Lock Guard

- Utilitaires

- Omar Usman

- Version: 1.42

- Mise à jour: 13 mars 2023

- Activations: 5

In trading, losses are inevitable, but they can be managed effectively with the right tools. Lock Guard © can be used for insuring positions in manual trading or as an addition to another robot. It is a powerful tool for saving a trader's main positions because it can prevent losses from getting out of hand.

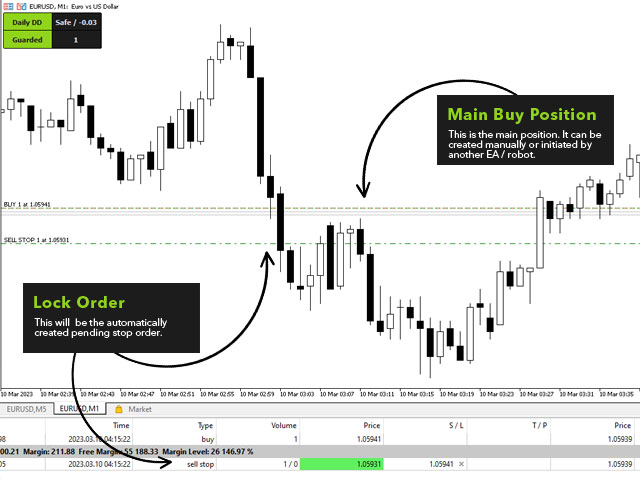

Lock Guard © is a trading tool that helps manage losses by automatically placing pending stop orders, which act as counter orders that become market orders when the price moves against the trader's main position. These stop orders prevent losses from increasing beyond a specified level, preserving the trader's main position and allowing it to generate profit when the lock closes or the price moves back in favor of the trader's main position. Each position is secured with a separate pending order, ensuring that they are all protected.

Benefits of using Lock Guard

Using Lock Guard offers several benefits, including:

Limiting losses

By freezing losses at a predetermined level, this EA helps prevent them from increasing and allows your main trading positions to remain active.

Flexibility

Traders have the flexibility to adapt the use of this EA to their specific needs, whether it's manual trading or using another robot, as it can be integrated with any trading strategy.

Multiple positions

Traders can use this EA to secure multiple positions, and there is no limit to the number of positions that can be locked.

Account Protection

This EA comes with an account protection feature that monitors your daily drawdown and prevents your account from exceeding the maximum daily drawdown limit set for it, ensuring the safety of your account.

Multi-direction Locking

With this EA, it's possible to lock the direction of any position, whether it's a Buy or Sell. There's no requirement to specify which positions should be monitored and protected by the EA.

Benefits of Hedging over traditional Stop Loss

- Hedging can provide greater flexibility in managing risk

- Hedging allows traders to continue holding a losing position with the potential for recovery

- Stop-loss orders can be vulnerable to slippage, especially in volatile markets

- Hedging can be used as a strategy to protect against unexpected market events, such as sudden price spikes or geopolitical events.

- Hedging can also be used to reduce the impact of currency fluctuations.

Usage

Attach this EA to any single chart.

Note: Please avoid attaching this to multiple charts if you're using the same Magic number. It's okay if you're using different Magic numbers per chart installation.

Lock Guard Settings

These are the settings within this EA:

[-- General --]

This section shows you all the general settings of the EA:

| Lock ID / Comment | This string serves as an identifier for the lock orders generated by the EA, and it is also used as a comment for these orders. |

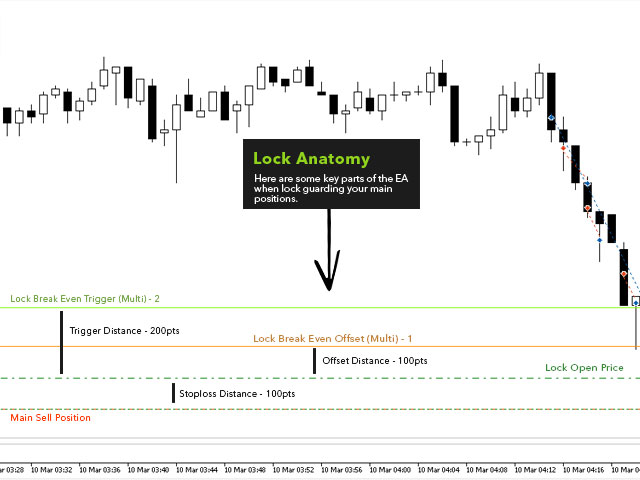

| Lock Break Even Trigger (Multi) | This acts as the trigger point for the break-even level/price of the lock order. For example, if the stop loss distance of the lock order is 100 points and the Lock BE Trigger Multiplier is 2, the lock's break-even level will be triggered when the price reaches the Lock Order's Open Price plus 200 points. |

| Lock Break Event Offset (Multi) | This determines the offset distance of the break-even level from the lock order's open price. For instance, if the stop loss distance of the lock order is 100 points and the Lock BE Offset Multiplier is 1, the break-even level for the lock order will be (Lock Order's Open Price + 100 points). It is important to note that the offset value must be lower than the trigger multiplier. |

| Default Stop Loss Distance (Points) | In the event that your main position lacks a stop loss, this EA will automatically set a default stop loss distance value and utilize it as the stop loss for your main position. |

| Set Magic Number (0 - Ignore) | If you intend to use this EA to manage trades made by another robot, you can input the magic number of the said robot in this section. If you want the EA to manage all positions, regardless of whether you are trading manually or using another robot, you can set the value to 0. |

[-- Account Protection --]

This section shows you all the settings for the account protection feature of the EA:

| Max Daily Drawdown (%) | This value represents the maximum daily drawdown allowed in your account balance. |

| What do you do if daily DD is hit | This is a list of options that you can choose from in the event that your max daily drawdown is reached. If you prefer to disable the account protection feature, you can select the "Do nothing" option. |

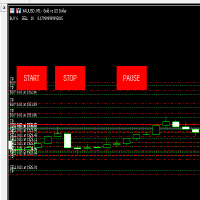

[-- Testing --]

This section shows you all the settings only available in Strategy Tester:

| Direction | This determines the direction of the orders that are automatically created for testing purposes. It can either be set to "Buy" or "Sell". |

| Lots | This determines the volume or lot size of the test order. |

Disadvantage of using Lock Guard

In a ranging market, the price moves back and forth between a defined range. This means that the price doesn't make any significant move, and it stays within a narrow range. The disadvantage of using Lock Guard in a ranging market is that it can lead to a successive hitting of your lock's stop loss. This happens when the price hits your lock order multiple times, causing a loss. As a trader, it's always a great idea to keep an eye on your main positions and make sure that they're not bouncing in and out in a ranging price movement.

Support

If you have any questions, feel free to contact me. I'm happy to help and answer your questions and concerns. 💚