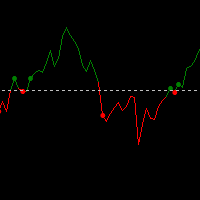

Open Close Cross Alerts

- Indicateurs

- Francis Soddo Wetaka

- Version: 2.0

Description:

Strategy based around Open-Close Crossovers.

Setup:

I have generally found that setting the strategy resolution to 3-4x that of the chart you are viewing tends to yield the best results, regardless of which MA option you may choose (if any) BUT can cause a lot of false positives - be aware of this. Don't aim for perfection. Just aim to get a reasonably snug fit with the O-C band, with good runs of green && red.

Option to either use basic open && close series data or pick your poison with a wide array of MA types.

An optional trailing stop for damage mitigation if desired (can be toggled on/off)

Positions get taken automagically following a crossover - which is why it's better to set the resolution of the script greater than that of your chart, so that the trades get taken sooner rather than later.

If you make use of the stops/trailing stops, be sure to take your time tweaking the values. Cutting it too fine will cost you profits but keep you safer, while letting them loose could lead to more drawdown than you can handle.

L'utilisateur n'a laissé aucun commentaire sur la note