Bayes Quantum Signals

- Utilità

- Diego Andres Unigarro Andrade

- Versione: 1.0

- Attivazioni: 5

How does Bayes Quantum Signal work?

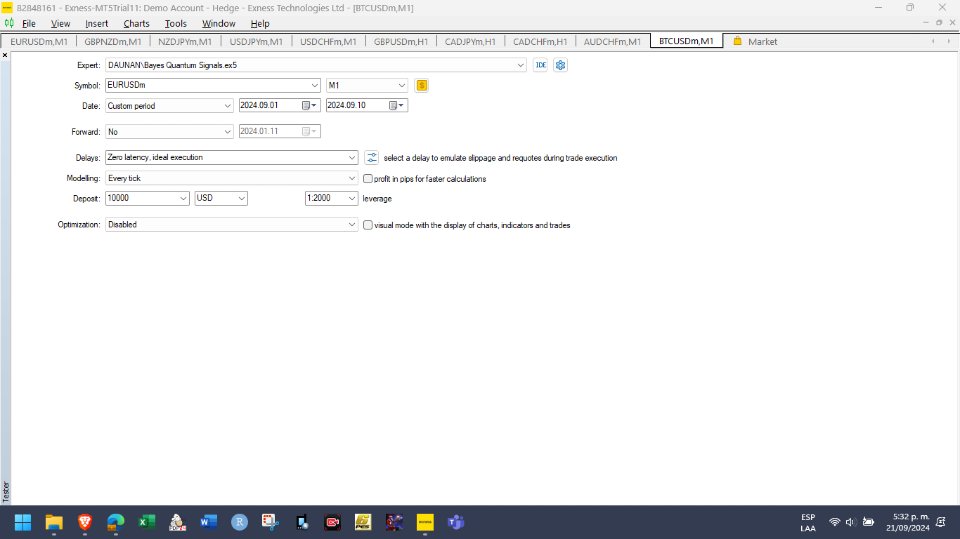

1. A historical database is taken, whose extension and temporality are defined by the same operator.

2. From this base, the system calculates the bullish and bearish prior probabilities, and weights them based on their standard deviation measured dynamically through an eGARCH model. The basic idea is that larger and more skewed returns will have a larger impact on the calculation of posterior probabilities.

3. At all times the system calculates the real-time return of the candle that is forming and weights it with the previously calculated standard deviation. This is where the system applies Bayes' Theorem to constantly update the conditional probability calculation. In natural language, this can be expressed as "given that return x is occurring right now, what is the probability that the price will go up or down?"

It is important to highlight that both the previous and posterior probabilities are updated in real time, that is, Bayes Quantum Signal always takes the last n candles for its calculations. This is the key point of the system, and it allows us to offer added value to our clients. Of course, a human cannot do this calculation in real time, or at least his/her margin of error will be much higher.

4. If the posterior probabilities are equal or exceed the inputs given by the user, then a buy or sell order will be activated as appropriate. The system allows you to modify the lot of both bying and selling operations before execution, as well as the take profit and stop loss of said orders (measured in points). Furthermore, these probabilities can be seen on the operator's screen, the color and font of which can be customized.

Input parameters:

For a better visualization, the EA will display a dialog box separated by the following sections, in which the user must define the following inputs for each type of order:

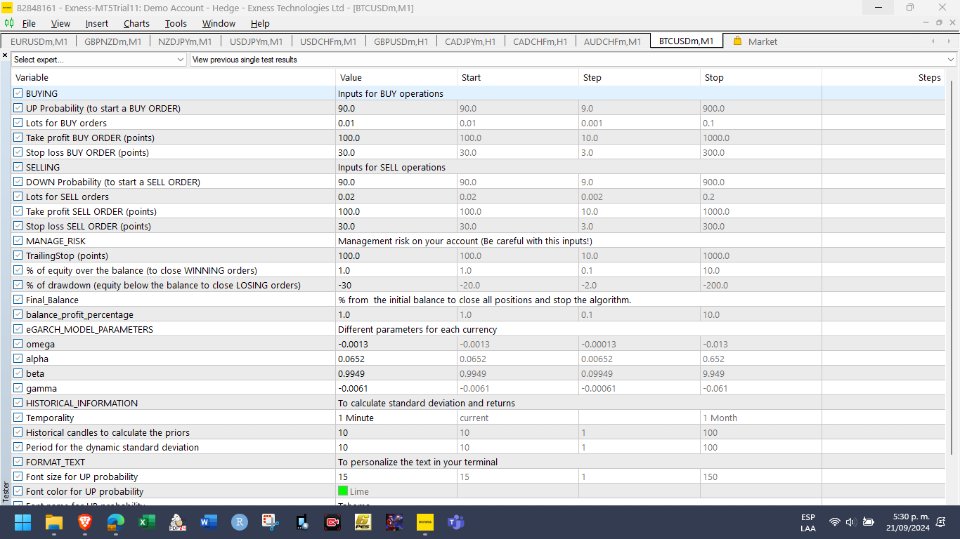

Buying operations

- UP Probability (to start a BUY ORDER): Minimum probability value for which the user wants to start a buy order. It is defined as a number from 0 to 100. For example, to enter when the algorithm calculates an 80% UP probability, you enter the number 80 as input (without percentage notation).

- Lots for BUY orders: Number of lots for each buy order. It is a fixed amount.

- Take profit BUY ORDER (points): Fixed level of take profit for each buy order. It is defined in points.

- Stop loss BUY ORDER (points): Fixed stop loss level for each buy order. It is defined in points.

Selling operations

- DOWN Probability (to start a SELL ORDER): Minimum probability value for which the user wants to start a sale order. It is defined as a number from 0 to 100. For example, to enter a sale order when the algorithm calculates an 80% down probability, you enter the number 80 as input (without percentage notation).

- Lots for SELL orders: Number of lots for each sale order. It is a fixed amount.

- Take profit SELL ORDER (points): Fixed take profit level for each sale order. It is defined in points.

- Stop loss SELL ORDER (points): Fixed stop loss level for each sale order. It is defined in points.

Risk management in your account:

Important note: Bayes Quantum Signal applies take profit and stop loss on some orders, which can be linked to the TrailingStop (points) input, where the user can define the points to apply trailing stops to previously defined levels.

In those orders that are created without take profit or stop loss, the algorithm manages its profits and losses with the 3 points defined below:

- % of equity over the balance (to close WINNING orders): Define the percentage of equity above the balance at which all WINNING orders will be closed.

- % of drawdown (equity below the balance to close LOSING orders): Define the percentage of equity below the balance at which all LOSING orders will be closed.

- Balance_profit_percentage: Define the final percentage you expect to obtain on your balance and at which all WINNING and LOSING orders will be closed.

eGARCH Model Specification:

At this point it is important to highlight that each financial asset will have its own parameters. It is recommended to study the fundamentals of the eGARCH model or access reliable sources to obtain these parameters. You can also run your own regressions in some statistical software for this purpose.

- omega: Long-term volatility

- alpha: Impact of lagged volatility on current volatility

- beta: Persistence of volatility over time

- gamma: Asymmetry or leverage on volatility

Parameters for historical information

- Temporality: Drop-down list in which the user can choose a temporality from one minute to one month.

- Historical candles to calculate the priors: Number of candles that the user considers for the model to calculate the prior probabilities. These are related to the previously chosen temporality. For example, if the user chooses a time frame of 1 minute, and in this input defines 10, the model will take prior information from the previous 10 minutes.

- Period for the dynamic standard deviation: Number of candles that the user considers for the model to calculate the standard deviation through the eGARCH model.

Inputs to format the text

The user can give the desired format to the text displayed on the screen, like this:

- Font size for UP probability: Font size for the bullish probability text.

- Font color for UP probability: Font color for the bullish probability text.

- Font name for UP probability: Font name for the bullish probability text.

- Font size for DOWN probability: Font size for the bearish probability text.

- Font color for DOWN probability: Font color for bearish probability text

- Font name for DOWN probability: Font name for the bearish probability text.

Final recommendations:

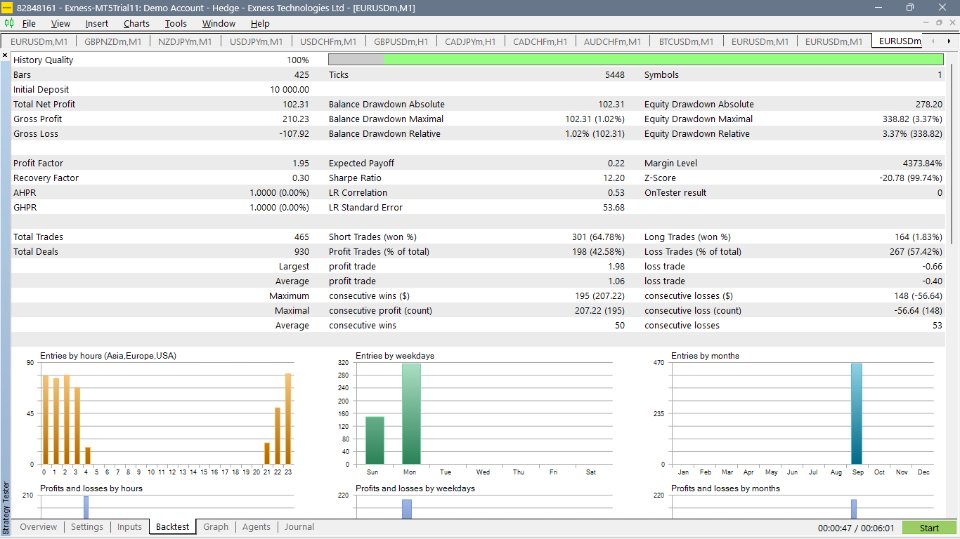

1. According to the tests carried out, this system is designed to open positions from 1 minute and on. It is important that you test the system to adjust it according to your own needs and investment objectives.

2. Please watch the full video in which I explain how the system works.

Thank you for your time.