Roberto Jacobs / Profil

- Informations

|

9+ années

expérience

|

3

produits

|

76

versions de démo

|

|

28

offres d’emploi

|

0

signaux

|

0

les abonnés

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Sergey Golubev

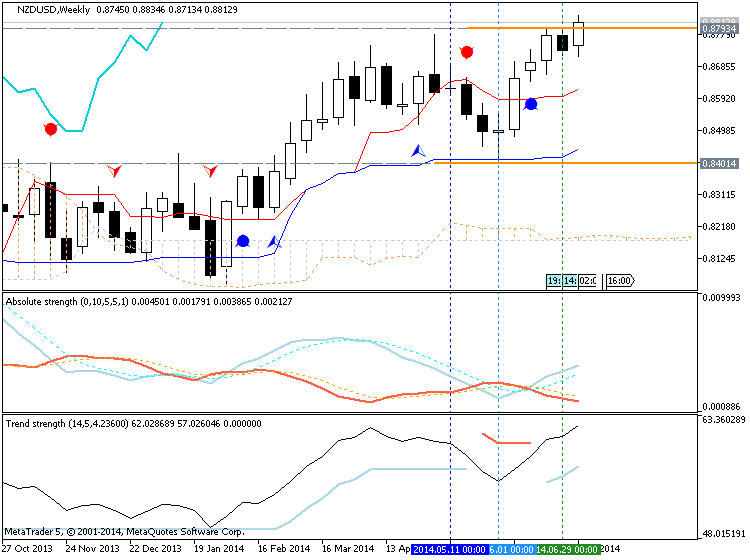

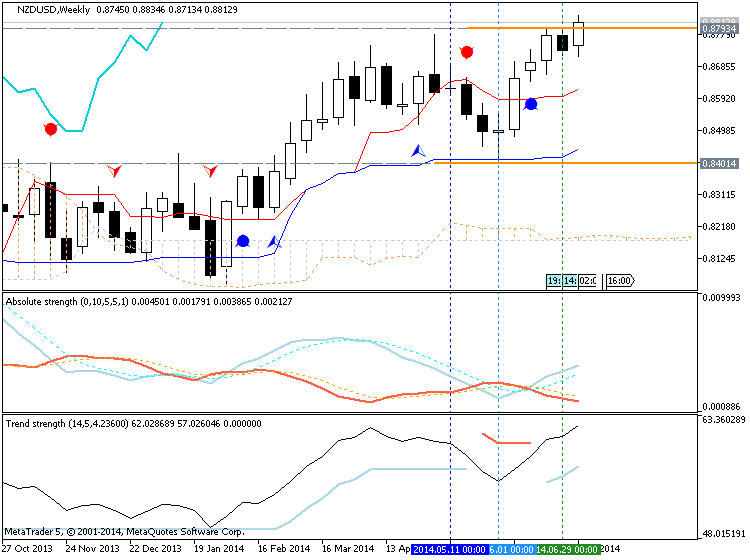

NZDUSD Technical Analysis 2014, 13.07 - 20.07: Bullish

D1 price is on primary bullish stopped by 0.8834 resistance level. H4 price is on flat with ranging between 0.8793 support and 0.8832 resistance with primary bullish. W1 price is on primary bullish crossing 0.8793 resistance level on open bar for

