Investologic Ichimoku

- Experts

- SAUD ALHINDAL

- Version: 1.2

- Mise à jour: 7 janvier 2023

- Activations: 5

Ichimoku EA

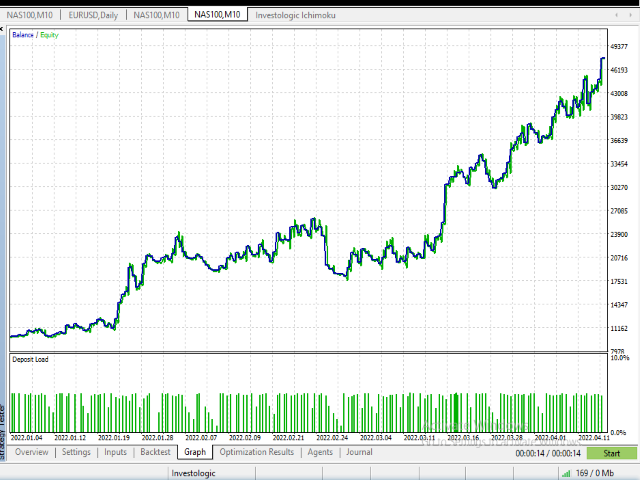

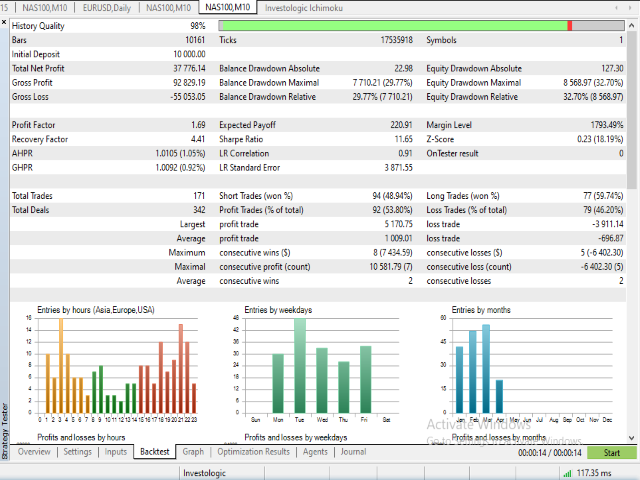

The EA is for the professional traders. Users MUST do some intensive test using "strategy tester" to fit user's needs.

with artificial inelegance the EA can manage trades, lot size, risk, and avoid high volatile choppy market.

Ichimoku strategy can work with any symbol or market in MT5 platform.

The Ichimoku EA is a specialized software designed for professional traders that uses the Ichimoku indicator and artificial intelligence to manage trades, lot size, risk, and avoid high volatile choppy market conditions. This EA can be utilized on any symbol or market within the MetaTrader 5 (MT5) platform.

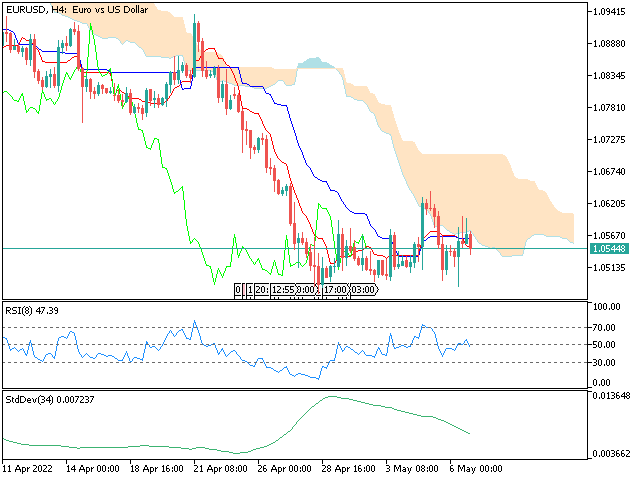

The strategy of the EA is based on the Ichimoku indicator, which is a comprehensive technical indicator that is used to identify support and resistance levels, determine trend direction, and identify potential trade opportunities. The Ichimoku indicator consists of several components including the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and the Chikou Span.

Tenkan-sen and Kijun-sen are used to identify the market trend and confirm trade entry points. Senkou Span A and Senkou Span B are used to identify potential support and resistance levels, and the Chikou Span is used to confirm the strength of the trend by comparing current price action to past price action.

The relative strength index (RSI) is also used to indicate the strength or weakness of the market by identifying oversold and overbought levels. A volatility filter, using the volume rising and standard deviation indicator, is utilized to filter the trend. This helps to reduce the risk of incurring losses during volatile market conditions.

Trade scenarios

involve entering trades when the price breaks above or below the Ichimoku cloud signal, which is represented by the Senkou Span A and Senkou Span B. Exit trades are based on the stop loss, take profit, and trailing stop levels, which are set using the average true range (ATR) calculations, with a risk-reward ratio or can be set manually in pips.

The EA also includes.

account protection features, such as margin cut-off when the margin exceeds the free margin. Additionally, it includes money management features, such as lot size optimization, set time to trading, push notifications, and a magic number.

The technical indicators employed by the EA include:

The inputs and options include:

- (Tenkan-sen, Kijun-sen,

- Senkou Span A,

- Senkou Span B,

- and the Chikou Span),

- RSI with levels,

- volatility filter,

- volume filter,

- and average true range.

- stop loss, take profit, and trailing stop levels,

- RSI, levels & time frame,

- trend filter & time frame,

- volume filter,

- trade box,

- lot size in % risk,

- ATR stop loss, take profit & trailing.

- risk reward factor, and money management,

- Lots Optimized,

- magic number,

- push notification,

- set time to trading.

It is important to note that the EA does not guarantee profit, and users must understand the strategy before using it. It is recommended to backtest the EA using the MT5 "strategy tester" to search for the optimal parameters for each specific symbol and time frame. Additionally, it is recommended to test the demo version on a real account and with real data to ensure its effectiveness. The EA works best with high volume trending markets like Forex majors.