Md Atikur Rahman / Profil

- Informations

|

1 année

expérience

|

3

produits

|

8

versions de démo

|

|

0

offres d’emploi

|

2

signaux

|

0

les abonnés

|

An experienced developer and professional forex trader, I have been working in software development for nearly 13 years and actively involved in the financial markets for over 5 years.

Throughout my journey, I have developed several products in the forex market and am now focused on bringing new and innovative solutions to the MetaTrader 4 and MetaTrader 5 platforms.

Please check my signals in the MQL5.

Inspiration EA MT5 HighRisk: https://www.mql5.com/en/signals/2266184

Inspiration EA MT5 LowRisk: https://www.mql5.com/en/signals/2266185

Please check my applications in the MQL5 Market.

Expert Advisor:

Inspiration EA MT5: https://www.mql5.com/en/signals/2263586

Inspiration EA MT4: Upcoming…

Script:

OrderHelper MT5: https://www.mql5.com/en/market/product/94863

OrderHelper MT4: https://www.mql5.com/en/market/product/94876

Personal Contacts:

Telegram: https://t.me/AtikurRahmanAtik

Email: arrahman5893@gmail.com

Skype: arrahman5893@gmail.com

Throughout my journey, I have developed several products in the forex market and am now focused on bringing new and innovative solutions to the MetaTrader 4 and MetaTrader 5 platforms.

Please check my signals in the MQL5.

Inspiration EA MT5 HighRisk: https://www.mql5.com/en/signals/2266184

Inspiration EA MT5 LowRisk: https://www.mql5.com/en/signals/2266185

Please check my applications in the MQL5 Market.

Expert Advisor:

Inspiration EA MT5: https://www.mql5.com/en/signals/2263586

Inspiration EA MT4: Upcoming…

Script:

OrderHelper MT5: https://www.mql5.com/en/market/product/94863

OrderHelper MT4: https://www.mql5.com/en/market/product/94876

Personal Contacts:

Telegram: https://t.me/AtikurRahmanAtik

Email: arrahman5893@gmail.com

Skype: arrahman5893@gmail.com

Md Atikur Rahman

Gold (XAU):

The precious metal is likely to gain amid tepid support for the greenback prior to the US central bank meeting, weakness on equities and record high inflation registered globally. The inflation-hedge is likely to look towards the highs from November 2021 around $1,877.

The precious metal is likely to gain amid tepid support for the greenback prior to the US central bank meeting, weakness on equities and record high inflation registered globally. The inflation-hedge is likely to look towards the highs from November 2021 around $1,877.

Md Atikur Rahman

The Dollar Index (DXY):

The US dollar may be vulnerable due to a Fed speak blackout before the FOMC meeting on 26 January but any losses are likely to be limited as the central bank has demonstrated a relatively consistent hawkish lean in the face of record inflation.

The US dollar may be vulnerable due to a Fed speak blackout before the FOMC meeting on 26 January but any losses are likely to be limited as the central bank has demonstrated a relatively consistent hawkish lean in the face of record inflation.

Md Atikur Rahman

Dollar Index (DXY):

