Trend Entry Levels

- Indicateurs

- Namu Makwembo

- Version: 1.1

- Mise à jour: 3 janvier 2025

- Activations: 5

Trend Entry Levels Indicator

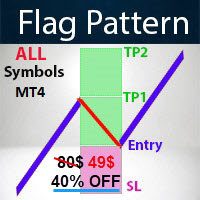

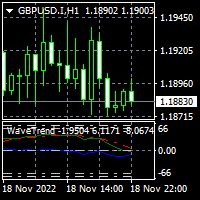

The Entry Levels Indicator is a trend-following tool designed to assist traders by highlighting key levels for trade entries and profit-taking. It is built to support trading strategies by providing information on market trends and levels for Take Profit (TP) and Stop Loss (SL). This indicator can be used by traders of varying experience levels to enhance their market analysis.

Features

- Non-Repainting Signals: Provides signals that remain consistent over time.

- Multiple Take Profit Levels: Displays TP1, TP2, and TP3 levels to align with diverse trading strategies.

- Entry Levels: Highlights levels that can be used for trade entries.

- Alerts: Offers visual and audible alerts to notify users of potential trade levels.

- Customizable Settings: Parameters can be adjusted to suit different preferences.

- Multi-Timeframe Compatibility: Can be applied across various timeframes.

- Simple Interface: Designed for ease of use.

Rules for Buying and Selling

-

Buy Signals:

- Observe an upward trend displayed by the indicator.

- Monitor for an Entry Level that corresponds to a buying opportunity.

- Utilize TP1, TP2, and TP3 as potential levels for profit-taking.

-

Sell Signals:

- Check for a downward trend as shown by the indicator.

- Enter a sell trade when the Entry Level is displayed.

- Use TP1, TP2, and TP3 as targets for exiting trades.

-

Stop Loss:

- Place stop-loss orders at levels suggested by the indicator or near recent highs/lows.

Important Notes

- Proper risk management should be employed in all trading activities.

- Practice using the indicator in a demo account before applying it to live trading.

Support and Updates

- Support is available through the MQL5 messaging system.

- Updates will be provided periodically to maintain functionality.

The Trend Entry Levels Indicator provides information that can help traders analyze the markets and make decisions. Users are encouraged to assess the tool independently to determine its suitability for their trading needs.