Aleksandr Belykh / Profil

- Informations

|

7+ années

expérience

|

2

produits

|

100

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

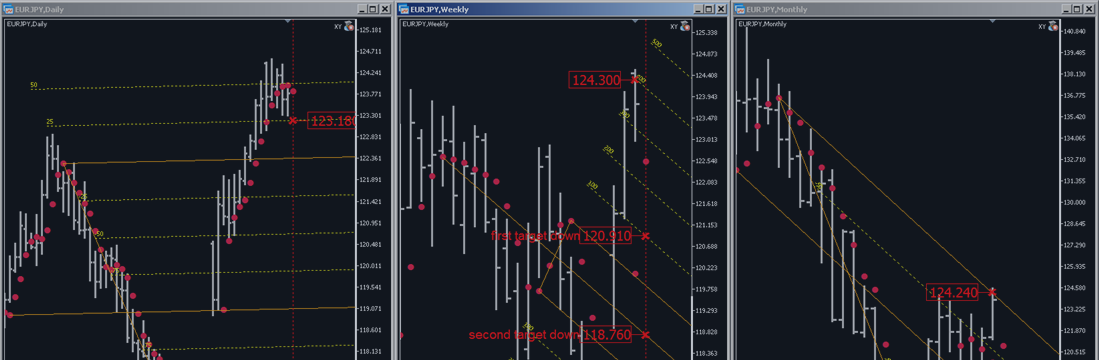

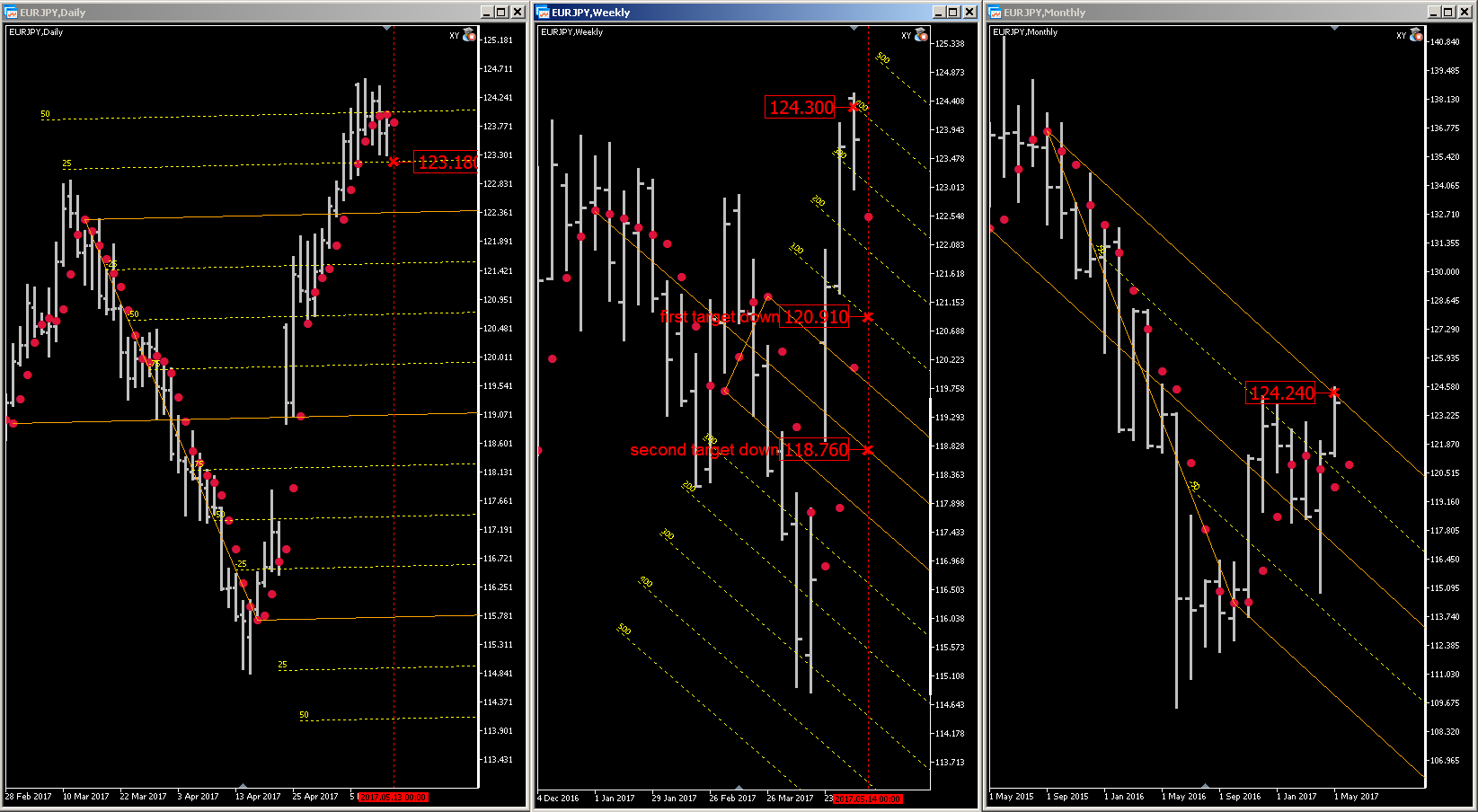

EURJPY trading opportunity 05.15 - 05.19 2017

EURJPY has good trading opportunity next week 05.15 - 05.19 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 124.24 (M), 124.30 (W), and 123.18 (D), where the price highly likely to bounce down from 124.30 (W) to first target down 120.91 (W) and second target down 118.76 (W), because area 124.24 (M) - 124.30(W) is strong resistance zone. Selling after broken level 123.18 (D) is a good idea.

