TRSI with Alerts MT5

- Indicateurs

- KEENBASE SOFTWARE SOLUTIONS

- Version: 1.0

- Activations: 5

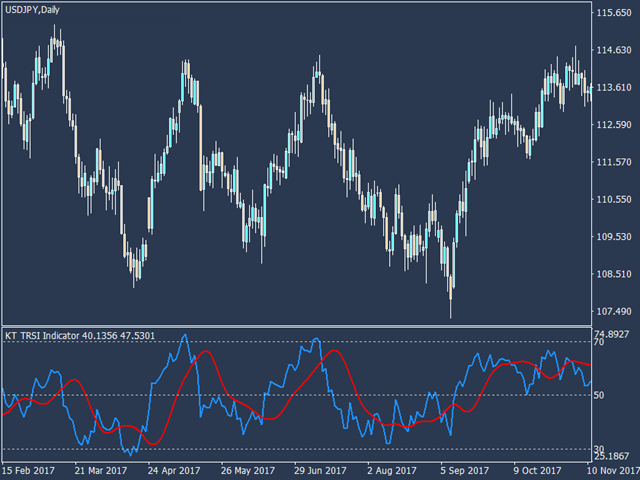

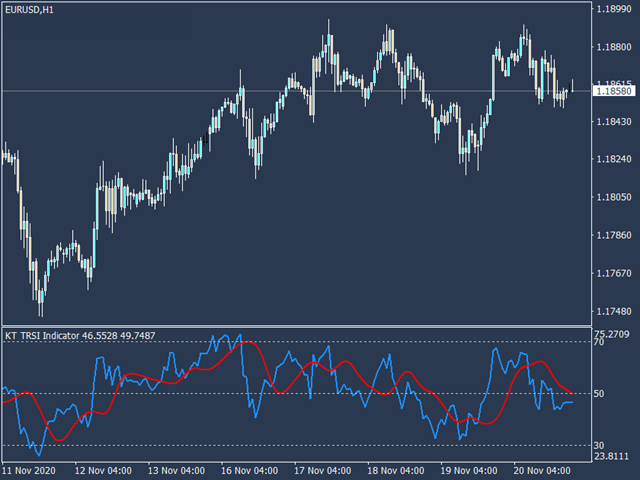

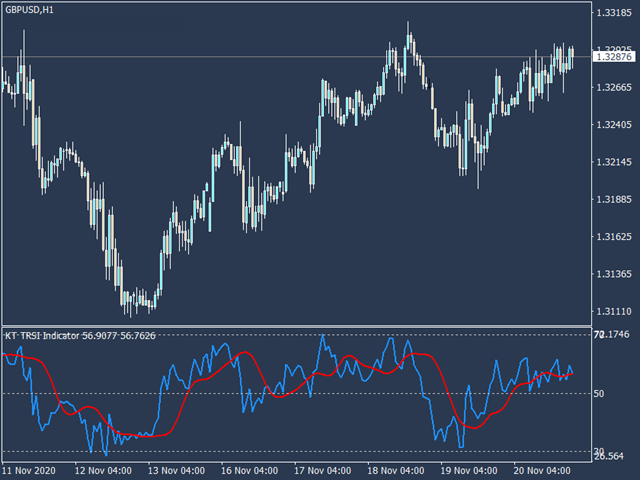

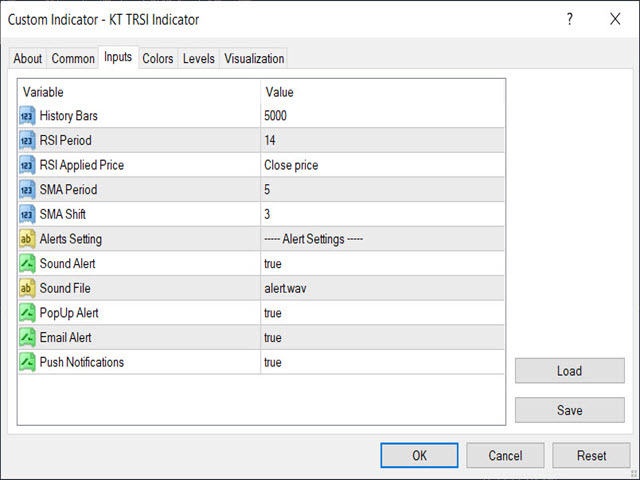

KT TRSI is an oscillator built using a combination of RSI (Relative Strength Index), EMA (Exponential Moving Average), and SMA (Simple Moving Average). Compared to the classic RSI, a TRSI is less susceptible to false signals due to the SMA's smoothing factor. Moreover, it is also equipped with all kinds of Metatrader alerts.

Simple Entry Rules

- Buy: When the Blue line(RSI) crosses above the Red line(TRSI).

- Sell: When the Blue line(RSI) crosses below the Red line(TRSI).

Advance Entry Rules

- Buy: When the Blue line(RSI) goes below the oversold level and then goes back above the oversold level with a Red line(TRSI) bullish crossover.

- Sell: When the Blue line(RSI) goes above the overbought level and then goes back below the overbought level with a Red line(TRSI) bearish crossover.

It is imperative to use other indicators and confirmations to make more informed decisions using the TRSI.

TRSI Formula

Tripple EMA = EMA of EMA of EMA of RSI.

TRSI = SMA of Tripple EMA displaced 3 bars to the right.