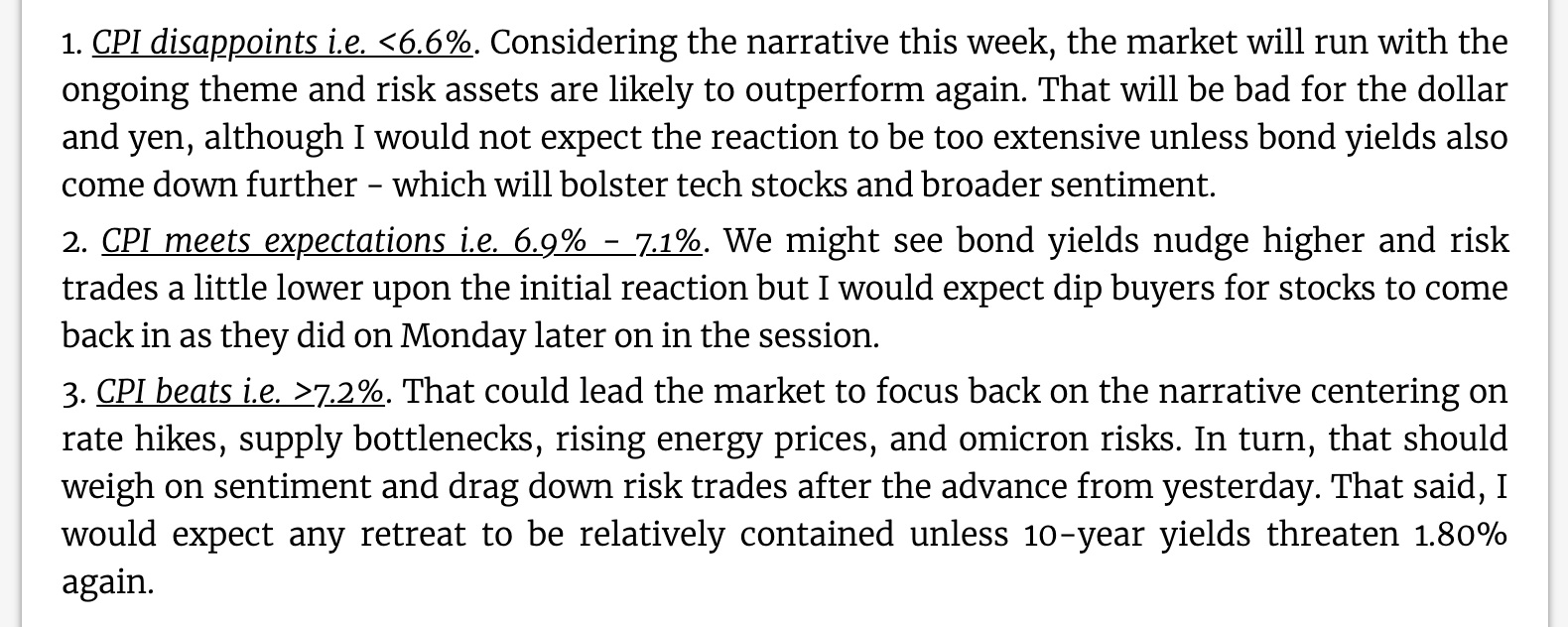

Despite the highest inflation seen in recent times, the excessive optimism from the US dollar hawks is likely to continue to abate following Fed Chair Powell’s less hawkish take on the balance sheet run-off during his latest speech.

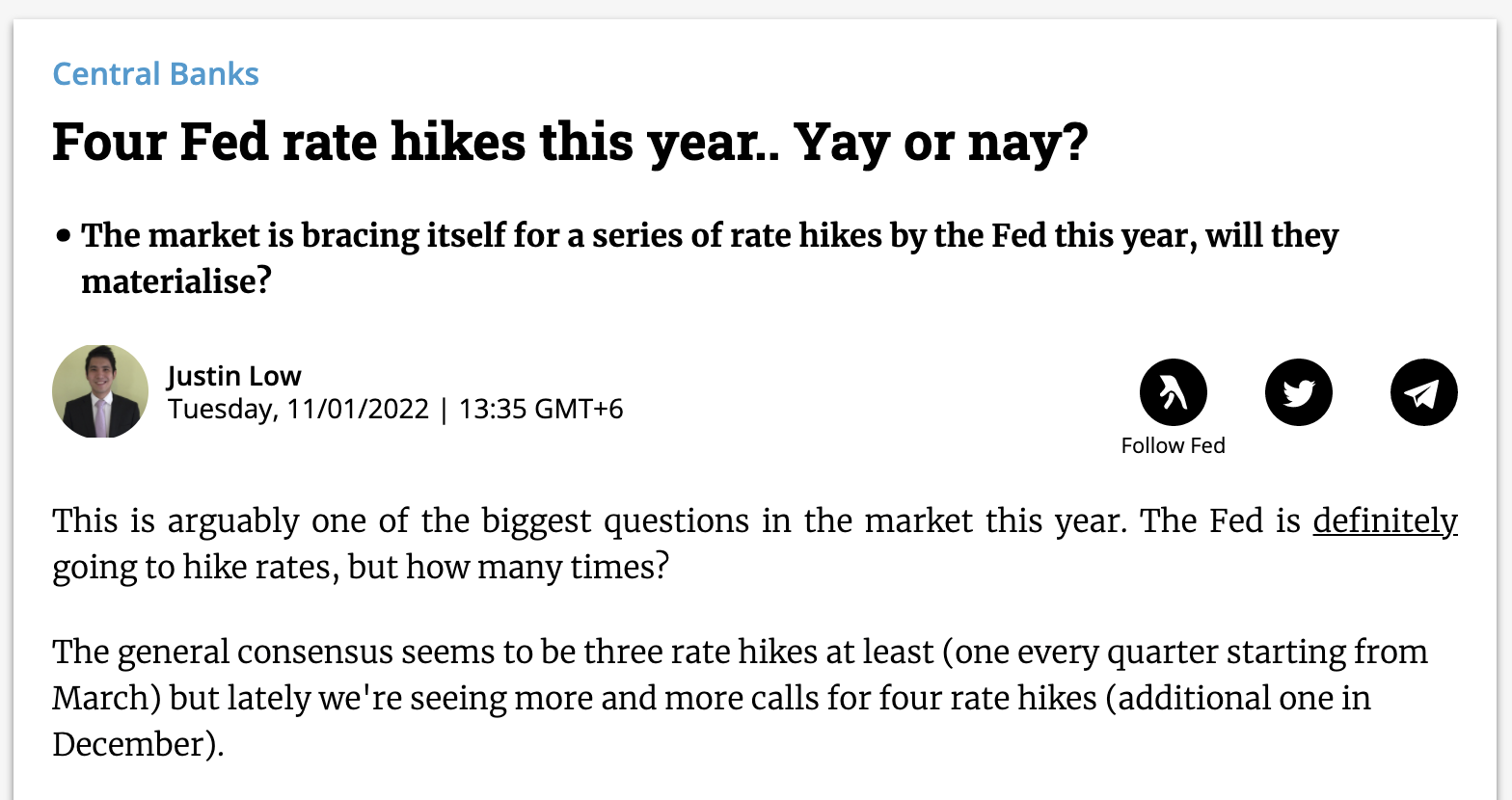

Fed’s Bullard expects four rate hikes in 2022 amid an elevated-prices environment, with the first of the few hikes likely to take place at the March central bank meeting.

Fellow policymaker Mester chimed in on the high inflation, stating that the underlying sources are not just from supply chain and wage issues, but from a wider spectrum.

Despite the highest inflation seen in recent times, the excessive optimism from the US dollar hawks is likely to continue to abate following Fed Chair Powell’s less hawkish take on the balance sheet run-off during his latest speech.

Fed’s Bullard expects four rate hikes in 2022 amid an elevated-prices environment, with the first of the few hikes likely to take place at the March central bank meeting.

Fellow policymaker Mester chimed in on the high inflation, stating that the underlying sources are not just from supply chain and wage issues, but from a wider spectrum.

Md Atikur Rahman

GOLD (XAUSUD):

Following the comments from Fed Chair Powell on a balance sheet runoff possibility only later in the year, the relatively dovish statement helped the precious metal to bounce off $1,800 as investors priced in firmer tightening after the release of the FOMC Minutes from the December meeting

Following the comments from Fed Chair Powell on a balance sheet runoff possibility only later in the year, the relatively dovish statement helped the precious metal to bounce off $1,800 as investors priced in firmer tightening after the release of the FOMC Minutes from the December meeting

Md Atikur Rahman

Gold (XAU):

The lower-than-expected NFP figure eased the bearish pressure on the precious metal as expected. A surpass of the psychological resistance at $1,800 would signal a continuation of the relieve.

The lower-than-expected NFP figure eased the bearish pressure on the precious metal as expected. A surpass of the psychological resistance at $1,800 would signal a continuation of the relieve.

Md Atikur Rahman

The Dollar Index (DXY):

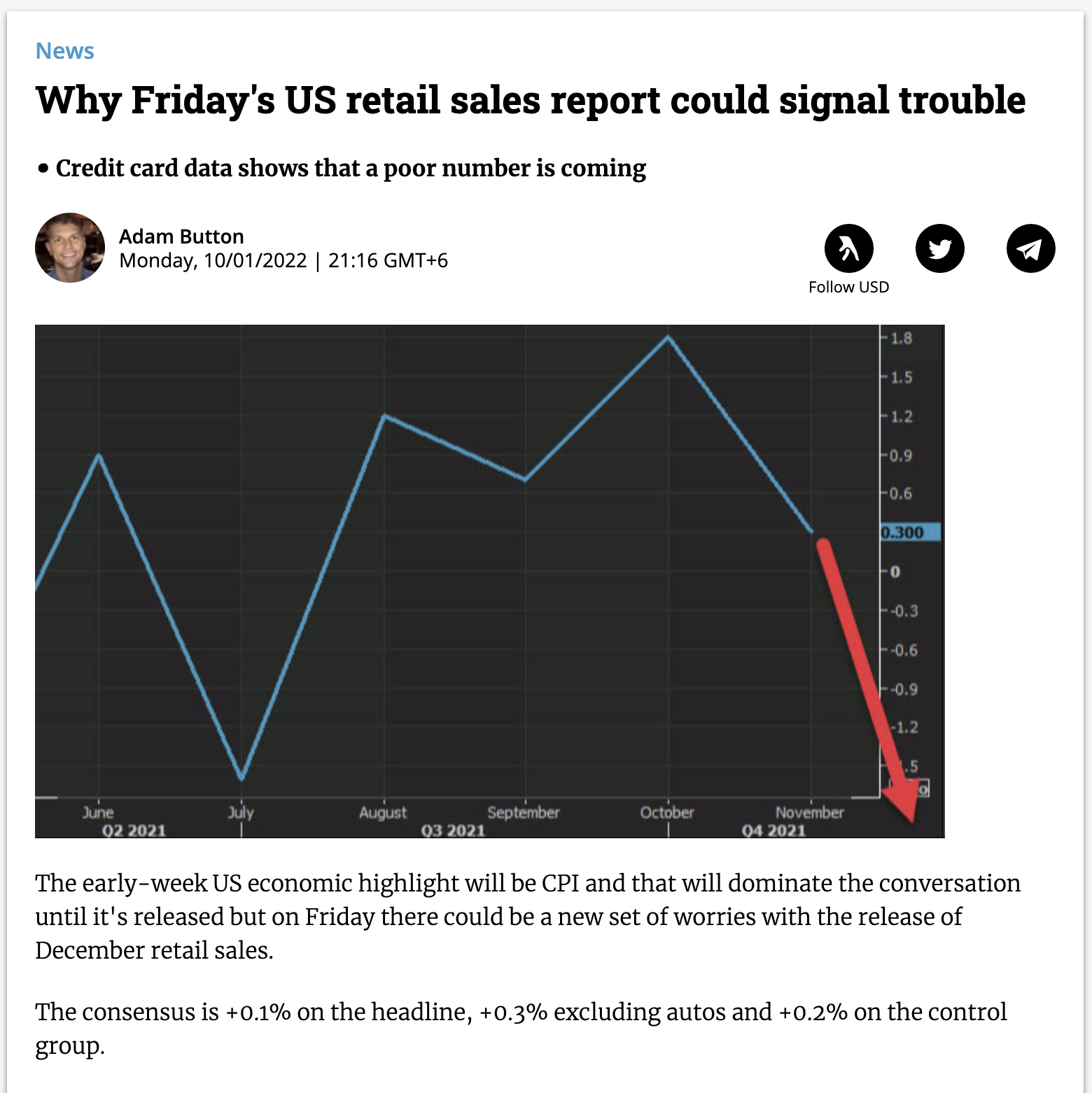

The US Nonfarm Payrolls added 199K jobs (expected 426K, prev. 249K), less than half of what was expected. Unemployment rate improved to 3.9% (expected 4.1%, prev. 4.2%).

On the geo-political front, the upcoming talks between the US and Russia on the Ukraine crisis and heated exchanges between the two countries on Kazakhstan is likely to provide directional motivation for oil and safe-haven assets.

Fed’s Daly prefers to see rate hikes gradually and reduce balance sheet earlier than previous cycles. However, the trim in the latter should not coincide with a rate hike.

On the data front, the lack of first-tier data releases today is likely to lead to a consolidation of the greenback, with possibility of mild losses following two back-to-back disappointing NFP reports.

The US Nonfarm Payrolls added 199K jobs (expected 426K, prev. 249K), less than half of what was expected. Unemployment rate improved to 3.9% (expected 4.1%, prev. 4.2%).

On the geo-political front, the upcoming talks between the US and Russia on the Ukraine crisis and heated exchanges between the two countries on Kazakhstan is likely to provide directional motivation for oil and safe-haven assets.

Fed’s Daly prefers to see rate hikes gradually and reduce balance sheet earlier than previous cycles. However, the trim in the latter should not coincide with a rate hike.

On the data front, the lack of first-tier data releases today is likely to lead to a consolidation of the greenback, with possibility of mild losses following two back-to-back disappointing NFP reports.

Md Atikur Rahman

USD: FOMC Meeting Minutes

The market reaction to the FOMC minutes has been a classic hawkish response. Talk about the balance sheet shrinking and a high comfort level with hiking soon have pushed odds of a March hike to 80%.