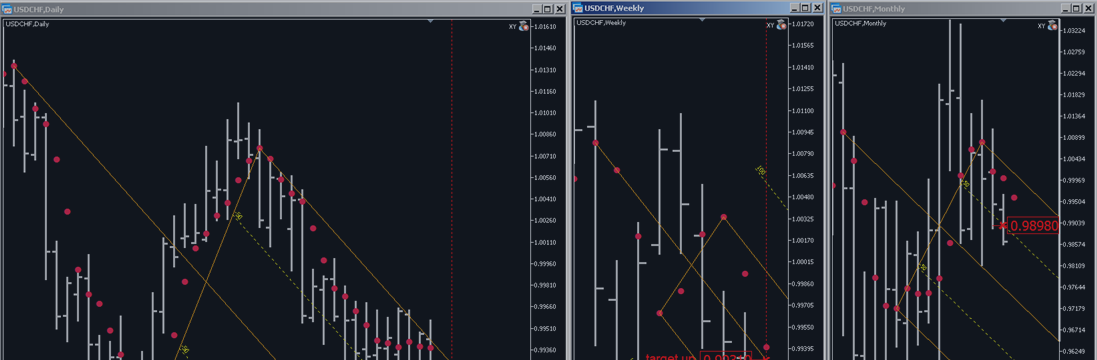

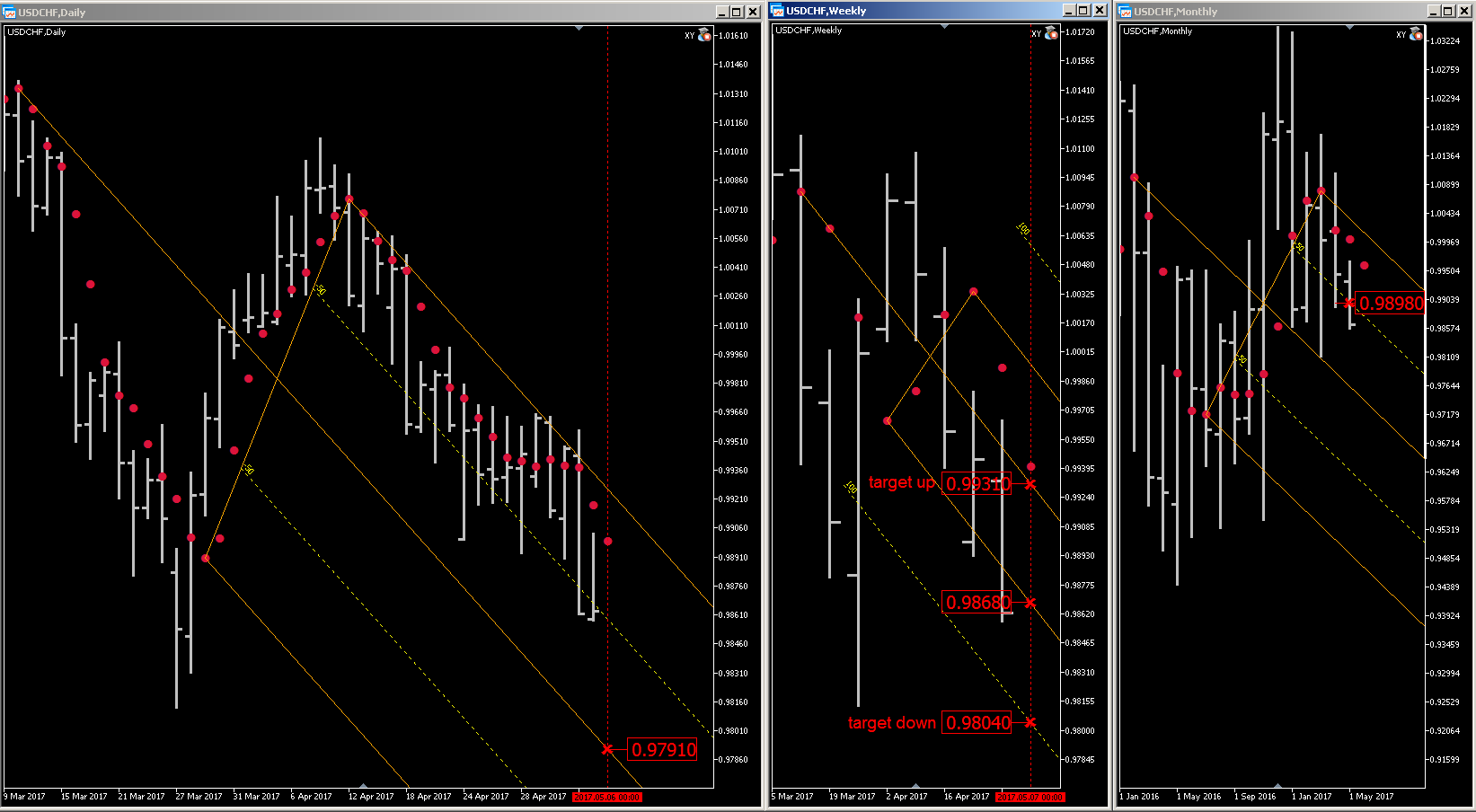

USDCAD trading opportunity 05.08 - 05.12 2017

USDCAD has good trading opportunity next week 05.08 - 05.12 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 0.9898 (M), 0.9868 (W), and 0.9791 (D), where the price at first highly likely to bounce down from 0.9868 (W) to target down 0.9804 (W), because 0.9804 (W) is brocken that is confirmed by the last two bars on daily timeframe. Since the price is in the monthly support area of the level 0.9898 (M) is highly likely price to bounce up from strong support zone 0.9804 (W) 0.9791 (D) is a good idea, if the price do nont breaks through the key level zone 0.9804 (W) 0.9791 (D) down on daily time frame, the target up is 0.9931 (W).

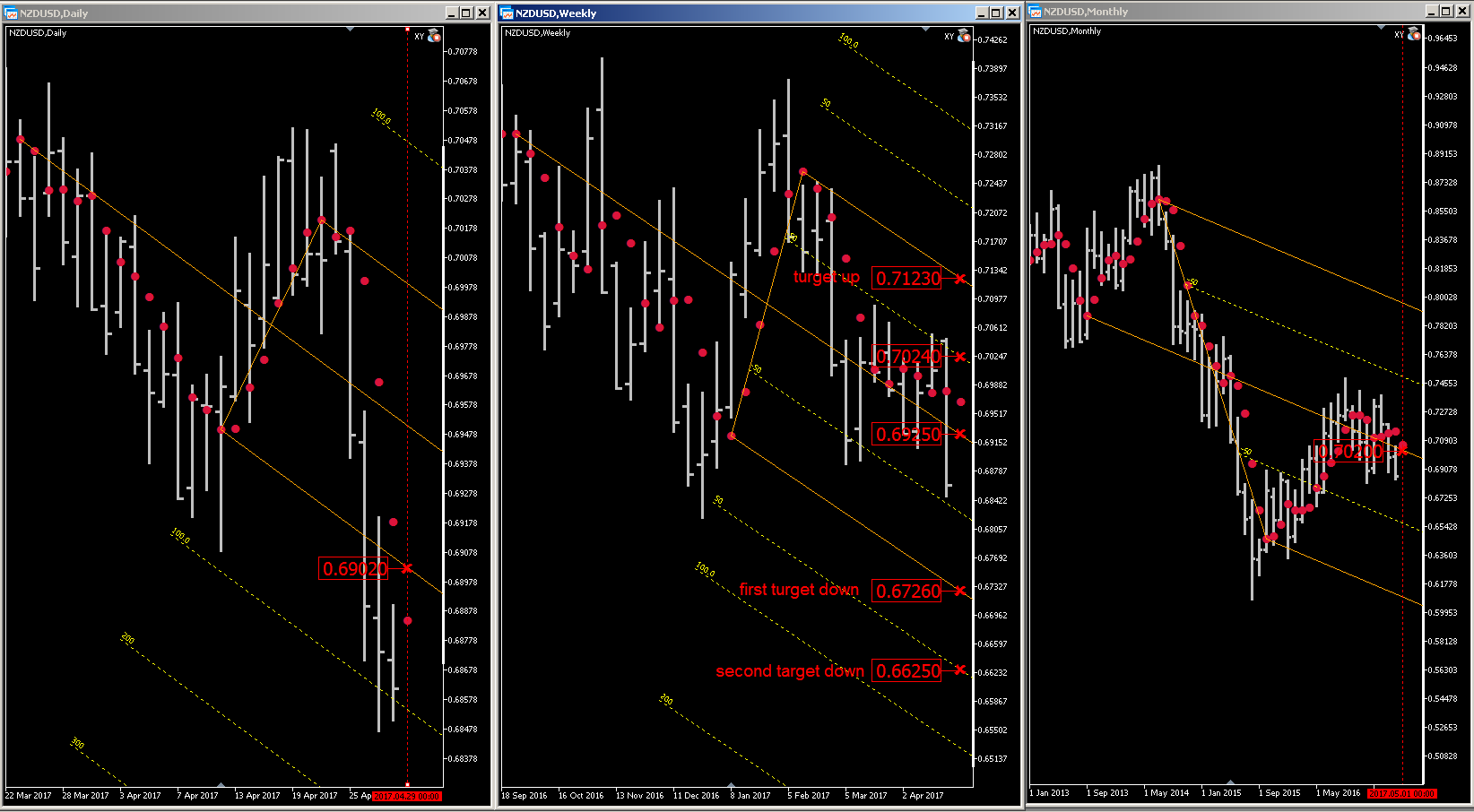

NZDUSD trading opportunity 05.01 - 05.05 2017

NZDUSD has good trading opportunity next week 05.01 - 05.05 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 0.7020 (M), 0.6925 (W), and 0.6902 (D), where the price is highly likely to bounce down to the target down level 0.6726 (W) as first target and 0.6625 (W) as second target, because area 0.7020 (M) - 0.6925(W) is strong resistance zone. Selling in the area 0.6925 (W) - 0.6902 (D) is a good idea. If the price breaks through the key level 0.7024(W) up on daily time frame, the target is 0.7123 (W).

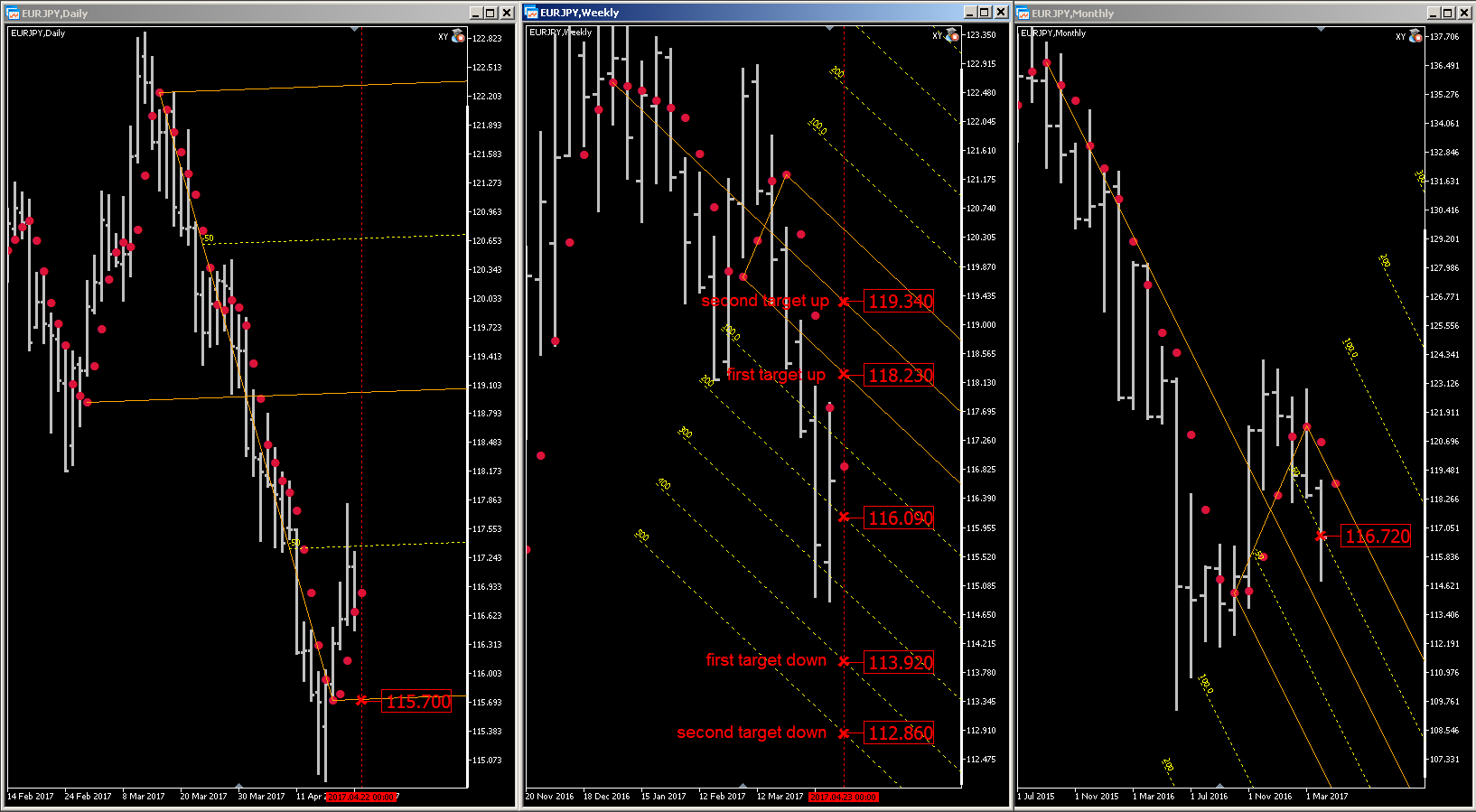

EURJPY trading opportunity 04.24 - 04.28 2017

EURJPY has good trading opportunity next week 04.24 - 04.28 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 116.72 (M), 116.09 (W) and 115.70 (D), where the price is highly likely to bounce up to the target up level 118.23 (W) as first target and 119.34 (W) as second target, because area 116.72 (M) - 116.09 (W) is strong support zone. Buying in the area 116.09 (W) - 115.70 (D) is a good idea. If the price breaks through the key level 115.70(D) down, the first target is 113.92 (W) and second target is 112.86 (W).

Cela fait plus d'un an que MQL5 a commencé à fournir un support natif pour OpenCL. Cependant, peu d'utilisateurs ont vu la vraie valeur de l'utilisation du calcul parallèle dans leurs Expert Advisors, indicateurs ou scripts. Cet article sert à vous aider à installer et à configurer OpenCL sur votre ordinateur afin que vous puissiez essayer d'utiliser cette technologie dans le terminal de trading MetaTrader 5.

Cet article se concentre sur certaines capacités d'optimisation qui s'ouvrent lorsqu'au moins une certaine considération est accordée au matériel sous-jacent sur lequel le noyau OpenCL est exécuté. Les chiffres obtenus sont loin d'être des valeurs plafonds mais même ils suggèrent qu'avoir les ressources existantes disponibles ici et maintenant (l'API OpenCL telle qu'implémentée par les développeurs du terminal ne permet pas de contrôler certains paramètres importants pour l'optimisation - notamment, la taille du groupe de travail ), le gain en performance par rapport à l'exécution du programme hôte est très important.

Fin janvier 2012, la société de développement de logiciels à l'origine de l’élaboration de MetaTrader 5 a annoncé la prise en charge native d'OpenCL dans MQL5. À l'aide d'un exemple illustratif, l'article présente les bases de la programmation en OpenCL dans l'environnement MQL5 et fournit quelques exemples d'optimisation naïve du programme pour augmenter la vitesse de fonctionnement.

Multitimeframe navigation and research tool MT4 ( XY expert advisor) is a convenient tool that allows analyzing the trading instruments on different time frames and fast switching between them. Easy to use. It has no adjustable parameters. Charts with an XY Expert Advisor can be either the same symbol (instrument) or different (from version 2.0). When a symbol is changed on one of the charts with the XY expert advisor , cascade change of symbols occurs on other charts with the XY attached. The

Le Profile du Marché a été élaboré par le brillant penseur Peter Steidlmayer. Il a suggéré l’utilisation de la représentation alternative de l'information sur les mouvements de marché « horizontaux » et « verticaux » qui conduit à un ensemble de modèles complètement différent. Il a assumé qu'il existe une impulsion sous-jacente du marché ou un modèle fondamental appelé cycle d'équilibre et de déséquilibre. Dans cet article, j’examinerai l'Histogramme des Prix - un modèle simplifié de profil de marché, et décrirai son implémentation dans MQL5.

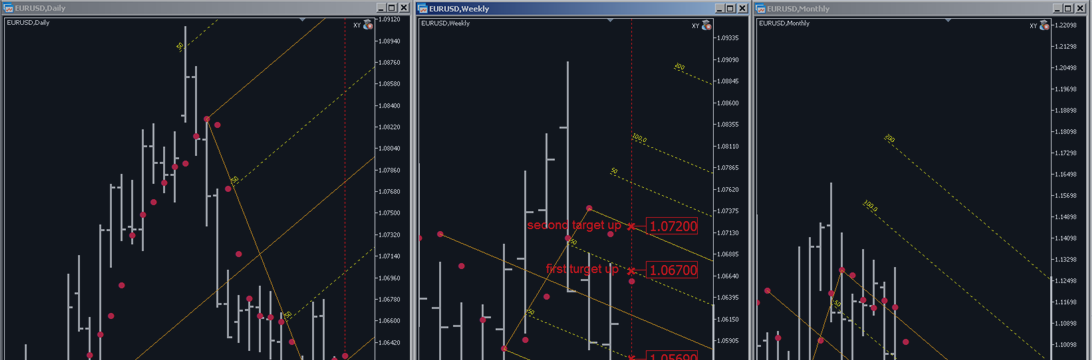

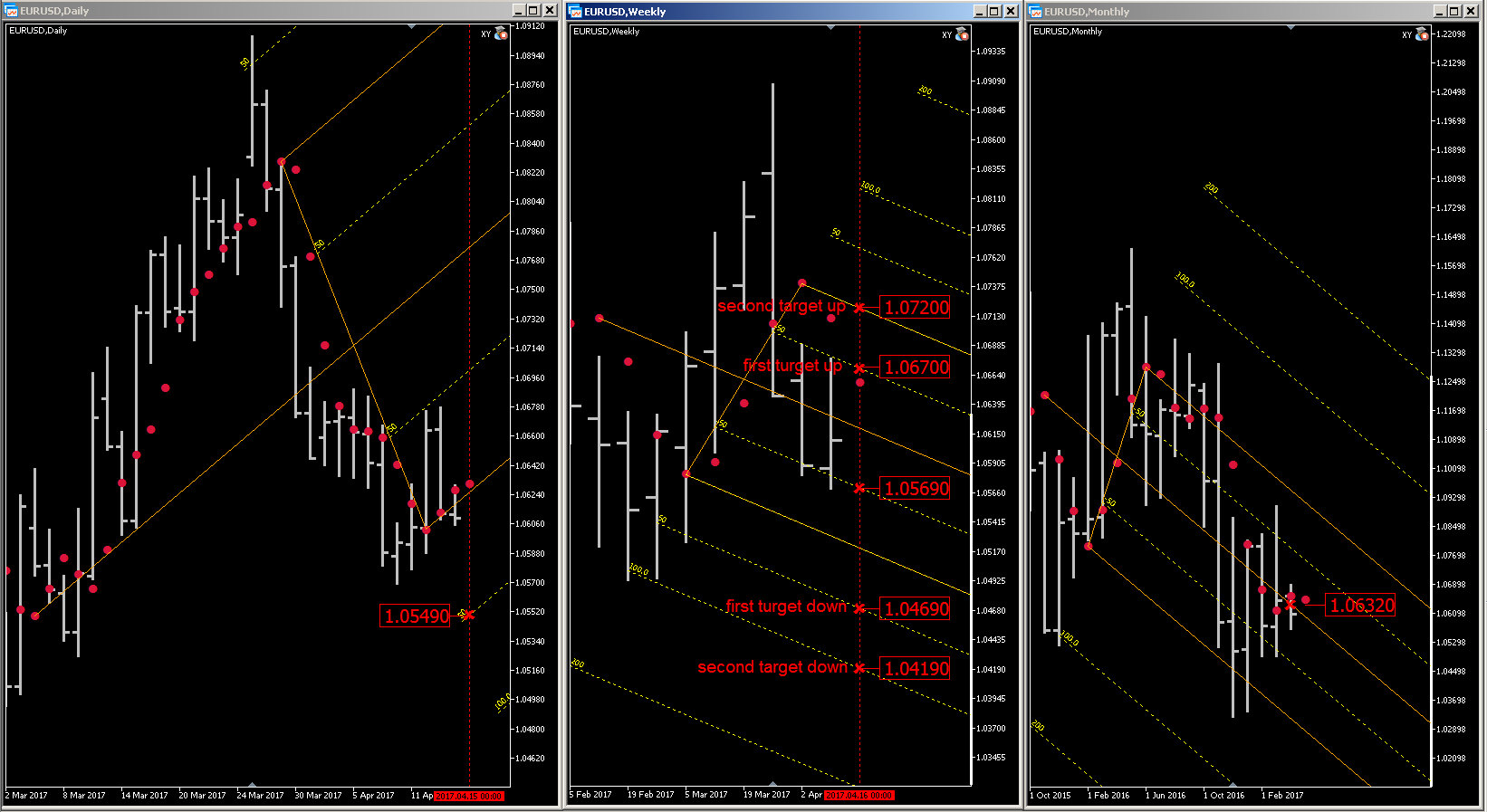

EURUSD trading opportunity 04.17 - 04.21 2017

EURUSD has good trading opportunity next week 04.17 - 04.21 2017. Multi time frame research using my tools (XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 1.0632 (M), 1.0569 (W) and 1.0549 (D), where the price is highly likely to bounce up to the target up level 1.0670 (W) as first target and 1.0720 (W) as second target. Buying in the area 1.0569 - 1.0549 is a good idea. If the price breaks through the key level 1.0549 (D) down, the first target is 1.0469 (W) and second target is 1.0419 (W).

Multitimeframe navigation and research tool (XY expert advisor) is a convenient tool that allows analyzing the trading instruments on different time frames and fast switching between them. Easy to use. It has no adjustable parameters. Charts with an XY Expert Advisor can be either the same symbol (instrument) or different (from version 2.0). When a symbol is changed on one of the charts with the XY expert advisor , cascade change of symbols occurs on other charts with the XY

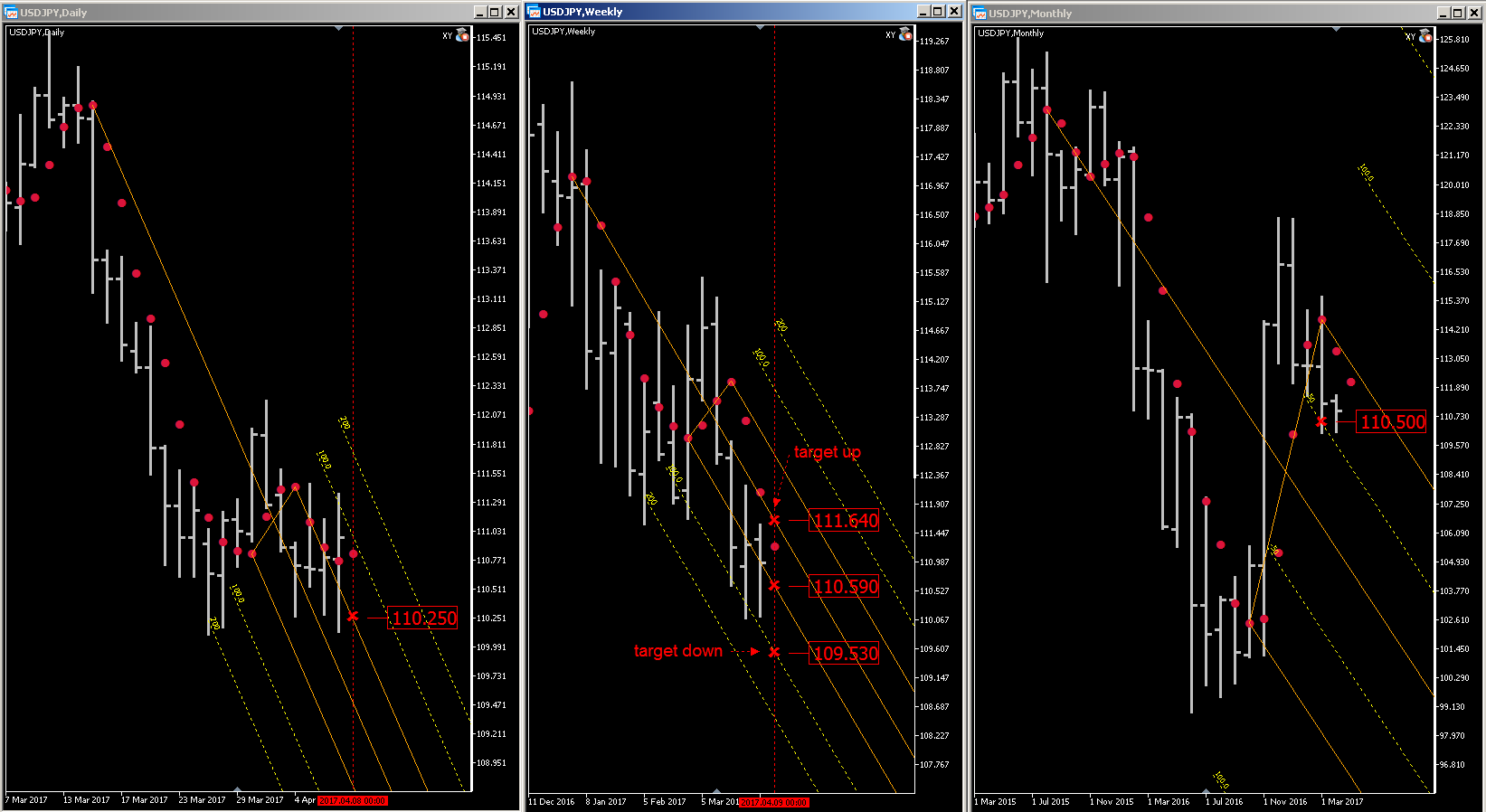

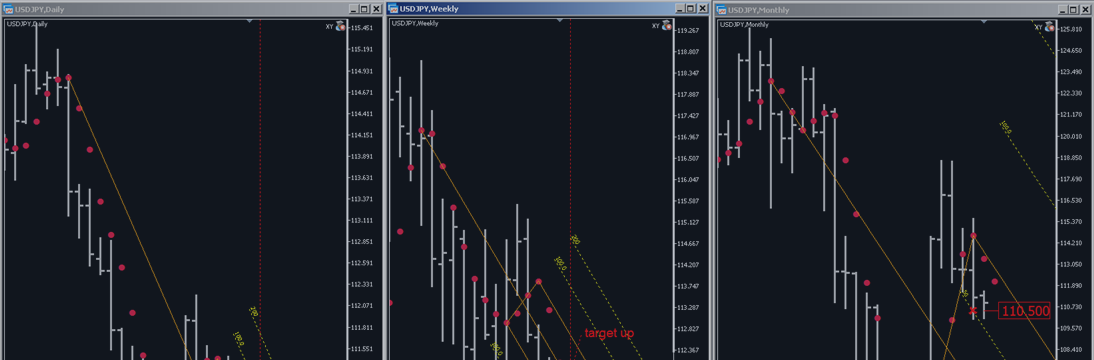

USDJPY trading opportunity 04.10 - 04.14 2017

USDJPY has good trading opportunity next week 04.10 - 04.14 2017. Multi time frame research using my tools (XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 110,50 (M), 110,59 (W) and 110,25 (D), where the price is highly likely to bounce up to the target up level 111,64 (W). Buying in the area 110,59 - 110,25 is a good idea. If the price breaks through the key level 110,25 (D) down, the target is 109,53 (W).