Focus Currencies and Technical Analysis (1-Hour Chart) August 27, 2024

EUR/USD - Strong Sell

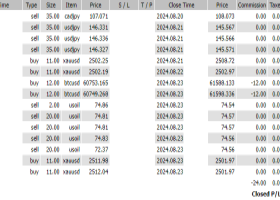

The EUR/USD pair started weakly at the beginning of the week but has recovered slightly, attempting to break higher around 1.1165. Germany's GDP data showed a 0.3% annual increase but a 0.1% quarterly decrease. The IFO Business Climate Index also slightly exceeded expectations, drawing market attention. Although U.S. durable goods orders increased significantly, the core component showed an unexpected decline.

GBP/USD - Strong Buy

The GBP/USD pair is trading around 1.3190, having declined from the previous day's high. Investors are anticipating a rate cut from the U.S. Federal Reserve, putting pressure on the dollar. Fed Chair Powell reaffirmed a dovish monetary policy in his Jackson Hole speech, but the market remains uncertain about the extent of the rate cut. Consumer credit and inflation data from both the U.S. and the UK are expected to impact the market this weekend.

AUD/USD - Strong Buy

The AUD/USD pair has recovered from a previous decline and is facing strong resistance around 0.6800. With continued pressure on the U.S. dollar, the Australian dollar is rising. Expectations are high for a rate cut by the Fed in September, with Powell expressing confidence in easing inflation risks. This week, Australia's Consumer Price Index (CPI) data is due, with expectations for a decrease from 3.8% to 3.4%.

USD/JPY - Strong Buy

The USD/JPY pair is showing slight growth, attempting a breakout at 144.70. Fed Chair Powell’s comments confirmed a rate cut in September, though the exact extent was not specified. BoJ Governor Kazuo Ueda is considering further monetary tightening if inflationary pressures increase. Japan's CPI has risen by 2.8%, and this week will see data on Tokyo CPI and retail sales.

XAU/USD (Gold) - Strong Buy

The XAU/USD pair is stagnant around 2510.00, waiting for new movements. The dollar is under pressure following Powell’s remarks, but inflation data this week is expected to have a significant impact. Both the ECB and the Bank of England have also suggested easing monetary policy, which could further support gold prices.