Alpha J

- Experts

- Liew Chan Hoong Liew Chan Hoong

- Version: 1.36

- Activations: 10

What is Alpha J?

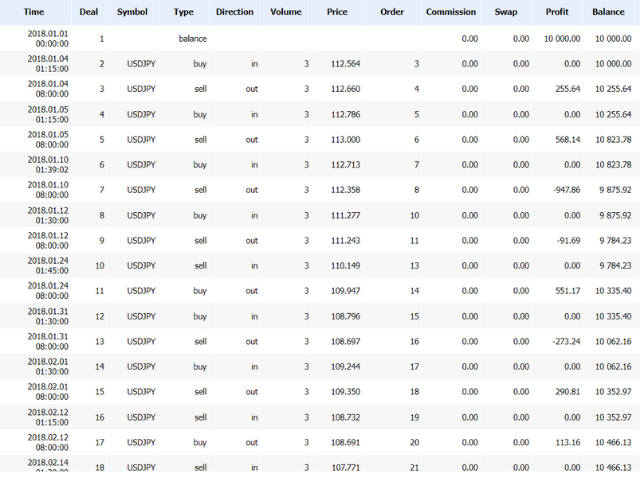

Alpha J is a fully automated system that trades the USD/JPY spike during the Tokyo session with great precision.

How is Alpha J built?

Alpha J is developed based on our proprietary algorithms and statistical models, which are the result of our years of intensive in-house research into the price volatility around the Tokyo session.

To avoid overfitting, Alpha J uses 80% of the price data to develop the model, and the remaining 20% to test and validate it.

How does Alpha J execute trades?

Step 1:

Alpha J carefully monitors how the USD/JPY behaves before and during the Tokyo session.

Step 2:

Alpha J measures and analyzes the price behavior during the two key time windows. Then, she applies exacting filters to perform a process of qualifying and disqualifying.

Step 3:

If the opportunity meets the strict criteria that have been set by Alpha J, she will enter the market at the point where there is a high probability of success to capture the maximal return with minimal risk, within the determined period.

In general, Alpha J is a highly specialized trading system that has been optimized to identify the most favorable opportunities to trade the USD/JPY spike during the Tokyo session, with a focus on maximizing the probability of success while minimizing risk.

How does Alpha J manage risk?

Alpha J has a strategic exit for every trade. Specifically, she applies momentum-exit and time-exit, meaning the trade will be closed when the price momentum has potentially maxed out or when the Tokyo session has approached the end.

Alpha J does not risk your money in areas outside of her expertise. She does not claim to be able to trade multiple currencies and any market conditions like other trading systems out there.

One currency pair (i.e. USD/JPY).

One market condition (i.e. price spike).

One trading session (i.e. Tokyo).

Alpha J is highly focused and specialized. By staying within her area of expertise, Alpha J is able to minimize the risks associated with the trade, and make informed trade decisions that are likely to lead to success.

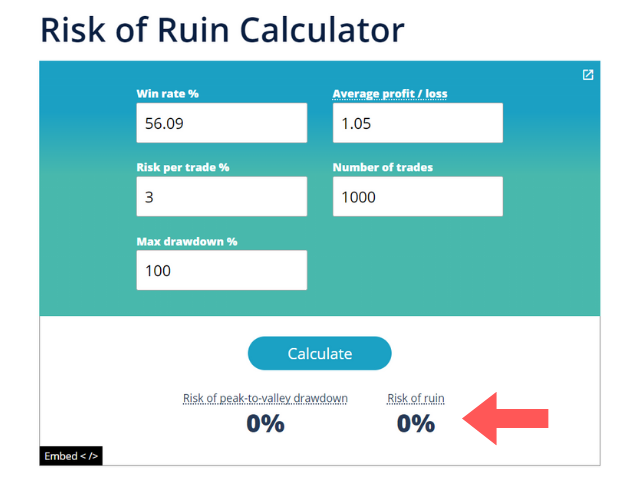

The Risk of Ruin calculator, as seen in the final screenshot, indicates that the likelihood of losing the entire account is virtually 0% (with 1000 trades simulation). This suggests that Alpha J has been exceptionally cautious and prudent when it comes to risk management.

Alpha J always prioritizes the safety of your account above all else. And no, she strictly does not apply martingale strategy or any aggressive approach of similar kind.

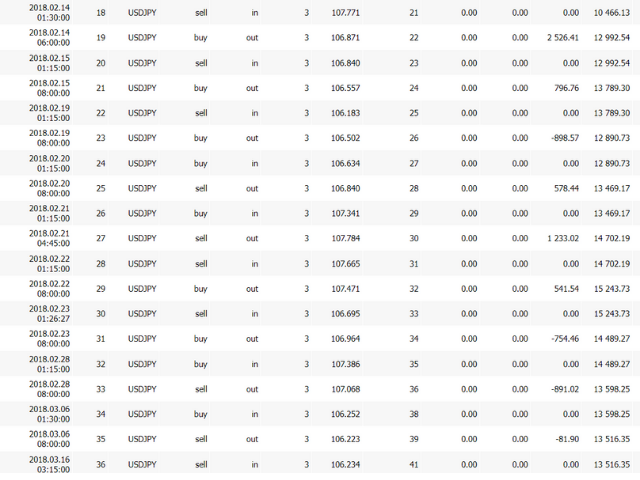

How has Alpha J been performing?

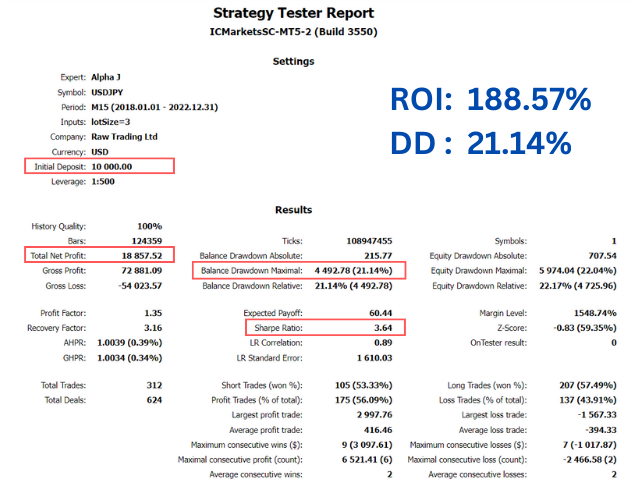

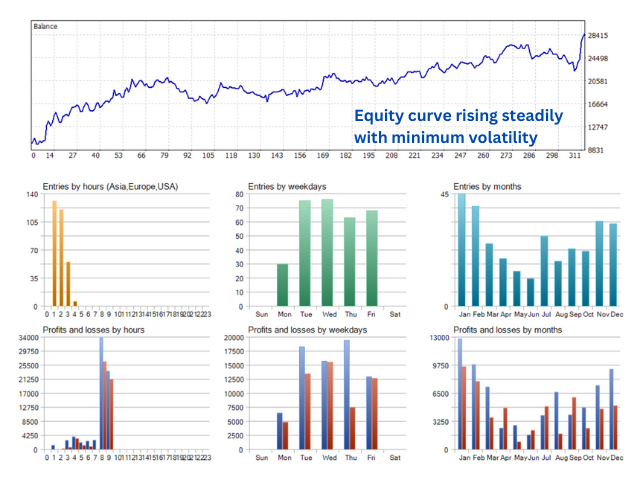

Alpha J has demonstrated impressive performance, with a 188.57% return from January 2018 to December 2022, and a maximum drawdown of just around 20%.

She has achieved a nearly 56% win rate and an overall reward-risk ratio of over 1.

Additionally, she also boasts a Sharpe ratio of 3.64, a Profit Factor of 1.35, and a Recovery Factor of 3.16.

The exceptional performance achieved by Alpha J is indeed rare among other trading systems.

Who is Alpha J for?

Alpha J is an ideal choice for traders who are looking for a proven and effective way to make sustainable profits without taking on excessive risk.

She is probably a bad option for those who intend to make quick profits with high risk bets.

What is the required setup?

- Currency Pair: USD/JPY

- Time Frame: 15-minute

- Broker: IC Markets (standard account)

- Platform: MT5 Desktop

- Leverage: 1:500

- VPS: Not necessary

- Optimization: Not required

What is the lot size for optimal results?

| Capital | Recommended Lot Size | |

| Careful | Ambitious | |

| $100 | 0.02 | 0.03 |

| $500 | 0.1 | 0.15 |

| $1,000 | 0.2 | 0.3 |

| $5,000 | 1 | 1.5 |

| $10,000 | 2 | 3 |

Who is the developer?

Chriis Liew CH, a professional forex trader since 2016, and his team offer expert-level education on forex trading through the popular mobile app (iOS & Android), JCP. The app has garnered a loyal following of over 30,000 monthly active users, and around 10k+ positive reviews since its launch in 2017.

Disclaimer:

Results may vary depending on the broker you use. Different brokers may have different trading conditions which can impact the performance of a trading strategy. Past performance is not necessarily indicative of future results. We are not responsible for any losses or damages arising from the use of our trading bot or the reliance on any information provided by us.