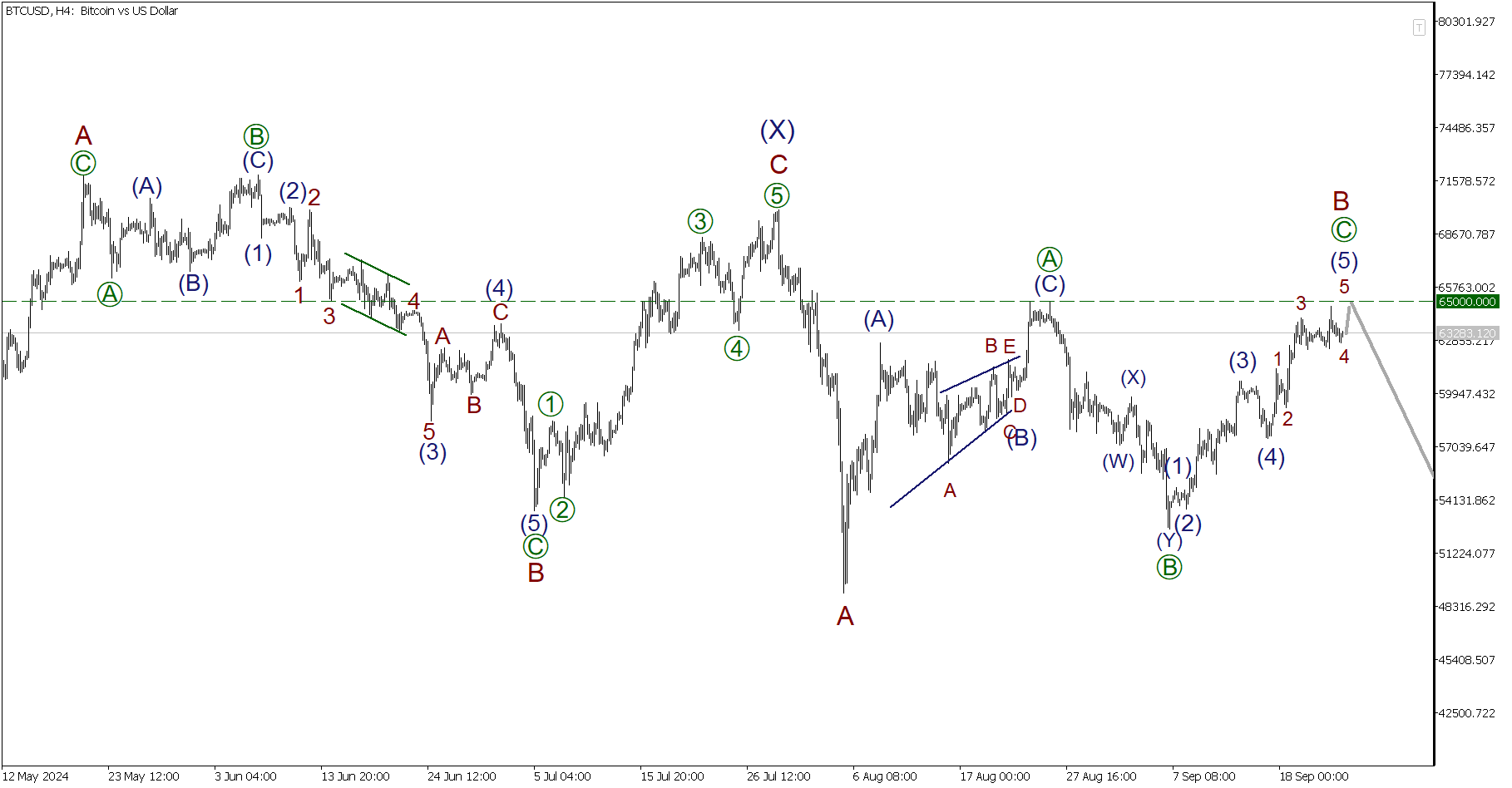

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-27112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-27112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 21.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-21112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-21112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 13.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-20112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-20112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 13.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-13112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-13112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 6.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

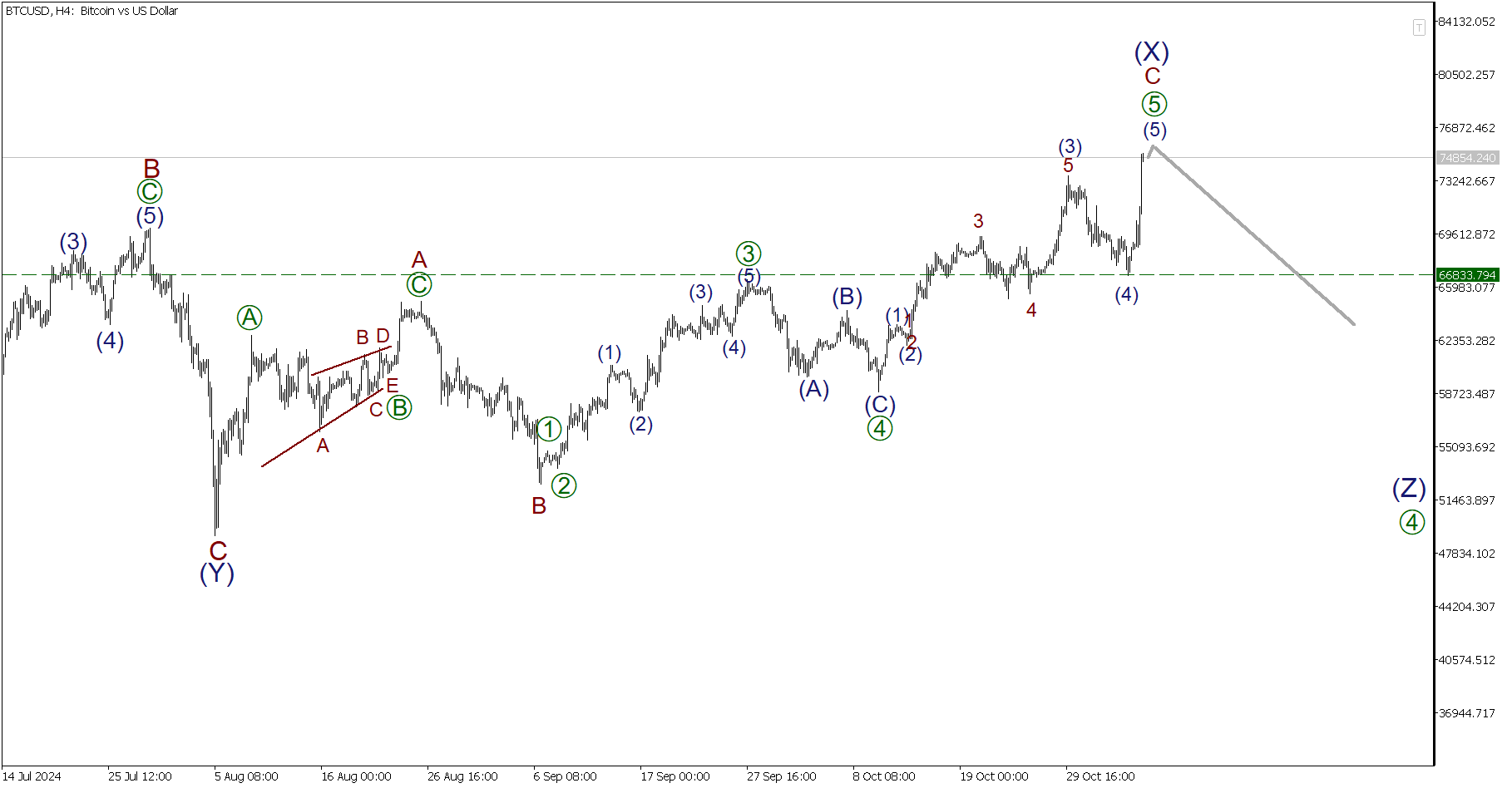

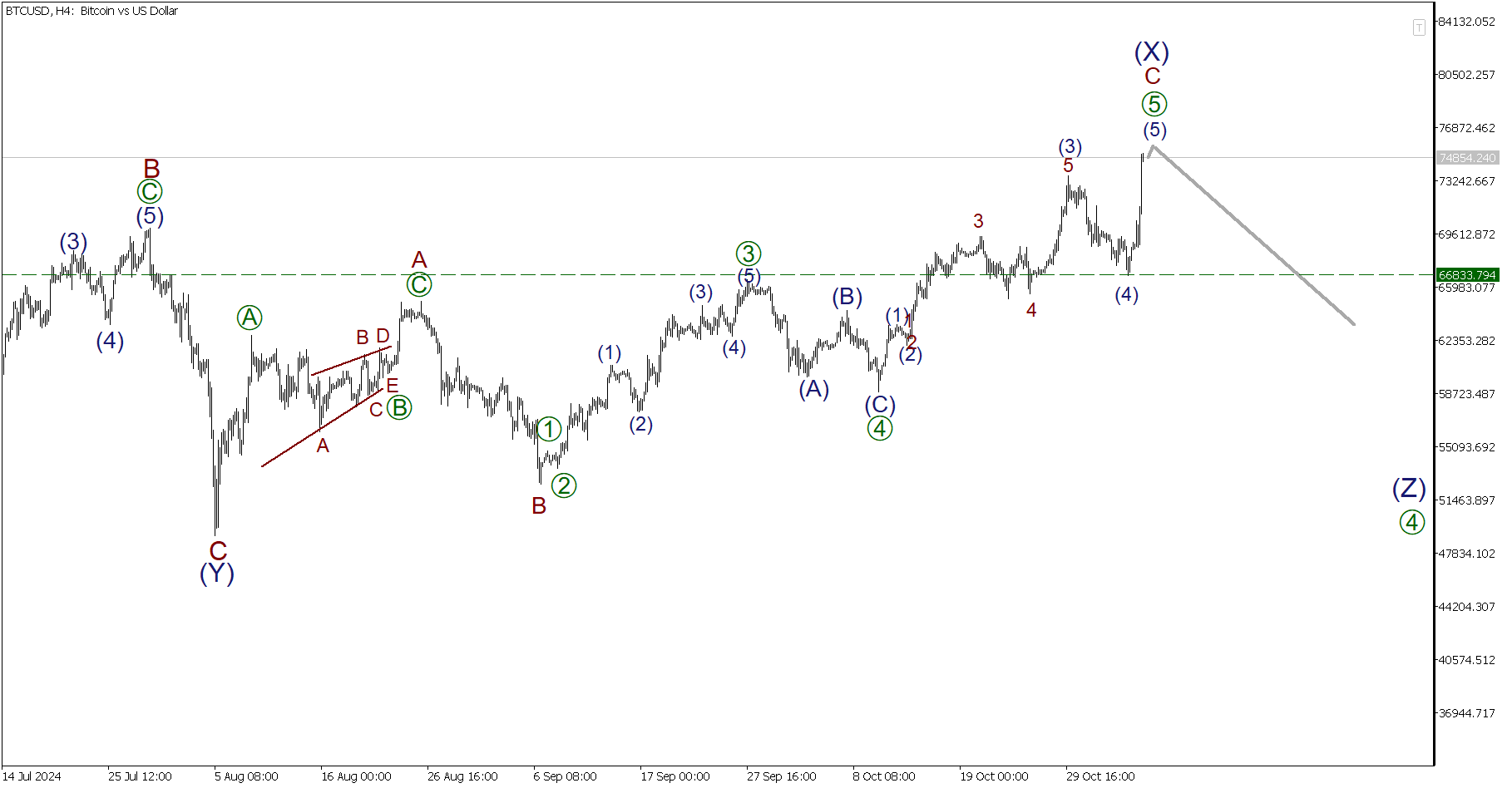

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-06112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-06112024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 1.11.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-30102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-30102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 30.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-30102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-30102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 28.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-28102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-28102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 25.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-25102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-25102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 22.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-22102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-22102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 17.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-17102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-17102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 15.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-15102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-15102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 10.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-10102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-10102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 08.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-08102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-08102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 03.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-03102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-03102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 02.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-02102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-02102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 01.10.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-01102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-01102024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 26.09.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-26092024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-26092024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

LiteFinance

Short-term Analysis for BTCUSD, XRPUSD, and ETHUSD for 24.09.2024

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-24092024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

We have prepared a short-term cryptocurrency forecast based on the Elliott wave analysis of Bitcoin, Ripple, and Ethereum.

The article covers the following subjects:

Elliott wave Bitcoin analysis

Elliott wave Ripple analysis

Elliott wave Ethereum analysis

Read more https://www.litefinance.org/blog/analysts-opinions/short-term-analysis-for-btcusd-xrpusd-and-ethusd-for-24092024/?uid=585411880&cid=12056&utm_source=mql5&utm_medium=article&utm_campaign=mql5

: