Roberto Jacobs / Profil

- Informations

|

9+ années

expérience

|

3

produits

|

76

versions de démo

|

|

28

offres d’emploi

|

0

signaux

|

0

les abonnés

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Indonesian Bonds Gain on Bank Indonesia Easing Expectations The Indonesian long-term bonds gained on Monday as market anticipate another 25-50 bps cut in 2016 due to soft economic growth. The benchmark 10-year bonds yield, which is inversely proportional to bond price fell 0.40 pct to -7...

Partager sur les réseaux sociaux · 2

128

Roberto Jacobs

GBP/USD Jumps to Highs Near 1.4220 The sterling met some upside pressure following a positive start of European equities on Monday, with GBP/USD testing highs above the 1.4200 handle...

Roberto Jacobs

FXWIREPRO: FTSE100 Faces Strong Resistance at 6225, Good to Sell on Rallies Major support -6080 (trend line joining 6006 and 6060) Major resistance – 6225 (200 day MA) The index has once again retreated after making a high of 6217. It is currently trading around 6169...

Roberto Jacobs

Technical Analysis of USDX for April 11, 2016 The Dollar index remains in a bearish trend but this trend is soon to end and reverse upwards as there are many divergence signs. Dollar bears should be very cautious as the 94 price level is heavily defended by dollar bulls...

Roberto Jacobs

Technical Analysis of Gold for April 11, 2016 Gold has broken upwards above the short-term bearish channel and above the short-term resistance at $1,145-50 giving a bullish signal. However, bulls need to be very cautious despite the small chances of making a new higher high towards $1,300...

Roberto Jacobs

Technical Analysis of USD/CHF for April 11, 2016 USD/CHF is expected to trade in a lower range. The pair remains under pressure below its key resistance and is expected to post further consolidations. Meanwhile, the relative strength index lacks upward momentum...

Roberto Jacobs

Sergey Golubev

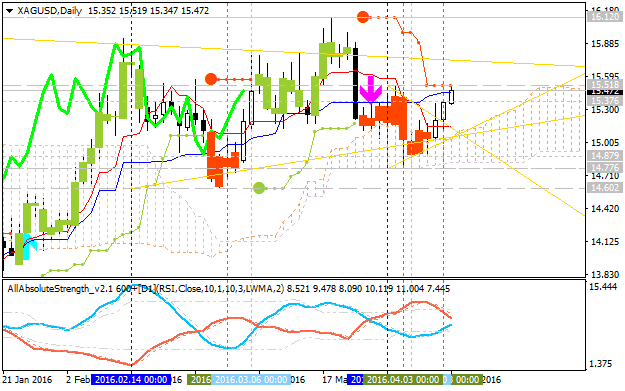

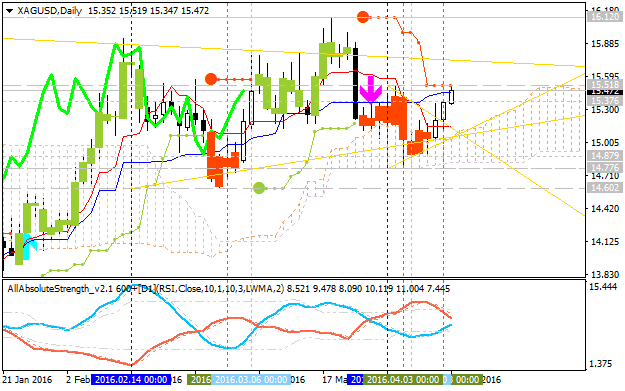

Commentaire sur le thème Forecast for Q2'16 - levels for SILVER (XAG/USD)

SILVER (XAG/USD) Technical Analysis 2016, 10.04 - 17.04: Buy Silver - bullish breakout with 16.12 as the nearest target Daily price is located above Ichimoku cloud and above Senkou Span line which is

Roberto Jacobs

JPY: Japan Strengthens Direct Intervention Threat - MUFG Lee Hardman, Currency Analyst at MUFG, suggests that the verbal intervention from Japanese officials has had only a limited impact at dampening yen strength in the near-term...

