Roberto Jacobs / Profil

- Informations

|

8+ années

expérience

|

3

produits

|

75

versions de démo

|

|

28

offres d’emploi

|

0

signaux

|

0

les abonnés

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

USD/CHF Reverses from 50-DMA, Dips Back Below 0.9700 Handle The USD/CHF pair witnessed some profit taking from the vicinity of 50-day SMA region (0.9725-30 area), dragging the pair to its session low level of 0.9693...

Roberto Jacobs

Technical Analysis of Silver for May 09, 2016 Technical outlook and chart setups: Silver has been trading sideways for 2 consecutive trading sessions between $17.25 and $17.45 levels respectively. The metal had reversed from $18.00 levels earlier and is trading at $17.40 levels for now...

Roberto Jacobs

Technical Analysis of Gold for May 09, 2016 Technical outlook and chart setups: Gold has dropped lower today and is trading at $1,280.00/81.00 levels for now. The metal might be supported at these levels and push higher one last time through $1,307.00/10.00 levels before reversing lower...

Roberto Jacobs

USD/JPY Now Focused on 105.00 – BBH Analysts at BBH have noted the relevance of the 105.00 handle amidst talks of BoJ intervention. Key Quotes “The dollar hit a low near JPY105.55 on May 3 before bouncing back to JPY107.50”. “Recall that the previous lows were in the JPY107.60-JPY107.70 area...

Roberto Jacobs

Technical Analysis of GBP/CHF for May 09, 2016 Technical outlook and chart setups: The GBP/CHF pair is seen to be stalling at 1.4020/50 levels and might be looking to reverse lower. The pair is trading at 1.4010 levels at this moment, and bears may want to push prices lower towards 1...

Partager sur les réseaux sociaux · 2

119

Roberto Jacobs

Technical Analysis of EUR/JPY for May 09, 2016 Technical outlook and chart setups: The EUR/JPY pair has bounced back after testing 121.40/50 levels today during early hours. It seems to be a double bottom in the making. The pair is trading at 122.66 levels for now, looking to continue higher...

Roberto Jacobs

EUR/USD: Further Downside on the Cards? – Commerzbank Karen Jones, Head of FICC Technical Analysis at Commerzbank, hinted at the possibility of a visit to the 1.1340 area in the short-term...

Roberto Jacobs

Sergey Golubev

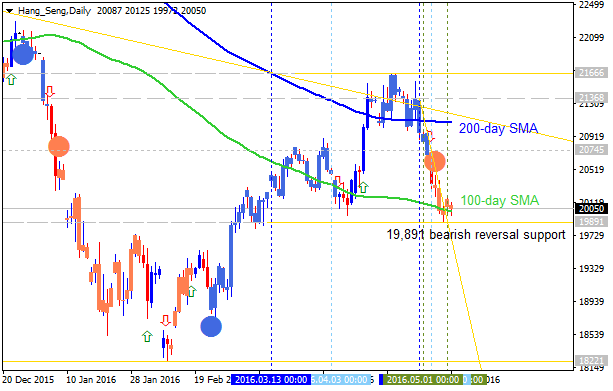

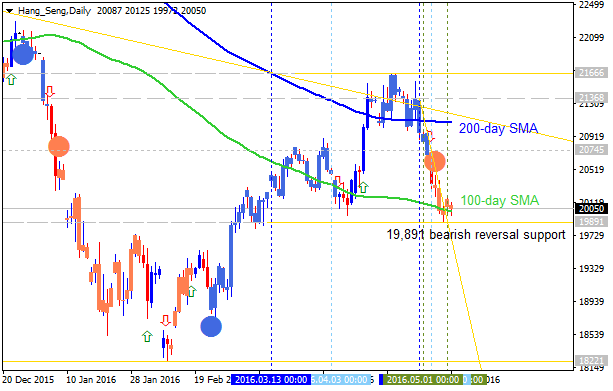

Commentaire sur le thème Forecast for Q2'16 - levels for Hang Seng Index (HSI)

Hang Seng Index Technical Analysis: key support level at 19,891 to be broken for the bearish reversal Daily price is located below 200-day SMA for the 100-day SMA crossing to below with the 19,891

