Roberto Jacobs / Profil

- Informations

|

8+ années

expérience

|

3

produits

|

75

versions de démo

|

|

28

offres d’emploi

|

0

signaux

|

0

les abonnés

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

MetaQuotes

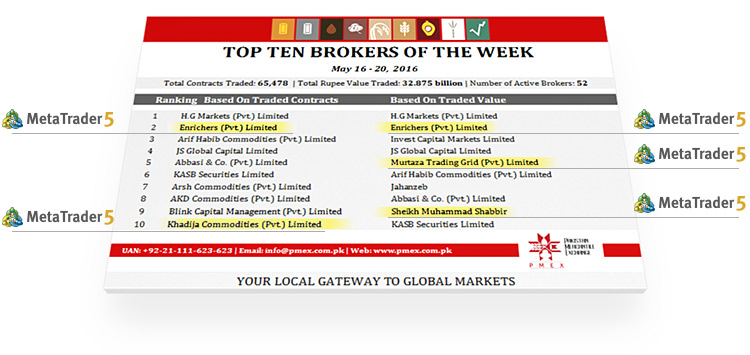

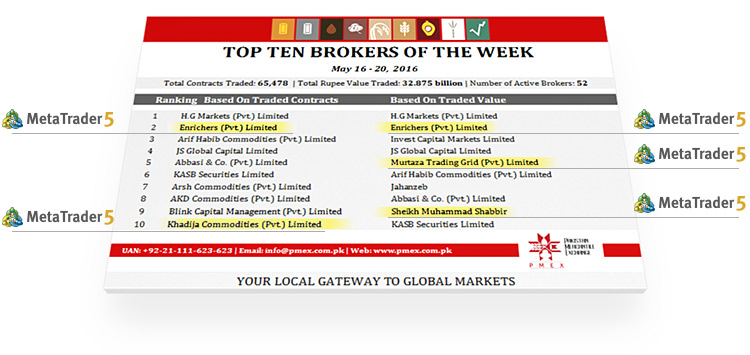

In 2015, we reported on the first broker launching MetaTrader 5 in Pakistan. A year later, four out of ten leading brokers offer the platform according to the Pakistan Mercantile Exchange (PMEX). The most remarkable thing is that MTG Financials Limited implemented MetaTrader 5 in February 2016 and found itself among the five leading brokers of Pakistan by May making an impressive leap forward in just three months!

1

Roberto Jacobs

Elliott Wave Analysis of EUR/NZD for June 1, 2016 Wave summary: Once again this pair has failed miserably and broken well below important short-term support at 1.6424 invalidating the short-term bullish count...

Roberto Jacobs

Elliott Wave Analysis of EUR/JPY for June 1 - 2016 Wave summary: Despite an unexpected large decline yesterday, we will let the bullish view have the benefit, as long as the low at 121.46 is able to protect the downside...

Roberto Jacobs

Technical Analysis of EUR/JPY for June 01, 2016 Technical outlook and chart setups: The EUR/JPY pair is seen to be trading at 122.40 levels for now after pulling back from lows at 122.00 levels. The pair is still stuck in the trading range between 122.00 and 124.00/50 levels respectively...

Roberto Jacobs

Technical Analysis of GBP/CHF for June 01, 2016 Technical outlook and chart setups: The GBP/CHF pair is seen to be trading at at 1.4390 levels at this moment after reversing sharply from 1.4600 levels yesterday. Please note that the rally that begun from 1.3400 levels looks to be complete at 1...

Partager sur les réseaux sociaux · 1

112

Roberto Jacobs

EUR/USD Jumps to Highs Near 1.1160 The common currency met a wave of buying interest following a negative start of European equity markets today, lifting EUR/USD to the vicinity of 1.1160. EUR/USD supported near 1...

Roberto Jacobs

USD/JPY Intermarket: Selling Dubious vs Intrinsic Valuations With USD/JPY rally having thwarted just ahead of 111.50 on Tuesday, the pair has experienced an abrupt reversal ever since, selling-off initially towards the 111...

Roberto Jacobs

Daily Analysis of USDX for June 01, 2016 The greenback remains strong in the mid term, as the 200 SMA is still a dynamic support on the H1 chart. The next resistance is still placed around the 96...

Roberto Jacobs

Daily Analysis of GBP/USD for June 01, 2016 The pair continues to trade into a bearish tone on the H1 chart, looking to extend the decline below the support level of 1.4464, which remains a solid demand zone on a short-term basis...

Roberto Jacobs

USD/JPY Weaker, Wobbling around 110.00 The Japanese yen is appreciating vs. its American counterpart today, sending USD/JPY to as low as the 109.70 area, although regaining the 110 neighbourhood afterwards...

Roberto Jacobs

GBPUSD Downside Risk; 50-Day MA Supports GBPUSD is now forming a neutral bias after the bullish move from 1.4004 to 1.4768 stalled and the market is consolidating just above the 50% Fibonacci of this upleg from April to May. This Fibonacci level lies just below the key psychological 1...

Roberto Jacobs

Yen Jumps as US Yields Fall Back and ‘Brexit’ Risks Creep Higher – MUFG Derek Halpenny, European Head of GMR at MUFG, notes that as was widely expected, PM Abe announced in the Diet today that he has decided to postpone the sales tax increase from 8% to 10% from April next year until October 2019...

Roberto Jacobs

UK Manufacturing PMI Preview: What to Expect of GBP/USD? The UK economy will release its May manufacturing PMI later in the European session. Markets expect the manufacturing PMI to tick higher to 49.9 from a sharp drop seen in April to 49.2 points...

Roberto Jacobs

FxWirePro: NZD/JPY Rejected at Chann NZD/JPY was rejected at channel top by 75.45 and has slipped lower to hit session lows of 74.44. Technicals on 4H charts support further downside in the pair, RSI, Stochs biased lower and MACD line shows bearish crossover on signal line...

Roberto Jacobs

US Oil Forms M-shaped Pattern, Good to Sell Below $48.60 Pattern Formed -M- shaped pattern Major support $48.60 US oil has jumped till $50.08 yesterday but not able break above $50.18 high made on May 26th 2016...

Roberto Jacobs

FxWirePro: Silver Faces Strong Support at $16.88, a Sustain Break Below Targets $15.62 XAG/USD is currently trading around $15.98 marks. It made intraday high at $16.05 and low at $15.94 levels. Intraday bias remains bullish till the time pair holds key support at $15.88 marks...

Partager sur les réseaux sociaux · 1

110

1

Roberto Jacobs

Oil Trades on the Back Foot Aahead of OPEC Meet, Drops -1% Oil benchmarks on both sides of Atlantic edged lower this Wednesday, as traders remain cautious ahead of weekly supply reports and OPEC meeting due tomorrow...

Roberto Jacobs

GBP/USD Under Pressure, Could Test 1.44 – UOB The research team at UOB Group has shifted to a neutral stance on GBP/USD, although a visit to the 1.4400 area should not be ruled out. Key Quotes “The break of the 1.4550 stop-loss yesterday indicates that the recent high of 1...

Roberto Jacobs

EUR/USD Well Supported at 1.1102/1.1058 – Commerzbank Karen Jones, Head of FICC Technical Analysis at Commerzbank, has reiterated the pair remains well supported in the 1.1102/1.1058 band. Key Quotes “EUR/USD is holding just above the critical 1.1102/1.1058 key support...

Roberto Jacobs

EUR/CHF in a Tight Range Around 1.1050 The Swiss franc is gathering steam vs. its European peer on Wednesday, with EUR/CHF trading on the defensive in the mid-1.1000s so far...

: