Aleksey Ivanov / Profil

- Informations

|

7+ années

expérience

|

32

produits

|

143

versions de démo

|

|

0

offres d’emploi

|

0

signaux

|

0

les abonnés

|

👑 Physicien théoricien, programmeur.

Je négocie depuis quinze ans en mettant l'accent sur la recherche de modèles mathématiques du marché.

----------------------------------------------------------------------------------------------------------------------------------

💰 Produits présentés:

1) 🏆 Indicateurs avec filtrage optimal du bruit de marché (pour sélectionner les points d'ouverture et de clôture des positions).

2) 🏆 Indicateurs statistiques (pour déterminer la tendance mondiale).

3) 🏆 Indicateurs d'études de marché (pour clarifier la microstructure des prix, construire des canaux, identifier les différences entre les inversions de tendance et les reculs).

----------------------------------------------------------------------------------------------------------------------------------

☛ Plus d'informations sur le blog https://www.mql5.com/en/blogs/post/741637

Je négocie depuis quinze ans en mettant l'accent sur la recherche de modèles mathématiques du marché.

----------------------------------------------------------------------------------------------------------------------------------

💰 Produits présentés:

1) 🏆 Indicateurs avec filtrage optimal du bruit de marché (pour sélectionner les points d'ouverture et de clôture des positions).

2) 🏆 Indicateurs statistiques (pour déterminer la tendance mondiale).

3) 🏆 Indicateurs d'études de marché (pour clarifier la microstructure des prix, construire des canaux, identifier les différences entre les inversions de tendance et les reculs).

----------------------------------------------------------------------------------------------------------------------------------

☛ Plus d'informations sur le blog https://www.mql5.com/en/blogs/post/741637

Aleksey Ivanov

Velocity of price change https://www.mql5.com/en/market/product/62315

The Velocity of price change indicator shows the average rate of price change at those characteristic time intervals where this rate was approximately constant. The robust algorithm used in Velocity of price change to smooth out the price from its random jumps, ensures the reliability of the indicator reading, which does not react to simple price volatility and its insignificant movements.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Velocity of price change indicator shows the average rate of price change at those characteristic time intervals where this rate was approximately constant. The robust algorithm used in Velocity of price change to smooth out the price from its random jumps, ensures the reliability of the indicator reading, which does not react to simple price volatility and its insignificant movements.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

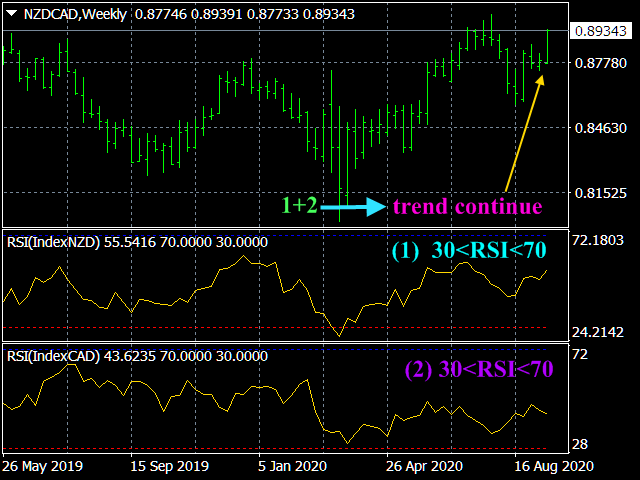

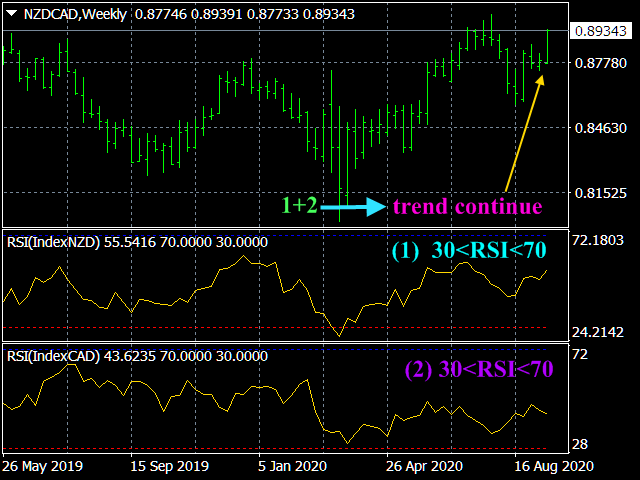

Absolute price https://www.mql5.com/en/market/product/54630

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

TrueChannel FREE https://www.mql5.com/en/market/product/61769

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

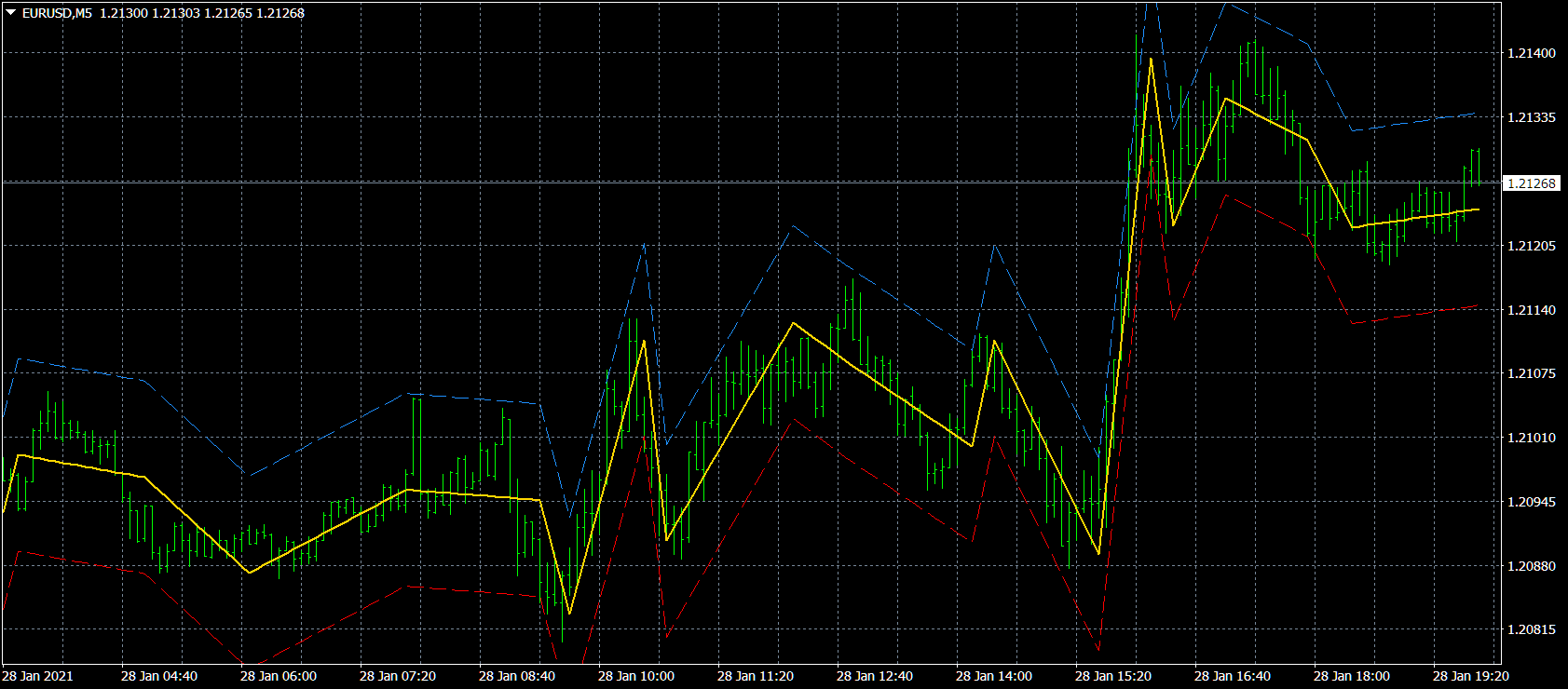

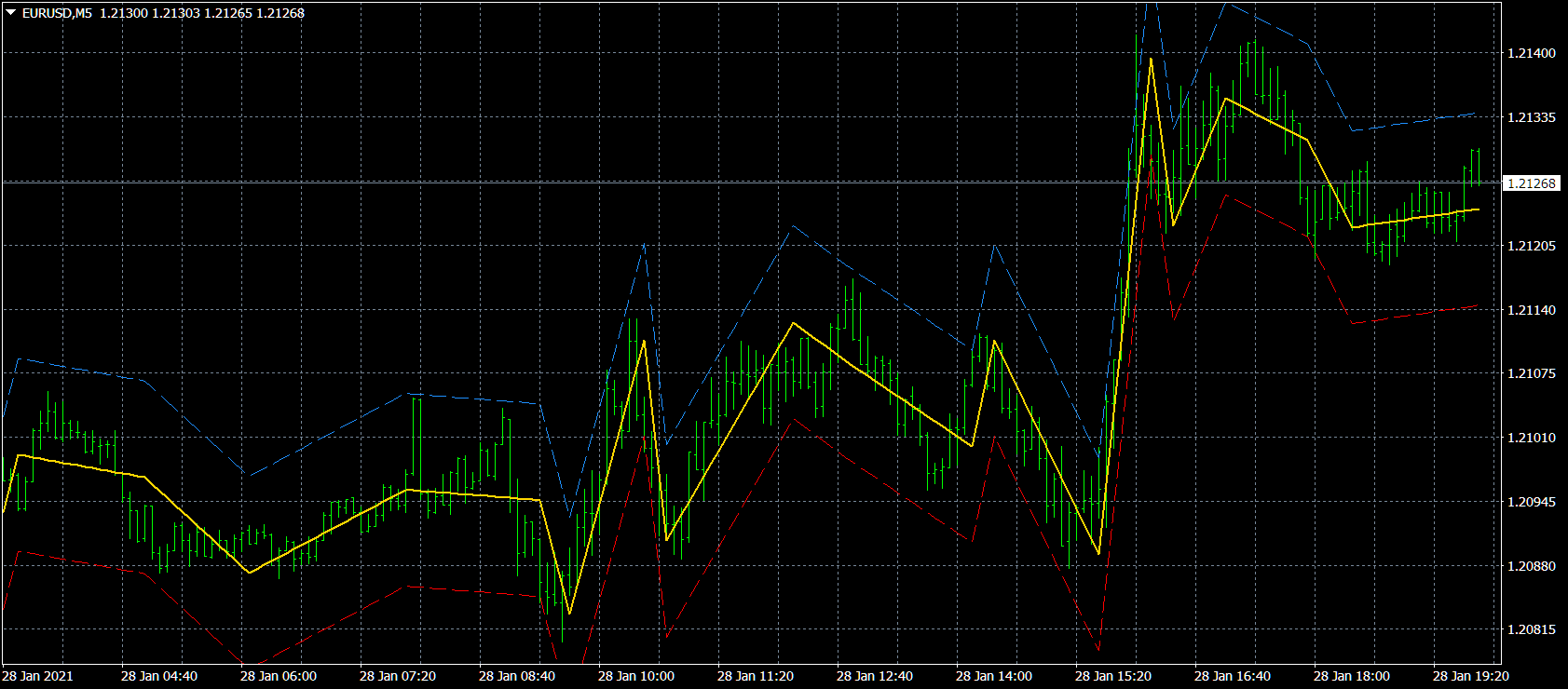

StatZigZag FREE https://www.mql5.com/en/market/product/61091

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends, I am a theoretical physicist and a trader, mathematically rigorously studying market processes, aspects of which I have already begun to present in my articles. https://www.mql5.com/en/articles/10955

https://www.mql5.com/en/articles/11158

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

https://www.mql5.com/en/articles/11158

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

Aleksey Ivanov

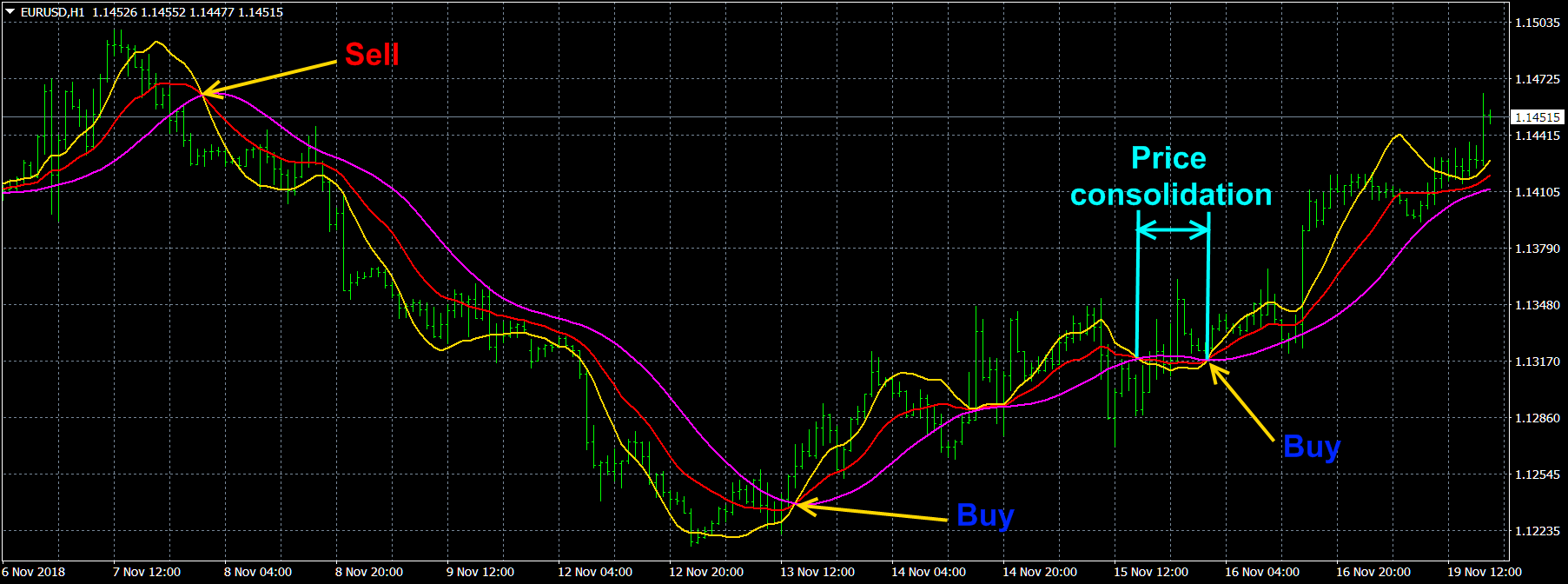

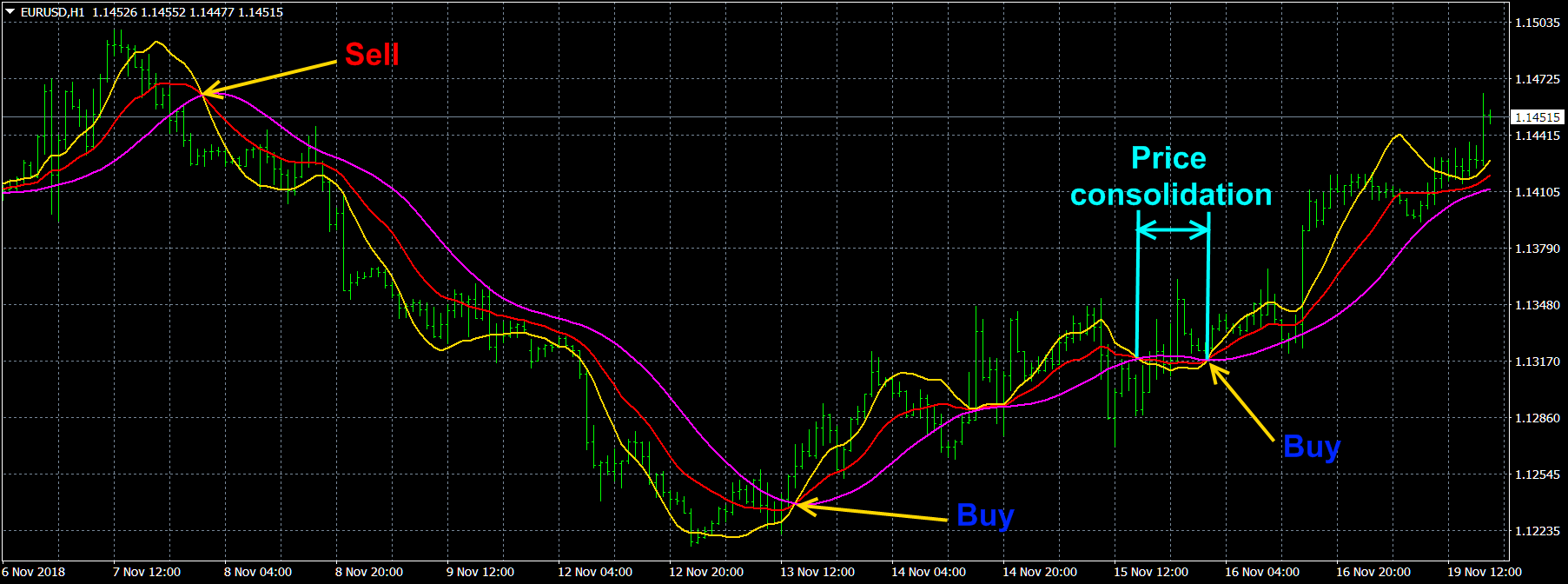

Identify Trend FREE https://www.mql5.com/en/market/product/36336

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Casual Channel https://www.mql5.com/en/market/product/71806

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. It is impossible to make money on false trends. («True and illusory currency market trends» https://www.mql5.com/en/blogs/post/740838 )

✔️Casual Channel indicator allows you to distinguish a true trend from a false one.

✔️The indicator has a built-in money management function.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. It is impossible to make money on false trends. («True and illusory currency market trends» https://www.mql5.com/en/blogs/post/740838 )

✔️Casual Channel indicator allows you to distinguish a true trend from a false one.

✔️The indicator has a built-in money management function.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

MACD Extrapolator https://www.mql5.com/en/market/product/81589

The indicator predicts the future values of the MACD indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The indicator predicts the future values of the MACD indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

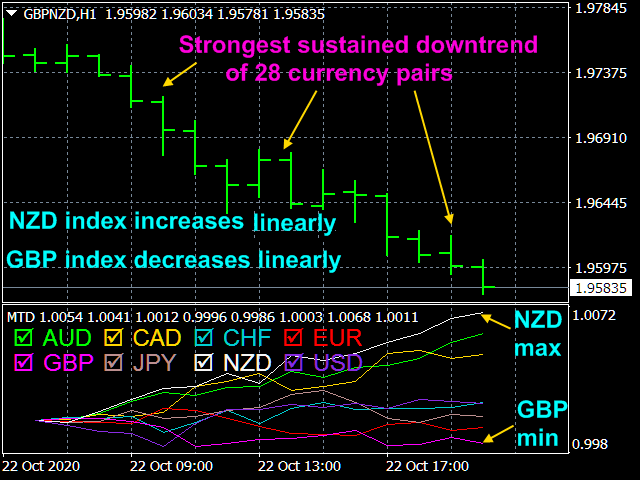

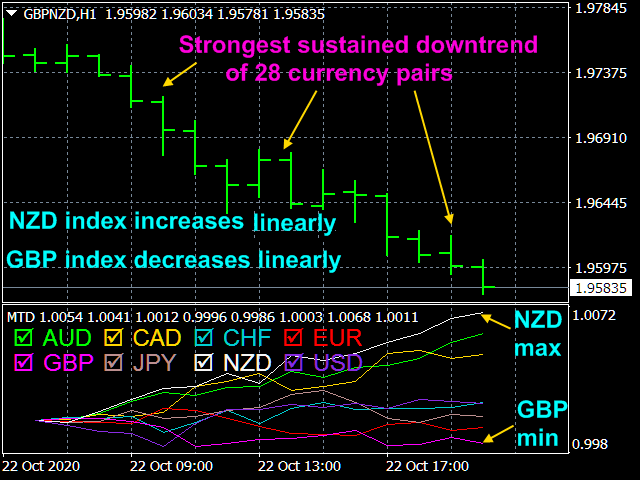

The Multicurrency Trend Detector https://www.mql5.com/en/market/product/56194

Multicurrency Trend Detector indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Multicurrency Trend Detector indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Profit Trade https://www.mql5.com/en/market/product/49806

Profit Trade is a deep development of the well-known Donchian channel indicator.

✔️ The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales.

✔️The filtration used in Profit Trade is extremely robust; and this indicator does not redraw.

✔️The indicator settings are extremely simple.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Profit Trade is a deep development of the well-known Donchian channel indicator.

✔️ The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales.

✔️The filtration used in Profit Trade is extremely robust; and this indicator does not redraw.

✔️The indicator settings are extremely simple.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Identify Market State https://www.mql5.com/en/market/product/46028

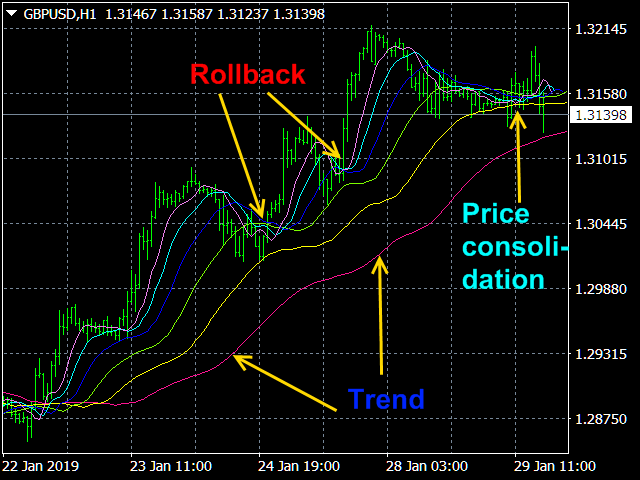

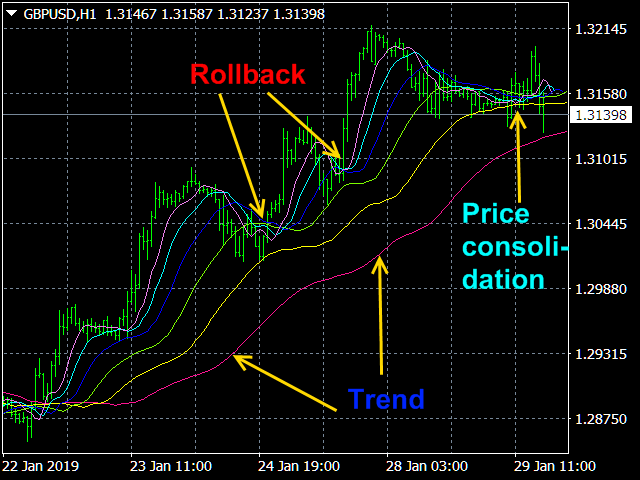

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

✔️ The indicator does not redraw.

✔️The indicator has all types of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

✔️ The indicator does not redraw.

✔️The indicator has all types of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Sensitive Signal https://www.mql5.com/en/market/product/34171

✔️The most sensitive indicator with optimal market noise filtering.

✔️The best indicator for scalpers.

✔️Calculates stop loss and take profit positions.

✔️It has built-in management and all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️The most sensitive indicator with optimal market noise filtering.

✔️The best indicator for scalpers.

✔️Calculates stop loss and take profit positions.

✔️It has built-in management and all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Profit MACD https://www.mql5.com/en/market/product/35659

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ One of my most profitable indicators with optimal filtering.

✔️The algorithms of this indicator are unique and developed by their author

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Cunning crocodile https://www.mql5.com/en/market/product/32028

✔️ One of the best indicators with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ One of the best indicators with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️ The indicator does not redraw.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

✔️ Here are indicators from the creator of the scientific rigorous theory of price movement Part 1 https://www.mql5.com/en/articles/10955 ,

Part 2 https://www.mql5.com/en/articles/11158 and

the author of the well-known Identify Trend indicator https://www.mql5.com/en/market/product/36336 .

✔️The algorithms of most indicators (Modern profitable indicators https://www.mql5.com/en/blogs/post/741637 ) are unique and developed by their author.

Part 2 https://www.mql5.com/en/articles/11158 and

the author of the well-known Identify Trend indicator https://www.mql5.com/en/market/product/36336 .

✔️The algorithms of most indicators (Modern profitable indicators https://www.mql5.com/en/blogs/post/741637 ) are unique and developed by their author.

Aleksey Ivanov

StatChannel https://www.mql5.com/en/market/product/37619

StatChannel is a bolinger bands indicator with no lag.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

StatChannel is a bolinger bands indicator with no lag.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Quality trend https://www.mql5.com/en/market/product/79505

The Quality trend indicator expresses the ratio of the strength of a trend or the speed of its growth (fall) to the degree of its noisiness or a certain norm of amplitudes of chaotic fluctuations of a growing (falling) price. The position of the indicator line above zero shows an increasing trend, below zero - a falling trend, the fluctuation of the indicator line near zero shows a flat.

If the indicator line begins to fluctuate rapidly around zero and approach it, then this indicates the imminent beginning of a trend movement. Quite often, an increase in the noise of even a rapidly growing trend or an increase in volatility indicates upcoming changes in the market, in particular, the end of the corresponding trend movement. Consequently, if the readings of an indicator with a high quality factor value suddenly start to decrease, then this indicates the imminent end of the corresponding trend movement. Therefore, the indicator readings are often leading and show the near end of a trend movement with a transition to a flat or even a change in the direction of the trend movement.

✔️The indicator does not lag behind and does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Quality trend indicator expresses the ratio of the strength of a trend or the speed of its growth (fall) to the degree of its noisiness or a certain norm of amplitudes of chaotic fluctuations of a growing (falling) price. The position of the indicator line above zero shows an increasing trend, below zero - a falling trend, the fluctuation of the indicator line near zero shows a flat.

If the indicator line begins to fluctuate rapidly around zero and approach it, then this indicates the imminent beginning of a trend movement. Quite often, an increase in the noise of even a rapidly growing trend or an increase in volatility indicates upcoming changes in the market, in particular, the end of the corresponding trend movement. Consequently, if the readings of an indicator with a high quality factor value suddenly start to decrease, then this indicates the imminent end of the corresponding trend movement. Therefore, the indicator readings are often leading and show the near end of a trend movement with a transition to a flat or even a change in the direction of the trend movement.

✔️The indicator does not lag behind and does not redraw.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

StochasticExtrapolator https://www.mql5.com/en/market/product/80820

The indicator predicts the future values of the Stochastic indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The indicator predicts the future values of the Stochastic indicator, which allows you to use this indicator much more efficiently.

The market has a very short memory; in any case, the information that formally describes it quickly becomes obsolete and loses its weight in the formation of the current price. Therefore, wavelet analysis is the most promising for predicting future market parameters. The author uses a number of wavelet functions (including the Morlet wavelet and a somewhat modified Gaussian function, which are shown in the last screenshot), the expansion by which, with a sufficient degree of reliability, allows extrapolating future values of oscillator indicators.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

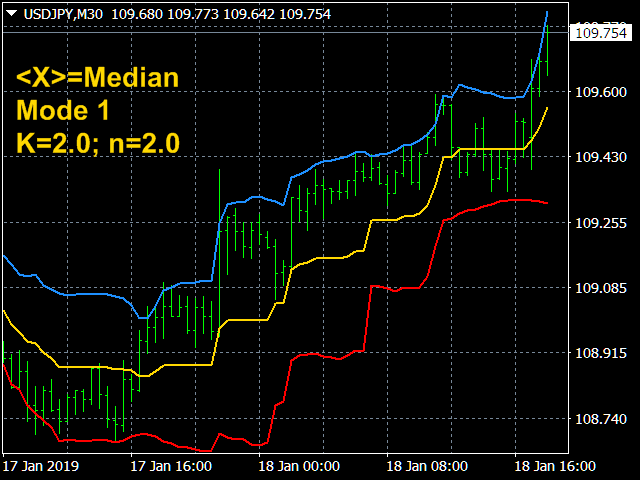

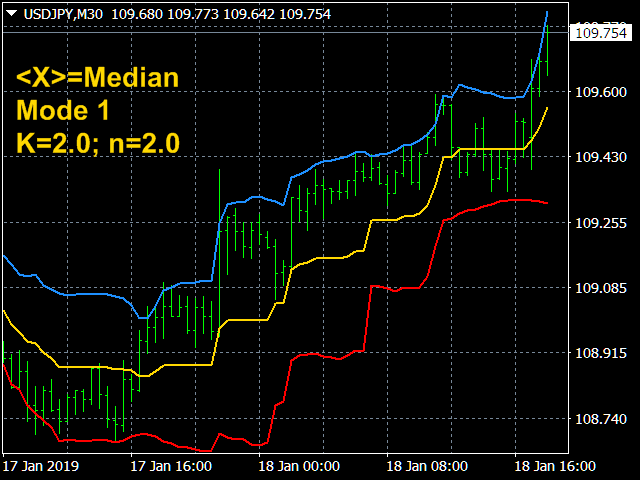

Channel Builder FREE https://www.mql5.com/en/market/product/34818

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line .

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The Channel Builder (CB) or Ivanov Bands indicator is a broad generalization of the Bollinger Bands indicator. First, in CB, the mean line is calculated using various averaging algorithms. Secondly, the mean deviations calculated by Kolmogorov averaging are plotted on both sides of the middle line .

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

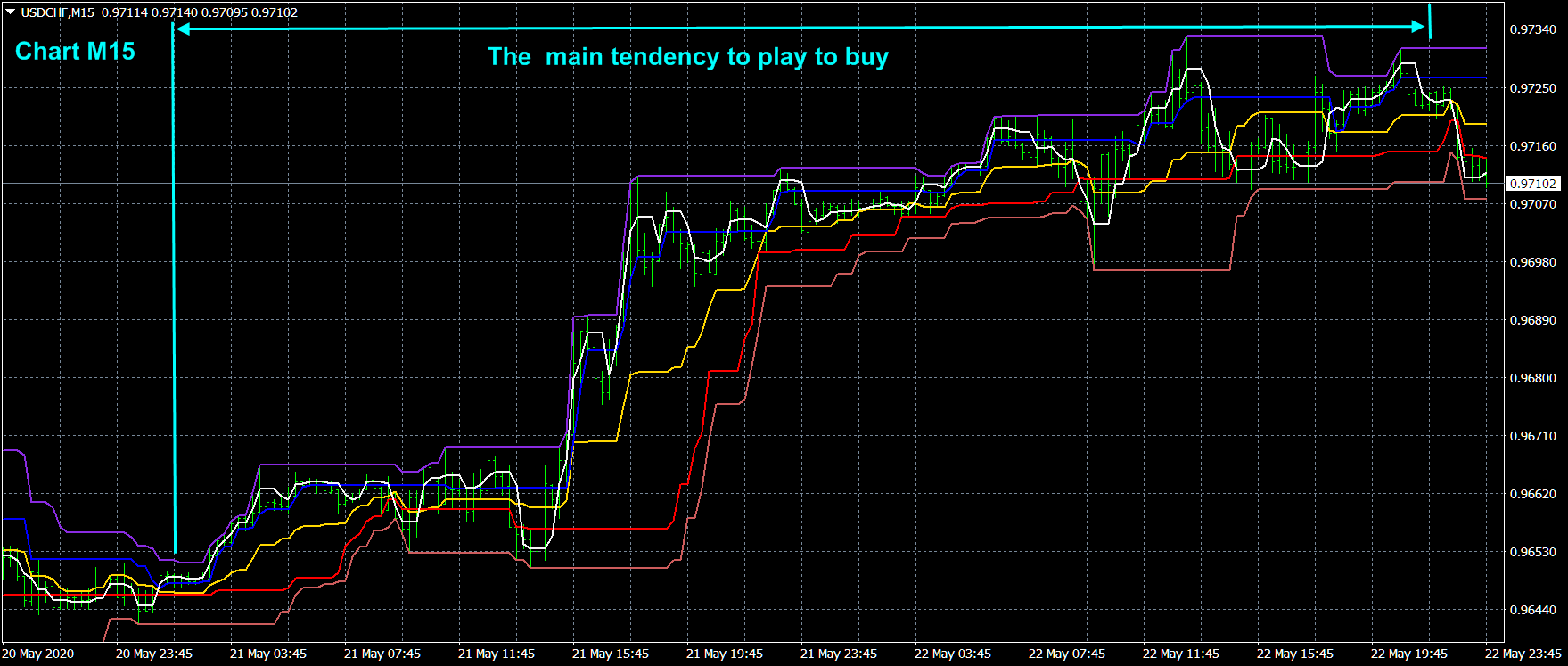

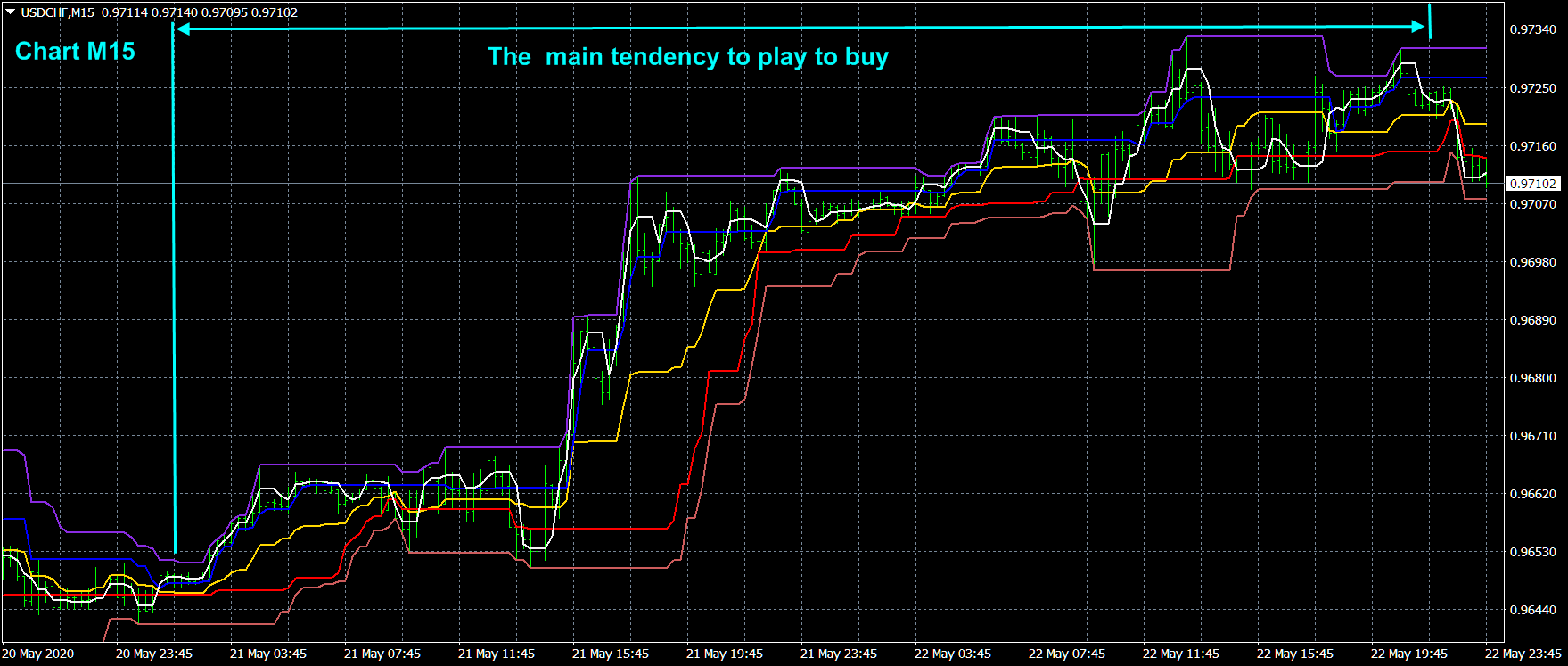

Alligator Analysis FREE https://www.mql5.com/en/market/product/35227

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

The “Alligator Analysis” (AA) indicator allows you to build various (by averaging types and by scales) “Alligators” and their combinations, i.e. allows you to analyze the state of the market based on the correlation of this state with a whole range of different "Alligators". The classic "Alligator" by Bill Williams is based on moving averages and Fibonacci numbers, which makes it one of the best indicators now. The classic "Alligator" is based on Fibonacci numbers and is a combination of three smoothed moving averages (SМMA) with periods 5, 8 and 13, which are part of the Fibonacci sequence. In this case, the moving averages are shifted forwards by 3, 5, and 8 bars, respectively, which are numbers from the same sequence (preceding the corresponding period values).

Alligators from the AA indicator is based, on the same principle as the classic “Alligator”, but on different parts of a number of Fibonacci numbers, as well as on different moving average averaging algorithms.

The indicator AA uses 6 types of averaging, where the classical averaging SMA, EMA, SMMA, LMA are supplemented by averaging the moving average by the median and averaging weighted by volume.

Line shifts can be removed. The colors of the AA indicator lines are set according to the type of color spectrum: from violet for a small smoothing period to red - for the largest period.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

: