Scanner market conditions

- Indicateurs

- Jaafar Tazi

- Version: 1.0

- Activations: 5

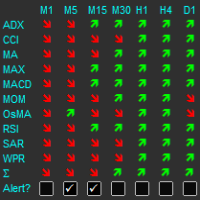

Market Conditions indicators can provide support to the trader so that he can identify market trends over a given period. The purpose of this model is to allow traders to have a global vision on the exchange markets. And the formula that we develop allow to scan the major currencies in the exchange market.

The model uses a purely statistical formula which is based on the historical data of the major currencies "eur, usd, gbp, jpy, aud, nzd, cad, chd". Of which 28 currency pairs are traded. It calculates the average of the returns of the major pairs in order to know the most demanded and least demanded currencies on the market.

the unit of measurement of the model are is in Pips.

Usage and Feature:

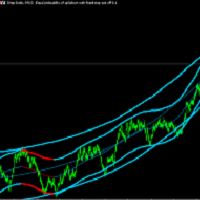

The model can be used on different timeframes depending on the trader's strategy. The results provided by the model represent the average evolution "in pips" of the currency .

For exemple :

If you decide to analyze the most volatile currency pair. You select the currency pair that contains the strongest and weakest currency.

If you decide to analyze the currency pair that is in range . You select the strongest and 2nd strongest or the weakest and 2nd weakest currency pair. Etc…

the the model can give you the most realistic representation of the conditions of the trading markets so that the trader can identify the entry levels and manage the risks in relation to the market conditions.

interpretation of the result

if currency>0pips it mean that the currency winning pips based on global market.

if currency<0pips it mean that the currency losing pips based on global market.

Set model parameters

In order to ensure that the model works properly, the user will need to upload the historical data of the 28 currency pairs for the H1 timeframe.

Each period represents a 1H candle. If you select a period of 24 the model will give you the market conditions over a interval of 24H "1 DAY" etc...

Which period is the most accurate

All periods can be used, it depends on the profile of the trader. But it is advisable to use an interval of 1 week "120 Period" To know the basic trends.

What impact of economic news on the model?

During economic news, market conditions tend to change.

Please note that the model does not provide market entry or exit levels but rather a realistic representation of market conditions. This allows the trader to know if the currency pair is trending or ranging.

Please for more information contact us.