Roberto Jacobs

EU Referendum Officially Kicks Off This Week - TDS Research Team at TDS, suggests that the UK’s EU Referendum officially kicks off on Friday...

Roberto Jacobs

Technical Analysis of NZD/USD for April 11, 2016 NZD/USD is expected to trade in a higher range as the key support is at 0.6770. The pair bounced off Friday from its key support base around 0.6770-0.6755, which should limit any downward attempts...

Roberto Jacobs

Technical Analysis of GBP/JPY for April 11, 2016 GBP/JPY is expected to trade with a bearish bias as the pair is expected to trade in a higher range. The pair might be forming an intraday "rounding bottom" pattern, and is likely to challenge its next resistance at 1.4170...

Roberto Jacobs

European Stocks Drop as Oil Falters Stock markets across Europe dropped in early trading, tracking weak Asian equities and drop in oil prices. At the time of writing, Stoxx 50 index was down 0.50%. Germany’s DAX was down 0.63% and France’s CAC was down 0.58%. UK’s mining heavy FTSE was down 0...

Roberto Jacobs

US: Weak Start to the Year Reinforcing USD Weakness - MUFG Lee Hardman, Currency Analyst at MUFG, suggests that the US dollar continues to remain on the defensive in the near-term undermined the Fed’s dovish policy shift...

Roberto Jacobs

Pressure Points, Negative Rates and the Fading Risk Rally – Danske Bank

11 avril 2016, 09:38

Pressure Points, Negative Rates and the Fading Risk Rally – Danske Bank Research Team at Danske Bank, suggests that the pressure points are building in financial markets after 1.5 months of risk rally...

Roberto Jacobs

USD/JPY Still Targets 106.63 – Commerzbank According to Karen Jones, Head of FICC Technical Analysis at Commerzbank, a visit to the 106.60 area remains on the cards. Key Quotes “USD/JPY charted an inside day on Friday as it attempts to absorb some of last weeks sharp falls”...

Roberto Jacobs

USD Short Remains Moderate - BNPP James Hellawell, Research Analyst at BNP Paribas, lists down the FX positioning analysis data for the week ending 11th April. Key Quotes • “AUD and CAD positioning is light at scores of +1 and -2 respectively while NZD short positions remain large at -27...

Roberto Jacobs

EUR/USD Neutral Near-Term – UOB In opinion of analysts at UOB Group, the pair’s outlook remains neutral in the next 1-3 weeks. Key Quotes “EUR held above the crucial support indicated at 1.1325/30 last Friday (low of 1.1347...

Roberto Jacobs

Kuroda’s Dovish Comments Fail to Lit a Fire Under USD/JPY

11 avril 2016, 09:31

Kuroda’s Dovish Comments Fail to Lit a Fire Under USD/JPY Bank of Japan’s (BOJ) Kuroda tried to weaken Yen but stating readiness to do more but failed as the USD/JPY pair remains weak around 107.80 levels...

Roberto Jacobs

BoE: Most Important Event for the UK – Danske Bank Research Team at Danske Bank, suggests that in the UK, the most important event this week is the Bank of England (BoE) meeting on Thursday. Key Quotes “We expect the BoE to maintain the Bank Rate and stock of purchased assets unchanged at 0...

Roberto Jacobs

Yen to Remain on Rise on Japan's Delicate Intervention Situation – Deutsche Bank

11 avril 2016, 09:27

Yen to Remain on Rise on Japan's Delicate Intervention Situation – Deutsche Bank Taisuke Tanaka, Strategist at Deutsche Bank, notes that the USD/JPY slid below ¥110 last week and this is the internal base rate for many Japanese exporters in the new fiscal year...

: