Three Moving Monsters

- Experts

- Jason Edward Todt

- Version: 1.0

- Activations: 5

Suitable for any time frame

Suitable for any currency pair

Intuitive easy setup

Configuring not required

CUSTOMIZABLE SETTINGS

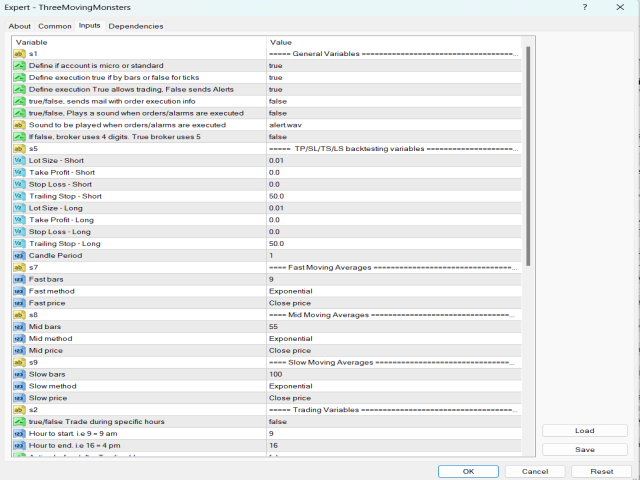

1. Main parameters

1.1 Two order comments for Long/Short orders

1.2 Two Unique magic numbers. For Long/Short

1.3 Maximum allowed spread

1.4 Maximum allowed slippage

1.5 All indicators used within this EA are fully customizable

1.6 Define broker digits

1.7 Use as a fully auto EA or use as an Indicator

1.8 Sends email with order execution

1.9 Play a sound when orders/executions are executed

1.10 Number of retries if an error occurs

1.11 Define colors to identify Buy/Sell orders

1.12 Turn pop-up message box alerts on/off (All notes will still be printed on the Journal tab regardless)

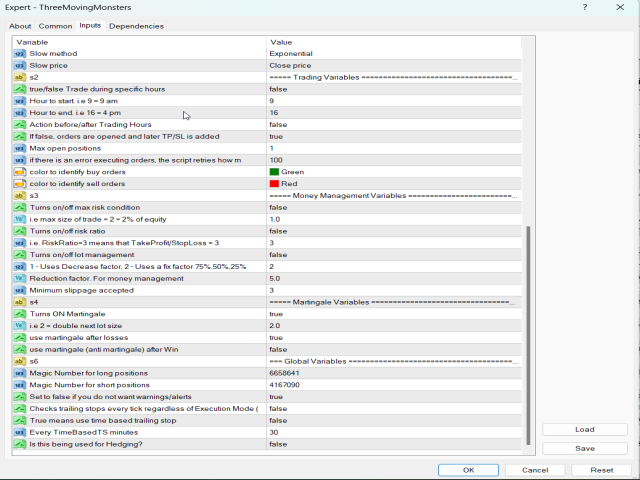

1.13 Define if being used for Hedging (EA will open trades but YOU are responsible for closing those trades.)

2. Money management

2.1 Fixed lot or Lot Size Optimization. Including micro or standard

2.2 Define maximum limit of orders

2.3 Turn on/off Risk Management

2.4 Turn on/off Risk Ratio

2.5 Set Risk Ratio

2.6 Turn on/off Stop Loss auto adjustment

2.7 Turn on/off Take profit

2.8 Define orders according to percentage of equity

2.9 Trailing Stop Loss

2.10 Define reduction factor

2.11 Set acceptable slippage

2.12 Turn on/off Martingale

2.13 Define Martingale to use after losses, only when breakeven is needed and not used during other trades

2.14 Define checks for trailing stop for every tick regardless of execution mode (Bars or Ticks)

3. Time limits

3.1 Customizable amplitude depth

3.2 EA Start and Expiration time in hours

3.3 Limit trading time

3.4 Trading start hour

3.5 Trading end hour

3.6 Define execution by bars or ticks

3.7 Define how many bars/ticks to count

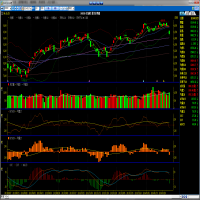

The triple moving average strategy involves plotting three different moving averages to generate buy and sell signals. This moving average strategy is better equipped at dealing with false trading signals than the dual crossover system. The third moving average is used in combination with the other two, to confirm or deny trades. This reduces the probability that the trader will act on false signals.

This indicator finds Regular divergence for pullback in the market and also finds hidden Divergence to show continuing trend.

This EA has dynamic sell loss and take profit control integrated.

Based on configurable lot values, the EA places orders by trend and Average True Range data of the used symbol. The strategy is based on utilizing trend direction changes and optimizing order size. Whenever a trend direction change takes place,

the EA would balance positive profits from the current trend orders with the negative loss orders and close all of the orders with the configurable profit in pips. The EA has flexible settings allowing you to change number of orders, lot sizes, order frequency and closing profit.

This EA offers the user a few options to secure profitable trades by breaking even or trailing the stop. These two options are enabled by default.

If an open trade gains at least 30 pips, it's stop loss is moved to the entry price for a risk-free trade. Later if the trade gains more pips, the trailing stop function comes in.

Trailing stop maintains a distance between market price and trade stop loss of 40 pips. At some point, price will hit either the adjusted stop loss or take profit of 50 pips.

In both cases the trade ends up a winner.

Trading in forex is speculative in nature and not appropriate for all investors.

Investors should use risk management because there is always the risk of substantial loss.

Past results and back testing are not necessarily indicative of future results.

Anyone interested to know the robot’s true potential must consider implementing the robot on a demo account and running parallel tests in various ways to

determine which markets would give it more winning chances.

Please use a different magic numbers on each pair to avoid order issues. Also, check the max spread limit number to avoid entering trades during high spread sessions.

Before adding this expert advisor to a chart, make sure there are NO open positions.

The longer the time period of the chart, the more reliable the reversal. It's also important to note that the longer the time period, the lower the number of signals generated.