Abiroid PinBar Arrow

- Indicatori

- Abir Pathak

- Versione: 1.0

- Attivazioni: 20

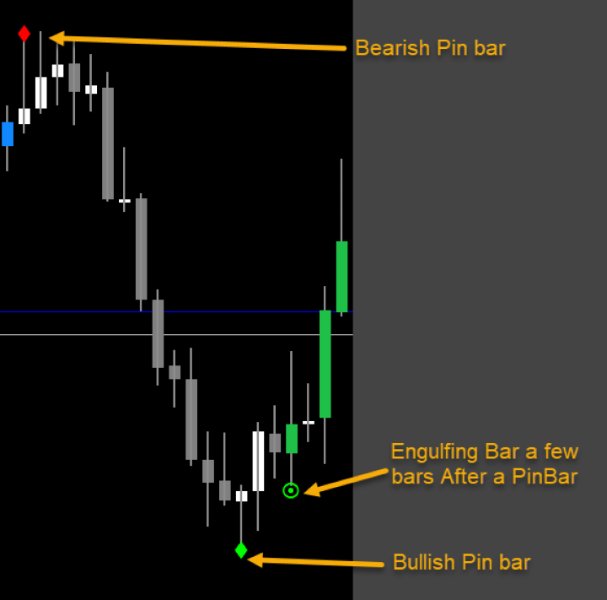

This is a Pinbar Arrows which will check for reversal pin bars.

Pin bars are not good for trend continuation. They are best when an ongoing trend ends and they signal a reversal. But it is better to validate the reversal.

Free Scanner and Detailed Post with Extra Downloads:

https://www.mql5.com/en/blogs/post/758569

Features:

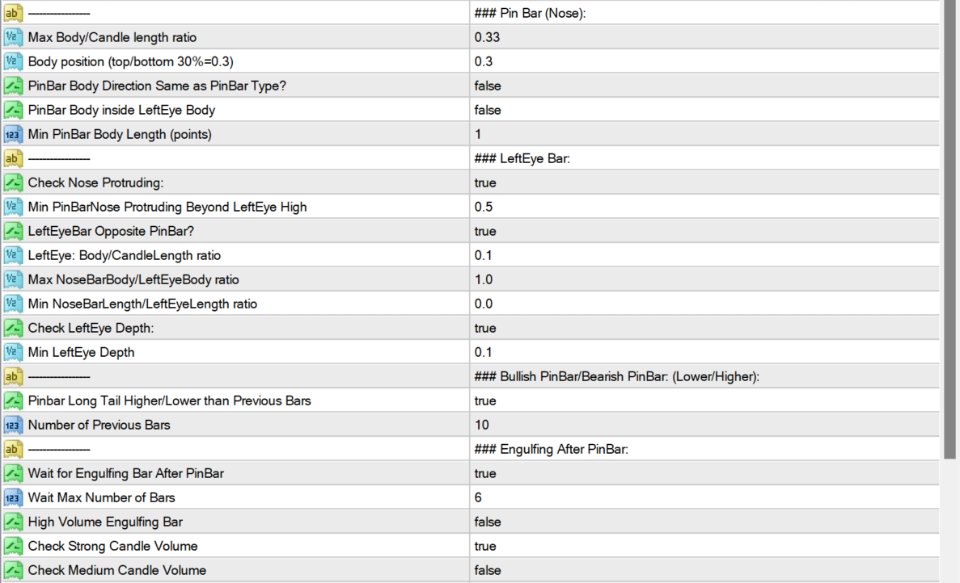

- Choose Pin bar checks: PinBar Body Options, PinBar Nose and Tail Options, Left Eye Options- Engulfing Bar After Pin Bar

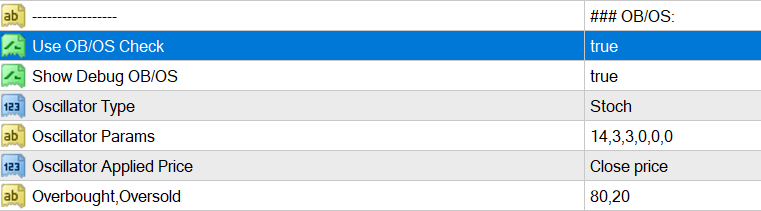

- Overbought/Oversold with CCI or Stochastic or RSI

- Distance of Pin bar body from nearest Quarter Point (Option to use Majors, halfpoints, quarters)

- Volatility Check

How to Use:

Note that Quarters Lines indicator is a separate indicator available in extras section above. The arrows indicator uses it internally and won’t display major lines on chart.

Very strong stop hunt pin bars, if you keep a very low candle body/length ratio: 0.015

Pin bars only if price is Overbought/Oversold, using CCI or Stochastic or RSI. Set your own custom period and OB/OS levels and other parameters.

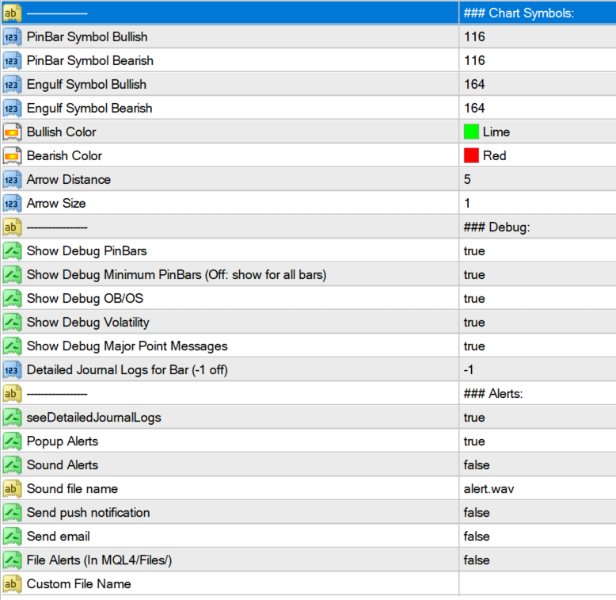

What Symbols Mean:

By default, Diamond is for a pinbar. And a circle is for engulfing candle after a pinbar. Bracket numbers show how many bars back the pin bar have happened.

Scanner and pin bar Arrows have similar settings. So a set file can be used interchangeably. Scanner does not have settings from arrows for debug messages and arrow spacing. Everything else is the same. So, same set file will work for both.

Settings:

Check blogpost for detailed settings explained.

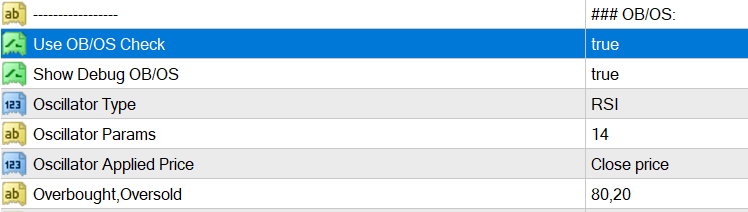

Overbought/Oversold Checks using Stochastic or RSI or CCI

UseOBOS: This setting enables the use of overbought/oversold checks.

Stochastic Params: KPeriod,DPeriod,Slowing,MA_Method,PriceField,Stoch_Mode

RSI or CCI Params: Period, OB/OS

Volatility:

UseVolatility: When true, it incorporates high volatility checks.

It uses the Chaikin Volatility (CHV). Low volatility produces a lot of pin bars. So not a good time to trade:

Major Points (like 1.00000 or half points: 1.50000 or quarter points like 1.25000 and 1.75000)

checkFullPoints, checkHalfPoints, checkQuarterPoints: If enabled, this checks for price proximity to major points.

Set your own Major Points. Because lower timeframes like M5 need major points like 1.00100, 1.00200 etc as majors. And higher timeframes like H1 need 1.00000, 1.10000, 1.20000 etc as majors.

Also, set minimum distance of pin bar from a major line, based on different timeframes. Use cross hairs tool to find in between distances.

Conclusion:

Pinbars are useful reversal signals. Best used during a good volatility market. To find when a trend might end. Not good to be used as a standalone.

Needs validation from other indicators like:

- Major levels or Pivots- Overbought/Oversold levels

- Other candle patterns like engulfing bars

- High volume bar in opposite direction

Don’t use all validating indicator simultaneously as signals will be very limited.