+33,654 USD. FRB Chair Powell Finally Announces Rate Cut! Time to Reconsider Dollar Selling Stance

FRB Chair Powell Finally Announces Rate Cut! Time to Reconsider Dollar Selling Stance

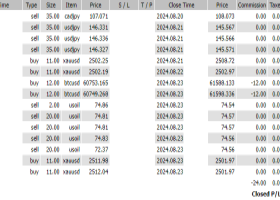

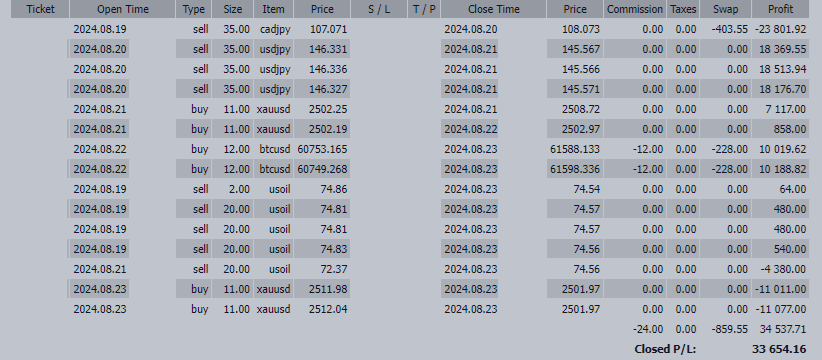

August 19 - August 23 Trades Resulted in a Total Profit of +33,654 USD.

This week, I sold crude oil, anticipating that the spread of Mpox infections to Asia (Philippines, Thailand) could lead to travel restrictions similar to those during the COVID-19 pandemic, resulting in grounded flights.

During the COVID-19 outbreak, crude oil prices dropped from the $70 range to as low as -$35, a decrease of nearly $100.

This time, I shorted crude oil in the high $74 range, and by midweek, prices fell to the low $71 range. I expected further drops of at least $10 if more Mpox cases were reported. However, since no new cases emerged, the price quickly rebounded to the entry point, resulting in a stop-out. It was unfortunate to end with a loss despite initially holding a significant unrealized profit.

While the lack of new infections in Asia is good news for everyone, including myself, as a trader, it’s essential to focus on profits without letting emotions interfere.

Moving forward, I will continue to monitor Mpox-related news closely. If the outbreak worsens again, I plan to re-enter short positions on crude oil.

Key Focus Points Moving Forward:

-

FRB Chair Powell Declares "Time for Rate Cuts" at Jackson Hole

- He confirmed confidence that inflation is on a sustainable path toward 2% during his speech.

- He expressed no desire to see a further cooling of the labor market.

Federal Reserve Chair Jerome Powell stated that the time has come to lower the key policy rate. While aiming to complete the job of slowing the worst inflation seen in decades, he emphasized that the Federal Open Market Committee (FOMC) would likely begin rate cuts in September. Powell also clarified the intention to prevent further cooling of the labor market.

Speaking at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming, on the 23rd, Powell said, "The time has come to adjust policy. The direction is clear, and the timing and pace of rate cuts will be guided by forthcoming data, changing outlooks, and risk balances." His remarks were based on a pre-distributed manuscript.

Powell also acknowledged recent progress in slowing inflation, stating, "I’ve gained greater confidence that inflation is on a sustainable path toward our 2% target."

(Source: Bloomberg)

Continuing to favor selling the USD.

-

BOJ’s Complex Decision-Making for Additional Rate Hike - Scenarios for This Year Remain

- BOJ Governor Ueda emphasized maintaining an accommodative monetary environment while hinting at the necessity of further rate hikes if economic and price trends continue as expected.

BOJ Governor Kazuo Ueda reiterated that if the economy and prices evolve as forecasted, the Bank of Japan is prepared to raise rates further, maintaining a scenario for an additional hike within the year. However, evolving market trends and political dynamics suggest that policy decisions may involve complex considerations.

(Source: Bloomberg)

Favor buying the Japanese yen. Plan to continue targeting USD/JPY for selling.

Key Points for Each Currency:

-

USD: Neutral to Sell

USD/JPY will be influenced by the statements of BOJ Governor Ueda and FRB Chair Powell, as well as the focus on the July PCE deflator and August Tokyo CPI. Particularly, if the PCE deflator's growth rate underperforms expectations, the potential for a larger rate cut in September may weigh on the upside of USD/JPY. -

JPY: Neutral to Buy

The yen’s performance will be closely watched concerning the LDP presidential election and domestic indicators, especially the August Tokyo CPI. Governor Ueda's possible hints at additional rate hikes could boost the yen. -

EUR: Neutral

EUR/USD will be influenced by the August Eurozone CPI, as the market watches for the possibility of a rate cut in the ECB’s September meeting. Geopolitical risks continue to cap the euro's upside. -

AUD: Buy

The AUD is expected to remain firm, supported by the RBA’s delayed rate cut relative to other central banks. The differences in policies between the RBA, FRB, and RBNZ will continue to support the AUD. -

NZD: Sell

The NZD may face downward pressure due to the RBNZ’s recent rate cut decision. -

ZAR: Neutral to Buy

The ZAR is likely to be supported by the ongoing economic recovery in South Africa, although geopolitical risks remain a concern. -

GBP: Neutral

The GBP may experience uncertain movements, influenced by the BOE's unclear stance on additional rate cuts and upcoming economic data. -

CAD: Neutral to Sell

The CAD may face pressure as the market anticipates additional rate cuts by the BOC in September.

Final Thoughts:

Thank you for reading this week’s FX Weekly Review. I’d like to discuss the emerging field of "VR Counseling," which is making waves in mental health care. Virtual Reality (VR) technology could potentially revolutionize mental health treatment.

VR counseling involves using VR headsets to conduct therapy sessions in a virtual environment. This allows patients to confront their mental health issues in a safe and controlled setting. Research from Stanford University (Rizzo et al., 2020) has shown that VR counseling is particularly effective in treating anxiety disorders and PTSD, with about 70% of patients reporting significant improvement in symptoms.

Although challenges remain, such as the cost of technology, VR counseling holds great promise for the future. As mental health is a crucial aspect of our lives and trading, keeping an eye on new technologies and treatments is essential. Have a great weekend!