The market reaction to the FOMC minutes has been a classic hawkish response. Talk about the balance sheet shrinking and a high comfort level with hiking soon have pushed odds of a March hike to 80%.

Md Atikur Rahman

USDJPY CHART (*** Note: Take Entry, if price breaks this trendline and closes below the trendline - 4h chart)

Md Atikur Rahman

The Japanese Yen (JPY):

Tepid moves can be expected for the yen on this new trading day of the year amid a light news flow and a lack of currency-specific economic data.

Central Bank Notes:

Retains its ultra-accommodative strategy

To scale back emergency pandemic relief funding from March

Japan’s economy has picked up it does still remain in a severe situation due to the COVID-19.

Tepid moves can be expected for the yen on this new trading day of the year amid a light news flow and a lack of currency-specific economic data.

Central Bank Notes:

Retains its ultra-accommodative strategy

To scale back emergency pandemic relief funding from March

Japan’s economy has picked up it does still remain in a severe situation due to the COVID-19.

Md Atikur Rahman

The Kiwi Dollar (NZD):

Light news flow and a lack of currency-specific economic data is likely to see a subdued direct interest in the Kiwi, with movements possibly mirroring the closely-related Aussie.

Central Bank Notes:

Need to raise OCR to 2.6% by 2024, pending economic outlook

Downgrades GDP in 2022 and unemployment rate; upgrades to CPI and GDP in 2023

Considered a 50bps rate hike at the latest meeting but sees 25bp as a steady approach

Light news flow and a lack of currency-specific economic data is likely to see a subdued direct interest in the Kiwi, with movements possibly mirroring the closely-related Aussie.

Central Bank Notes:

Need to raise OCR to 2.6% by 2024, pending economic outlook

Downgrades GDP in 2022 and unemployment rate; upgrades to CPI and GDP in 2023

Considered a 50bps rate hike at the latest meeting but sees 25bp as a steady approach

Md Atikur Rahman

The Australian Dollar (AUD):

Hospitalisations due to the coronavirus, the figure that Australian authorities are monitoring, jumped by 18 per cent to 1,066 at its latest. The country continues to see new record highs in daily infections as it is aiming to learn to live with the virus.

Central Bank Notes:

Kept Cash Rate at 0.1%. and weekly bond purchases of AUD 4 billion per week until mid-February 2022.

A slower progress towards employment and inflation goals warrants a taper in February and review again in May.

Consider to raise rates only until actual inflation is sustainably within the 2%-3% target range.

Hospitalisations due to the coronavirus, the figure that Australian authorities are monitoring, jumped by 18 per cent to 1,066 at its latest. The country continues to see new record highs in daily infections as it is aiming to learn to live with the virus.

Central Bank Notes:

Kept Cash Rate at 0.1%. and weekly bond purchases of AUD 4 billion per week until mid-February 2022.

A slower progress towards employment and inflation goals warrants a taper in February and review again in May.

Consider to raise rates only until actual inflation is sustainably within the 2%-3% target range.

Md Atikur Rahman

The Australian Dollar (AUD):

The upcoming Monetary Policy Meeting Minutes could highlight the relatively less obvious monetary policy shift from the consistently dovishness central bank.

Central Bank Notes:

Kept Cash Rate at 0.1%. and weekly bond purchases of AUD 4 billion per week until mid-February 2022.

The upcoming Monetary Policy Meeting Minutes could highlight the relatively less obvious monetary policy shift from the consistently dovishness central bank.

Central Bank Notes:

Kept Cash Rate at 0.1%. and weekly bond purchases of AUD 4 billion per week until mid-February 2022.

Md Atikur Rahman

Dollar Index (DXY):

Fed’s Daly expects inflation rate and GDP growth to ease in 2022 while remaining bullish on the US economy.

Fellow member Williams does not see a need to further increase in the pace of taper, which is set at $30 billion per month from January.

Central Bank Notes:

Taper pace increased to US30 billion from January; end in March 2022

Emphasised clear divide between tapering and rate lift-off

Fed’s Daly expects inflation rate and GDP growth to ease in 2022 while remaining bullish on the US economy.

Fellow member Williams does not see a need to further increase in the pace of taper, which is set at $30 billion per month from January.

Central Bank Notes:

Taper pace increased to US30 billion from January; end in March 2022

Emphasised clear divide between tapering and rate lift-off

: