Aleksey Ivanov / Profil

- Informations

|

7+ années

expérience

|

32

produits

|

143

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

Je négocie depuis quinze ans en mettant l'accent sur la recherche de modèles mathématiques du marché.

----------------------------------------------------------------------------------------------------------------------------------

💰 Produits présentés:

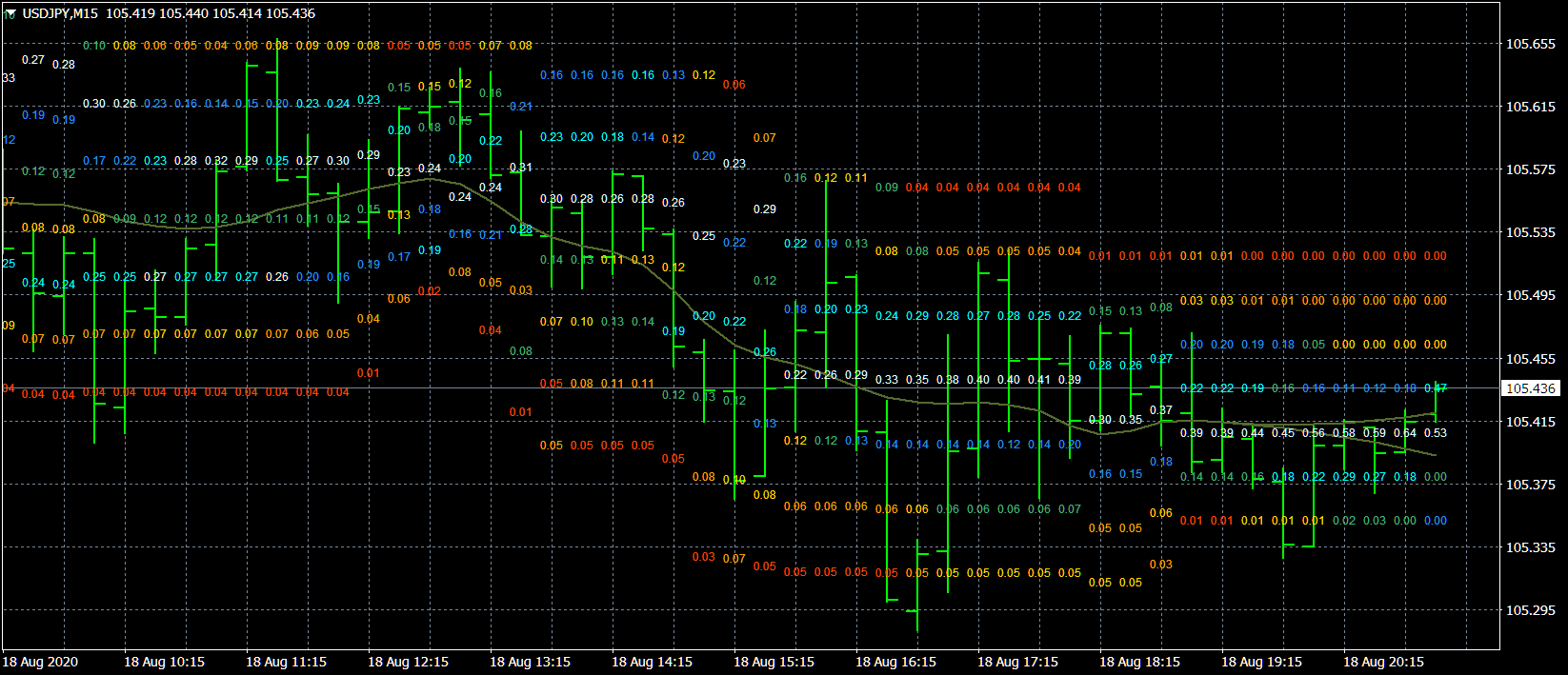

1) 🏆 Indicateurs avec filtrage optimal du bruit de marché (pour sélectionner les points d'ouverture et de clôture des positions).

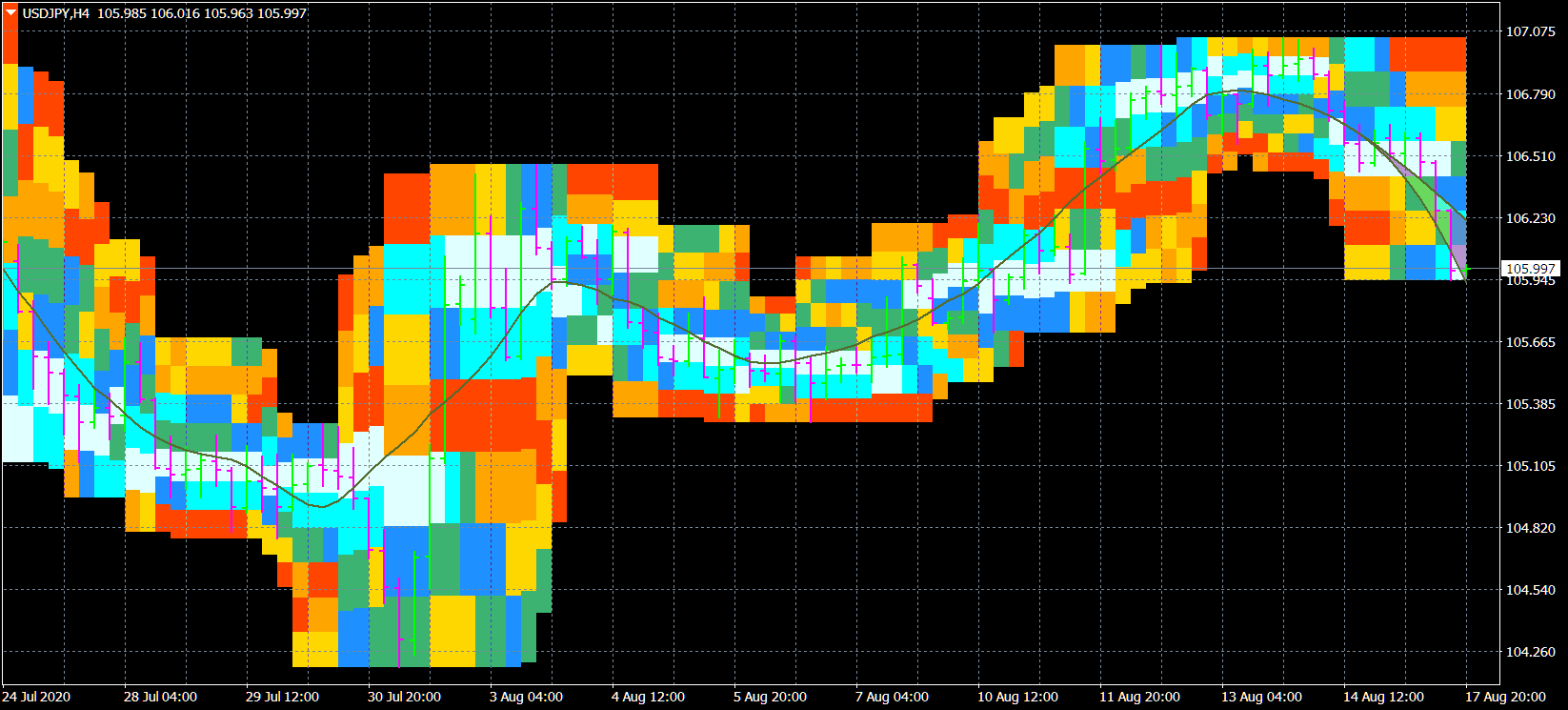

2) 🏆 Indicateurs statistiques (pour déterminer la tendance mondiale).

3) 🏆 Indicateurs d'études de marché (pour clarifier la microstructure des prix, construire des canaux, identifier les différences entre les inversions de tendance et les reculs).

----------------------------------------------------------------------------------------------------------------------------------

☛ Plus d'informations sur le blog https://www.mql5.com/en/blogs/post/741637

https://www.mql5.com/en/market/product/50988

https://www.mql5.com/en/market/product/42445

https://www.mql5.com/en/market/product/27070

https://www.mql5.com/en/market/product/52668

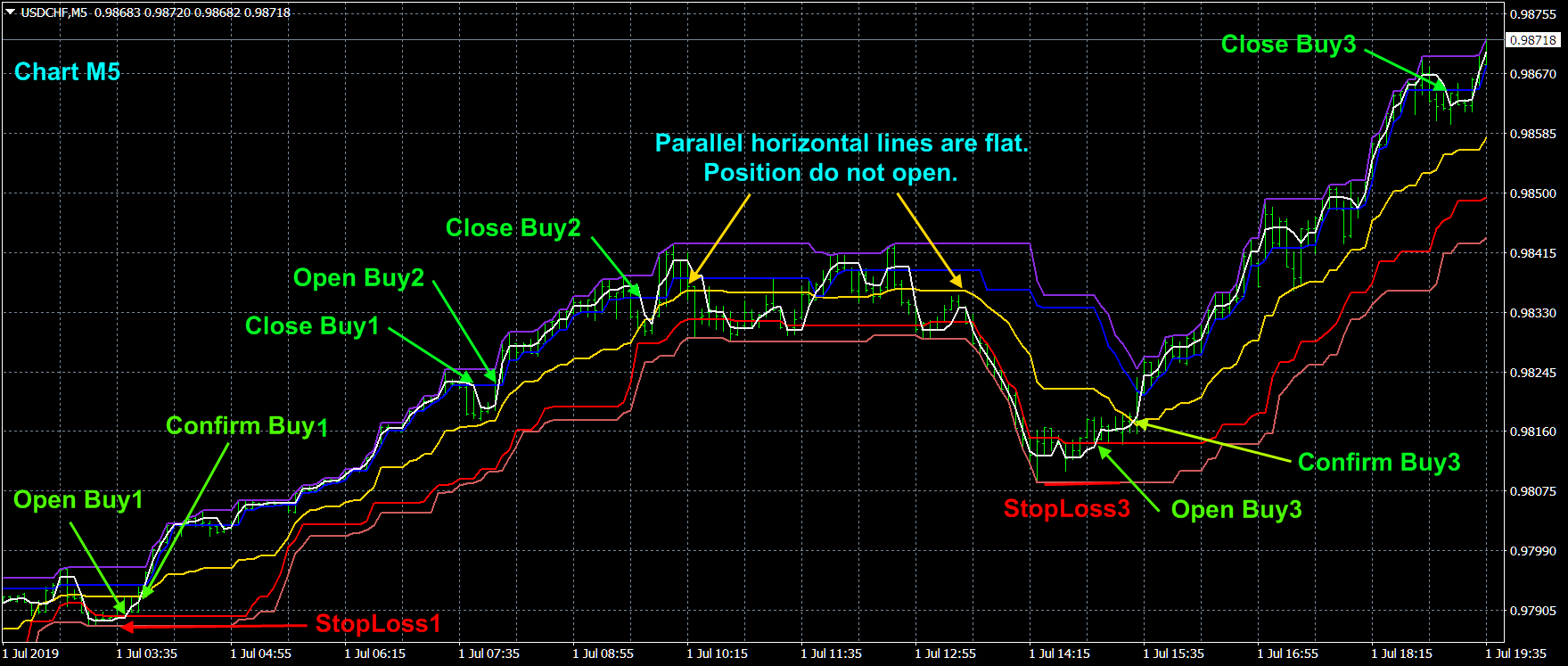

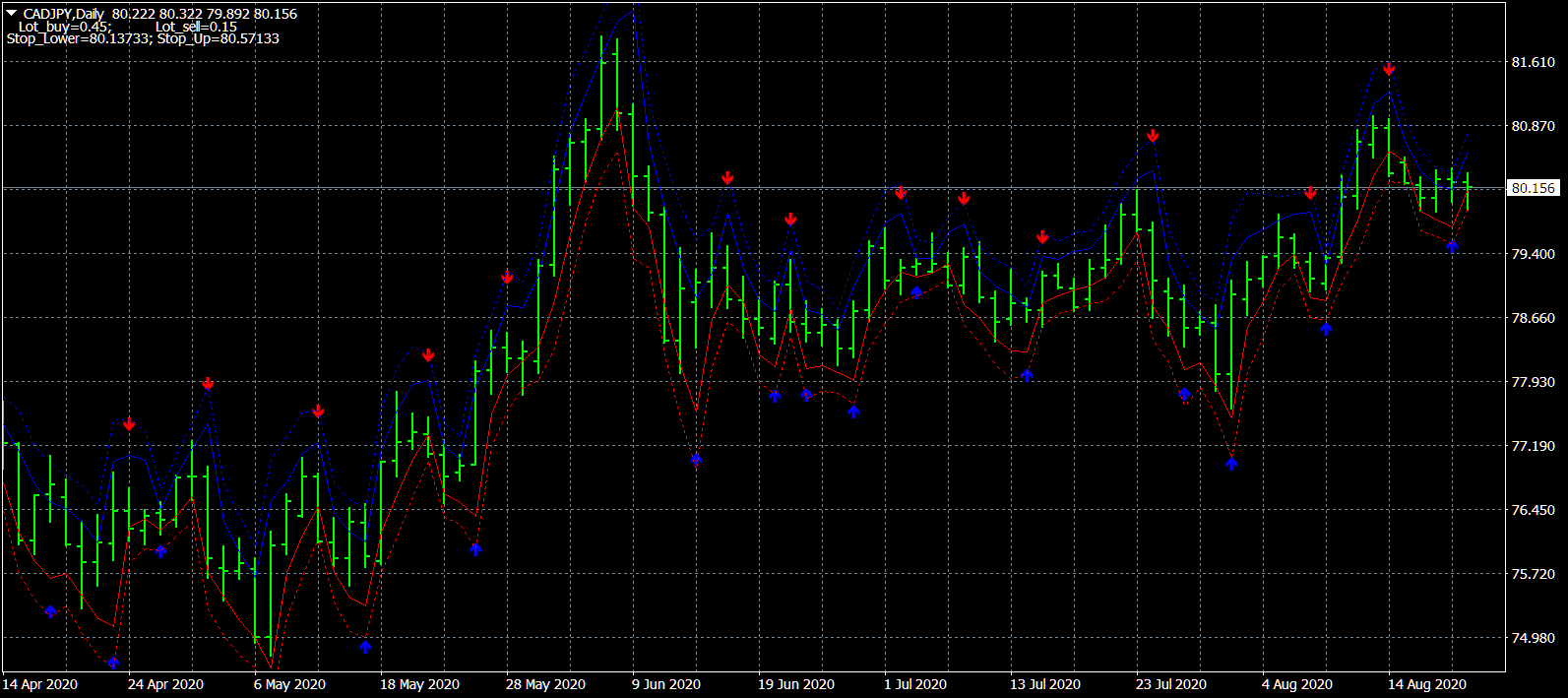

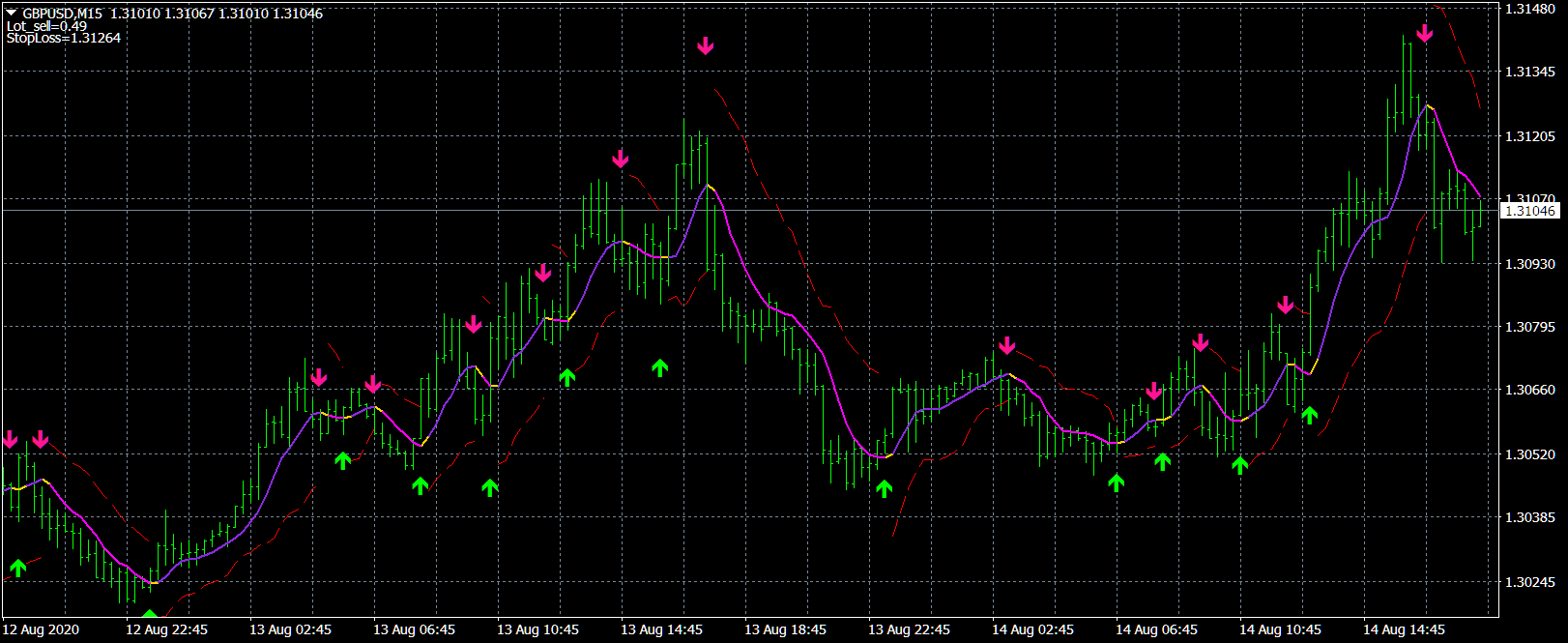

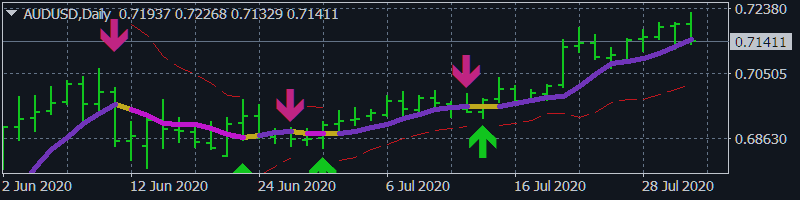

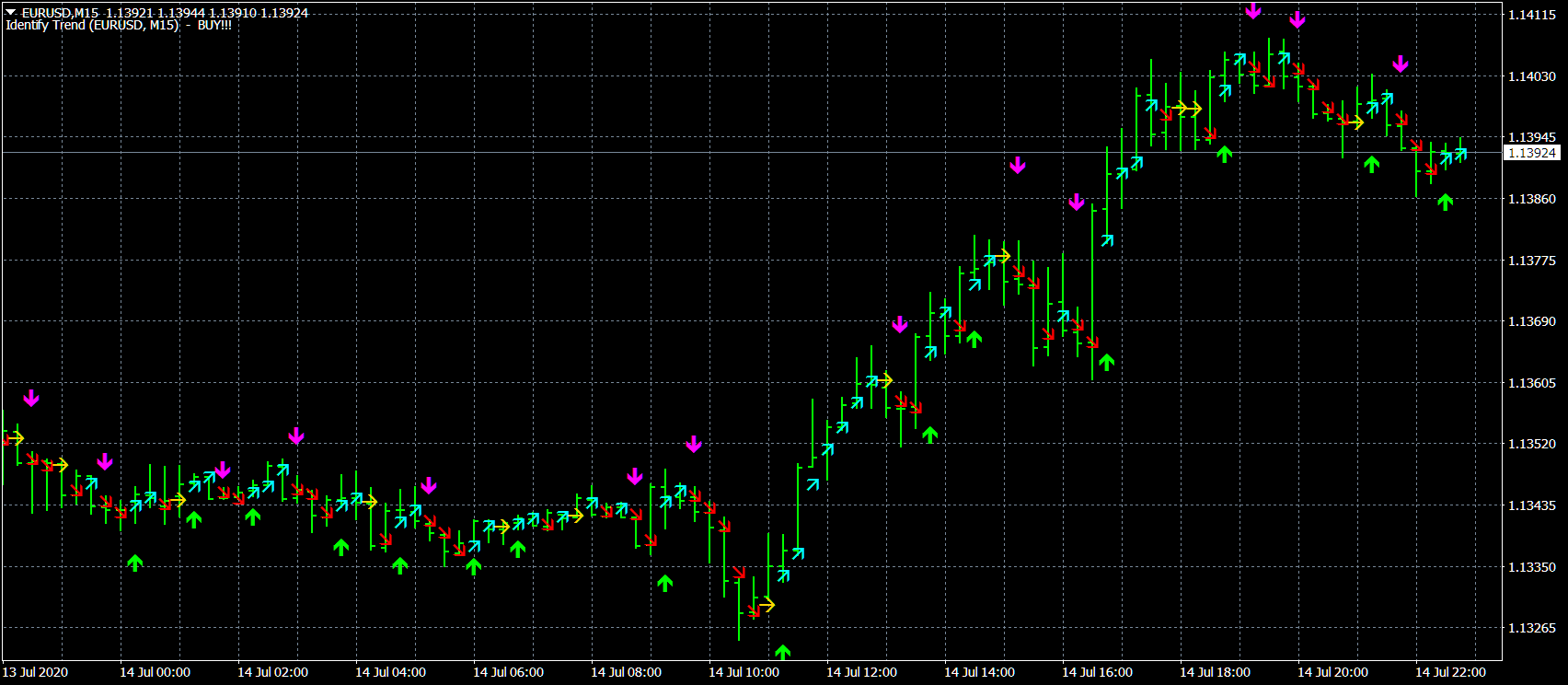

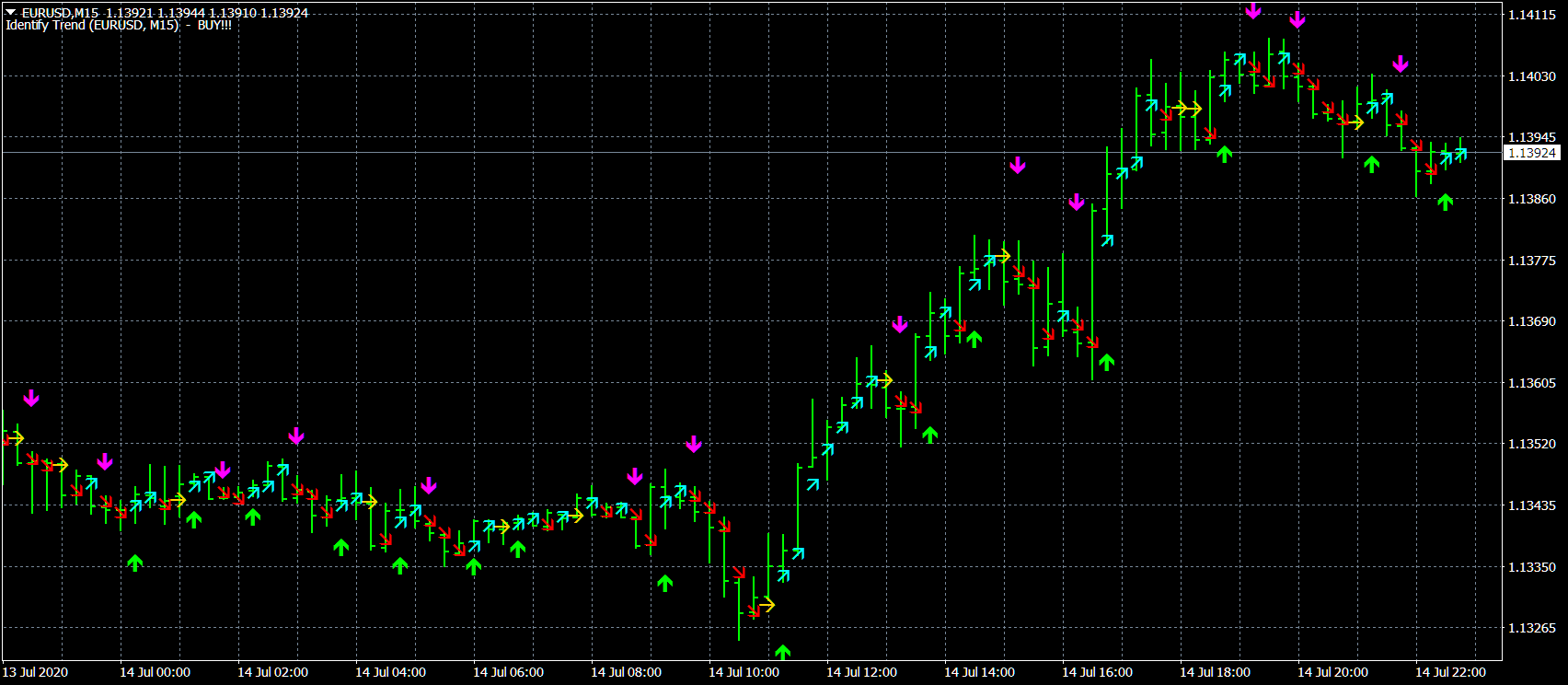

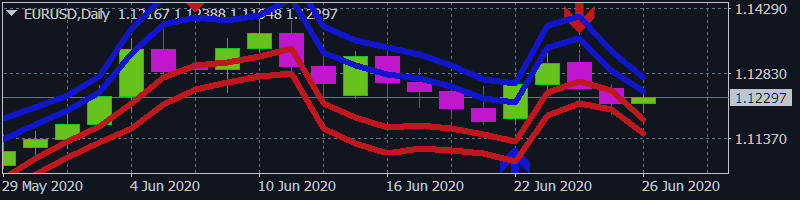

The indicator calculates and shows: 1. The direction of the trend; 2. Entry and exit points of positions; 3. StopLoss lines calculated from current price probability distributions and selected probability of closing an order by StopLoss before the trend reversal; 4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

The indicator calculates and shows: 1. The direction of the trend; 2. Entry and exit points of positions; 3. StopLoss lines calculated from current price probability distributions and selected confidence levels; 4. Lot sizes based on the accepted risk level, deposit size and StopLoss position.

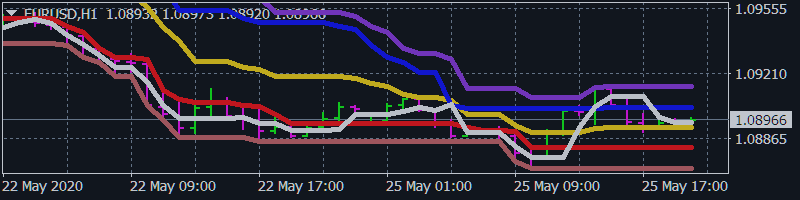

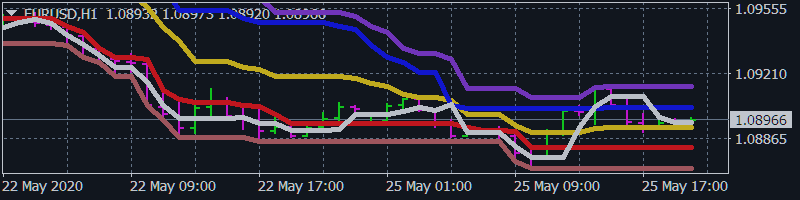

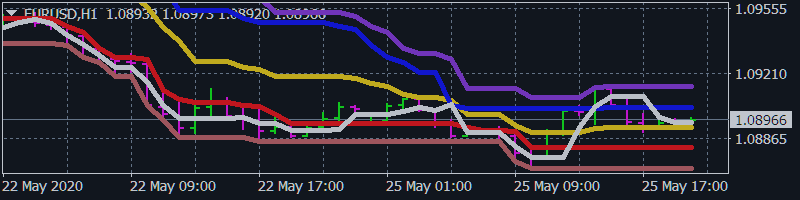

The Robust filter indicator is based on the robust filtering algorithm developed by the author using the multi-period averaged moving median. The algorithm for this averaging is shown in the last screenshot. The indicator calculates and shows: 1. The direction of the trend; 2. Entry and exit points of positions; 3. StopLoss lines

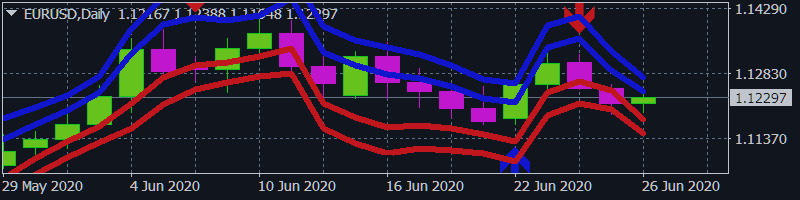

The product is clearly underestimated. Set the averaging period to three and you will get the (First version) popular Identify Trend indicator (https://www.mql5.com/en/market/product/36336 ) along with an additional channel of price fluctuations; moreover, free of charge and without restrictions on the timeframe.

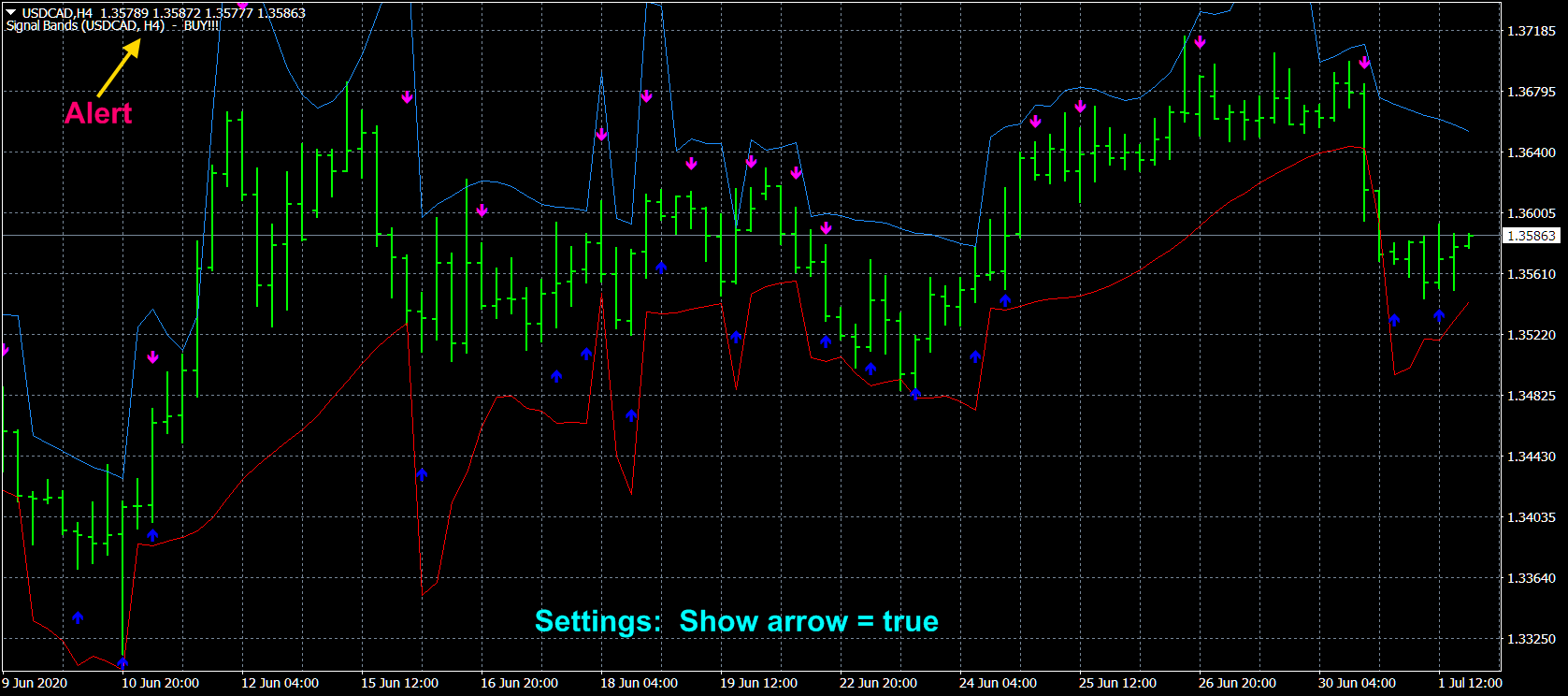

1. Introduced the option of showing signals with arrows.

2. Added all types of alerts.

The principle of constructing indicator lines and their meaning . The Signal Channel indicator uses a robust filtering method based on two moving medians applicable to the High and Low prices, i.e. the lines <High> and <Low>, where <..> is the sign of linear averaging, which are shifted by certain values in an uptrend and by opposite values in a downtrend, which allows you to get a narrow

The product is clearly underestimated. Set the averaging period to three and you will get the (First version) popular Identify Trend indicator (https://www.mql5.com/en/market/product/36336 ) along with an additional channel of price fluctuations; moreover, free of charge and without restrictions on the timeframe.