✅ [U.S.–China Tariff Easing Report Triggers Risk Reversal]

— Market stabilizes temporarily, but Trump's next move could reverse everything. Watch for weekend profit-taking pressure —

■ Market Summary (Tokyo Afternoon – Early Europe)

| Theme | Details |

| 📰 WSJ Report: Trump Administration Considering Tariff Cuts | Proposal to gradually reduce tariffs from the current max of 145% to 50–65%. Market reacts positively with risk-reversal trades gaining momentum. |

| 🤝 U.S.–Japan Finance Ministers’ Meeting Passes Uneventfully | U.S.: “No FX targets set”; Japan: “No structural framework discussed.” This eased yen appreciation fears, offering support to USD/JPY. |

| 💬 Overall Sentiment: Cautious Relief | However, one new Trump comment could reverse the tide. Light stop-loss management remains essential. |

■ USD/JPY: Targeting 144 on Reversal Momentum

| Situation | Strategy |

| 🔼 USD/JPY surpasses 143.80 as London opens | ✅ Aim for a test of 144.20–30. For momentum followers, strictly cut losses if support at 143.50 breaks. |

| 🔁 If U.S.–China tensions don’t flare again | 🎯 A push toward 145 next week becomes likely. Watch for moves by option traders and CTAs. |

| 🔻 If Trump resumes aggressive rhetoric | ❌ Beware of a "fake breakout" scenario. Best to treat the 144 zone as a scalp target for now. |

■ BTC/USD: Risk-On Rebound Continues

| Market View | Commentary |

| 📈 Current Price: ~$87,500–88,000 | Risk sentiment improves, opening the door for a return to the $100,000 range. |

| 📊 Technicals | 4H 20EMA holding as support. A break above $88,500 may trigger further upside. |

| 🛡 Strategy | ✅ Buy on dips around $87,000. Target: $100,000+. Daily chart suggests trend resumption. |

■ Key Economic Events Today

| Event | Currency/Impact |

| 🇨🇦 Canada Retail Sales (February) | CAD: Old data, likely ignored. Beware of spillover effects from position adjustments. |

| 🇺🇸 University of Michigan Consumer Sentiment (Final) | USD: Little expected change from preliminary; may support USD sentiment if unchanged. |

| 🇬🇧 🇨🇭 🇸🇪 Speeches by UK, Swiss, Swedish central bankers | Limited impact expected, but algorithmic reactions to surprise remarks remain a risk. |

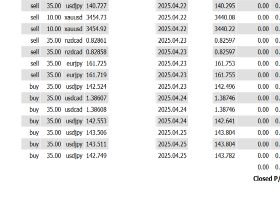

✅ Trade Strategy Summary (April 26)

| Asset | Strategy |

| USD/JPY | 🎯 Buy 143.60–143.80 → Take profit 144.20–30 / Stop below 143.50 |

| BTC/USD | 📈 Continue buying dips. Breakout above 88,500 may trigger acceleration. Watch for a move past 100,000 |

| GOLD (XAU/USD) | 📉 Reversal in progress → Caution for downside risk; short-term selling on rebounds |

📌 Note:

The U.S. Fed enters its “blackout period” tonight, during which policy-related remarks are suspended until the May 2 FOMC.

→ As a result, markets will be increasingly sensitive to Trump’s comments, as well as geopolitical and trade headlines.

→ Stop-loss management is critical.

![✅ [U.S.–China Tariff Easing Report Triggers Risk Reversal] ✅ [U.S.–China Tariff Easing Report Triggers Risk Reversal]](https://c.mql5.com/6/970/splash-762079.jpg)

![✅ [Dollar Selling Accelerates Again] Trump’s “Pressure on the Fed” and Reciprocal Tariffs Fuel U.S. Risk ✅ [Dollar Selling Accelerates Again] Trump’s “Pressure on the Fed” and Reciprocal Tariffs Fuel U.S. Risk](https://c.mql5.com/6/969/splash-preview-761963.png)

![✅ [Volatility subsides, but market remains in “day trading mode”] ✅ [Volatility subsides, but market remains in “day trading mode”]](https://c.mql5.com/6/969/splash-preview-762005.jpg)