Roberto Jacobs

Sergey Golubev

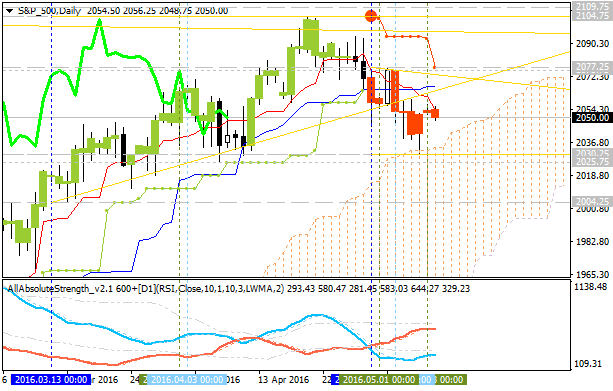

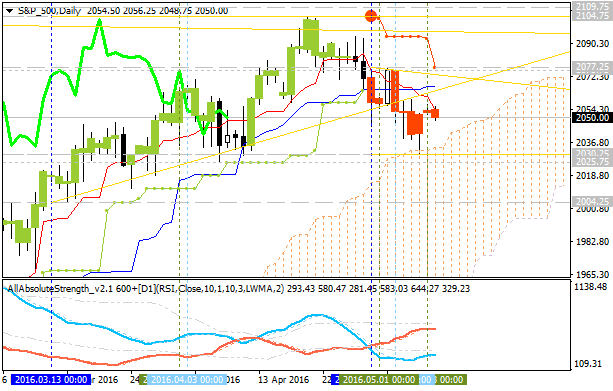

Commentaire sur le thème Forecast for Q2'16 - levels for S&P 500

S&P 500 Technical Analysis: bullish ranging breakdown Daily price is on bullish ranging breakdown: the price is on secondary correction by breaking key support levels with the Chinkou Span line which

Roberto Jacobs

EUR/USD Potential Decline to 1.1300 – UOB In view of the research team at UOB Group, EUR/USD risks a test of the 1.1300 area in the next 1-3 weeks. Key Quotes “We just shifted to a neutral stance last Friday and there is no change to the view”...

Roberto Jacobs

EUR/CHF Sinks to Lows Near 1.1050 After a failed attempt to extend the recent breakout of the 1.1100 handle, EUR/CHF has now returned to the mid-1.10s, or daily lows...

Roberto Jacobs

Elliott Wave Analysis of EUR/NZD for May 9 - 2016 Wave summary: After a slightly deeper correction to 1.6479 a new rally quickly broke back above resistance at 1.6745, indicating that a low is now in place at 1.6479 and more upside should be expected in the coming days/weeks ahead...

Roberto Jacobs

Elliott Wave Analysis of EUR/JPY for May 9 - 2016 Wave summary: The price spiked lower on Friday to a low of 121.46 but was immediately rejected. This could be what we have been waiting for to secure the bottom for a new long-term rally back to 141.06 and higher...

Roberto Jacobs

Gold Slides Further, Drops Back Below $1280 Gold weakened on Monday and extended its weakness during European session and dipped back below $1280 to currently trade near session low of $1279. On Friday, gold spike to $1295 on the back of what seemed to be poor US jobs report...

Roberto Jacobs

Oil Picture Even More Blurred – SocGen Kit Juckes, Research Analyst at Societe Generale, notes that the oil prices are higher this morning, in reaction to concerns about the fire in Fort McMurray, and appointment of a new Oil Minister in Saudi Arabia...

Roberto Jacobs

Technical Analysis of EUR/USD for May 09, 2016 When the European market opens, some economic news will be released such as the Sentix Investor Confidence and German Factory Orders m/m. The US will release economic data too such as the Labor Market Conditions Index m/m and Mortgage Delinquencies...

Roberto Jacobs

Technical Analysis of USD/JPY for May 09, 2016 In Asia, Japan will release the Consumer Confidence, Average Cash Earnings y/y, Monetary Policy Meeting Minutes, and the US will release some economic data such as the Labor Market Conditions Index m/m, and Mortgage Delinquencies...

Roberto Jacobs

Daily Analysis of Major Pairs for May 9, 2016 EUR/USD: This pair moved upwards on Monday and Tuesday, tested the resistance line at 1.1600, and then started a bearish movement. From the resistance line at 1.1600, the price dipped by 200 pips, to close at 1.1403 on Friday (May 6, 2016...

Roberto Jacobs

EUR/GBP Recovers to Move Back to 0.7925 Resistance The EUR/GBP pair rebounded from early morning lows of 0.7890 and added on to its strength during early European session to currently trade at day's peak 0.7927...

Roberto Jacobs

US: Starting to Labour? – ING James Smith, Economist at ING, suggests that the Friday’s Labour Report was fairly mixed, with sub-consensus payrolls growth, but better wage data and it won’t change too many minds on FOMC – the key now lies in the activity data...

: