Currency crosses

- エキスパート

- Fuguang Liu

- バージョン: 1.3

- アップデート済み: 21 9月 2024

- アクティベーション: 5

Currency balance hedging arbitrage is a common currency arbitrage method in the original quantitative trading, but conventional hedging arbitrage is not easy to achieve due to spreads, slippage, swaps, handling fees and other reasons.

In order to achieve profits, we have made optimizations in this strategy, breaking the concept of balanced arbitrage, using factors such as the judgment of entry opportunities, the staggered entry time, and increasing or decreasing the position of currency pairs, etc., to break the balance but maintain relative stability, and then realize the unbalanced indirect arbitrage, which has been tested for many years and has been tested by the market.

Strategy Features:

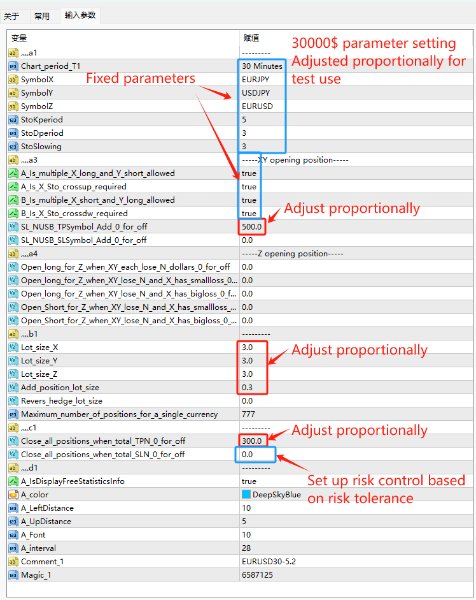

1. The target currency pairs of the strategy are USDJPY, EURJPY and EURUSD, enable the logical USDJPY and EURJPY priority hedging, generate profits and exit the target value, otherwise, when there is a loss, calculate the strength of EUR and USD, and start the EURUSD currency to hedge again.

2. When arbitrage cannot be achieved when a certain set value is reached, the ratio of USDJPY and EURJPY positions can be further increased (or decreased).

3. Instead of brainless hedging, you can enter the market after judging the direction according to the trend inflection point of different cycles, which increases the possibility of rapid arbitrage after entering the market

4. When you use it, you can load it on a currency of EURUSD, select the period you want to operate, and choose the H1 chart

5. Although there are no strict requirements, low spreads, low overnight fees, and low handling fees will be more friendly to the strategy