Roberto Jacobs

Sergey Golubev

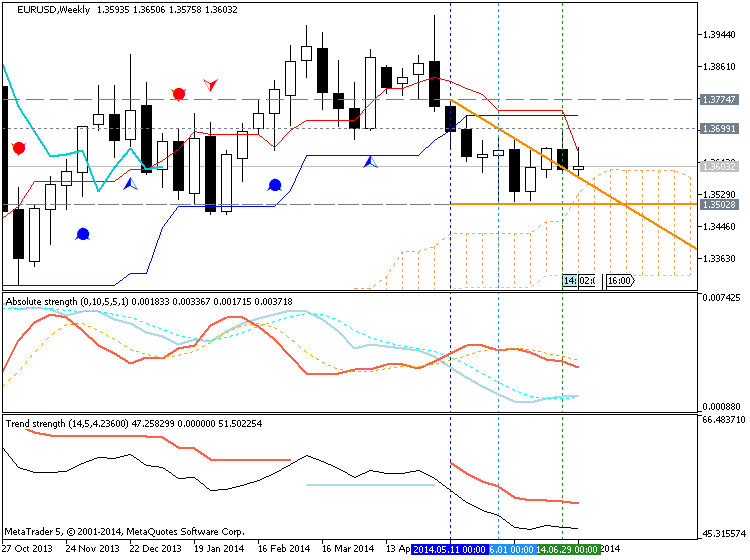

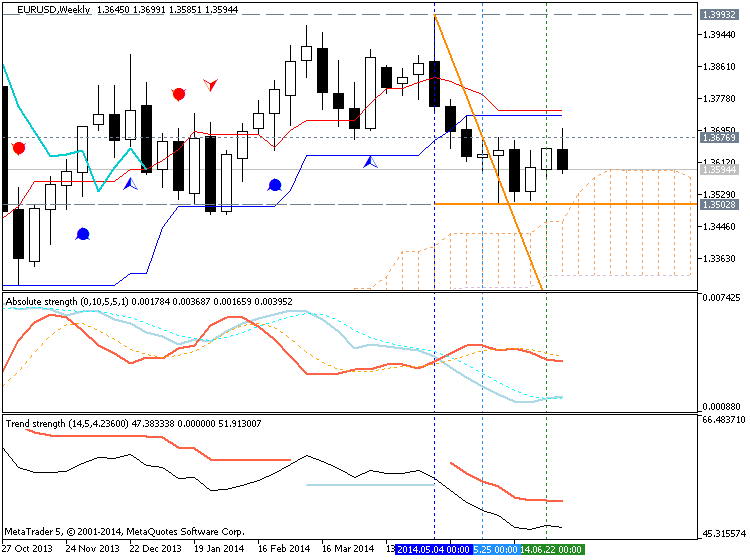

The EUR/USD pair tried to rally during the course of the week, but as you can see gave back quite a bit of the gains in order to form a shooting star. Nonetheless, the market seems to be stuck between the 1.35 level as support, and the 1.37 level as resistance...

2

Roberto Jacobs

Sergey Golubev

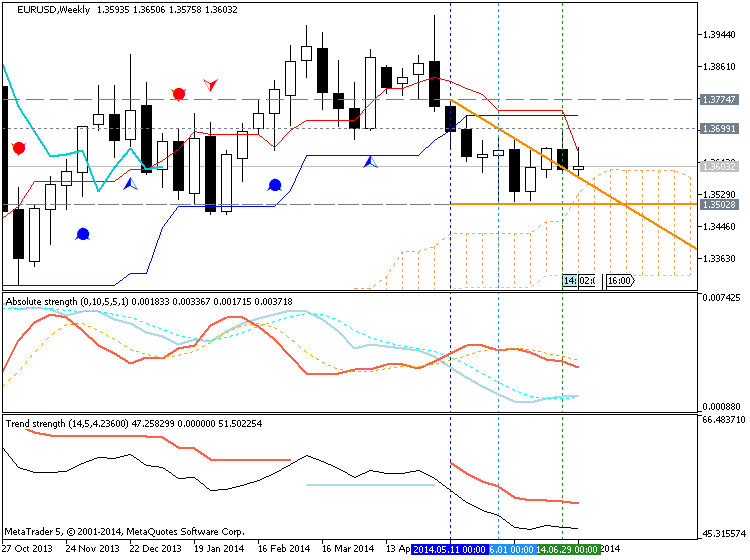

EURUSD Technical Analysis 2014, 13.07 - 20.07: Ranging Bearish

D1 price is ranging between 1.3699 resistance and 1.3575 support levels within primary bearish market condition. H4 price is on flat within primary bearish; Chinkou Span line of Ichimoku indicator is very near to be crossed with historical price for

Roberto Jacobs

Code publié Forex Indicator Price Degrees with Trend Alerts

This indicator will write value degrees of the lastest position of price at the current timeframes, and when position and condition of trend status was changed, the indicator will give an alerts.

Partager sur les réseaux sociaux · 3

3963

Roberto Jacobs

Sergey Golubev

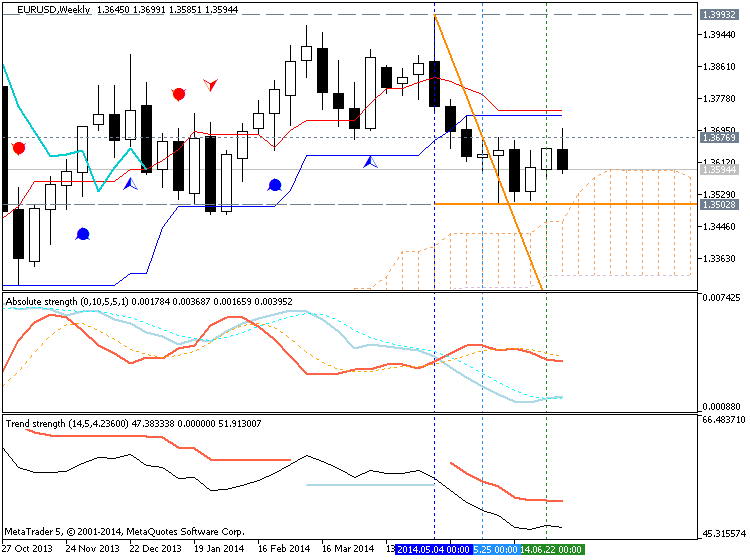

EURUSD Technical Analysis 2014, 06.07 - 13.07: Breakdown within Bearish

D1 price is on breakdown started on open bar within primary bearish. The price is trying to break 1.3596 support and 1.3575 support levels for the breakout to be continuing. H4 price is on flat condition of primary bearish, and W1 price is ranging

Roberto Jacobs

Roberto Jacobs

2014.07.06

Hi my friend Sergey..You are smoking, she also smoking.. never mind.. ha.ha..ha..

: